Original author: Biteye core contributor Lucky

Original editor: Biteye core contributor Crush

Original source: @BiteyeCN

Pendle is a revenue tokenization protocol built on multiple chains. By separating the principal and interest of interest-earning tokens, users can purchase corresponding underlying assets at a discount.

At the same time, for yield traders, they can express their bullish and bearish views on the yield of interest-earning assets by trading yield tokens (YT). The detailed mechanism will be expanded below.

The development history of Penlde is as follows:

Pendle will be launched on the mainnet in June 2021;

In November 2021, it was launched on Avalanche , and completed 2 rounds of financing in the same year, with a total financing amount of US$370w institutional round financing and 4337 ETH crowdfunding round financing;

In November 2022, the V2 version will be officially launched, and its AMM model will be rebuilt to improve transaction efficiency;

In March 2023, Pendle will be listed on Arbitrum ;

In July 2023, Binance announced the launch of Pendle, and then Pendle announced the launch of the BSC mainnet, a big step forward in the multi-chain process;

01 Liquidity mining to earn rewards

Before understanding how to earn rewards through liquidity mining, let’s briefly understand the mechanism of Pendle :

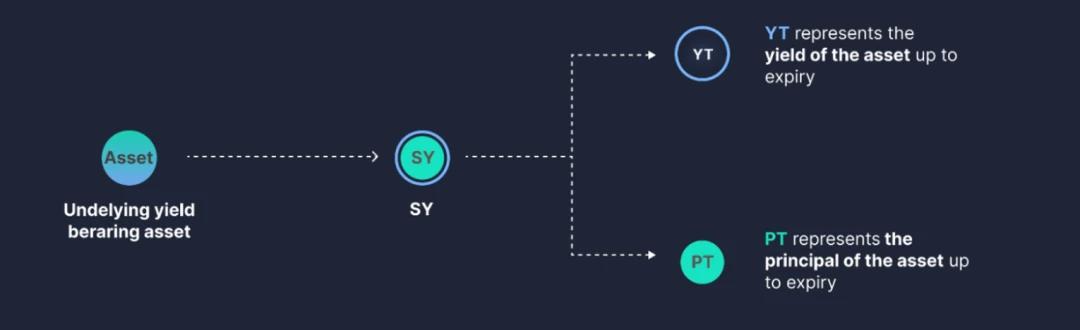

First, Pendle encapsulates interest-bearing tokens, such as cDAI, stETH, etc., into SY (standardized income tokens). For example, after stETH is encapsulated, it becomes SY-stETH.

Then, SY is split into two components, principal and income, namely PT (principal token) and YT (yield token). This process is called revenue tokenization, which involves splitting the revenue into separate tokens.

PT is the principal token. Holding PT means that you enjoy the ownership of the principal, which can be redeemed after expiration. If the user has a PT-stETH that expires after one year, it means that the user Years later, it can be exchanged for stETH worth 1 ETH .

YT is a revenue token. Holding YT means owning all the current income generated by the underlying assets and can be claimed at any time. If the user owns 1 YT-stETH, and the rate of return of stETH is 5%, then the YT token will accumulate 0.05 stETH after the end of one year.

So from the above process, we can draw YT+PT=SY.

In this way, Pendle designed an AMM pool that only needs to provide unilateral liquidity. The default setting of the liquidity pool is PT/SY. At the same time, using the relationship of YT+PT=SY, the PT/SY pool can be used for lightning exchange of YT .

(Example: When a user buys income tokens (YT), the buyer can send SY tokens, the AMM contract will withdraw SY from the liquidity pool to mint PT and YT, send YT to the buyer, and sell PT for SY comes and returns to the liquidity pool.)

That is to say, Pendle can achieve the effect of trading principal token PT and income token YT through a single pool of PT/SY.

(It should be noted that since any principal token and income token are tokens with a maturity date, in the AMM model, the prices of the two are not only driven by the influence of market traders' transactions, but also will be affected by time.

For the principal token PT, its transaction value will increase with time to ensure that the underlying assets can be exchanged 1:1 when it expires;

For the interest-earning token YT, since it represents the interest that can be generated from the current date to the maturity date, as time goes by, the time from the current date to the maturity date gradually becomes shorter, and the generated interest gradually decreases. So the YT value will automatically decrease over time, becoming 0 on the expiry date.

