AI could be the lifeline of the next decade's economy?

Written by: Ren Qian, Xu Muxin

Editor: Liu Jing

Source: Undercurrent Waves

The era of hot money has come to an end, and the whole world is in the same mood.

The "longest bull market" in US stocks that began in 2009 and lasted for 13 years will come to an abrupt end in 2022. The impact will continue until 2023: According to the latest data from Crunchbase, US start-ups raised only $27.6 billion in the second quarter of this year, compared with $45.2 billion in the first quarter, a drop of about 40%. Compared with the same period last year, it even plummeted by 55%.

Coatue, an American hedge fund, has always presented itself as a technology investor. Over the years, its actual strategies in dealing with different cycles and its understanding of the macro have surpassed most of its peers. Especially in 2022 when the U.S. is experiencing great inflation and unprofitable technology stocks are falling sharply, Coatue plans to withdraw in advance, slashes positions, and frees up nearly 80% of the cash in his hands, which is praised by the industry. We have also studied Coatue's investment strategy in China.

In recent years, Coatue has generated an Investor Deck of the year almost every year. The key message for 2022 is that if the bear market is a domino, Coatue thinks we're not done yet: the unprofitable tech crash is just the first step (down 73% from February 2021 to February 2022), According to Coatue's inference at the time, the market was far from bottoming out.

This year, Coatue further pointed to the advent of the era of recession, while pointing to the "breakthrough" moment of the next technology super cycle: AI may become the new lifeline of the economy.

In the 46-page PPT for 2023, Coatue marshals a trove of macroeconomic data to try to explain what it means for a recession. They also provide some interesting analysis, pointing out the stock performance of big tech companies, and what entrepreneurs can learn from it.

In June, at the East Meets West conference, Coatue showed this PPT, which stated that 59% of economist respondents believe that the global economy will enter a recession in the next 12 months. The following is the key information intercepted by "Undercurrent Waves".

Is the boom in tech stocks a dream or reality?

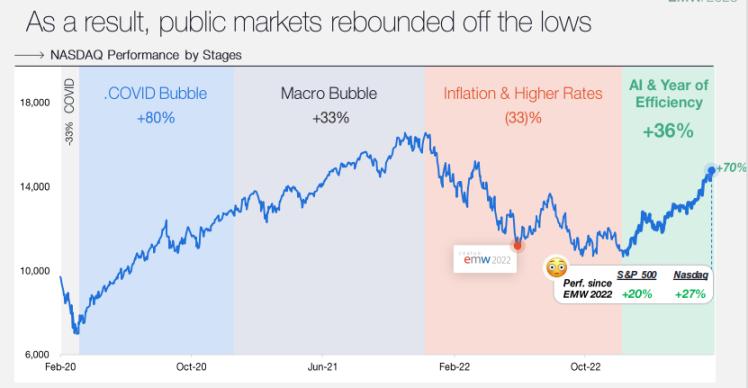

Coatue first reviewed its Investor Deck in 2022, in which the predictions on issues such as difficulty in fundraising, cost reduction and efficiency increase were verified, but it predicted the macroeconomy too pessimistically: the same as the predicted macroeconomy will be in 2023 Compared to a hard landing, the economy appears to have bottomed out in 2023, with a 20% increase in the S&P.

These backlashes were broadly attributed to:

1. First of all, it reflects that the inflation rate has slowly dropped from the high point in the macro, and has dropped from the peak of about 9% in 2022 compared with the same period last year, and Coatue predicts in the chart that in the rest of 2023, the inflation index will drop to 2021 levels;

2. Although the top companies in Silicon Valley are laying off large numbers of employees, overall the U.S. unemployment rate has reached a record low in the past two years, only around 3.6% to 3.7%;

3. The European energy crisis has been suspended, and the price of natural gas has returned to before the outbreak of the Russia-Ukraine war;

4. China has come out of the epidemic crisis, and the economy has regained its vitality;

5. The giants in Silicon Valley are transforming one after another, returning to business common sense and focusing on profitability;

6. A better dawn appears in the field of AI. The enthusiasm of OpenAI and ChatGPT makes people smell the smell of a new super cycle or coming.

That's why markets are recovering, with the S&P up 20% and the Nasdaq up 27%.

