Original title: "Endgame Perils of Restaking"

Author: Tripoli

Original compilation: czgsws

TL;DR

Re-staking protocols may generate substantial gains for validators, but their success risks compromising Ethereum's ability to self-regulate staking participation and moderate centralization forces. We believe that the logical end goal is to limit the validator population to a certain size.

Ethereum's long-term challenge is getting fewer people to stake

The general consensus among the uninitiated is that in Ethereum’s final phase, staking participation will move closer to chains like Solana and Cardano, both of which have roughly 70% of the token supply staked and inactive. However, there is a deep consensus among the Ethereum developer community that this is not a good outcome.

In a sense, Bitcoin minimalists are right about Ethereum’s monetary policy, it is not static and may change in the future. However, they are heading in the wrong direction, Ethereum will not experience hyperinflation, there is a good chance that collateral demand will be much higher than expected, and the corresponding reward return will be reduced.

Readers who strongly believe that Ethereum will be regulated may think that more staking participants are a positive for Ethereum, but remember that proof of stake works against monetary policy. Higher issuance (and thus higher staking yield) does not reduce the likelihood of holders holding; instead, it encourages holders to stake their assets and achieve a higher annualized rate of return.

For example, people claim that EIP-1559 is a very robust currency scheme, but 1559 actually lowers staking APR and encourages network activity instead of staking/holding.

Re-staking protocols such as EigenLayer provide yields outside of the Ethereum protocol, distorting market incentives, and undermining Ethereum’s monetary policy controls. The agreements paint a worrying picture of a possible hyperfinancial endgame for crypto assets.

monopoly dynamics

Ethereum’s monetary policy includes a built-in negative feedback loop to prevent overstaking: As more people lock their ETH into contracts, yields decrease. This reduces additional staking activity and lowers the opportunity cost of choosing to use the chain.

