Author | Baize Research Institute

Watching the latest investments from crypto VCs can help you see where the market is going and spot new trends early. Which tracks and projects are VCs optimistic about recently? This article sorts out 28 projects that received investment from top crypto VCs in June to help readers quickly understand. It should be noted that any of the following items and opinions should not constitute investment advice. DYOR

1. DeFi

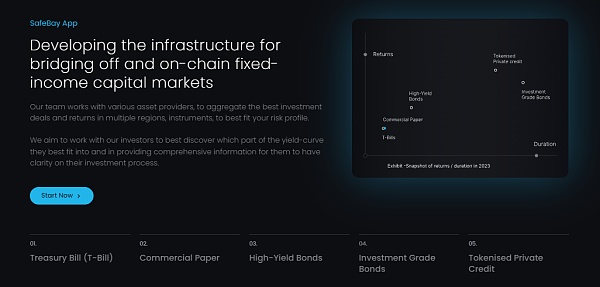

1. SafeBay

June 6, 2023

Seed round: $1.115 million

Investors: Big Sky Capital, Borderless Capital, AXL Ventures, Algorand Foundation and Angel

SafeBay Finance is a DeFi treasury platform developed by Kilde, a digital private debt platform in Singapore. It is built on the Algorand network and provides compliant, tokenized securities and credit products with different risk profiles. It aims to help blockchain-native companies effectively manage their short-term Financial assets are essentially RWA (Real World Assets) tokenization projects.

At present, the DApp and token sales have not yet started, the Official Twitter is not active, and the number of followers is small.

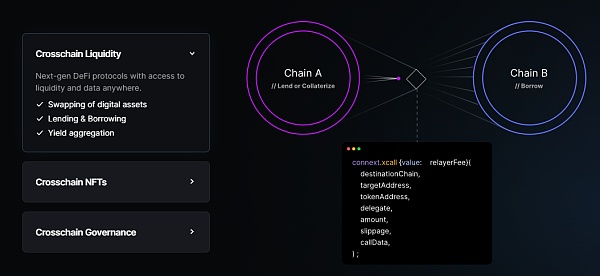

2. Connext

June 14, 2023

Strategic investment: $7.5 million

Investors: Polychain Capital, Coinbase Ventures, NGC Ventures, Ethereal Ventures, Polygon Ventures, IOSG Ventures, Fenbushi Capital, 1kx, Hashed, etc.

Connext is a cross-chain protocol that can be used for fast, trustless communication between different blockchain networks, enabling asset transfers between blockchains and contract work across EVM chains. Use cases include building cross-chain liquidity, cross-chain DApp with the theme of chain NFT and cross-chain governance.

Currently, Connext processes over 1.2 million transactions. There are more than 30 protocols integrated with Connext, including Metamask, Planet IX, DODO, etc.

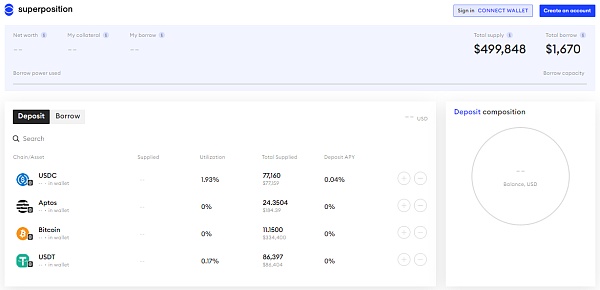

3. Concordia

June 17, 2023

Seed round: $4 million

Lead investors: Kraken Ventures, Tribe Capital

Other investors: Cypher Capital, Saison Capital

Concordia is a multi-chain collateral management protocol designed to simplify the cross-chain risk of funds. Users can mortgage funds on one chain and lend or transfer funds from other chains. Currently, Superposition, the first lending product based on the Concordia protocol, has been launched on the Aptos network.

Note: The current TVL on Superposition is less than 500,000 US dollars, please pay attention to the risks when participating.