The trend performance of Nasdaq since February 2020 has gone through the following five stages: the new crown period, the new crown bubble period, the macro bubble, inflation & high interest rates, and AI and high-efficiency years

So, do all the above data indicate that the economy is doing well?

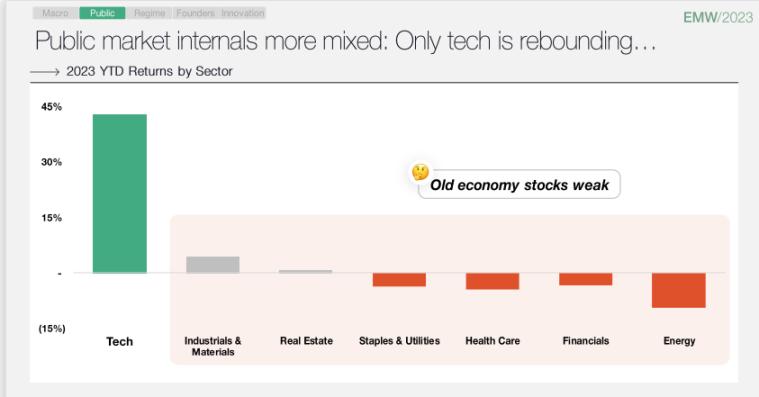

If you disassemble the above data, you will find that although the S&P has been rising all the way, in fact, only the technology sector has rebounded significantly.

But behind the brilliant performance of technology stocks, it is actually related to the low situation in 2022. In 2022, many technology stocks will drop by as much as 90%, and the price-to-sales ratio (PS) of the well-known technology company Affirm even dropped below 2. It can be said that this is a year when the valuation of technology stocks is severely reshuffled and reset.

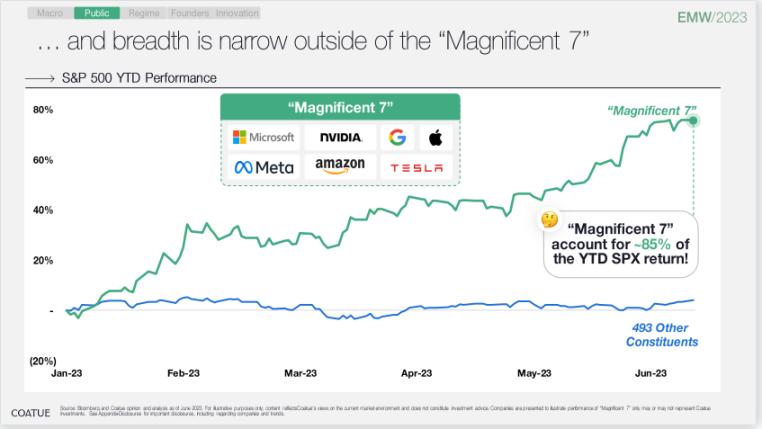

Another worry is that the "Big Seven" accounted for at least 85% of the 45% return on technology stocks. The remaining 493 stocks in the benchmark rose just 2.2 percentage points, according to Bank of America data.

The so-called "Big Seven" was first proposed by the Bank of America in the report: Microsoft, Nvidia, Google, Apple, Meta, Amazon, and Tesla are collectively referred to as the "Big Seven". The inspiration may be Derived from the title of a film adaptation of "Seven Samurai".

The seven stocks accounted for 8.8 percentage points of the roughly 10 percent gain in the S&P 500 this year and 31 percent of assets in the global wealth investment management sector, up 44 percent since the start of the year. Take Nvidia, for example. Since the release of its stunning first-quarter earnings report, Nvidia's market value has exploded by about $185 billion, which means that this stock has contributed to one-fifth of the S&P 500's gains this year, even though it only accounts for the index. 2.7% of the weight.

Therefore, it may be just an illusion of a "tech bull market". Vulnerabilities arise when the weight of a market rally rests on the shoulders of a limited number of stocks, as Bank of America fears.

Beyond tech stocks, pressure remains on economically sensitive sectors: crude oil, regional banks, transportation, and retail all showed vertical declines.

