This paper attempts to start from the mechanism of dopamine, and the error tendency of VC historical attribution. Try to chat about group tendencies and individual pursuits.

Positive incentives form behavior habits, behavior habits shape personal identity, and personal identity determines discourse patterns.

Positive incentives form best practices, best practices shape institutional identity, and institutional identity determines behavior patterns.

1. Viewpoint

Cannot be kidnapped by gambling dogs.

From a certain point of view, the industry has been hijacked by Dopamine, so that VC, which represents the core of the industry's values, began to waver, "Will he make trouble?" "How does GTM do?". The subtext of the analysis framework is, can he catch the traffic pool? And obviously the billboard of this industry is the top gainer, and the top gainer of Dafa is the Super Bowl midfielder. So much so that on a calm night with high darkness and high winds, you can set off huge waves by puffing your cheeks on your hips. This successful habit builds.

The amazing thing is that if Founders follow the framework of VC, they may find that Meme is the best GTM among all projects, Native private domain traffic, and Traditional Times Square big screen. If you look carefully at those Token Funds whose analysis frameworks are extremely focused on GTM, you can draw a conclusion that they just want to invest in a Meme. What do we call such a fund? "Consumer Fund?" "Subculture Fund?" "Trend Fund?" But what is certain is that it is definitely not Crypto Fund.

Jump out of the overall inertia effect and return to the original heart.

What kind of soil breeds what kind of projects, in the face of positive feedback and procyclical knee-jerk reactions, it is mostly difficult to jump out of the existing framework. But it is worth noting that only by jumping out of the existing framework can we capture the opportunities of other cycles. Our ultimate career achievement is the result of the superimposition of multiple cycles, but each way of survival will bloom in a specific cycle, so hold on to your frequency. Resonance in due course.

Don't look for an LP with a different frequency for the sake of scale, don't find a VC with a different frequency for the lack of funds, and don't yearn for a new technology/new trend that can solve all problems in one go because of the so-called involution. If you can't build yourself a healthy source of dopamine, every unexpected pleasure will have its price.

Not to be kidnapped by users, not by capital, not by LP.

Because real investors and real users have not yet become users. Most of the participants just want to turn you into a meme consumer. Be very vigilant about concepts, because if the concept is wrong, the strategy will be wrong; An enhanced version of Carving the Boat and Seeking the Sword. The sword is actually on the bank, not in the river. But the people on the boat desperately want to exert their own influence on the boat, and desperately leave their own place on the boat, but is that important? unimportant. Because ships can disappear at any time.

As if every cigarette contributes two or three bullets to the country, we can say that safety comes from dopamine. From the perspective of Crypto, dog gambling is to Crypto what cigarettes are to national security. From a personal level, I sincerely hope that people can self-discipline and enjoy freedom; on the whole, how can the group inertia that so many inspirational books can't cure be cured in an instant? We rely on dopamine instead of serving dopamine, and we use dopamine instead of serving dopamine. With the help of dopamine, we can develop personal habits, and with the help of dopamine, we can also build collective beliefs, and beliefs do not matter right or wrong. It helps us reduce pain and regain courage when we face major crises.

2. Pump traffic-nomics

The society's recognition of a concept is always gradually diluted in a network, and the concept collides and diffuses with every individual like a Brownian motion. It is against common sense to quickly form a consensus in the short term. Even if one person reads a book, he needs to chew, digest and ruminate, and then combine it with practice to truly make a stable and long-term evaluation.

Concepts require stress testing, and concepts are an adaptive process. In contrast, Pump&Dump is much more direct, allowing users to get feedback quickly.

And use this to generate a sense of self-accomplishment "Look, I am awesome, 500% in one day"

"Look, I'm awesome, 500% in 1 day", "Look, I'm awesome, 500% in 1 year", "Look, I'm awesome, 500% in 10 years". Probably all belong to the same disease.

