Currently, Telegram Bot is developing rapidly in terms of iteration, and Banana Gun is one of the emerging forces. It has successfully occupied one-third of the market share and formed a three-legged situation with the main competitors in the market.

Original author: Shilian Investment Research

Original source: Shilian Investment Research

Project Description

Currently, Telegram Bot is developing rapidly in terms of iteration, and Banana Gun is one of the emerging forces. It has successfully occupied one-third of the market share and formed a three-legged situation with the main competitors in the market. Compared with other trading robots, Banana Gun has little functional difference. It mainly focuses on sniping newly launched tokens or already issued tokens.

However, in addition to the functionality of the trading robot, Banana Gun has a more important vision, which is to use its economic model to create a sustainable ecosystem project. In this ecosystem, robot users become token holders, and token holders also become robot users, forming a virtuous cycle. This design aims to create value for token holders over time, making Banana Gun a long-term project.

author

Elma Ruan, a senior investment researcher at Shilian Investment Research, has a dual master's degree in marketing/finance from an Ivy League school, 5 years of experience in WEB3, and is good at DeFi, NFT and other tracks. Before entering the encryption industry, she worked for a large securities company Served as an investment manager.

1. Research points

1.1 Core investment logic

Users using tools to snipe new projects require a certain technical threshold, and trading robots have become a link between ordinary crypto users and high-tech personnel. Banana Gun is a popular Telegram Bot that was launched recently. Its simple and easy-to-use interface and powerful functions have won a certain reputation. This project has risen rapidly, providing a variety of functions such as sniping new projects online, following orders, selling coins, etc., and has brought a lot of popularity to the current market. The trading robot project mainly focuses on sniping new trading transactions, and has attracted much attention because of its potential profitability. As far as the product is concerned, it mainly guides users through its economic model.

As of 2023, Telegram has 700 million monthly active users and 55.2 million daily active users, making it one of the top 5 downloads in the world. Banana Gun, like other trading bots, chose Telegram as its platform mainly because of its large user base and API for creating bots. Telegram values privacy and security, consistent with the values of the cryptocurrency community. The Telegram platform enables Banana Gun to stay in touch with users, automate user services and optimize processes to reduce manual workload. By providing APIs, Telegram allows Banana Gun to create programmatic bots on the platform for social networking, transactions, etc. and attract users to interact. Overall, Telegram's functionality and large user base make it an ideal platform for Banana Gun to reach and interact with its target audience.

Following the success of Unibot, Banana Gun enters the world of Telegram bot trading. DEX (Decentralized Exchange) trading bots are becoming increasingly popular among aggressive traders. Banana Gun highlights the features of new currency sniping and is popular among users who like to chase new projects. This user-friendly feature is also one of the reasons why Telegram Bots like Unibot are soaring. Users can easily perform transactions on mobile devices or PCs in one step. At the time of launch, Banana Gun’s market capitalization was relatively low, making its token highly attractive to investors looking for high returns. This attraction comes from the token economic model. Banana Gun’s token reward and burning mechanism is relatively complete. The project economic model is a positive flywheel mechanism, allowing users who hold $Banana tokens to receive rewards. Another positive is that the project has maintained strong data and an active user community even after its launch, laying the foundation for long-term success.

Unibot's surge has triggered FOMO among retail investors in the market for the BOT sector, increasing attention to similar projects. With the strong launch of Banana Gun, another competitor Unibot also announced plans to adjust handling fees to maintain market competitiveness. Unibot and Maestro are Banana Gun’s main competitors and have a strong following in the cryptocurrency community. The iteration speed in the field of robots is rapid, and Banana Gun occupies one-third of the market share, indicating that this is a critical moment for competition in the Bot market. Since the project announced its currency issuance, its momentum has become increasingly fierce and it is expected to seize the top spot in the market. This fierce competitive environment requires Banana Gun to maintain innovation and steady development to stay ahead of the fierce competition.

However, Banana Gun’s smart contract has undergone two audits and still has loopholes. This is a serious technical problem that requires high vigilance. Anonymous programmers discovered these vulnerabilities using ChatGPT, highlighting the need for further security improvements in the project. In addition, after going online, Unibot holders may engage in FUD, perhaps because Unibot is a competitor of Banana Gun, and holders may try to undermine the success of Banana Gun by spreading fear, uncertainty, and doubt. The negative impact of this kind of competitor requires the project side to prepare a response strategy. In terms of functionality, Banana Gun still has some shortcomings and has not yet reached a level of functionality similar to Unibot. Although the project team is working hard to improve it, this may make some investors lose interest in the project, especially those who value comprehensive functionality. . Finally, the high FDV (fully diluted valuation FDV = price * total number of tokens) of Banana Gun's tokens after they are launched may deter some investors looking for low-risk investments. Taken together, these shortcomings require in-depth thinking and resolution by the project side to ensure the long-term and steady development of the project.

In the current bear market and volatile market, investors’ attention has turned to sniping newly launched tokens because it is cheaper and less risky than the secondary market. Especially for retail investors, this strategy is more popular. In addition, the core needs of on-chain innovative projects are still buying and selling, and projects that can attract traffic and make profits will receive more attention. In the future, the industry may develop into various application models such as web pages or applications, relying on platforms with large traffic for implementation. Profitability will become an important factor affecting the status of the project. Overall, Banana Gun has huge potential in the market, but investors should always be aware of market risks and conduct proper due diligence on their own.

1.2 Valuation

The current FDV of Banana Gun has exceeded US$84 million, and its valuation is approximately 12 times its pre-launch valuation. For details, please refer to 4.2.

2. Basic information of the project

2.1 Project introduction

Banana Gun is a trading robot based on Telegram. Its main products are Sniper bot and Sell bot. Compared with other copy robots, the advantage of Banana Gun is that it focuses on sniping opening transactions. It allows users to snipe upcoming tokens or trade already issued tokens. Banana Gun aims to become the preferred sniping/manual buying bot on the Ethereum network and will consider expanding to more blockchain networks in the future.

2.2 Past development and roadmap

Future roadmap:

The future roadmap includes the following goals:

• Promote Banana Gun's services to more users and increase user usage.

• Continuously increasing the size of the treasury and revenue share.

• Capture a larger market share to take advantage of economies of scale.

Additionally, in terms of specific features, Banana Gun plans to:

1) Expand the robot's transaction application to other blockchains, currently limited to the Ethereum chain.

2) Develop a web version of the robot trading application so that users can use these functions on the web page, not just on the Telegram platform.

2.3 Team situation

Overall situation

The specifics are unclear at this time as no official news about the team has been announced.

2.4 Financing situation

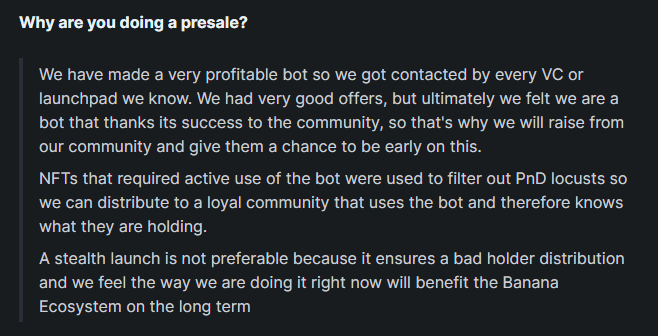

Venture capitalists and incubators had been in contact with the Banana Gun project and had a preliminary understanding of the project, but ultimately decided not to invest. Currently, the development of Banana Gun is mainly driven by funds raised by the community.