For LP, the position value of its LP = PT + SY = 2 SY-YT, so if the holding LP expires, the liquidity provider will not bear the free loss. )

Liquidity Provided:

1) In the simple mode: After selecting the liquidity pool to be provided, the user can choose any single mainstream asset to provide liquidity, such as ETH, wBTC, USDT, USDC , etc.

Pendle will automatically convert the assets provided by users into interest-earning assets in KyberSwap, and then package them into standardized tokens SY and add them to the liquidity pool.

2) In Pro mode: users can provide/withdraw liquidity through Zap in/Zap out operations, and can choose whether to enable zero price to affect Zap mode.

To put it simply, in the Zap in mode of the model, when adding liquidity, a part of the underlying assets will be used to purchase PT from the PT/SY pool, and the rest will be packaged as SY. However, purchasing PT may result in a price impact. When the zero-price impact Zap mode is turned on, the underlying assets will be completely packaged as SY, part of which is used to mint PT and YT. Then PT and the remaining SY are used to provide liquidity, and YT will be returned to the user's wallet. This eliminates the step of purchasing PT, thereby avoiding any potential price impact.

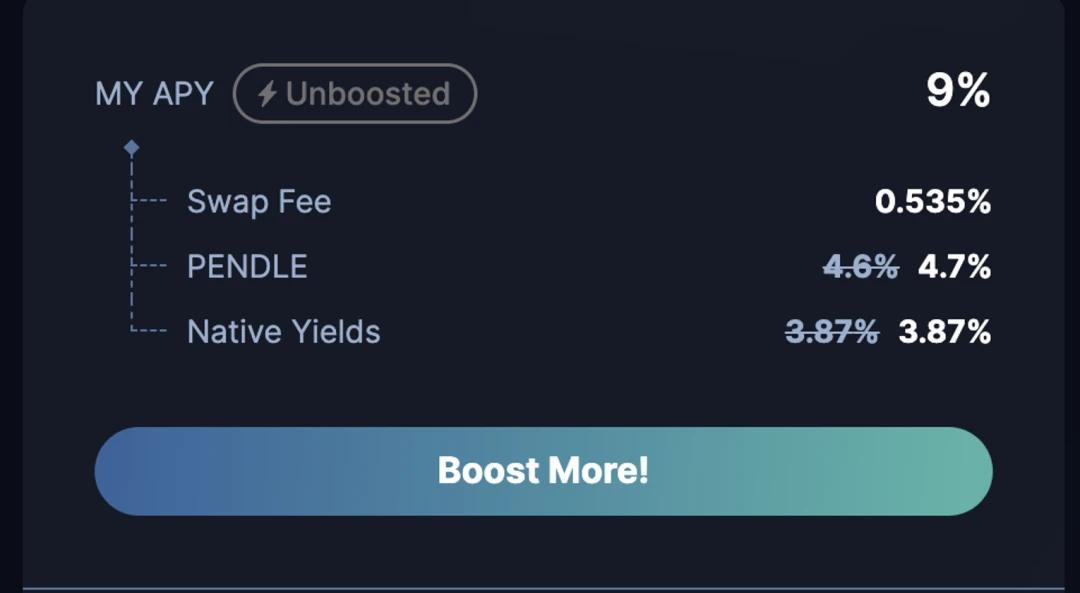

As we said above, when providing liquidity in Pendle , as long as it is held until maturity, there will be no Impermanent Loss, so as LPs, what sources of income can we obtain? The following are the main sources of income for LP in Pendle :

1. Transaction fees generated by the liquidity pool;

2. $ Pendle token rewards;

3. Income from underlying assets;

4. Incentives from token project parties; (not necessarily available)

(At the same time, holders of vePendle can also have Boosted benefits)

