Although Litecoin’s halving event is coming, the market’s attention does not seem to be high, which has raised concerns about its future. In this article, researcher Alex will explore the psychology of the halving event, whether Litecoin still needs to exist, and the market's reaction to it. The following is the original text:

I researched Litecoin and its upcoming halving event, which is about 70 days away, so the gist of this article is: the psychology of halving events, and whether Litecoin still needs to exist.

First, let's look at the historical background:

Litecoin was created based on Bitcoin in 2011 with faster block times and a different mining algorithm. Litecoin, like Bitcoin, halves the block reward every 4 years to reduce inflation and increase scarcity.

Why is the halving event Bullish?

First, because miners' rewards are halved, this reduces the structural sell supply. Less selling volume = higher price, simple as that.

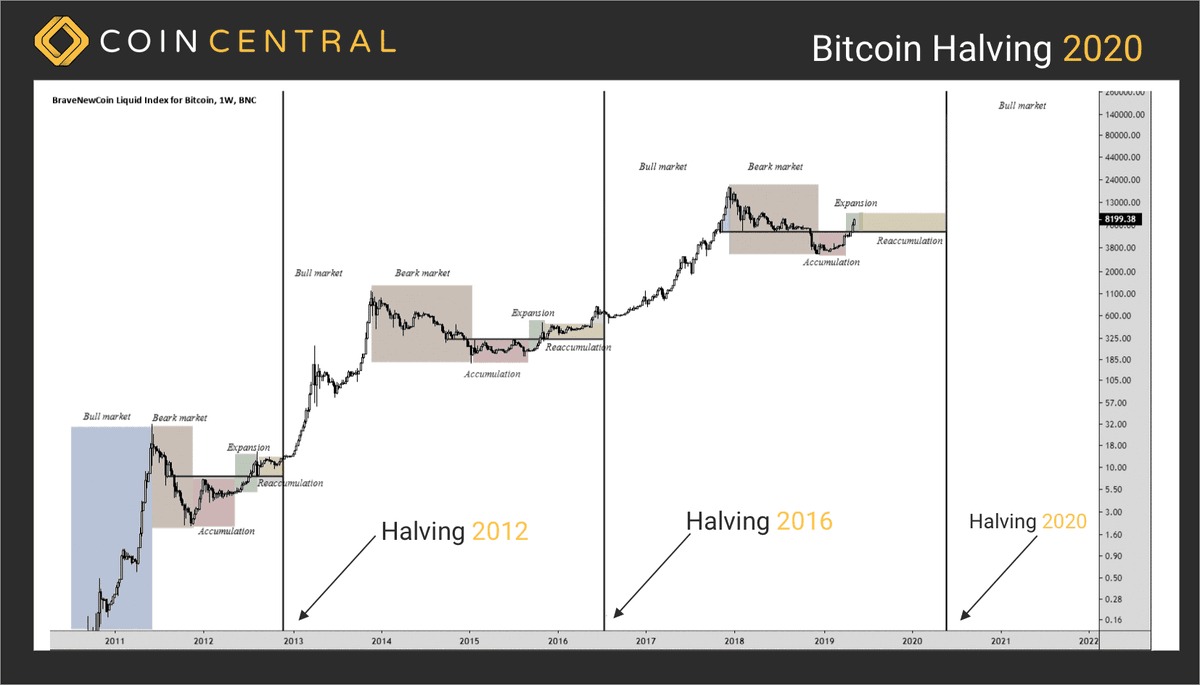

After three Bitcoin halving events, the price has shown a parabolic upward trend, and most people associate halving events with Bullish. The best narratives appeal to people of all IQs.

Is the halving event necessarily Bullish?

uncertain.

As the halving event reduces the number of rewards, it reduces the diversity of types of participants who can profit and secure the network. Therefore, ceteris paribus, each halving event weakens the security of the network while increasing scarcity.

When people bid on the halving event, it is effectively a vote of confidence that the security of the network is worth protecting.

Now let’s take a look at Litecoin’s halving event.