3. Business analysis

3.1 Service objects

Banana Gun mainly serves people who are interested in cryptocurrency and want to participate in token transactions in a fast and efficient way. The following are several categories of users who may benefit from Banana Gun's services:

1) Investors and traders: Banana Gun can help investors and traders conduct sniper purchases before the project goes online, or safely purchase tokens after the project goes online. It provides convenient trading channels to meet their investment needs.

2) Novice users: For novice users in the cryptocurrency field, Banana Gun provides a simple and easy-to-use platform that allows them to easily participate in token transactions and obtain profit opportunities.

3) Users who are keen on new projects: The main feature of Banana Gun is new currency sniping, which provides convenience for users who like to participate in new projects and obtain early investment opportunities. They can use the Banana Gun to preemptively purchase newly issued tokens for greater potential gains.

3.2 Business details (function details)

1. Configurations (initial configuration)

To use the Banana Gun, the user must follow the following sequence.

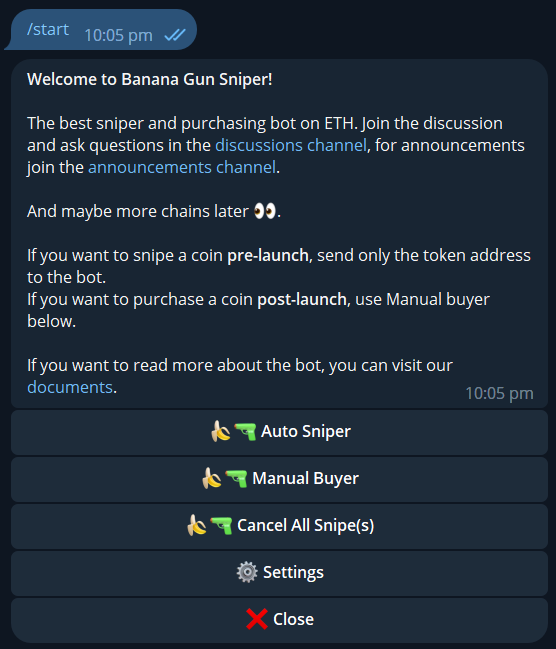

To start setting everything up, enter /start in Banana Gun Sniper Bot and the main panel will pop up.

Click "Settings" to configure Banana Gun/Add Wallet according to user's preferences.

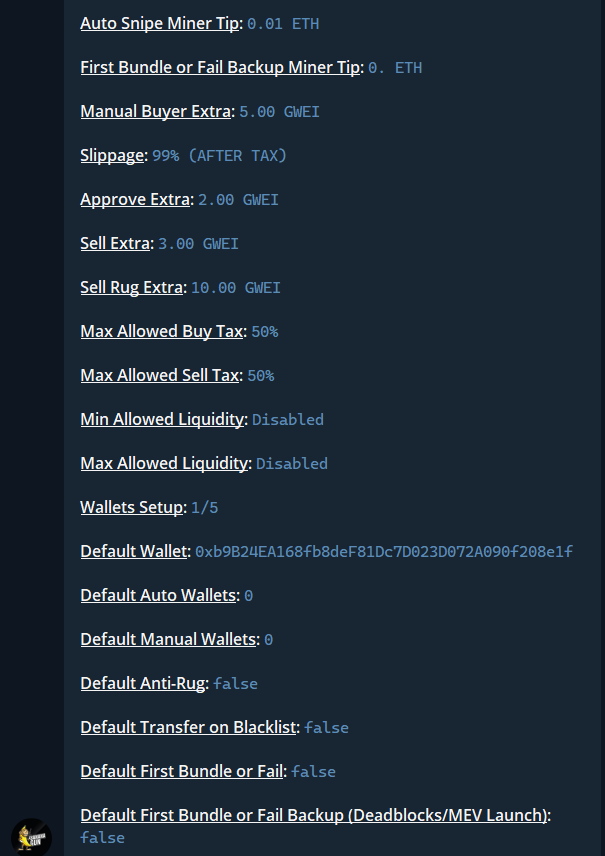

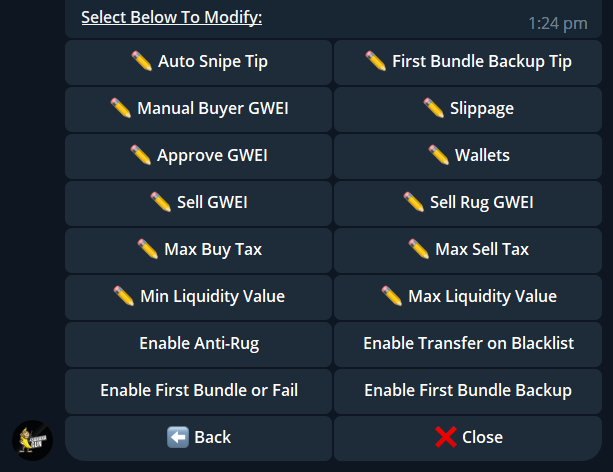

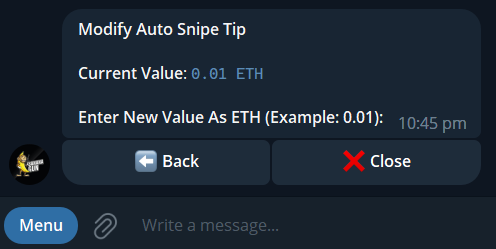

Auto Snipe Tip (automatic snipe tip)

Auto Snipe Tip is a function that is suitable for unlisted tokens that are planned to be snapped up. It allows users to set an amount of extra Ether they are willing to pay as a bribe to get a chance to snap up an item earlier than other snappers. That is, by tipping more, users can improve their position in the transaction block, thereby increasing their chances of a successful snap. NOTE: The Banana bot uses Ether as bribe, not Gwei. This way, users do not need to calculate how much ETH to bribe. Additionally, Banana will use 100% of the entered amount.

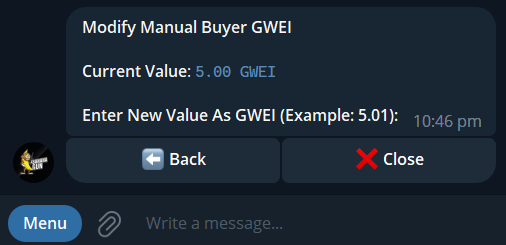

Manual Buyer Gwei (Manual Buyer Gwei)

This function is applicable to the purchase of tokens that are already online. It allows users to set the amount of additional Gwei they are willing to pay to enter a purchase transaction earlier than other manual buyers. Using more Gwei allows users to gain an earlier position in the transaction block, thereby increasing their chances of purchasing the token.

Simply put, the core of this feature is to allow users to make token purchases as early as possible using higher transaction fees (Gwei) to gain priority in the transaction block. This can increase the chances of successfully purchasing tokens and improve the efficiency of users' snap-up purchases.

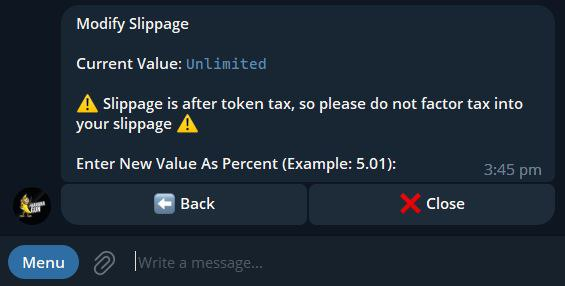

Slippage

Slippage is a concept involving price fluctuations, usually in the range of 0-100%. It is suitable for project releases with no maximum transaction quantity limit. What slippage does is allow for price fluctuations or failure during a trade.

