Original author: Ignas|DeFiResearch

Original source: Twitter

Compilation: wesely, the way of DeFi

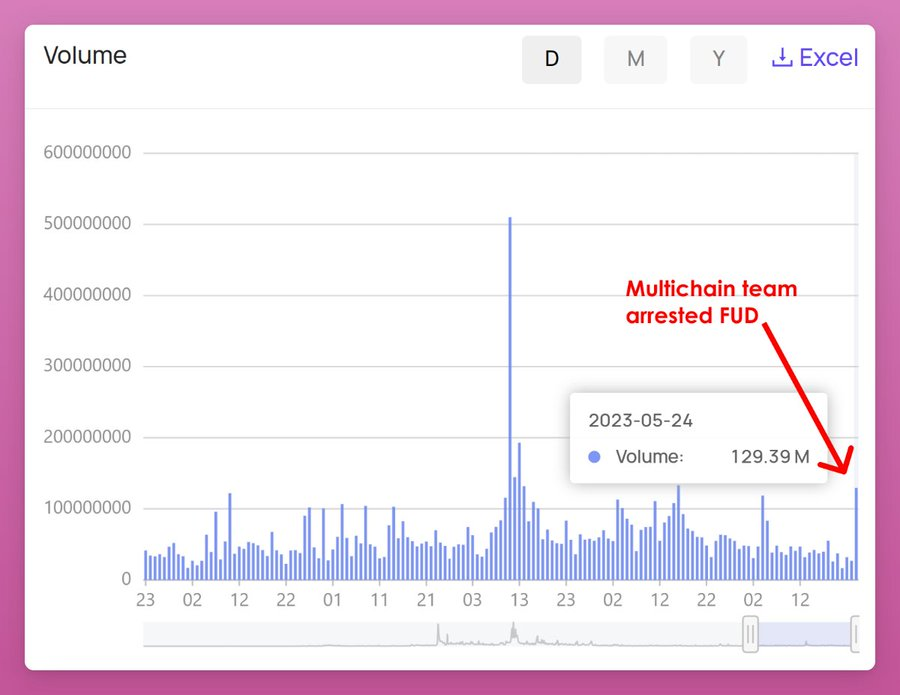

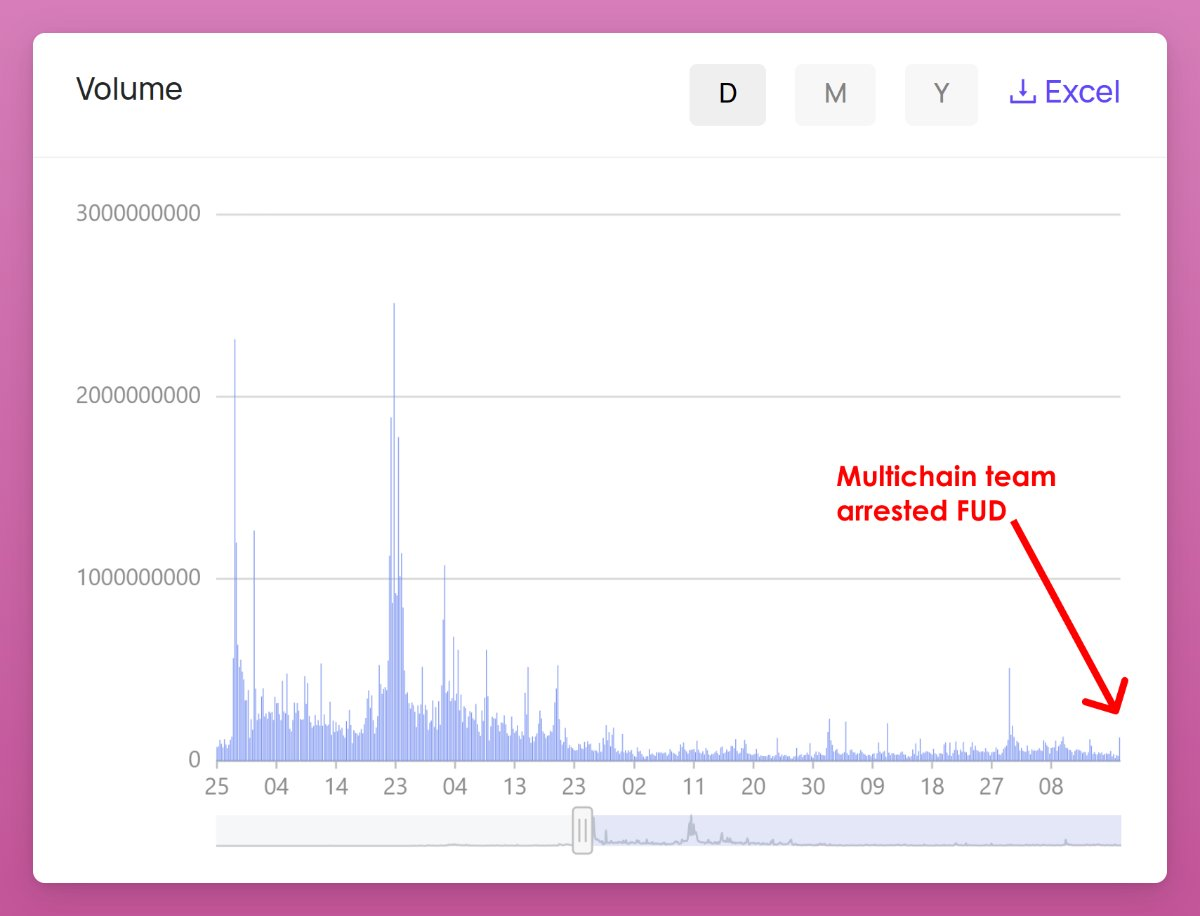

At present, Multichain's Cross-chain transaction volume is about 129 million US dollars, second only to Stargate, but if we take a long-term view, the bridge fund does not seem to show obvious signs of panic.

According to the apes_prologue report, Fantom is the L1 most vulnerable to Multichain’s wrapped token.

According to the apes_prologue report, Fantom is the L1 most vulnerable to Multichain’s wrapped token.