Hot money is scarce, and the whole world is hot and cold

While individual technology stocks are soaring, Coatue also sees the dilemma of more technology companies. Coatue judged that if the past was the era when hot money flooded the market, then now is the era of returning to common sense. Because the rules of the game have long since changed:

1. If it is said that "money is free" in the past era, now you must bear a 5% risk-free interest rate;

2. The era of barbaric growth has passed, and now we must face the possibility of slowing growth;

3. Return to rational valuation from bubble valuation;

4. From capital drive to innovation and management drive;

5. From expanding at any cost to focusing on profitability.

Coatue surveyed the market and found that the combined market capitalization of unicorn companies (valued at more than $1 billion) was about $5 trillion based on the last public financing records. Today, this number is only 25,000 One hundred million U.S. dollars.

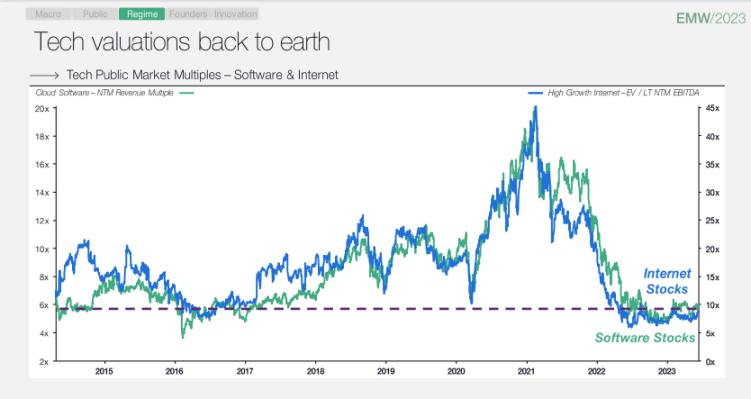

Tech stock valuations are dropping from the sky to the ground.

The Coatue report shows that the EV/NTM Revenue Multiple (company value divided by the company's revenue expectation for the next year) multiple of cloud software and Internet companies has dropped from a high of 20x in 2021 to less than 6x today, and the valuation multiple has dropped from 45x dropped to the same level.

Behind this is the slowdown in revenue growth. According to Morgan Stanley's analysis of the market value of listed companies' software, it can be seen that the company's revenue growth rate has a very obvious positive correlation with valuation.

Objectively, it becomes difficult for enterprises to achieve revenue growth. For example, in a survey of 68 cloud software companies, Coatue found that its ARR (annual recurring revenue) increased by 20% between 2017 and 2020, and reached 50% during the epidemic, but since 2022 it has dropped to - 20%.