Simply put, slippage means that when a trade is made, the purchase price may fluctuate or the trade may fail due to market conditions or other factors. The percentage of slippage determines how much price movement is allowed. Higher slippage means larger price movements are likely to be accepted, while lower slippage indicates less acceptance of price movements.

First Bundle Backup TIP (Bundle sniper tip)

When a cryptocurrency encounters transaction blockage or MEV, the 'First Bundle or Fail' function will be disabled, and the 'First Bundle Backup' function will be activated. First Bundle Backup is like a banned snap-up, because users pay extra Ether as a bribe to the block builders to have priority over other snap-ups.

NOTE: This option is only available for MEV launches and tokens where Deadblocks exists

Approve Gwei

Set how much additional Gwei the user is willing to spend to ensure token approval when selling. Using more Gwei can prioritize user transactions and complete them faster.

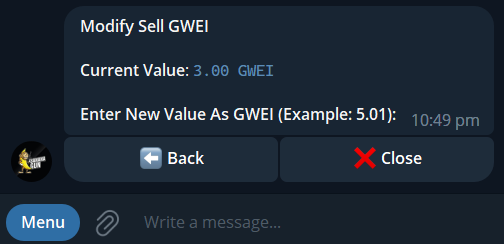

Sell Gwei (Sell Gwei)

Set how much additional Gwei the user is willing to use to sell the desired tokens. Using more Gwei can prioritize user transactions and complete them faster.

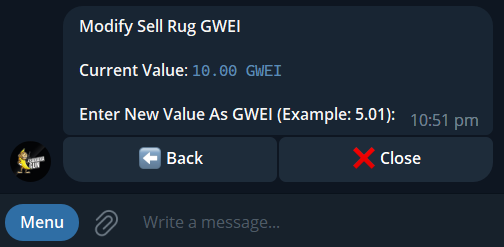

Sell Rug GWEI

DEV will send out a remove broadcast before RUG. After being monitored by the bot, the bot will enable the defense mechanism. If the user's Gwei setting is higher than DEV's remove operation, the token can be successfully sold before the project RUG to avoid capital losses.

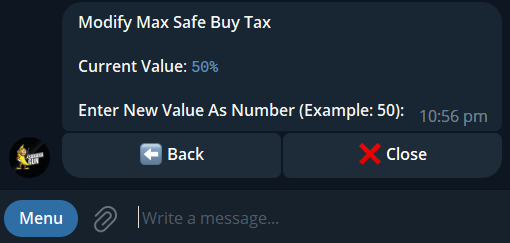

Max Buy Tax (maximum purchase tax rate)

The rush bot/manual buyer is triggered when the purchase tax rate for the selected token is equal to or lower than this amount. For example: The purchase tax rate for XYZ tokens at launch is 99%. Bots will not activate and sniping remains in 'pending mode'. If the developer lowers the purchase tax rate to 75%, the bot will launch within the same block. This can avoid the impact of high tax rates on purchases and ensure the efficiency and cost of purchases.

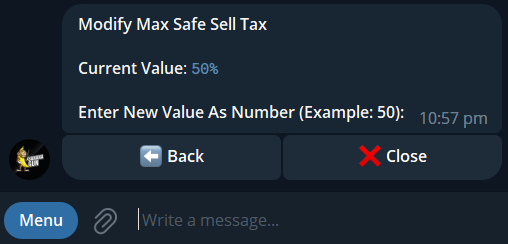

Max Sell Tax

The rush bot/manual buyer is triggered when the selling rate of the selected token is equal to or lower than this amount.

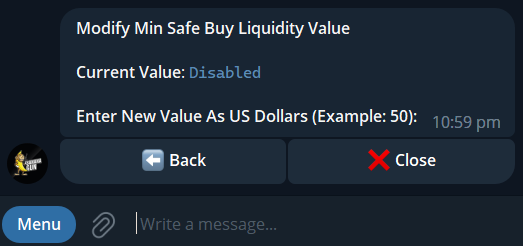

Min Liquidity Value

The rush bot/manual buyer will only trigger when the market liquidity of the token reaches or exceeds the amount set by the user. This ensures sufficient market liquidity at the time of purchase and avoids transaction problems or high costs.

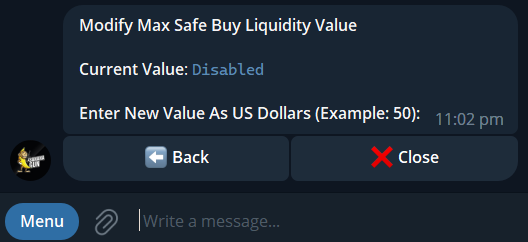

Max Liquidity Value

The rush bot/manual buyer will only trigger when the market liquidity of the token reaches or falls below the amount set by the user.

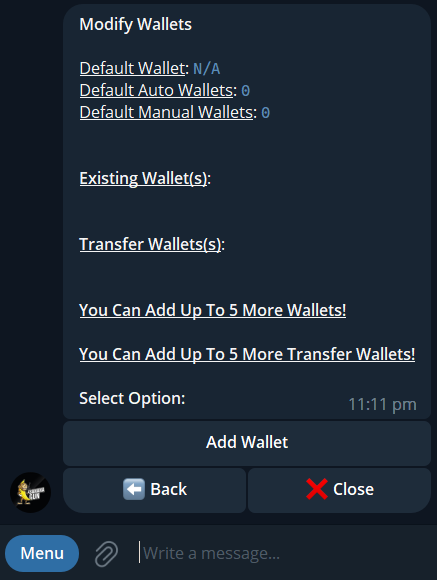

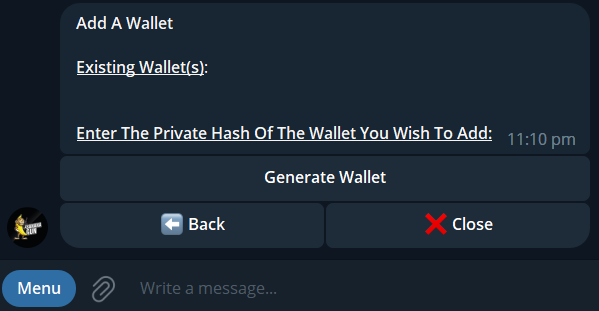

Wallets Setup

In the Banana bot, users can connect up to 5 wallets. Users can choose to import an existing wallet or choose to have a new wallet generated by Banana Bot.

2. How to snipe (snipe steps)

By following the steps below, users will be able to use the Banana Gun to snap up yet-to-be-released tokens on the Ethereum network.

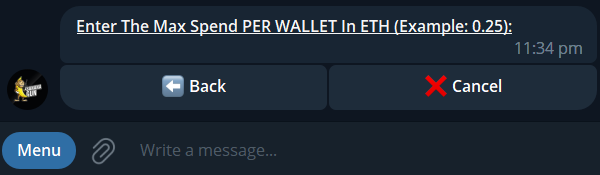

1) Paste the token contract address (CA) that the user wishes to snap up into the BananaGun Sniper bot, and a question will pop up asking how many Ether coins it will cost.

Example: Prelaunch data tells users that the maximum allowed purchase amount will be 0.02 WETH (a form of Ethereum) as the maximum wallet. If the user enters 0.1 WETH, Banana Gun will spend as much WETH as possible to get the maximum wallet, but no more than 0.1 WETH. If the price of the largest wallet is higher than 0.1 WETH, it will buy 0.1 WETH worth of tokens.

