Topic summary about LSD

Author: Vernacular Blockchain

Produced by: Vernacular Blockchain (ID: hellobtc)

Cover: Photo by Shubham Dhage on Unsplash

Ethereum has successfully completed the Shapella upgrade at 6:30 on April 13, Beijing time. According to the real-time data of Token Unlock, after the upgrade is completed, the net withdrawal of Ethereum is 50,000 tokens. In the next 11 hours, it is estimated that The withdrawal amount is 107,000 ETH, and there are still 525,000 ETH pending withdrawal. At present, the total number of pledges on Ethereum has dropped to 17.64 million, and the annualized rate of return on pledges is 5.06%.

The conversion of Ethereum to PoS has ignited the new DeFi track-LSD (Liquid Staking Derivates), that is, liquid staking, which has become one of the most popular narratives in the industry since the first half of 2023. Redemption makes the LSD track more complete.

Birth of LSD

The block production of the earliest Ethereum is similar to that of Bitcoin, mainly in the PoW mode. Miners use graphics cards to produce blocks to obtain ETH rewards.

On December 1, 2020, Ethereum officially entered the 2.0 era, starting the transformation from POW to POS. However, at this time it is still the initial stage of ETH2.0, but POS has not yet been realized. The real POS will not be realized until The Merge upgrade in the second half of 2022, that is, Ethereum officially enters the 2.0 era.

A significant change brought about by Ethereum 2.0 is that ETH 2.0 verifiers/verification nodes only need to mortgage 32 ETH to participate in the consensus mechanism of the 2.0 ecological network to obtain rewards, which is to change the traditional method of obtaining rewards through the graphics card computing power production interval. Way.

Starting from December 1, 2020, users can pledge ETH on the beacon chain of Ethereum, which is also the opening of the liquid staking track LSD.

So what exactly is Ethereum 2.0 staking? How to participate in ETH2.0 pledge and maximize returns? For details, please refer to this article: "Ethereum enters the 2.0 era, can it bring a new wealth effect?" Start from the first step to understand ETH2.0 pledge" .

Thriving through ups and downs

By December 2021, the Ethereum 2.0 pledge has been in operation for nearly a year. According to the official data of ethereum.org, as of December 24, 2021, the number of ETH participating in the pledge of Ethereum 2.0 has exceeded 8.75 million, and the pledge amount accounts for The total circulation of Ethereum exceeds 14.28%, of which the total number of verifiers is 273,600.

A series of Ethereum 2.0 pledge services have also emerged in the market. What are the specific service types of these ETH pledges? For details, please refer to this article: "London's upgraded Ethereum has burned more than 1 million tokens, and the Ethereum 2.0 pledge track is gradually becoming clear? " .

However, the Luna unanchoring event that began on May 8, 2022 has brought a heavy blow to the entire industry, and the price of ETH has also suffered a severe setback. The subsequent unanchor of stETH will inevitably bring panic, but stETH will be like Will the stablecoin de-anchor drag down ETH ? Looking back at the past now, it is obviously negative. However, the article at that time "stETH caused a big panic, will Ethereum follow in the footsteps of Luna?" An article that tells you what you should be most worried about " , there is an in-depth analysis about the death spiral that stETH will not bring about Ethereum.

Since the successful conversion of Ethereum to PoS in September 2022, the pace of Ethereum upgrade has been much faster, and ETH pledges have also continued to develop well, which has also brought a lot of vitality to the long and dull bear market. Coupled with the announcement of the Ethereum Shanghai upgrade to be carried out this year, the redemption function of pledged ETH will be opened, which means that pledged users can start to get back ETH.

Faced with the pledge of a huge amount of 18 million ETH , once the redemption function is opened, will it bring about selling pressure on ETH , resulting in a sharp drop in price? And, what is the development of the current popular LSD track? This article gave us the answer "Ethereum has ushered in an important upgrade again, will 16 million ETH be unlocked and smashed?" The track is heating up...》

Sudden regulation triggers a new pattern?

Since The Merge of Ethereum, the LSD track has been advancing all the way, and it seems to have become the biggest new narrative in the encryption industry in 2023. On February 9, the U.S. Securities and Exchange Commission SEC suddenly supervised the policy, "hoping to cancel the encrypted asset pledge service for retail customers in the United States." As soon as the news came out, Kraken, which ranks second only to Coinbase in ETH pledge volume, announced the termination of its encrypted asset pledge service for US users.