Pump & Dopamine

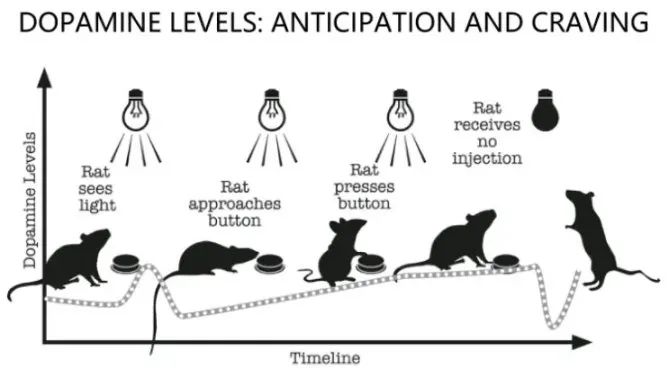

The pump model and the dopamine model are very similar. Dopamine's model consists of four parts "cue-craving-respond-reward". The early Cue is the signal (Pump), Craving is the order, and the Respond is (Kol shows the order, buy the dip). The final reward is the financial incentive/ social proof.

The pump model and the dopamine model are very similar. Dopamine's model consists of four parts "cue-craving-respond-reward". The early Cue is the signal (Pump), Craving is the order, and the Respond is (Kol shows the order, buy the dip). The final reward is the financial incentive/ social proof.

When the cue occurs, the user's dopamine will increase rapidly, and they will be very excited to see the 50% return rate. From the perspective of the project operator, when there are few real participants in the early stage, there is a high probability that the transaction volume and price. As the Pump stops, the user's dopamine will drop and enter the Craving state.

In this state, the trough of dopamine will attract users to place an order, and subconsciously "do something?" At this time, the project party should focus on the natural transaction volume after Pump, which is an important indicator of user preference.

After the user places an order, the market enters a natural state, some users lack motivation, and there are signs of behavior such as stop profit. At this time, it is necessary to further encourage user behavior, and let users accept votes through small actions, such as "encourage sharing", " Encourage Interaction", "Encourage Meme Production Activities", similar to the Rat_Press_Button in the picture. Since the user has already boarded the car, superimposed marginal incentives can easily prompt the user to carry out secondary transmission. Users often hope to use the actual behavior (Craving) to pursue the reward (stimulus) implied by the previous (Cue).

Next, in the respond stage, by observing the user’s boarding situation and behavior recognition, you can choose Pump (behavioral stimulus core contributors), or Dump (take profit and return chips). The indicators to focus on are FOMO transactions/liquidity pool, core contributors/fan enthusiasts who got on the car for the first time. If there are many new users and there are many craving behaviors, then Pump can strengthen their behavior; on the contrary, if there are many old users, then you can choose Dump to take profit chips, because proper Dump will not affect the psychological feelings of old users, but can The bottom further tempers trust in the project. Through Pump&Dump, we can continue to accumulate core supporters throughout the life cycle of Meme (by continuously giving these supporters positive incentives), so that they fully accept our project vision, which is the saying "let users earn money" .

Some people will question "why something without a core like Meme can work"? A gentleman can share adversity, but can share happiness in adversity; on the contrary, a villain can share happiness, but not adversity. The scholar rebellion failed for three years, the left wing had far more internal conflicts than the right wing, and it was much more difficult to unite. Interests are the simplest mechanism for establishing cooperation. The repetition of interests can make people lose their minds. As long as the interests continue to flow, people's cooperation can be intimate. As long as the market maker is strong enough, there will always be immature users joining this farce.

The core of the rise of meme is to meet the psychological needs of leek users, high turnaround expectations ("500% increase"), high identity ("all PEPE, all Ben"), high sense of participation ("group chat topic"), high Social value ("Meme research expert, profit posting"), high sense of presence ("I bought Meme in the early days"). Investing in Meme is equivalent to being on TV for a while, participating in a collective event, gaining organizational recognition, and gaining social status. In essence, it is a consumer behavior.

The project party can use Pump&Dump to mass-produce cheap dopamine for users, which is equivalent to psychological massage. How can I make this massage smoother? Rewards are more diverse, Cues are more common, and Actions are easier to participate in.