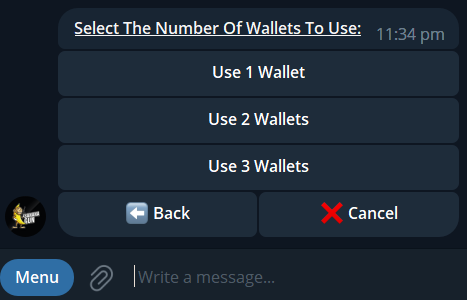

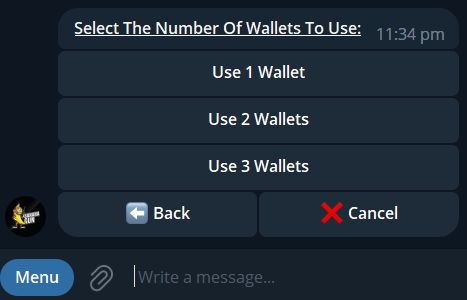

2) Select the number of wallets the user wants to purchase.

If the user has set up a default wallet (automatic), Banana will skip this step.

3) The user's sniper is activated . If the Banana Gun is triggered and successfully entered, the tokens will be loaded into the Banana Gun Sell Bot.

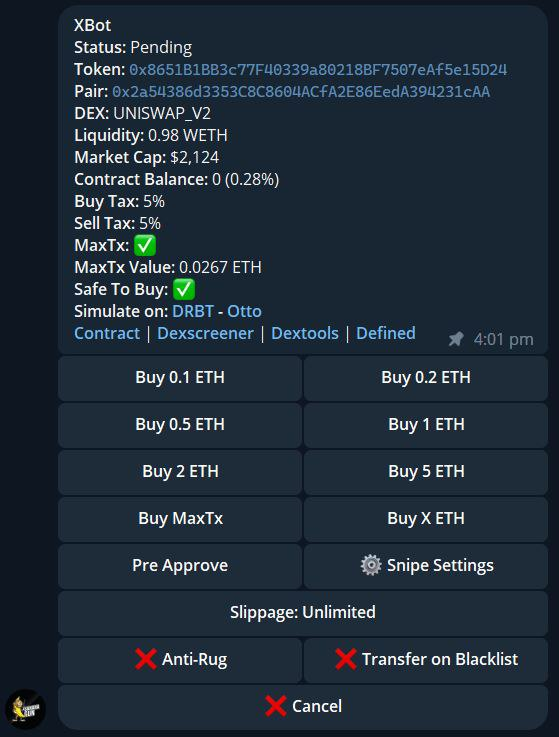

3. Pending Snipes Pending snipes

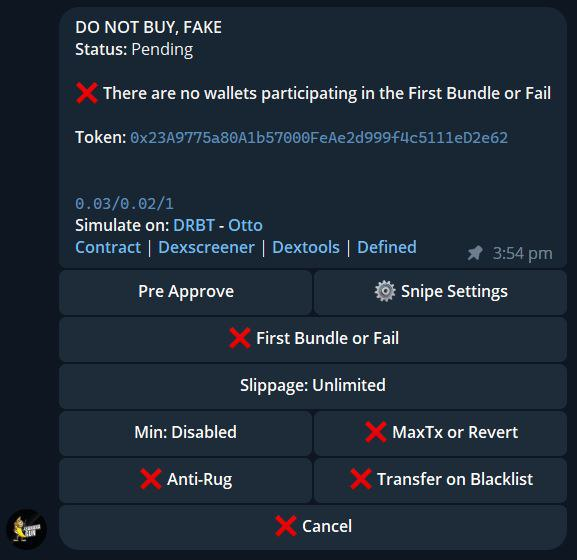

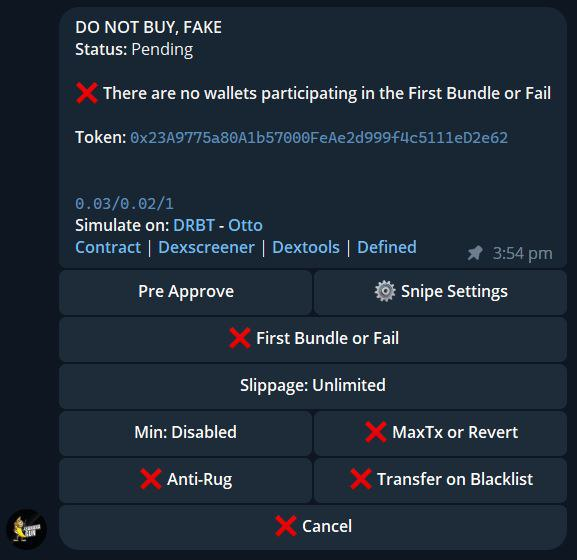

When the user has successfully set up a sniper, the user will see a popup showing the details of the launched sniper and displaying the following buttons.

Pre ApprovePre-approval

The default setting is to approve purchased tokens after sniping. Users can pre-approve the token if they want to complete the transaction as quickly as possible.

Snipe SettingsSnipe Settings

Click this button if the user wishes to change the settings when launching a rush sale.

IMPORTANT: Changing any settings here will only change the settings for this rush. Settings for other pending rushes will not be changed and new rushes will adopt the settings of the primary settings.

MaxTx or Revert maximum transaction volume or rollback

Automatically set the maximum transaction amount (maxTx), and roll back if the maximum amount that can be spent is exceeded (if the robot detects that the maximum transaction amount is not set, sniping will not be possible).

For example: the maximum trading volume of the token is 2%, and the maximum payout set by the user is 0.1 ETH. If at the time of the user's purchase, the value of 2% exceeds 0.1 ETH, the user's transaction will be rolled back (the user's current Gas fee will be spent, and taxes will be applied when the rush sale is performed).

Slippage

The normal range is 0-100%, which is suitable for transaction publishing without setting a maximum transaction limit. This range allows for large price swings or the possibility of failure.

Min (Mintoken) Minimum number of tokens

Users can set a minimum percentage or amount of tokens they want to buy.

For example: if the user sets the minimum token amount to 1%, and the maximum spend to 0.1 ETH. If at the time the user purchases, 0.1 ETH is equivalent to only 0.5% of the tokens, then the purchase will fail (this will incur the current gas fee and the corresponding tax will be applied when the sniper is executed)

First Bundle or Fail Backup First Bundle or Fail Backup

If the user sees a check mark, it means it's turned on. If the user wants to turn off the "First Bundle or Fail Backup" function, the user can turn it off.

Anti-Rug anti-rush buying

If the user sees a check mark, it means that the "Anti-Rug" function is turned on. If users want to snap up purchases without enabling the anti-snatch feature, users can turn it off.

Transfer on Blacklist

If the user sees a check mark, it means the option is turned on. If the user wishes to snipe without enabling blacklisted transfers, the user can turn it off.

First Bundle or FailFirst Bundle or Fail

If the user sees a check mark, it means it is enabled. Users can turn it off if they wish to snap up a deal without first bundle or failure.

Cancel Cancel

Users can cancel the snap sale.

4. Manual Buying Manual Buying

1) First paste the CA (contract address) that the user wishes to purchase. It automatically detects whether the token has been listed and passed the secure tax and secure liquidity details set by the user. If the token is already live, the Banana bot will ask the user how many wallets to purchase from.

Note: If the user has set up a default wallet (manually), Banana will skip this step.

2) The Banana bot will send the token details and the user will have various options to determine how much ether they want to spend.

