Original title: MakerDAO Increases DAI Savings Rate to 8%

Originally Posted by Joo Kian, Analyst, Delphi Digital

Original source: delphidigital

Compiled by: Luffy, Foresight News

Source: https://makerburn.com

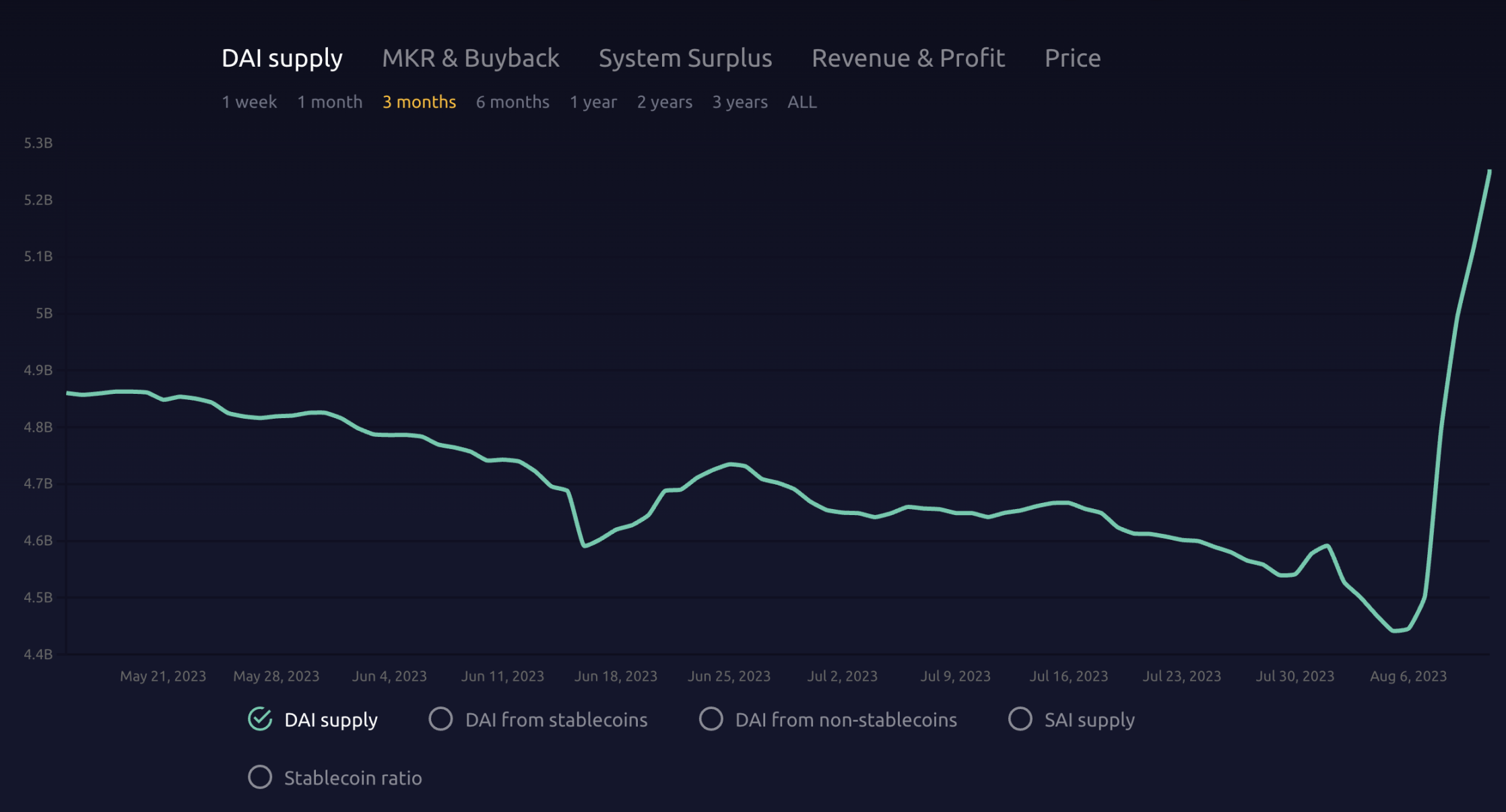

MakerDAO recently increased the deposit rate (DSR) of the stablecoin DAI from 3.19% to 8% (the interest rate increase is realized through the EDSR mechanism), a move aimed at stimulating the growth and demand of DAI by enhancing the attractiveness of DSR. As a result, DAI now offers the highest yield among stablecoins, outperforming various money market yields and decentralized exchange LP returns. The increase in DSR has brought a massive inflow of DAI, with the total increasing from about $340 million to $1.18 billion.

Source: https://makerburn.com

The DSR change also incentivized depositors to mint more DAI via Maker vaults, with the DAI supply clearly shifting from a constant decline prior to August to an upward trend.