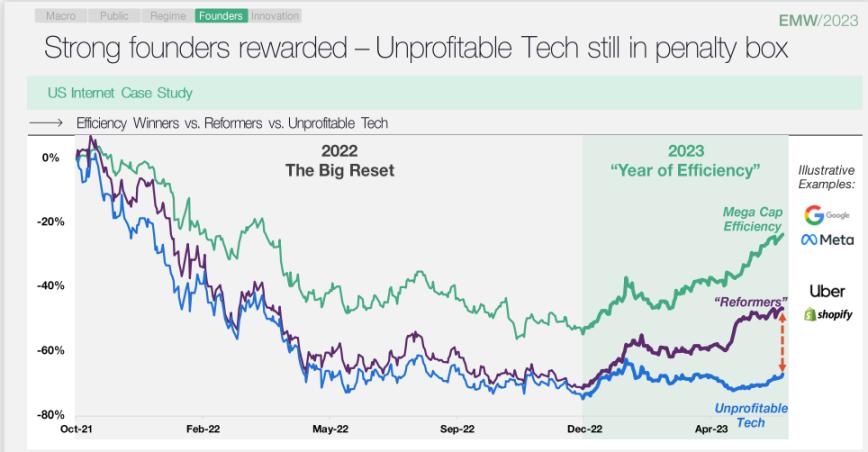

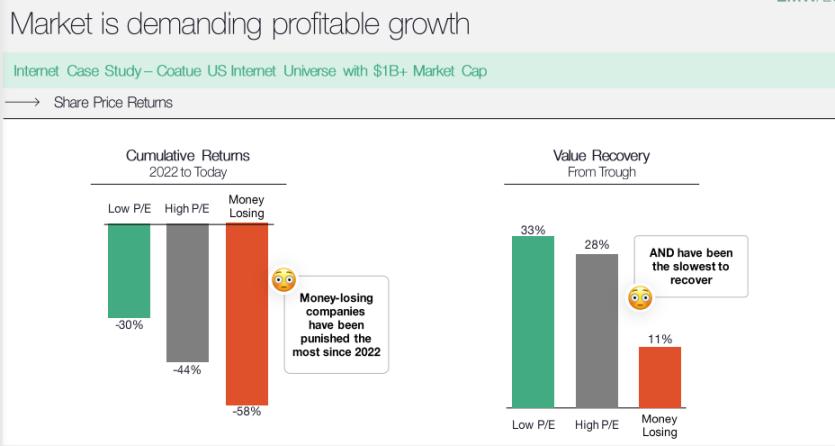

Still, the market is desperate to see earnings growth, so unprofitable companies are penalized the most in 2022, and their valuations recover the slowest from their troughs.

Coatue further noted concerns.

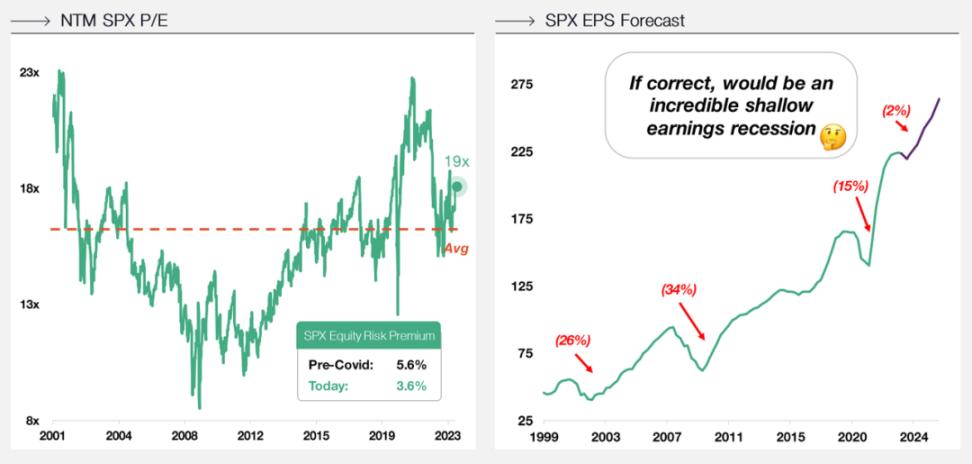

1. Stock valuations are slightly expensive

The equity risk premium index has dropped from 5.6% before the epidemic to 3.6%, and the earnings per share forecast will plummet to 2% after 2024 from 15% around 2020.

During the epidemic, the United States adopted an unlimited quantitative easing monetary policy, issued a large number of US dollars, and the real interest rate reached a historical low in 10 years, causing the prices of risky assets represented by US stocks (especially unprofitable technology stocks) to be full of bubbles again. If this number is correct, it would be an incredible earnings recession.

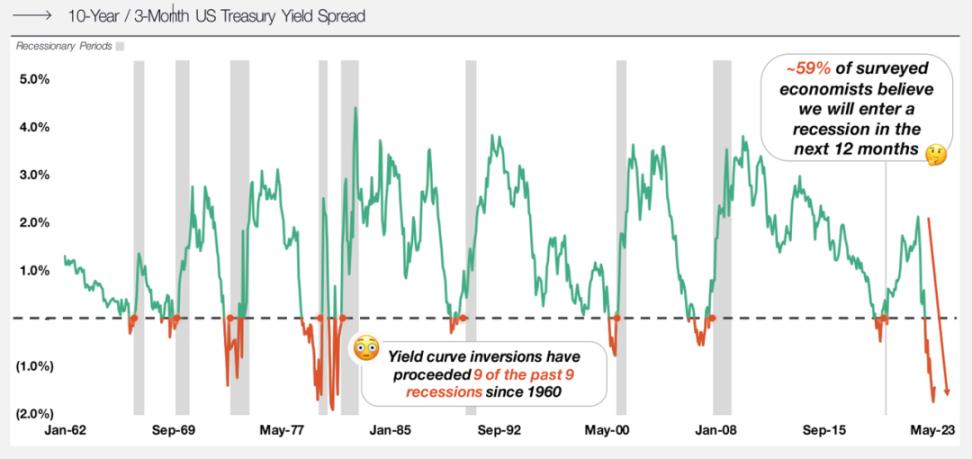

2. The economy is not out of the woods yet

Looking at the 10-year/3-month U.S. Treasury yield spread, Coatue mentions that since 1960, 9 of the past 9 recessions have yield curve inversions, but now 59% of the economics of respondents believe a recession will occur within the next 12 months.

