Note: This article is from @Rocky_Bitcoin Twitter, which is an encryption analyst. The content of the original tweet is organized by MarsBit as follows:

Since the #LSDFI soul torture was issued last night , many partners are very interested in the #LSD track and want to know what arbitrage plan there is. I will write a related introduction today, and talk about the mainstream solutions currently on the market. (The content is for reference only, DYOR)

The content is divided into 3 parts:

Part 1: ETH pledged in exchange for xxETH.

The second part: xxETH re-arbitrage.

The third part: LSD-related data tracking kanban.

Part 1: ETH pledged in exchange for xxETH.

(xxETH calls it Liquid Staking Tokens (LSTs), which will be replaced by LST later)

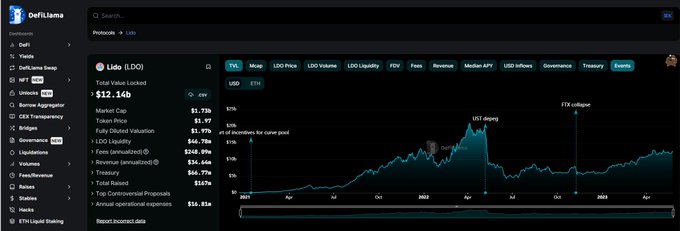

1. LDO(stETH)

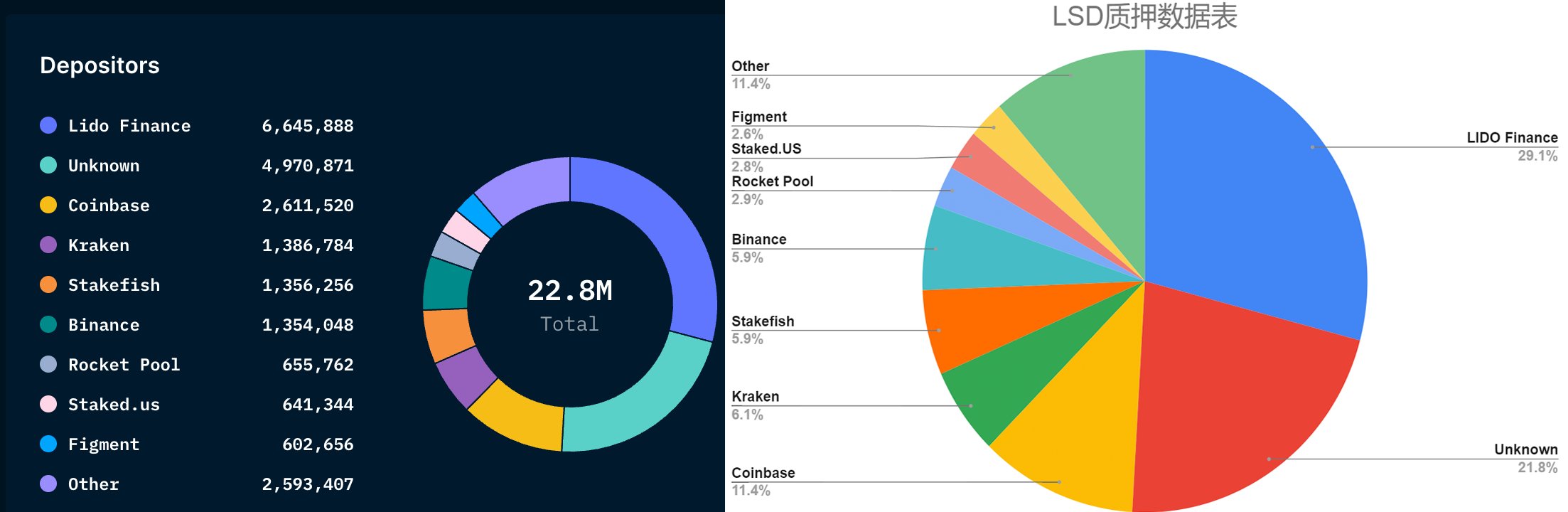

Average annualized rate of return: 4.9%. Market share: 71% (excluding non-core data)

Advantages: Pioneer of the LSD track, No. 1 market share, strong Liquidity, reasonable fees, strong community, friendly UX interface, most LSDFI protocols support stETH

Disadvantages: Currently the largest ETH pledge pool, high concentration may bring a large risk factor, and there is a risk of being attacked. Lido DAO governance voting has no self-limitation, which may lead to unfair governance and deviation from future development direction.

