Designed for professional traders, Blur is an Ethereum-based Non-Fungible Token marketplace used by many Non-Fungible Token traders due to its user-friendly features such as low fees, high speed, and Non-Fungible Token floor Depth Chart . On the same site, users can also use Blend, also known as Blur Lend, which is Blur's separate lending protocol.

This article will cover both the user-mechanical and more in-depth aspects, including navigating the platform, buying or using Non-Fungible Token , and using trader-friendly features like Non-Fungible Token scanning. We will also look at Blend and how borrowing and lending on this protocol works.

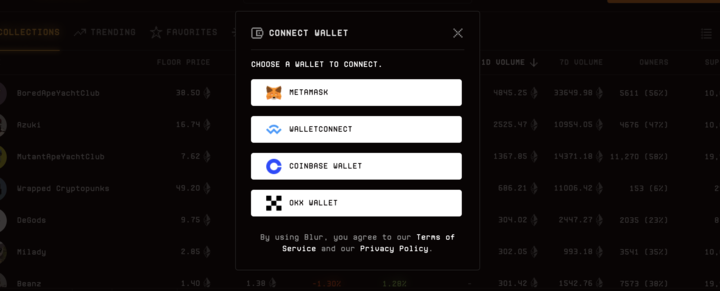

Traders will first need to connect their wallet to view or trade on the platform.

Step 1: Make sure the user is accessing the correct website and network

When connecting your wallet to the website, you need to first make sure that you are accessing the correct website domain (Blur.io). You should also check if you are using the Ethereum Mainnet.

Step 2: Connect the wallet

As of June 20, 2023, Blur currently supports three different wallets – Metamask , Coinbase, and OKX wallets. If you are using another wallet, such as Trust Wallet, you can use WalletConnect to connect other supported wallets. After connecting his preferred wallet to the website, the user is free to explore the platform.

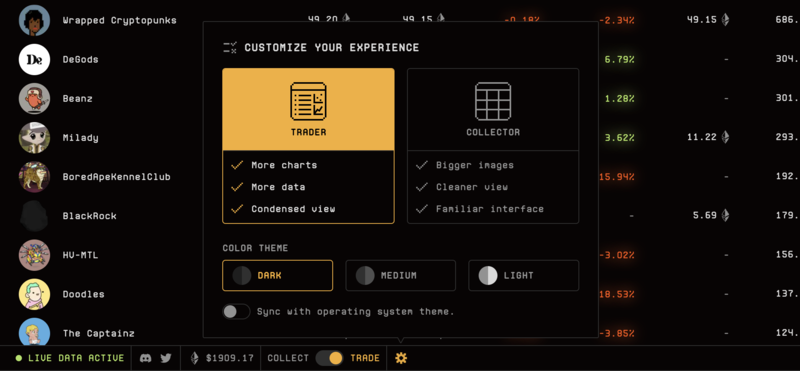

Step 3: Customize the human interface (Optional)

At the bottom of the screen, the user will see a settings icon. There we can choose between 3 different color themes that are dark, Medium or light. Depending on the preferences of the end user, we can also choose to use the built-in dark theme.

Users can also choose between trader or collector mode. Trader mode provides a more detailed interface, with more charts and data summarized in the view.

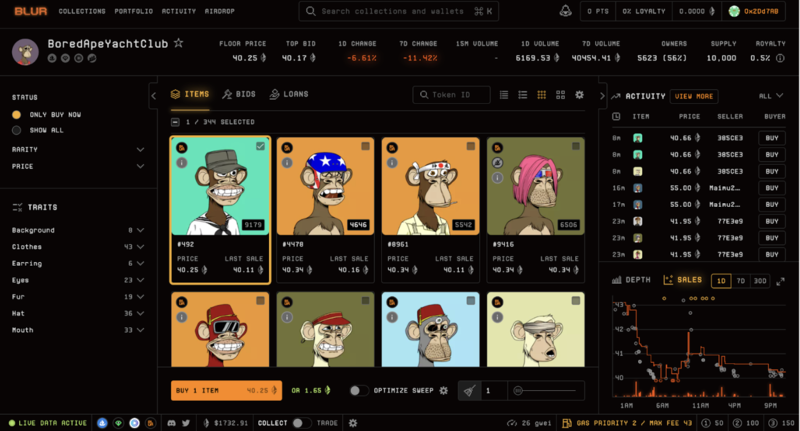

Trader mode:

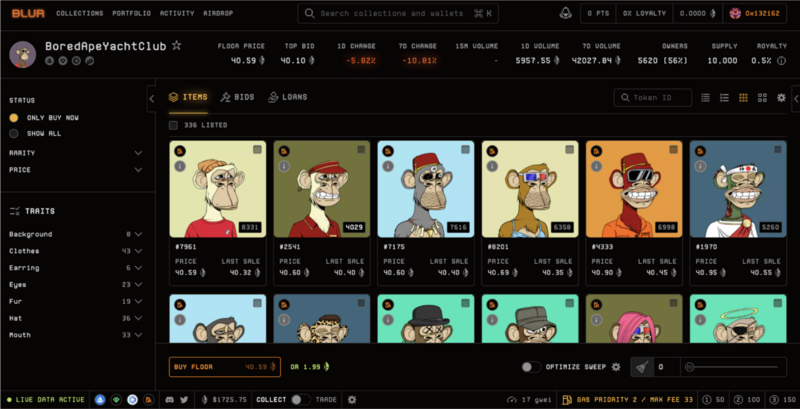

On the other hand, collector mode provides a cleaner and more familiar interface but is much more general than trader mode.

Collector mode:

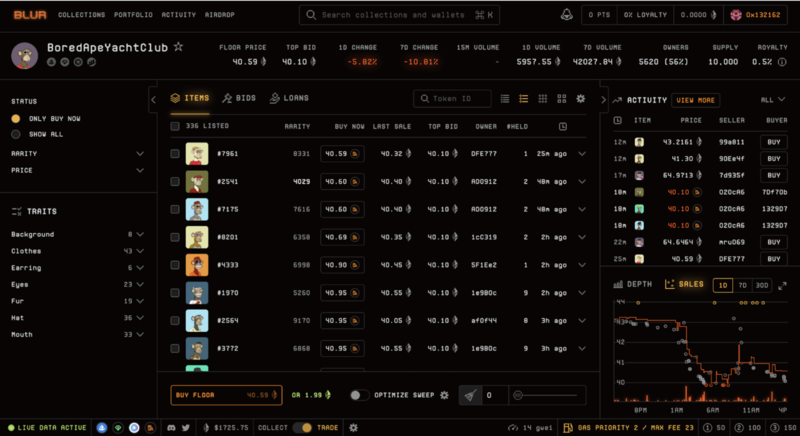

As seen above, the trader mode combines more in-depth charts like the Non-Fungible Token floor Depth Chart and more detailed information on the top bids or owners. The Non-Fungible Token floor price Depth Chart shows the number of collections sorted by price. While the trader mode may be better for seasoned traders, the collector mode will be more relevant and less confusing for other traders.

To find an Non-Fungible Token collection that interests them, you can search for it through the search bar at the top of the page. After selecting an Non-Fungible Token that the user is interested in, they can continue their purchase by clicking the “Purchase” button.