IMPORTANT NOTE: If the user chooses to purchase an amount of ETH that exceeds the maximum wallet amount, the system will use the largest wallet share to purchase and deduct the required amount from the user's ETH. Excess Ether will be returned to the user's wallet. In other words, the system will try to use the largest wallet amount to meet the user's purchase needs, and the excess money will be returned to the user.

If Banana Gun successfully purchases a token, the token will be automatically loaded into the Banana Gun Sell bot.

5. How to handle active tokens

The Banana Gun Sell Bot is responsible for processing active tokens purchased through the Banana Gun Sniper Bot.

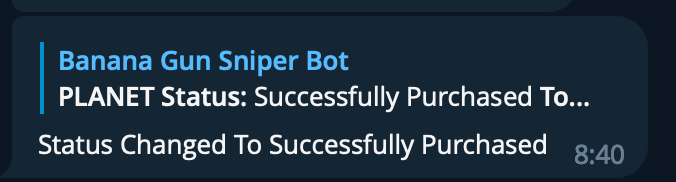

When a user successfully purchases a token, the user will receive the following notification on the Banana Gun Sniper Bot:

After receiving this message, the token will be automatically loaded into the Banana Gun Sell Bot.

Liquidity - WETH in the liquidity pool.

Market Cap - The market capitalization of the token.

Contract Balance - The amount of token supply remaining in the contract address.

Tax - Sales tax on tokens.

Transfers - If the user wishes to transfer the tokens to another wallet, there is a transfer tax on the tokens.

Timestamp - The last time this window was updated.

All Sell WalletsSell Wallets

If the user clicks this button, the token will be sold on each wallet (if the user purchased using multiple wallets).

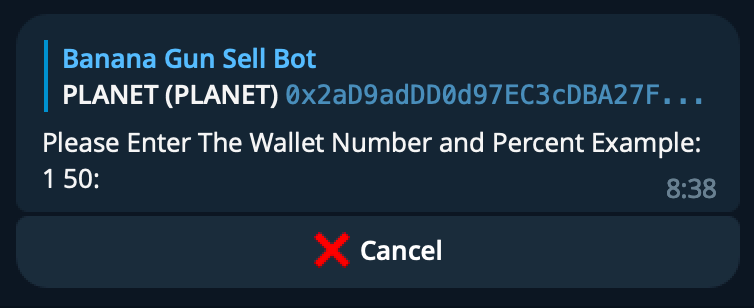

Sell% Wallet sells a certain percentage of tokens in the wallet

When the user clicks this button, the user can choose to sell a percentage of the tokens on each wallet (if the user purchased using multiple wallets). For example: "1 50" - this means that the system will sell 50% of the tokens in wallet 1. In other words, users can choose to sell a portion of their wallet’s tokens at a certain percentage.

Sell W # for sale

If the user clicks this button, 100% of the tokens will be sold in wallet #1.

Slippage

Slippage refers to the range of fluctuations allowed in transaction prices during execution, which usually ranges from 0% to 100%. Slippage applies to situations where there is no maximum trading limit set, which allows for some degree of volatility or failure in trading prices.

Transfer on Blacklist

When the user clicks this button, the system will automatically transfer the tokens in the wallet purchased by the user to the user's transfer wallet. This way, users can avoid being blacklisted. Developers may blacklist early purchasers, which means they can no longer participate in certain activities or enjoy certain benefits. By clicking a button and transferring tokens to the user’s transfer wallet, users can circumvent the risk of being blacklisted.

SettingsSettings

Users can configure specific tokens. These configurations are the same as those in the overall configuration mentioned earlier. However, it should be noted that if the user makes any changes here, it will only affect the settings of the current snap-up activity and will not change the settings of other pending snap-up activities. New rush sales will use the settings in the main settings, not changes made by the user here. So be careful to ensure your intentions and expectations when setting it up.

Anti-Rug anti-sell protection

If the user sees a check mark, it means the option is turned on. If the user wishes to snipe without enabling anti-sell protection, the user can turn it off.

main idea:

The core idea of this operation is to ensure that when purchasing tokens, an anti-sell protection measure is enabled to avoid loss of token value caused by malicious operations. If the user does not want to use this protection, they can choose to turn off this option.

RemoveRemove

Tokens can be removed from the Banana Gun Sell Bot via this button. If the user feels that the window is not updating, it means there is a problem with the TG API, and the user can remove it and reload it to solve the problem. If a user removes a token from the Banana Gun Sell Bot, then it loses anti-snap protection, meaning the user is temporarily unable to sell the token until the user reloads it.

3.4 Industry space and potential

3.4.1 Classification

Telegram Bot has excelled at attracting investors, and its success is attributed to a precise audience that is native to the cryptocurrency space, making it relatively easy to attract customers. However, this approach may ignore potential users in non-crypto fields.

Under the current market conditions, Telegram robots operate based on the mode of chasing small coins, and most coins have a short rising cycle and may rise and fall sharply within a few hours. Users will use robots to constantly find new explosive points. As the market as a whole tilts toward a bear market, mainstream cryptocurrencies such as Bitcoin and Ethereum no longer attract the attention of more native users, which may affect the attention and liquidity of the Altcoin market. In addition, the security of user wallets is also a major obstacle to long-term development. Nonetheless, Telegram Bot’s outstanding performance has brought new vitality to the market.

Common cryptocurrency trading bots, classified by their main functions and categories, these bots provide various functions in different areas of cryptocurrency trading and analysis:

DeFi robots:

Unibot - DeFi robot for trading.

WagieBot - DeFi bot for trading and tracking.

Boltbot - DeFi bot for trading.

0xSniper - DeFi bot for trading.

NitroBot - DeFi bot for trading.

Xbot - DeFi robot with customizable trading.

ASAP - DeFi bot dedicated to Discord.

SwipeBot - DeFi robot supporting artificial intelligence trading of $ETH, $ARB, $BSC.

Bridge Bot - DeFi bot for cross-chain operations.

AI DEV - DeFi robot that supports AI trading and token issuance.

All In - DeFi robot that supports AI trading.

Data analysis robots:

Cipher Protocol - Bot for data analysis.

NeoBot - Bot for data analysis and tracking.

Meowl - A bot that provides data analysis and tool suite.

TokenBot - Bot for social trading.

Trace AI - A robot that supports AI data analysis.

Scarab Tools - Robots for data analysis.

BlackSmith - A robot that supports AI data analysis.

TrackerPepeBot - A robot that supports AI data analysis and contract security detection.

DAGMI - robot for tracking.

First Sirius - Robot for data analysis.

The DIG - A bot for token and NFT data analysis.

WallyBot - Bot for wallet analysis.

Airdrop ambush transaction:

Farmer Friends

LootBot

alfa.society (providing airdrop tips)

other:

EnigmaAI - a robot that supports custom AI trading on centralized exchanges.

NexAI - A robot that provides a variety of AI tools.

0x1 - A versatile cryptocurrency trading robot.

MagiBot - Bot for private transactions.