Fees: 10% of generated rewards are charged as a fee, split 50/50 between the node operator and the DAO.

Staking website: https://lido.fi/

2. Coinbase (cbETH)

Average annualized rate of return: 6%. Market share: 12.5% (excluding non-core data)

Advantages: The interface is simple and easy to learn, very suitable for novices.

Disadvantages: cbETH price anchoring is not stable, and the difference between the actual ETH price and -5% fluctuates up and down.

Fees: 25% of rewards generated are charged as fees.

Staking URL: https://coinbase.com/earn/staking/ethereum

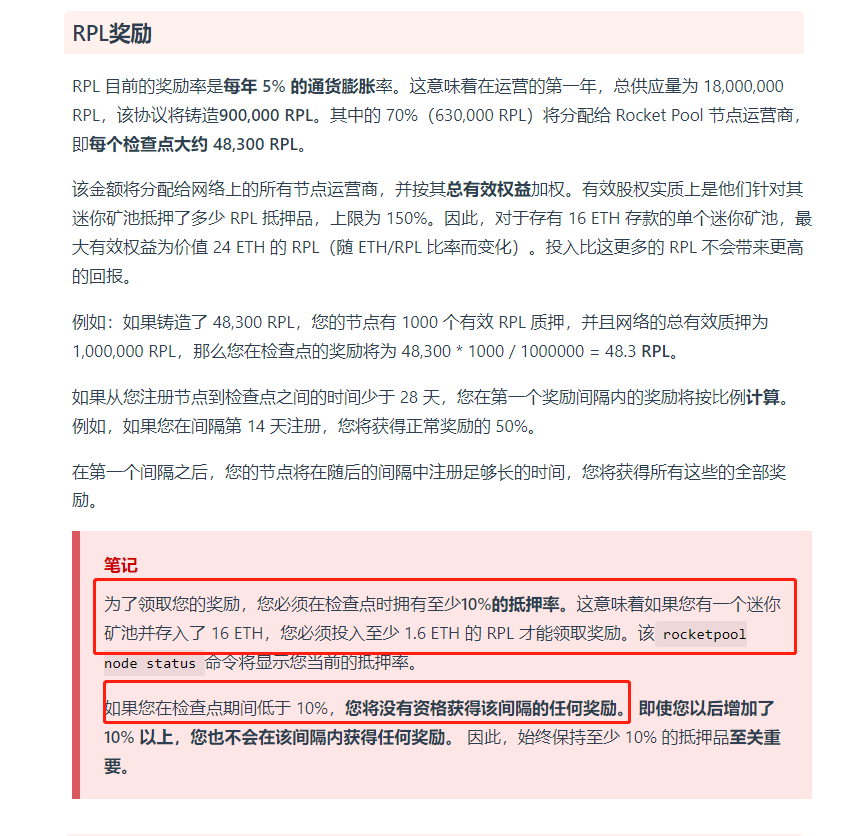

3. Rocket Pool (rETH)

Average annualized rate of return: 5.17%. Market share: 7.6%

Pros: Best decentralized ETH staking protocol. DAO voting governance has a self-limiting mechanism, which is relatively fair and sets an example for the decentralization of ETH.

Cons: Less capital efficient, for those nodes mini pools always have to maintain at least 10% collateral. Otherwise, rewards cannot be claimed. (such as 👇👇 picture)

Fees: Fixed rate, 14% revenue is collected by node operators, no protocol input capture.

