Editor | Callum@Web3CN.Pro

Table of contents

1. Project Introduction

2. Project Vision

3. Development history

4. Team background

5. Financing information

6. Project structure

- Mintlayer wallet

- Tokenization standards

- Decentralized Exchange (DEX)

7. Development results

- Project development

- Ecological construction

- community status

8. Economic Model

- Token distribution

- economic model

9. Advantages and Risks

1. Project Introduction

Mintlayer is a Proof-of-Stake (PoS)-like Layer 2 protocol that brings smart contract programmability to the Bitcoin blockchain and aims to enhance decentralization by enhancing decentralized finance (DeFi) applications on the Bitcoin network. exchanges (DEX), stablecoins, and tokenization standards to address Bitcoin’s scalability issues and improve functionality. The two main elements that the Mintlayer decentralized protocol brings to the Bitcoin ecosystem are asset tokenization and trading on DEXs. It provides DeFi protocols with a blockchain environment with more powerful features through its scaling solutions: batch transactions and Lightning Network, reducing transaction size and fees, creating a win-win situation for all parties involved.

Mintlayer enables the creation of tokens and smart contracts powered by Bitcoin, inheriting Bitcoin’s security and providing interoperability with Bitcoin. This makes DeFi use cases such as those currently found on Ethereum and other blockchains possible and scalable for the first time in a truly Bitcoin-native environment (using real Bitcoin, without pegs or encapsulation). Mintlayer also supports access control lists that enable the creation of compliant tokens and NFTs, support for features such as the Lightning Network, transaction batching and signature aggregation, and the first Gas currency free market (payments can be made with any token issued on Mintlayer transaction fee).

2. Project Vision

As a side chain of Bitcoin, Mintlayer aims to allow Bitcoin holders to access DeFi, stablecoins, NFTs and other tokenized assets, while fully inheriting the overall security of Bitcoin's proof-of-work.

As the name of the project suggests, it hopes to be a new layer for minting various assets: stocks, bonds, stablecoins, asset-backed tokens, and more. But importantly, these assets should not be issued just on any random blockchain base network, but exclusively on the Bitcoin layer. This is why Mintlayer was ultimately built on Bitcoin, as it envisioned a financial order surrounding the Bitcoin standard.