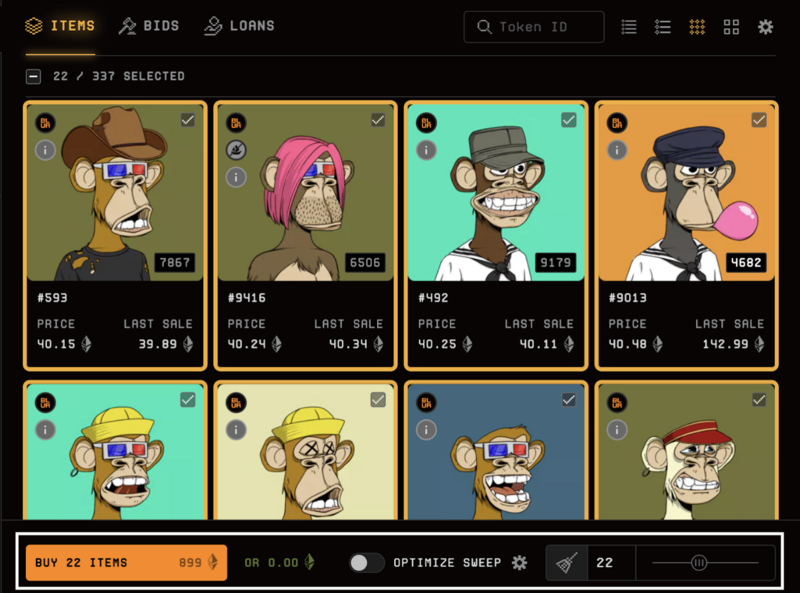

Non-Fungible Token scanning feature

As mentioned, Blur has trader-friendly features like Non-Fungible Token floor scanning. This feature allows users to purchase multiple Non-Fungible Token of a collection at a floor price, which is the lowest price at which a single Non-Fungible Token is listed. There is also a “scan optimization” function that allows users to exclude pending or flagged Non-Fungible Token during scanning. To use this feature, simply set the number of Non-Fungible Token users want to scan (up to 50 at a time) and press “buy” and complete the transaction.

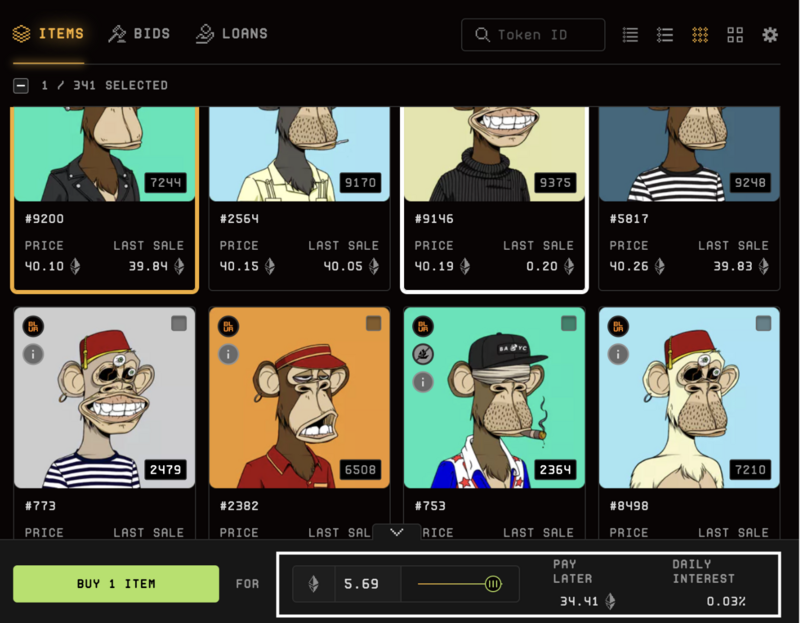

Buy first, pay later

Instead of paying Non-Fungible Token in full, Blur Lend also offers an alternative payment method, the “Buy First, Pay Later” program.

Similar to how one can pay a mortgage, the user will have to deposit a certain amount to the Non-Fungible Token and pay the rest in installments. The upfront payment for Non-Fungible Token can be adjusted based on personal preference, with users wanting to deposit less paying more interest.

“After purchasing BNPL, you can repay your loan at any time for full ownership of your Non-Fungible Token . Or list your Non-Fungible Token at any time and keep any profits when you sell.”

