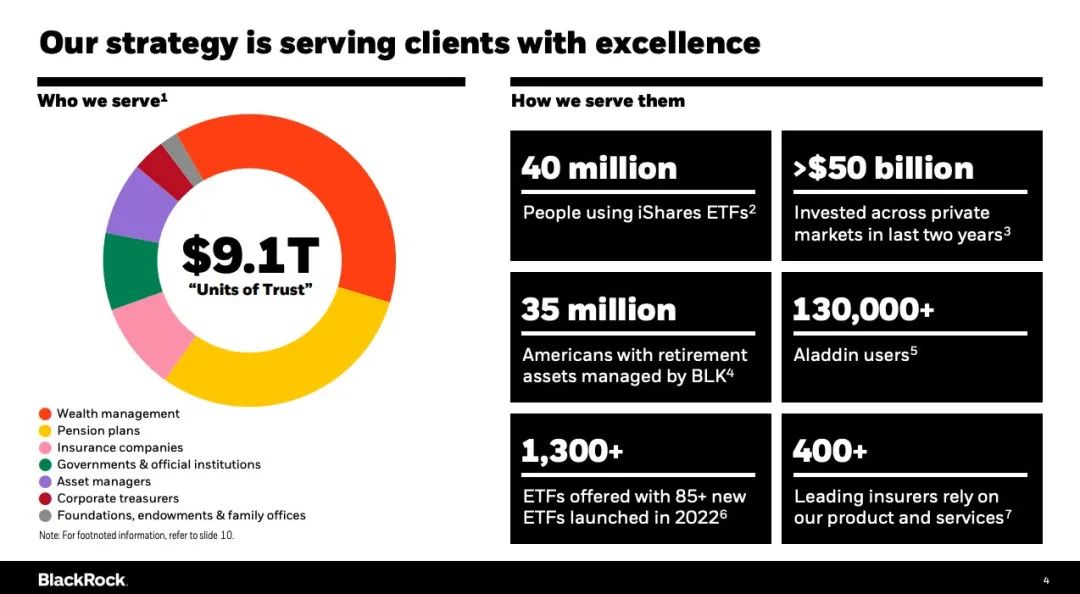

Blackrock is the largest asset manager in the world, currently managing approximately $9 trillion in assets.

Author: Hei Mi, Bai Ze Research Institute

If BlackRock's bitcoin spot ETF application is approved, it could spark a new wave of cryptocurrency frenzy, flooding the market with trillions of dollars of institutional money, sending BTC and altcoin prices skyrocketing.

This article takes a look at some of the projects that could directly benefit from BlackRock's Bitcoin Spot ETF.

Note: This article is only for information sharing, the author has no interest relationship with the project mentioned, and does not make any endorsement. DYOR

Why is BlackRock able to exert such enormous energy?

Blackrock is the largest asset manager in the world, currently managing approximately $9 trillion in assets.

This month, BlackRock's move against the trend to apply for a Bitcoin spot ETF is considered a proof that "institutions have re-entered the encryption market."

