Reprint please indicate from the "Biteye" community

Author: Biteye Core Contributor Lucky Editor: Biteye Core Contributor Crush

*The full text is about 2800 words, and the estimated reading time is 5 minutes.

On April 21, according to Binance’s official announcement, Binance is about to launch the 31st Launchpad project Open Campus (EDU) and open a special BNB session. This sale will be based on the investment model, and Binance will determine it based on the user’s 5-day BNB daily average holdings The amount that users can invest.

The little-known project Open Campus suddenly entered the field of vision of encryption users, so what kind of project is this? What are the advantages worth using on Launchpad?

Next, this article will analyze this IEO project focusing on the concept of education platform from 1) protocol introduction; 2) core partner introduction; 3) token model; 4) thinking; four aspects.

01

Protocol introduction

Open Campus is a decentralized Web3 educational content platform. Its vision is to use blockchain technology to create a fairer education system and provide educators with new opportunities to earn income. The platform's financing in 2022 China used 6% of the tokens to raise 6 million US dollars, with a valuation of 100 million US dollars, and the financing cost was $0.1.

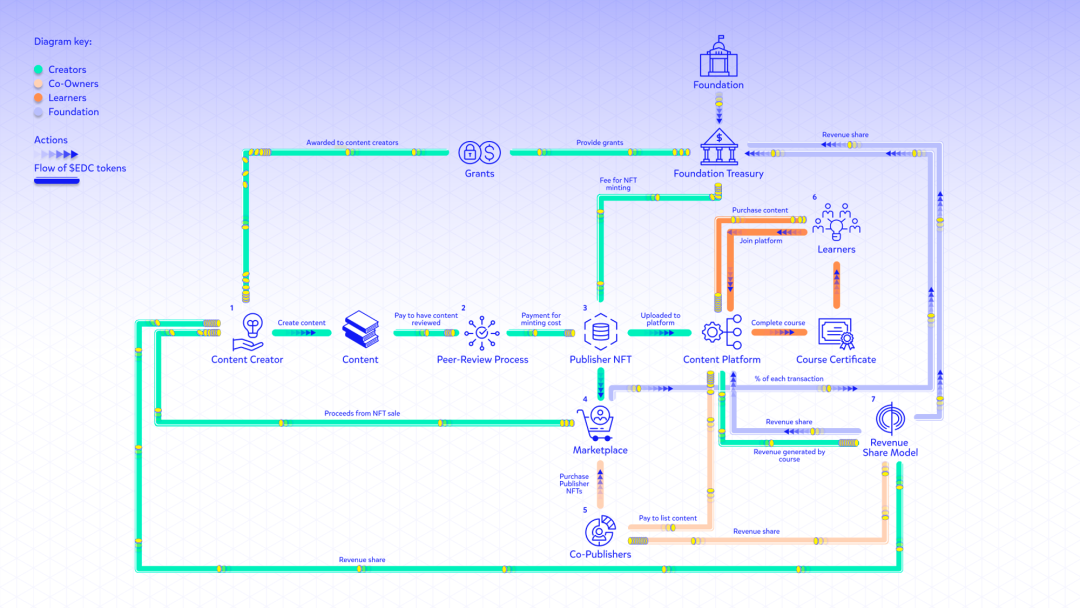

As an educational platform protocol, Open Campus aims to build a Web3 online course platform through the following process, with the aim of attracting more creators and learners to join the ecosystem, as follows:

1) content creators produce educational content;

2) Content creators pay $EDU tokens to review their content;

3) Once the content is approved by the peer reviewers, content creators can pay to mint their content into Publisher NFT;

4) Then, the creator can sell the Publisher NFT in the market to obtain the proceeds minus the handling fee (the handling fee enters the treasury of the EDU Foundation), and these Publisher NFTs are purchased by interested buyers;

5) Holders of Publisher NFT are responsible for promoting content together with the platform and content creators;

6) Learners on the platform can register on the platform, purchase courses, and get certified after completing the courses;

7) Publisher NFT holders, content creators, education platforms, and EDU Foundation treasury share the income of Publisher NFT.