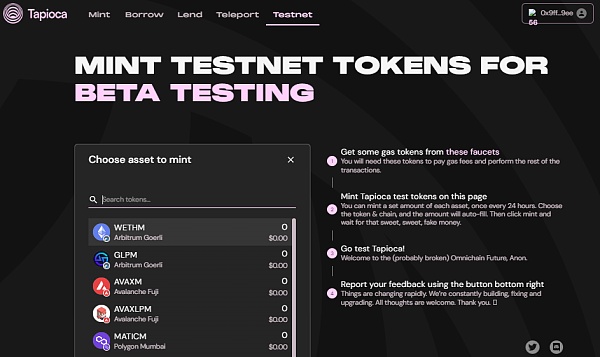

4. Tapioca DAO

June 17, 2023

Seed round: $6 million

Investors: LayerZero Labs, Fisher8 Capital, Parc Capital, Jones DAO, DCFGod, etc.

TapiocaDAO is a full-chain DeFi platform based on LayerZero, a general-purpose messaging network, across more than 17 EVM and non-EVM chains, helping to reduce liquidity fragmentation. The platform provides various functional products, such as Singularity for lending (Sushiswap-based Kashi), Yield Box (BentoBox V2) for token vaults, and USDO, a decentralized over-collateralized full-chain stablecoin.

At present, TapiocaDAO has been launched on the test network, and the official has confirmed the launch of the native token TAP, so early test network users may get AirDrop(just a guess):

• Connect wallet and change network to testnets like Arbitrum Goerli, Polygon Mumbai, etc.

• Get testnet tokens on the platform

• Go to the "Mint" option to test USDO minting functionality

• Test lending functionality

• Test token cross-chain functionality in the “Teleport” option

5. Earn Network

June 21, 2023

Seed round: $2.7 million

Investors: SHIMA Capital, DFG, LD Capital, BIXIN Ventures, ViaBTC Capital, Cronos, etc.

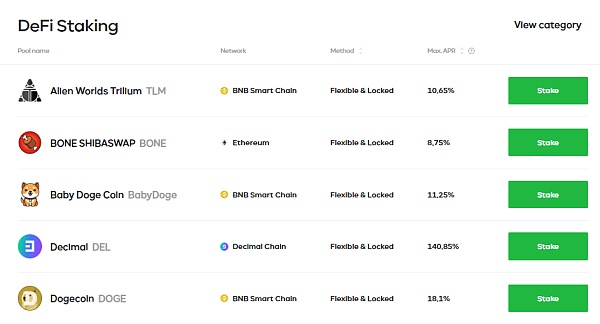

Earn Network is a multi-chain DeFi aggregation platform designed to connect fund pools in different DeFi markets, so as to provide users with more intuitive income opportunities related to pledge, re-pledge, and liquidity pledge.

6. Maverick Protocol

June 21, 2023

Lead investor: Founders Fund

Other investors: Pantera Capital, Binance Labs, Coinbase Ventures, Apollo

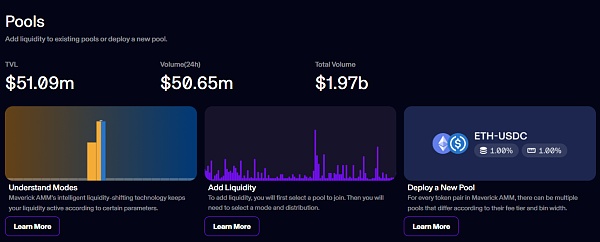

Maverick Protocol is a DEX with four dynamic liquidity strategies designed to provide traders, liquidity providers, DAO treasury and protocol developers with the most liquid market and greatly improve capital efficiency.

7. AlloyX

June 29, 2023

Pre-seed: $200

Lead investor: Hack VC

Other investors: Circle Ventures, DCG, dao5, STRATOS, LECC, MH Ventures, etc.

AlloyX is a RWA project that facilitates investment in real-world businesses by tokenizing credit. The highlight is that AlloyX allows users to access multiple credit agreements through a single vault. AlloyX provides an avenue for individuals, DAOs, and institutions to easily build diversified investment strategies in RWA by aggregating asset pools from various credit protocols (Goldfinch, Maple, etc.) into the platform.

Current TVL is around $5 million.

