Author: @Christine, PSE Trading Trader

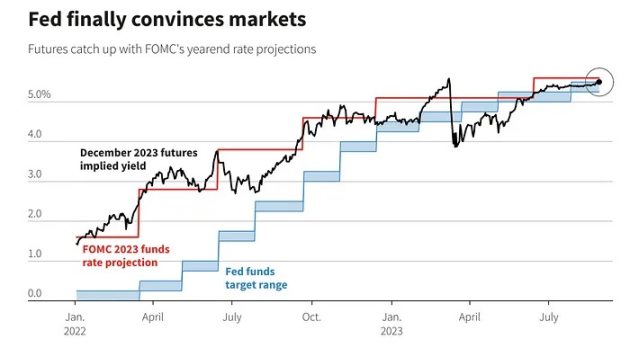

The core reason is intuitive: Despite various economic challenges, U.S. stocks continue to demonstrate their resilience. S&P 500 companies' earnings performance was solid and exceeded market expectations, which undoubtedly gave the market a positive signal. We have so far not observed the large-scale expected recession or significant slowdown. The market has already adjusted in advance for the unknown situation that may arise in the inflation situation in the coming months. In addition, the Federal Reserve has clearly expressed its policy direction of suspending interest rate increases after November, which will undoubtedly give a boost to the stock market before the end of this year.

While macroeconomic conditions remain volatile, major stock indexes have managed to break out of their trading ranges, a sure sign that investors' risk appetite is gradually returning. Thanks to the support of Three Arrows and FTX, the cryptocurrency market is also growing in popularity.

As the macroeconomic outlook gradually becomes clearer, Bitcoin prices have rebounded 40% from the bottom. As inflation discussions fade from the market's horizon, investors' attention has once again returned to growth stocks and artificial intelligence. As economic conditions further stabilize, I firmly believe that the price of Bitcoin still has the potential to rise further.

U.S. stocks: continue to rise

Since September, the price of Bitcoin has remained within a certain range of fluctuations, while at the same time, the U.S. stock market has shown a steady upward trend. Although no major new economic data was released last week, existing data shows that the economy still shows strong resistance in the current higher interest rate environment. We are not observing spectacular economic growth, but we are not seeing any warning signs of a severe recession or a massive retracement. The estimated growth rate of GDP in the third quarter is more than 3%, which has exceeded the Atlanta Fed's forecast.

Against the backdrop of economic recovery, the recovery of productivity in 2022 is undoubtedly the biggest bright spot. This will help offset the impact of the hiring slowdown, after all, while job growth has been lower, we have not yet received any negative employment reports.

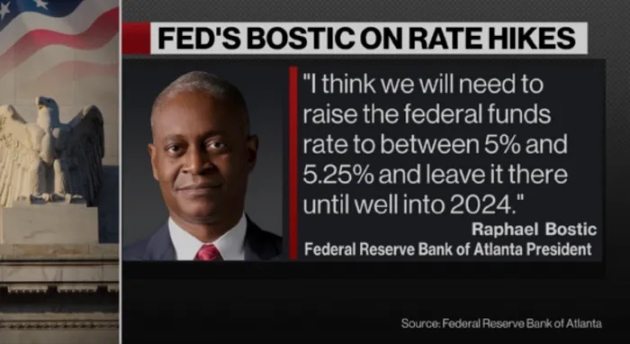

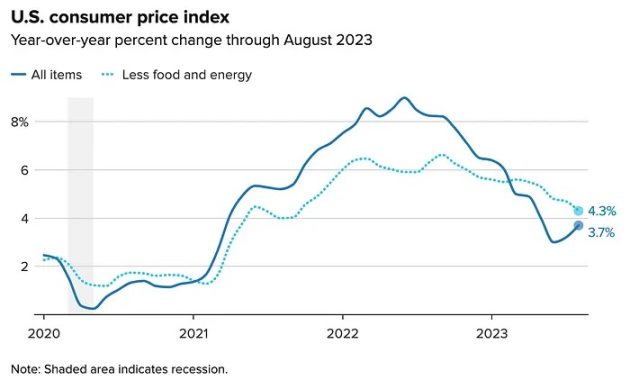

My personal view is that the high interest rate environment may remain for some time, but I do not understand why the Fed needs to continue to raise interest rates at this time. Economic growth has already struggled in September, and while markets are predicting the Fed may raise interest rates again in November, I haven't seen any reason to support that forecast. Last week's inflation report showed slightly higher inflationary pressures, but that was mainly due to rising oil and energy prices. The core inflation index is expected to gradually improve, and the downward trend in the annualized inflation rate will continue.

The Fed appears to be beginning to recognize the economic risks that may arise if it continues to raise interest rates - such as a decline in bank loans, an increase in auto loan delinquencies, troubles in the commercial real estate market, and student loans starting to accrue interest again. Consumer pain etc. However, so far, these risks have not caused substantial damage to the economy, and data still show that our economy is in a healthy state.