As can be seen from the above process, what Open Campus essentially wants to do is to allow educational content producers to turn educational content into NFT, so that teachers can obtain funding sources and follow-up income by selling their educational content, and this income is provided by NFT Holders, creators, platform sharing.

02

Introduction of core partners

The first adopter of Open Campus was Tiny Tap, and in June 2022, Animoca Brands acquired 84% of TinyTap for $38.9 million, so essentially Tiny Tap is a subsidiary of Animoca Brands.

Tiny Tap is a UGC educational game platform from Israel. Founded in 2012, it focuses on providing children with educational content in the interactive game mode. Currently, there are more than 250,000 interactive courses on the platform, mainly for groups from preschool to Young learners in sixth grade, currently expanding to older learners.

The TinyTap platform provides creators with an easy-to-use creation tool that creators can use to create their own educational games. Here is an example:

Suppose a teacher wants to create a math game to help students learn addition.

1) Log in to your Tiny Tap account and select "Create New Game".

2) Select the "Addition" theme and set the game's name and cover image.

3) Add the first page of the game, set as an addition problem, such as "2 + 3 = ?".

4) Add interactive elements, such as text boxes or number cards, so students can enter answers and interact.

5) Add correct and incorrect feedback, such as "Congratulations! You answered correctly!" and "Sorry, the answer was incorrect, please try again.".

6) Add more questions and pages to allow students to practice multiple times.

7) After completion, the game can be published on the platform and shared with other users.

This is just a simple example, in fact, creators can use various elements and interactions to create their own educational games to meet different learning needs and teaching goals.

Before being acquired by Animoca, let's take a look at Tiny Tap's original business model. After summarizing TinyTap's public information, we can roughly infer that TinyTap's business model is based on subscriptions, sales of educational content, and advertising revenue to make profits.

As follows:

TinyTap offers a free authoring tool that allows users to create their own educational games and upload them to the platform.

TinyTap has an educational games marketplace where users (parents) can buy and use games to learn. TinyTap earns revenue from these sales, a portion of which goes to creators.

TinyTap also offers a subscription service where subscribers (content authors and parents) get access to more games and features. TinyTap generates revenue from these subscriptions.

In addition, TinyTap also displays advertisements on its platform and generates revenue from advertisers.

From the announcement of Animoca Brands’ acquisition of Tinytap, we can draw the following key messages:

1) Tiny Tap is one of the top 10 best-selling children's apps in the US App Store, with more than 8.2 million registered home users, more than 100,000 creators, and many famous publishers such as Sesame Street and Oxford University Cooperation established.

2) Tinytap is not a shell company, the company has a revenue of $17.6 million from 2019 to April 30, 2022. (It should be noted that due to the impact of the epidemic in recent years, Tinytap’s revenue may have increased to a certain extent, but it is not certain whether its service revenue will reach the level during the epidemic after the epidemic.)

3) The cost of Animoca's acquisition of 80.45% of Tinytap's shares was the current price and shares of US$38.875 million, which means that Tinytap's valuation at that time was about US$48.3219 million.

For content creators, their original income in Tinytap roughly comes from three parts:

1) Whenever a family purchases or renews a TinyTap subscription, the resulting subscription profit (ie subscription revenue minus customer acquisition costs) will be distributed to content creators. The amount an individual content creator earns depends on the engagement their content generates.

2) Payment when non-subscribers directly purchase educational games from content creators.

3) Platform rewards: TinyTap regularly organizes various competitions and events to encourage content creators to create better games and provide bonuses and rewards to winners.