2. CEX

8. Bit2Me

June 15, 2023

Amount: $15 million

Lead investor: Investcorp

Other investors: Telefónica Ventures (VC arm of Telefónica, Spain's largest telecommunications company, Stratminds VC, EMURGO, YGG CEO Gabby Dizon

Bit2Me is a cryptocurrency exchange based in Spain where users can deposit funds through bank transfers and other methods to trade cryptocurrencies. In February of this year, Bit2Me was approved by the Bank of Spain, becoming the first company in the country to legally provide cryptocurrency and fiat currency exchange and encrypted wallet hosting services.

3. NFTs

9. Spinamp

June 2, 2023

Amount: $1.2 million

Lead investor: PTC Crypto

Other investors: 1kx, Archetype, NoiseDAO, Coop Records, Fire Eyes DAO, top music NFT collector Degen Davinci, Lens Protocol chief growth officer Christina.lens, etc.

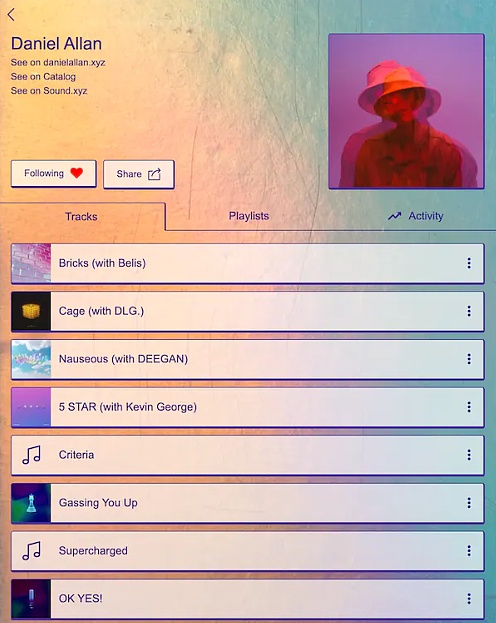

Spinamp is an NFT music aggregation market, which aims to integrate music NFTs on different chains, and users can play and trade music NFTs on the platform. Think of the platform as Opensea for music NFTs, or Spotify for NFTs.

Currently, Spinamp aggregates music NFTs from 30 platforms including Sound.xyz, Catalog, Nina, Zora, NOIZD, Lens, Arpeggi, Decent, OpenSea Collections, Songcamp, HedsDAO, and Manifold.

Highlights:

• Artist profiles showcasing their music NFT releases across all platforms

• Constructed API and SDK, other DApps can be integrated with one click

• In the future, the interactive function (social) between artists and the community will be launched

10. Dew Drops

June 6, 2023

Pre-seed: $1.5 million

Lead investor: Dream Ventures

Other investors: VaynerFund, Polygon, Ruttenberg Gordon, Investments, Slow Ventures

Dew Drops is a relatively innovative NFT market that provides collectors with a convenient way to access NFT by using SMS as a medium. Every day, the platform will send a carefully selected artist and his works to the collector group through text messages. If collectors are interested, they can directly reply to the text message "I want a few pieces" to buy easily.

11. DGPals

June 15, 2023

Strategic Investment: Undisclosed

Investor: Hashed

DGPals is a Web3 gaming platform that has grown into a strong crypto gaming community by issuing various NFT series, token DGG for governance and staking, in-game currency OPL, and hosting a series of games and events.

12. Tegro

June 26, 2023

Seed round: Unannounced

Investors: Polygon Ventures and other private institutions

Tegro is a multi-chain NFT market, the highlight is that it focuses on NFT20 transactions.

NFT20 is an ERC-20 token backed by ERC-721, ERC-1155 NFT with a 1:1 deposit. In fact, it is fragmented NFT. Hold NFT20, you own the corresponding part of the original NFT. The advantage of this is that it can easily cross-chain, multi-asset swap (NFT20 transactions with other NFTs), and liquidity mining (to improve liquidity).

At present, Tegro is holding a transaction to earn points activity, which can be exchanged for prizes such as native tokens TGR, NFT and USDT .

13. Hook Protocol

June 28, 2023

Amount: $3 million

Lead investors: Collab+Currency, Lattice

Other investors: Slow, Sfermion, Maven11, Contrary, etc.

