Arbitrum's recent AirDrop has undoubtedly once again achieved the myth of "creating wealth" in the currency circle. If compared with the first AirDrop conducted by Optimism at the end of May last year, what is the effect of "creating wealth" of Arbitrum's AirDrop? So far, two of the four major Layer 2 star projects have conducted AirDrop, which has aroused users' strong expectations that ZkSync and Starknet will also conduct AirDrop in the future. So what are the AirDrop rules for Optimism and Arbitrum? What commonalities can provide users with reference? Another question worthy of attention is, what impact will the AirDrop have on the fundamentals and ecology of the network?

The data news column PAData under PANews comprehensively analyzed the AirDrop data and on-chain data and found that:

1) The capital scale and user scale of Arbitrum’s AirDrop are larger than the first AirDrop.

2) Arbitrum’s AirDrop may be more friendly to ordinary users, while the first AirDrop may be more friendly to highly active users. Judging from the estimated average "wealth creation" effect, most addresses can make a profit of $700 in the first AirDrop; if estimated according to the maximum number of AirDrop, a single address can make a profit of up to $45,000. Most addresses can earn $1,350 in Arbitrum’s AirDrop; if estimated according to the maximum number of AirDrop, a single address can earn $13,800.

3) The second AirDrop is about 0.27% (11,742,277.10 OP) of the initial supply, which is equivalent to 13.73% (589,553,144.34 OP) left without AirDrop. The remaining part may be used for the next 3 rounds and more.