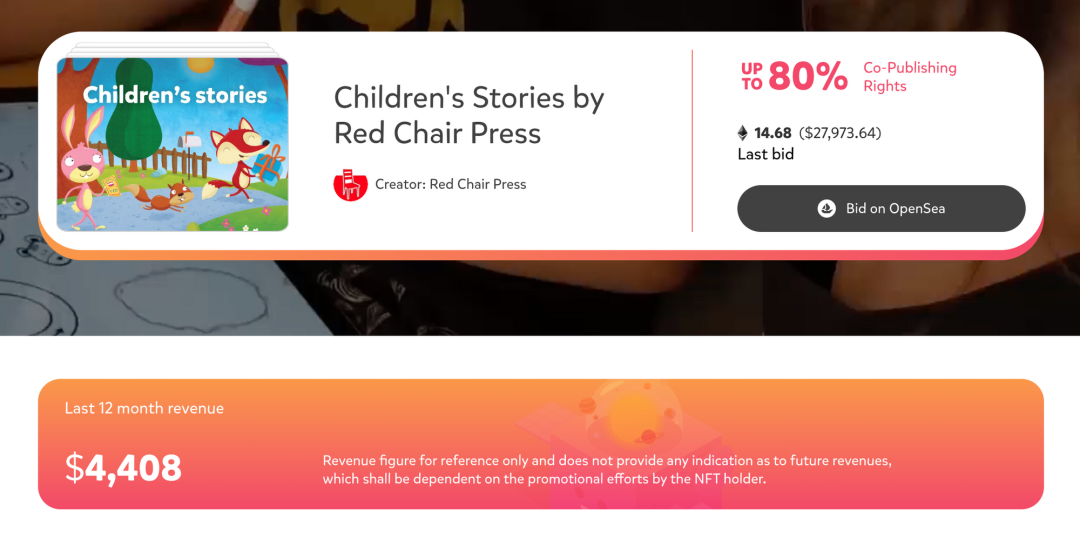

After Tinytap was acquired by Animoca in June 2022, the platform launched the Publisher NFT sales model as a new source of income for educational content creators.

Currently, Publisher NFT has held two auctions:

The first time, in November 2022, generated a sale of 138.926 ETH, of which 67.7 ETH (approximately $111,000 at the time of sale) went to teachers who created NFT-related content, and the second time was in December 2022.

The two auctions generated a total of 257ETH in sales, and a total of 12 teachers earned income from the NFT auction.

For buyers of Publisher NFT, when they hold NFT, they can get a share of the paid income of these educational content on the platform, and enjoy the benefits of subscribing to the educational content permanently.

From the development of Tinytap above, we can draw the following conclusions:

TinyTap provides a no-code educational authoring and learning platform that enables educators to create and share interactive educational content and earn a share of the revenue when learners use that content.

TinyTap's recently launched Publisher NFT leverages Web3 technology and community to improve income opportunities for educators, enabling the community to directly support the development of learning while reaping the benefits.