02 How to trade yield

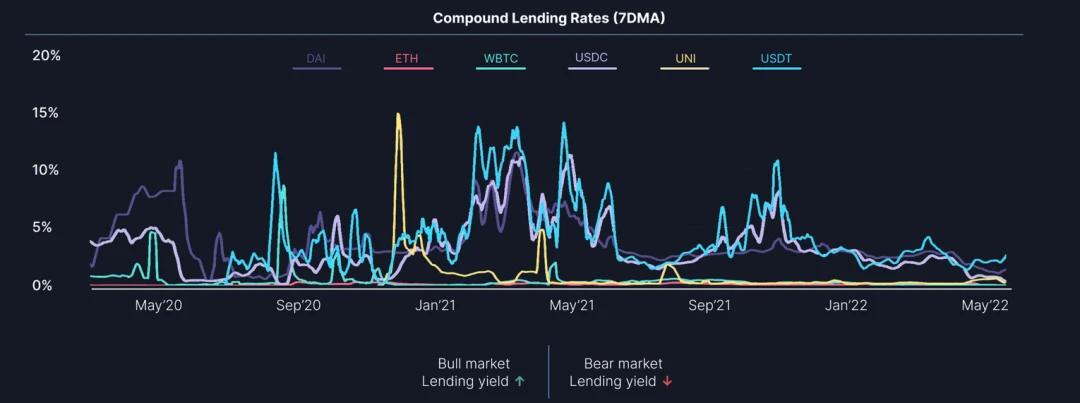

When understanding yield trading, we need to understand that the underlying yield of any asset is volatile.

For example, to deposit in Compound , we deposit USDC, but the deposit interest rate obtained will be the interest rate that changes according to the market loan demand.

We pledge ETH, and the pledge rate of return also changes with the number of miners and the activity and income of the block.

The figure below shows the interest rate curve of deposit assets in Compound in 2020-2022. It can be seen that in a bull market, the interest rates of most assets rise, and in a bear market, the interest rates of most assets fall, with fluctuations ranging from 0% to 15%. wait.

Therefore, for interest rate fluctuations, when users are optimistic or not optimistic about the future interest rate performance, they can perform corresponding operations in Pendle to express their views and benefit. The following will introduce one by one:

1) When users are optimistic about the future rate of return, they can hold/buy YT at this time.

Because YT represents the income from the current moment to the maturity date, if the user is optimistic about the subsequent trend of the return rate of the underlying assets, he can long view of the return rate by long YT.

2) When users are not optimistic about the future rate of return, they can hold PT/sell YT at this time.

If the user is not optimistic about the follow-up trend, in the user's perception, the current interest rate is higher than the future interest rate, so it is the best way to lock in the current interest rate, so holding and buying PT to lock in the current interest rate will be more good operation.

At the same time, Pendle also introduced the numerical reference of the underlying APY, that is, the value of the rate of return of the assets held is used as a reference to facilitate users to trade the rate of return. (Comparing the rate of return of the underlying asset with the implied rate of return, which is the rate of return traded in the market, that is, the fixed rate of return/buying discount.)

1) When the rate of return of holding the underlying assets > the implied rate of return, you can consider buying YT at this time to long on the implied rate of return of the asset, or sell PT to obtain the underlying assets and do LP at the same time.

2) When the rate of return of holding the underlying assets is less than the implied rate of return, the opposite direction of the above operation can be considered at this time.

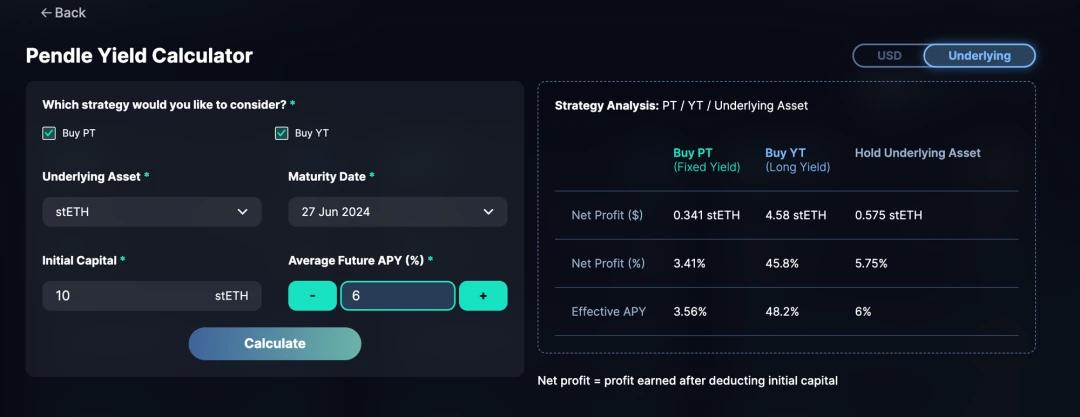

In order to better see the income of different operations, Pendle has launched a income calculator. Figure 1 is looking at the future rate of return. When it is believed that the future rate of return of stETH can reach 6%, the corresponding profits can be brought by each operation.