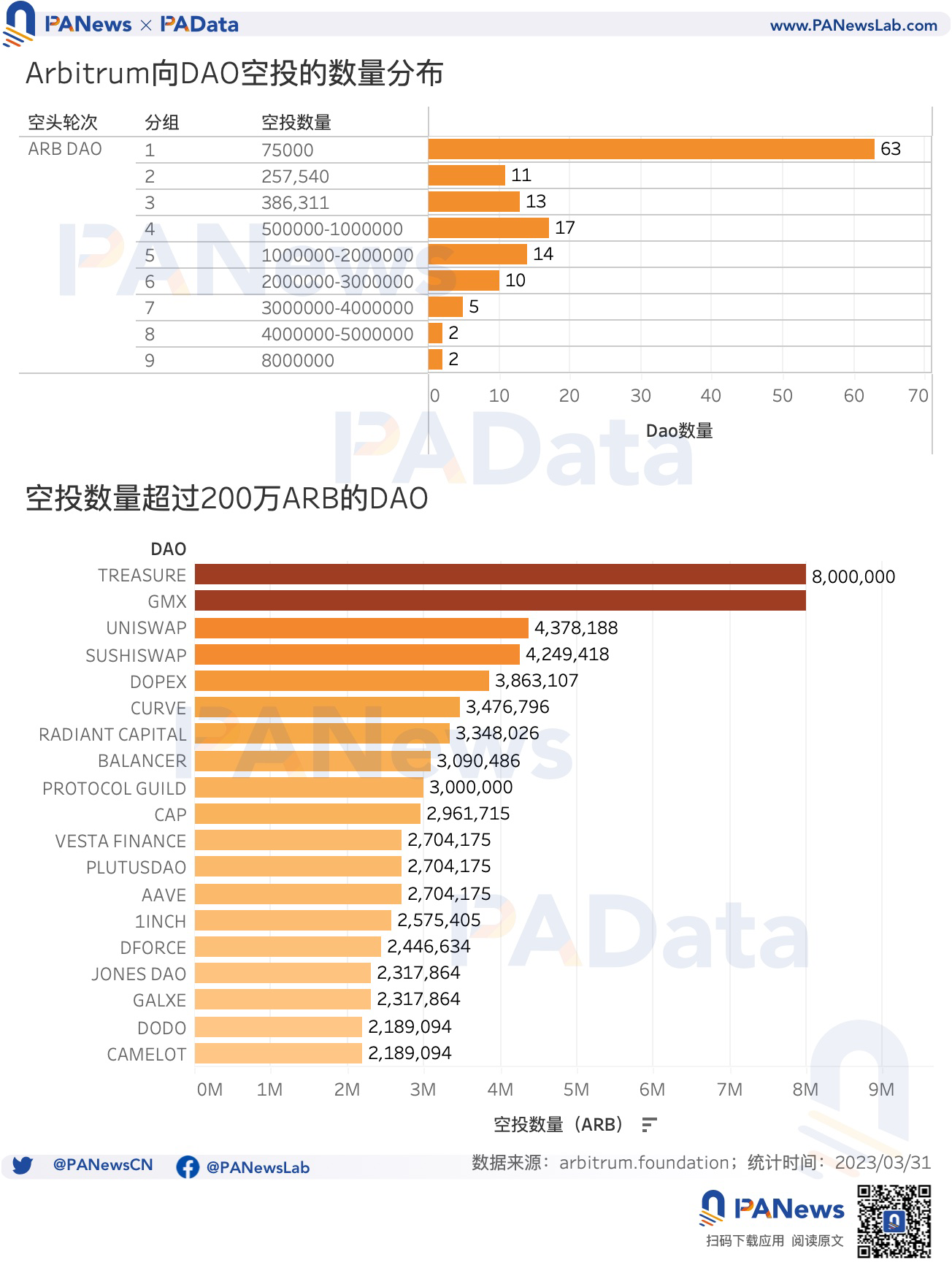

4) Some of the DAOs that have received the Arbitrum AirDrop consider AirDrop the obtained AirDrop to users again, which may form a de facto "second round". 137 DAOs received AirDrop ranging from 75,000 ABR to 8 million ARB, and 19 DAOs received AirDrop of more than 2 million ARB, including GMX, Uniswap, DOPEX, etc.

5) Since the Arbitrum AirDrop, the activity on the Nova chain has increased slightly, and the number of daily transactions and the number of new addresses have increased by more than 196%. This is related to rumors that Arbitrum may incentivize Nova users in the future, but nothing has been confirmed yet.

6) Both Optimism and Arbitrum increased the total locked-up amount of DeFi on their chains after the AirDrop. Among them, within one month after the two rounds of AirDrop of Optimism, the total locked-up amount increased by 101% and 10% respectively. Since the AirDrop of Arbitrum, the total lock-up amount has also increased by 7.97%.

Most addresses earned about $700 in the OP AirDrop and about $1350 in the ARB AirDrop

