CFTC's regulatory action on Binance or has some connection with SBF and FTX?

Written by: Nancy

On March 27, the Washington-based U.S. Commodity Futures Trading Commission (CFTC) announced the prosecution of the crypto exchange Binance (Binance) and its CEO and founder CZ. The agency stated that it has continued to investigate Binance since at least 2021. Binance has illegally operated in the U.S. market and violated regulations aimed at preventing illegal financial activities. It also obtained internal chat records through undisclosed special means. Subsequently, Binance responded that the indictment seemed to contain incomplete factual statements, disagreed with the characterization of many of the issues alleged in the indictment, and called on the community to "ignore FUD news, fake news, malicious attacks, etc."

At the same time, the United States released 13 new indictments against FTX founder SBF. Councilor receives funding from SBF. And FTX has also hired a number of former CFTC officials in 2021.

As we all know, FTX’s political influence in the United States is much higher than that of Binance. This article reviews the timeline of the “collapse” between Binance and FTX, the establishment of political relations between SBF and CFTC, and the timeline of Binance being investigated by the CFTC. Some people in the industry speculate that the CFTC’s supervision of Binance Or have a certain relationship with SBF and FTX.

FTX Hires Former CFTC Officials After Parting Ways With Binance

SBF is not only a lobbyist for U.S. encryption regulatory policies, but also builds a strong political force with the help of regulatory political games in Washington. Previously, PANews also published an article disclosing that SBF has a close relationship with the US regulators, except for the current US SEC chairman and former CFTC chairman Gary Gensler. Many old departments of the latter have joined FTX during his tenure from 2009 to early 2014. .US, and the entry time of these senior officials is also very delicate.

Time goes back to December 2019, when Binance announced a strategic investment in FTX, and at the same time helped the latter’s ecological development to keep pace with the development of Binance’s ecology, making the latter’s valuation within half a year of its launch. $1 billion. However, after more than two years of rapid development, the popularity of FTX is comparable to that of Binance, and the business has created direct competition. In July 2021, when FTX announced that it had completed a $900 million Series B round of financing at a valuation of $18 billion, Binance revealed that it had completely withdrawn from FTX's equity investment.

According to a Reuters report, when FTX applied for a license for its subsidiary in Gibraltar in May 2021, it was required to submit information about its major shareholders. FTX’s lawyers and consultants wrote to Binance at least 20 times, but Binance did not respond This request was ignored, which is also considered by the outside world to be the direct cause of the "breakup" between the two.