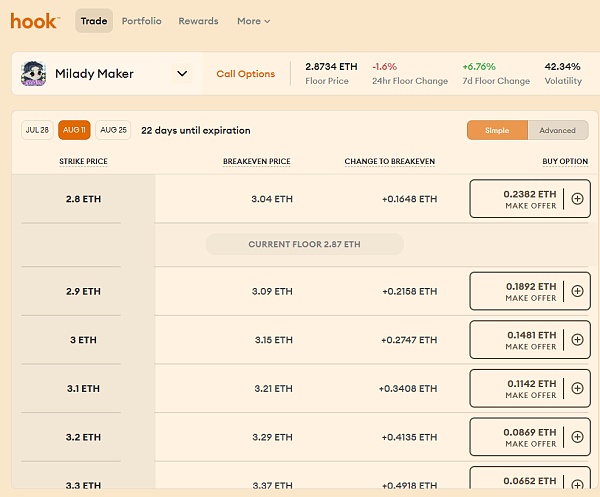

Hook Protocol is an NFT call option agreement, users can create call options for any NFT they hold.

Let's say I create a call option on my BAYC NFT. This NFT is worth 100 ETH today.

Xiao Ming thinks that the NFT will increase next month, but he does not have 100 ETH to buy the NFT. Therefore, Xiao Ming bought an option with a strike price of 120 ETH and a 30-day expiration from me for 5 ETH . Three things can happen:

• If the value of NFT is lower than 120 ETH after one month, Xiao Ming's option is worthless. At this point, I will keep the 5 ETH earned from selling the options.

• If the value of NFT is higher than 120 ETH but less than 125 ETH after one month, Xiao Ming still has a loss in this transaction, and the value of the option is between 0-5 ETH .

• If the NFT value is higher than 125 ETH after one month, Xiao Ming made a lot of money through this transaction (NFT price - 125 ETH). For example, if the NFT is worth 130 ETH, Xiao Ming earns 5 ETH, realizing a 100% return in one month, but if Xiao Ming chooses to buy an NFT, he can only make a profit of 30%.

Therefore, Hook Protocol is actually useful for both active trading and passive holding . NFT holders can generate income by selling call options, while traders can build long positions by investing only a small amount of ETH to buy call options, which is more capital efficient.

4. Web3 service

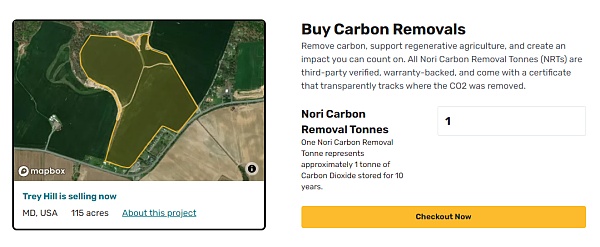

14. Nori

June 6, 2023

Amount: $6.25 million

Investors: Toyota Ventures, M13, Placeholder, Cargill

Nori is an early Web3 service company established in 2017, and it is also the first carbon offset trading platform on the chain. By allowing suppliers to mint NRT (an NFT representing Nori's carbon offset tons) on the Ethereum network, it provides more A transparent carbon market lays the foundation. Companies with carbon offset needs can find suitable suppliers on the platform's market, conduct peer-to-peer transactions, and use USDC and other payment methods to purchase suppliers' NRT.

At present, Nori has migrated to the Polygon network, which significantly reduces the Gas fee for each transaction.

15. Meanwhile

June 6, 2023

Two seed rounds: $19 million

Lead investors: Sam Altman, CEO of OpenAI, Lachy Groom, former head of Stripe Issuing, Gradient Ventures

Other investors: Muoro Capital, 6th Man Ventures, Hudson Structured Capital Management, etc.

Meanwhile, the first and only fully Bitcoin-denominated life insurance company, only accepts BTC as premiums and pays all claims in BTC . The person in charge of the company and some investors believe that BTC is becoming a global store of value currency and functional currency.

Joining the waiting list is currently available on the platform's official website.