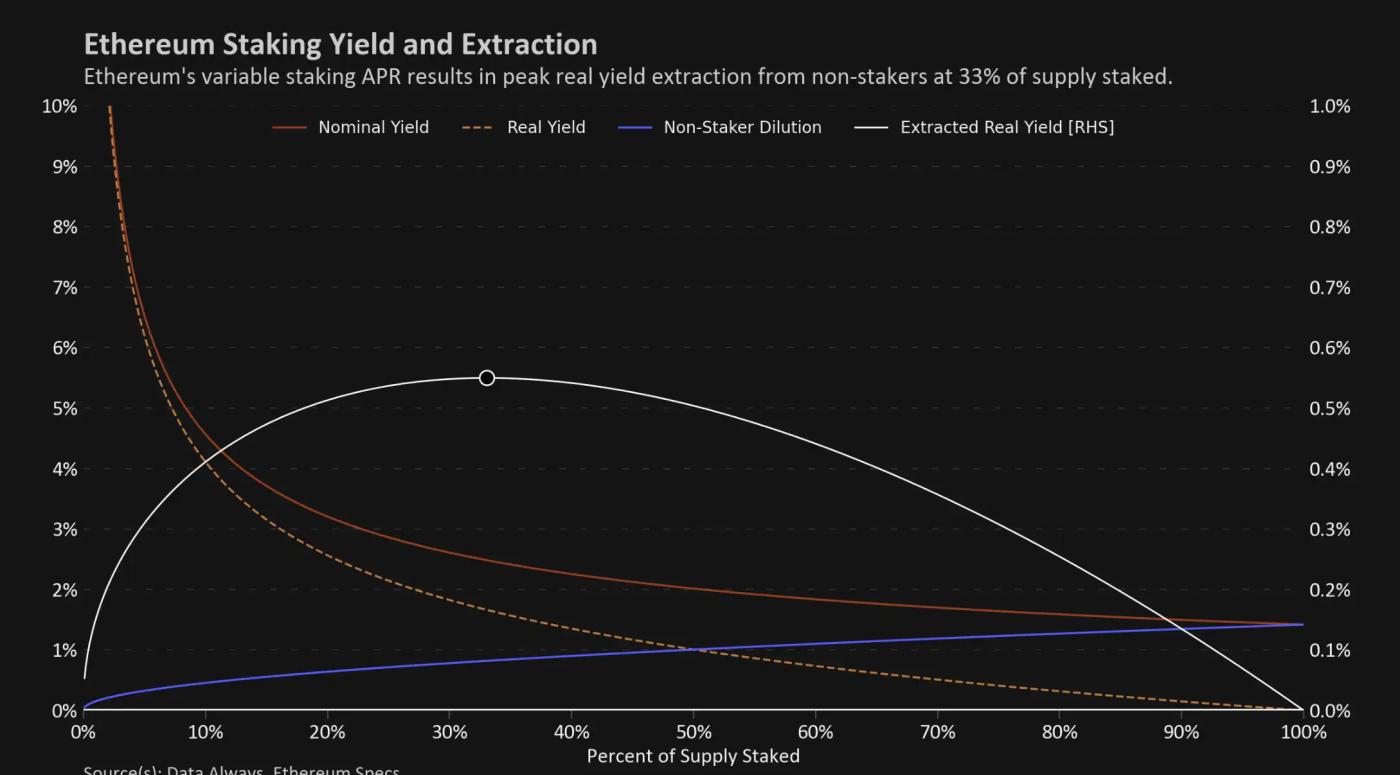

I find that imagining the various stakers as single or small groups of monopolies and calculating the optimal real yield they can extract from non-stakers and the share of supply they will lock is a useful way to analyze this feedback loop .