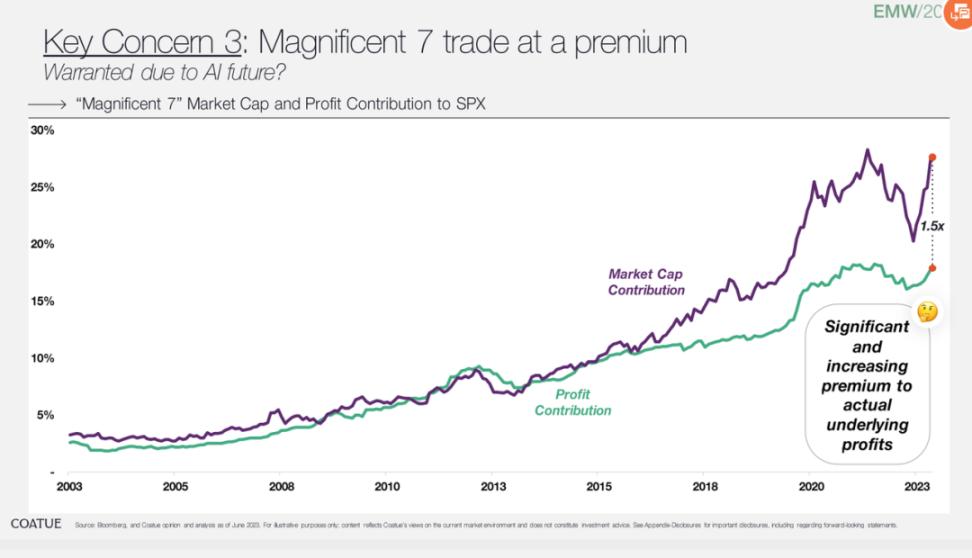

3. Market value and profit contribution index of the "Seven Giants"

Before about 2016, the two lines of market value and profit were basically the same, but in recent years, the premium of actual basic profit has been significantly and continuously increasing.

Unicorns will be repriced

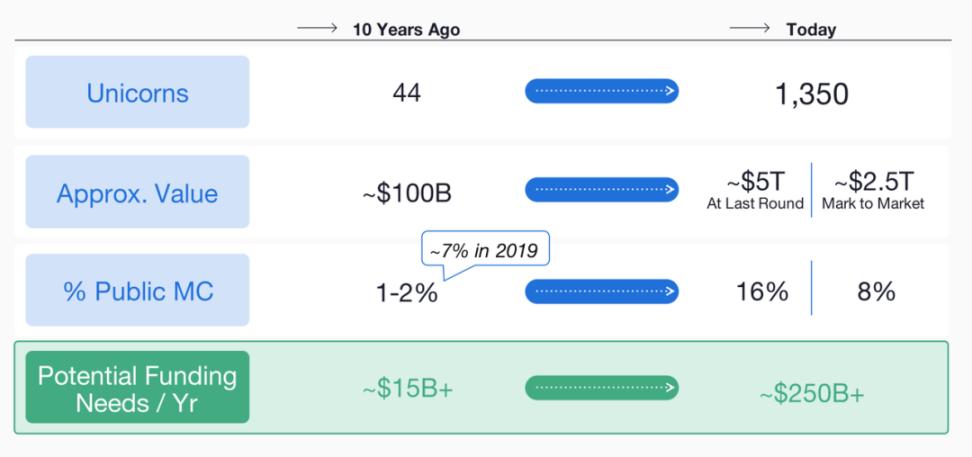

Coatue pointed out that the number of unicorns in the world has reached 1,350 today, a 30-fold increase from 44 ten years ago; the total valuation has also ranged from US$100 billion to US$5 trillion. As a result, the potential annual capital demand of these unicorns has also soared from the previous US$15 billion to US$250 billion.

However, a practical question is, can these unicorns really raise so much money? the answer is negative. Because investors have more alternative options: they can buy Meta or Google stock at 20 times P/E, or they can buy Nvidia at 50 times P/E. Another point is that money was "free" in the past, but now you have to bear a 5% risk-free interest rate.