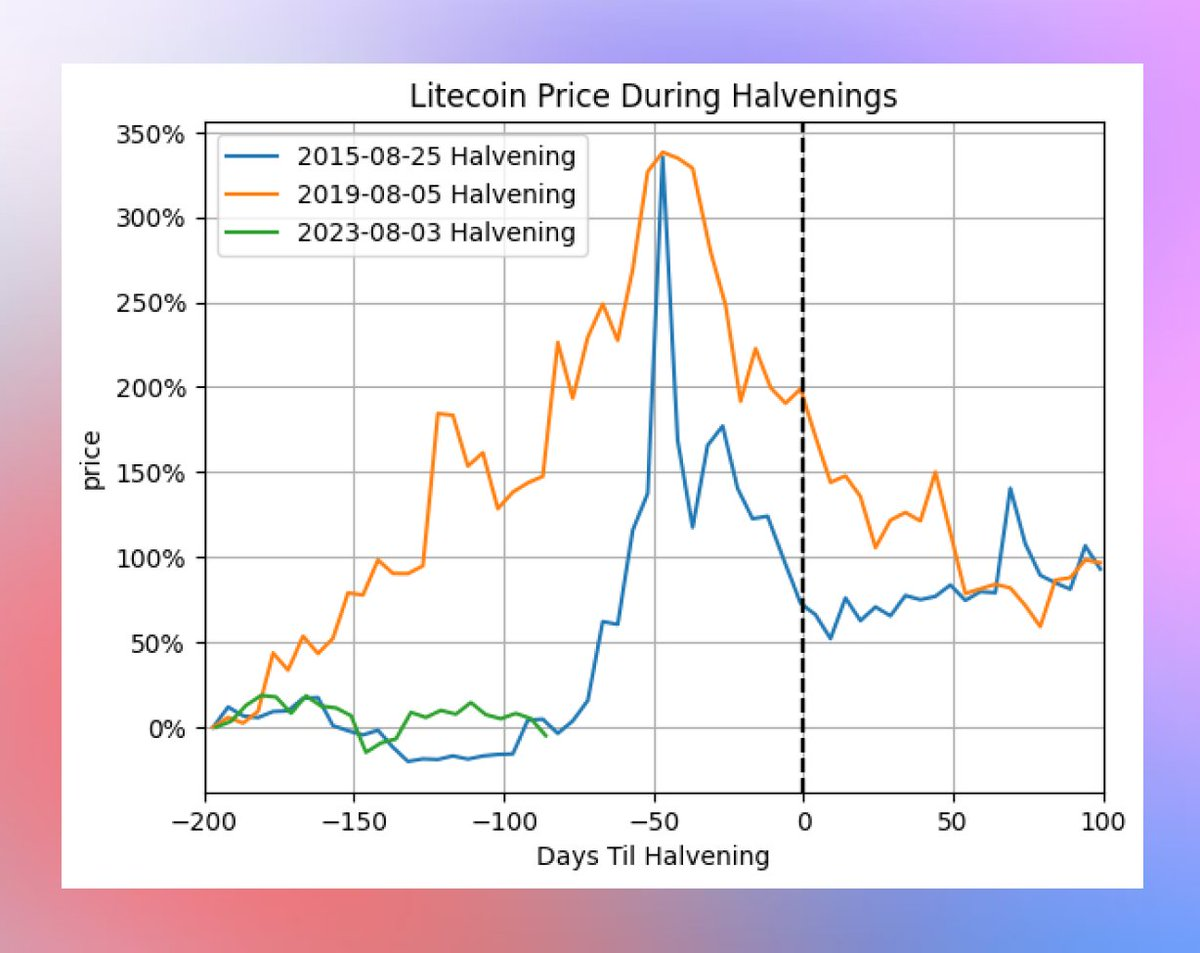

With less than 70 days until the halving event, we have yet to see a strong interest in it. Past Litecoin halving events have peaked in price approximately 50 days prior to the halving event.

We cannot extrapolate from two data points from completely different coins. But the stupidity of cryptocurrencies never stops, and the indifference to Litecoin’s halving event may be a sign that cybersecurity isn’t worth saving. Since 2019, more innovative cryptocurrencies have appeared on the market, leaving poor Litecoin behind.

But to be honest, I don't think Litecoin is ready to go away. Most of the people I talk to support the halving event, they just don’t have a strong Schelling point for bulls to enter yet.