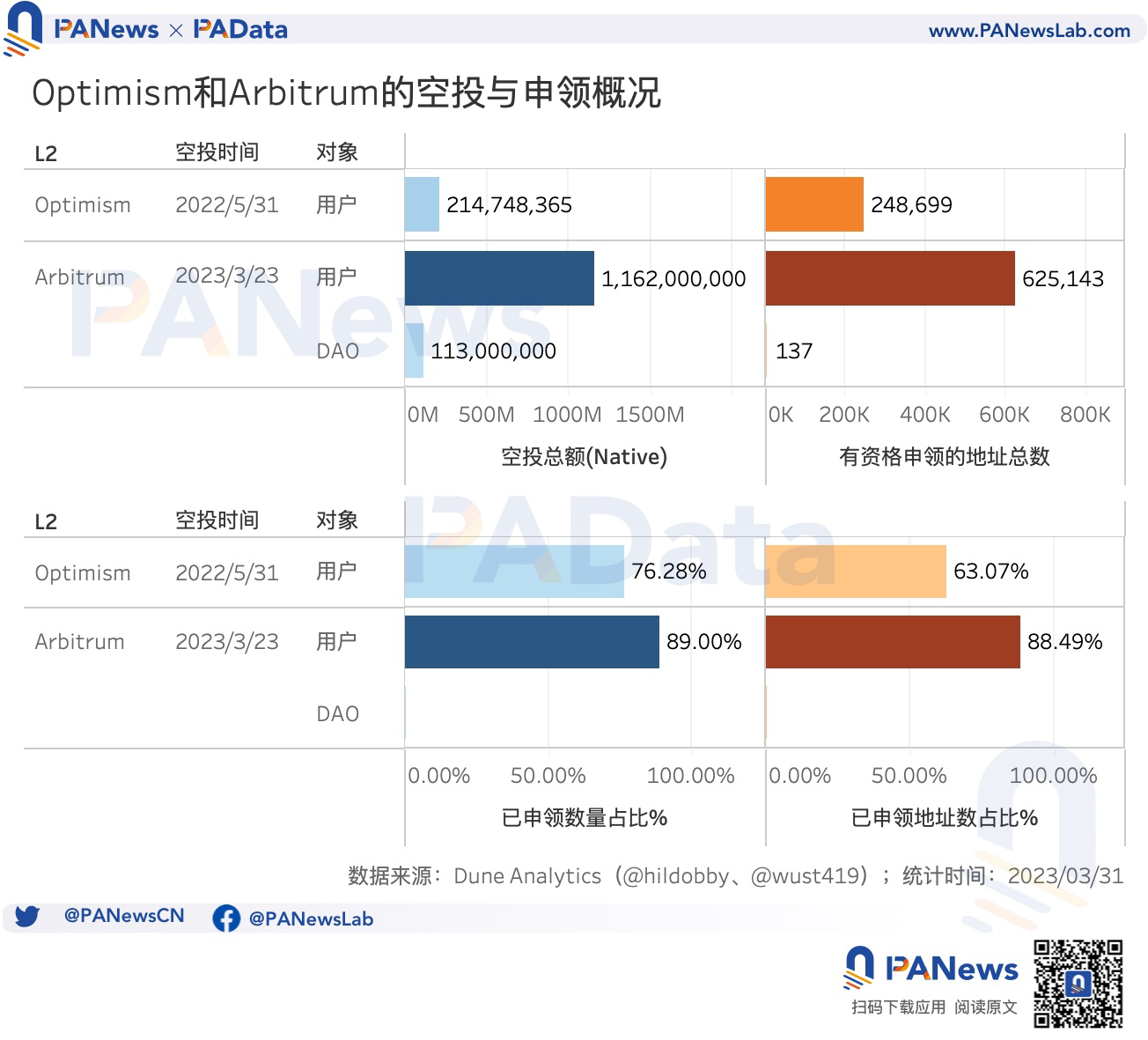

The scale of Arbitrum’s AirDrop is larger than the first AirDrop. Judging from the objects of the AirDrop, Arbitrum’s AirDrop not only covered 625,100 user addresses, but also covered 137 important DAO Treasury addresses. Optimism only covers 248,700 user addresses.

From the perspective of the number of AirDrop, the total amount of Arbitrum AirDrop reached 1.275 billion ARB, 91% of which were for users. Optimism’s first AirDrop totaled 215 million OP. Based on the estimated price on the first day of launch, the estimated value of Arbitrum’s AirDrop is 1.715 billion U.S. dollars (the price on the first day of launch shown by Coingecko is about 1.35 U.S. dollars), and the estimated value of the first AirDrop is 3.00 billion (Coingecko shows a price of around $1.40 on the first day of launch).

Up to now, 88.49% of Arbitrum’s AirDrop addresses have claimed 89% of the tokens, and the remaining tokens can still be claimed until September 23. In contrast, only 63.07% of the addresses in the first AirDrop of Optimism claimed 76.28% of the tokens, and the completion of the AirDrop was not high.

So, with such a large-scale AirDrop, how much profit can each address make?