3.4.2 Market size

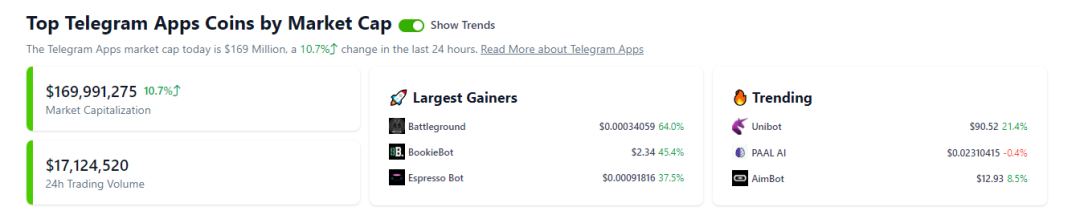

Although Telegram Bot has attracted much attention recently, in fact, bots similar to plug-ins have already existed, and are not limited to Telegram and Discord platforms. However, in the recent market environment, the TG trading robot has shown outstanding performance and attracted widespread attention. Coingecko's data shows (2023.09.14) that the current total market value of the Bot sector is approximately US$169 million, and the transaction volume in the past 24 hours was approximately US$17 million.

Judging from the enthusiastic market response to TG trading robots, it can be observed that the demand for this type of robots is growing rapidly and may continue to expand in the future. This trend is likely to be driven by the rapid development of the digital currency and blockchain markets and investor demand for automated trading and ancillary tools.

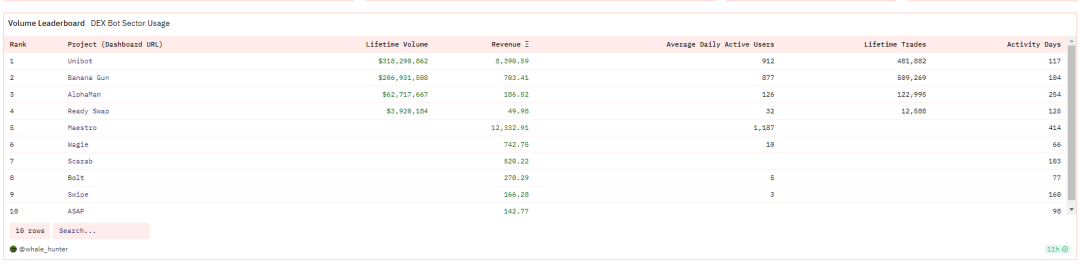

According to Dune data, the Bot sector currently has more than 100,000 users, with a total transaction volume of US$570 million and a total number of transactions of more than 1.01 million. The total market value of the projects that have been launched and issued tokens in the Bot sector is approximately US$92 million, and the total transaction volume of BOT tokens is as high as US$390 million. From the data point of view, the Bot sector shows high market activity and user participation, showing huge potential.

This trend reflects growing investor trust and demand for robotic trading tools. As the digital currency market continues to develop and automated trading becomes more popular, the Bot sector is expected to continue to thrive.

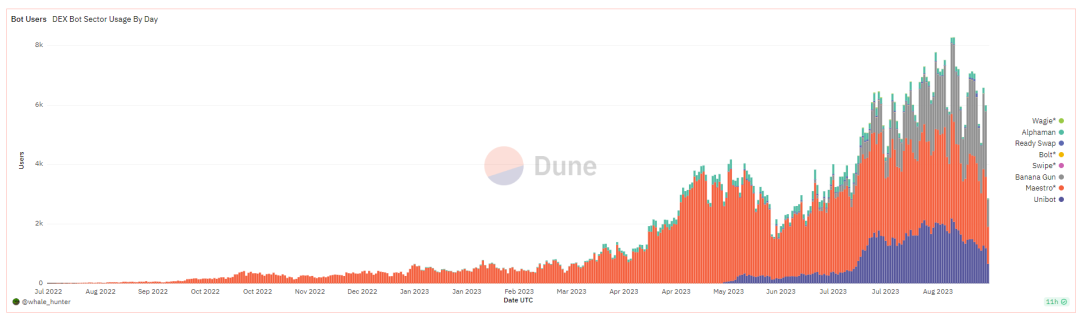

From the perspective of the number of users, Unibot, Banana Gun and Maestro currently form a competitive situation. In the past, Maestro dominated and held the majority of the user share. However, as Unibot and Banana Gun entered the market, they began to gradually erode Maestro's dominant position in terms of users. This shows the fierce competition.

In terms of transaction volume, Unibot, Banana Gun and AlphaMan rank among the top three (the transaction volume data on Maestro is not yet clear). However, AlphaMan’s total trading volume is only one-third that of Banana Gun. This shows that AlphaMan is relatively weak in terms of trading volume.

Judging from market development trends, as competition intensifies, these platforms may further improve user experience and functions, attracting more users and transaction volume.

3.5 Business data

• Operational data

User situation

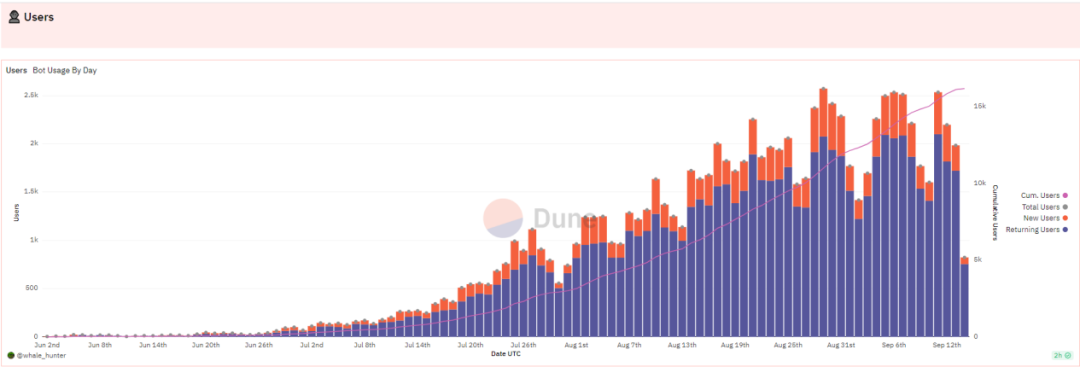

According to Dune data, the project currently attracts a total of 16,195 users, with the number of daily active users fluctuating between 1,700 and 2,300. The proportion of daily new users is about 15% of the total number of users. The project's user growth trend began in mid-July and reached a relatively high and stable level by mid-August. It is worth noting that after the project token was launched, no obvious surge in new users was observed.

Trading Volume and Revenue

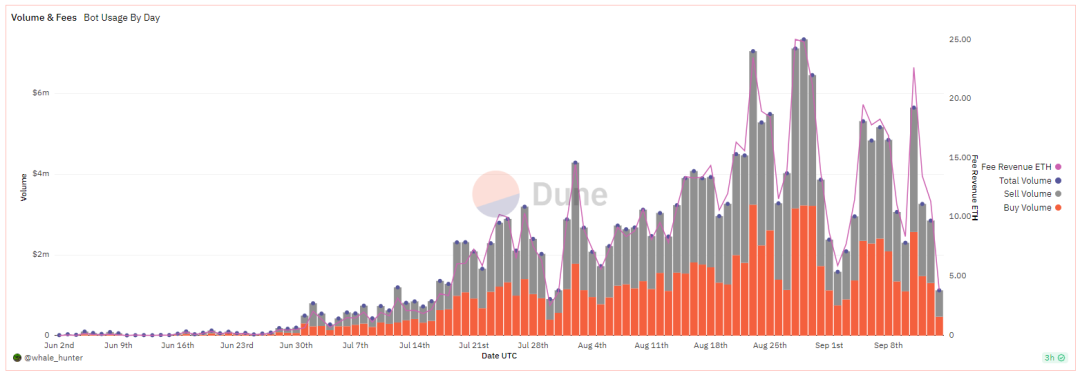

According to statistics, so far, the Banana Gun robot has achieved a total transaction volume of US$210 million since its inception, with nearly 600,000 transactions. On average, each user has conducted 32 transactions, and the average transaction amount per user for $12,000. It is worth noting that, as can be observed from the chart data, the proportion of the Banana Gun robot used for buying and selling is relatively even. There was a wave of small peaks in trading volume in early August and early September, and recent data shows that trading volume has declined, which may be affected by the risk of contract vulnerabilities.

