The wave of artificial intelligence has swept through for nearly half a year, and it has also allowed Nvidia to push open the door of the trillion-dollar club in the US stock market.

Nvidia, which only wanted to get a share of the game image computing at the beginning, did not expect to become the leader of AI computing more than 20 years later, almost monopolizing the entire AI server chip market.

The last one to dominate the server market was Intel, but its CPU lost to Nvidia's GPU in high-performance computing. At the same time, Intel also lags behind TSMC in chip manufacturing technology, and its product strategy has been in a passive state. In contrast, the leading Nvidia has already surpassed the dust, and AMD is also chasing after it, copying Intel's nest.

With the success of Nvidia, the research and development direction of the next generation of chips is more focused on how to deeply integrate AI models. The choice is not only GPU, because most of the high cost of increasing computing power is due to AI chips, so Nvidia’s model training on the chip side. The leading position will undoubtedly be challenged, and companies such as Intel, AMD, and Qualcomm are gearing up and getting ready.

So, in AI chips, will there be the next Nvidia?

01 AI chips must first pass a threshold

According to the deployment location, AI chips can be divided into cloud, terminal and edge side; according to the division of tasks, they can be divided into training chips and reasoning chips. The cloud is for model training in the data center. The chip needs to support a large amount of data calculations. The terminal and the edge side have slightly weaker computing power requirements, but require fast response capabilities and low power consumption. Nvidia has dominated the field of training chips, but There is no shortage of chips that are more suitable than GPUs for reasoning.

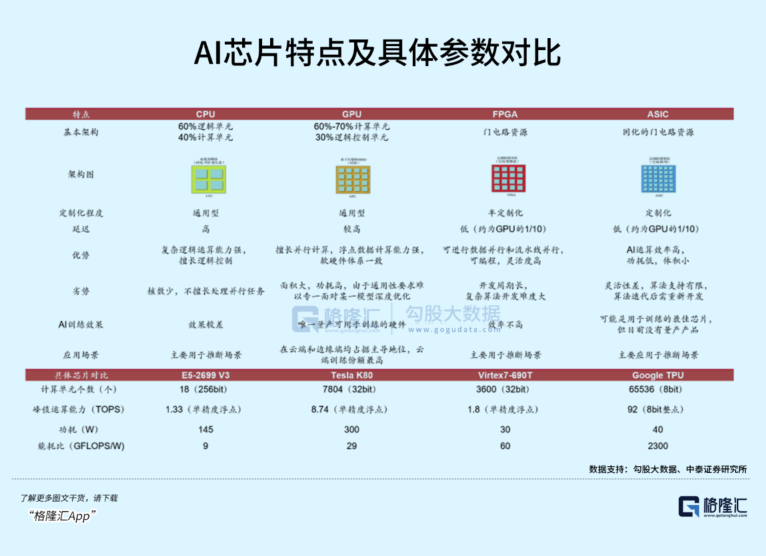

Dedicated AI chips with different performances include GPU, ASIC, FPGA, NPU, etc., which can be referred to as XPU for short, and the different names reflect the differences in their respective architecture levels. Dedicated AI chips have the ability to match GPUs in the areas they are good at, although less scalable, but ahead of more general-purpose GPUs in performance and computing power, although the latter can do more things.

This goes back to the logic that the CPU was abandoned in the field of machine learning. Will there be a new chip that can attack the GPU in the future?

At present, the world's major manufacturers are particularly fond of making cores, but there is no need for general-purpose chips to be made by themselves, and they will only be laid out in line with their important business directions.

For example, Google's TPU uses ASIC, which is only for convolutional neural network accelerators, Tesla 's Dojo is a machine vision analysis chip specially used for FSD, and domestic Baidu and Ali also spend a lot of energy on self-developed chips.

For a long time, dedicated processors have not really brought a threat to GPU, which is mainly related to the positive cycle formed by market capacity, capital investment, and Moore's Law.

According to IDC data, in China's AI chip market in 21 years, GPU accounted for 89% of the share; NPU processing speed is 10 times faster than GPU, accounting for 9.6% of the share, ASIC and FPGA accounted for a small proportion, the market share was 1% and 0.4% respectively .