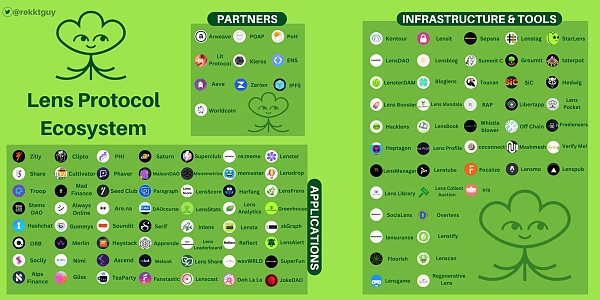

16. Lens Protocol

June 8, 2023

Amount: $15 million

Lead investor: IDEO CoLab Ventures

Other investors: Tencent, Kraken Ventures, Delphi Digital, General Catalyst, Blockchain Capital, PTC Crypto, Uniswap CEO Hayden Adams, OpenSea co-creator Alex Atallah, entrepreneur Balaji, Polygon co-creator Sandeep Nailwal, etc.

In May last year, Lens Protocol, a Web3 social media platform built by the veteran DeFi lending protocol AAVE , was launched on the Polygon network, and it has been more than a year since then. However, its daily active addresses of less than 3,000 have been controversial.

Even so, in addition to official products, there are currently hundreds of applications developed or integrated based on Lens, covering different fields such as tools, DAO, communities, games, and videos, and the ecology is in a state of flourishing.

It is believed that with the real money support of various encryption industry leaders in this round of financing and the blessing of the recently launched V2 version, Lens will be getting closer and closer to its dream of "Web3 Social Kingdom".

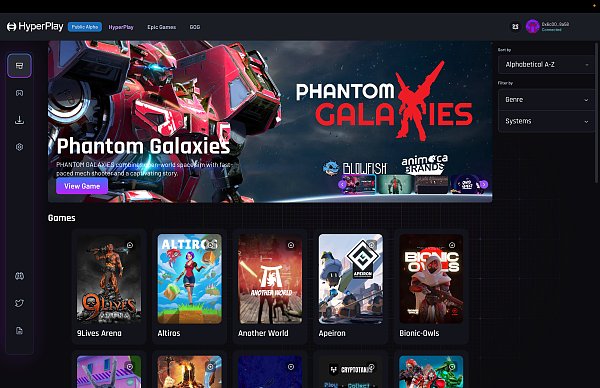

17. HyperPlay

June 8, 2023

Series A: $12 million

Lead investors: Griffin Gaming Partners, BITKRAFT

Other investors: Consensys (parent company of MetaMask), Ethereal Ventures, Delphi Digital, Game7 DAO, Mirana Ventures, Monoceros Ventures

HyperPlay is a Web3 game store (can be understood as the Web3 version of Steam), established by MetaMask and Game7 DAO in November 2022, aiming to aggregate Web3 games, players can install games directly through HyperPlay, and connect to encrypted wallets with one click , bring your own tokens, NFT, and achievements into the game.

At present, more than 40 chain games have been launched on the HyperPlay platform, among which the more popular ones include "Thetan Arena", "The Sandbox", "Phantom Galaxies", "Bushi", "My Crypto Heroes" and so on.

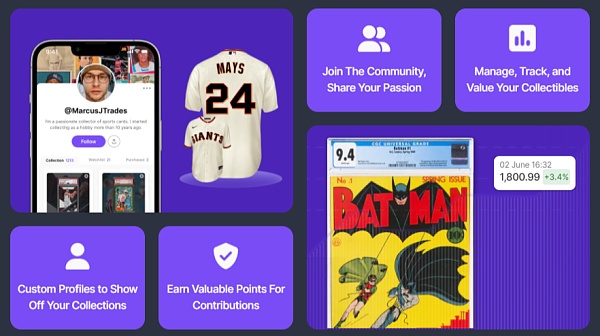

18. Collectibles.com

June 13, 2023

Seed round: $5 million

Lead investor: Blockchange Ventures

Other investors: GFR Fund, Blockwall Capital, PayPal co-founder Peter Thiel, Hollywood actor Orlando Bloom, Braintrust CEO Adam Jackson, etc.

Collectibles.com is a blockchain-based collectibles trading market, whether it is NFT, comic books, stamps or souvenirs, it can be traded on the market. The DApp is not yet live.