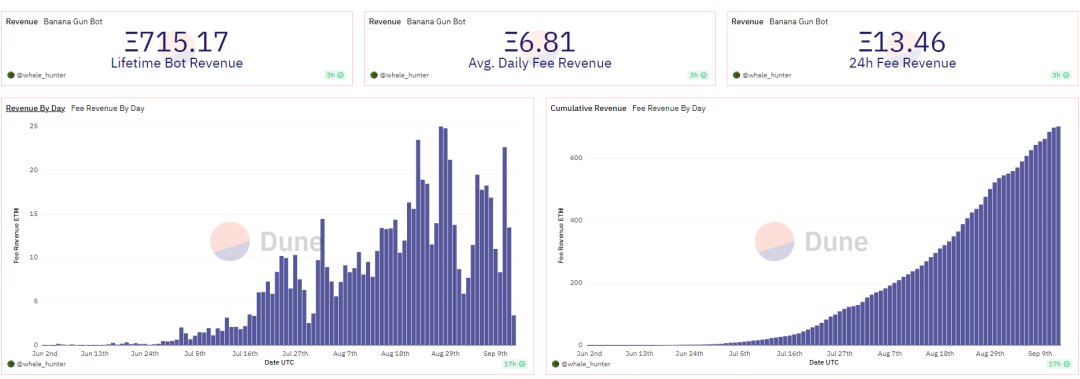

profit

From a profit perspective, the total profit of the Banana Gun project is 715 Ethereum, which at the current price (as of September 14, 2023) amounts to $1.13 million. The average daily profit is about 6.81 ether, and in the past two months, the highest single-day profit reached 25 ether, and the lowest single-day profit was 2.3 ether. It should be noted that the return levels were consistent with the peak period of trading volume, but there has been a certain degree of downward trend. This may be affected by market fluctuations and project operating strategies.

• Social media data:

Twitter: 22,000 subscribers

Telegram: 7491 subscribers

3.6 Project competition landscape

User data is one of the important indicators for project comparison. It reflects the popularity of the tool in the market and user participation. In the comparison of this project, we will focus on the top three bot tools Maestro, Unibot and Banana Gun in terms of user data .

3.6.1 Project introduction

Maestro

Launched in 2022, the Maestro sniper robot is one of the first sniper robots on the market. It is mainly used to quickly snipe new contract positions on DEX (decentralized exchange). With the development of DEFI, there are more and more user experience problems, and the Maestro robot is one of the best tools to solve these problems. It currently supports three chains: BNB chain, Ethereum and Arbitrum.

Although using the Maestro robot is free, a 1% transaction tax is charged on each successful trade. In addition, Maestro also offers a paid premium subscription service, offering a more advanced version, "Maestro Pro Bot", for which users pay $200 per month. Subscribers will enjoy faster speeds, more concurrent transactions, exclusive access to token metrics, and more.

Unibot

Unibot is a bot that provides DeFi trading tools on Telegram. It can execute various instructions, such as token exchange, copy trading, asset cross-chain and other operations. Unibot aims to build a simple and easy-to-use wallet and tightly integrate with DEX to provide users with a convenient cryptocurrency interaction experience. Through advanced algorithms and powerful infrastructure, Unibot is able to provide high-speed features, including private nodes for sniping, private trading options, wallet monitoring and token tracking.

3.6.2 Project comparison

1) User data (2023.09.14): Banana Gun has 2,741 daily users, Unibot has 1,340 daily users, and Maestro has 2,661 daily users. According to recent data, Banana Gun accounts for 39.3% of the user market, Maestro accounts for 38.2%, and Unibot accounts for 19.2%. Overall, Banana Gun and Maestro account for a larger proportion of users, and Unibot lacks stamina.

2) Trading data (2023.09.14): Based on the total trading volume, Banana Gun’s trading volume was US$210 million, while Unibot’s trading volume was US$320 million. These data for Maestro have not yet been recorded. Given that Unibot was released earlier than Banana Gun, this may partially explain its higher volume. Overall, although Banana Gun is relatively new, its trading volume also shows the market’s attention and recognition of it.

3) Handling fee:

-Banana Gun: 0.5% fee from manual trades and 1% fee from sniper trades;

-Unibot will charge users a default 1% handling fee for transactions. Users who hold at least 10 $Unibot and connect their wallet to the robot will enjoy a 20% fee discount. In addition, users who interact with the robot through recommended links will receive an additional 10% discount on handling fees.

When buying and selling $Unibot, a 5% tax will be charged each time, of which 1% goes to liquidity providers, another 2% is distributed to token holders, and the remaining 2% is used for team and project operating costs.

- Maestro charges a 1% handling fee on all transactions.

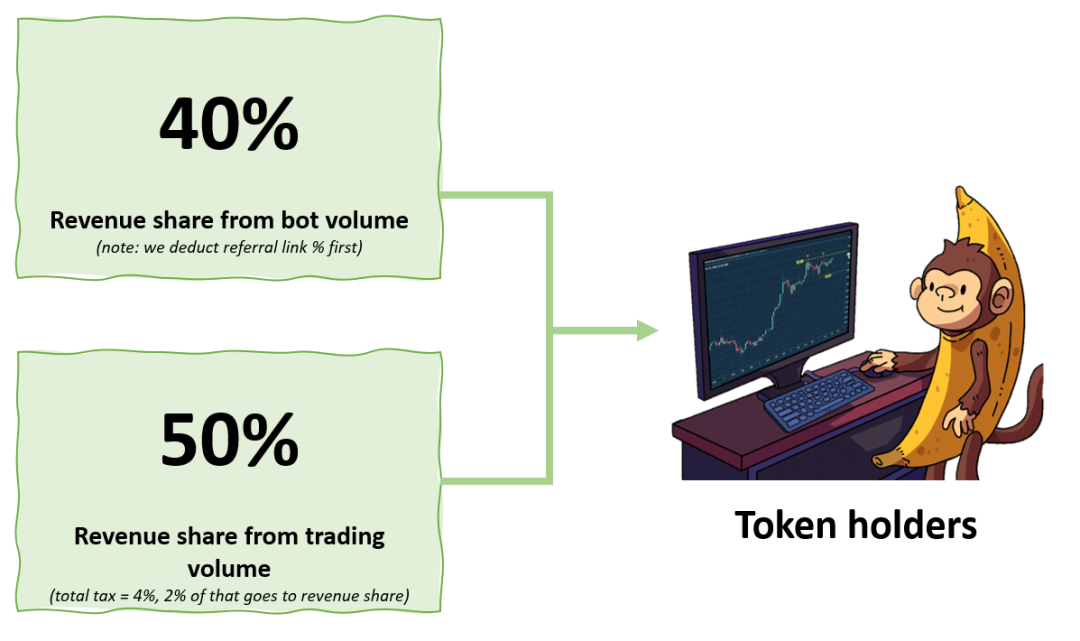

4) Income distributed to holders:

-Banana Gun comes from robot trading income (40% after referral) and 50% tax income.

-Unibot’s distribution mechanism is to distribute 40% of all robot transaction fees to token holders. This allocation mechanism does not require staking, but users must hold at least 10 $Unibot tokens. Income rewards are distributed in the form of ETH.

