Original author: @0xShinChannn

Original source: Twitter

Note: The original text comes from @ 0xShinChannn's long tweet.

@ApertureFinance core team member @RobMcStodda summarized the various revenue agreements of Uniswap V3 through the traditional Web2 style sign wall.

I did a simple compile. In addition, @ApertureFinance will launch a private beta on July 10th, and there will be token AirDrop incentives, welcome to join DC and pay attention~

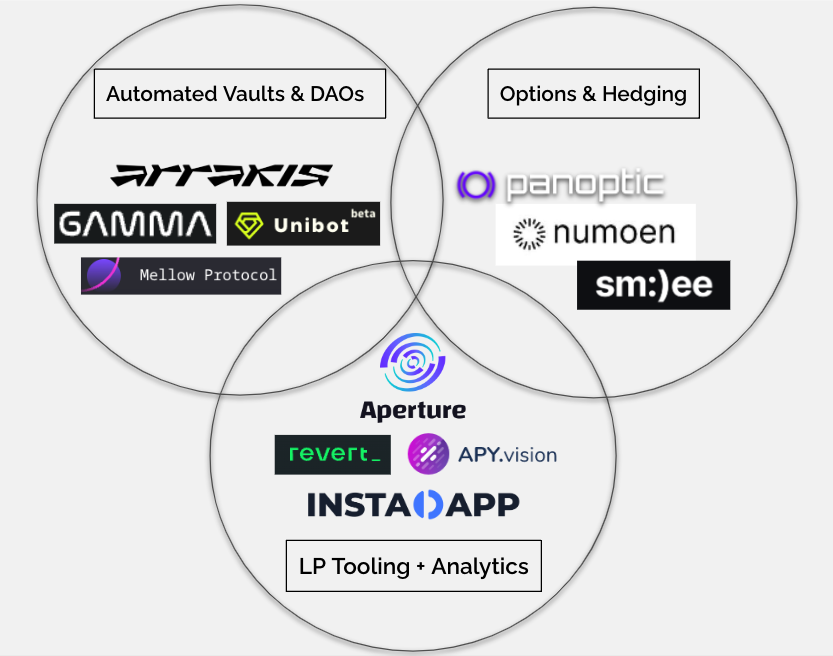

LP tools: position rebalancing, fee compounding, opening/closing position analysis tools: profit and loss (PnL), backtesting, etc. These protocols solve the core needs of LPs who need to manually manage Liquidity @ApertureFinance @revertfinance @Instadapp @ApyVision

Automated Vaults: These are typically coded structured product vaults designed to automatically rebalance around specific price ranges. Mainly useful when volatility is low or the market tends to be sideways. @DiamondProtocol @GammaStrategies @mellowprotoco

The DAO: UniV3 allows DAOs to provide Liquidity to governance tokens in a novel way, without requiring too many Stablecoin or $ ETH. Some protocols aim to automate this process for DAOs. @ArrakisFinance

Options: Providing Liquidity on Uniswap is like selling options with no expiration date. Some protocols seek to further create option Liquidity and expiration. @Panoptic_xyz @SmileeFinance Hedging: With perpetual contracts, you can create direct hedges for your Uniswap positions. @numoen

Original author @RobMcStodda 's English tweet: https://twitter.com/RobMcStodda/status/1664427642744111104