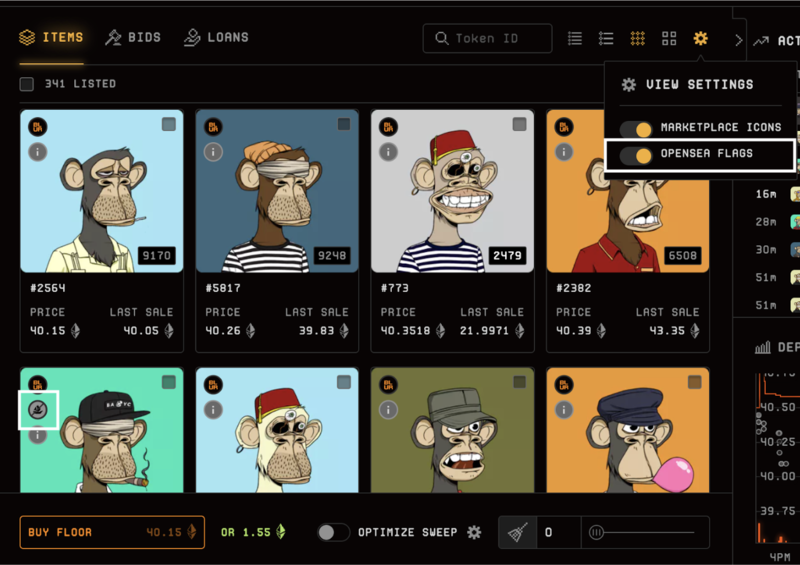

Flag OpenSea

In its settings, users will also find an option called “OpenSea Flags”. Once a certain Non-Fungible Token is stolen, the user submits a report to OpenSea, and that Non-Fungible Token can never be traded or sold on their platform again.

This is a useful feature when purchasing Non-Fungible Token as it shows the Non-Fungible Token that have been blacklisted on OpenSea, potentially protecting the user from a fraudulent transaction. Blacklisted Non-Fungible Token are also harder to resold on the secondary market, so it's important to recognize and watch out for such signs.

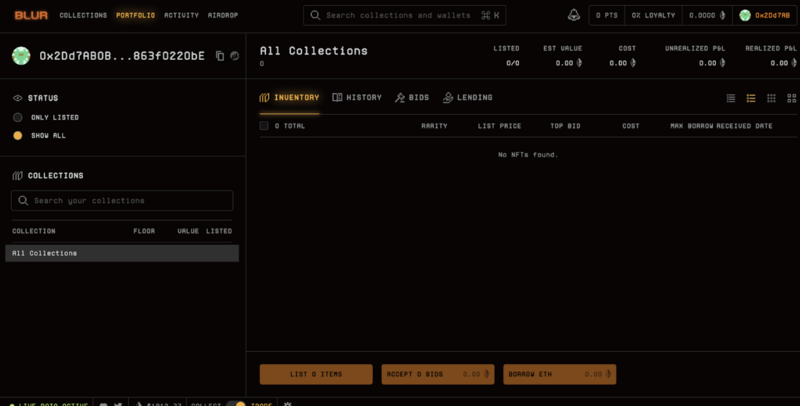

Selling users' Non-Fungible Token on Blur is much simpler. When a user connects their wallet to Blur, their Non-Fungible Token holdings will appear as part of the portfolio.

Step 1: Go to Portfolio

To sell, we simply click on the inventory tab in our portfolio, select the Non-Fungible Token we want to list, and click the “List items” option.

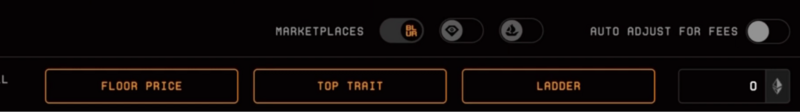

Step 2: Set the list price

Blur allows users to list multiple Non-Fungible Token at once. Traders can also set their own Non-Fungible Token quotes or use one of the three trader-friendly listing features on Blur – 'Floor Price', 'Top Trait', or 'Ladder'.