Variable Reward– How to Produce Psychological Dopamine?

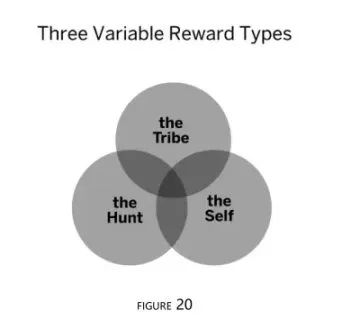

According to our previous "Cue-Craving-Respond" model, we can commercialize the dopamine model "Cue (Trigger)-Craving (Action)-Respond (Variable Reward)". Variable rewards is the most noteworthy Skinner BF Skinner divided Rewards into three categories 50 years ago:

- the tribe. social motivation

- the hunt. incentive

- the self. Ability Achievement Driven

We can see it on Meme. The influence of Pump in two senses, one is the flow effect, and the other is to shape the behavior of investors. Specifically: when MM pumps quickly, if the community concept is unanimous and there is less selling pressure, investors can give huge incentives with a small amount of chips. First, spread through the billboard, and second, encourage users with vested interests to share. For users In other words, it is a hunt reward and a tribe reward. Encourage posting (“especially because the project is life-changing”). On the one hand, it consolidates the fundamentals of stock investors, and on the other hand, it expands the exposure to incremental investors through the profit-making effect of stock investors.

Some people say that blogging on the chain is more fair, but does the group want fairness? No, it's dopamine. What you want is to be recognized, what you want is to be respected, and what you want is infinite presence. Pump is "Look at me, I have so much profit in a day!" At the bottom, "Look at me buying bottoms, I found value opportunities", Consolidate "Look at me and the community, I am firmly optimistic about this project."

Some people say that blogging on the chain is more fair, but does the group want fairness? No, it's dopamine. What you want is to be recognized, what you want is to be respected, and what you want is infinite presence. Pump is "Look at me, I have so much profit in a day!" At the bottom, "Look at me buying bottoms, I found value opportunities", Consolidate "Look at me and the community, I am firmly optimistic about this project."

How to make Cue everywhere? –Crypto's traffic pool model

Friends who watch a lot of Douyin should be familiar with some common sayings, "Fans, remember to light up the fan light board in the upper left corner", "If you think the anchor's opinion is 6, please send 666", "Everyone give the anchor a thumbs up, we are popular When it reaches 5000, we will start again." The significance of these words is to cater to the Douyin rules and push the live broadcast room to a larger traffic pool, that is to say, those who meet a series of indicators such as "like popularity", "interaction popularity" and "fan light board" can get Greater exposure, more opportunities for sales deals.

There is also such a traffic pool model in Crypto. If you meet certain conditions, you will get an upgrade. Generally, there are several upgrade logics, TX "transaction volume", "gas consumption", "Top Gainer", "Liquity Pool", "TVL", "Cex", "Community", "Capital".

When certain conditions are met, you can leverage the flow pool. Imagine a champagne tower model, the first floor is cex banner, the second floor is dex billboard, and the third floor is Kol/Community.

Assuming that a small Meme coin project starts from the bottom, how should he engage in momentum? "Mainly focus on the second layer, and negotiate the third layer.

Assuming Alice made a meme project called $Normal, on a flat morning in the market, if she suddenly pumps, the surprise attack is successful, and it is on the Top Gainer list of each Dashboard. It happened that an influencer named Ben saw this project and was amazed. At this time, we say that Alice succeeded in stages, and she successfully opened a gap in the traffic front.

After that, Alice continued to contact the community/MM/Venture, and here he may encounter a problem: "Which came first, the chicken or the egg?"

MM will ask "How many users are there in your community?", the community will ask "What kind of investment did you get?", and investors will ask "How do you do GTM?" Here, Alice only needs to keep a steady mind and a steady pace, and use the project The concept is to do A/B Test on different channels.

