Author: Riyad Carey Compiled: Cointime.com 237

The launch of Worldcoin is one of the most unique and controversial events in recent years. Much of this controversy stems from concerns about Worldcoin's goal (creating a global identity network) and the sci-fi method of achieving it (eyeball scanning). MIT Technology Review has a good summary of this here. I will focus on analyzing token economics, trading, and liquidity to explain why this launch is unique.

Token Economics

Worldcoin's white paper is already published on its website, but for those of us in the US, the token economics section is conspicuously missing. However, by using a VPN, I was able to reveal some geo-restricted secrets, here are the most relevant details:

1. The initial supply limit is 10 billion WLD.

2. The maximum circulating supply at launch was only 143 million WLD, of which 100 million was lent to manufacturers in markets outside the United States.

3. 75% of the total supply is allocated to the "Worldcoin community", 13.5% to investors, and 10% to the development team.

4. Tokens for investors and development teams are locked for 12 months after launch, and then unlocked linearly over the next 24 months.

Unfortunately, Worldcoin's token economics are not unique and rather confusing. It has distinctions between "circulating" and "unlocked" supply (unlocked is the upper limit of circulating supply; governance determines how quickly unlocked tokens enter circulating supply), various inflation and lock ratios, and unclear language.

In simple terms, the current circulating supply is 111 million WLD tokens, of which 100 million tokens are loaned to market makers. An additional 11 million tokens have been claimed by those participating in the pre-launch phase, who will earn 25 WLD tokens by verifying their identities. As more users claim their allocated tokens, the circulating supply will increase. By this time next year, 1.6 billion WLD tokens will be unlocked (it's unclear how many will be in circulation), after which inflation will really kick in, with the unlocked supply expected to reach 5 billion by the end of 2025.

Currently, just over 1% of the total supply is in circulation, nearly all of which is on loan to market makers. Worldcoin provided more detail on these arrangements than in the past, saying that the five market makers “received a loan of 100 million WLD within 3 months of the token launch,” after which they could return the tokens or pay each 100 The purchase price for 10,000 tokens is $2.00 + (0.04 * X) to purchase tokens, where X represents the number of tokens purchased divided by 1 million.

This approach, especially involving five market makers, yields some interesting game theory. Importantly, it anchors the price of WLD at around $2. This in turn makes it more likely that people will scan their eyes and earn 25 tokens. Let’s now take a look at how this unique arrangement works both on-chain and off-chain.