Source: https://makerburn.com

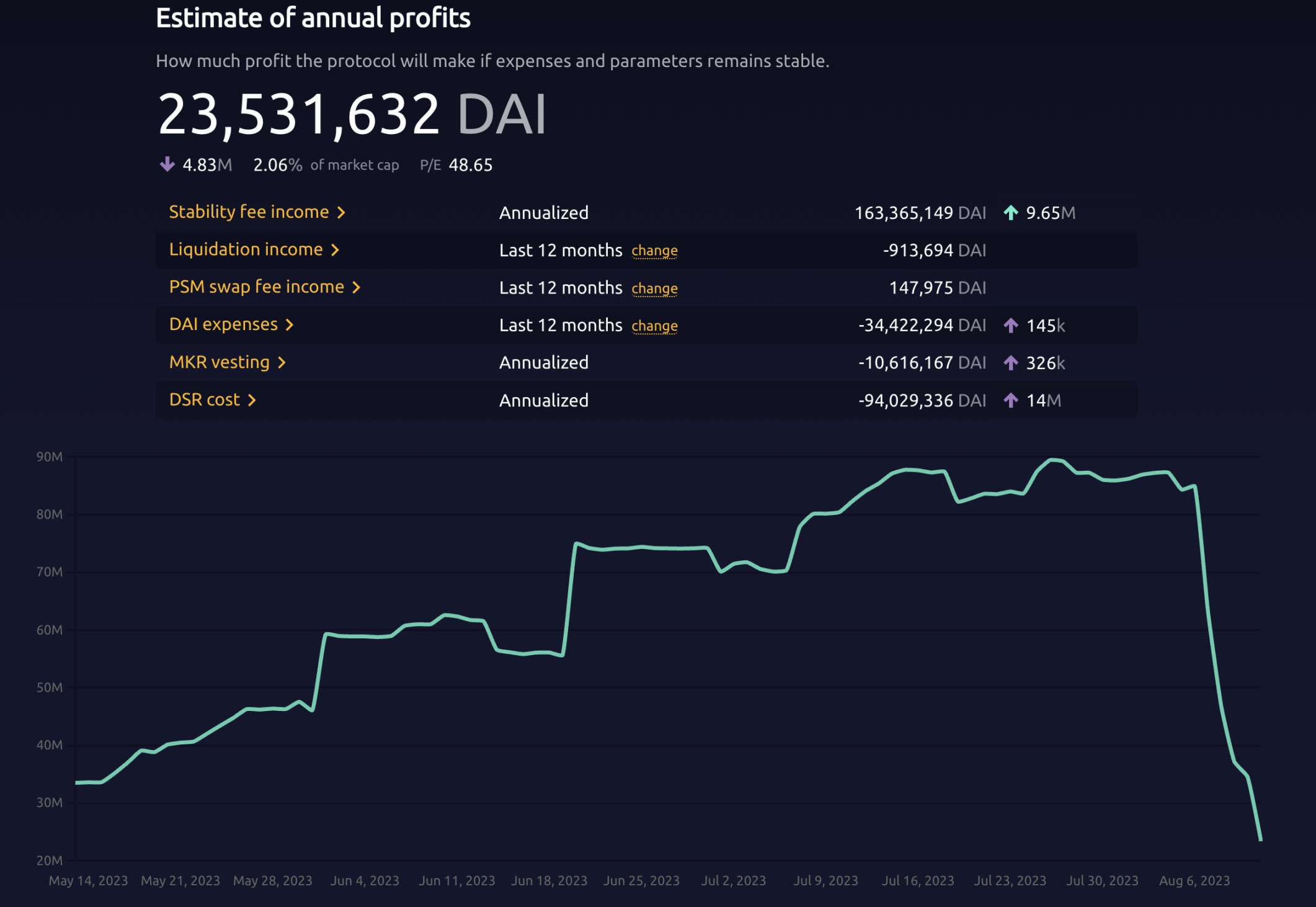

However, this expansion has also come with significant financial implications. With the DSR currently set at 8%, Maker's annual operating costs are estimated at $54 million. As a result, this will reduce Maker's projected annual profit to $23 million/year from $84 million/year in early August. Still, the reduction in revenue from these protocols is seen as an acquisition cost to reignite DAI demand.

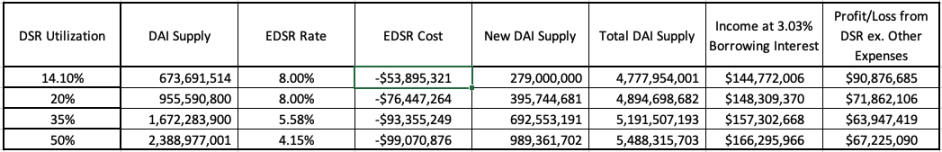

Is this mechanism sustainable? The following is my inference on paper. In terms of current data, the EDSR is three times the DSR base rate of 3.19%. As DSR utilization increases, the deposit rate is reduced (capped at 8%).

- When the DSR utilization rate is 0-20%, the deposit rate is 3x DSR = 8%

- When the DSR utilization rate is 20-35%, the deposit rate is 1.75x DSR = 5.58%

- When the DSR utilization rate is 35-50%, the deposit rate is 1.3x DSR = 4.15%

Here, I use the ratio of current "DAI supply" to "New DAI Supply" in the DSR to predict potential DAI supply growth. Furthermore, since EDSR reverts to the base DSR of 3.19% at DSR utilization >50%, it is reasonable to assume that DSR utilization will not exceed this threshold, as it would not be economical for savers.

As more DAI is minted, Maker will earn more interest on the newly minted DAI than it pays on DSR. As DSR deposits increase, this dynamic will put pressure on Maker margins, leading to lower profitability unless the 4.15% EDSR level is met.

Conclusion: Yes, the DSR new interest rate mechanism is sustainable.

The enhanced DAI DSR offers an attractive alternative to on-chain yield compared to US Treasuries. Given its high yield, DSR utilization is likely to stabilize below 35%, in line with the current Treasury rate benchmark of 5.5%. This move is intended to advance Maker's growth and lay the groundwork for the introduction of the Maker SubDAO to increase the demand and utility of the DAI and MKR tokens.

Note translator: The original text was published on August 8. Due to the large changes in the current data, the translator replaced the relevant data in the text with the latest data on August 11.