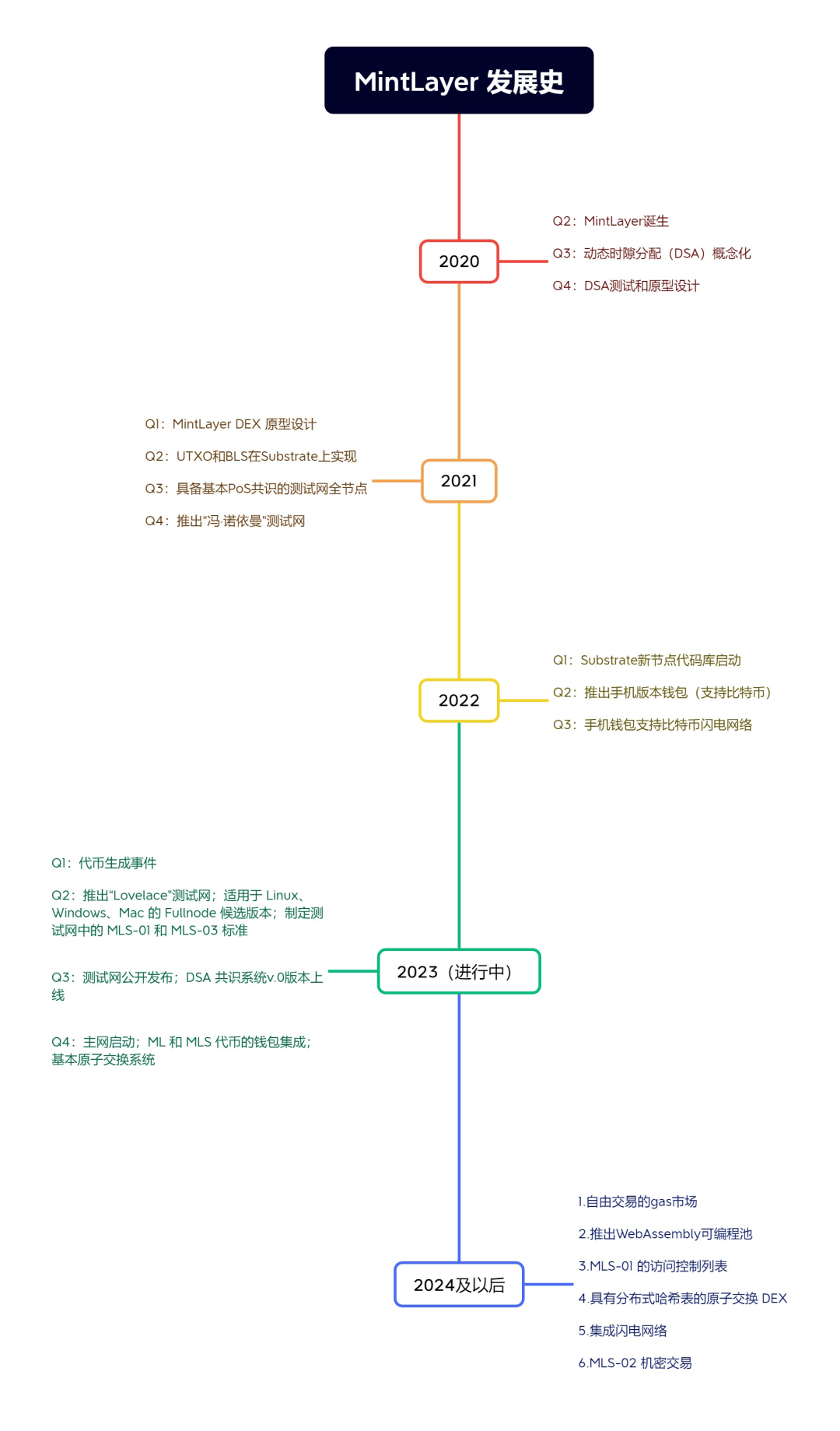

3. Development history

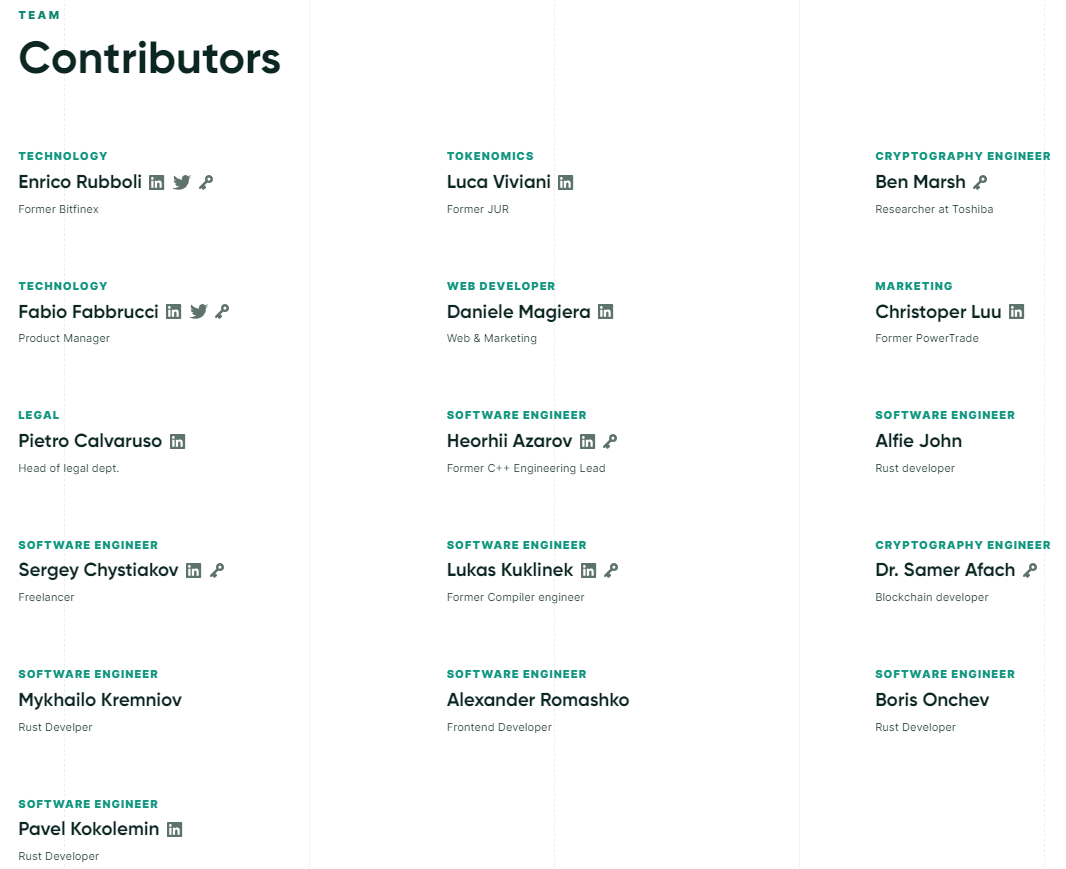

4. Team background

The team behind MintLayer is RBB Labs, a software company providing fintech, financial and trading solutions headquartered in San Marino with 16 core contributors. CEO Enrico Rubboli is a software developer with 17 years of experience and a cryptocurrency expert, a former Tether and Bitfinex developer. He is particularly passionate about Bitcoin and interested in new technologies, architecture and design.

RBB Labs provides blockchain solutions, network security, software engineering, consulting and education services to the public, and is currently leading the development of multiple blockchain projects, including Mintlayer and Stablecomp (Stablecomp is a DeFi platform that allows users to easily evaluate Opportunity to earn compound interest on stablecoins, make distributions and collect interest on multi-chain dApps).

5. Financing information

On May 24, 2021, Mintlayer raised $5.2 million in seed funding. Including Lotus Capital, Moonrock Capital, Jun Capital, EXnetwork, CryptoDormFund, Matrix Ventures, Black Dragon, Sky Ventures, Blockpact, MoonFounde and other investment institutions and some other KOLs.

In this round of financing, Alphabit, Moonwhale, 4SV, X21 and Iconomy Partners also joined the project as Mintlayer advisors. These companies will directly or indirectly leverage their skills, expertise and extensive networks to help the Mintlayer ecosystem and its user base, as well as provide guidance for the project's rapidly expanding market. In addition to this, it has a strategic partnership with the San Marino Innovation Center.

In addition, according to the investment and financing data website Crunchbase, on October 1, 2021, Mintlayer completed a $12 million Series A financing. However, this round of financing has not been officially verified by Mintlayer, nor has the investment institution been announced.

6. Project structure

Mintlayer wallet

Mintlayer Wallet (Mojito Wallet) has multi-token support, including Bitcoin (BTC), Mintlayer (ML) and all tokens issued or linked to the chain (with MLS token standards), mainly including light wallets and full node wallets. type.

1. Light wallet

- Store, send and receive Bitcoins like any other traditional Bitcoin wallet

- Store, send and receive ML tokens and all MLS-01, MLS-02, MLS-03 standard tokens

- Batch transactions with other nodes before broadcasting to the network to pay lower fees, reduce the burden on the blockchain and speed up transactions.

- Trade using the Lightning Network (BTC, ML and MLS-01 standard tokens).