Ideally, some fans may start to help Alice preach together. At this time, the traffic sneak attack strategy cannot be stopped, and a proper pump should be used to input confidence to the core supporters. There must be a wave after every AMM, and after the AMM, behavior casting and incentives for new users who get on the car must be carried out in a timely manner. AMM has two meanings: one is that you can directly judge the quality of narrative expression and the quality of community channels from the amount of purchase orders. The second is that you have to mobilize the enthusiasm of the community, so that the community can contribute to publicity while paying for the car.

After a few rounds, we will be able to screen out some of our users.

Some friends questioned: What value has been created in this process? "The business model is not the creator's model, but the screening model/matching model.

All transactions are GDP, which means Worked. The whole thing is like a positive feedback knee-jerk reaction. The rocket launch is very controllable step by step. As long as there are a steady stream of new users, then this gameplay can continue to be played continuously.

Shit attracts flies until there are no more flies, that's the logic of business. A place that encourages competition will logically not have Easy Balls, but a place that is affectionate to the weak will always have Easy Balls, and a supply system based on incomplete personality groups has evolved. We insult the sickle because there are still leeks. When the leeks are finished, the sickle will be polished for technology. I'm not making excuses for the scythe, I wish the scythe had a higher purpose, but the overall culture doesn't encourage productivity, but morality. The price of being affectionate to the weak is changing the order of the strong. We can say that a sickle with pursuit has no sense of security, and it is understandable to choose to cut first. It is also difficult for the sickle to pursue. If the sickle has a pursuit, then who will play the villain, who is capable and kind, and how to perform the rest of the play? The reason why the environment becomes an environment is that members are coupled to form an ecology, and it is difficult for everyone to escape their roles.

Shit attracts flies until there are no more flies, that's the logic of business. A place that encourages competition will logically not have Easy Balls, but a place that is affectionate to the weak will always have Easy Balls, and a supply system based on incomplete personality groups has evolved. We insult the sickle because there are still leeks. When the leeks are finished, the sickle will be polished for technology. I'm not making excuses for the scythe, I wish the scythe had a higher purpose, but the overall culture doesn't encourage productivity, but morality. The price of being affectionate to the weak is changing the order of the strong. We can say that a sickle with pursuit has no sense of security, and it is understandable to choose to cut first. It is also difficult for the sickle to pursue. If the sickle has a pursuit, then who will play the villain, who is capable and kind, and how to perform the rest of the play? The reason why the environment becomes an environment is that members are coupled to form an ecology, and it is difficult for everyone to escape their roles.

Third, what exactly are we investing in?

story:

"Why did you come to Crypto?"

"Because it's easy to get money"

"Do you know what the price of good financing is?"

Meme contains broader psychological needs than gaming needs. Most of our products fall into the category of Meme, lacking users with more mature fundamentals and personalities. A large number of investors entered in the early stage, but because the threshold for investors was lowered, small and medium investors were more emotional and exited faster.

The proven core demand of the Crypto market: the dog betting demand. Judging from the current services paid by users, Trading Fee is the most important cash flow. Cex/Dex/NFT MarketPlace is the cash cow in the industry. In addition, there are some information service requirements, including Dashboard/Newsletter/Community and so on. And the chain-end infrastructure around the dog gambling service.

Data source: Fees - DefiLlama

Data source: Fees - DefiLlama

The main portrait of the user: Betty is the user, three typical characteristics

1. The empty self. For example, "posting profit slips", by posting slips to prove your excellent vision, to prove that what you say is true, and to fill your sense of existence.

2. Mu Qiang. Mu Qiang is also a typical feature of the systemic procyclicality of the entire market. From the point of view of the propagation network, if the nodes in the network have a follow-up effect, the momentum of the entire network will be very strong. Imagine a net in the outline. After the nodes are moved, the whole net will float.

3. Passive and superficial. Due to the user's nihilistic ego and Mu Qiang's characteristics, the "WeChat Business Strategy" is very effective, the exaggerated self-labeling and the reconfirmation of "I have made money".

