This article is machine translated

Show original

n/1 The current mining income of the VELO/USDC trading pair is about 110%. Here is a Yield Farming tool that can help you achieve an annualized mining income of about 300% 🔥🔥@ExtraFi_io. @ExtraFi_io quadrupled TVL ($15M) in the last two weeks Let's see how he did it

(To emphasize, I think this protocol has a good user experience, and I do not recommend buying his tokens)

n/2 @ExtraFi_io is a Yield Farming protocol based on the #Velodrome protocol, which achieves up to three times the LP mining income by borrowing from the internal lending pool of the protocol.

Extral's business is mainly divided into two parts:

1⃣ Borrowing

2⃣ Leverage group LP

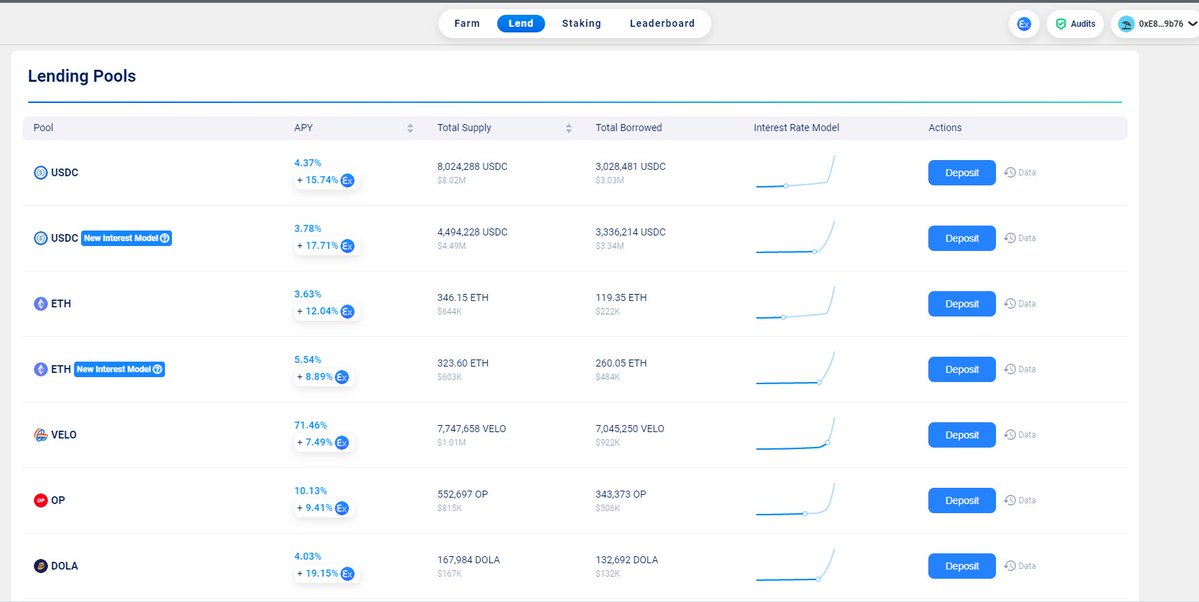

n/3 The loan part can only save money, not borrow money. Users can get interest income + protocol token incentives by depositing money in the loan pool

n/4 For the LP part of the leverage group, when the user needs a leverage mining strategy, the protocol will borrow money from the loan pool to provide the user group LP to achieve the effect of leverage mining.