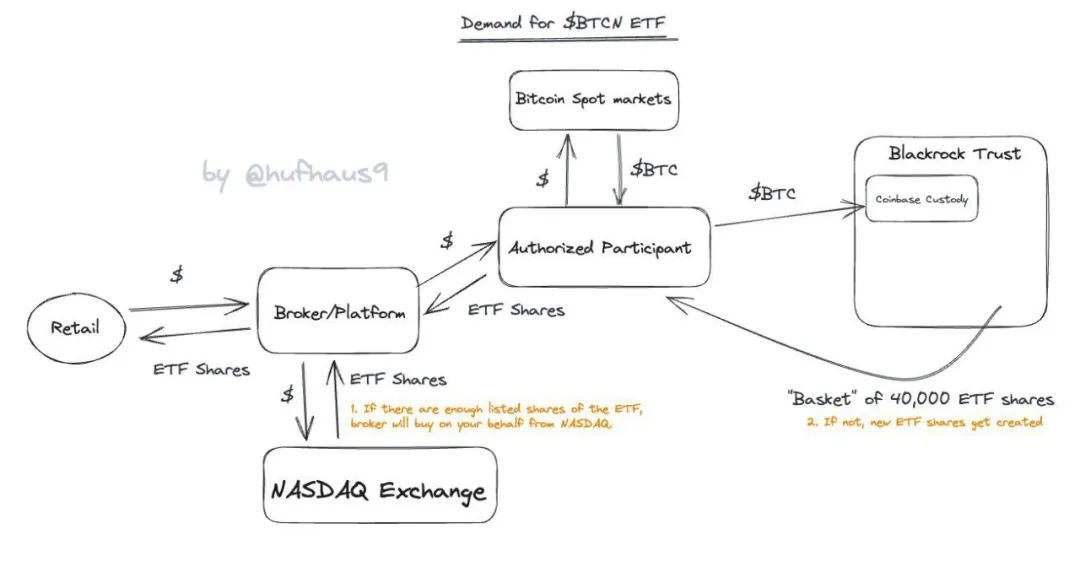

In simple terms, let's say you want to invest in Bitcoin. Instead of registering yourself with a cryptocurrency exchange, depositing money to buy bitcoin, and paying taxes on each transaction, you can buy BlackRock's bitcoin spot ETF and they will do these things for you. You get a receipt to prove your ownership of the ETF, and then track the value and performance of the bitcoin. In addition to using the Coinbase custody account to manage these bitcoins, BlackRock cannot use your bitcoins to "do evil", all they can do is to provide you with more cost-effective services.

What's really interesting, however, is BlackRock's relationship with the U.S. government and the Federal Reserve.

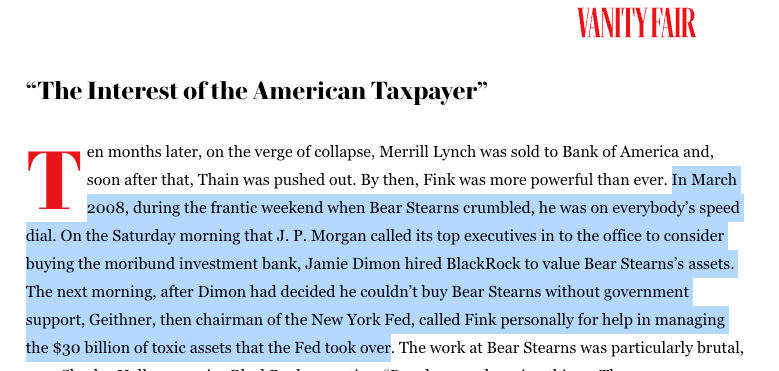

Who did the Fed let manage the troubled assets they took over from Bear Stearns in 2008?

The answer is BlackRock.

Who did the Fed turn to in 2020 when it wanted to buy some corporate bonds to help prop up the economy?

The answer is BlackRock.

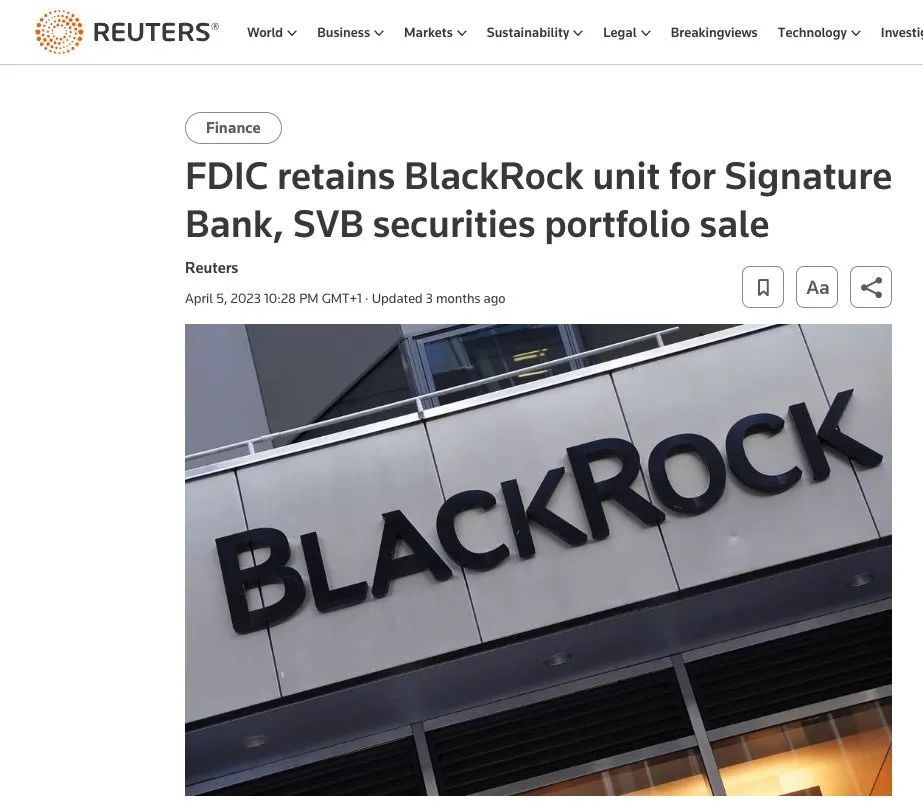

In 2023, who will the FDIC turn to to help take stock of Signature and Silicon Valley Bank?

The answer is BlackRock.

This is why Eric Balchunas, senior ETF analyst at Bloomberg, said that BlackRock's application for a bitcoin spot ETF is "a big event" for the entire encryption market.