The main needs and user portraits have led to several current situations: 1. The non-gaminggou native cash flow is scarce, and the survival of Native projects is a problem. 2. Heavy dependence on external funds and insufficient hematopoietic capacity. 3. The way of making money depends on the capital market in the short term and serves the capital market. As a result, VC, users, and project parties have a very high degree of overlap. Following this, several synthetic problems arise.

Problem 1: Kidnapped by Gaminggou users.

It can be "yes" but "no". Eth can have ETH, but it is not an ETH service tool. From a certain point of view, this industry has been hijacked by Dopamine, and the judgment framework of VC has given a high weight to "making troubles". "Will he make troubles?" "How does GTM do?" Can you use the traffic capture pool to catch users of gambling dogs? If we believe in the logic of "users determine their needs", then in the current situation, we can only develop the infrastructure needed for dog gambling. In fact, existing users do not determine the future needs of the industry, and early investors are not product users.

According to the existing VC framework to customize the project, you may find that Meme is the best GTM among all projects, Native private domain traffic, and Traditional Times Square large screen. If the VC analysis framework is extremely focused on GTM "quick exit, many users, and high multiples", you can draw a conclusion that they just want to invest in a meme. Fast food users decide on fast food projects and fast food VC, and then come to a conclusion that we want Mass Adoption, in other words, we need to continue to suck blood.

The question that VCs need to establish is, where exactly are the sources of excess returns? If it is Token, exit quickly, there are many retail investors. That takes advantage of the low threshold for Token investment and high leek content. If it is decentralized and anti-censorship, it is the network world infrastructure that has emerged under the drastic changes in the betting world. The world is very complicated, you can either mow or invest, but please don't lie to yourself. The latter will have no cash flow for a long time, and there is no story to make you quit. Do you still invest?

If you don't serve Gambling Dog, who else do you think Crypto infrastructure can serve? Finding the first user source outside the company is the Iphone moment of this industry. Users are more staunch industry supporters than VCs.

Question 2: Correctly handle the relationship between users and future vision.

From the perspective of Crypto, dog gambling is to Crypto what cigarettes are to national security. From a personal level, I sincerely hope that people can self-discipline and enjoy freedom; on the whole, how can the group inertia that so many inspirational books can't cure be cured in an instant? We use the dog instead of serving the dog, and we use dopamine instead of serving dopamine. With the help of dopamine, we can develop personal habits, and with the help of dopamine, we can also build collective beliefs, and beliefs are neutral. They help us reduce pain and regain courage when we face major crises.

4. How to find a self-consistent investment theme?

The picture of the network country: institutional strength + economic foundation enables DAO to have the power to talk to the sovereign. Under the construction of virtual infrastructure, with the endowment of production factors that sovereign countries do not have, they can export products and services that sovereign countries do not have, form an economic foundation and cultural consensus, and seek opportunities for dialogue with sovereigns through the establishment.

Look around this vision: 1. What is a service that is difficult for a sovereign state to build? 2. Why is globalization still needed at extreme times? 3. Who is the most staunch supporter of building infrastructure? 4. Who will be the core users of Crypto in the next 3 years? Or bet on the dog?

So what is a self-consistent investment field for a Crypto fund?

- There is only one necessity for the existence of Crypto, safe/strong/stable. Decentralization / anti-censorship / anti-regulation is an existence that transcends ideology and interests. Invest in "Second Base" (Asimov). The dry food for disaster prevention and reduction at home, and then you told me that it must be delicious and delicious. The characteristics of its disaster prevention are the first, and the color, fragrance and taste are the second. In aggregate, the return on investment depends on the large beta. The income source of compressed biscuits depends on the external environment, not from the perfect color, fragrance and taste.

- The development of Crypto must rely on the community and cannot rely on capital (capital oriented towards clear returns). Crypto is not a commercially measurable solution, with its own huge beta assumptions. It is necessary to find the most relevant and most motivated people to invest. The US dollar fund is not, and the Token Fund may not be either. Crypto may be more like a non-profit organization, and what needs to be considered is Public Good.

