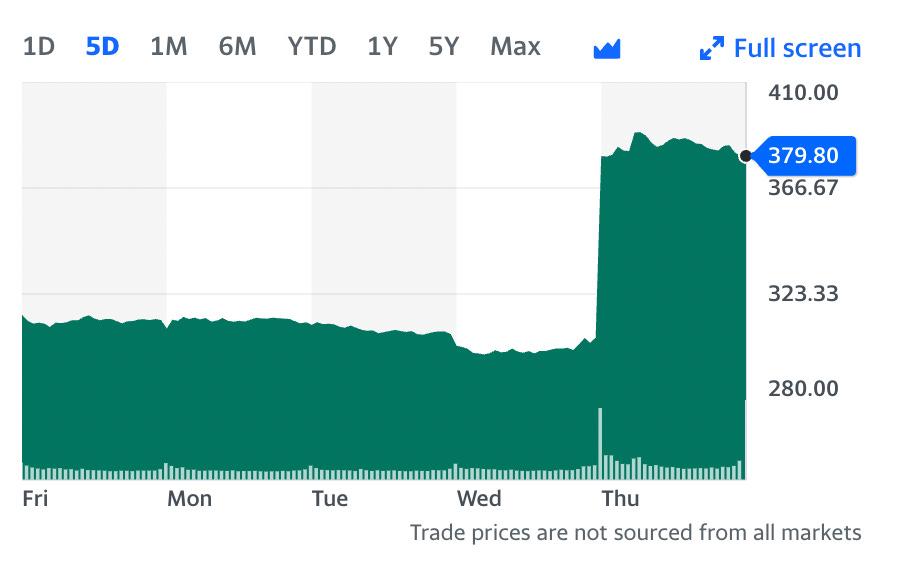

Nvidia reported earnings after market close yesterday. I am not going to post their actual numbers here. But I want to talk about all the short sellers who bet on its earnings report and lost their shirts. There are quite a few NVDA 0.00 posts on /r/wallstreetbets and /r/stocks before the earnings reports. Most of these reports were shouting that NVDA is overpriced and it was priced for perfection and could only go down. Well, guess what. Nvidia had a stellar quarter driven by AI and its stock price went up 25% during today’s trading session.