transaction

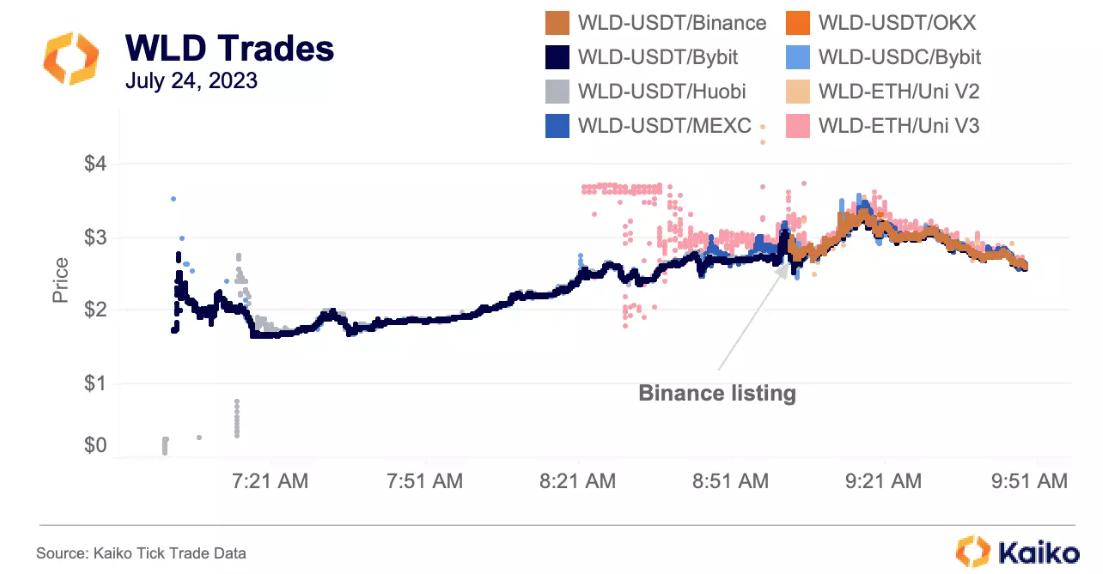

This may be the most orderly launch yet for such a highly regarded token. Bybit and Huobi were the first two exchanges to list the token, and Huobi appears to have had a few false starts at first, indicated by the gray dots on the bottom left. However, once trading on Huobi actually started, the two exchanges converged within about 8 minutes.

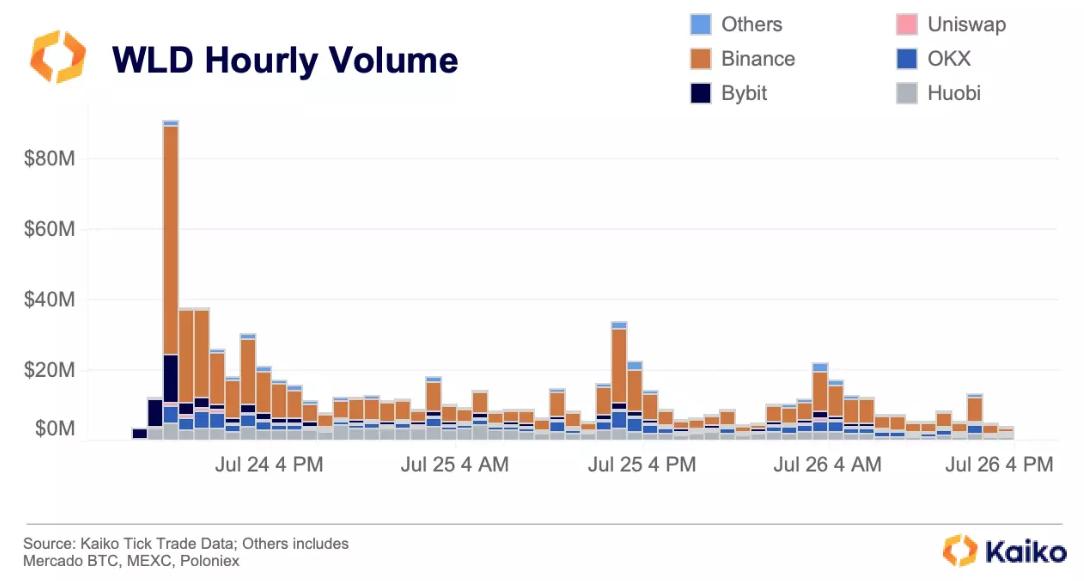

Taken together, it is clear how the Binance listing has quickly changed the dynamics of the market. In the first two hours, the total volume on other exchanges was $16 million. In the first hour of listing on Binance, volume reached $65 million, followed by Bybit’s $14 million. It is also interesting that Huobi’s hourly volume remains relatively stable compared to other exchanges.

