Halved emotions and logic

Many friends believe that the impact of "halving" on #Bitcoin is scarcity, which has driven people to hoard and speculate on BTC.

In fact, the so-called "halving" means that the output is halved. The entire network invests the same cost (computing power) in mining, but the BTC output is halved.

If the computing power of the entire network is reduced by half, the cost of BTC mining will remain unchanged. Due to expectations (expected BTC to rise) and sunk cost factors (the cost of mining machines is a sunk cost, as long as the mining output is higher than the liquidity cost, miners will continue to mine), the computing power of BTC will most likely be higher than the halving.

Otherwise, as long as BTC's computing power exceeds half, BTC's mining cost, or production cost, will increase. As more and more high-cost BTC are mined, the price of BTC is pushed to highs. Therefore, the highs of several rounds of the BTC bull market were not near the halving, but more than a year after the halving.

Therefore, the logic of "halving" to promote the bull market is not only the situation, but also the cost factor. Of course, cost cannot determine price, especially for "coins", it is too common for prices to fall below cost haha.

LTC halving

Some friends believe that the performance of LTC halving in 2023 is far inferior to that in 2019, and it may not perform well in this round of BTC halving.

The 2019 Litecoin halving occurred in August, while the currency price peaked in June. This of course has the effect of halving the mood.

But do you think this is a coincidence? In June 2019, the Federal Reserve began to cut interest rates!

Macro and Bull Market

Many currency enthusiasts sneer at macro, because in the past, BTC and US stocks did not have a high correlation.

But in fact, it is possible that BTC has barely escaped the macro cycle.

it is known:

BTC halved for the first time on November 28, 2012, and BTC reached its peak about 12 months later (November 2013).

On July 9, 2016, BTC halved for the second time, and BTC reached its peak about 17 months later (December 2017).

On May 12, 2020, BTC was halved for the third time, and BTC reached its peak about 18 months later (November 2021).

Maybe we didn't find it:

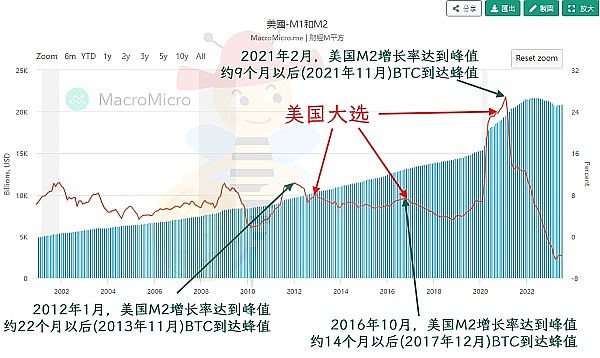

In January 2012, the growth rate of M2 in the United States reached its peak, and BTC reached its peak about 22 months later (November 2013).

The growth rate of M2 in the United States reached its peak in October 2016, and BTC reached its peak about 14 months later (December 2017).

In February 2021, the growth rate of M2 in the United States reached its peak, and BTC reached its peak about 9 months later (November 2013).

The most accurate one is (???):

After the US election in November 2012, BTC reached its peak about 12 months later (November 2013).

After the US election in November 2016, BTC reached its peak about 12 months later (November 20173).

After the US election in November 2020, BTC reached its peak about 12 months later (November 2021).

Little Bee has analyzed more than once that Satoshi Nakamoto designed BTC to be halved every four years, and if miners were not rushing to mine, the halving would occur approximately in January after each presidential election (when the president takes office). Satoshi Nakamoto's design definitely took into account the policies and economic cycles of the United States, and was definitely not the result of Little Bee's obscenity!

Looking at the chart, most of the past three U.S. elections have occurred near low or small peaks in the growth rate of M2 money supply. As long as the M2 growth rate is greater than zero, it is releasing water, and the M2 growth rate is near the peak, indicating that it is in the stage of accelerating water release. Little Bee's understanding is that using a looser monetary policy during the election may be beneficial to economic prosperity.

The release of water will lead to abundant US dollar liquidity in the market, and of course some of it will promote the speculative market.

2015

At this point in the analysis, the conclusion is already very obvious.

BTC’s bull market that occurs every four years is driven by the “halving” and also influenced by macro factors.

The key to #LTC’s halving surge may not be the halving, but the macro. Therefore, if LTC does not perform well when it is halved in 2023, everyone does not need to worry too much. There is no need to worry about whether there will be a bull market in 2025, or even too much worry about LTC.

The positive impact of the BTC halving will still be there. The Federal Reserve will always cut interest rates, and US dollar liquidity will always shift from tightening to a loose environment.

In 2006-2007, the Fed kept interest rates high for about 14 months. The most pessimistic expectation is for an interest rate cut by the end of next year, and the optimistic expectation is for an interest rate cut in the second quarter of next year.

Therefore, due to the influence of macro factors, from the beginning of interest rate cuts to when M2 reaches its peak, the bull market cycle should be pushed back again, not to the end of 2024 as originally thought, or even to 2026. The specifics are still difficult to predict.

When to buy the dips?

On the topic of when to buy the dips, we still have to wait for this month’s Fed dot plot to come out. The dot plot can reveal two turning points.

Stopping raising interest rates is a turning point, and starting to cut interest rates is a second turning point. There may be a small emotional rebound at the turning point, but it is not optimistic. After all, this is the first time since 1960 that the M2 money supply in the United States has experienced negative growth, and the liquidity of the US dollar is tight. Even if the interest rate has just been cut, it is still a high-interest period, and previously high-interest loans have entered a period of repayment pressure. This stage is also risky. .

The buy the dips hunting bee believes that some patience is still needed. Note that some copycats have been relatively active recently. Some copycats may have opportunities in the short term. In the long term, copycats should still be very cautious.