Sissi|Author

background

2022 is going to be a tough year for cryptocurrencies. The thunder of many projects and the deteriorating macroeconomic environment have caused a sharp decline in crypto assets. Previously, many projects achieved business growth by adopting an incentive token economic model, but lacked sustainability. Especially in the crypto winter period, when asset prices plummeted, the incentives did not work. It is very important to design a good economic model, use tokens to motivate all parties to participate in the business, promote a positive cycle of the business, continue to grow, and maintain a reasonable currency price through the balance of supply and demand. Next, we will review the changes in the token economics of 6 mainstream projects in 2022. The changes are aimed at promoting the sustainable development of projects, reserving momentum for the next bull market and creating more value.

Bitcoin ($BTC)

“Taproot” Upgrade, Increased Adoption

As one of the central players in the encryption industry, Bitcoin will perform as expected in 2022, outperforming most other encrypted assets. Whether it is an asset or the underlying public chain, it is the focus of the entire industry. From the early forked chain, to the maturity of the Lightning Network, to the emergence of various technologies such as RGB, Bitcoin has been in the process of development iteration.

The recent “Taproot” upgrade is by far the most significant Bitcoin protocol upgrade. Designed to improve the privacy and efficiency of the network, it is larger than previous upgrades and is expected to have a more significant impact in the years to come. In addition, the "Taproot" upgrade also encourages the implementation of smart contracts, which can be used to eliminate intermediaries in transactions and open the door to DEFI for top cryptocurrencies.

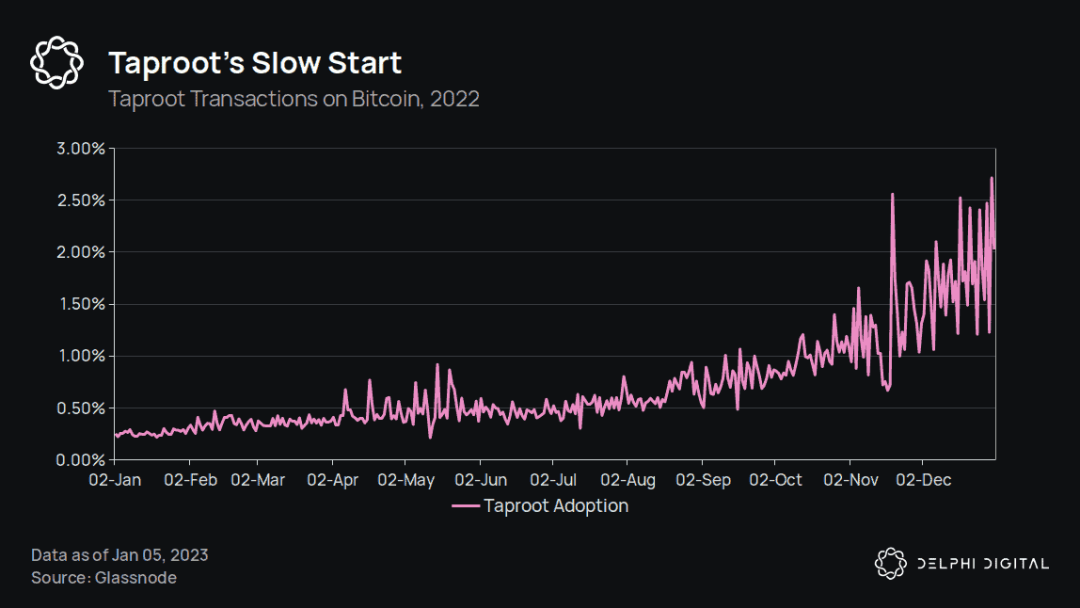

As can be seen from the figure below, the adoption rate of Taproot is not high at the beginning of 2022. After one year, the proportion has reached 2.5%, and the proportion may continue to increase in the future. In addition, many upgrades in Taproot are very fundamental, providing greater help to the development of some infrastructure, such as introducing more asset issuance and stable currency issuance through the Lightning Network.

Ethereum ($ETH)