Highlights:

• Has a social system

• AirDrop rewards for users based on loyalty

• Has an asset value evaluation system

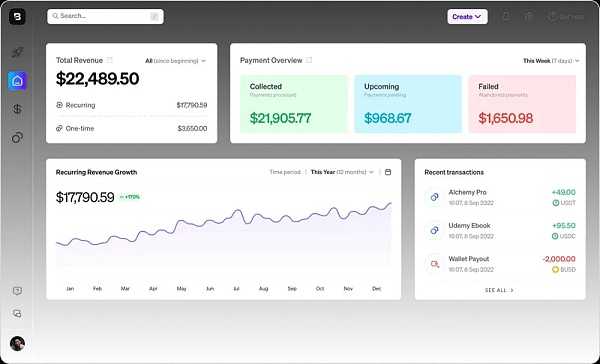

19. BoomFi

June 13, 2023

Amount: $3.8 million

Lead investor: White Star Capital

Other investors: Passion Capital, Blockchain Founders Fund, Kraken Ventures, GSR, Aqua Now, Mantle Network, etc.

BoomFi is a payment platform for sending, receiving and converting cryptocurrencies that simplifies crypto payments with features such as free trials, discounts and token gating, designed to allow businesses and merchants to seamlessly accept cryptocurrencies.

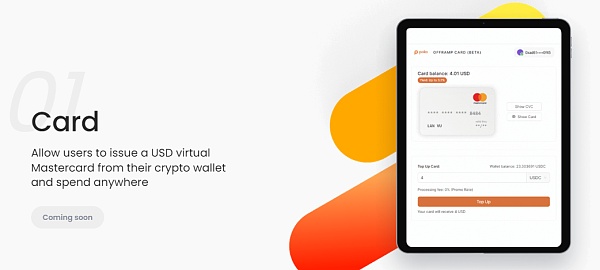

20. Poko

June 15, 2023

Seed round: $4.5 million

Lead investors: Y Combinator, NAZCA, Global Founders Capital

Other investors: Goodwater Capital, Soma Capital, Amasia, CreditEase, Dentsu Ventures, Orange DAO, MS&AD Ventures, Plug and Play

Poko is a crypto payment platform that is focusing on three products, virtual debit card (create a virtual debit card on the platform and spend in physical stores or store stablecoins to earn interest), on-ramp aggregator (in many fiat currency <->Choose one of the cryptocurrency providers for conversion), direct checkout function (purchase FT/NFT directly with legal currency).

According to the company, more than 11 million active wallets are using its payment channel in Latin American, Indian and Southeast Asian markets.

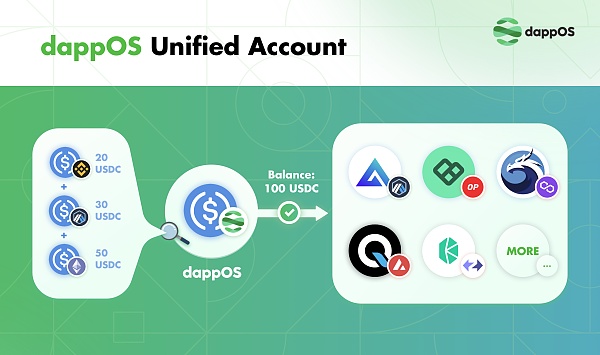

21. dappOS

June 20, 2023

Pre-Seed: Unpublished

Investors: Binance Labs

dappOS is an innovative DApp operating platform, which aims to reduce the barriers for users to interact with encryption protocols and provide users and applications with a more friendly operating system.

To attract the next wave of billion new users to adopt Web3, user experience matters. The current DApp is still very difficult for new users to use, mainly due to two problems, one is the creation of wallets on the chain (private keys are easy to lose), and the other is the complicated interaction process (approval of various contracts), which is also It is to be solved by the popular account abstraction concept (ERC-4337) in early 2023.

dappOS abstracts the concept of the existing public chain by becoming an intermediate layer between users and DApps, and solves these two problems well. In the upcoming V2 version of dappOS, new functions such as unified account, task-related order execution, and new bidding system will be included.

