Original author: 0xNing0x

Original source: Twitter

A boring market with exhausted Liquidity+ exhausted narrative

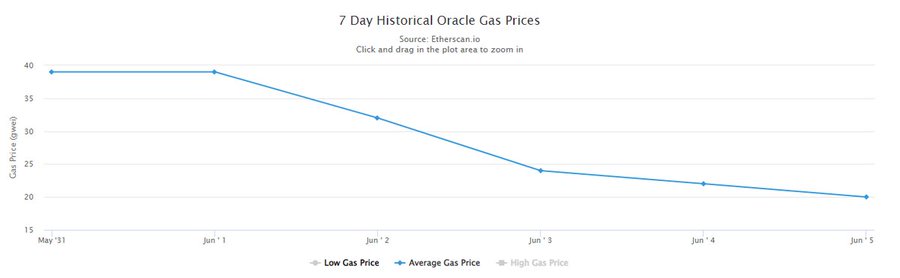

June is here, and seasonal factors have begun to dominate the trend of the crypto market. The lack of Liquidity is even worse. The 24h trading volume of popular new coins such as $ARB and $SUI is only more than 100 million US dollars today. $PEPE is even worse. The 24h transaction volume is only 80 million US dollars, which is less than the average Gas fee of the Ethereum mainnet interaction. Today it has dropped to 22 gwei

On June 1st, this value could still be maintained at the average level of 40 gwei in May. Unexpectedly, it has dropped sharply in the past few days ~50% of the average Gas fee. The MeMe craze has basically come to an end. In particular, after Ben completed the final harvest, most MeMe coin players lost their enthusiasm for attacking the new MeMe coin. Now it is only a derivative narrative derived from BRC20, which can still make some ripples, but the pool is too small. , There are too many crocodiles, and most people are still intimidated and kept at a distance.

Can't beat gold + can't beat the weak market of US stocks

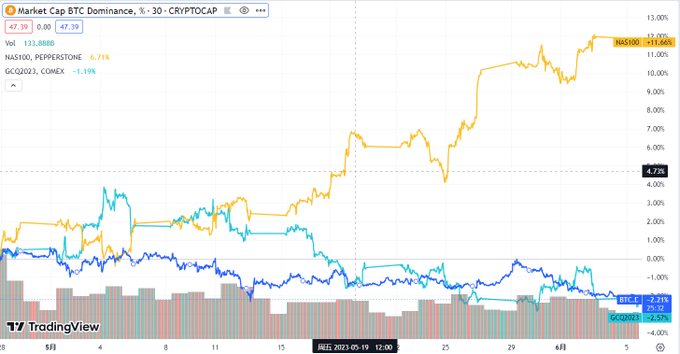

Recalling that in March, BTC, which has both the attributes of a safe-haven asset and the attribute of a risky asset (I call it the duality of hedging and risk), was extremely strong. Gold rose with gold, and U.S. stocks rose with it. U.S. stocks rose.

By May, BTC had completed de-correlation with gold and U.S. stocks. It was weak, and it could neither outperform gold nor U.S. stocks. The duality of hedging and risk has also changed from a blessing to a curse.

In such a weak market, only contract players and MeMe Coin Hundred U God of War can still enjoy themselves.

Last Friday, the issue of the U.S. debt ceiling was finally resolved. A-shares, U.S. stocks, and Japanese stocks all rose strongly.

Therefore, it is expected that June will continue the weakness in May.

The era of big tearing is coming, and the bubbles and grievances accumulated in the bull market are released in the bear market

At the beginning of June, Lumao Studio started tearing up the capital public chain of SEI to engage in KYC, then He Yi yesterday tore down Chinese KOL malicious FUD on Binance, followed by Jason tearing up L2 to become a ghost town, and then the Move capital public chain High FDV unlimited unlocking provoked public outrage.

Good show, that is one play after another.

SEI, L2, and Move public chains are all beautiful bubbles blown by the last round of bull market, and cannot withstand the wind and rain of this round of bear market.

99% of their users are wool parties, most of the TVL is double-counted, most of the TX on the chain is swiped, and only 3 digits of real daily active users cannot support their market value of tens of billions of dollars at every turn.

However, the exchange, which was expanding rapidly in the bull market, suddenly looked back and realized that it could not afford to support such a large and high-salary team with fee income, so it started various show operations.

On the one hand, cut expenses and lay off employees without a bottom line; on the other hand, open source, listing CX currency, listing MeMe currency, listing relationship currency + fixed-point liquidation + Void issuance of Stablecoin+ swallowing frozen currency. In short, in order to survive for myself, I did not hesitate to rub employees and users on the ground.

The large-scale adoption of ChatGPT is just a silver needle to burst the encryption narrative bubble. AI was born at about the same time as the blockchain, and how successful the mass adoption of AI is today makes the encryption narrative seem hollow.

No wonder, A16Z, Paradigm betrayed the revolution. No wonder, Zhu Xiaohu regards Web3 people as crazy.

It is expected that in the boring + weak June, in the market environment of Liquidity+ exhausted narrative + underperforming the mainstream market, more institutions, exchanges, and project parties will join the battle.

In June, we will not be crypto traders, we will be Web3 eaters.