Author: Jiang Haibo, PANews

With the emergence of disruptors such as Liquidity Collateralized Derivatives Finance (LSDFi) and MakerDAO Enhanced DAI Deposit Rate (ESDR), stablecoin holders have more needs to earn income. Since MakerDAO's EDSR allocates 5% annualized income to DAI holders, other stablecoins may be exchanged for DAI to obtain income, and thus be "blood-sucked", resulting in a reduction in issuance, or a premium turning from positive to negative. In order to cope with this dilemma, some stablecoin issuers are also actively updating their strategies during this process.

USDC: Hold in Coinbase and earn 5% annualized return

Maker’s Pegging Stability Module (PSM) allows for the 1:1 minting of DAI using centralized stablecoins such as USDC, or the redemption of DAI into centralized stablecoins. After the launch of this feature, the proportion of USDC in DAI’s collateral gradually increased until it exceeded 50%. This has also caused DAI to be criticized, believing that DAI has lost its decentralized characteristics. Although the issuance of DAI has increased, this part of DAI does not have a stable rate and has no value for Maker. Instead, it bears the counterparty risk of USDC. , which was also reflected in this year’s USDC de-anchoring incident.

The situation began to change after Maker gradually invested the funds in PSM into RWA. In the process, the USDC in PSM would be redeemed for U.S. dollars and purchased U.S. bond ETFs. At this time, the pressure turned to Circle, the issuer of USDC. Since there are no handling fees for the minting and redemption of USDC, Circle was reduced from a beneficiary of DAI to a compliance channel that helped Maker attract funds to purchase U.S. bonds.