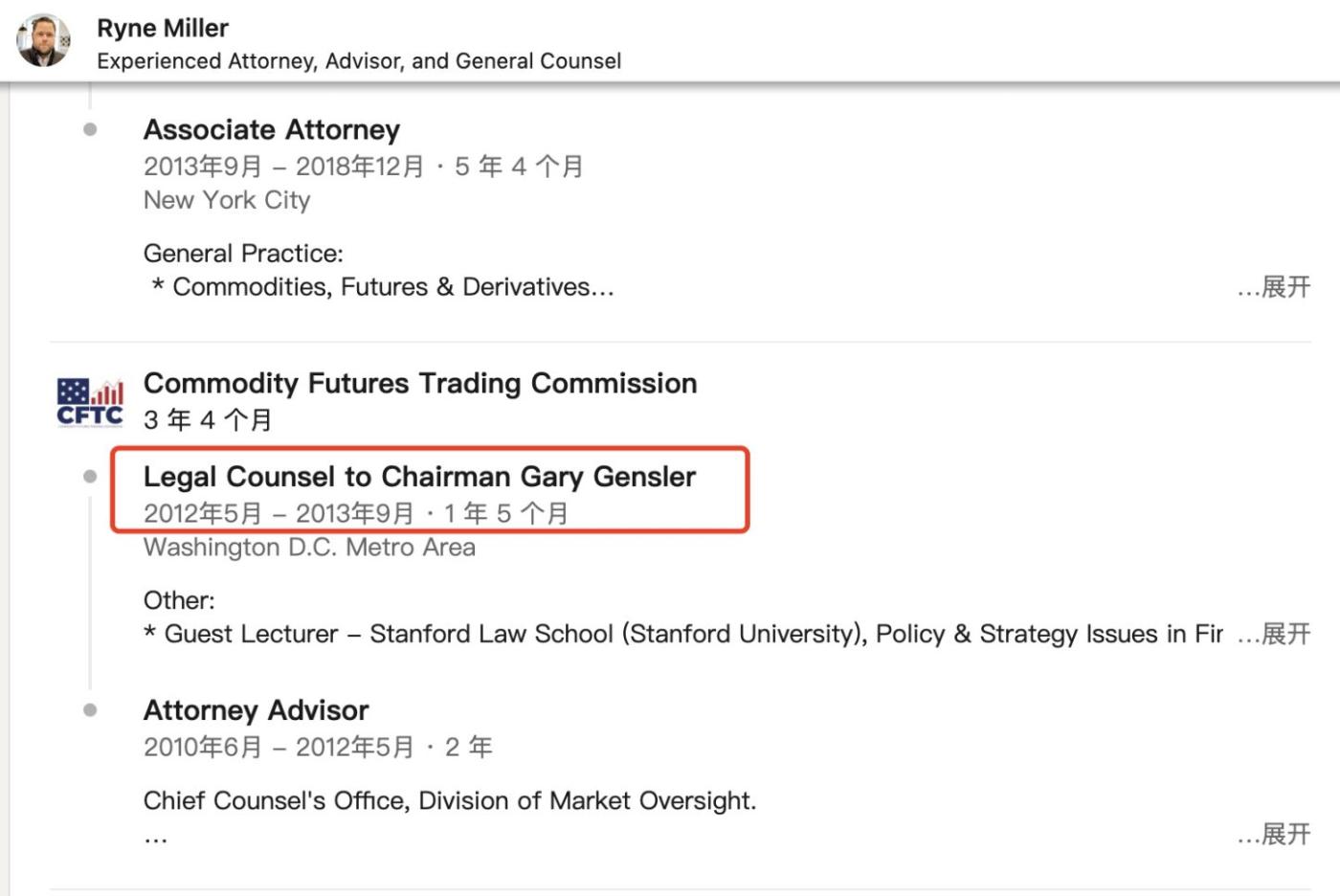

In the year after "parting ways" with Binance, SBF established inextricable ties with CFTC officials to expand its political influence. In August 2021, FTX hired former CFTC chairman Ryne Miller, who served as Gary's legal counsel from 2012 to 2013, as the exchange's general counsel. During her tenure, Ryne Miller also helped arrange meetings and dinners for the SBF with former CFTC Commissioner Dan Berkovitz, the SEC's general counsel, and Mark Wetjen, among others.

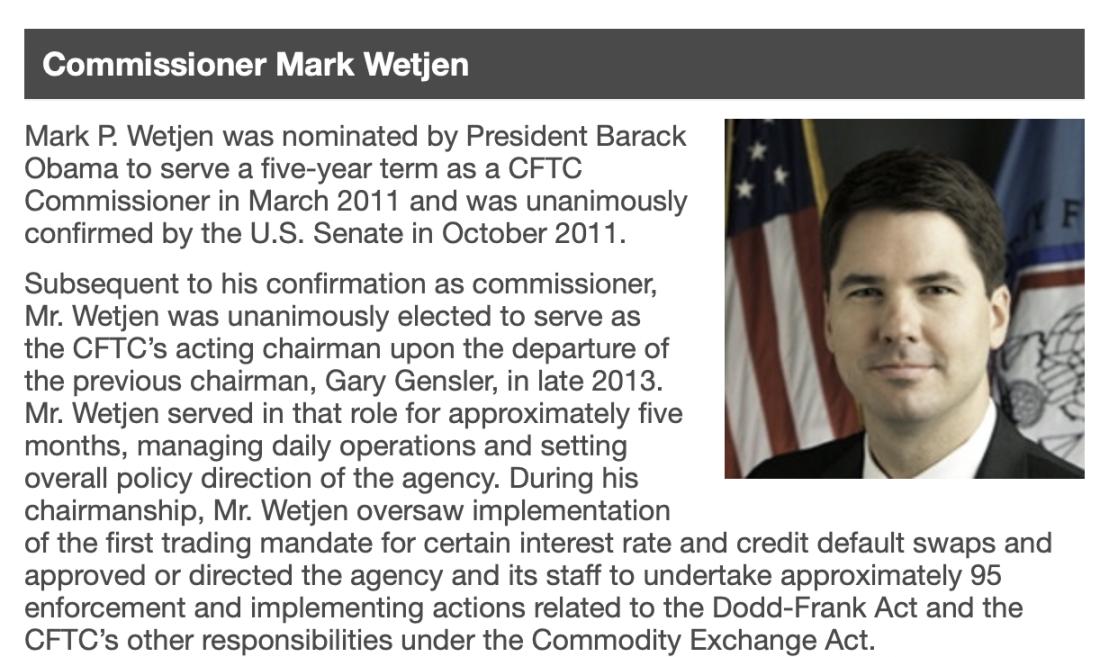

In November 2021, FTX hired Mark Wetjen, head of policy and regulatory strategy and current director of FTX subsidiary LedgerX (a CFTC-registered Derivatives trading platform), who was nominated by former U.S. President Obama Chairman Gary Gensler was elected Acting Chairman following his departure, and the two worked together for a time.