Here we focus on interpreting the unified account. The unified account allows users to only need to pay attention to the total amount of assets, and realize the universal use of assets in any dApp of any chain, just like in a centralized exchange, once the funds are deposited, there is no need to distinguish which chain the funds are deposited on, and the balance is in The spot and wealth management sectors are common. For example, user A's wallet balance in dappOS is 100 USDC, of which 50 USDC is on Ethereum and 50 USDC is on BNB Chain. User A only needs to sign once to confirm the transaction and then use it on GMX on Arbitrum or Benqi on Avalanche The total balance of 100 USDC does not need to pay attention to the distribution of USDC or consider the issue of Gas payment.

Therefore, users only need to interact on the dappOS platform to use different DApps across different chains at the same time, and also enjoy the Web3 interaction process with a Web2 silky experience. dappOS, which takes "user experience" as its own responsibility, deserves long-term attention.

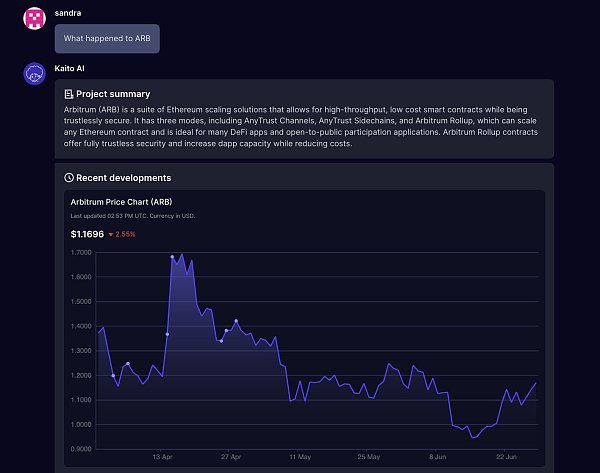

22. Kaito AI

June 22, 2023

Series A: $5.5 million

Investors: Superscrypt, SPARTAN

Kaito is a crypto search engine with built-in ChatGPT that aims to revolutionize crypto research. Kaito uses AI technology, cryptography to bring together terabytes of unstructured information, making it easily accessible to investors, researchers, developers, and the public through AI. It is worth mentioning that Kaito’s last round of financing attracted more familiar investors, including Red Shirt Capital and Dragonfly Capital.

5. L1/L2/Infrastructure

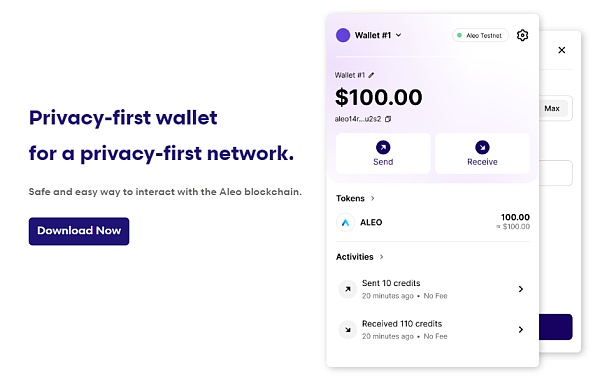

23. Leo Wallet

June 2, 2023

Seed round: $4.5 million

Lead investor: HackVC

Other investors: Data Collective, Coinbase Ventures, Amplify, Opensea, Santiago Santos

The star privacy public chain Aleo is in the testnet stage.

Leo Wallet is a privacy-focused wallet designed for the Aleo network. It provides functions such as token transactions, pledges, transactions, and games directly in the wallet. Developed by Demox Labs, Leo Wallet provides users with a comprehensive solution for managing their Aleo assets and transaction activity while prioritizing privacy.

Highlights:

• More than 15,000 users

• The first dedicated wallet for the Aleo network

24. Kakarot

Pre-Seed: Unpublished

Investors: StarkWare, Lambda Class, Ethereum joint creation Vitalik Buterin, Ledger joint creation Nicolas Bacca, Zama joint creation Rand Hindi

Starknet is the Ethereum zk Rollup L2 solution. Since Cairo is used as the programming language, it is not compatible with EVM, so there is an "entry barrier for Ethereum developers".

