Original Author: Nancy, PANews

Looking at the current encryption market, most of the popular public chains are mostly POS models, and it seems difficult for POW to come up with a masterpiece, especially since Ethereum turned to the POS mechanism. Recently, new POW influencers such as Kaspa and Dynex have made the market start to pay attention to the POW track again.

Among them, with the help of AI outlets, Dynex, which focuses on the "neuromorphic computing platform" narrative, not only attracted many miners to participate, but also attracted attention in the secondary market due to dozens of times the increase. But at the same time, Dynex began to face multiple doubts from the encryption community, and negative news such as the founder’s suspected fraud and white paper plagiarism continued to spread.

Claiming to build a neuromorphic supercomputing blockchain, attracting attention due to pull

According to the official introduction, Dynex is a neuromorphic supercomputing blockchain based on the DynexSolve chip algorithm, which improves the speed and efficiency of the decentralized network by adopting the effective workload proof (PoUW) method, and aims to provide a platform for machine learning, financial technology, and biology. Pharmaceuticals, etc. provide computing power.

The Dynex network nodes are composed of PoUW miners, allowing any miner to perform Dynex chip calculations and get the native token $DNX in return, thus realizing a decentralized network for high-speed and efficient execution calculations, even surpassing quantum computing. Not only that, Dynex also adopts a completely anonymous peer-to-peer transaction privacy method, and its token $DNX has no IC0, no pre-mining and no team reservation.

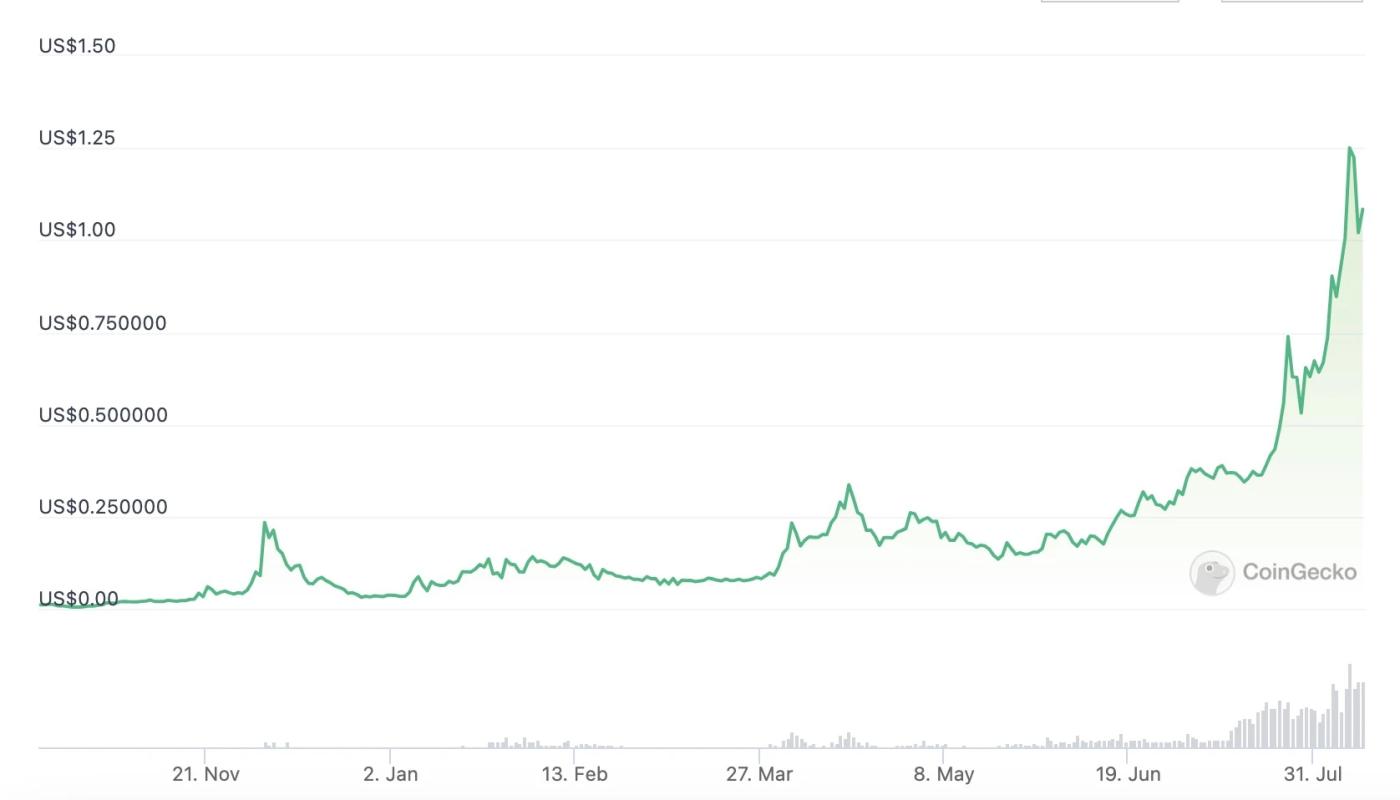

Technically, it is difficult for many ordinary investors to verify (we will expand in detail below), but the market performance of Dynex is amazing. According to CoinGeoko data, since the beginning of this year, the price of $DNX has increased by more than 34.7 times.