- Crypto's Mass Adoption is a very fragile assumption. All decentralized infrastructures that establish Trust must have Mass Adoption on the basis of the complete collapse of the centralized Trust. Using an extreme mental model, the heyday of trustless is the stage of full trust bankruptcy for all beware of all. That is to say, Crypto's Mass Adoption is a passive state, and there is a high probability that it will not be able to Mass. Trust between people still exists. There are limits, and mass adoption is impossible.) There are two options for the project: one, dilute security, obtain efficiency, and capture existing users (mostly gambling dogs). Two, maintain safety, improve innocence, and occupy the total mind (look forward to the future).

- The investment project is not investing in the dog gambling community, the vertical gambling dog community? Stacked Horse Boy aaS? ; The investment project is not to invest in trendy subculture meme, "I am using XXsocial, I am a trendy person, please Fo me"; if you admit that you are a consumer fund, you can invest in the first two.

- If the LP can't bear it, keep looking for a suitable LP.

Who are the core users of Crypto in the future?

- It is the subject that has been harmed in the context of deglobalization.

- Globalization is the prerequisite for the survival of these subjects, and it also provides assistance for the development of these subjects. Not only basic questions, but also bonus questions.

What is a typical Founder of Crypto?

- Stay hungry, stay patient. For a long period of time, it was difficult for the industry to capture cash flow without gambling. Without cash flow, there is no way to maintain a stable team. DAO must be used to disperse risks and build consensus. Users in the industry will grow rapidly with the bankruptcy of external credit. We are the backup state of the world, and we are the second base. It means that external demand changes drastically, and once the stress test comes, it will definitely be overwhelming.

- Occupy your mind all the time. How to establish a clear brand awareness in the case of a small user base is the second problem to be solved. Staying "halal" secures the future.

- The situation faced by Founder is to stabilize internal employee expectations and cultivate internal team (community) capabilities. The team (community) is the basic disk, but the pump is not.

# Epilogue

This article introduces the relationship between Dopamine and Pump&Dump, as well as Crypto’s traffic pool strategy, sorts out some core problems and phenomena in the current industry, and talks about the Crypto investment theme in my eyes.

Positive feedback forms behavior habits, behavior habits shape personal identity, and personal identity determines discourse patterns.

Positive feedback forms best practices, best practices shape institutional identity, and institutional identity determines behavior patterns.

To open an egg from the inside is life, to open it from the outside is to break the egg. It is time to return to Jinggangshan, to the days when there was no money, no people, and no guns. She wants to be a Nuwa in the online world, and wants to make the online world as real as the physical world. Then ask yourself if you can delay gratification, after all, Nu Wa will not ask "how long will it take to pay back".

Hunger is valuable, at least let you know what you are doing? How much do you want to do this? Investing in a self-consistent fund is much more important than investing in a profitable fund.

Q&A:

Why can't primary investors make money?

Judging from the current situation, the spread of Meme is the biggest source of profit, and first-level investors do not have enough experience in Meme spread.

Should real Crypto investors make money?

The dry food for disaster prevention and reduction at home, and then you told me that it must be delicious and delicious. The characteristics of its disaster prevention are the first, and the color, fragrance and taste are the second. In aggregate, the return on investment depends on the large beta. The income source of compressed biscuits depends on the external environment, not from the perfect color, fragrance and taste.

Why is it more beneficial to have a VC background as a founder of Crypto?

Most crypto projects have no internal cash flow, and the founding team's income mainly comes from the capital market. Whoever is better at disseminating and refining narratives in complicated details is more likely to succeed. The problems that VC deals with are formal logic, not substance. When we examine investors, we focus on their abstract ability and ability to grasp the key to problems. why? Because the profit source of VC is mainly capital premium, and the bottom layer of capital pricing is pheromone, which is abstracted and communicated by a wide range of investors. The ability to process pheromones is at its core. The Founder is responsible for the actual business operation and ensures that the vision can be realized. It is a description and execution ability from abstraction to reality. The former is an abstraction from details to principles, and the latter is a deduction from vision to execution. Capability maps are different.