- Peer-to-peer exchange of BTC, ML and MLS-01 standard tokens using Atomic Swap DEX

2. Full node wallet

Mintlayer full nodes are coupled to Bitcoin Core nodes. Additionally, Mintlayer full nodes use utreexo, which compresses the size of the UTXO set to 1 KB. Therefore, even in the long run, the processed node will not occupy more than about 3GB of space (about 3 days of blockchain space at maximum throughput).

Mintlayer full nodes offer all light wallet functionality, plus the following:

- Stake ML tokens and become a "participant" in the network.

- As a "participant", propose or sign blocks and earn transaction fees.

- MLS-01 tokens are created by executing transactions on the Mintlayer chain.

- Pegged to BTC and created as MLS-01/02 tokens for faster transactions and lower fees (private transactions are also possible).

- Create custom smart contracts and programmable pools, and build DeFi systems.

- Connect to multiple oracles to query DEX data or identity data, and also facilitate DEX transactions or decentralized identity applications. Provides a standard wallet API to program oracles to help build smart contracts on Mintlayer.

Tokenization standards

The MLS-01 abbreviation stands for Mintlayer Standard Version 0.1. It represents the basic standard specification for Mintlayer tokens, with a typical list of rules that must be implemented to be properly processed by Mintlayer wallets. Thanks to this standard, each MLS-01 can be received, sent or stored in any Mintlayer multi-token wallet.

Mintlayer uses the Bitcoin UTXO structure, which has three basic characteristics:

- Compatible with technologies already implemented in Bitcoin, such as atomic swaps and the Lightning Network.

- Be more privacy oriented.

- Payments can be batch aggregated in a single transaction, saving a lot of space required for a single transaction per payment.

MLS-01 standard tokens and ML are only transferred on the Mintlayer side chain and do not need to occupy Bitcoin blockchain resources. The MLS-01 standard allows tokens and ML to be transferred only on the Mintlayer sidechain, preventing congestion on the Bitcoin blockchain. A key feature of MLS-01 is the ability to implement access control list (ACL) conditions, similar to the functionality in Ethereum ERC-20. ACLs provide transaction customizability, compliance features that facilitate token issuance or updating security tokens to comply with corporate policies or legal requirements. Additionally, they take into account conditions such as utility token payouts, token non-fungibility, transaction thresholds, and time locks. Token issuers can update token conditions with a new transaction containing revised rules. ACL governance flexibility depends on the original set of rules for token creation.

The MLS-02 standard uses attack-proof private transactions with ring signatures to ensure privacy and anonymity. These privacy features increase data requirements for transactions and add additional verification steps. Therefore, MLS-02 cannot benefit from transaction batching like MLS-01, resulting in higher transaction fees.

The MLS-03 standard is Mintlayer’s iteration of non-fungible tokens (NFTs).

Decentralized Exchange (DEX)

Mintlayer focuses on creating an atomic swap decentralized exchange (DEX) to enable decentralized finance for Bitcoin. Mintlayer DEX will allow 1:1 atomic swaps with native Bitcoin for other tokenized assets in the ecosystem. Unlike other competitors, these atomic swaps on the network are unique because there are no intermediaries, pegs, wrappers, or syndicated tokens. Since atomic swaps allow native Bitcoin, it eliminates counterparty or intermediary risk or users. Its Bitcoin-like UTXO architecture combined with Schnor signatures enables more efficient transaction aggregation. This aggregation helps reduce payment sizes by up to 70% while enhancing privacy and increasing transaction throughput. It offers more privacy and a native tokenization standard with high confidentiality compared to account-based blockchains like Ethereum. Mintlayer gained scaling capabilities such as Lightning Network swaps or decentralized exchange (DEX) trading from Bitcoin. These scaling capabilities prevent congestion and fee increases even when transaction volumes are high.