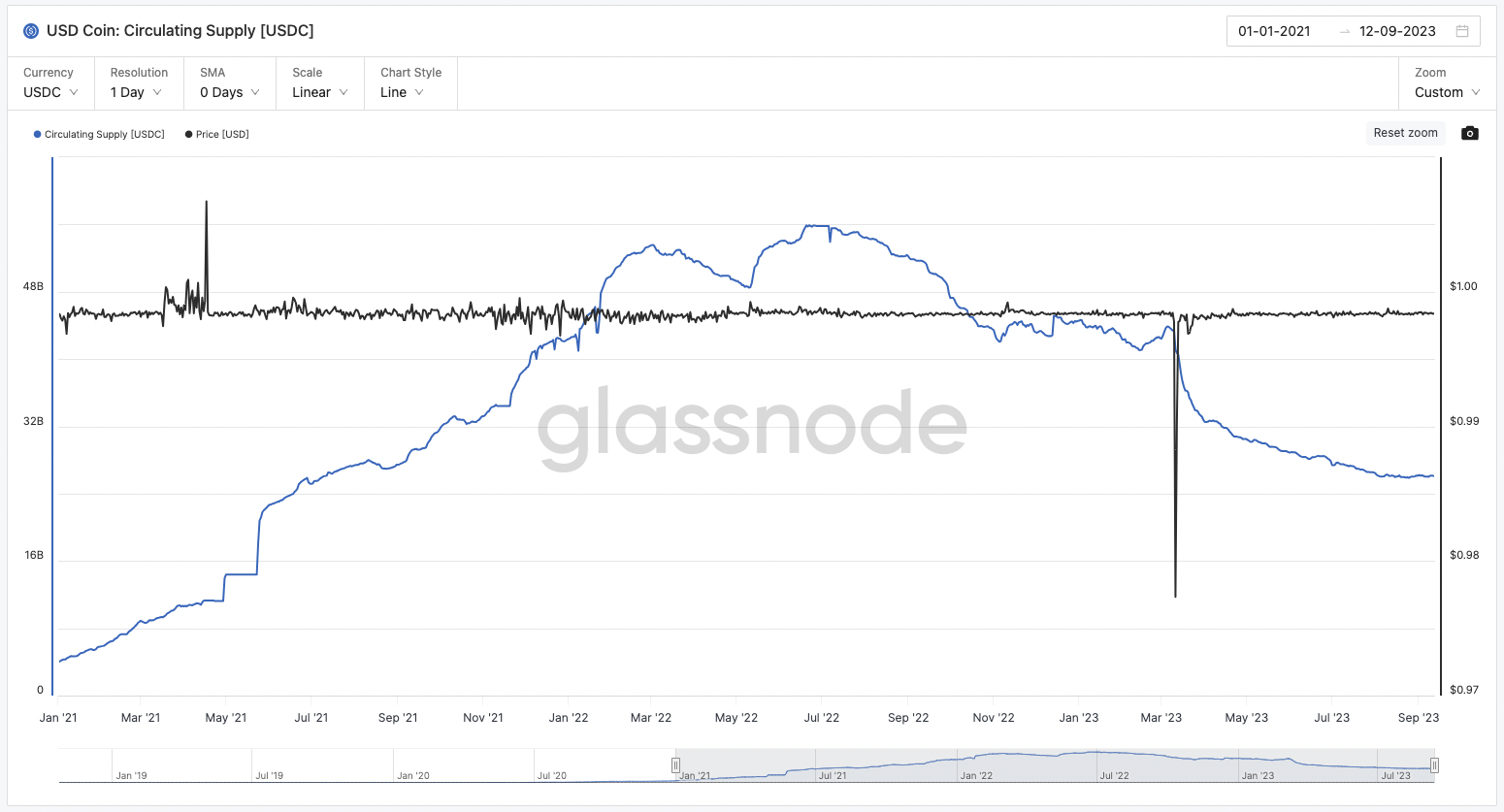

According to glassnode data, the issuance of USDC has dropped from 55.9 billion in June 2022 to 26.08 billion currently (September 12, 2023). Among them, Maker’s behavior of redeeming USDC to buy U.S. bonds played a certain role.

In September 2022, Coinbase launched a proposal on the Maker Forum, hoping to deposit part of the USDC in PSM into Coinbase Prime to participate in Coinbase's institutional reward program. This part of the funds can earn an annualized return of 1.5%.

But since then, Maker has not stopped redeeming USDC to buy treasury bonds. In July this year, when there were only more than 300 million USDC left in PSM to ensure necessary liquidity, Maker co-founder Rune launched a proposal to implement EDSR and increase the DSR to 8% to attract incremental funds. Later, the EDSR was reduced to 5%.

In this case, Coinbase continues to choose to follow up. Users can get 5% annualized income just by holding USDC on the Coinbase exchange.

Recently, the issuance of USDC seems to have escaped the downward trend, but due to Coinbase’s profit sharing, the income received by USDC issuers will decline. Also on the centralized stablecoin track, new competing products such as PYUSD and FDUSD have emerged.