It can be seen that if you buy YT at this time, if the future yield reaches 6%, you can get nearly 50% of the rising income.

However, it should be noted that if the future rate of return only reaches 2%, it can be seen from Figure 2 that the loss has also reached 53%. Therefore, for YT trading, it is an operation with high returns and high risks .

03 vePendle and the ecological status behind it

In the V 2 version, the Pendle team officially introduced the Ve model into the Pendle token in the V 2 version, endowing the Pendle token with the ability to capture value.

At present, users can obtain vePendle by locking Pendle . The lock-up period ranges from 1 week to 2 years. The longer the lock-up period, the more vePendle you can get under the same amount of Pendle . Currently, the total locked-up Pendle has reached 38. 038,735, with an average lock-up period of 429 days.

The benefits that can be obtained by holding vePendle are as follows:

1) The reward when Boost can provide liquidity can be up to 2.5 times the original basic APY of Boost.

2) vePendle holders will be able to obtain " Base APY" + "Voter APY" = Max APY holding and voting income.

Base APY Source: Pendle takes a 3% fee on all earnings generated by YT. Currently, 100% of the fee is allocated to vePENDLE holders; part of the income of PT that has expired (Matured) but has not been redeemed by the holder ( Redeem ) will also be distributed to vePENDLE holders in proportion. The above rewards constitute the "Base APY" of vePENDLE.

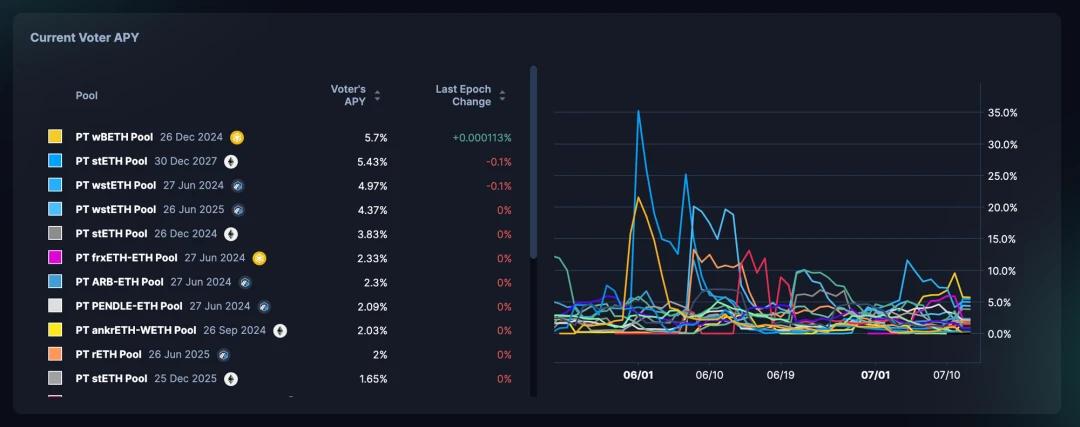

Voter APY source: veP holders can guide the distribution of liquidity rewards in the Pendle token model to different pools by voting, thereby incentivizing the liquidity in the voting pool.

vePendle voters will be entitled to 80% of the transaction fees of the voted pool, which constitutes "Voter's APY".

The figure below shows the historical APY and current APY that current vePendle holders can vote for.

It can be seen that after adopting the vePENDLE model, its ability to capture value will generate greater attraction and demand for liquidity providers and long-term investors who are optimistic about Pendle .