If “Floor” is selected, Blur will automatically list all traders' Non-Fungible Token at the floor price, helping their Non-Fungible Token to sell faster. Selecting “Top Trait” will list the Non-Fungible Token at the higher price, the floor price of the best spot the Non-Fungible Token has. Users can also select the “Ladder” option, which helps them organize their list prices.

Step 3: Complete listing

After setting the list price, traders only need to set the desired royalty rate, sale time and transaction confirmation. You are done with your Non-Fungible Token listing! Now just wait for an interested buyer to buy or bid on Non-Fungible Token.

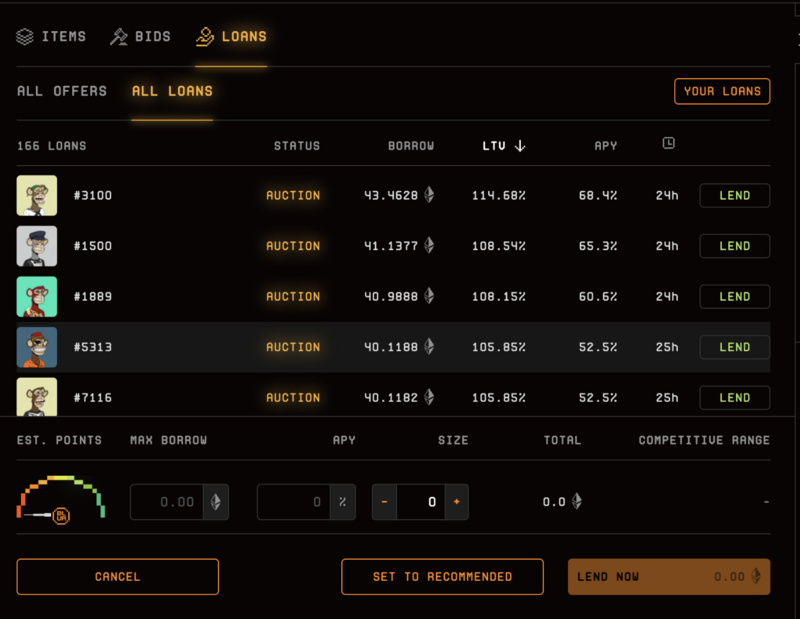

Blend is an indefinite peer-to-peer lending protocol. Different from the “Buy Now, Pay Later” program mentioned above, Blend also allows Non-Fungible Token holders to borrow ETH while using their Non-Fungible Token as collateral.

“Today, the only way to get Liquidation on your Non-Fungible Token is to sell them.

If you have Punk and want to buy new Non-Fungible Token for 10 ETH but don't have dollars in your wallet, you have to sell your Punk.

This forces holders out of the collection and affects the floor price.

With Blend, Non-Fungible Token holders can now borrow ETH with their Non-Fungible Token without having to sell.”

As seen above, Non-Fungible Token holders will be able to borrow their desired amount of ETH and set their own APY (Annual Percentage Yield) and LTV (Loan to Value). Lenders will then have the option to choose between different types of loan levels.

Unlike other lending protocols, Blend loans do not have a fixed interest rate or expiration date. In addition, because Blend does not use oracle, users can also define their own interest rates. Lenders also have flexible terms, allowing them to withdraw their loan at any time.

While this generally seems like a game of chance for valuable rewards, there are notable risks involved. For example, if our lender decides to withdraw its loan and fails to find a new lender within the specified time frame, the borrower loses the collateral (Non-Fungible Token). It is important that users do their own due diligence and determine their own risk tolerance.

In less than a year after Blur's release, Blur surpassed OpenSea in numbers and continuously brought new ideas into the Non-Fungible Token market. It will be interesting to see what other new ideas Blur will bring in the future.

Join Telegram of Bitcoin Magazine: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to Coinecko