In addition to entering the encryption market through Bitcoin spot ETFs to seize the traffic and handling fees brought by Bitcoin transactions, we can also find through the annual report that BlackRock is also interested in the tokenization of RWA (Real World Assets), especially It is the tokenization of stocks and securities.

What projects might benefit from this?

1. Bitcoin L2 ecology led by Stacks

Stacks can be said to be the most prosperous Bitcoin L2 network in the current ecosystem.

Similar to the Rollup L2 network designed to expand Ethereum, Stacks also packages multiple transactions into a batch and submits them to the Bitcoin network for verification, thereby effectively reducing the number of transactions on the Bitcoin network. Improve overall performance.

Stacks adopts the Proof of Transfer (PoX) consensus mechanism. Miners need to spend Bitcoins to mine the native token STX , so that Stacks can borrow the security of the Bitcoin network and allow Bitcoins to be used on dApps in the Stacks ecosystem. (It’s worth noting that STX was the first token approved by the SEC in 2019)

As the Bitcoin NFT protocol Ordinals unveiled the prelude to the Bitcoin ecological explosion, the handling fee soared, and Stacks returned to the public view again. The popularity continued to rise in the past two months, and the price of STX rose by more than 4 times in more than a month.

Therefore, the approval of BlackRock's Bitcoin spot ETF may play a role in boosting STX and the broader Bitcoin L2 ecology.

In addition, Stacks will introduce five important features in the latest upgrade Nakamoto in Q4 in 2023, which is expected to be an additional catalyst for STX prices, including sharing network security with Bitcoin and creating a decentralized Bitcoin anchor currency SBTC.

2. Project mentioned by BlackRock: Energy Web

Energy Web is an organization dedicated to accelerating the decarbonization of the global economy through open source software and blockchain solutions. Sustainable grid balancing; bringing transparency to supply chains for emerging green products like sustainable aviation fuel. The group has struck deals with several large energy producers and fossil fuel companies over the years, including publicly traded Shell and Volkswagen.

Its Mainnet, Energy Web Chain, was launched in 2019. It is an EVM enterprise-level public chain that adopts the Proof of Authority (PoA) consensus mechanism. Blocks and transactions are verified by pre-approved participants (usually partner companies). Act as the administrator of the system. But whether it is an enterprise or an individual developer, dApps can be deployed on the network, such as DeFi with the theme of energy trading, and any user can use it. However, its native token EWT only serves as the most basic verifier reward and Gas token, and has not been endowed with more utility.

This month, the organization announced that it will launch a Polkadot parachain called Energy Web X. The easiest way to understand it is that the two blockchains share a token. The idea of Energy Web X is simple, it is to add a kind of utility to EWT - so that anyone can gain trust by staking tokens, become a working node, and get token rewards for running computing jobs for energy companies. Small token holders can stake their tokens to trusted nodes to earn income.

It is worth noting that when BlackRock launched Bitcoin Private Trust last year, it mentioned that Energy Web is helping to improve the transparency of Bitcoin green mining. After the press release was issued, the price of EWT tokens rose by 24%. Therefore, the approval of BlackRock's bitcoin spot ETF may have a positive effect on Energy Web, the largest decentralized energy ecosystem, and the adoption of more energy companies will also have a further impact on the price of EWT. impetus.

3. RWA track that BlackRock is interested in: Polymesh, Realio Network

As mentioned in the first part of this article, BlackRock is interested in tokenizing RWA.

Polymesh is an institutional-level L1 network tailored for regulated assets such as security tokens. The token standard is inspired by ERC-1400, providing more functionality and security to facilitate the issuance of assets on the chain and management. Transparency and compliance are one of the highlights of the network, and all issuers, investors, stakers and node operators need to complete identity verification.

POLYX is Polymesh's native token and is classified as a utility token under the country's laws under the guidance of the Swiss financial regulator FINMA. POLYX has multiple utilities for staking, governance, creation and management of security tokens.

Realio Network, formerly a P2P digital asset issuance and trading platform focusing on real estate private equity investment, has established an interoperable and scalable L1 network based on the Cosmos SDK, focusing on the issuance and management of RWA tokens, and also provides KYC/AML compliance, investor certification and other tools to meet compliance requirements.

At present, its leading product Realio.fund investment platform has been launched, providing Multichain token issuance tools, fully automatic compliance process and other functions, in which users can invest in cryptocurrencies more safely.

Realio Network adopts a dual-token Proof-of-stake model, RIO and RST, with multiple utilities such as pledge, governance, and key management.

As the two most powerful projects on the RWA track, Polymesh and Realio Network are bound to benefit from the wave brought about by the approval of BlackRock's Bitcoin spot ETF.