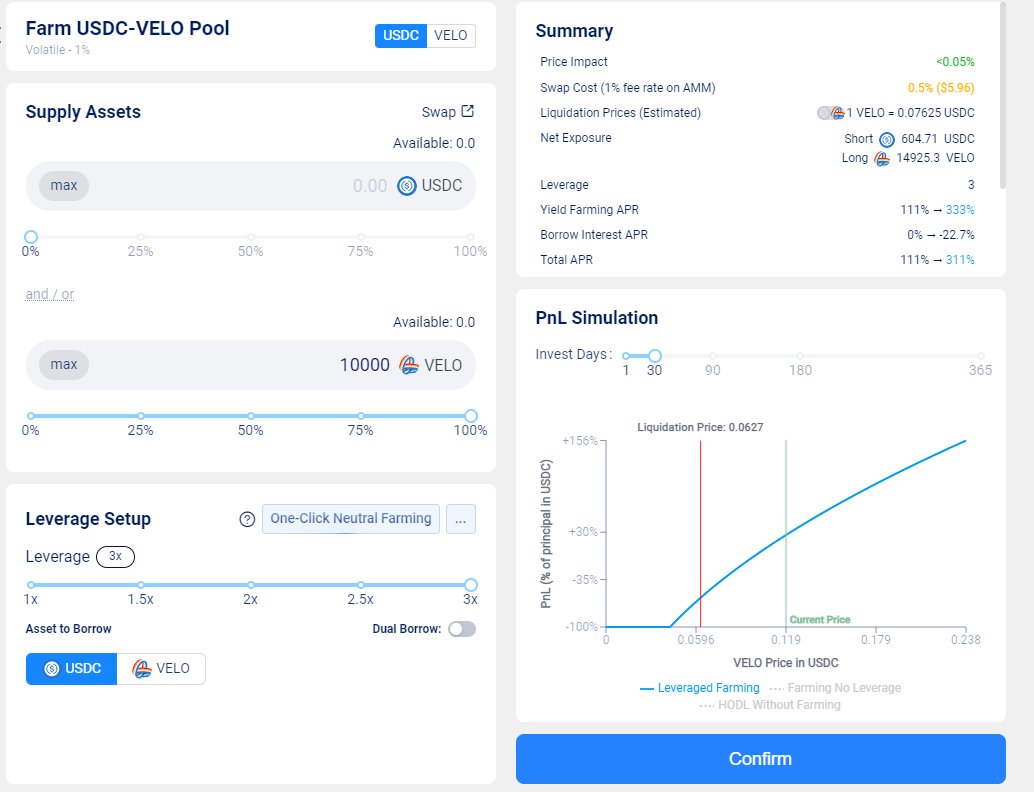

Let me give a simple example. For example, if you have 10,000 VELO in your hand, and you are bullish on VELO in the next time, then you can choose the VELO/USDC pool. If the leverage is tripled, the annualized return will be about 300%.

n/5 The specific implementation method is that, for example, you now have 10,000 Velo agreements to lend about 2,380 USDC from the lending pool, exchange 604 USDC for about 5,000 VELO, and finally combine about 15,000 Velo and 1,776 USDC to form LP . Finally, the effect of triple leverage mining is realized. Forming LPs through borrowing has several advantages (the disadvantage is that it will explode)👇👇:

n/6 1⃣We know that if the price of Velo rises, the group LP will cause us to gradually sell Velo as the price rises, and the income is not as good as holding Velo. But don’t forget that our leveraged mining is long Velo here. It can be seen that when the price of Velo rises by 46.2%, the actual income of LP is 61.9% (slightly lower than 1.5 times, but still higher than holding Velo)

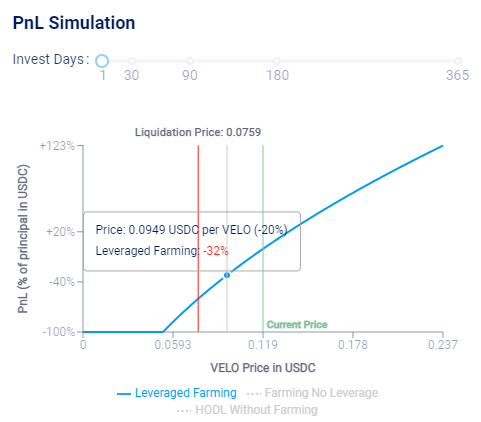

n/7 2⃣ Then the price falls, will we lose more because of the leverage? Yes, but not completely. For example, on the first day after we completed the LP group, velo fell by 20%, and the actual loss of the LP group was 32%. But the assumption here is that it plummets within a day. If you put the time into 30 days, the result will be completely different.

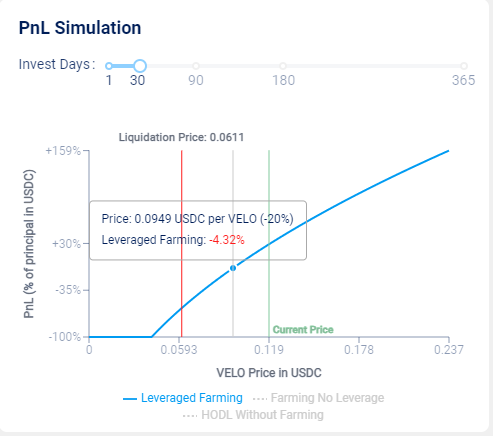

n/8 If the price of velo drops by 20% within 30 days of LP operation, the actual loss of lp is 4.32%, because through the leverage mining group LP, our mining income is enlarged, and the mining income makes up for the loss brought by the price. loss.

At the beginning of n/9, I wrote this agreement because I really think it is very useful. I have seen a lot of leverage mining tools, but I have never seen an agreement that can make the front end so good and calculate the user's income so clearly. But I do not recommend buying protocol tokens at all.

n/10 The essence of this agreement is to subsidize lending through its own tokens, so that people in leveraged mining can borrow money at a relatively low interest rate, thereby promoting the benefits of leveraged mining. So in essence, Extra is subsidizing Velo's TVL with its own token. The more similar projects there are, the more Velo benefits.

n/11 Lastly, the $EXTRA token has little use right now and is a mining coin in the short term. I wrote this Thread mainly because some friends were curious about the principle of this project yesterday, so I wrote it to share. Although the agreement has been audited, but DEFI, in the end, it still depends on the test of time. If you use it yourself, pay attention to the risks

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content