03

token model

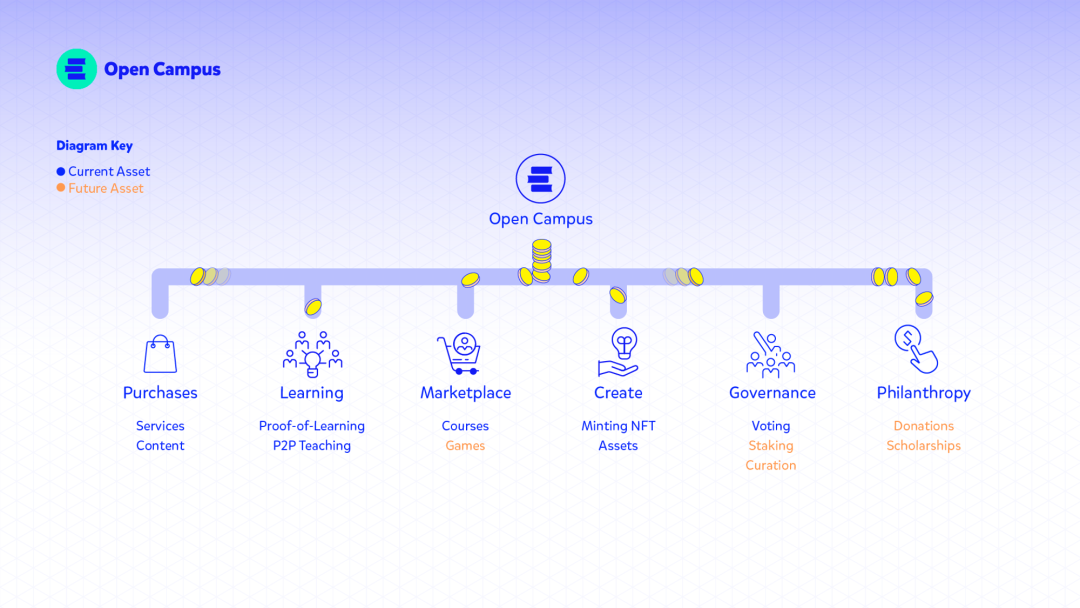

The governance token of Open Campus is $EDU, with a total of 1 billion tokens, which are used for the following functions:

Governance: EDU token holders can submit and vote on DAO proposals for the protocol (for example, directing the use of tokens allocated to the ecosystem).

Payment: EDU can be used as a payment method for products and services provided by companies adopting the protocol (such as TinyTap, where % of the proceeds will be allocated to the protocol).

On-chain revenue sharing: Contributors (including content creators, publishers, and platforms) receive a share of protocol revenue in EDU.

User Acquisition: EDU can be used to incentivize and guide Web2 users to Web3 as they can receive discounts on access to products offered by protocol ecosystem partners such as TinyTap.

Content ownership: Users can purchase co-publishing rights through Publisher NFT and EDU.

The allocation is shown in the figure below:

04

think

From Binance’s announcement, we can see that the price of Binance Launchpad is 1EDU=0.1U, and the initial issuance is 14.5%, that is, the market value of Open Campus corresponding to this currency price is 14.5 million U.S. dollars, and the market value of the whole market is 50 million U.S. dollars;

https://research.binance.com/cn/projects/open-campus

When Open Campus raises $6 million in 2022, the corresponding valuation is $100 million;

Tinytap, the first partner in the Open Cpmpus ecosystem, is valued at around US$48.32 million;

Open Compus also announced that its possible future partner is Gems Education, an international private school with 60+ schools around the world, and the source of income is tuition, but Open Compus did not announce how the two will cooperate in the future.

Judging from the EDU price of IEO, the market value of 50 million may be underestimated based on the common bubble valuation standards of the blockchain. started.

It can be seen from the partners of Open Cpmpus that his development plan is to cooperate with companies that have established certain resources and users in the original Web2, and combine their tokens and NFT models with these educational companies to give the platform instant Creators of educational content have more diversified sources of income.

But is this way of empowering Web2 with Web3 feasible, and if so, how helpful is it to creators of educational content?

For creators on Tinytap, if their educational content is popular, they can already make profits through subscription income and payment income. Issuing Publisher NFT is more like selling part of copyright, and then the follow-up income is the same as that of NFT holders. It is divided up, that is, through the form of NFT to sell the copyright to realize part of the future income in advance.

Can this way of empowering Web2 by Web3 work, and is this monetization model just needed? This monetization model is more like icing on the cake, transferring and sharing the risk . Those who pay the bill need to be optimistic about the income that the NFT of the educational content can earn in the future, and whether the ecological participants in the educational platform are willing to buy What about this order? It remains to be seen, and the author currently holds a relatively pessimistic attitude.

But from another point of view, perhaps this kind of project will still have a certain effect on the popularity of NFT in Web2. Perhaps through the penetration of major giants into the Web2 industry, people in various industries can gradually establish a strong understanding of encryption. The recognition of the industry will add bricks and tiles to the real Mass Adoption in the future.

about Us

Biteye is an overseas Web3 learning and research community, which generates content and tools in a community-driven way, and governs and motivates through DAO!

WeChat group: add little assistant @Biteye01 into the group Twitter: @BiteyeCN Discord: discord.gg/Biteye

*Disclaimer: The content shared in this article is only for learning and exchange, does not constitute any investment advice, and does not represent the position of Biteye. If you like our articles, follow us!