1. 35% of Fantom's total TVL is locked in it.

2. 40% of Fantom assets (excluding its native $ FTM token) are issued by Multichain ($650M)

3. Multichain issued 81% of the total market cap of Stablecoin in the Fantom ecosystem

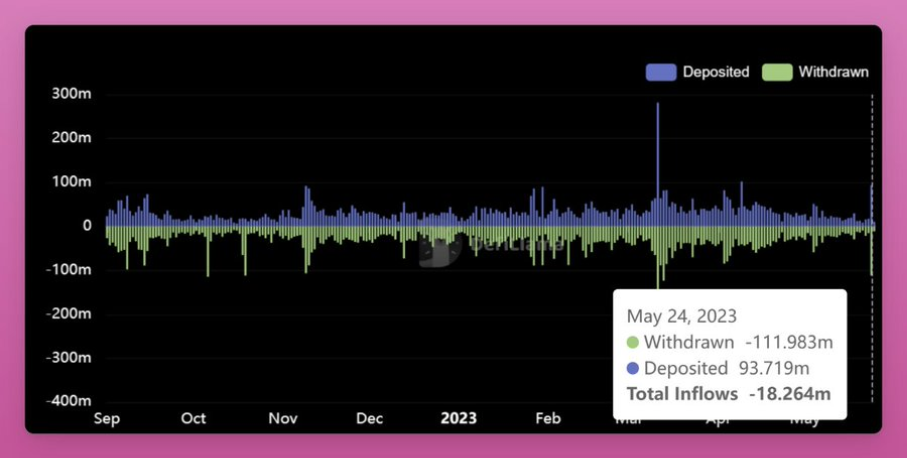

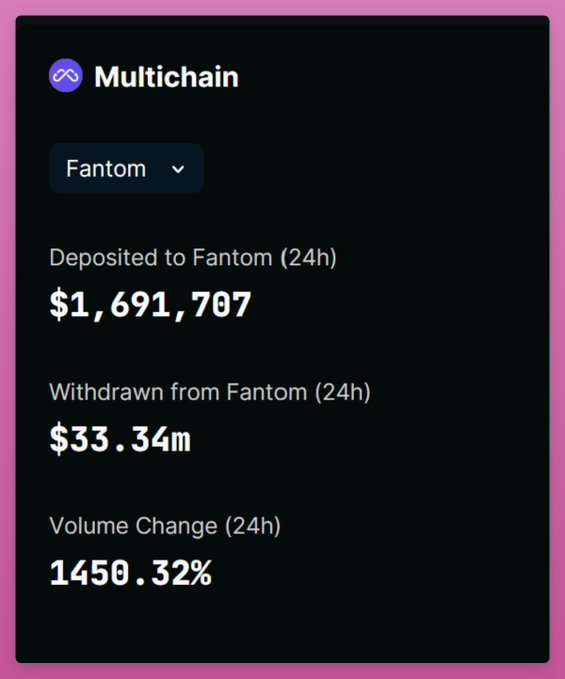

It stands to reason that we should see a large number of Fantom withdrawals on the chain, in fact, the withdrawal amount is only 18 million US dollars more than the deposit, accounting for only 1% of Fantom's total TVL $1.78B USD, so there does not seem to be too much panic .