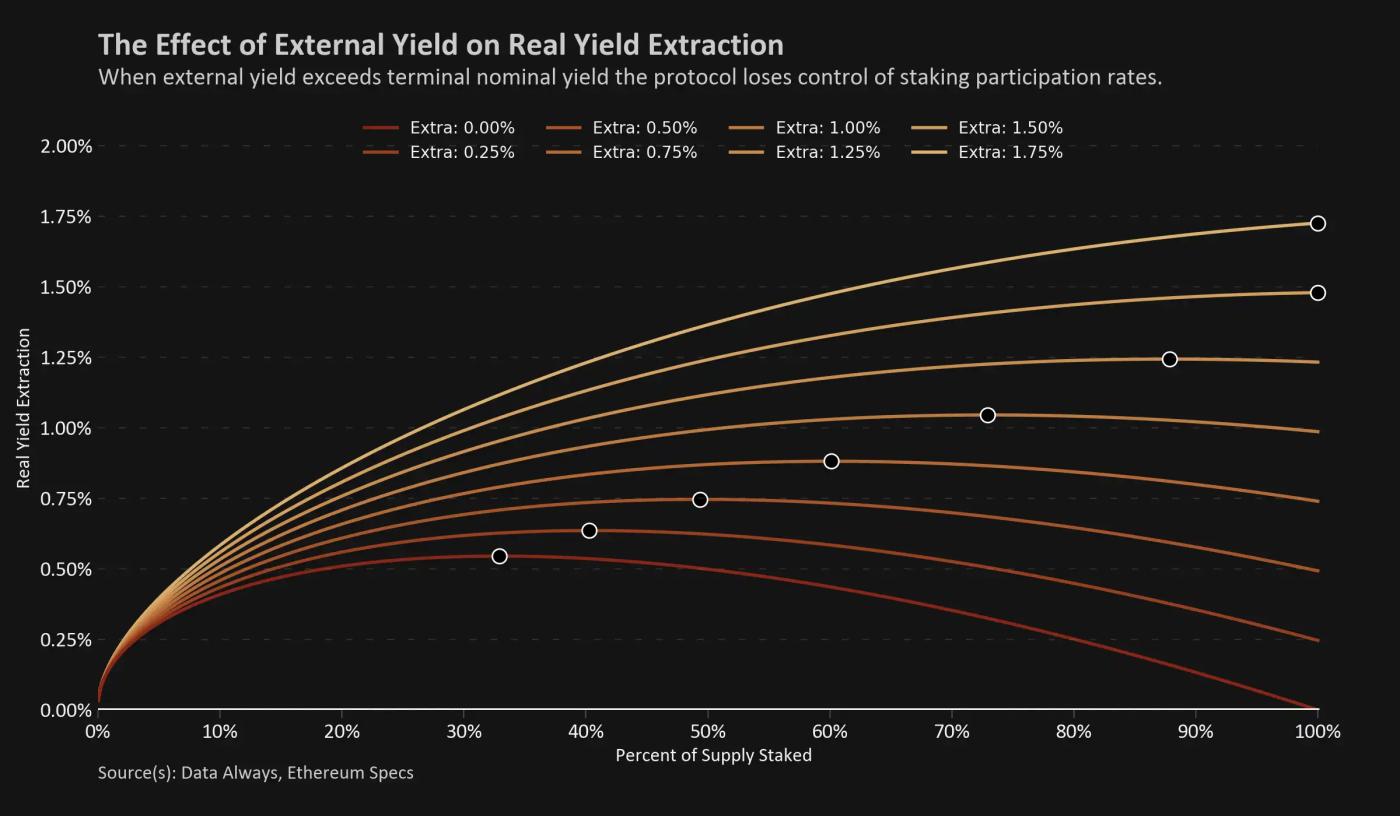

I have discussed this model in the past, but to remind readers how extracting the actual yield curve works, we should realize that staking rewards come purely from dilution by other holders and validators. If an individual owns and stakes all of the ETH in circulation, they are only diluting themselves, thus earning zero real benefit. Likewise, if there are no stakers to secure the network, then no one gains. These two boundary conditions imply the points of maximum yield extraction at 0% and 100% staked supply, which we plot in the graph above.

Any deviation from this peak would indicate a less-than-maximum collection of non-staker interests. We see the peak in the chart above as the lowest point where long-term free markets are likely to drive staking participation, around 33%.