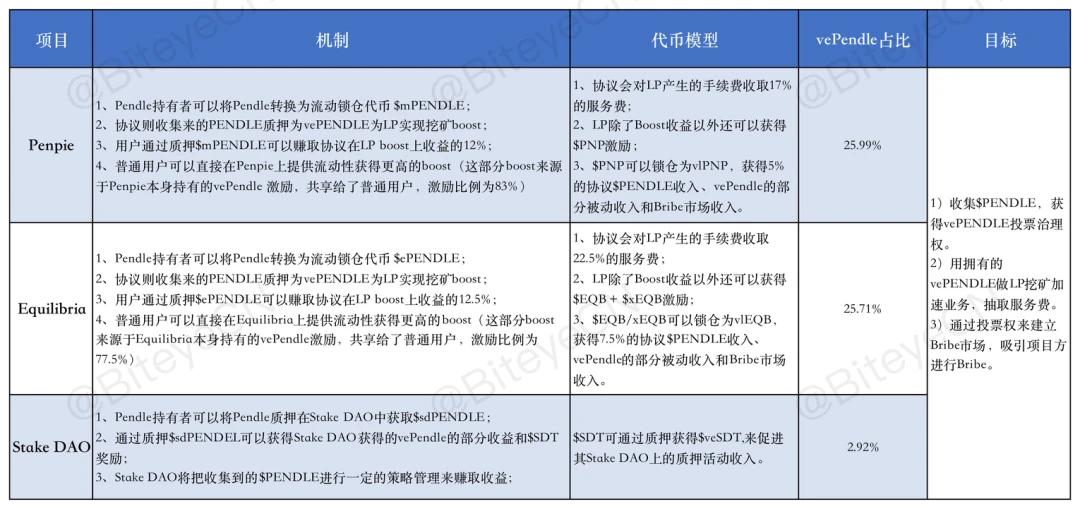

At present, the Pendle protocol adopts the veToken and Gauge voting model for liquidity mining incentives. Therefore, around the voting right governance of vePENDLE, many project parties use ideas similar to Convex to strive for the voting rights of vePENDLE to guide Pendle ’s liquidity incentives. ,As follows:

The above projects attract a large number of ordinary users to provide liquidity through the collection of vePEDNLE and the mechanism of obtaining Boost income without pledge.

The current construction of these protocols around Pendle is conducive to the long-term development of the Pendle protocol, from the perspective of increasing influence and attracting funds.

(It should be noted that the exchange of $mPENDLE, $ePENDLE and $ Pendle currently has poor liquidity and has a large discount.)