Kakarot is the zkEVM launched by Starknet, which supports developers to build and deploy Ethereum smart contracts, while maintaining compatibility with the Ethereum ecosystem and interoperating with Starknet. The testnet is expected to be launched in August.

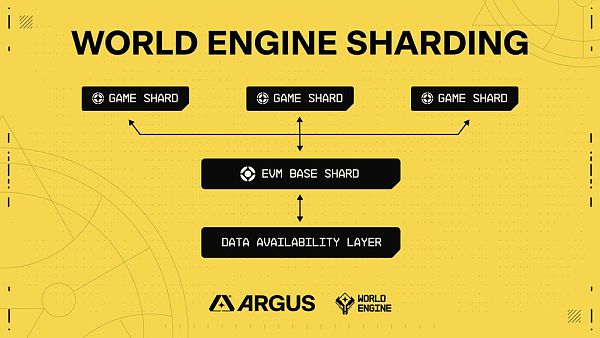

25. Argus

June 7, 2023

Seed round: $10 million

Lead investor: HAUN

Other investors: Alchemy, Robot Ventures, ANAGRAM, Dispersion Capital, EG, Entrepreneur Balaji

Argus is a chain game developer. As early as 2020, the company used zkSNARKs technology to build a popular fully open game "Dark Forest" on Ethereum. Players can build their own smart contracts to operate independently Market, information exchange center, guild, mercenary system and other functions.

However, due to the limitations of the current blockchain architecture, it is challenging for developers to build fully on-chain games. Therefore, Argus is developing a public chain World Engine that focuses on chain games. World Engine uses a sharding architecture, and game developers can choose to distribute their game load to different shards, so that they can not only build high-performance games, but also seamlessly interact with content on other shards through the shard routing system operate.

26. Taiko

June 8, 2023

Second seed round: $12 million

Lead investor: Generative Ventures

Other investors: IOSG Ventures, GSR, Kucoin Ventures, OKX Ventures, BAI capital, etc.

Taiko is an Ethereum zk Rollup L2 solution, and it is one of the top five zkEVM players named by Vitalik on Twitter. The goal of Taiko is to scale Ethereum in a way that mimics (equivalent) Ethereum as much as possible - both technically and ideologically.

As of this writing, Taiko is live on the Alpha-4 testnet.

27. Gensyn

June 12, 2023

Series A: $43 million

Lead investor: a16z crypto

Other investors: CoinFund, Canonical Crypto, Protocol Labs, Eden Block, Maven 11, etc.

"AI training should be decentralized and permissionless" - Edward Snowden (2022)

Gensyn is a decentralized AI computing network that uses blockchain and cryptography to verify whether deep learning tasks have been completed correctly, and pays on-demand through tokens. Gensyn aims to provide more efficient, safer, and more reliable computing resources for the training of AI models.

Top VC a16z explained the reasons for investing in Gensyn in a blog post. They believe that the project has great potential in solving some existing problems in the field of AI. For example, traditional cloud computing models usually require a lot of time and resources to complete AI training. , and Gensyn takes advantage of the blockchain technology to enable efficient allocation and utilization of computing resources, while the characteristics of decentralization ensure that the computing network is not affected by a single point of failure.

28. Mythical Games

June 27, 2023

C1 round: $37 million

Lead investor: Scytale Digital

Other investors: a16z crypto, Ark Invest, Animoca Brands, PROOF, MoonPay, Westcap, etc.

Mythical Games is a large Web3 video game and metaverse development company, the most popular games produced include NFL Rivals (NFL official NFT game) and Blankos Block Party (metaverse game), released last September on The Epic Games Store launches, attracts over 2.5 million users, and generates $1 million in sales per day.

As a metaverse unicorn company with strong technology and brought NFT out of the circle, Mythical Games has raised a total of about 280 million US dollars through 4 rounds of financing. There are many investors like a16z, Ark Invest, Animoca Brands, Binance, FTX , Galaxy, these top players in the currency circle, and even celebrities from the sports and entertainment world, such as NBA legend Michael Jordan. Mythical Games expects to raise additional funds for greater growth in the future.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.