7. Development results

Project development

As a sidechain (with its own blockchain), Mintlayer always stays close to Bitcoin's design philosophy and only deviates from it when it is absolutely necessary to provide advanced functionality. One of the changes is an alternative consensus mechanism. Bitcoin is based on Proof of Work (PoW), while Mintlayer is a Proof of Stake (PoS)-like protocol. Mintlayer’s consensus mechanism is new and is called Dynamic Slot Allocation (DSA) consensus. Mintlayer is the first blockchain to use this mechanism, which has similarities to PoS. DSA uses Bitcoin hashes as a source of randomization to elect block signers. These are the entities that verify chain activity, thereby earning network fees as compensation.

Every 1008 Bitcoin blocks constitute a Mintlayer round of block creation, in which block signers (also known as block creators) complete the task of creating new blocks. By acting as maintainers and builders of the Mintlayer consensus, block signers also establish a chronological history of transactions, thereby tracking time. Best of all, anyone on the Mintlayer system can record checkpoints on the Bitcoin blockchain. However, only block signers can "lock" them, meaning full nodes must be run to enforce them. Mintlayer relies on these checkpoints as an important method of preventing remote attacks on its blockchain, anchoring Mintlayer transactions and blocks to the Bitcoin main chain through a built-in checkpoint system.

Ecological construction

Currently in the development stage of ecological projects, the Mintlayer ecosystem provides a range of opportunities for projects with the sole purpose of unlocking the full potential of Bitcoin. Therefore, projects at all stages can apply for support.

Here are the infrastructure and keys to building a project on Mintlayer:

- Ecosystem Fund: Select and fund the best DeFi projects with real use cases. The tool also connects project founders with the Mintlayer network of angels and venture capitalists.

- Incubator Program: Nurture early-stage projects to launch them and assist with business strategy, software development, token economics, funding, legal hurdles, and more.

- Accelerator Program: For established projects looking to port (or migrate) to the Mintlayer protocol, this program provides funding and consulting to projects to quickly mature.

- Grants: Offers grant opportunities to open source developers to build on Mintlayer.

community situation

Twitter: 88,000 followers, average fan interaction

Discord: 30,000 people, Telegram: 35,000 people, and the number of active people in the community remains at about 10%.

8. Economic Model

The Mintlayer Token (ML) powers the Mintlayer network and maintains security on the blockchain, with the purpose of supporting staking, governance, and ecosystem tools.

