Original author: Ignas | DeFi Research

Original source: Twitter @DefiIgnas

Compile: MarsBit, MK

Is the golden age of decentralized stablecoins approaching? Don’t be misled by the $125 billion drop in the stablecoin market (DeFi only makes up 9% of it). Keep an eye out for exciting changes in the DeFi stablecoin space as they pave the way for an upcoming bull run:

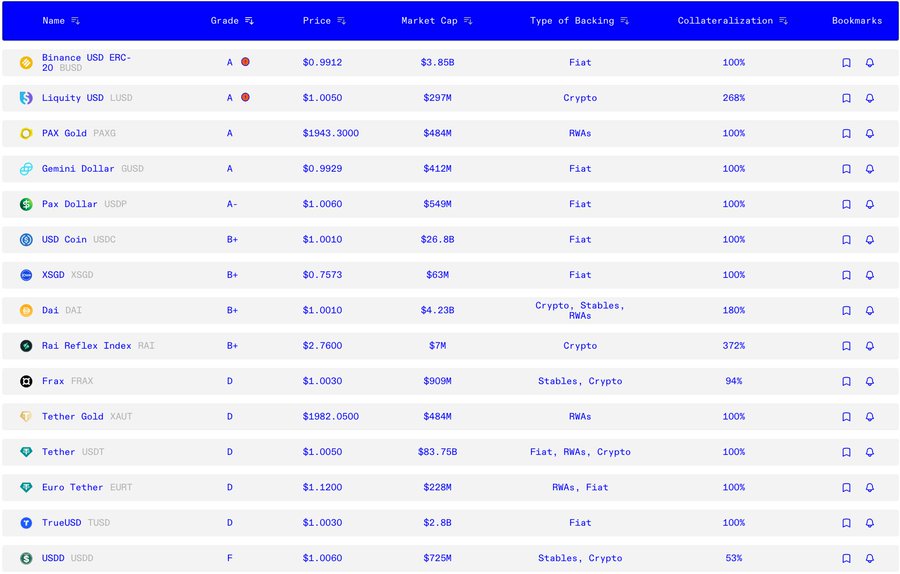

Safety first! The non-profit organization Bluecore has released its economic security ratings for the top stablecoins. The safest ones are BUSD, PAXG, GUSD, and LUSD is the safest DeFi stablecoin. Safer than USDC. LUSD became a safe haven when the USDC decoupling event happened in March.

DeFi stablecoins like DAI and RAI received a B+ rating, while USDD and TRON’s USDD received an F. These ratings are important because these will cover experimental DeFi stablecoins. Whether you're a DeFi farmer or a risk-averse, there's a stablecoin that's right for you.

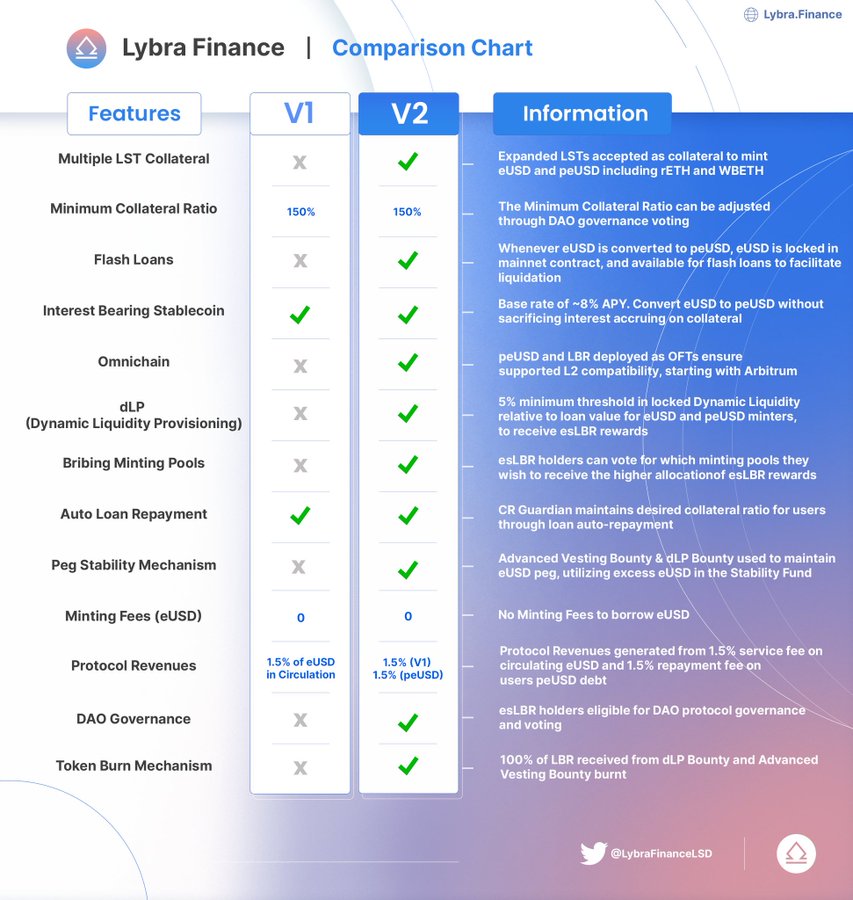

Let's take a look at Libra's eUSD, which is a challenge to LUSD. It is a fork of Liquity that accepts stETH as collateral, unlike Liquity. This enables holders to earn an annual yield of about 7.2%. However, eUSD’s yield distribution method is through rebasing, which has raised adoption issues in the DeFi space.