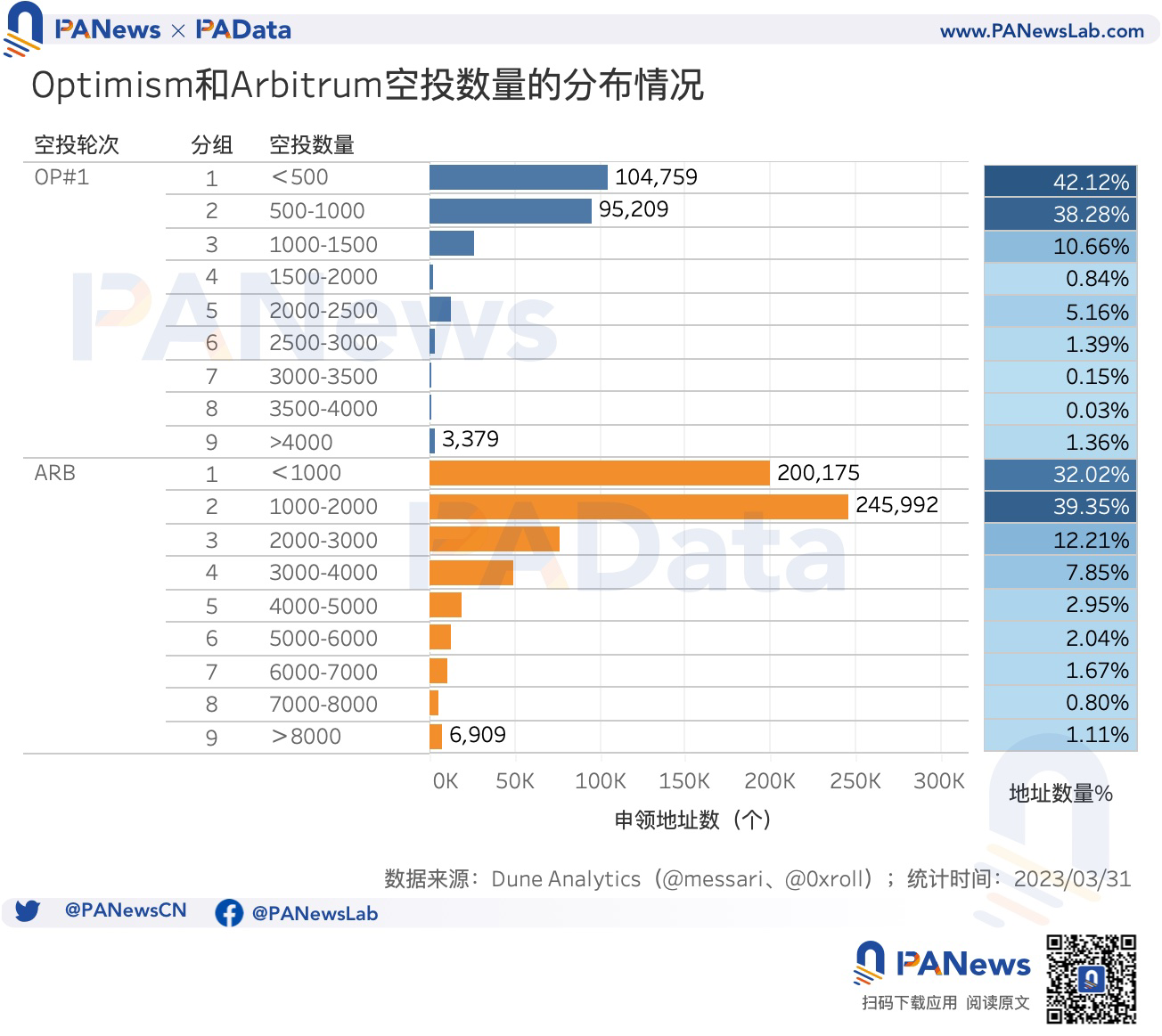

According to the AirDrop standard announced by the Optimism official community, a single address can get at least about 272 OP, and the highest can get 32432 OP. The number of AirDrop obtained by different addresses varies greatly. According to the group statistics of DuneAnalytics (@messari), 42.12% of the qualified addresses received AirDrop of less than 500 OP, and 38.28% of the qualified addresses received AirDrop between 500-1000 OP, that is, more than 80% of the qualified addresses received profits from Within 1000 OP.

If the group average of 0-1000 OP is 500 OP as the number of AirDrop obtained by the majority of addresses (mode), and combined with the closing price of OP on the day of the AirDrop and within one month thereafter to estimate the average "rich" effect, then, Most addresses can make a profit of $700, and the highest profit within 1 month after the AirDrop is $770. If the maximum profit of a single address is considered, according to the estimation of the maximum number of AirDrop, a single address can make a profit of 45,000 US dollars, and the maximum profit within one month after the AirDrop is about 50,000 US dollars.

Let's look at Arbitrum again. According to the AirDrop standard published on the official website of the Arbitrum Foundation, the number of AirDrop available to a single address is between 625 ARB and 10250 ARB. According to the group statistics of DuneAnalytics (@0xroll), 32.02% of the qualified addresses received AirDrop of less than 1000 ARB, and 39.35% of the qualified addresses received AirDrop between 1000-2000 ARB, that is, more than 70% of the qualified addresses received profits from Within 2000 ARB.

Similarly, the group average value of 1000 ARB from 0-2000 ARB is used as the number of AirDrop obtained by the majority of addresses (mode), and combined with the closing price of ARB on the day of the AirDrop and since then to estimate the average "wealth creation" effect, then most The address can make a profit of $1350, and the highest profit so far is about $1400. If the highest profit for a single address is considered, then based on the estimated maximum number of AirDrop, a single address can make a profit of 13,800 US dollars, and the highest profit so far is about 14,000 US dollars.

In contrast, when considering the profit of a single address, the profit of most addresses in the Arbitrum AirDrop($1,350) is about double that of the first AirDrop of Optimism ($700). The largest profit of the address in the Arbitrum AirDrop($13,500) was only about 30% of Optimism ($45,000). Arbitrum’s AirDrop may be more friendly to the general public, while the first AirDrop may be more friendly to highly active users.