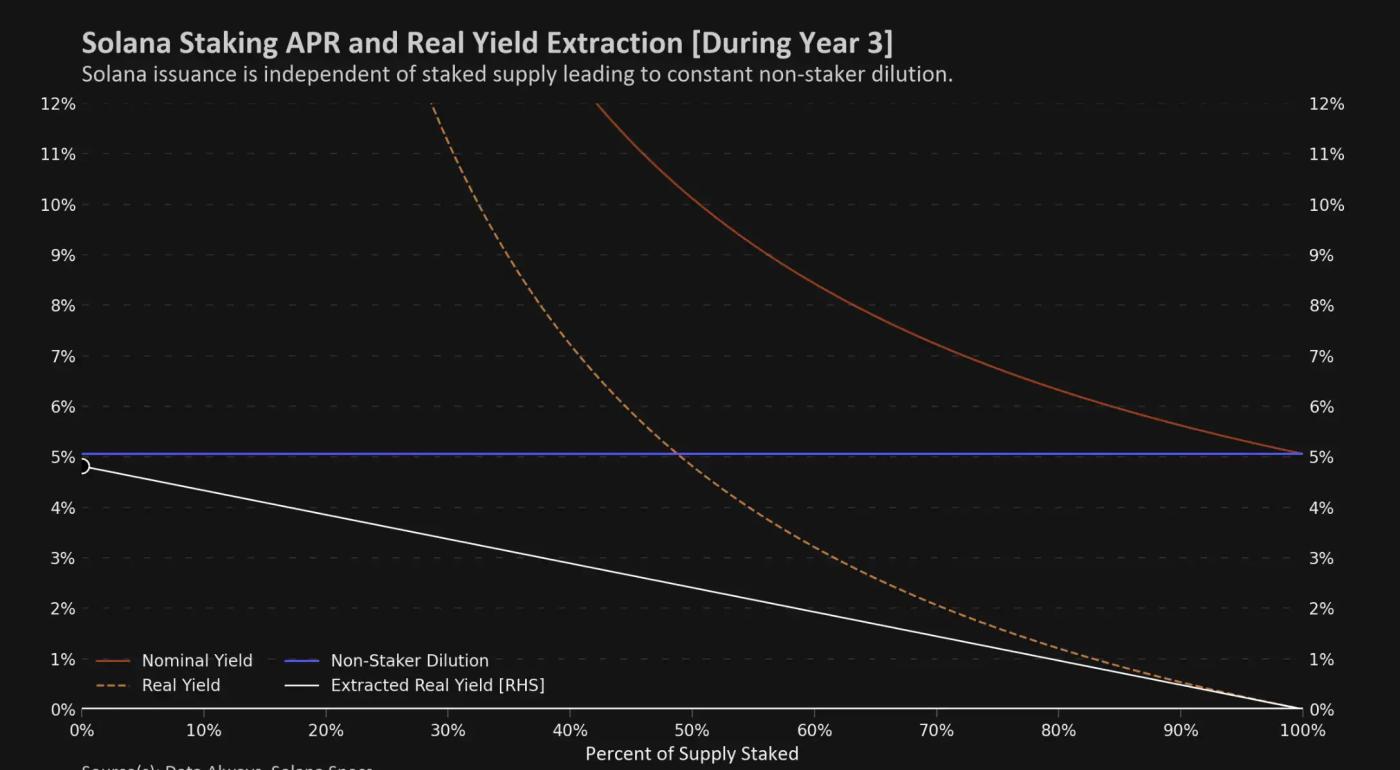

In stark contrast to Ethereum’s launch schedule, Solana’s launch is pre-set and independent of the number of validators. Therefore, to maximize extraction, monopoly stakeholders ideally hold as little supply as possible (to minimize self-dilution). In practice, however, everyone can easily delegate their stake, the issuance is still there, and the ecosystem is still developing, so we observe very high participation rates.

The role of cost and risk

This article focuses on factors that increase staking returns, but it is important to note that operating costs and risk adjustments are equally important. With the arrival of the "Shanghai" upgrade, the risk profile of participating in staking will change significantly, and more detailed discussions may be required at that time.