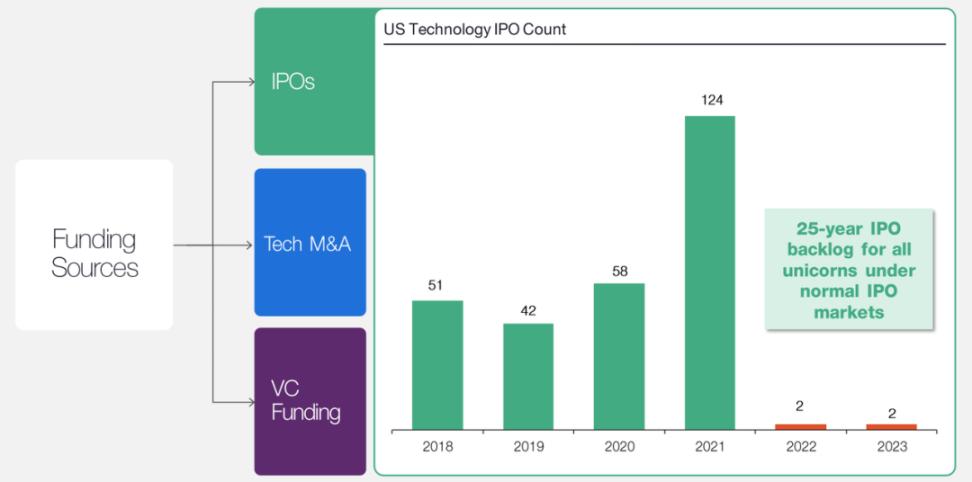

Another unavoidable trend is that today's exit and follow-up financing channels are narrowing. There will be 124 IPOs of US technology stocks in 2021, but only 2 in 2022 and 2023, dropping to freezing point.

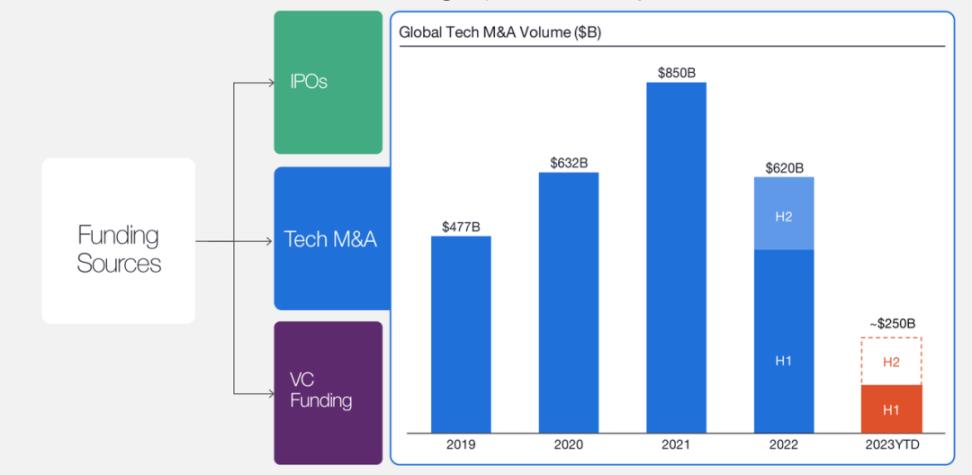

The global technology M&A transaction volume will be 620 billion U.S. dollars in 2022, but according to Coatue's forecast, it will only be 250 billion U.S. dollars in 2023.