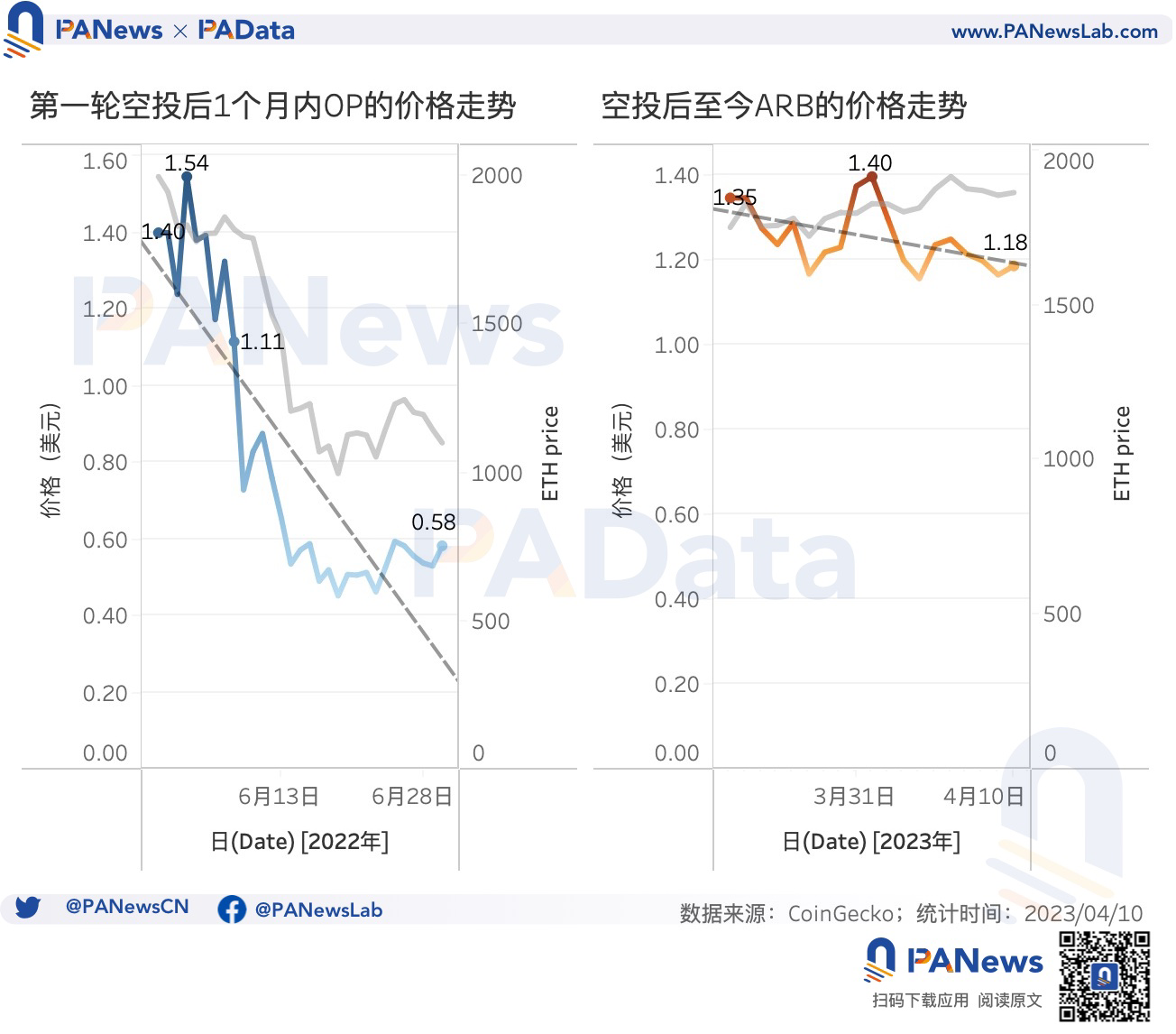

It is generally believed that tokens will undergo greater selling pressure after the AirDrop, and the price will drop. Judging from the first AirDrop, this is indeed the case. OP dropped from $1.40 on the day of the AirDrop to $0.58 one month later, a drop of about 58.57%. ARB has also experienced large fluctuations since the AirDrop, and faced a large selling pressure in the early stage.

Further combining the price trend of ETH, it can be found that the price trend within one month after the OP AirDrop is statistically correlated with the trend of ETH, but the price trend since the ARB AirDrop is opposite to the trend of ETH, but this may be influenced by the Arbitrum Foundation The comprehensive governance package Arbitrum Improvement Proposal (AIP-1) launched was questioned by the community. This shows that the trend of the token price after the AirDrop is affected by both internal and external factors. On the one hand, the price trend of the AirDrop token has a certain relationship with the overall encryption market. The user's selling strategy needs to consider the market environment. On the other hand, the price of AirDrop tokens is also related to the consensus and confidence of the community, and the AirDrop will more closely connect roles such as foundations, communities, and developers.

The second AirDrop: The size of the second round of OP AirDrop is only 0.27% of the initial supply

