Original Author: Jiang Haibo

On August 9th, Rune Christensen, the co-founder of MakerDAO , published the article "SparkDAO SPK Pre-mining Airdrop; SubDAO Mining Overview" in the forum, mentioning SparkDAO's SPK airdrop and SubDAO's token economics that everyone is concerned about.

The Spark Protocol is the first product in Maker Endgame's transformational phase. With Maker raising the DSR (DAI deposit rate) to 8%, users are more likely to be exposed to Spark, a lending protocol built on top of Aave's V3 code (10% of Spark's profits will also be distributed to Aave). Now the "Use Dai " button on the MakerDAO official website has been switched to jump to the Spark homepage. From here, you can either deposit collateral to borrow DAI, or deposit DAI in the form of sDAi (SavingsDAI) into the DSR contract to get 8% rate of return. It can be seen that Maker currently supports Spark. The following PANews will explain the Spark retroactive airdrop rules and precautions.

Retroactive airdrops are the solution to the EDSR arbitrage problem

Spark's retrospective airdrop is mainly a solution to the problems caused by the implementation of EDSR (Enhanced DAI Savings Rate). In a previous article, we mentioned that in order to maintain the demand for DAI in the months before the launch of Endgame, Maker enabled EDSR and increased DSR to 8% above the US bond yield.

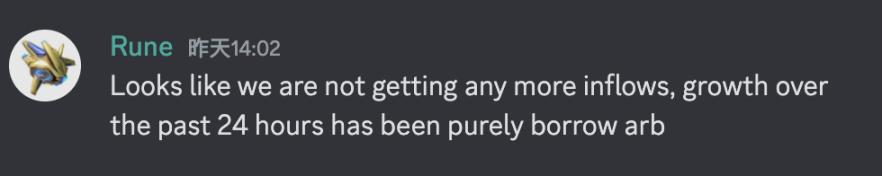

But it also brings problems. Maker hopes to allocate as much funds as possible to users who normally hold DAI, but the arbitrage activities of whale have increased Maker's expenditure on DSR. Rune also stated in Discord on August 10 that there was no capital inflow in the past 24 hours, and the newly minted DAI and the part deposited into the DSR contract were entirely for loan arbitrage.

Rune has proposed an anti-arbitrage proposal, hoping to reduce the upper limit of EDSR from 8% to 5%, while increasing the stable fee rate of encrypted mortgage lending (except ETH-A, ETH-B, ETH-C) to 5% .

If the proposal is implemented, the arbitrage funds will leave, and the circulation of DAI will also decrease. Except for the part of USDC minted DAI through PSM, the rest of the data may return to before the implementation of EDSR, and the proportion of USDC PSM in the newly added DAI than very small.

To this end, Rune proposed to establish a retroactive SubDAO token mining airdrop for Spark protocol users, rewarding early users for their support of the Spark DAO community.

SPK and SubDAO Token Distribution Rules

SparkDAO is a member of SubDAO in Maker. According to the original idea, it will transition to Creator SubDAO after the Creator SubDAO model is established.

Each Maker's SubDAO has its own SubDAO tokens, which are minted by Maker Core and distributed mainly through mining, so Spark's token SPK should also follow the SubDAO token standard formulated by Maker.

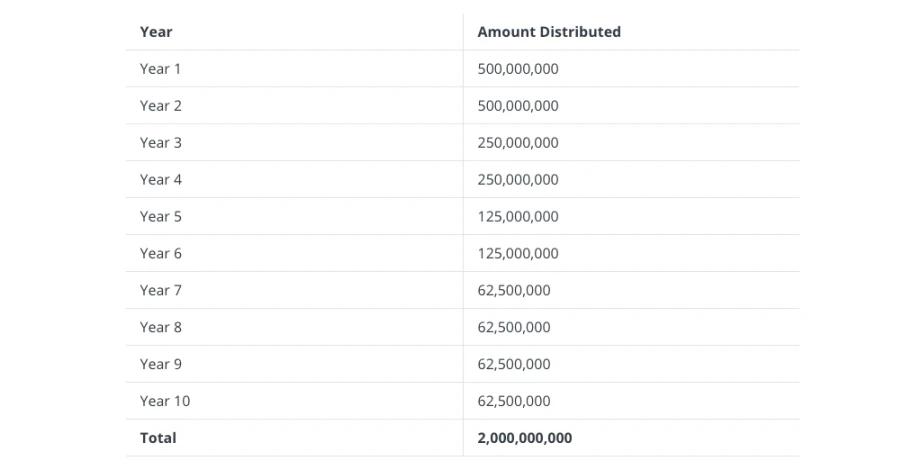

According to the token economics document of Endgame on Maker's official website, the initial supply of each SubDAO token is 2.6 billion. Among them, 400 million will be used to motivate SubDAO employees; 200 million will be sold within 2 years to provide DAI to fund SubDAO; the remaining 2 billion will be distributed through liquidity mining within 10 years. The specific distribution schedule is shown in the figure below Show.

Of the mining allocation of these SubDAO tokens, 75% will be allocated to NewStable users (an upgraded version of DAI, Maker expects to upgrade DAI and MKR tokens in the future, which was mentioned a few months ago), 25 % is allocated to NewGovToken (upgraded MKR) users.