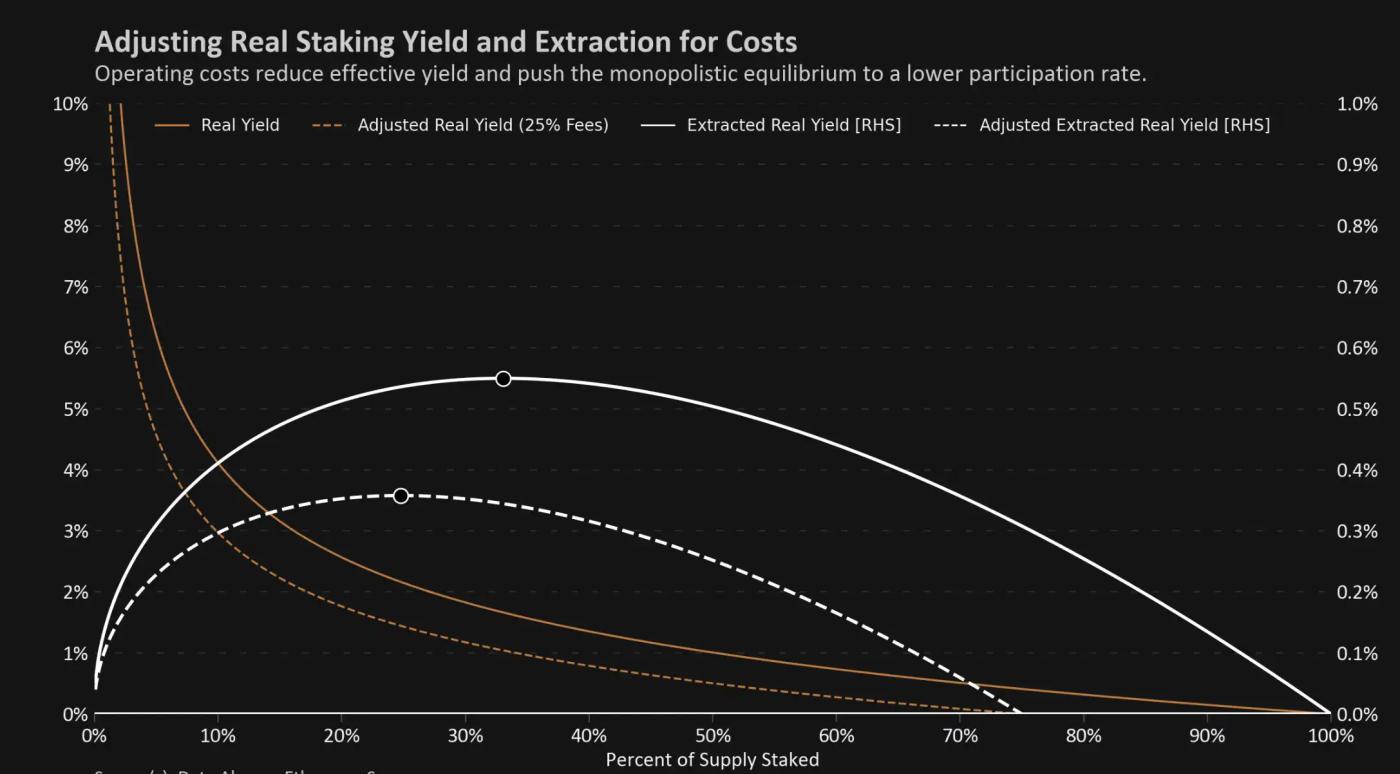

For this analysis, we will incorporate operating cost and risk adjustments by allowing the reader to choose a discount rate. This allows for some flexibility; for example, a 25% rate could represent a centralized exchange's staking fee, a Liquid Staking Token (LST) with a 15% rate and an additional 10% contract risk discount, or a home Discounts for any type of issues that stakers may encounter.

One thing to note is that fees are charged in nominal value, but the rewards that stakers should be interested in are measured in real value. When we adjust the fee, the actual return no longer approaches zero, but turns negative at high fee rates or high staking participation. The disconnect between nominal costs and real benefits shifts the monopoly equilibrium to lower participation rates.

In the diagram below, we generated profiles for different rates.

One could argue that a discount rate closer to 50% is appropriate before validator withdrawals are enabled, but we are not trying to suggest that the ecosystem is currently close to meaningful equilibrium.

Re-hypothecation and the role of external returns

Restaking, a term used to describe various activities in the staking ecosystem. When people are talking about LSTs, such as Lido's stETH or Rocket Pool's rETH, restaking generally refers to feeding staking rewards back into the ecosystem to create more validators and increase the yield earned by the protocol. Also, in early 2022, restaking is the term typically used to describe circular stETH transactions that got out of hand. Companies deposit ETH into Lido to obtain stETH, then mortgage these stETH Tokens to obtain leverage, and re-stake to obtain additional returns. This article does not discuss either of these two restaking methods.

Today, restaking is most commonly done with protocols like EigenLayer, a series of smart contracts that allow Ethereum stakers to restake their collateral to secure secondary applications or protocols. Stakers will soon be able to earn yields that exceed Ethereum’s monetary policy by choosing custom additional conditions defined by smart contracts. If you are new to this concept, I suggest you read the following:

· Consensys description of this type of protocol

The key difference between restaking using a protocol like EigenLayer or LST transactions using a loop is the concept of intrinsic and extrinsic rewards. While both approaches increase returns and risks, circular staking is limited by the negative feedback loop embedded in Ethereum’s monetary policy. In contrast, the Ethereum protocol cannot prevent users from using external yield protocols.