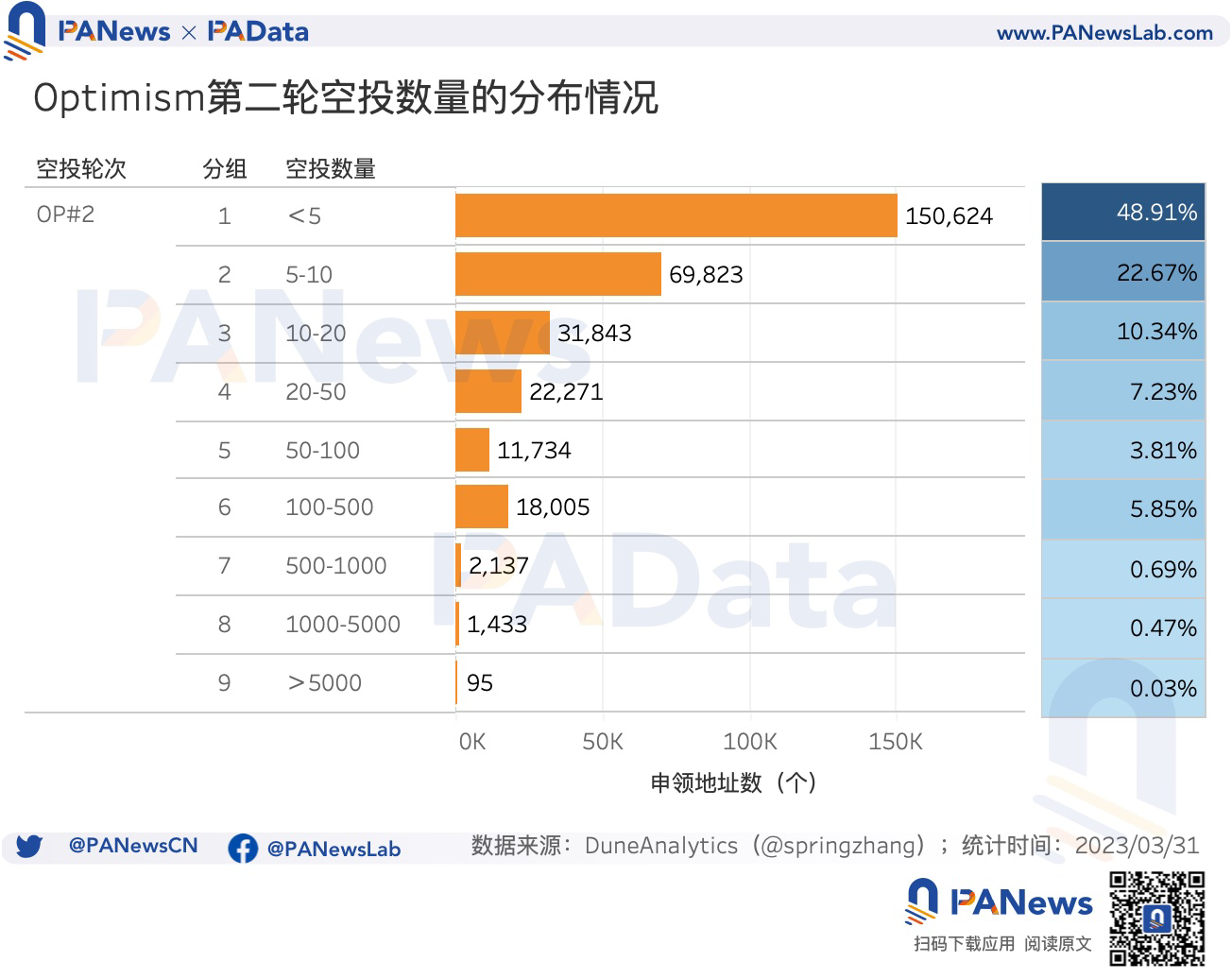

Optimism conducted a second AirDrop on February 9 this year for users who participated in governance and actively used the network. The total AirDrop were about 11.7423 million OP, and the number of addresses eligible for AirDrop was about 308,000. According to the AirDrop rules announced by the Optimism official community, the initial total supply of OP will be 4,294,967,296, of which 19% (816,043,786.2 OP) will be used for AirDrop. The first round has AirDrop 5% (214,748,364.80 OP), and the second AirDrop is estimated based on the quantity, which is about 0.27% of the initial supply (11,742,277.10 OP), which is equivalent to 13.73% (589,553,144.34 OP) left without AirDrop. The remaining part may be used for the next 3 rounds and more.

Judging from the grouping of AirDrop, about 72% of the AirDrop addresses received less than 10 OP. If combined with the group average of 5 OP and the price on the day of the second AirDrop, most addresses can only get $13.8. The effect of "creating wealth" is far less than the first AirDrop.

Arbitrum did not indicate in the AirDrop rules that there will be other rounds of AirDrop in the future. However, part of this AirDrop was given to the DAO, and some projects will AirDrop the obtained AirDrop to users again. Allocations were voted on, which may have formed a de facto "second round".

Arbitrum made a comprehensive evaluation of the launch time, local or multi-chain, TVL, transaction volume, transaction value and other indicators of the protocols under DAO governance, and AirDrop 75,000 ABR to 8 million ARB to 137 DAO Treasury addresses. Among them, 46% of the DAOs received an AirDrop of 75,000 ARB, which is equivalent to $101,300 according to the estimated price on the first day of listing. In addition, 19 DAOs received more than 2 million ARB AirDrop, including GMX, Uniswap, DOPEX, etc.

After the AirDrop, the activity on the Optimism chain decreased, and the activity of ArbitrumNova rose sharply