In the past three decades, the rise of wafer foundries such as TSMC and Samsung has shaped the trend of division of labor and specialization. Technological advancements in equipment and advanced manufacturing processes have allowed chip design companies such as Nvidia and Qualcomm to show their talents, and technology companies such as Apple and Google. Big manufacturers began to use chips to define products and services. The soil for dedicated chip design is fertile, and everyone is the beneficiary.

In the view of competitors, GPU is not a chip specially designed for machine learning. The reason for its success is mainly due to the combination of the complex ecology formed by the framework software layer, which improves the versatility of the chip.

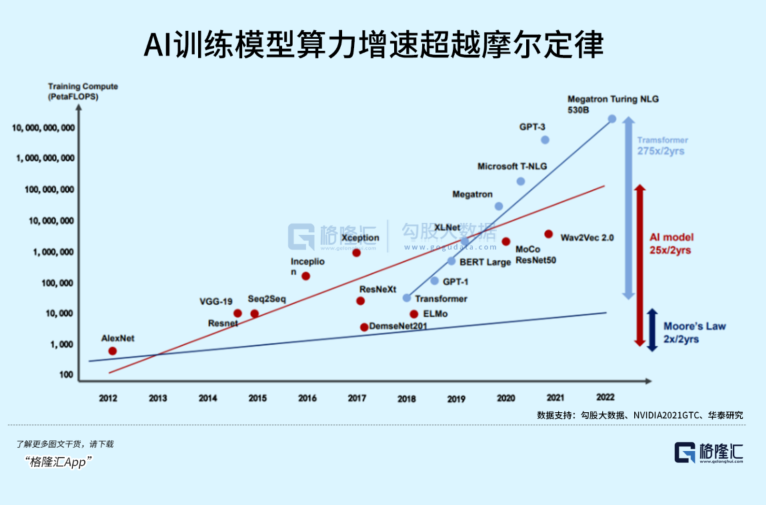

In fact, since 2012, the demand for computing power of the head training model has increased by 10 times each year, and has been approaching the computing power limit under Moore's Law.

Since the Tesla M2090 in 2011, data center product GPUs have been updated and iterated, and Volta, Ampere, Hopper and other architectures for high-performance training computing and AI training have been launched successively, maintaining the speed of launching a new generation of products every two years. The power also increased from 7.8 TFLOPS to 30 TFLOPS, an increase of nearly 4 times.

The latest H100 has even shortened the training time of large models from one week to one day.

Based on Nvidia's high share in the field of AI chips, it can be said that the computing power growth of AI model training in the past was mainly supported by Nvidia's GPU series, which formed a positive feedback. The development cost of Nvidia chips.

Compared with the future demand for computing power, the technical iteration of a general-purpose chip will eventually gradually slow down. Only when a dedicated processor runs through this positive cycle can it be possible to keep pace with general-purpose chips in terms of cost.

However, the difficulty lies in that special-purpose processors only focus on market segments, and the market size is not comparable to that of the general-purpose market. Compared with the performance improvement per unit of general-purpose chips, it often takes longer time or larger shipments to achieve Dilute the cost, but with the accelerated penetration of AI in application scenarios, the expenditure on AI chips will also increase significantly in the future, and dedicated AI chips, CPU, and GPU are expected to become three parallel lines.

According to Precedence Research, the global AI chip market size will be US$16.86 billion in 2022, and will grow at an annual rate of about 30%, and is expected to reach about US$227.48 billion by 2032.

02 Three divisions, how to fight against courtesy?

Nvidia's monopoly on computing power has been accelerated and strengthened under the current large-scale model war, and the contradictions are increasingly intensified. The demand for GPU procurement exceeds the expectations of TSMC and Nvidia. If the supply is insufficient, the price will rise, and the cycle will continue.

Major domestic and foreign technology manufacturers maintain a consistent attitude in choosing self-developed chips, or help other chip factories compete with Nvidia, stimulate new supply and reduce chip costs.

At the beginning of last month, AMD rose 12% intraday because of news that Microsoft is working with AMD to fund the latter's expansion into AI chips and cooperate with the chip maker on a chip code-named Athena (Athena) , but Microsoft officials later denied the news.

