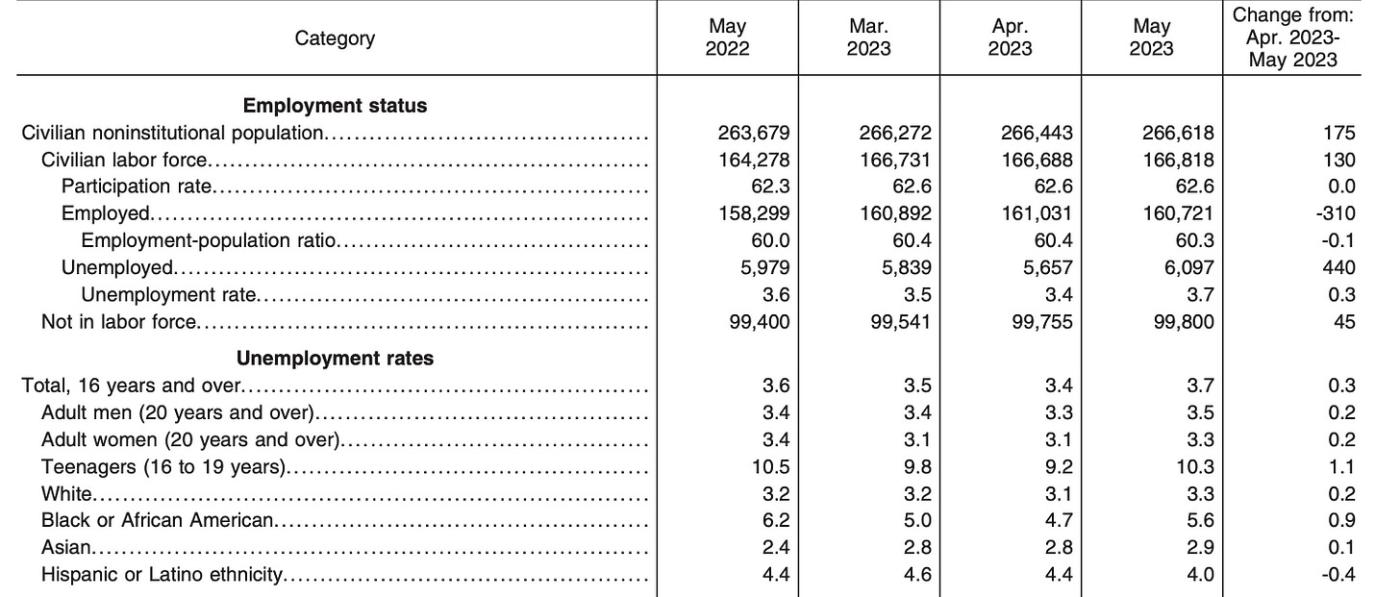

The May jobs report is out. 339K jobs were added in May vs. 195K expected. The unemployment rate inched up to 3.7% in May, up from 3.4% in April . The labor force participation rate was 62.6% in May, unchanged from April but still below the February 2020 level of 63.3%. Average hourly earnings rose 0.3% MoM and 4.3% YoY, still way above the 2% inflation rate the Fed targets.

With the PCE report last week and Jobs report today, it appears that inflation is still hot and the labor market is stronger than expected. But the Fed officials signaled a rate hike skip in the next FOMC meeting. I do think there is a pretty strong tightening force ahead such as the pending restart of student loan payments, the Fed’s ongoing quantitative tightening and replenishment of the treasury general account after the debt ceiling deal. The money supply has been decreasing since last summer. It’s anecdotal but a few of my friends in tech no longer have the same kind of liquidity to invest in the hot AI sector even if they really want to. Outside AI, very few early stage deals are happening right now and many startups are shutting down. This makes sense actually because the liquidity that was drained out of the system had to come from somewhere and I suppose tech is one of the sources. It took 12-18 months for the pandemic free money to cause inflation. It’s probably going to take some time for the tightening to take effect but something is definitely happening and I will hold on tight to my treasury bills in the next couple of quarters in case something breaks.