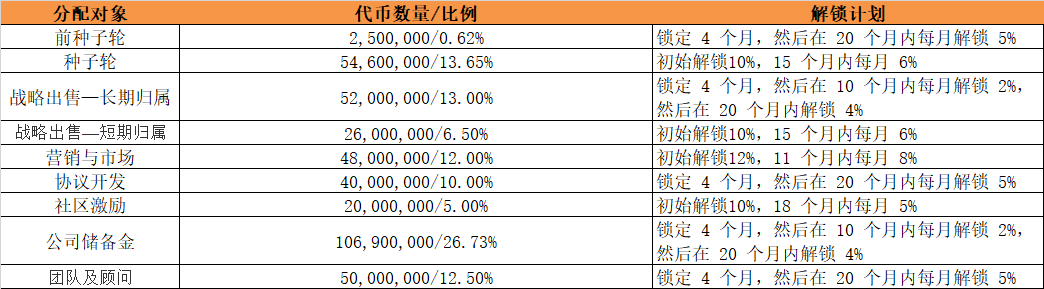

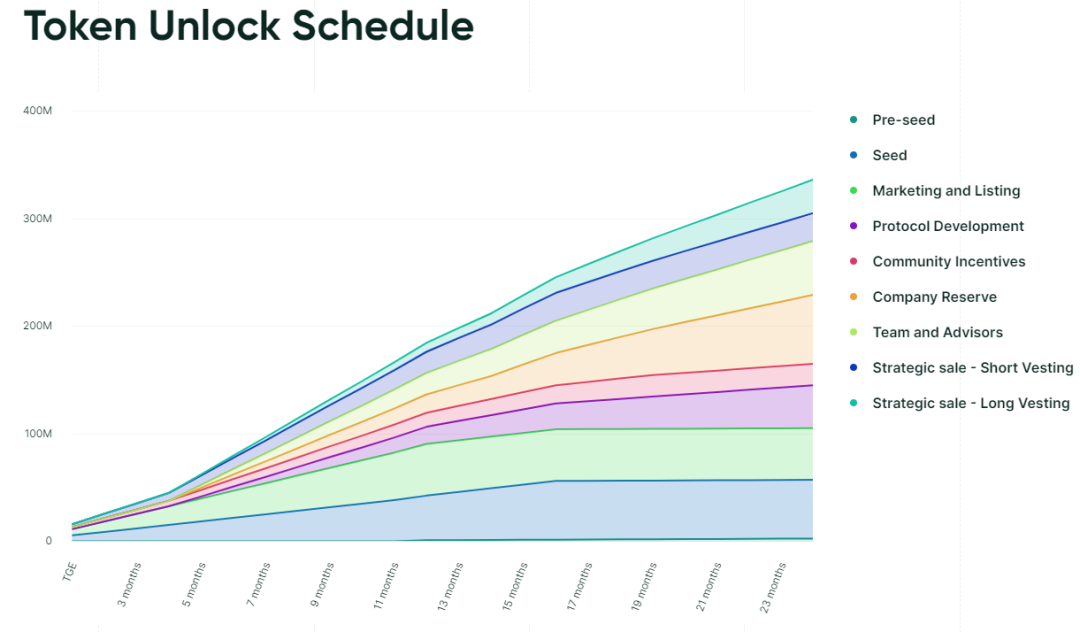

Token distribution

The total supply of ML is 600,000,000, and when the mainnet launches, 400,000,000 ML will be created. Each Mintlayer block generates a block reward for the block creator until the total supply reaches the 600,000,000 ML hard cap. It is expected to be produced approximately 10 years after the Genesis Block.

The initial distribution of 400 million tokens is as follows:

The initial unlocked token supply is set to 15,820,000 ML, and the token distribution details are:

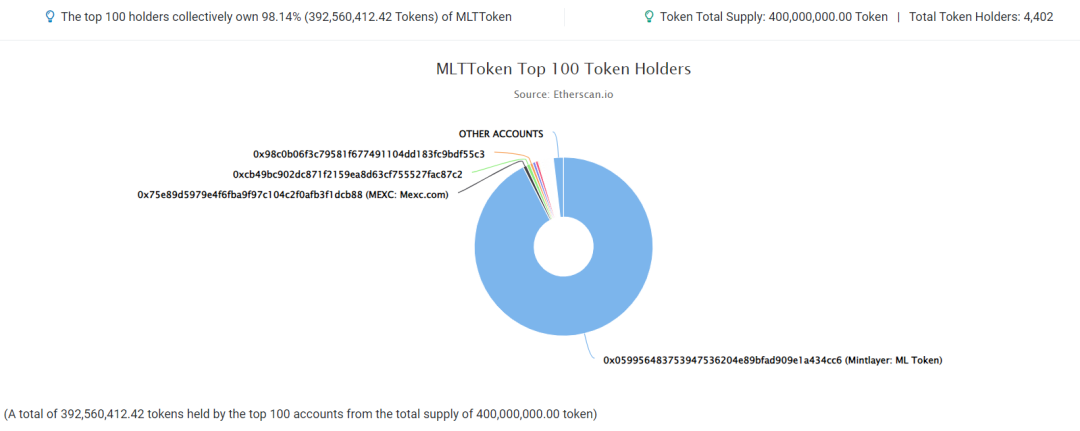

Analysis of ML token holding addresses:

According to Etherscan data, as of September 11, 2023, ML currently has 4,402 currency holding addresses, with the top 100 holdings accounting for 98.14% and the top 10 holdings accounting for 96.03%.