04 Pendle data analysis

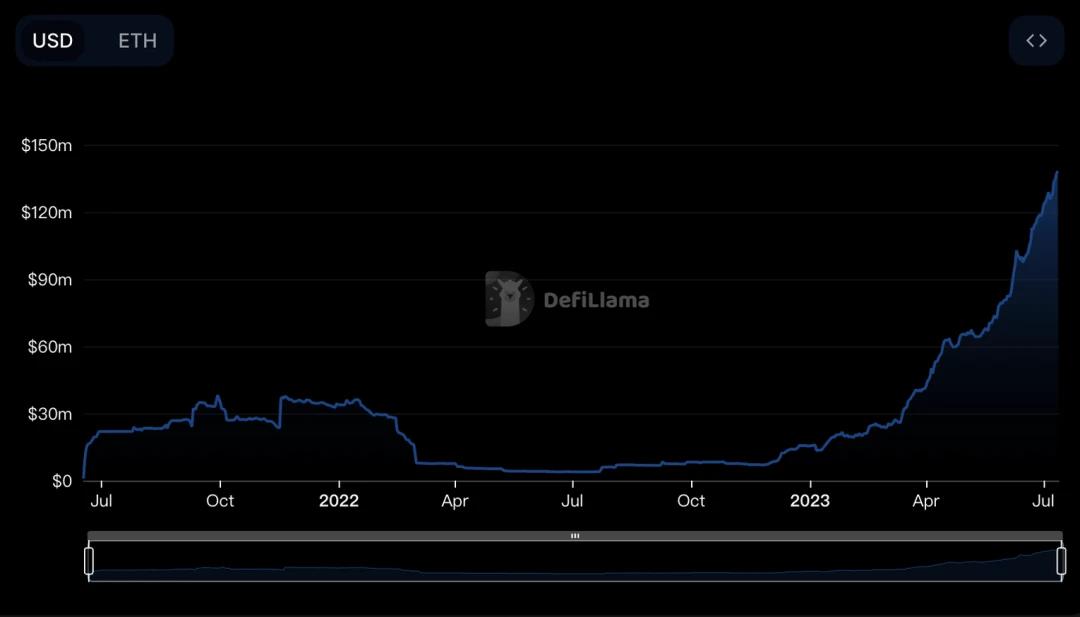

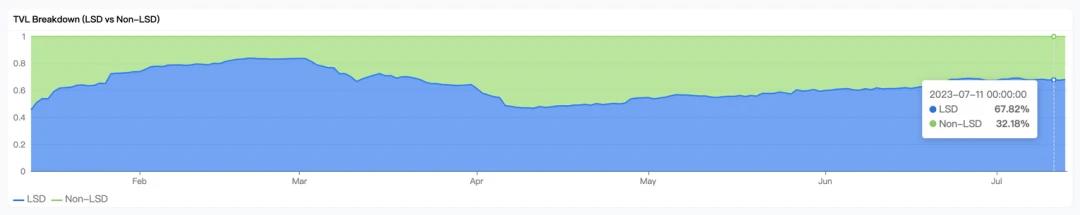

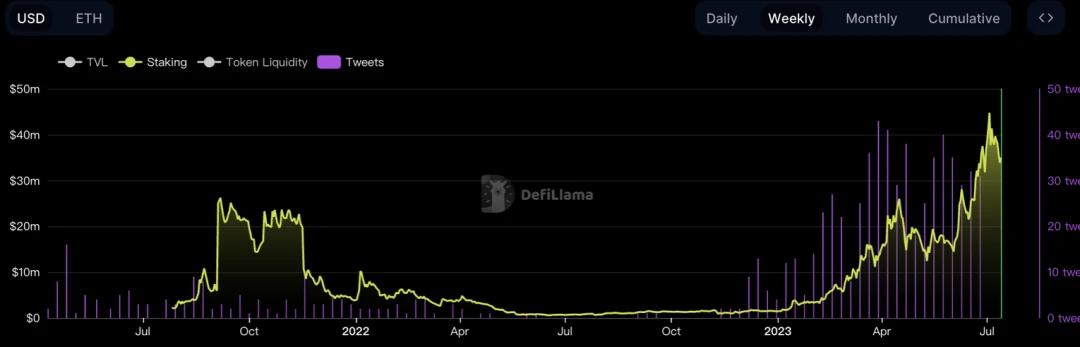

As of July 18, the total TVL of Pendle is currently 143.76 M. From the data of Defillama, we can see that the TVL of Pendle has maintained a substantial growth since 2023, from around 15 M at the beginning of the year to now, an increase of nearly 10 Times, of which nearly 70% of TVL comes from the contribution of the LSD sector.

(Data source: https://defillama.com/protocol/ Pendle)

(Data source: https://app.sentio.xyz/share/lv18u9fyu1b558xf?&)

In order to better understand the current adoption rate of Pendle in the encryption market, we selected the pledge rate and the number of tweets on social media for observation.

From the figure below, we can see that since the beginning of the year, Pendle ’s social media influence has continued to increase, and the number of tweets has gone from zero for several consecutive months to nearly 20-40 tweets per week.

Twitter is one of the most influential platforms in crypto adoption, and the continued growth of Twitter's influence can lay a good foundation for Pendle 's mass adoption.

Judging from the user's pledge situation, the pledge amount on Pendle is also increasing.