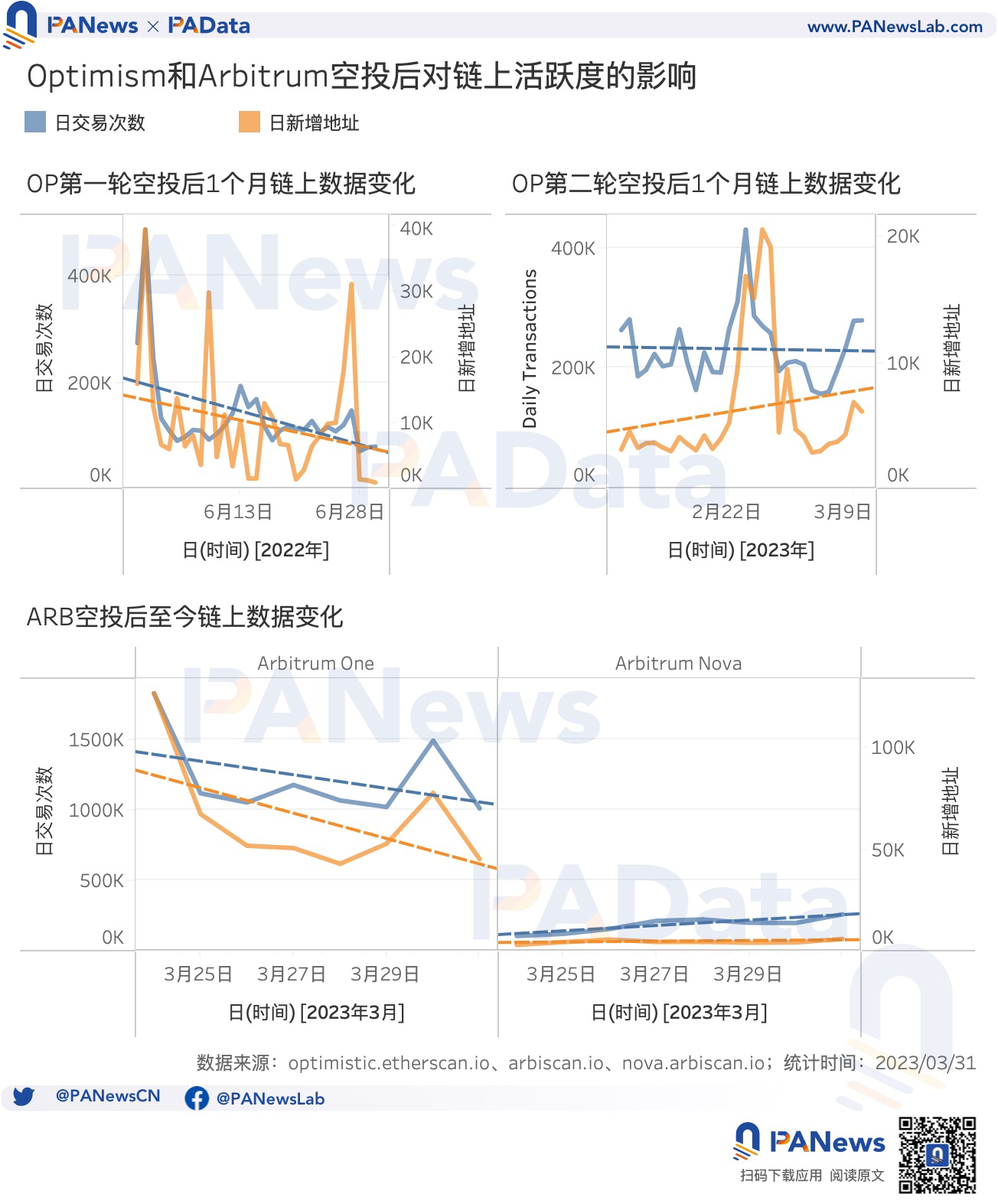

One of the main purposes of AirDrop is to increase the activity of the network by incentivizing users. According to statistics, within one month after the first AirDrop of OP airdrops, the number of daily transactions on the chain dropped from 273,800 to 78,600, a drop of 71.31%, and the number of new daily addresses dropped from 15,900 to 885, a drop of 94.42%. Within one month after the second AirDrop of OP airdrops, the number of daily transactions on the chain rose from 262,800 to 279,000, a slight increase of 6.17%, and the number of daily new addresses increased from 3,071 to 6,088, an increase of 98.24% .

In general, in the short term after the OP AirDrop(within 1 month after the first AirDrop), the activity on the chain did not increase, but in the long term (within 1 month after the second AirDrop), the activity on the chain increased Improvement, but it is difficult to attribute this improvement only to AirDrop.

The situation of Arbitrum is similar. According to statistics, since the ARB AirDrop, the number of daily transactions of ArbitrumOne, the main reference network for this AirDrop, has dropped from 2,733,900 to 1,006,700, a drop of 63.17%, and the number of new addresses per day has dropped from 107,200 to 45,000, a decrease of 57.96%. It can be seen that in the short term (as of March 31), the activity on the chain has also not increased.

However, ArbitrumNova’s on-chain activity has increased slightly during the same period. Since the AirDrop, the number of daily transactions has increased from 86,500 to 256,800, an increase of 196.94%, and the number of new addresses per day has increased from 1931 to 5725, an increase of 196.48 %. This is related to rumors that Arbitrum may incentivize Nova users in the future, but nothing has been confirmed yet.

It can be seen that users may actively participate in on-chain interactions in anticipation of future AirDrop, as shown by ArbitrumNova, and recent on-chain data from ZkSync and Starknet. However, this expectation-driven behavior does not necessarily have long-term continuity , or in other words, it does not necessarily have long-term continuity for a wide range of ordinary users, so it will not appear as a long-term upward trend of on-chain data, just as the current on-chain data of ZkSync and Starknet have begun to fall. The increase in activity on the chain may be affected by more complicated factors, and AirDrop are just one of them.