Frax: Circulation has dropped significantly

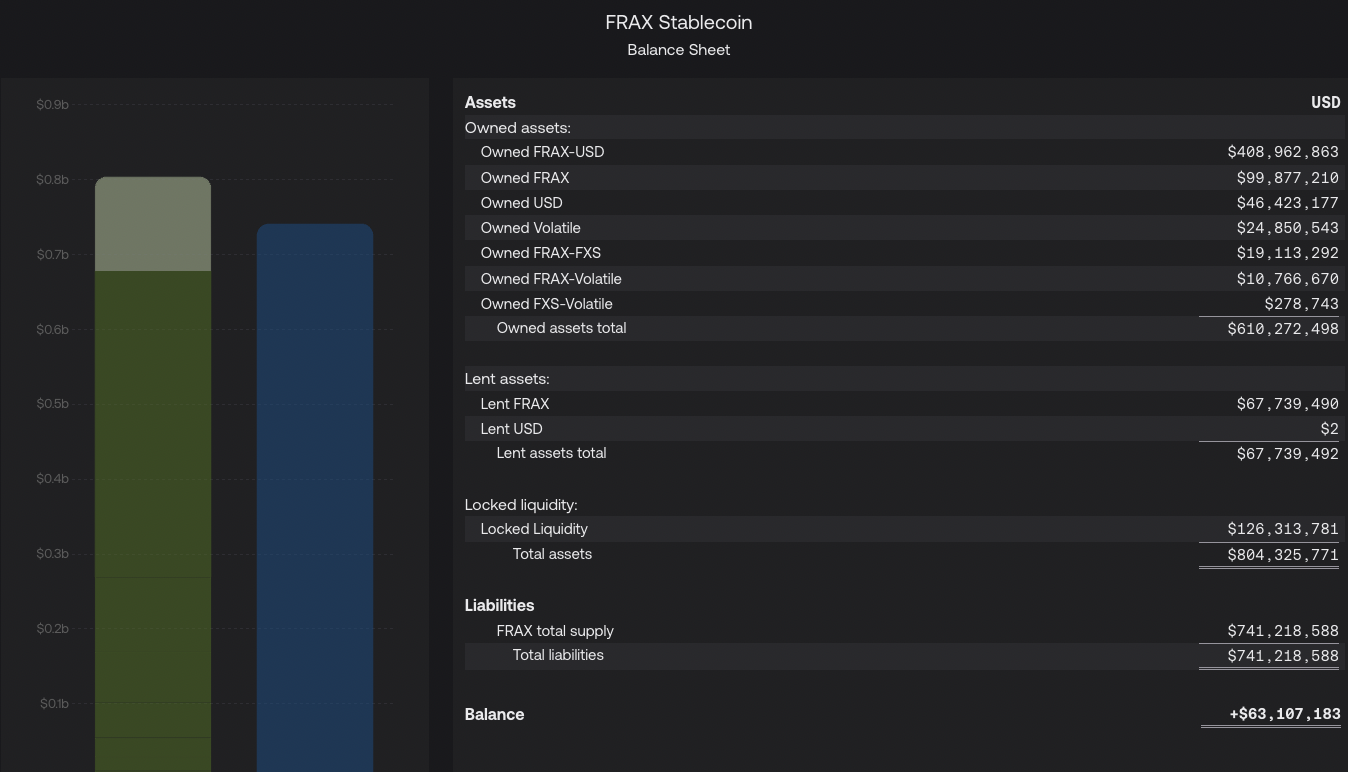

From the beginning, the vast majority of reserves in stablecoins issued by Frax Finance have been in USDC. As shown in the figure below, since the vast majority of Frax Finance's reserves are FRAX-USD held by the protocol, that is, the liquidity of FRAX, USDC and USDP on Curve. This means that part of the circulating Frax is held by the protocol, and USDC accounts for a high proportion of the remaining reserves. When DAI has a higher yield and is relatively safer, the issuance of FRAX stablecoins is easily affected.