Among them, 4 of the top 10 addresses are contract/exchange/LP addresses, accounting for 94.13%. After deducting this proportion, the top 100 addresses total 4.01%. It can be seen that the current concentration of ML currency holding addresses is relatively high, and tokens are mainly concentrated in the hands of teams and market makers.

economic model

1. Pledge

The main purpose of ML tokens is to cover transaction fees and additional costs associated with specific transactions (such as token creation transactions) and to allow users to stake and join the network as block producers in order to pass the consensus protocol.

Mintlayer’s consensus protocol relies on a pool of funds to act as block producers in the network. The main benefit of this is that it allows any number of users to become an active part of the network and earn rewards. A pool must be created with no less than 40,000 ML tokens, which is exactly 0.01% of the total initial supply, and any user can stake to the pool to receive rewards later.

During the first 10 years of the network's operation, each block will have a block reward when it is generated. Block rewards are paid in $ML. The amount of rewards obtained is proportional to the amount of equity owned by the mining pool, that is, if the delegated mining pool has 10% equity, you can expect to receive 10% of the block reward.

Block producers also receive transaction fees from the blocks they create, and network users can pay fees using any MLS-01 token transferred on Mintlayer (including ML).

2. Community involvement

Mintlayer is an open source project. To encourage community-driven protocols, the $ML token allows its holders to express their opinions on the development of the network. Users can help determine the order of development of roadmap events, suggest features, and more.

3. Ecosystem Tools

ML tokens can be used to pay network fees as well as token issuance fees that users pay when issuing tokens on Mintlayer. RBB LAB’s services can be purchased using ML tokens:

- Minlayer smart contract development

- Security audit of Mintlayer smart contracts

- Software engineering for decentralized applications on Mintlayer

9. Advantages and Risks

Advantage

Mintlayer is a unique project that can act as a sidechain when isolating Mintlayer's native functionality, as it has its own independent blockchain, PoS consensus, checkpointing system, and the ability to use its MLS-01 or MLS-02 The token standard pegs native BTC to wrapped Bitcoin equivalents. While Mintlayer inherits L2 functionality due to its Lightning Network integration, users are able to benefit from off-chain transaction efficiency using BTC, ML or MLS-01 tokens.

MintLayer allows participants to use BTC to achieve more use cases without relying on centralized exchanges. By leveraging the security of the world's largest encryption and integrating with the Lightning Network, Mintlayer can provide developers with a platform to build applications with real-world financial use cases.

risk

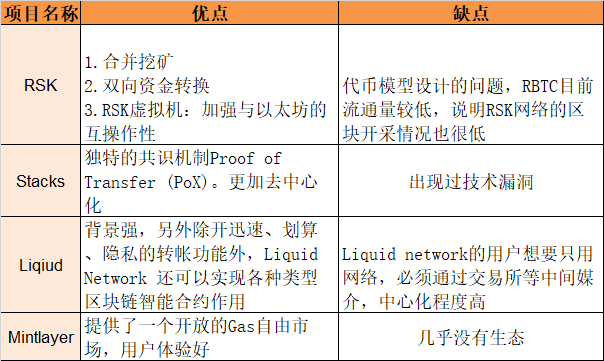

First of all, projects on Bitcoin Layer 2 and side chains are gradually getting started. In addition to MintLayer, there are also some early projects such as RSK, Stacks, and Liqiud Network. It is unknown whether MintLayer can stand out among these competing products.

Secondly, the current scale of the Bitcoin ecosystem is still far behind that of Ethereum. First, there are fewer well-known projects compared to Ethereum. Second, the user scale is not as good as that of Ethereum. The Bitcoin Layer 2 ecosystem is still in the construction stage. It needs to be verified by the market.

All in all, as Bitcoin scaling solutions continue to develop and more and more people explore the Bitcoin ecosystem and expand the capabilities of the blockchain, Mintlayer deserves continued attention.

references

https://docs.mintlayer.org/