To address this and other issues, Libra is rolling out v2, which includes a new stablecoin — $peUSD. Upgrades include Omnichain functionality, minting with multiple collaterals, and easier integration in DeFi protocols. The v2 version is currently running on the Arbitrum testnet.

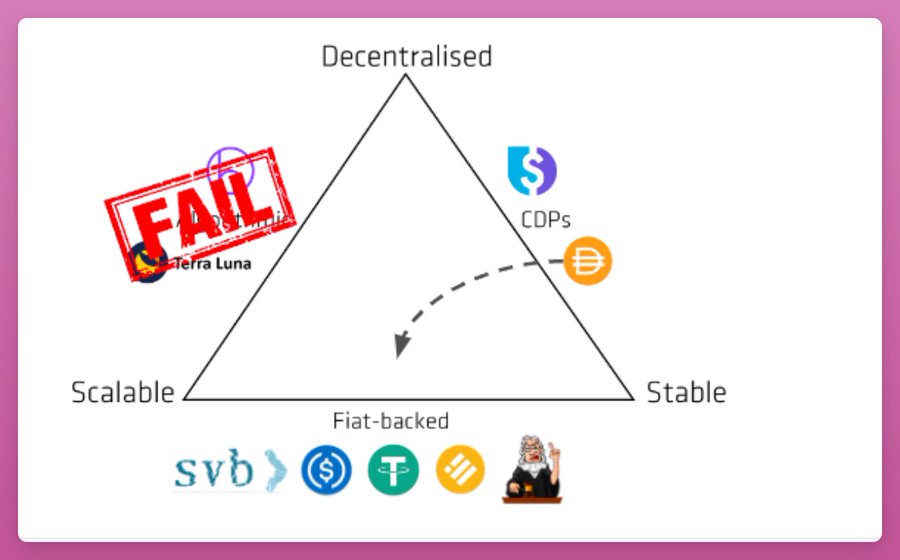

Liquity stands out for its 0% interest rate, one-time borrowing fee, and censorship resistance. But to keep up with the competition, Liquity is rolling out v2, which aims to solve the "trilemma of stablecoins," namely decentralization, stability, and scalability.

Liquity V2 introduces primary protection leverage and a secondary market to ensure that even if the price of Ether falls, it remains stable thanks to a triangular arbitrage model backed by reserves. While complex, it offers leverage, earnings and trading opportunities. This will be launched in 2024.

Why is the founder of SNX confident in decentralized stablecoins? I guess it has something to do with Synthetix V3. Although sUSD’s market cap has dropped to $94 million, things may change with the launch of V3. It promises exciting improvements to the @synthetix_io ecosystem.

Key improvements to sUSD:

• Multi-collateral stake: V3 allows different collateral assets to support synthetic assets, no longer only $SNX. Expect $sUSD liquidity to increase.

• Synthetix Loans: Mint $sUSD without debt pool risk and issuance fees.

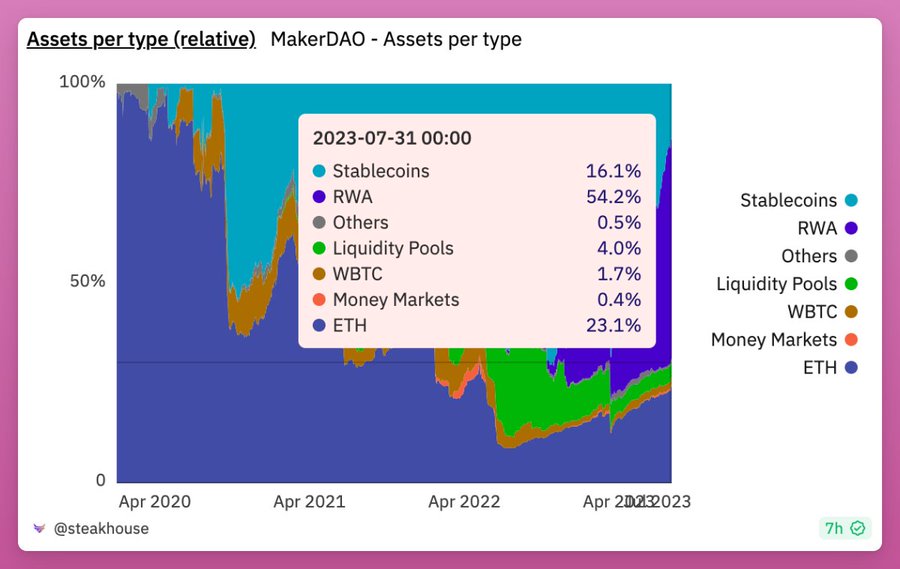

Maker is thriving:

• MKR up 26% in a month

• DAI is about to earn 8% through DSR👀

• Spark Protocol, a DAI-focused fork of Aave, reaches $57M in total locked value

• Maker cuts its reliance on USDC from 65% to 17%

• It is now the third largest revenue generator, overtaking Lido

Turning to $FRAX: it has a D (unsafe) rating from Bluecore. Issues mentioned include partial collateralization of $FXS and heavy reliance on centralized assets, but with the launch of V3, this may change soon.

Not all details have been released, but Frax is voting now, partnering with FinresPBC to hold and manage low-risk cash-equivalent assets. This will make traditional assets accessible on-chain while returning earnings to the Frax protocol while reducing reliance on USDC.

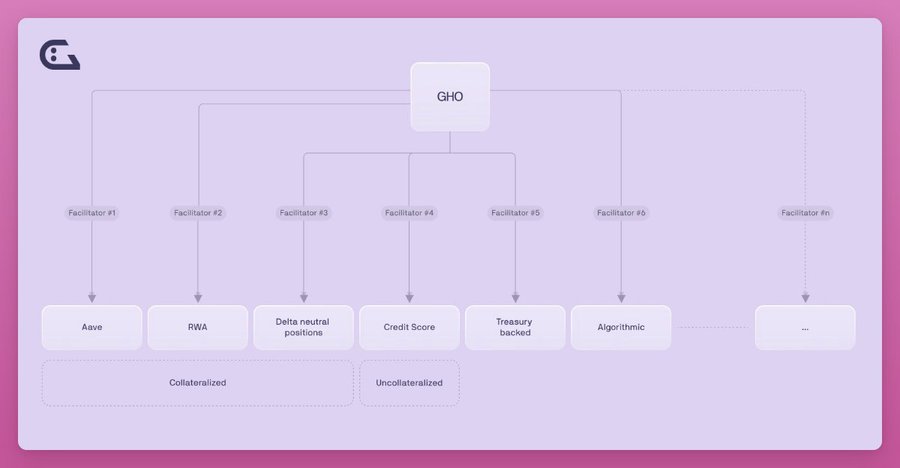

Meanwhile, Aave's $GHO is an upstart. With a market cap of $11 million, it's off to a steady start. The potential of GHO goes beyond Aave: to facilitate the minting of GHO through real-world assets, treasuries, or partial algorithmic methods such as the FRAX model.

Key things to know about $GHO:

Key things to know about $GHO:

• Overcollateralized and can only be minted/burned by approved facilitators

• Interest set by Aave governance (currently 1.5%)

• Not available to the Aave Ethereum marketplace

• Borrowing discount model for $stkAave holders.

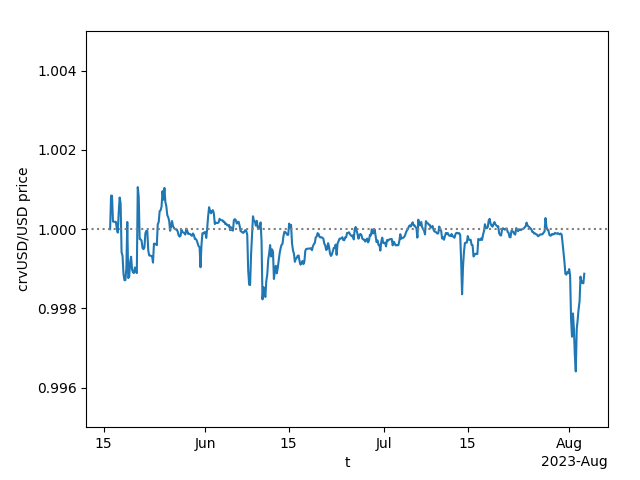

Curve's $crvUSD has proven critical to the platform.

Following the hack, crvUSD played a key role in providing liquidity to Fraxlend's CRV/FRAX lending pool and $CRV in TriCypto's pool. while keeping the hook up. The launch was really well timed.

– Recent events feel somewhat similar to the SVB/USDC situation. However, crvUSD is only down 0.35% and is now only 0.1% away from the peg

The loan settlement AMM algorithm of the soft settlement mechanism makes crvUSD stand out. It solves the liquidation problem by gradually switching between collateral and crvUSD: selling collateral when the price falls, and buying it back when the price rises. This brings more transaction volume.

The $UST debacle, and the USDC decoupling, taught us many lessons for improvement. What works today may not work tomorrow, and what seems impossible now may become the norm in the near future. After Learning These Lessons, DeFi Stablecoins Are Moving Forward