From the perspective of computing power, data from the hiveon.com computing power management platform shows that as of August 10, $DNX’s computing power accounted for 18%, ranking first among the POW coins listed on the platform, far surpassing KAS , ETC, RVN and other projects.

In addition, Mining Pool Stats data shows that as of August 10, Dynex's network computing power is 1.09 GH/s, ranking 38th. In the past 6 months, the computing power of Dynex has also shown an overall upward trend. Although there was a short-term decline due to the algorithm upgrade, it recovered quickly. From the perspective of computing power distribution, the computing power of the top three mining pools accounts for nearly 84.4% of the total.

The founder was punished by the SEC for fraud, and the white paper was suspected of plagiarism

While Dynex became popular, doubts about the plagiarism of the white paper and the background of the project team began to appear. Dynex is an anonymous team. Anonymous identities are not uncommon in the Web3 world that focuses on decentralization and privacy, but this means that once these projects do evil, it will be difficult for users to hold them accountable.

Regarding the anonymity of the team’s identity, according to the Dynex Chinese channel’s tweet, Dynex’s parent company is a Nordic chip company, which has not yet been made public due to taxation and other issues. However, the community did not accept this statement. Some community members found that Daniel Mattes, the founder of Dynex, was fraudulent. Linkedin information shows that Daniel Mattes is an Austrian Internet entrepreneur and venture capitalist who has founded several companies, including artificial intelligence company 42.cx, VoIP company Jajah, and mobile payment and ID recognition startup Jumio.

Among them, Daniel Mattes, as the former CEO of Jumio, was charged by the US SEC in 2019. According to SEC public documents, Daniel Mattes defrauded investors before the company went bankrupt, not only falsely reporting the company's revenue, but also secretly selling the company's stock without reporting it. Although Daniel Mattes neither admitted nor denied the allegations, he eventually agreed to pay more than $17 million to settle and is no longer allowed to lead a public company in the United States.

Not only that, according to Twitter user @OlivierHelden, the predecessor of Dynex is DeepQ, which not only has the same neuromorphic chip project, but also the Adobe Stock Flash serial number of the DeepQ promotional video on Youtube is exactly the same as the promotional video on Dynex’s official website ( At present, the video of Dynex has 404 cannot be displayed). Interestingly, another community member revealed that his account was banned after he asked about the relationship between DeepQ and Dynex in the Discord community.

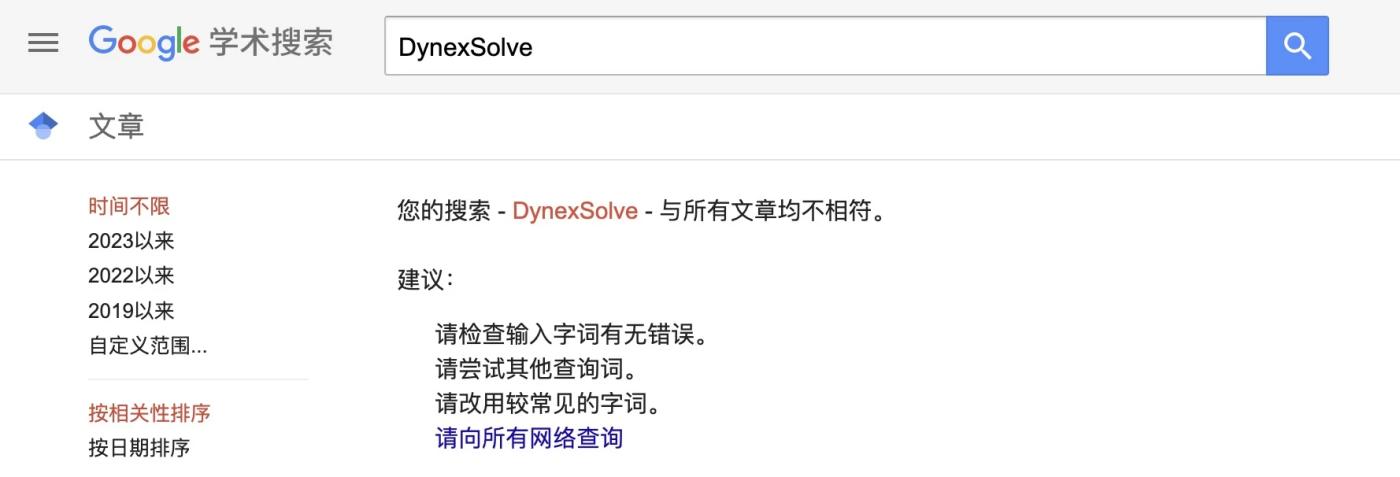

In addition to the team background, DynexSolve and PoUW, the two core strengths of Dynex's publicity, have also been questioned about their authenticity. According to KOL@陈剑Jason, Dynex can transform any modern GPU into an analog neuromorphic computing chip through DynexSolve, but such a revolutionary technology has not yet had any public papers. Not only that, neuromorphic computing has not yet been applied in the real world, including top universities, the US military, Intel and IBM are still in the exploratory stage.