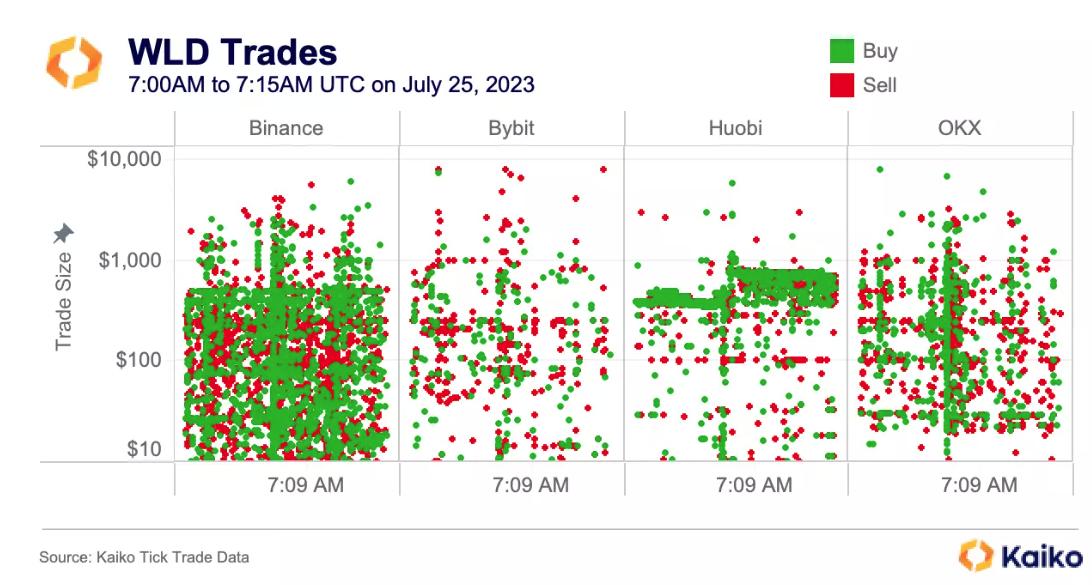

To investigate further, we can zoom in to a random 15-minute time period on July 25th. The chart below shows all trades greater than $10 on some exchanges, using a logarithmic axis to better visualize smaller trades. Vertical clustering is intuitive: these are the time periods with higher trading volume. Horizontal clustering typically represents TWAP transactions, which is evident in Huobi's chart.

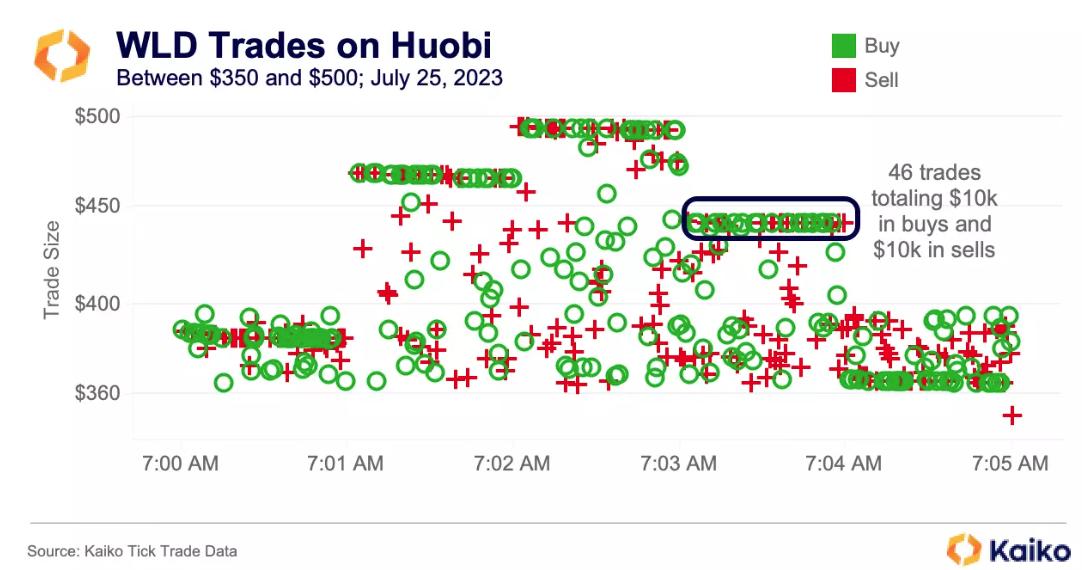

However, when looking closely at the Huobi exchange, these horizontal buildups are not TWAP orders; they are perfectly balanced between buys and sells. In the past, we have determined that this is a telltale feature of artificial volume.