Why does Crypto investment often appear in Pinduoduo? (Leading investment ratio is low)

Fundamentally, it is difficult to have demonstrable results. Concept-driven + no investor suitability threshold + Kol matrix exposure makes the project very flexible. From the perspective of the investor analysis framework, the winning rate is low and the flexibility is high.

What aren't DAOs? A simple Discord is not a DAO, a piece-rate system is not a DAO, and a bet on stones to open a blind box (investment) is not a DAO either. Judging from the current situation, the purpose of investing in DAO is to obtain quotas, and the purpose of ordinary DAO is to disperse risks. Contributor and Socialist Successor are very similar. Why is DAO called a free prostitution channel? What is not a DAO? In the special industry of Crypto, because the operating cash flow is concentrated in CEX, NFT Marketplace, Staking, and MEV. The object of business service is directly or indirectly dependent on the company, which leads to the better cash flow of those who manage the company closer to the company. Because of this, Founders below the waist are not allowed to join the narrative team, because it is difficult to make profits in fundamentals, and the capital premium has become the main source of Founders. DAO came into being at this time to solve two problems: 1. There is no cash flow, so the revenue is shared through Token. 2. Take risks and share narratives. What DAO solves is the problem of crediting shares. The industry has limited cash flow, and the game exists on Day1.

reverie

story one

"Why do you come to Crypto?" "Because it's easy to raise money" "Do you know the price of easy financing?"

story two

"What SocialFi?" "How is this different from a subculture vertical?"

"Can we Earn?" "If someone throws money, is it you?"

"They don't understand the currency circle" "You mean continuously throwing money, robbing the traffic pool, and listing IDOs"

story three

"Why do web3 AI?" "Let users have a better interface" "How does the data come from?" "We will access various APIs." Is there any case that allows users to form the smallest loop? For example, what common questions you can answer very well, and these questions are still frequently asked by users.” “I think we can help users find”

story four

"This industry cannot thrive on doodles," he said.

The master said, “The nature of trustlessness in this industry makes where the cost of trust is the highest, it will definitely be replaced.

The doodle migration must be the fastest. Their needs must also be the most robust.

It is likely that the industry will depend on them to support them. Adam Smith said the invisible hand, self-interest makes good,

I think this is called intangible goodness, and self-evil can also promote goodness. "

He said that "the industry will have Mass Adoption in the future, and App Chain in the future"

The master said, "Security is the source of this industry. Since it is the infrastructure of the metaverse, the incomparable resilience is the foundation of our existence. Mass Adoption needs the support of a large environment. The external environment must be bad enough, and it must be No Trust before it can be Trustless."

He said "USDT is the Iphone moment of the industry"

The master said, "Think about who is the most staunch supporter of the industry and who benefits the most from the development of this industry? It's the wandering capital. Nomad who is guilty of the crime is the backbone of the industry, definitely not the dollar fund and big names , they have too many choices.”

Story five:

Evaluators have two methods

One is called "Has he made any money?"

One is "What is he doing now?"

Story Six: The overall sense of absurdity:

Day1 The ideal first day, decentralization/personal sovereignty/network country/de-trust.

Day2 Token is running all over the mountain, and black U is flying all over the sky.

On Day 3, when leeks are fertile, 3M will withdraw. MM opened on both sides, and VC raised the pole.

Day4 Mass Adoption Metaverse, infrastructure construction is busy.

The Day5 traffic model is in my heart, and TopGainer is my best. To ask how the project works, Meme community AMM.

Day6 The leeks are exhausted until they are dead, and the giant whales start to dry when they leave the table. I asked Crypto where to find it, but there was no head or money.

Day7 There is no need for ancestral land to bury the bones, dare to ask the sun and the moon to change the sky.

story seven

"What's the password recently?"

"I told you, can you believe it?"