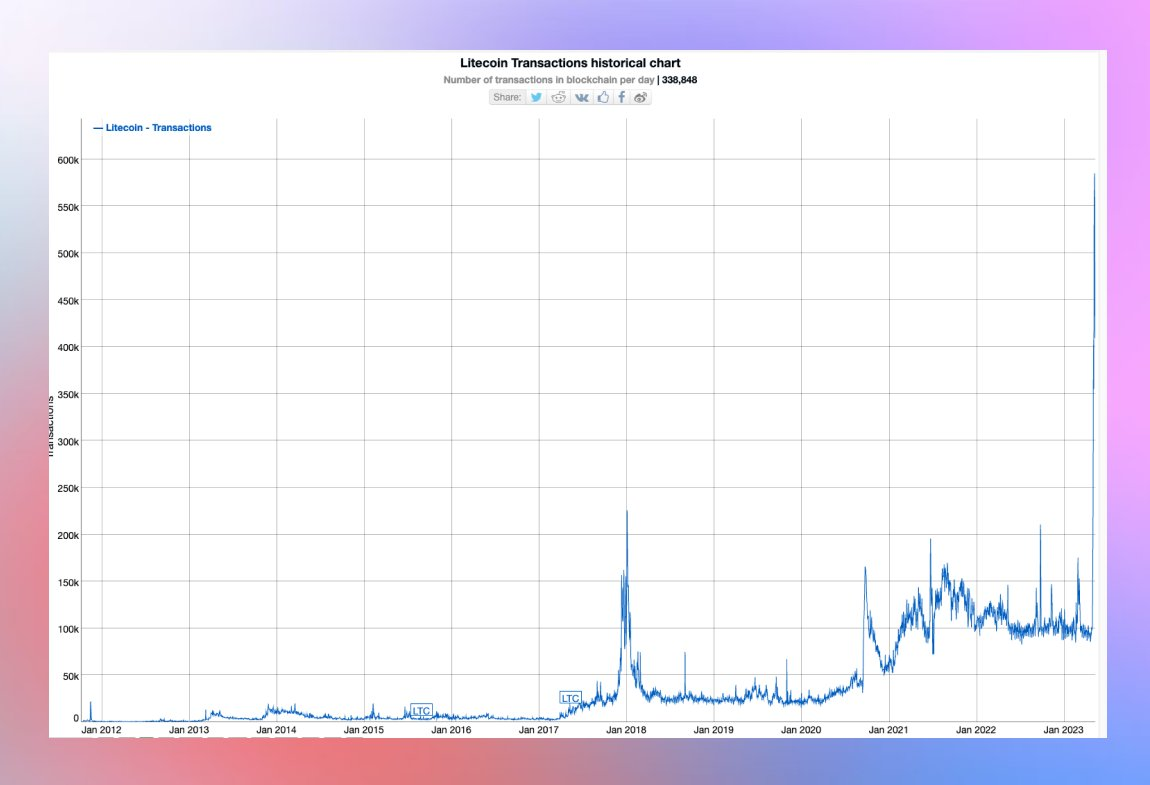

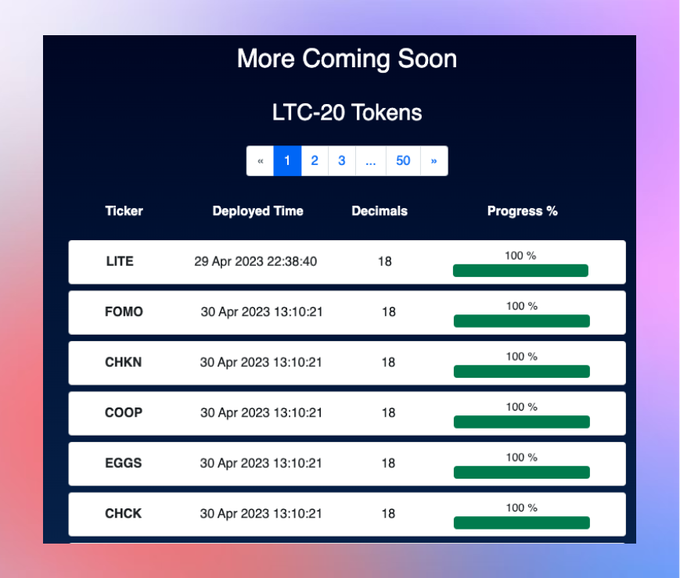

Meanwhile, Litecoin’s on-chain activity has been quietly growing since the May 3 launch of LTC-20, a Bitcoin fork of the BRC-20 token standard. This past week has seen more transactions than ever before.

Litecoin, which also hit an all-time high for active addresses last week, has its own assortment of LTC-20 tokens for speculators to gamble on.

There is a disconnect between the attention being drawn on-chain and the indifference on price action.

Now might not be the right time to take risks on altcoins, which have been slaughtered in the past few weeks.

But it also means less competition with other narratives.

Now may not be the right time, but I think if the market decides to save Litecoin, the time is close.

If it doesn't show up in the next 100 days, I think it will be a good sign that other dinosaurs are losing their influence.

*Disclaimer: I hold a hedged position against Bitcoin because I think it's a pretty good risk/reward investment. It does not constitute investment advice, please do your own research.

Disclaimer: This article does not constitute investment advice. Users should consider whether any opinions, viewpoints or conclusions in this article are in line with their specific conditions, and abide by the relevant laws and regulations of the country and region where they are located.