Staking URL: https://stake.rocketpool.net/

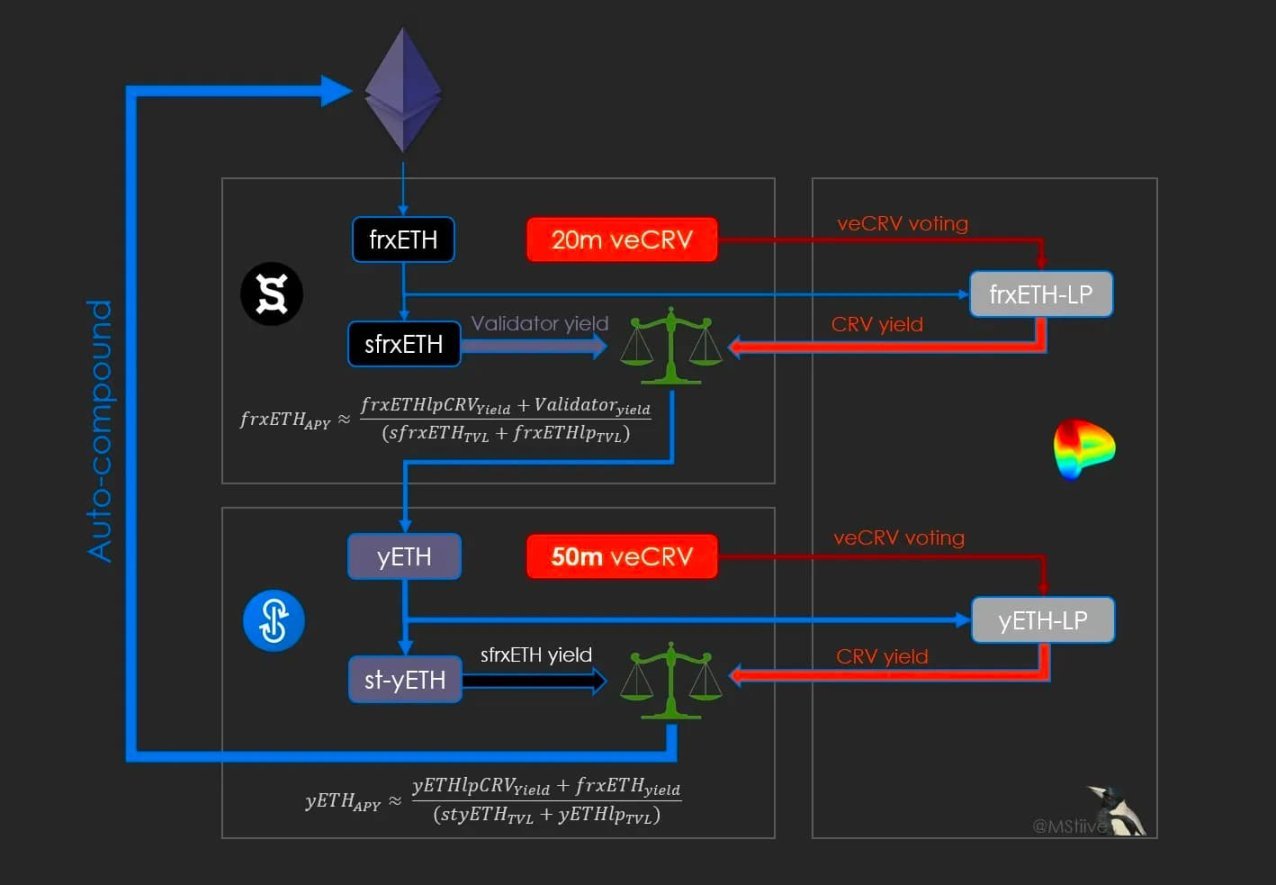

4. FXS(frxETH)

Average annualized rate of return: 8.85%. Market share: 2.42%.

Pros: Benefit from dual CRV and CVX systems. A dual-token system is adopted, similar to ANKR , which helps to separate volatility tokens and profit tokens, allowing multiple profit distributions between Liquidity Provider and staking rewards, respectively, to achieve higher APR income.

Disadvantage: When the supply of frxETH is locked to sfrxETH, if the ratio of ETH in the pool is low, it may face the problem of Liquidity depletion.

Fees: A 10% fee is charged for rewards generated.