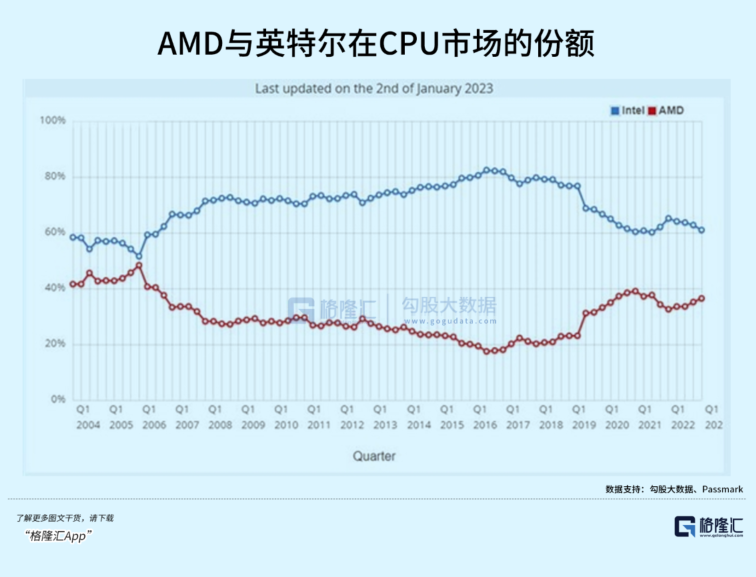

This is reminiscent of the " WINTEL " alliance in the 1990s, which mutually achieved Microsoft's position in the PC operating system and Intel's position in the CPU. At this time, AMD has become the most powerful threat to Intel's market share.

The computer market was hit hard last year, and the weakness at both ends of enterprise servers and consumer electronics caused a lot of drag on CPU shipments. Both Intel and AMD experienced the biggest decline in more than 30 years, down 21% and 19% respectively.

Although the main business is showing signs of fatigue, the competitive landscape of the industry has undergone tremendous changes again.

According to Passmark data monitoring, in the data center market, AMD’s share soared to 20% last year, stealing nearly 10% of Intel’s (2022, 70.77%) share, and as of January 2 this year, AMD was approaching 40% again , back to the level of 2004.

AMD has been able to catch up, on the one hand, with the help of TSMC, its product portfolio has been continuously optimized, and the adoption rate of EPYC Milan processors for data centers has increased. Last year, the revenue of this business increased by 64%.

Another aspect has to do with poor strategic decisions by competitors. In the past ten years, Intel, which has maintained a leading position, has been lacklustre in CPU innovation, and its product strength has been declining relative to competitors.

When Apple wanted Intel to develop a mobile phone CPU for the first-generation iPhone, CEO Paul Otellini refused because the offer was too low. The x86 leader miscalculated the opportunity for the mobile terminal.

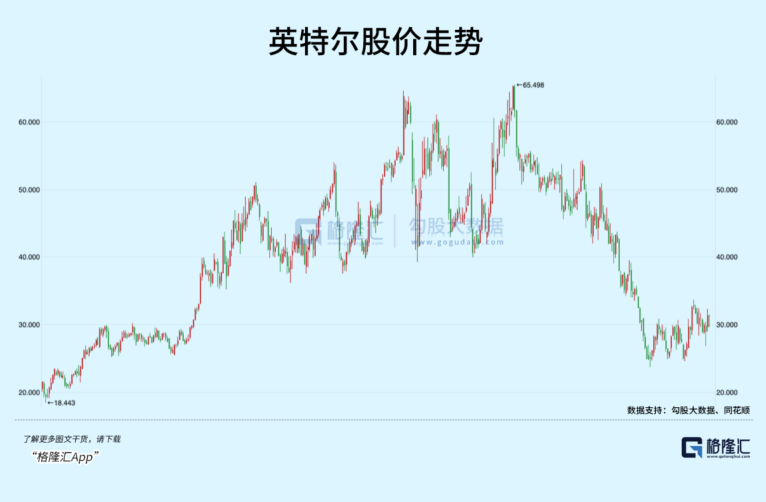

In addition to lack of strategic vision, there is also a new product launch plan that keeps skipping tickets. Intel is an old man in the old IDM era. Now TSMC and Samsung are leading the iteration of advanced manufacturing processes. They are the base for continued upgrades of general-purpose chips such as CPUs. Intel’s own technology The backwardness of technology is counteracting the pace of product updates, and it is more of a "squeezing toothpaste" style addition. From the high point in 2021 to the present, its market value has been cut by more than half.