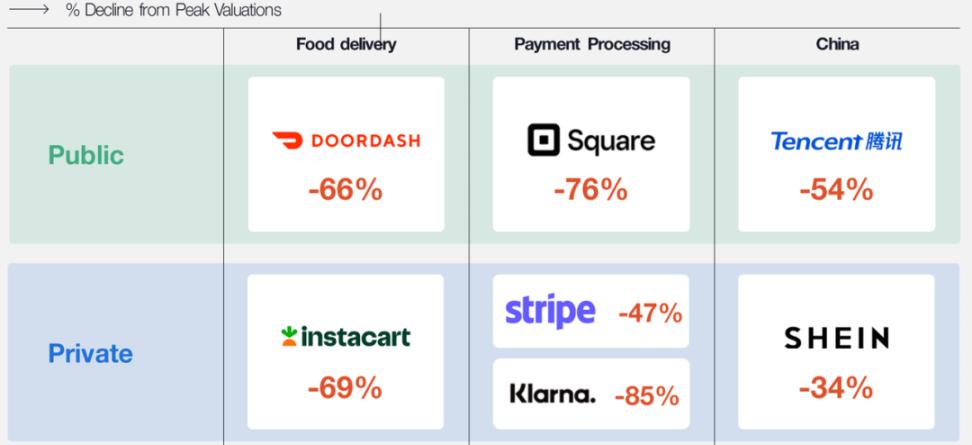

The current valuation of most unicorn companies is unfair, and many large companies are facing repricing. The valuations of those unicorns that got new money are also sharply corrected, such as Klarna -85%, Stripe -47%, SHEIN -34%.

Coatue believes that if many unicorns do not reprice, they may never receive new funds.

For the founders, what they are facing now is such an environment: from only focusing on growth to focusing on efficiency, and now they must pay attention to both efficiency and scale growth.

The economy is more resilient, but we're not out of the woods yet. This means to the founders that the era of free money is over, a new market system is being established, and companies need to adapt to the "new normal".

The speeches of the star CEOs in Silicon Valley this year are also worth pondering——

Mark Zuckerberg said after layoffs that "the more streamlined the better", in Meta's "efficient year", he realized the importance of reducing costs and increasing efficiency.

Shopify CEO Tobias Lütke said "to keep the most important things important." He realized that the company found the real pillars of survival, rather than aimlessly expanding its boundaries.

The "Musk's annual golden sentence" selected by Coatue is: "We are going to lay off 80% of Twitter's employees." The Silicon Valley Iron Man who made a big deal to acquire Twitter may have realized that "Twitter Can it run on its own without anyone?"

AI ushers in a new supercycle

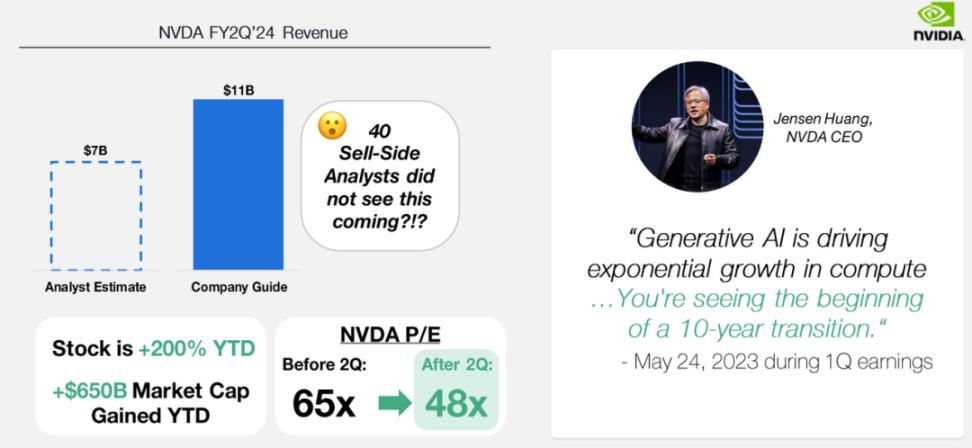

Coatue believes that Nvidia's blowout report in the second quarter is the "breakthrough" moment of the next technology super cycle, and AI may become the lifeline of the economy in the next decade.

Every super cycle of global business often originates from underlying technological innovation. And the biggest variable in 2023 will come from the emergence of generative AI.