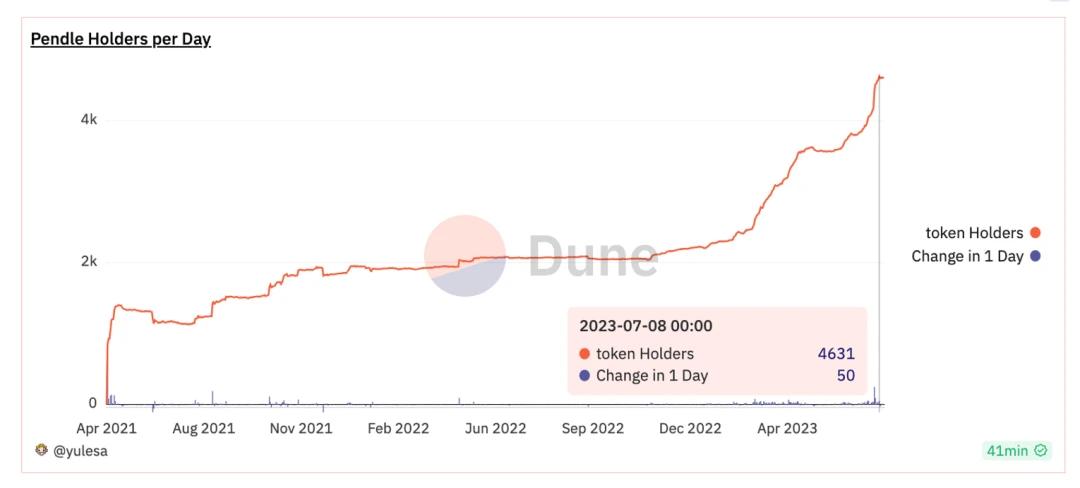

From the number of Pendle Holders, we can also see the confidence of Pendle current users in the future of Pendle . The growth is as follows:

(Source: https://dune.com/yulesa/ Pendle)

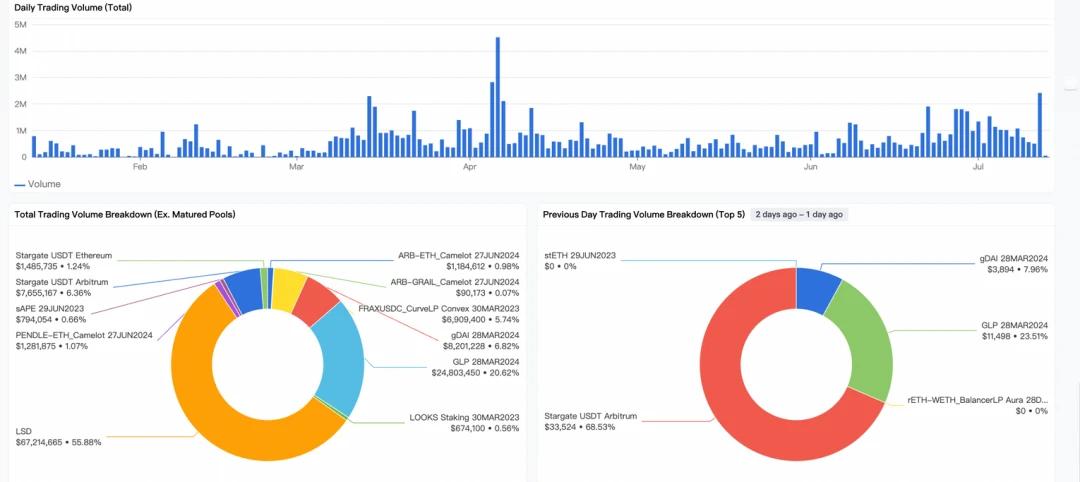

Judging from Pendle current agreement transaction volume, its main agreement transactions are concentrated in the LSD sector, accounting for 55.58%. It can be seen that Pendle 's agreement development is closely related to the LSD track.

With the further development of the LSD track in the future, if Pendle can continue to maintain this growth trend, its TVL and various data are more likely to grow synchronously with the LSD track.

At the same time, the second most traded asset on the agreement is GLP, which is an interest-generating token in GMX . GMX is currently the largest perpetual exchange on ARB , and the current development status of GMX is relatively good.

It can be seen that Pendle ’s main targets with large trading volume are targets with stable development and guaranteed yield, which shows that such assets are more attractive to users.

(Source: https://app.sentio.xyz/share/lv18u9fyu1b558xf?&)