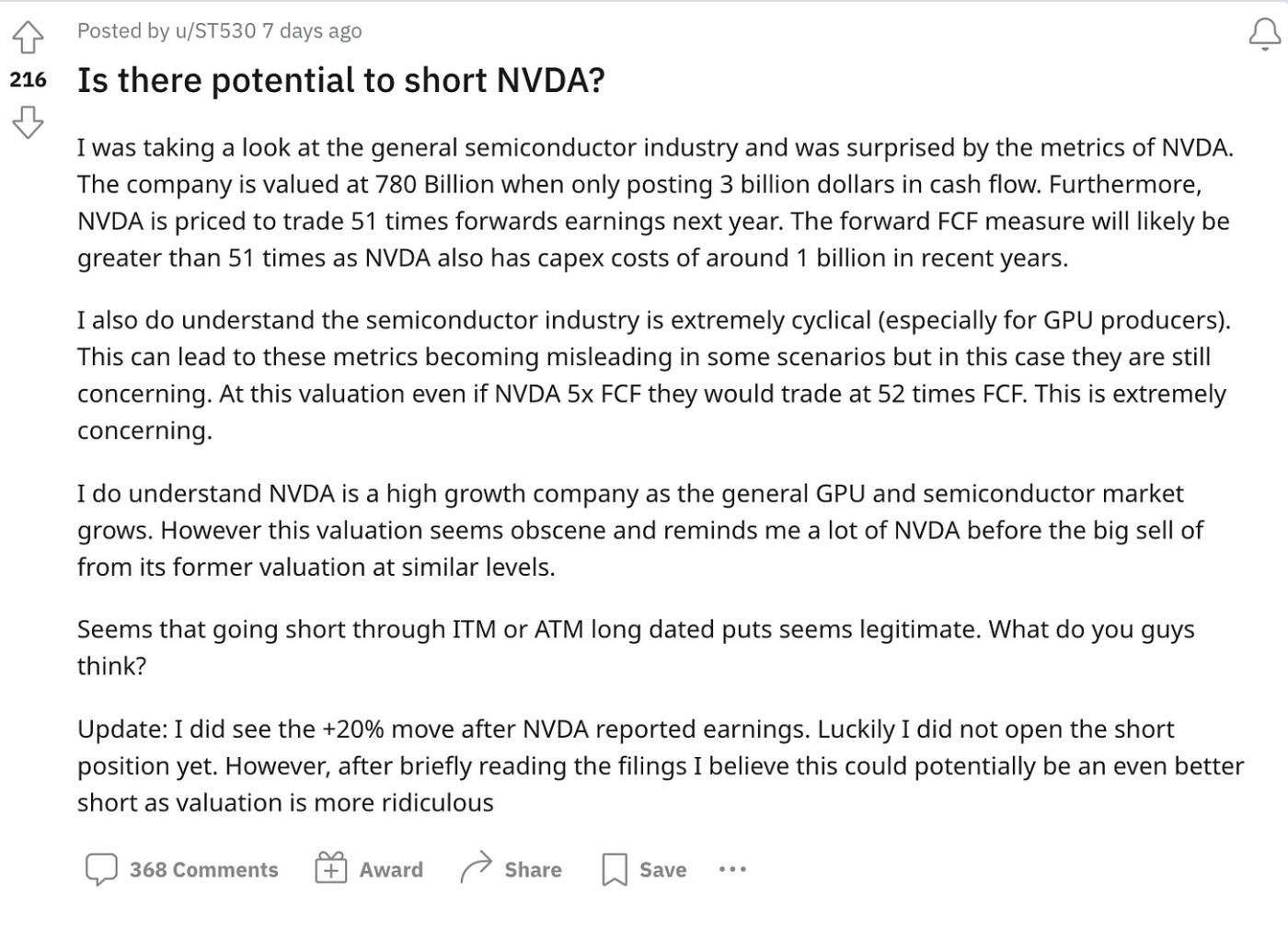

I have always thought short selling is a dangerous game to play and I have seen people who shorted Tesla stock and got annihilated. One thing I learned from observing the stock markets in the past 25 years is that the stock price is only loosely correlated with the fundamentals. But too many stock traders put too much weight on fundamental analysis. Stock prices are not determined by the fundamentals. Mechanically, it’s determined by supply/demand and bid/ask. Namely, how eager traders want to sell vs. buy a stock? Sure, there are all kinds of stock valuation methods like discounted cash flows or relative valuation analysis. But practically speaking, it doesn’t really matter. Think about it. If fundamentals matter that much, cryptos won’t trade at the prices they are currently at. Do people really think Cardano and Dogecoin are worth more than Docusign or Hashicorp in a fundamental sense? Before playing this stock picking game, I suggest people clearing out the bias for fundamental analysis. At the very least, don’t wear your fundamental analysis hat when you are shorting or buying with margin. The following is the screenshot I took from this reddit post:

I completely agree with the analysis above that Nvidia stock is overvalued and the semiconductor industry is indeed cyclical. I also think Tesla stock is overvalued. But what I think doesn’t matter. What reddit posters think also doesn't matter. The price movement is mostly driven by market dynamics. If there are no sellers after a stellar earnings report but many short sellers who want to buy to cover their positions, Nvidia’s stock price will inevitably go up. Plus, we live in a hyperconnected world where prices can be easily manipulated. Again, just look at cryptos.

I used to think that in the long run the stock prices would converge with fundamentals. But now I am not sure. My current hypothesis is that in the long run, there are points of time that the stock prices and fundamentals converge. But most of the time, they are quite different. In my opinion, betting on short-term movements based on fundamentals is no different from gambling unless it’s a cut-and-dry case of bankruptcies or acquisitions. But I wouldn’t even participate in those cut-and-dry cases. I mostly own index funds. I only pick stocks as a hobby to test my understanding of the world. My current strategy is to buy stocks that are cheap and wait until its price converges with the fundamentals. At that point, I take profits. So far, this strategy seems to work. I am patient and I have never been forced to liquidate my positions. I am no longer frustrated when fundamentals and prices diverge. I consider divergence the norm rather than the exception. Seeing things that way helps me make more rational decisions.