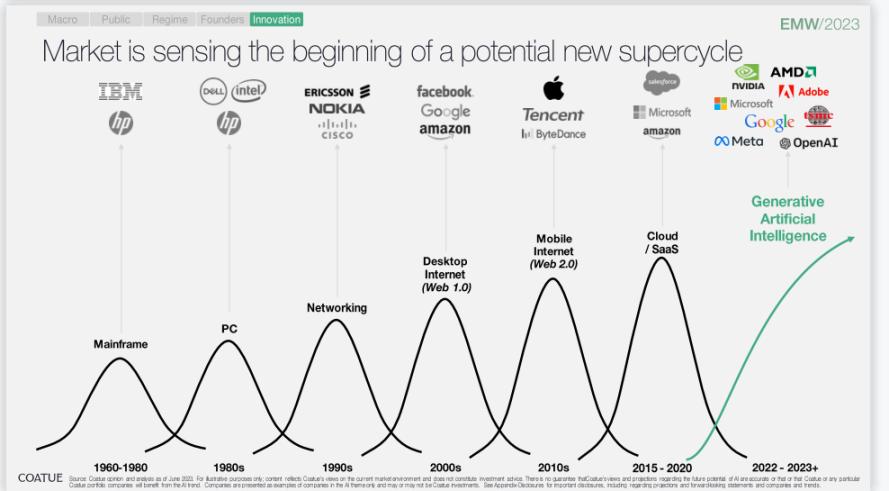

Coatue analyzes the great companies born out of super cycles from the 1960s to the present. For example, IBM in the central processing unit era; HP and Intel in the PC era; Nokia and Cisco in the networking era; Web1 is Facebook, Google and Amazon; Web2 belongs to Apple, Tencent, and ByteDance; The hottest "Big Seven" may be signaling that the "singularity moment" of the AI supercycle is coming.

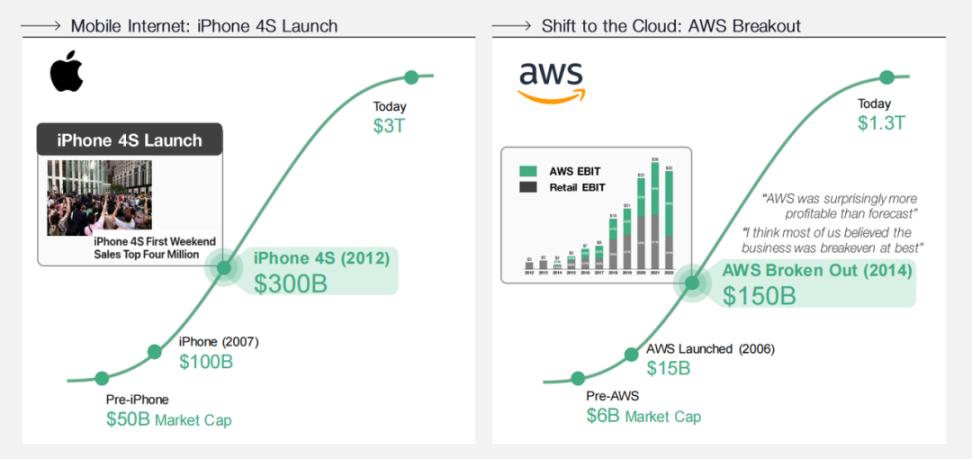

Every major cycle comes with a breakthrough moment. Coatue used two eras of mobile Internet and cloud computing as examples.

1. The release of the iPhone 4S (the fifth generation of the iPhone).

If the market value of smartphones in the pre-iPhone era was US$50 billion, the advent of the iPhone in 2007 raised it to US$100 billion, and the appearance of the iPhone 4S in 2012 tripled the value to US$300 billion.

iPhone 4 is the most successful mobile phone in Apple's history, and it is also a milestone product in the history of mobile phones. If the launch of the first three generations of iPhone means the success of the iPhone player role, then the role of the fourth-generation iPhone is positioned as a disruptor of the industry.

Second, the advent of the cloud computing cycle is due to the breakthrough of AWS.

Most people thought of the AWS business as break-even at best, and it turned out that its earnings were staggeringly higher than expected. Amazon's cloud business will exceed US$80 billion in revenue in 2022, contributing 40.5% of its business growth.

As soon as Amazon's annual financial report was released in 2014, this company that does not use profit as an indicator once again surprised the outside world. It accounted for nearly 50% of cloud computing revenue, reaching US$1.56 billion. Amazon's stock price rose by 14.1% on that day, and its price-earnings ratio was nearly 1,000 times. The AWS business is Amazon's breaking point. As a category in its own right, AWS has grown and become more profitable than the company as a whole.

So, judging from Nvidia's revenue in the second quarter (Nvidia's share price has risen by 200% so far this year, and its market value has increased by US$650 billion), does it also mean that it is a breakthrough moment in the AI era?

Nvidia CEO Jensen Huang said, "Generative AI has brought exponential growth in computing, and we are witnessing the beginning of a decade of change."