I have been thinking about how the growth of Pendle products should be done before. It can be considered that the rise of Pendle is inseparable from the LSD Summer brought about by the Shanghai upgrade. Then how should Pendle further break through the increasingly fierce competition in the LSD track? Occupy a place in the mainstream ecological niche?

Let me briefly talk about my views on the new product Pendle Earn:

In my mind, opportunities exist in the following two directions:

1. Barriers to entry

2. Business scope

In this update of Pendle, Pendle Earn mainly solves the problem of its entry threshold. Pendle has actually adjusted the user threshold before, setting up a simple mode and a professional mode, and meeting the needs of different users by distinguishing UI/UX.

This update goes a step further by changing these two modes to "Earn" and "Trade".

What good is that?

The intuitive statements of Earn and Trade can easily occupy users' minds, that is, users can clearly understand the products corresponding to their needs with just a glance.

Users who make fixed rate income use Earn, and do not need to understand AMM, implied rate of return, PT/YT mechanism, etc., to obtain fixed rate of return. Users who make interest rate swaps use Trade, and everyone has a bright future.

Earn's current advantage is that it can claim APY income at any time + withdraw at any time (real-time price settlement), which is more convenient than before - it is foreseeable that after the launch of Earn products, it can be withdrawn and used at any time (just like Shanghai upgrades and opens withdrawal permissions) It will further promote the growth of Pendle TVL ⬆️up only.

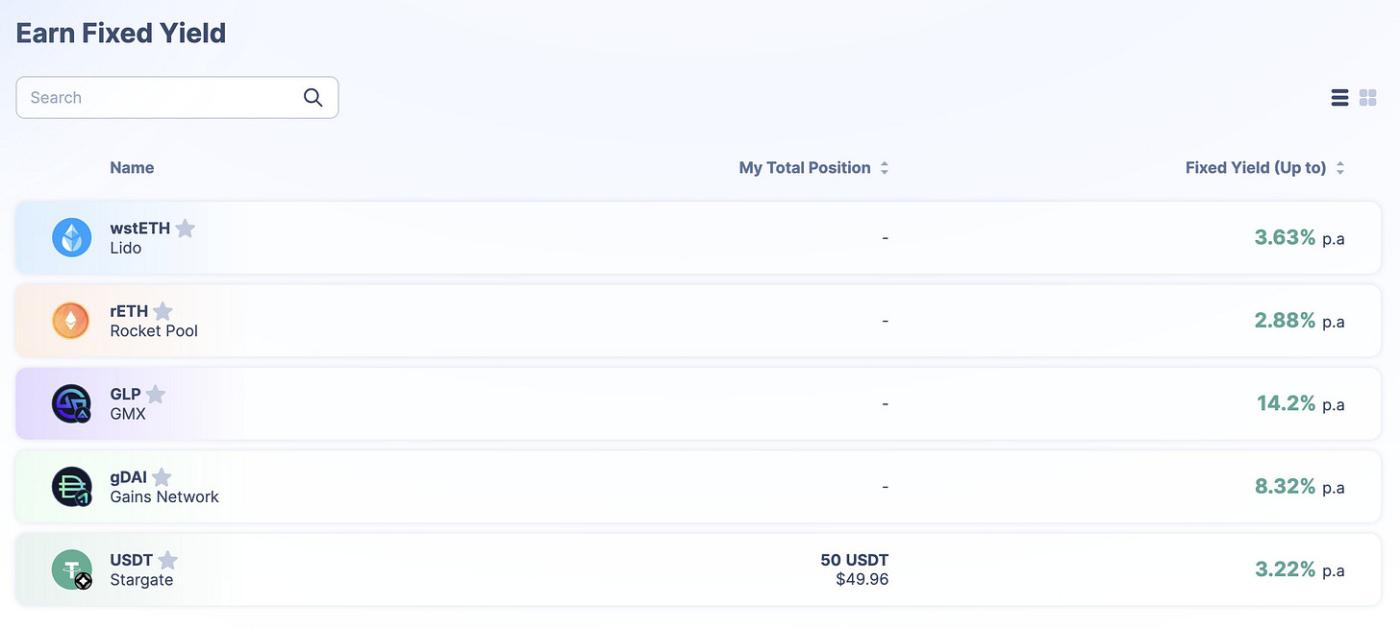

Currently, Earn supports five types of assets: wstETH, rETH, GLP, gDAI and USDT

In my humble opinion, Pendle Earn products are less attractive to veterans on the chain. They will choose to arbitrage PT/YT prices and do more complicated operations (see @ViNc2453 ’s tweet for detailed operation tutorials), or Go to mines with higher APY and higher risks.

But for beginners, or lazy people, Pendle Earn will be a good choice, and it will also give you some space to develop strategies. For example, the interest rates of assets such as ETH pledge, GLP, and gDAI are all floating. We only need to enter Pendle Earn when the interest rate is relatively high—for example, when the Ethereum chain is active and GMX traders are active. The rate of return can be fixed.

Or, by providing liquidity, get higher rewards through vePENDLE boost. Fixed Yield and LP have different types of income.

From another perspective, Earn also opens a door for CeFi products, which can provide its users with Pendle Earn fixed income products. While attracting CeFi users, it also promotes higher adoption of Pendle—and users don’t need to worry about centralized opaque black-box operations.

Returning to what was mentioned above, if Pendle wants to be adopted on a large scale, it needs to solve 1) entry barriers; 2) business scope; two key points. With this upgrade, Pendle has solved the problem of high barriers to entry. At the same time, it also hopes to expand its competitiveness in the LSD business through the Earn product, that is, to obtain higher liquidity adoption and solve the pain points of weak business competitiveness.

At present, Pendle still has a long way to go. I hope that while improving the competitiveness of LSD products, they can expand their business scope as much as possible (such as RWA, lending, LP and other scalable tracks, which are essentially Expand the market size and capacity), and truly occupy a territory in the Ethereum DeFi ecosystem.

DM me on Weibo/Twitter, or send an email to mengyanaddict@163.com, join the "Sleeping Club" and learn more about trending narrative analysis and Alpha Call. (Price 288U/year)

Weibo: @雨中疯着

Twitter: https://twitter.com/qiaoyunzi1

Notion database: https://tasteful-resolution-466.notion.site/81e0728219f24bc6b6f40159936b4106