Regarding the distribution time of 2 billion SubDAO tokens and the distribution ratio between DAI and MKR, Rune's speech in the forum is consistent with Endgame's token economics. The other parts are slightly different. Rune mentioned that in addition to the SubDAO tokens generated by mining, there are 300 million tokens allocated to the labor bonus pool and paid to project contributors. The rewards for the pre-mining part also come from this additional SubDAO token. currency pool.

What is certain is that the total amount of SPK and other SubDAO tokens exceeds 2 billion. In addition, there are 300-600 million tokens used for employee incentives and protocol development, and the retrospective reward part comes from the latter. The specific number of SPK tokens awarded will be determined in subsequent proposals.

Precautions

Retroactive airdrop start time

The main purpose of the retroactive airdrop is to prevent the outflow of funds after the implementation of the anti-arbitrage scheme, and it will also start from the time when the anti-lending arbitrage is implemented. That is, it is not currently in effect and will be calculated from the beginning of the implementation of the proposal to increase the lending rate to 5%.

Allocation criteria

Rune mentioned in the forum that the allocated SPK tokens will be distributed proportionally to Spark protocol borrowers using volatile assets as collateral based on the borrowing amount and tenor. That is, only borrowing in Spark is eligible for air investment.

Airdrop time

Referring to Rune's Endgame timetable, SubDAO will be launched in the second phase of Endgame, which will also start the official mining of SubDAO, and the airdrop should also be in this phase. The first phase of Endgame is planned to be launched in early 2024, which means that the airdrop will be after this time period. The recently discussed plan to issue MKR at a ratio of 1:12000 and upgrade to a new governance token (NewGovToken) will also be implemented in the first phase of Endgame. The new governance token will support SubDAO’s lock-up mining , the name of the new governance token has not yet been determined.

rate of return

According to Rune, the goal of Spark's airdrop is to only distribute "low single-digit" yields to users, rather than a large amount of free funds, so the yield should not be high.

Spark D 3 M Debt

The DAI loaned from Spark does not come from user deposits like other loans, but from the credit line allocated by Maker to Spark through D 3 M (direct deposit module). According to the statement that "the airdrop is allocated to Spark protocol borrowers who use volatile assets as collateral", this part should be included in the airdrop. Therefore, if you want to get an airdrop, users who borrow DAI through Maker can swap their loan positions to Spark.

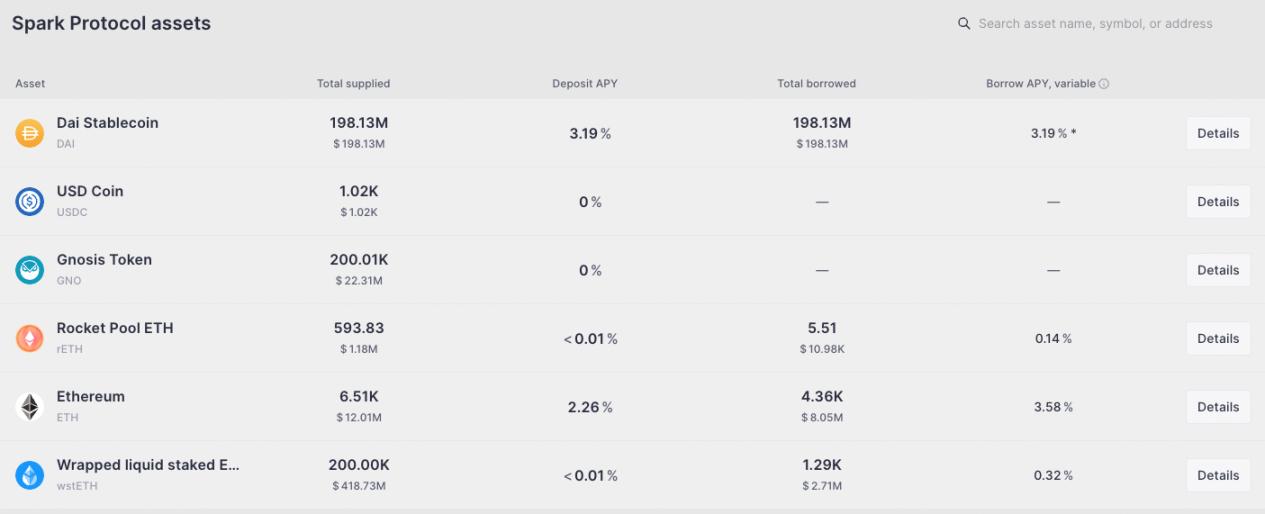

I would like to remind you that the debt ceiling of Spark D 3 M was only raised from 20 million DAI to 200 million DAI in the executive vote on August 6, and as of August 11, 198 million DAI has been used, which is about to reach the upper limit.

Should sDAI loans be included in airdrops?

By depositing DAI into DSR through SavingsDAI, users can obtain deposit certificate sDAI. While Spark currently disables deposits and lending of sDAI, in theory Spark should support it and plans to do so once anti-arbitrage takes effect. So if sDAI is used as collateral to borrow other assets, can the behavior of using these assets as collateral be airdropped?

Should sDAI be considered a "volatile asset"? It's not very volatile, but it's not a stablecoin either. If the air investment qualification of sDAI is recognized, it may lead to meaningless revolving mortgage lending; if it is not supported, there is no collateral for other non-volatile assets in Spark, which needs to be specifically excluded. This point is still debated.