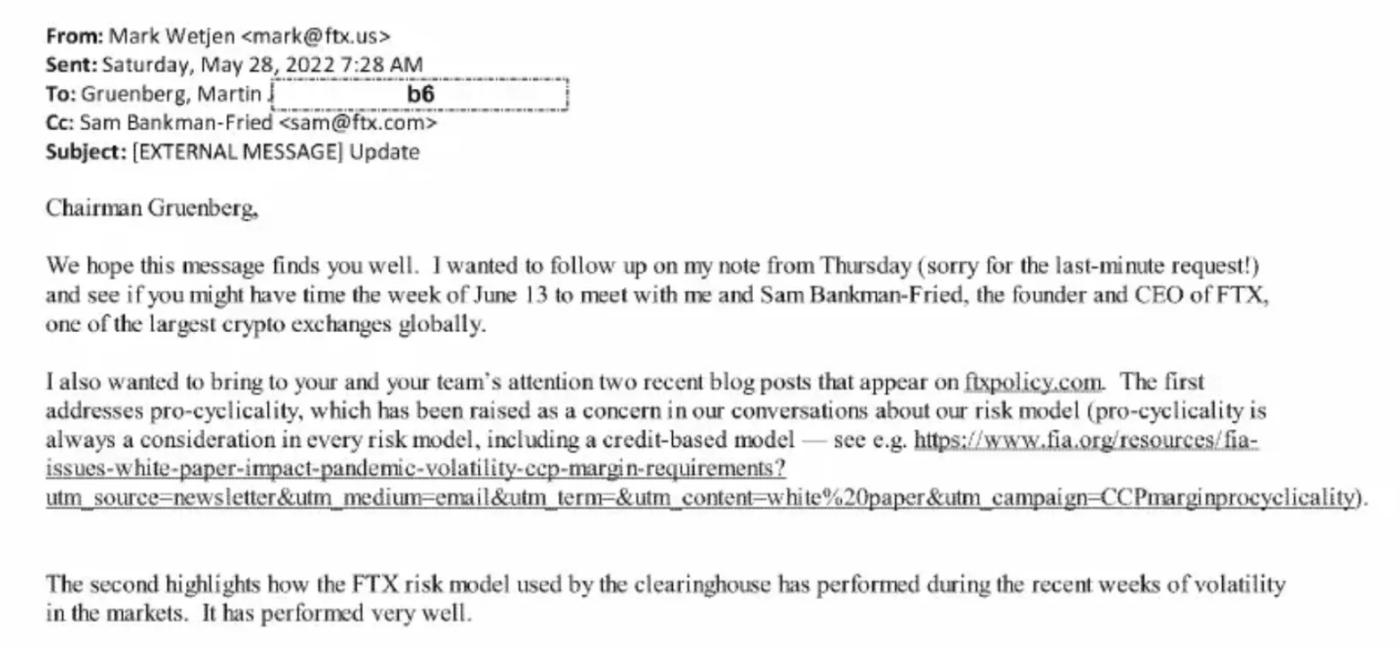

It is worth mentioning that with the help of Mark Wetjen, Martin J. Gruenberg, chairman of the US Federal Deposit Insurance Corporation (FDIC), also met with SBF in June 2022, only 5 months after FTX filed for bankruptcy. According to several emails shared by The Washington Observer, the SBF tried to persuade the FDIC to accept crypto-friendly regulations through Gruenberg, claiming in the email to the latter, “We submitted an application to the CFTC, There is a plan for the CFTC on how to do it. All the CFTC has to do is approve it. Once the CFTC does this, other exchanges will follow, and other major exchanges in the United States can also have a CFTC license." Not only that, Mark Wetjen also once The current CFTC chairman Rostin Behnam and his chief of staff David Gillers were invited to hold an emergency meeting to discuss LedgerX, a Derivatives platform under FXT. Behnam himself admitted that he had met with SBF several times.