As for PoUW, analyst Chen Jian Jason said that for a blockchain, PoUW is too non-standard in the beginning, process, and end stages. The number and frequency of tasks are non-standard, and the difficulty of completing tasks and The time-consuming non-standard and the correctness of the verification task results are non-standard, resulting in the inability to stably generate blocks and effectively verify them, and this chain will not have basic usability.

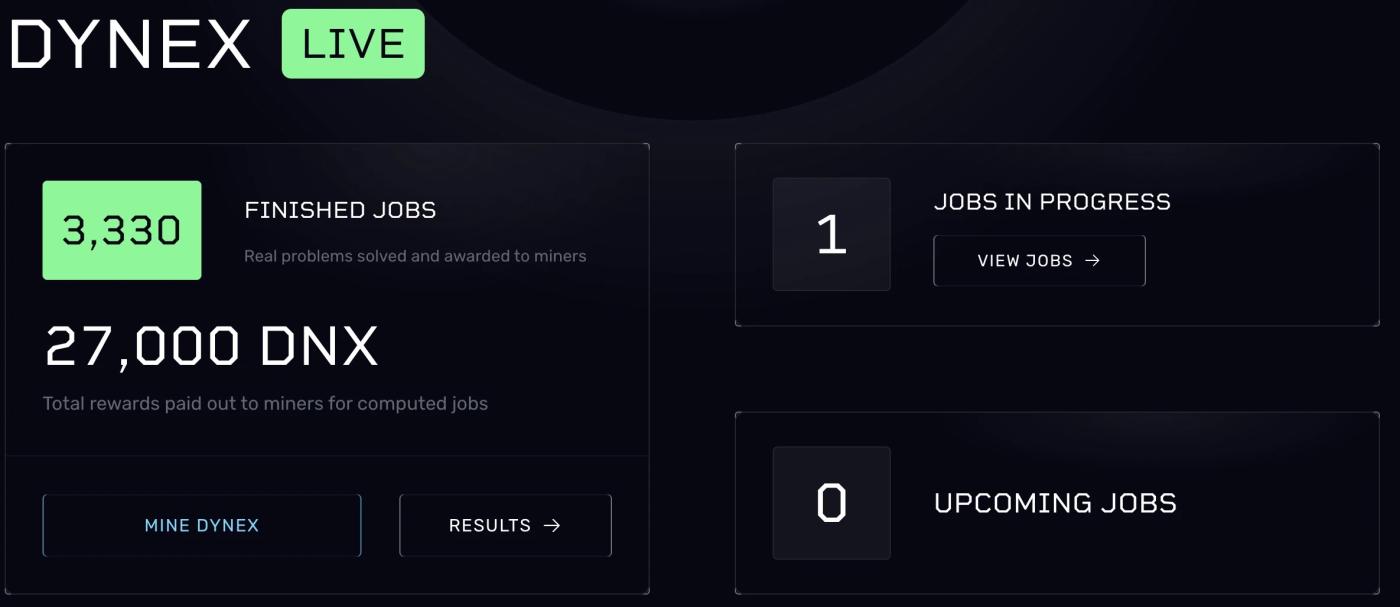

It is worth mentioning that Chen Jian also pointed out that Dynex’s official website shows that 3,300 tasks have been completed, but only one is currently in progress, and these tasks are all black boxes. They have no idea what they are doing, and there is no release of tasks. Entrance.

Regarding these technical issues, some community members also believe that Dynex can conduct ML public testing externally, indicating that its technology can withstand public torture. However, the current public beta has been delayed several times due to technical issues.

In addition, Dynex’s white paper is also copied and pasted. As shown in the figure below, part of Dynex’s content almost copied the white paper of the digital memory computer (DMM) of the patented American company MemComputing.

Comparison of parts of Dynex and DMM white papers

In short, with the popularity of AI and the concept of POW, Dynex is also expected to be favored by funds. In particular, with the explosion of Kaspa bringing a wave of POW mining, and after Ethereum shifted from POW to POS, a large number of mining machines were idled, and Dynex has also become the migration target of miners. As Dynex is a project that requires strong technical research and development capabilities, it is reasonable for the community to have various doubts out of interests, but in order to dispel doubts from the market, it is necessary to show "hard power".