The number of matches for buying and selling also increased very quickly. The five clusters shown above represent around $100,000 in volume in just 5 minutes.

fluidity

Considering that five market makers borrow nearly all of the token's circulating supply, we expect the market to be very liquid. The chart below shows market depth at 0.1% and 1%, indicating how much buying and selling there is within a certain range of mid-price levels.

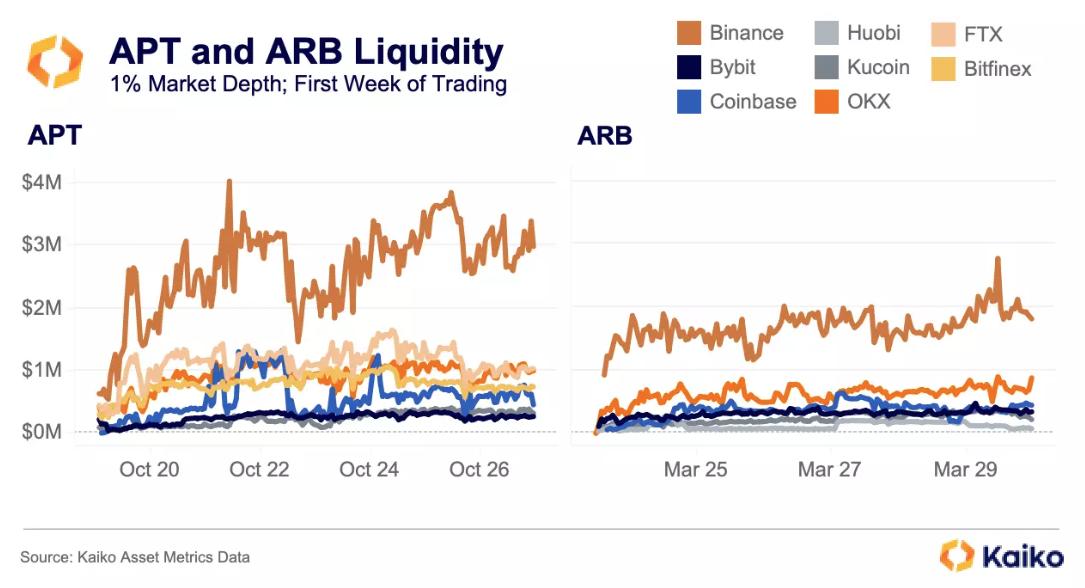

The launch of APT came just before the FTX crash, causing a lot of liquidity to exit the market. As a result, APT’s liquidity surged during the first few days of trading, with Binance hitting $2.75 million the day after its listing. Binance was followed by FTX, which hit $1.5 million around the same time. Just two days after listing, APT’s total liquidity at the 1% level exceeded $8 million. Unfortunately, Aptos did not provide details of any arrangements it has with market makers.

About five months later, the ARB launched via an airdrop, causing some technical issues that delayed some users from claiming their tokens. The Arbitrum Foundation also lent market maker Wintermute 40 million ARB tokens. During the first week, ARB’s liquidity was mainly concentrated on the Binance exchange, where it remained at a level of $2 million. This was followed by OKX, which never broke $1 million, and Coinbase, which only briefly topped $500,000. Conclusion Considering that nearly all of the circulating supply of WLD tokens is loaned out to market makers, it is somewhat surprising that liquidity remains low, especially compared to ARB, which at the time had approximately $50 million worth of loans out. WLD's borrowing value is currently around $220 million, yet total liquidity at the 1% level is just under $3 million. Also, the total volume has still not surpassed $1 billion.

Taken together, the nature of the launch suggests the team may feel they need to assign an attractive dollar value to their token. It can be challenging to convince people to scan their eyes for a coin that doesn't exist yet; it can be even more challenging if the coin's price is, say, $0.10. Currently, 25 WLD tokens are worth just over $50 and will likely remain in this range for the next three months. So far, this seems to be enticing people to sign up and scan.