Original article: " MystenLabs and FTX debtor's 123-page court document, what information about SUI is revealed?" "

Author: Julian

Recently, according to relevant court documents, Mysten Labs reached an agreement with FTX debtors on March 22 to repurchase FTX’s equity investment in Mysten Labs and SUI token warrants for $96.3 million in cash.

The 123-page document discussed in detail the situation of FTX's investment in MystenLabs in August 2022. Combining court documents and a series of recent actions of Sui, SuiWorld made some summary and analysis:

1. Mysten Labs completed a round B financing of over US$300 million at a valuation of approximately US$2 billion

This financing information was made public last year. FTX and B-round investors obtained Sui Token token warrants by investing in MystenLabs' B-round preferred equity.

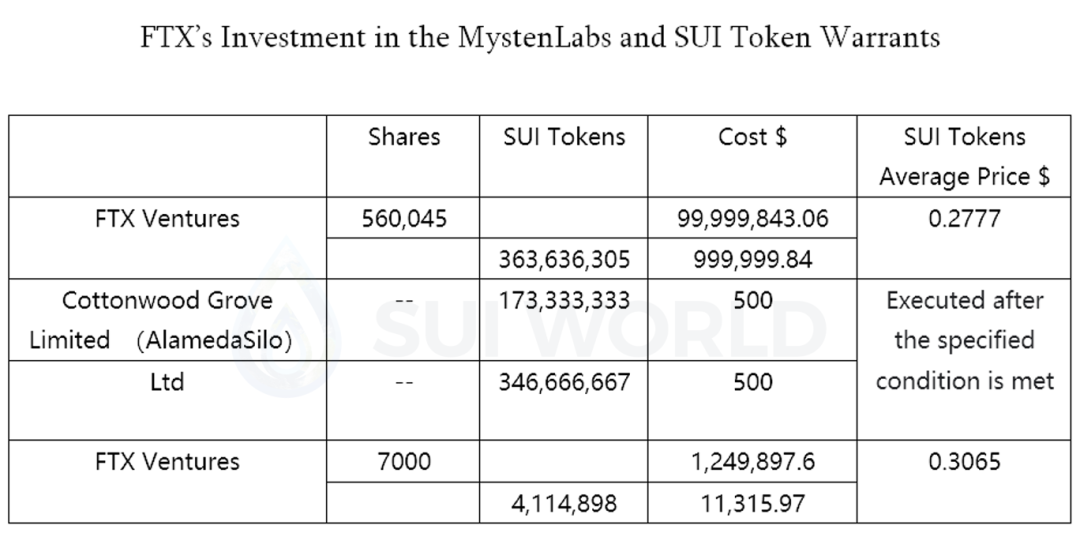

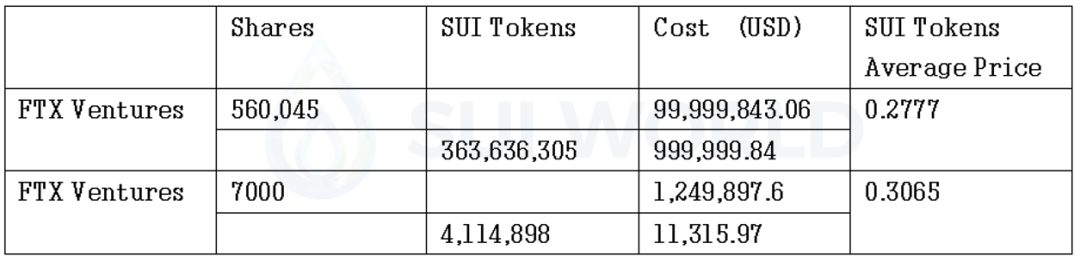

2. FTX received approximately 890 million Sui Tokens for approximately US$102 million

FTX invested a total of 102 million US dollars in MystenLabs' B round of financing, obtained about 570,000 preferred shares, and obtained about 890 million Sui Token token subscription warrants. The average cost of FTX investing in Sui Token as the lead investor is very low, about $0.114.

FTX has two acquisitions of SUI token warrants that are very important: Cottonwood Grove Limited (Alameda) and FTXTrading obtained approximately 173 million and 346 million token warrants for a total of 519 million Sui Tokens at a price of US$500. These 5.19 Sui Tokens will be used to make market transactions on the FTX platform after meeting certain conditions after the Sui NetWork Mainnet launch and Sui Token launch. (Sui World Note: Cottonwood Grove Limited is a wholly-owned holding company of AlamedaResearch)

As a former leading trading platform and market maker, an important condition for FTX to lead the investment of more than US$100 million in Sui is that its market makers Alameda and FTX Trading have obtained 519 million Sui Tokens for almost free to use in FTX. com platform. But with FTX crashing before Sui launched, the protocol for this token warrant is also gone.

3. The cost of Sui Token chips for some B-round investors is about US$0.28-0.31

Aside from FTX’s market-making chips, other B-round investors can still refer to FTX Ventures for the cost of obtaining Sui Token token warrants. The average cost is between 0.28-0.31 US dollars.

4. Sui will take back a lot of low-cost institutional chips

In addition to the Sui Token investment chips between US$0.28-0.31, for the lead investor FTX, an additional 519 million Sui Token market-making chips were obtained.

Today, Mysten Labs repurchases FTX’s equity investment in Mysten Labs and SUI token warrants for $96.3 million in cash, which means that a large amount of FTX’s low-cost investment chips and market-making chips have been recovered. It is a good thing for the Sui Token that will be launched in the future.

It is worth mentioning that FTX also led the investment in another Move chain, Aptos, with a similar valuation and investment amount. FTX’s investment plan for Aptos may be very similar to Sui, that is, FTX holds a large amount (more than 1/3 of the circulation) and low The cost of investment chips and market-making chips. This means that some low-priced chips of Aptos, which went online before the FTX collapse, have already entered the market, and the unsold chips will also wait for the disposal plan of FTX creditors.

5. FTX debtors can continue to “seek higher offers from other third parties”

The document also discloses that currently FTX debtors can continue to “seek higher offers from other third parties” until the court finalizes the sale date. Mysten Labs' equity investment and Sui token warrants are still attractive to many institutions.

6. The biggest external obstacle is missing from the launch of the SUI Mainnet

After dealing with the issue with the FTX debtor, the biggest external obstacle to the launch of the SUI Mainnet has been dealt with. The launch of the SUI Mainnet and the release of Sui Token do not need to consider the handling of the previous investment chips from FTX.

7. US$96.3 million corresponds to a US$100 million fund

Once the $96.3 million cash repurchase is completed, there will be no short-term financial impact on Mysten Labs, which just raised more than $300 million last year. The long-term impact may mainly lie in Mysten Labs' layout of Web3, such as investment and acquisition of Web3 projects.

This also corresponds to the previous news that Evan Cheng, CEO of Mysten Labs, is seeking to raise more than $100 million for a Web3 fund, which will not be limited to the Sui ecosystem. Hashed co-founder Alex Shin and veteran hedge fund investor Sandeep Ramesh will join the newly created Web3 Venture Fund as general partners.