Talk about the valuation and subsequent development of ordi.

1. The ecological niche of ordi

2. Benchmarking against various indicators of pepe

3. Realize the predetermined ecological niche, the key node in the path

4. Odds calculation and trading plan

This article was written in the knowledge planet of the community yesterday morning. Part of the content has been fulfilled, but the rest still has a certain reference value. In line with the principle of water and water, let’s post it shamelessly.

The key to evaluating ordi is to look at the ecological niche matching and the evolution of the entire brc20 narrative.

Regarding ordi, there are three valuation criteria:

1. The top dogs on the second floor of the head, such as aidoge at its peak, the highest valuation of the first meme on arb is about 300 million

2. The top local dog in the new era of the Mainnet, pepe at its peak, with the highest circulating market value of 1.6 billion

3. SHIB in 21 years has started the animal currency frenzy and opened a new meme track. The peak valuation is 60 billion (bull market), and the current circulation is 6 billion. Looking at it now, the first standard is obviously exceeded. Ordi’s target is directly pointed at pepe. If pepe is used as a reference, there are several classic situations:

1. It took only 22 days for PEPE to reach 100,000 people, and 260 days for SHIB, which is 11.8 times faster than him.

2. There is a dealer behind PEPE, and it is said that the market maker fee exceeds 40 million US dollars.

3. PEPE itself is a top meme, but it has never been discovered.

4. PEPE is a project in which the entire existing currency circle is fully informed and partly involved.

5. Quickly listed on the exchange, matcha, gate, ok, and then listed on Binance to reach the peak.

Then we come to the case of standard ordi:

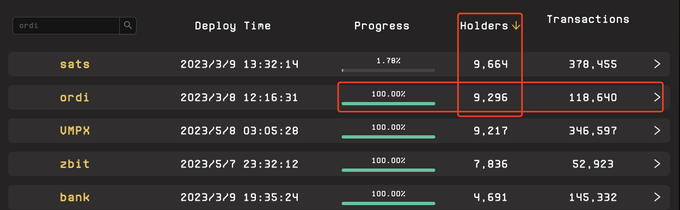

1. The number of currency holding addresses has increased by 6,000 in the last half month, and the existing number is 9,000. The number of addresses grows too slowly;

2. Is there Zhuang behind ordi? It is said that there are local pushers from Shenzhen entering the venue, but there is no doubt that the participating crowd is still mainly Chinese;

3. The speed of listing on the exchange is not as fast as expected, partly due to technical reasons, but Binance's intrusion into orc is a bit hurtful.

4. New standards for Litecoin and various tokens to grab Liquidity.

So in other words, the current ordi is still in development, and it doesn't show the hegemony for the time being

So let's go back and see, what is ordi?

1. BTC 's native token issuance standard masterpiece with mixed reviews;

2. The current biggest beneficiary of the Bitcoin halving narrative is a project supported by long-term game miners;

3. The strategic cooperation between okex and Huobi, and the establishment of a new track leader with new industry standards have room to look forward to. Pepe is the climax of the meme season (not new), but brc20 can open a new era.

Whether it is speculation or investment, gambling is a great future.

However, key nodes need to be implemented step by step:

1. Ordi's login to okx should be a high probability event. For example, the news has appeared for 7 days, and the time is getting closer. (I posted the article yesterday, and it’s ok today)

2. Obtained huge financing through leading market agreements such as unisat. Once implemented, it means that real institutions will enter the market, and the track will be recognized by mainstream big money.

3. Defi head protocol, release brc20 standard tokens, support the ecological development of BTC. This is a bit difficult, because the defi protocol belongs to the ETH faction and has nothing to do with BTC. However, some of BTC's own protocols, such as lightning network, rgb, and existing side chains STX, rif, issuing mapped assets, etc., support the brc20 protocol. On the whole, the key nodes are the process of step-by-step recognition and advancement by the mainstream.

Although optimistic, you can't stud, let alone believe in it.

On the one hand, it is to take one step at a time and wait for key events to appear. On the one hand, it is to take some precautions in terms of price.

Assuming that from the perspective of the second goal, pepe circulates 600 million yuan, with a maximum of 1.6 billion yuan. Ordi circulation is 240 million, with a maximum of 600 million.

There is about 3 times the space away from pepe, and about 8 times the space beyond pepe.

The current price of the gate is 12, but Ordi once had a lot of chips changing hands at around 10 yuan. If you can take over at around 10 yuan, setting a stop loss of 7 yuan before the gate is equivalent to 30% of the 3 times space for a hand. If the price is lower, Just sexier.

There are several conditions for stop loss:

1. The price returns to the previous low;

2. In terms of time, after waiting for half a month but not seeing the above-mentioned "key node" appear, it is automatically regarded as a narrative failure.

Special reminder: There is no guaranteed profit or loss in investment, and everything has a probability.