On the other hand, AMD has broadened its product categories all the way, pursued a cost-effective strategy, and successively acquired ATI and Xilinx, becoming the first chip manufacturer to win CPU+GPU+FPGA at the same time. In 2018, AMD’s CPU process on the PC side overtook the car for the first time, and its market share began to increase rapidly. In 2019, it teamed up with TSMC to take the lead in leaping into 7nm, and also achieved process surpassing on the server side. Last year, its market value surpassed that of Intel.

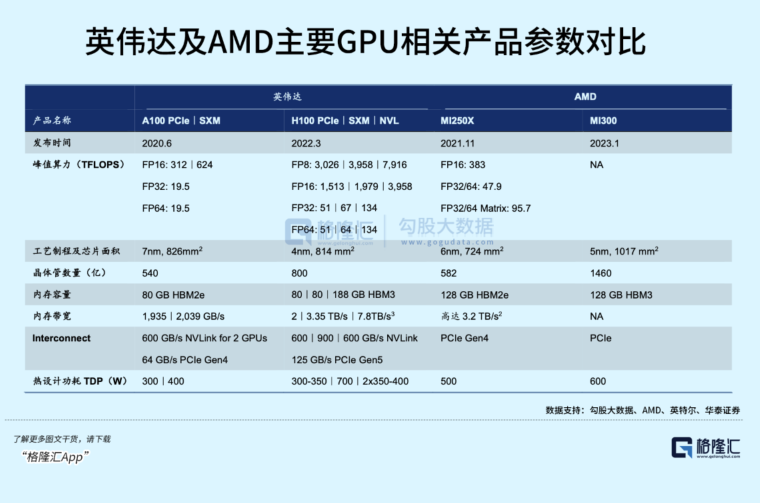

Not long ago, AMD launched the Instinct MI 300, which combines CPU+GPU dual-architecture, to officially enter the AI training end. This chip directly benchmarks Nvidia's Grace Hopper in terms of specifications and performance.

This is an important move for AMD management after emphasizing AI as a strategic focus. Unlike Nvidia, which rents out its own computing power at the same time, AMD focuses on building a competitive chip matrix and confronting it head-on. It may start to break through from the data center of cloud manufacturers. It is expected to start heavy volume in the fourth quarter of this year.

In fact, it's not that the two CPU giants fought and left Nvidia aside, but they couldn't catch up.

Since 2015, Intel has spent huge sums of money to acquire a large number of artificial intelligence companies, such as Altera, Mobileye, Nervana, etc., but the result has not brought much help to the business, it is more like raising these companies and waiting to scratch the lottery.

Intel has also been planning to launch a GPU comparable to Nvidia, but the plan has been skipping tickets.

In 2021, Intel announced a flagship GPU code-named "Ponte Vecchio" for use in data centers, only to see delays in delivery. As a successor, Falcon Shores GPU combines x86 CPU and Xe GPU, also skipped to 2025.

It is true that Nvidia's success is not just about hardware. Different from Intel's past hardware-first path, Nvidia's GPU architecture has maintained a two-year evolution rate, and it has built a software ecological barrier with a general-purpose computing framework.

In the process of chip development, the winner who defines the standard is often the strong and the strong. To compete with Nvidia, cost performance is a necessary weight, and the ecological circle is also the key. The development of computing power to promote the progress of AI also depends on the competition and mutual surpassing of these manufacturers.

In these respects, whether it is AMD, Intel, or other big latecomers, there is still a long way to go.

Gelonghui statement: The opinions in this article are from the original author and do not represent the views and positions of Gelonghui . Special reminder that investment decisions need to be based on independent thinking. The content of this article is for reference only, not as any practical advice, and the transaction is at your own risk.

This article is from the WeChat public account "Gelonghui APP" (ID: hkguruclub) , author: Freddy, 36 Krypton is authorized to publish.