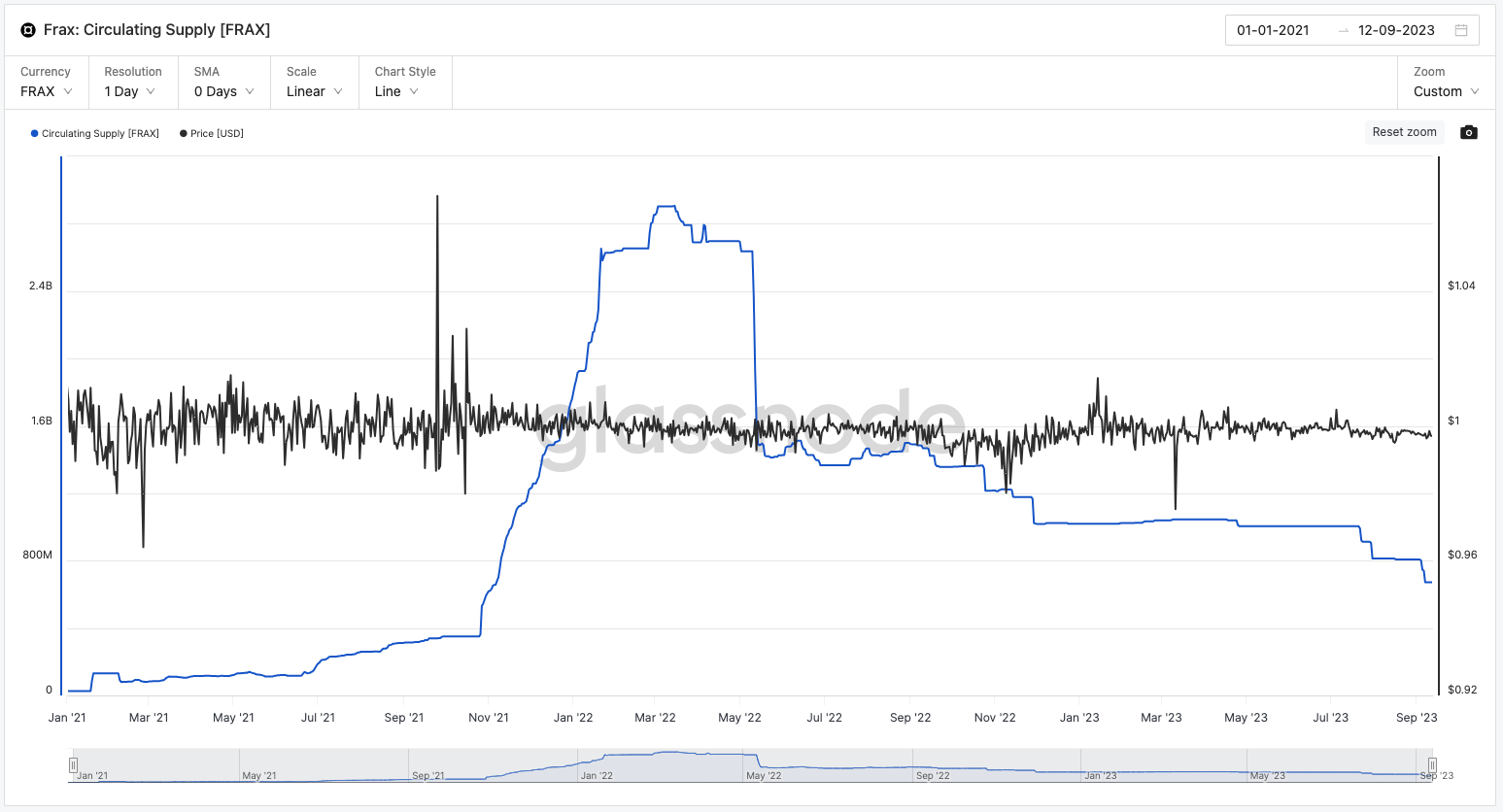

According to glassnode data, Frax’s circulation has dropped from 2.9 billion in March 2022 to the current 670 million. Even compared with the 810 million when Maker’s EDSR took effect, the current circulation has dropped by 17.3%.

On the occasion of Maker’s EDSR taking effect, Frax founder Sam Kazemian proposed to cooperate with the US company FinresPBC to redeem USDC and USDP into US dollars to earn interest through the FRAX v3 RWA asset strategy. After deducting costs, the remaining earnings generated by FinresPBC for Frax will be returned directly to the protocol.

Liquity: LUSD premium turns from positive to negative

As Maker gradually turns to RWA, Liquity's LUSD has become a representative project on the completely decentralized stablecoin track. It only supports the use of ETH as collateral to mint LUSD.

Precisely because the current Liquidity only supports ETH as collateral, it has to consider adding new features in the face of competition from forked product versions Gravita and Lybra.

During the Stable Summit in July, Liquidity founder Robert Lauko announced plans for Liquidity V2, which will take into account decentralization, stability, and scalability. Liquidity V2, expected to be publicly released in 2024, will add leverage and lending products and support staked ETH as collateral.

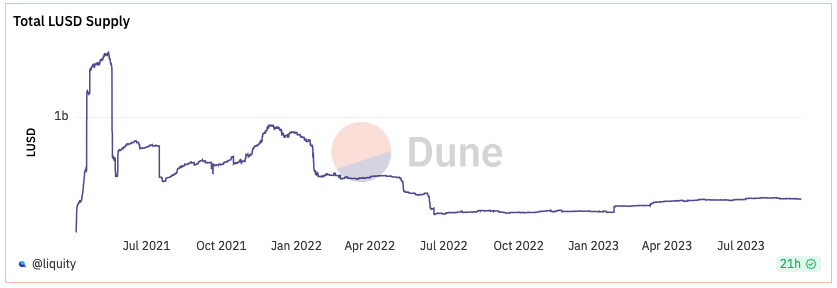

According to official data, the circulation of LUSD has dropped from 1.56 billion in May 2021 to the current 287 million. If compared with the 297 million when Maker EDSR took effect, the decrease is relatively small.

But the impact on the price of LUSD seems to be greater. According to CoinMarketCap data, LUSD has continued to be in a negative premium stage for more than a month, which is the first time in the past year.

Lybra Finance: Most of the funds were withdrawn after Lybra V2 upgrade

As for U.S. bonds and LSDFi, which one is the better solution in the interest-bearing stable currency field? At present, U.S. debt projects are temporarily winning.