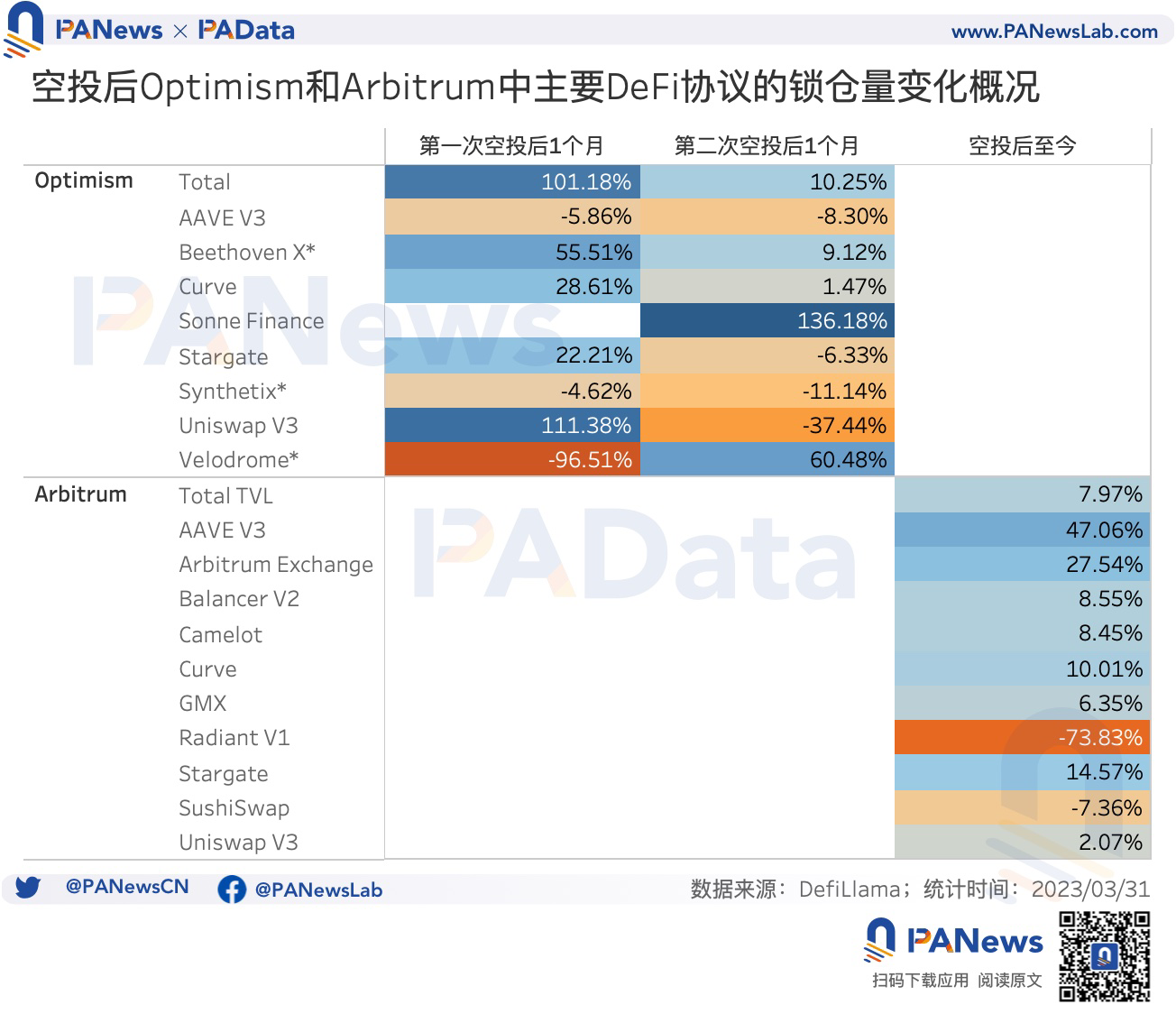

Another main purpose of the AirDrop is to promote the development of the ecology on the chain. At the same time, the interaction between users and the protocol on the chain is often the basis for the AirDrop. According to statistics, both Optimism and Arbitrum have increased the total lock-up amount of DeFi on their chains after the AirDrop. Among them, the total lock-up amount of Optimism increased by 101.18% within one month after the first AirDrop, and one month after the second AirDrop. During the period, the total lock-up amount increased by 10.25%. Since the AirDrop of Arbitrum, the total lock-up amount has also increased by 7.97%.

However, the lock-up volume of the leading protocols after the AirDrop has varied. Among them, the lock-up volume of Uniswapv3 increased by 111.38% within one month after the first AirDrop, and the lock-up volume of SonneFinance increased by 136.18% within one month after the second AirDrop, a significant increase. Since the Arbitrum AirDrop, the locked volume of AAVE v3HE ArbitrumExchange has increased significantly, all above 25%.