05 Multi-chain development of Pendle

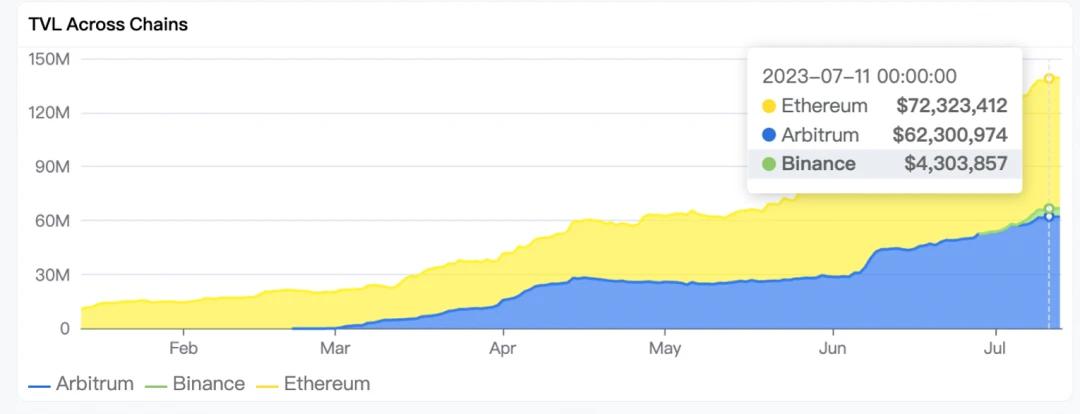

From the history of Pendle ’s development, it first deployed the Ethereum mainnet, followed by its launch on Avalanche and Arbiturm, and recently launched BSC.

It can be seen that Pendle has always maintained a well-paced development plan, and has been developing in the direction of multi-chain expansion. It can be said that it is the protocol with the long number of chains currently supported in the LSDFI track.

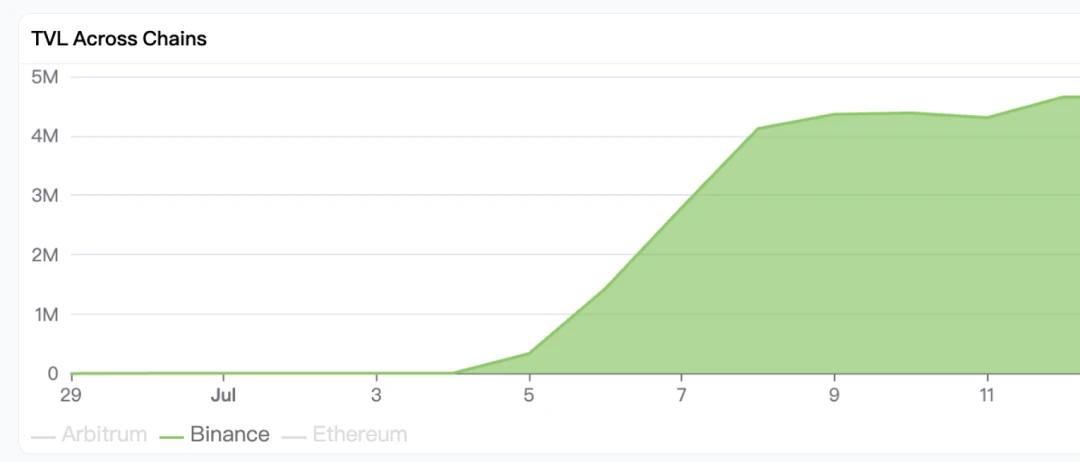

From the TVL distribution in the figure below, it can be seen that since the BSC chain has not been online for a long time, its TVL is mainly concentrated on ETH and Arbitrum.

(Avalanche has withdrawn the development focus of Pendle from this chain due to the large decline in TVL and its adoption rate in 2023.)

BSC has only been online for more than a week, and its TVL is currently $4.6 M, which can be said to be a good cold start performance. At present, there are only two pools on BSC, and the interest-bearing targets are all ETH. With the increase of its pool in the future, the TVL on this chain is expected to further increase.

(Source: https://app.sentio.xyz/share/lv18u9fyu1b558xf?&)

06 Summary

Pendle is a relatively old Defi protocol, which has developed rapidly recently. On the one hand, it has kept up with the development of the LSD track and launched related products in a timely manner;

On the one hand, it keeps up with the current status of multi-chain ecological development in the blockchain, and actively deploys its products in multi-chains.

At the same time, the agreement has undergone major changes in the token model this year. The vePendle model was introduced in the v2 version, which greatly enhanced the value capture capabilities of its tokens and attracted more users and investors. The ecological construction of the agreement.

In the future, if Pendle can continue to maintain its leading position in LSDFi and follow the development of the LSD track, there is a high probability that it will have greater growth potential in the future.