However, this sudden supervision did not cause a big blow to the Ethereum pledge track . Even under the influence of the SEC's supervision, the pledged ETH in some centralized institutions will also accelerate the outflow to decentralized LSD service platforms such as Lido Finance. For details, please see this article "Termination of Service! The US SEC launched an attack on the leading platform, and the pattern of the Ethereum LSD track changed? " .

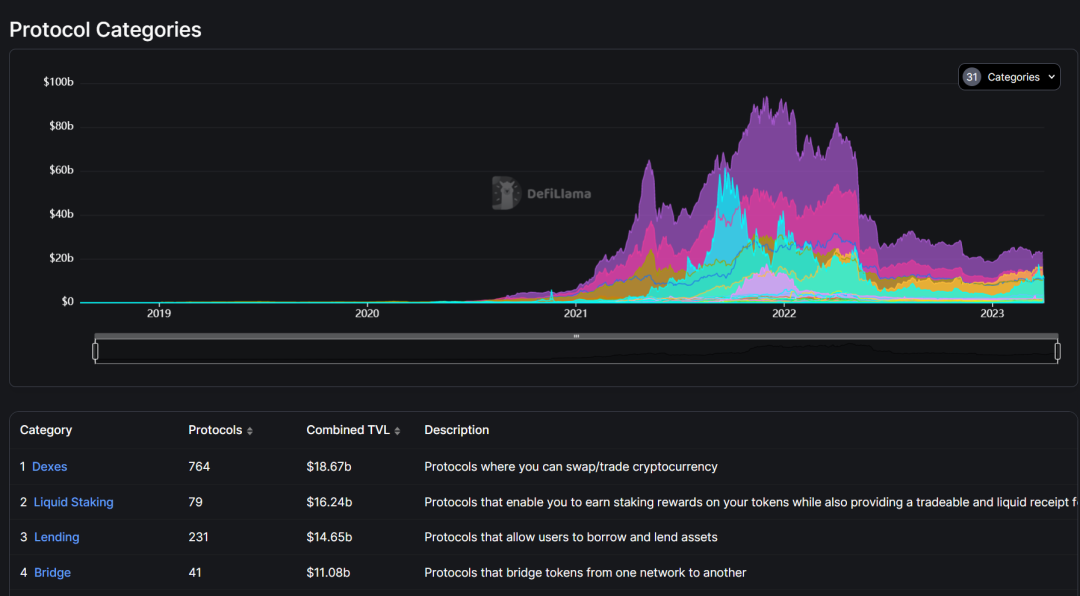

According to defillama data, as of now, the total value of encrypted assets deposited in Liquid Staking (Liquid Staking) is 16.2 billion US dollars, which has become the second largest encryption sector.

What benefits will the development of LSD bring to the entire market? First of all, what is certain is that the vigorous development of LSD has brought new opportunities to the broader DeFi ecosystem. As more and more users participate in staking, liquidity will flow to LSD, creating greater liquidity in DeFi protocols utilizing LSD. This increased liquidity will open up more opportunities for liquidity staking, liquidity provisioning, and other DeFi strategies, making the entire crypto ecosystem more robust and efficient. For the impact of LSD and the future competition pattern, you can read this article "Ethereum LSD: It has become the second largest encryption market field, and March will usher in a bright moment" .

summary

On September 15, 2022, Ethereum finally completed the merger of The Merge, marking the official transition of the mainnet from Proof of Work (PoW) to Proof of Stake (PoS).

However, after the merger, the redemption function of the ETH pledge on the beacon chain was not opened . It was not until the "Shanghai Upgrade" officially launched this morning that the redemption of ETH was opened.

With the arrival of the Shanghai upgrade, Ethereum did not bring a large amount of ETH redemption as some people expected, and the market price did not plummet. Of course, in addition to Ethereum’s gradual unlocking mechanism, the market’s expectations for the value of Ethereum are also the reason for this situation. After all, the current Ethereum has become synonymous with green and environmental protection after POW has been converted to POS, saving more than 99.9% of energy. Moreover, Ethereum has officially entered the era of deflation, coupled with the vigorous development of its ecology, in the long run, Ethereum Fang is really worth looking forward to.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The content of this article is for information sharing only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of your country or region.