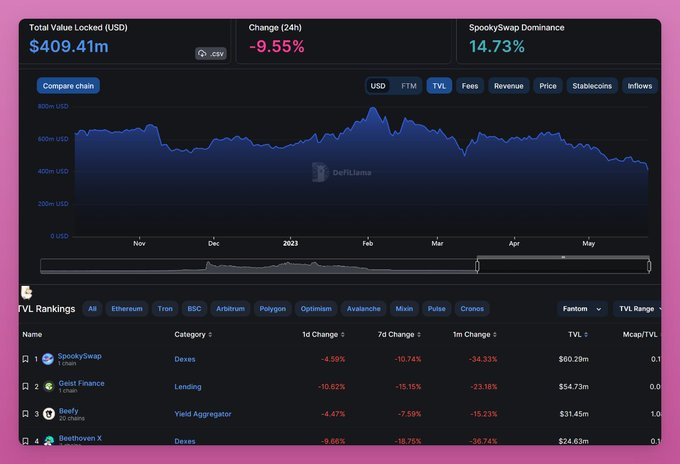

Due to the reliance on Multichain, Fantom should have experienced a large outflow of TVL, with a TVL drop of 9.55% in US dollars, but after deducting the impact of FTM prices, the data shows that there is no obvious capital outflow.

Due to the reliance on Multichain, Fantom should have experienced a large outflow of TVL, with a TVL drop of 9.55% in US dollars, but after deducting the impact of FTM prices, the data shows that there is no obvious capital outflow.

The clearest sign of panic is Multichain LP on Fantom chain. In total, the relevant LPs withdrew a total of $33 million from the Fantom chain, while only depositing $1.7 million.

The clearest sign of panic is Multichain LP on Fantom chain. In total, the relevant LPs withdrew a total of $33 million from the Fantom chain, while only depositing $1.7 million.

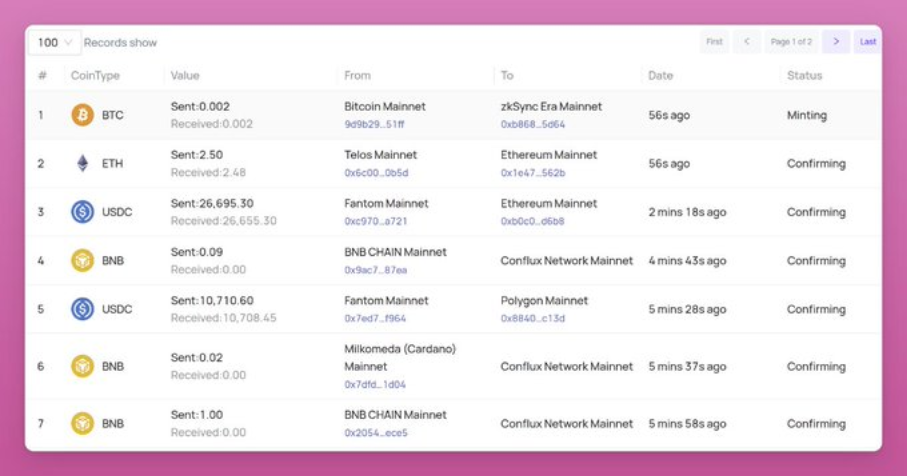

Multichain reported that “partial Cross-chain is unavailable due to force majeure,” with KAVA, zkSync, and Polygon zkEVM routing temporarily suspended, with 83 transactions pending for more than a day.

Multichain reported that “partial Cross-chain is unavailable due to force majeure,” with KAVA, zkSync, and Polygon zkEVM routing temporarily suspended, with 83 transactions pending for more than a day.

Perhaps the worst is yet to come, but on-chain data shows that there has not been a massive outflow of funds. However, what is worrying is that the team has been lacking in effective communication. It is reported that the current Multichain CEO Zhaojun has not been online for a week.

Perhaps the worst is yet to come, but on-chain data shows that there has not been a massive outflow of funds. However, what is worrying is that the team has been lacking in effective communication. It is reported that the current Multichain CEO Zhaojun has not been online for a week.