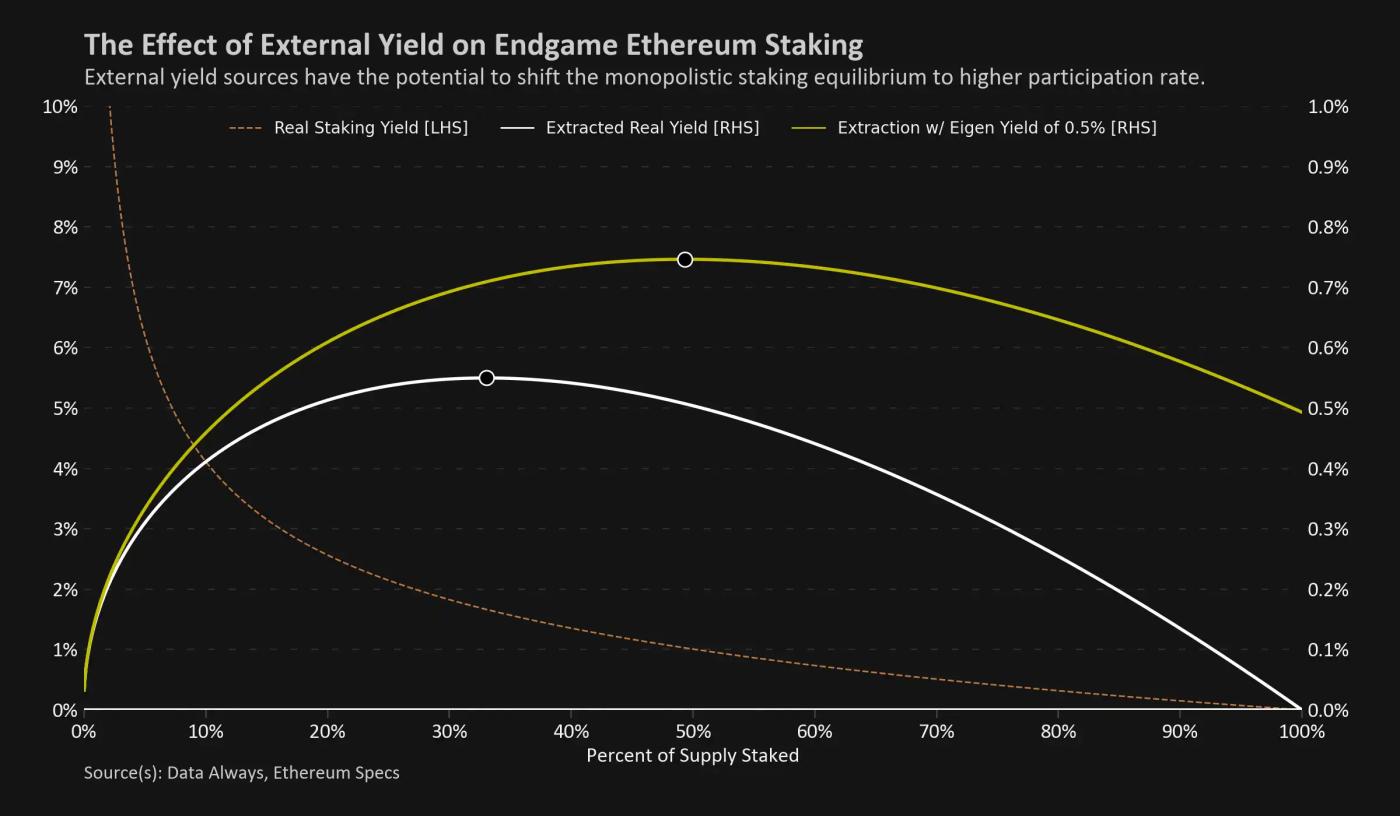

The result is that circular staking moves the equilibrium point to a lower percentage of staked supply, while external re-staking moves the equilibrium point to a higher percentage of staked supply.

When we model evolving equilibrium points for different external rehypothecation yields, the results are striking. Since external rewards are not self-diluting, even a small increase in rewards can have a huge impact on the staking ecosystem. A protocol like EigenLayer that yields as little as 1% can push even the best staking dynamics to unsustainable levels.

Adoption of a minimum viable issuance policy is generally considered by the Ethereum research community to be the key to curbing high staking participation rates. The idea is that if too many people want to stake, lowering yields will make staking less attractive, while also improving the monetary properties of cryptoassets.

Due to the competitive nature of the network, the Minimum Viable Issuance policy may still have the desired effect, but in a monopoly optimization problem, re-staking will subvert the results. In this dynamic, reducing protocol issuance reduces the effect of self-dilution and encourages monopolies to stake more tokens and take advantage of external benefits.

To regain monopoly equilibrium and reduce the optimal staking level for large players, the correct game-theoretic strategy would be to shift to increasing staking APR, imposing more value on other holders, rather than earning re-staking rewards.

Low issuance and high participation may be acceptable outcomes for the network, but it is important to monitor changes in centralization of staking. For example, if Lido's integration with EigenLayer was the most popular outcome in the market, MVI probably wouldn't be an effective solution either.

in conclusion

The re-staking protocol distorts the intrinsic staking feedback loop. In the long run, Ethereum may not be able to adjust APR to resist high staking participation rates and centralization forces.

The core solution to this problem has been discussed for years, and Data Always believes that eventually there needs to be a cap on the number of active validators. To continue this discussion, one should look to Ethereum's Robust Incentives Group, and Anders and Barnab's work on auctioning validator slots.