4. The strong are always strong: Take Render and GMX as examples

If BlackRock's bitcoin spot ETF application is approved, it could trigger a new round of cryptocurrency boom, and projects that have performed well this year may benefit from it, such as Render and GMX.

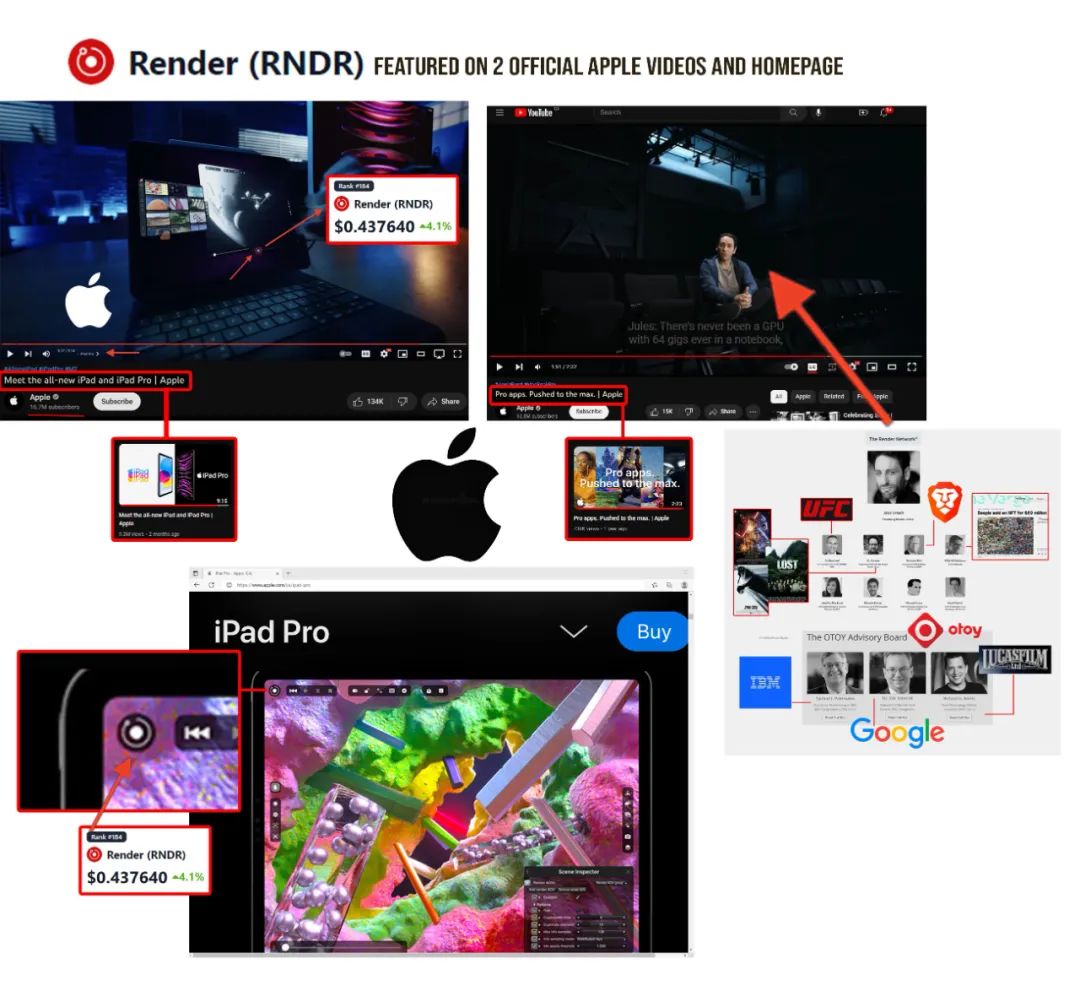

Render Network is a blockchain-based GPU rendering network designed to connect idle GPUs with creators who need additional GPUs to maximize resource utilization. As a kind of infrastructure, rendering has huge business scalability, and it is also a part of artificial intelligence and metaverse narrative, so it is one of the benchmarks of the Depin (distributed physical infrastructure network) track.

Its native token RNDR is one of the tokens with the strongest rise this year, and has completed a good rebound in the bear market. The reason may be the partnership between its parent company OTOY and Apple. Apple’s official product promotion videos have appeared many times. Render Network Logo. Recently, RNDR has adopted a new token economic model "burn and mint" (BME), making it a highly deflationary token, which may be a catalyst for its price to continue to rise in the future.

Perpetual DEXs are gaining more users as the US SEC sued centralized cryptocurrency exchanges Coinbase and Binance this month. Traders trying to get rid of CEX and KYC are looking for a "new home" on the sustainable DEX track.

GMX, the leading project with a total transaction volume of more than $133 billion, is likely to continue to grow as a result.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.