Staking URL: https://app.frax.finance/frxeth/mint

5. Stakewise

Average annualized rate of return: 5.42%. Market share: 1.20%

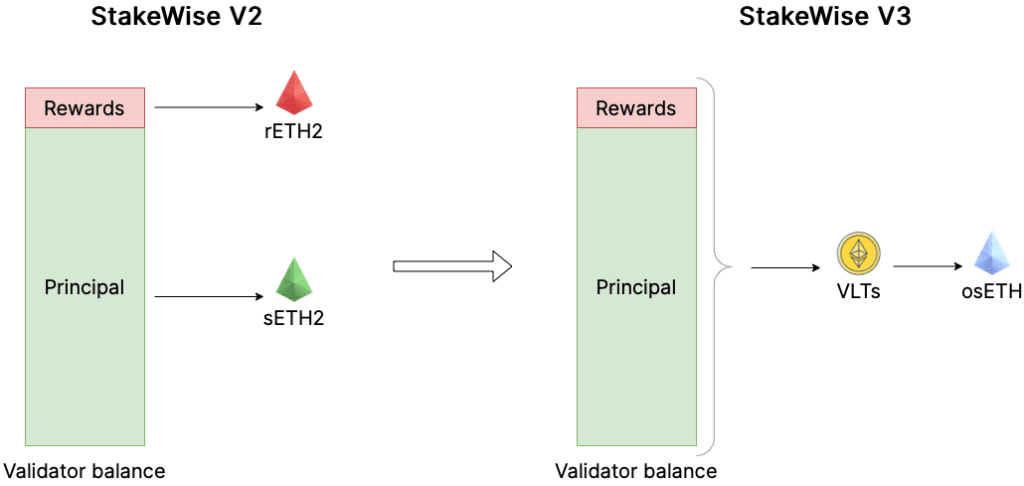

Advantages: The dual-token system is adopted, sETH2 is used as the principal, and rETH2 is used as the reward, which provides greater flexibility and GAS efficiency than the single-token model when LPing or leveraged pledge.

Disadvantages: Due to the Horcrux verification system, it is not so decentralized, it divides the validator key into 7 parts, and distributes it to 7 influential people in the Ethereum community, which is easy to internal fraud.

Cons: Stakewise tokens have average performance and low trading volume. In addition, there are fewer Defi protocols that support Stakewise.

Fees: A 10% fee is charged for rewards generated.

Staking website: https://app.stakewise.io

6. Binance pledges ETH

Average annualized rate of return: 4.35%. Market share: 1.2%

Advantages: The interface is simple and easy to learn, very suitable for novices.

Disadvantage: The withdrawal process is slow, it takes 15 days to complete, and during this waiting time, BETH will not receive any benefits.

Cost: unknown.

Staking website: binance.com

7. Pendle (buy stETH at a discounted price)

Average annualized rate of return: 0.65%-8.65%. Market share: 0.56%

Pros: Up to 8.83% discount on buying stETH. Pendle enables stETH holders to gain leveraged income exposure without the risk of liquidation, positions can be sold at any time prior to expiration, where the price will vary. The principal ETH can be redeemed in full after the maturity date.

Disadvantages: The Pendle model is very complicated, and it may be difficult for ordinary users to understand, resulting in a lot of learning costs and thresholds.

Cost: unknown.

Pledge URL: app.pendle.finance

The second part: xxETH re-arbitrage.

Example: Deposit stETH into #Curve's stETH centralized liquidity pool and earn an extra 3.92% APY on top of stETH APY.

1. Pendle

APR: 10%-60.9%

Advantages: Buy discounted ETH, USDC and provide Liquidity to earn the highest yield.

URL: app.pendle.finance

2. unshETH

APR: 5.2%-27.12%

Advantages: Support more farm rewards for ETH pledged tokens (WETH, sfrxETH, rETH, wstETH, cbETH).

URL: https://unsheth.xyz/deposit

3. sfrxETH

APR: 5.88%

Advantages: frxETH holders can earn additional staking income by depositing tokens into the sfrxETH vault.

URL: https://app.frax.finance/frxeth/stake

4. Curve

APR: about 3%

Advantages: There is an excellent Liquidity pool stETH/ ETH on Curve, which provides Yield Farming rewards. Users are rewarded with APR in the form of CRV and LDO .

URL: https://curve.fi/#/ethereum/pools

5. Flash stake

APR: 5.04%

Advantages: Pledge ETH, LSD tokens and get benefits in advance.

URL: https://app.flashstake.io/stake

The third part: LSD-related data tracking kanban.

1. #Tokenterminal displays the core projects pledged on the chain, and related core data (protocol revenue, MEV rewards, number of active users, etc.), chart display.

URL: https://tokenterminal.com/terminal/markets/liquid-staking

2. #Defillama More detailed details of each LSD data (including pledge amount, TVL, 7D change, 30D change, market share, etc.)

Website: defillama.com

3. Data tracking of #Nansen facts, including the latest staking situation, whose wallet, when it was pledged, and how much the wallet earned. Yesterday’s tweet showed Sun Ge’s pledged wallet, which shows everything at a glance.

URL: https://pro.nansen.ai/eth2-deposit-contract

4. The data sheet of #DUNE is also very complete. It's worth a look.

@DuneAnalytics

URL: dune.com

Finally, if you like today's content and sharing, please forward and like it a lot. Your support is the driving force for our continuous growth. grateful