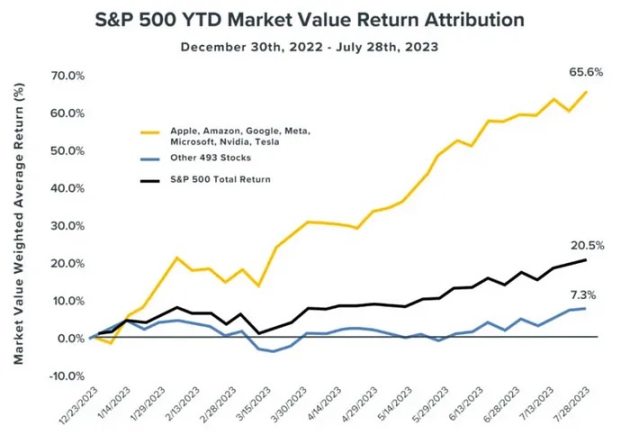

S&P 500: Increasing preference for growth stocks

Recently, we have observed an increasing preference for growth stocks in the S&P 500. In the current higher interest rate environment, growth stocks like the Big Seven are likely to enjoy higher valuations than defensive and cyclical stocks. The seven technology giants include Apple, Alphabet (Google’s parent company), Amazon, Microsoft, Meta, Nvidia and Tesla. Since 1990, the total amount of interest paid by the S&P 500 has essentially mirrored the yield on investment-grade bonds, so higher investment-grade yields are likely to lead to higher interest payments.

Notably, before interest rates started to rise, growth companies had already extended their debt maturities earlier, locking in historically low interest rates. Additionally, the S&P 500's cash-to-total debt ratio remains relatively high, at 53% for growth companies, compared with 28% for cyclical companies and 14% for defensive companies. This means that if interest rates remain higher for a period of time, growth companies may earn more interest income.

Looking back at 2022, soaring interest rates have led to a contraction in P/E ratios, especially for growth stocks. However, this year we've seen P/E ratios expand amid continued high interest rates. A deeper look at fundamentals suggests growth stocks are likely to see their P/E ratios expand compared to cyclical and defensive stocks.

Looking ahead, average interest rates are expected to be higher than they were after the financial crisis. That could increase interest payments and hurt S&P 500 companies' earnings. However, growth companies deferring debt maturities in 2020 should help limit losses as interest rates stabilize at new normal levels. Given the large difference in leverage, defensive and cyclical stocks are likely to feel more pain from relatively higher debt. As a result, the relationship between growth stock valuations and interest rates may be more complex than many assume.

Macro perspective: August CPI and future outlook

After months of slowing, core CPI accelerated again in August, driven in part by significant increases in air fares. Prices for core services other than rent increased, as did prices other than housing. While some expect core PCE inflation to edge up slightly, the PPI details suggest commodity prices may be accelerating again. However, the Fed is likely to stick to its plan - I expect them to raise rates by 25 basis points in November. This is consistent with our continued stable growth and inflation that is slightly above target. Sticky inflation could mean a period of high interest rates. The Atlanta Fed's wage tracker slipped, but still supported price inflation of 2%. Risks include union negotiations that could lead to higher labor costs and a government shutdown if Congress fails to act.

The economy appears to be growing in a diversified manner, moving away from spending on services and towards more consumer goods, business investment and residential investment. Manufacturing output fell slightly, but low jobless claims and modest industrial production growth pointed to a strong economy.

The upcoming FOMC meeting and housing data will be a focus. Given the recent weak signs of stable inflation and the labor market, the Fed is likely to keep policy rates steady. Their forecasts are likely to show lower GDP growth and unemployment expectations for 2023. Core PCE forecasts are also likely to decline. Housing starts should increase due to tight supply, but high interest rates and high prices may limit this growth.

There are signs of easing in the labor market - such as the ratio of job vacancies to unemployed people falling slightly and the unemployment rate rising slightly. But labor demand remains strong, so it looks more like normalization at a level that maintains wage growth above 4%. The Atlanta Fed's wage tracker confirmed a slowdown in wage growth. Sticky inflation and sticky labor costs appear to be related. Upcoming auto union talks will be critical for future price inflation. Additionally, the jump in ISM services may reflect rising energy costs. But third-quarter GDP is expected to be strong on strong and broad-based gains in consumer spending.

The economy appears to be growing in a diversified manner, moving away from spending on services and towards more consumer goods, business investment and residential investment. Manufacturing output fell slightly, but low jobless claims and modest industrial production growth pointed to a strong economy.

The upcoming FOMC meeting and housing data will be a focus. Given the recent weak signs of stable inflation and the labor market, the Fed is likely to keep policy rates steady. Their forecasts are likely to show lower GDP growth and unemployment expectations for 2023. Core PCE forecasts are also likely to decline. Housing starts should increase due to tight supply, but high interest rates and high prices may limit this growth.

There are signs of easing in the labor market - such as the ratio of job vacancies to unemployed people falling slightly and the unemployment rate rising slightly. But labor demand remains strong, so it looks more like normalization at a level that maintains wage growth above 4%. The Atlanta Fed's wage tracker confirmed a slowdown in wage growth. Sticky inflation and sticky labor costs appear to be related. Upcoming auto union talks will be critical for future price inflation. Additionally, the jump in ISM services may reflect rising energy costs. But third-quarter GDP is expected to be strong on strong and broad-based gains in consumer spending.