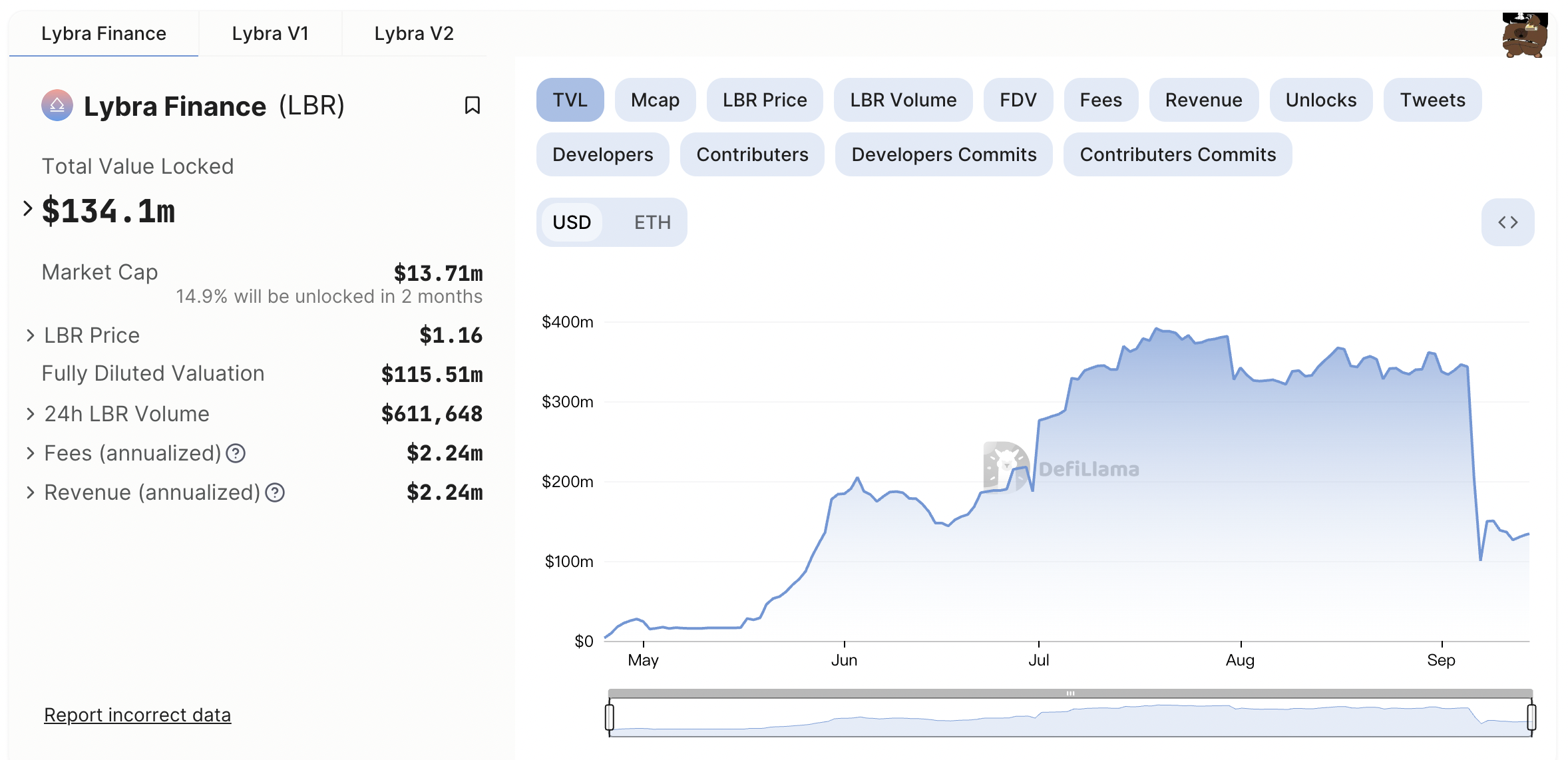

Lybra is the leading LSDFi project, supporting the use of ETH pledged derivatives to mint eUSD. Holders of eUSD can earn higher returns than Maker EDSR, but due to the recent sharp decline in data, it is also mentioned here. According to DeFiLlama data, the combined TVL of Lybra V1 and V2 versions has dropped from $343 million on September 5 to the current $129 million. Lybra V2 was recently launched, which is a full-chain version of Lybra that supports more collateral and can expand stablecoins to other chains without sacrificing interest.

Similarly, eUSD (OLD) was priced at $1.04 on September 5, with a market capitalization of $184 million, according to CoinGecko data. But as of September 13, according to Etherscan data, the circulation of eUSD (OLD) and eUSD was only 29.3 million and 36.02 million respectively, and the sum of the two dropped by more than half compared with before.

This shows that in the Lybra V1 to V2 migration, most previous funds chose to leave directly. Although it is not certain whether it is due to Maker EDSR, the main income of users in Lybra still comes from the liquidity mining subsidies provided by the project, and the attractiveness may decrease as the price of governance tokens drops.

summary

With the development of LSDFi and the launch of Maker EDSR, stablecoin holders may prefer to share the income from the stablecoins they hold. Other stablecoins that cannot generate income may be sucked in the process, resulting in a reduction in issuance. Or the price turns into a negative premium.

Among several stablecoins observed by PANews, the circulation of FRAX has dropped significantly, the LUSD premium has turned from positive to negative, USDC has followed up by allocating 5% annualized income to holders in Coinbase, and Lybra’s eUSD reached V1 The issuance volume was reduced by more than half during the migration to V2.