After "Merge", the issuance will decrease and deflation will start

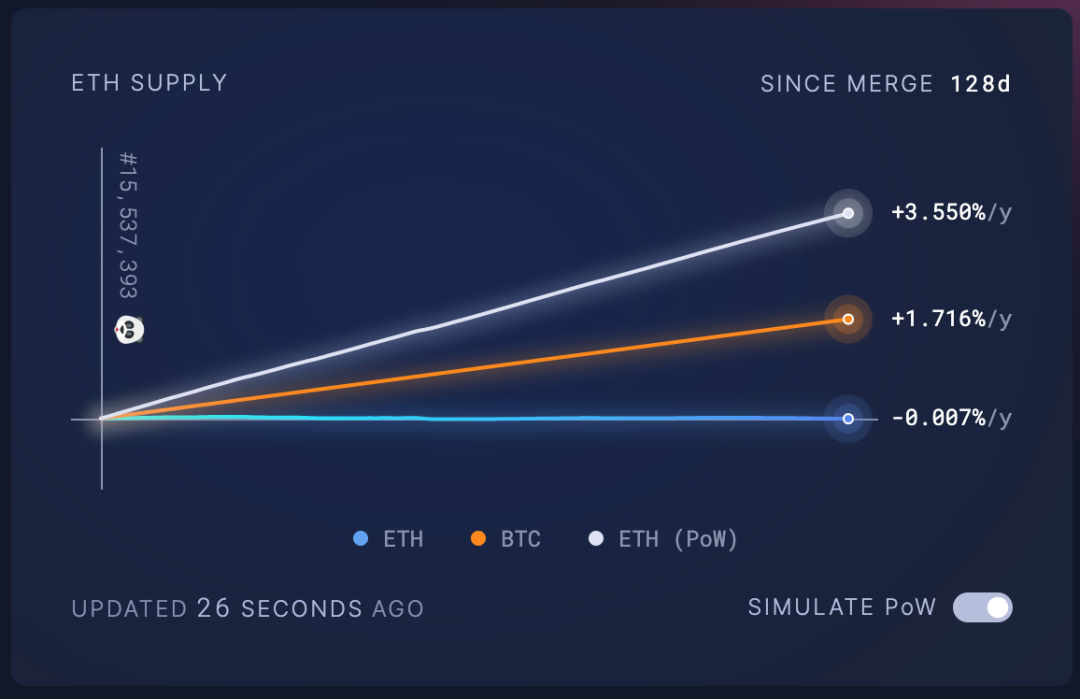

Ethereum completed the "Merge" on September 15, 2022, officially shifting from the proof-of-work PoW consensus algorithm to the proof-of-stake PoS. The merger will result in a reduction of ETH issuance from 4.2% to 0.2%, as well as a burning mechanism. Depending on the transaction volume of the network, the network is expected to experience a net deflation of 1-2%. Judging from the following supply map of ETH on January 21, 2022, even in a bear market, ETH after "Merge" began to deflate. Under the same circumstances, if the POW consensus mechanism is adopted, the inflation is around 3.55%.

source: https://ultrasound.money/

Cosmos ($ATOM)

The newly released 2.0 token economy makes token issuance predictable

The official Cosmos 2.0 white paper was released in September 2022, proposing a new token economics design aimed at improving scalability and security, and making token issuance more predictable.

1.0 Under the token economy, the token economy balances security and liquidity by regulating the inflation issuance through the pledge rate. If $ATOM the collateralization rate is below the lower threshold, token issuance is increased and additional collateralization is incentivized for increased security but resulting in lower liquidity. If the pledge rate exceeds the upper threshold, the issuance is reduced, the pledge is reduced, and liquidity is improved (at the expense of security). There is always a balance between security and liquidity. The theoretical annualized inflation rate of $ATOM is between 7% and 20%, but it actually remains above 10%.

Under the new 2.0 token economy, the monthly token issuance will drop from 10 million $ATOM to 300,000 in 3 years, and will enter into a stable or even deflation after 3 years. Under the new token economy, the high inflation during the initial issuance period has caused great controversy in the community, and users who already hold $ATOM are worried about being diluted. Even after Cosmos revised the white paper, it was changed to issue 4 million in 10 batches $ATOM, but it was still strongly opposed by the original founder of Cosmos, Jae Kwon, who believed that most of the $ATOM would eventually flow into the national treasury.

Yearn Finance ($YFI)

Using the veToken model, incentives for holders of $YFI are consistent with Yearn's long-term development

At the end of 2021, in order to strengthen the connection between the performance of the protocol and the token $YFI, the community passed the proposal of "evolving YFI token economics". It introduces the classic veToken model: granting governance rights to long-term holders of YFI and rewarding income. In exchange for locking $YFI, $veYFI holders receive:

- Repurchase $YFI by increasing the yield on yVault deposits and all gauge rewards;

- veYFI locks early exit penalty;

- Governance rights, including gauge weights and deciding how to distribute staking rewards in the yVault.

SushiSwap ($Sushi)

Removal of subsidy incentives

In December 2022, the CEO of SushiSwap, which started with token economic incentives and took this as its core, announced that emission-based rewards are unsustainable. In the newly implemented token economics, the liquidity providers of the protocol will no longer be subsidized. And Sushi is researching veToken and measuring the feasibility of the model, hoping to implement it in Sushi's token economics and governance.

PancakeSwap ($Cake)

Limit the upper limit of token supply & lock tokens to obtain multiple benefits

In May 2022, the Pancake community voted through a new token economics plan to curb inflation and bring more benefits to long-term holders.

The unlimited supply of $CAKE has been one of the most widely discussed topics in the community. The new proposal caps the maximum supply of $CAKE at 750 million, no change to current emissions, and multiple benefits for users who lock their $CAKE through the regular staking option. Derivative tokens and rights are as follows:

- $vCAKE - Strengthen governance voting

- $iCAKE – Enhanced IFO Advantage

- $bCAKE – Improve farm profitability

at last

Based on the original token economic model, the above mainstream projects have improved the design of token supply, utility, and incentive mechanisms to ensure the long-term sustainable development of the project. In terms of incentive mechanism and governance, some tend to use the veToken model adopted by many projects.

A token economic model that matches business development is an important factor for the success of the Web3 project. A well-designed token economic model will bring a good user experience, increase value, and improve profitability. Conversely, a bad token economic model will lead to rapid depreciation, poor experience, loss of users, and even project collapse .

TEDAO: The content of this article comes from TEDAO, which is for study and research reference only, not investment advice. For reprinting/content cooperation/seeking reports, please contact TEDAO for authorization and indicate the source.