SBF invites meeting with FDIC Chairman Martin Gruenberg Email source: Washington Observer

SBF invites meeting with FDIC Chairman Martin Gruenberg Email source: Washington Observer

In addition, Jill Sommers, a member of the FTX board of directors, is also a former CFTC commissioner. He was nominated by former President Obama and served two terms. He also worked with Gary Gensler; Introduce the situation of FTX.

The "Digital Goods Consumer Protection Act" promoted by SBF and others gave CFTC more regulatory powers in the encryption field, and the Democratic Senator Debbie Stabenow who was in charge of drafting it was Behnam's former employer. Increase the institution's governance capabilities in the spot market in the field of digital assets and commodities. The objects of supervision include trading platforms, intermediaries or broker-dealers, etc., and more resources are needed to expand the supervision capabilities. Not only that, but FTX had previously sought CFTC approval to clear margin trades directly for clients, an idea Behnam praised in public comments despite warnings from some federal regulators.

Dennis Kelleher, president of the non-profit organization Better Markets, once said about the email exchanges between CFTC and FTX, "CFTC has an open policy, basically as long as FTX wants to communicate, it can be achieved. Obviously, FTX hired former CFTC officials for contact and influence. CFTC."

In addition to the "backer" of CFTC, FTX has also provided political donations of up to 93 million U.S. dollars to many congressmen and various political factions in Washington, D.C., which also makes SBF a frequent visitor to Washington's political circles. I go to Washington every few weeks to talk to regulators and policy makers”, and also posted a post to insinuate that CZ cannot freely enter and leave Washington, and even criticized CZ in a private meeting in Washington.

Regarding SBF's encryption influence in Washington, Terry Duffy, CEO of CME Group Inc., once described it this way, saying, "The whole of Washington 'seems to be fascinated by SBF's innovative promise'. I have been in Congress for 25 years. I've never seen a Washington, D.C. like that in years, with regulators to members of Congress singing hymns I've never heard before."

CFTC Investigation Begins Exactly in 2021, Binance Denies Allegations

The CFTC announced that it has filed a civil lawsuit in the U.S. Federal Court for the Northern District of Illinois, accusing Changpeng Zhao and three entities operating the Binance platform of multiple violations of the Commodity Exchange Act (CEA) and CFTC regulations, and accusing Binance’s former Chief Compliance Officer Samuel Lim aided and abetted Binance breaches.

The CFTC said Binance evaded its obligations by not properly registering. Since at least 2021, the CFTC has been investigating whether Binance failed to prevent U.S. residents from buying and selling cryptocurrency Derivatives. CFTC rules generally require platforms to register with the agency when allowing U.S. persons to trade these products. Not only that, CFTC Chairman Rostin Behnam also stated that the Binance case is a continuous fraud and will be actively debated in court, and the CFTC will continue to use its powers to discover and stop misconduct in the volatile and high-risk digital asset market .

In other words, the CFTC has continued to investigate Binance since 2021. However, Binance denied the CFTC's allegations and stated that it has blocked the US through various means such as nationality, IP address, mobile operator, device fingerprints, bank deposits and withdrawals, blockchain deposits and withdrawals, and credit card bank identification codes. client, and has been working with the CFTC for over two years, and will continue to work with regulators in the United States and around the world in the future.

Although Behnam stated at the first congressional hearing of FTX's bankruptcy that his agency could not prevent the collapse of FTX because it was not under the jurisdiction of the CFTC, the role played by the CFTC in the history of FTX's development has made the agency questionable. Dennis Kelleher noted in a report, “Instead of actively regulating cryptocurrencies and scrutinizing its claims with skepticism, the CFTC spends most of its time cheering up the industry and trying to expand its jurisdiction, rather than Worried about investor, customer and market protection."

It is worth mentioning that Binance.US chose to set up its own political action committee at this moment after FTX went bankrupt and could no longer provide support for the US political arena. In preparation for the 2020 federal election and the presidential election, there is currently no plan to donate to the U.S. Political Action Committee (PAC). Meanwhile, Binance is also using the same lobbyist law firm Hogan Lovells as Binance.US to lobby U.S. lawmakers, since it has never operated in Washington, D.C.

All in all, with the thunderstorm of FTX, no matter whether it intends to promote the investigation and suppression of competitors through political influence, the tightening of supervision in the entire Stablecoin market has become a fact. The regulatory storm against Binance and the encryption market may have just begun.