-Maestro currently has neither revenue sharing nor referral rewards.

5) Main products:

-Unibot: A recommendation system with revenue sharing function.

-Banana Gun: Its main feature is the separation of buyer and seller bots.

-Maestro: Trading tools currently available for Ethereum, BSC and Arbitrum chains. It has some special features, such as Presale Snipe, TG Group Mirroring, and Bribes+Bundle Snipes (Advanced version only).

6) Future development:

- Maestro plans to launch more features and tools to meet user needs.

-Unibot plans to launch more trading strategies and customization options to improve the robot's flexibility and adaptability.

-Banana Gun plans to launch a WEB version of the robot and expand to other chains.

3.7 Token model analysis

3.7.1 Total amount and distribution of tokens

Token name: $Banana

Applicable blockchain: Ethereum

Token unlocking status: Please refer to the picture below

• A total of 2.5 million tokens are available for circulation in the pre-sale and liquidity pool.

The token will be set with a 4% buying tax and a 4% selling tax (this tax will gradually decrease as the market capitalization increases significantly)

- 2% will be distributed to token holders

- 1% will be allocated to the team

- 1% will be allocated to the treasury

• The project party will provide initial liquidity with 500K $Banana tokens and $325,000 in liquidity funds, totaling $650,000. This will give Banana a starting market cap of $1.63M, so the initial price will be $0.65, the same as the pre-sale price.

The liquidity ratio set in this way is relatively healthy, about 40%, relative to the circulating market capitalization. This ratio is an ideal balance in terms of market volatility and trading depth. Simply put, this configuration allows the market to have sufficient liquidity while reducing the risk of extreme volatility.

3.7.2 Pre-sale and airdrop situation

Pre-sale

Time: 3 weeks

Rules: Users can accumulate bound NFT by completing various tasks in the robot

Design purpose: to screen out users who are loyal to the robot

Rewards: These NFTs will be used to determine who will be whitelisted and participate in the launch

detail:

· Maximum fundraising: 800E

· Maximum holding amount of a single address: 1E

· Pre-sale price: $0.65

· Listing price: $0.65

· Starting market capitalization: $1.56 M

· Starting FDV: $6.5 M

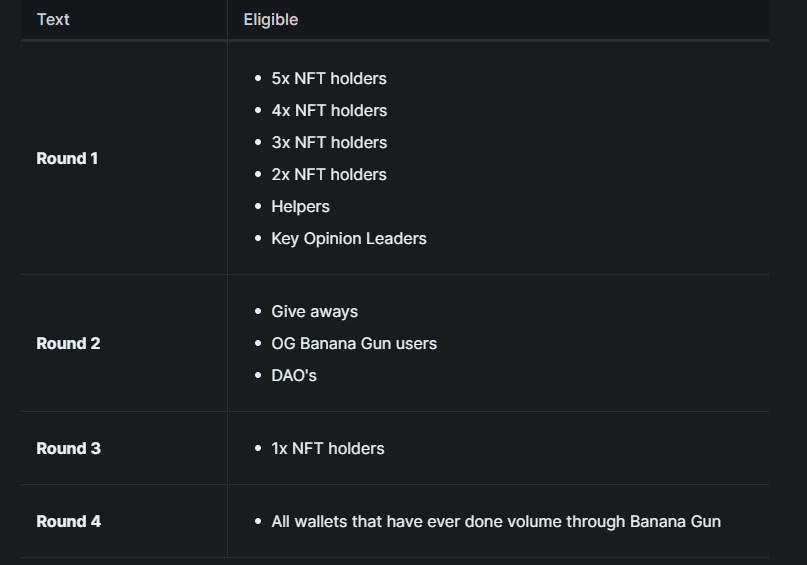

(These spots will be opened in different rounds on a first-come, first-served basis. After each round, the remaining spots will be moved to the next round)

airdrop

The project will conduct two airdrops, one for NFT holders and one for social task completers:

1) Airdrop A total allocation: 100,000 $Banana

Object: NFT holder

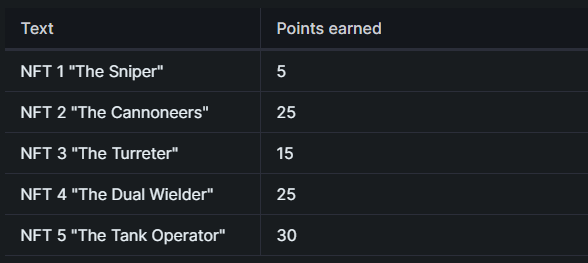

The fine print: Depending on the requirements and difficulty of each NFT, the points an NFT holder can earn will vary. The airdrop will be released in linear phases for a period of 2 months.

Calculation Rules:

- Determine the total quantity of each NFT

- Calculate the total points by multiplying these amounts with the points for each NFT

- Divide the total airdrop amount of $100,000 by the total number of points

- Get dollar amount per point x number of points

2) Total allocation of airdrop B: 20,000 $Banana

This part of the airdrop is mainly for people who complete social tasks, such as community members, KOL, etc. The specific details have not been announced yet.

3.7.3 Income for Token Holders

1) Holder income sharing

Source of income: From robot trading income (40% after referral) and 50% tax income.

Significance: It aims to encourage token holders to hold tokens, and combined with the future growth potential of the project, provides a certain stable basis for the token price.

Note: Only tokens that are not locked will accrue revenue share (50% of the tokens held by the team will be locked for long-term holdings and will not be counted). This benefit is only available to users who own $Banana tokens. If the tokens are sold before the snapshot, no proceeds will be obtained, and users can claim them at any time on Banana Gun’s dApp.

2) User rewards

Now, users can trade through the bot and be rewarded with a small share of Banana tokens (these tokens will also enjoy revenue sharing). Over time, this ratio grows rapidly. In this way, bot users become token holders, and token holders become investors.

The project rewards users who use the robot with Banana tokens. When using Banana Gun's robot to trade, users will pay transaction fees (this is a common practice among all robots).

The fees are as follows:

Manual purchase = 0.5%

Auto rush = 1%

In order to motivate loyal robot users, the project will encourage transactions using Banana Gun by returning part of the fees in the form of Banana tokens. The rebate ratio will be calculated according to the following formula:

Banana Cash Back = Fees Paid (USD) * Adjustment Factor X

(The adjustment coefficient X is an adjustable multiplier, taking a value between 0.05 and 1)

Example: John, a short-term trader, likes to conduct speculative and purchasing transactions through Banana Gun. In total, he bought and sold a total of $10,000 worth of tokens in one week with an average fee of 0.75%. Meanwhile, Banana is trading at $10 and has a multiplier of 0.2.

The fee he paid was $75 in ETH

The cashback he received is 75 * 0.2 = 15 USD, which is equivalent to receiving 1.5 Banana tokens

This means he can get paid for the tokens he originally intended to buy.

3.7.4 Token model value capture

The goal of the token model is to promote the positive cycle of the token economy and maintain a low-inflation model. Through measures such as buyback mechanisms, adjustable coefficients, and revenue sharing with investors, it aims to balance supply and demand, control the inflation rate, and ensure the sustainability of the token economy. This can minimize the impact of selling pressure on the token price and promote the active participation and investment of token holders, as follows:

1) Buyback via 1% treasury tax: In all cases, this offsets most of the inflation.

2) Adjustable coefficient: Project parties can use this control lever to accurately balance issuance.

3) Ape-to-earn will bring higher robot trading volume, thus forming a virtuous cycle.

4) A high proportion of revenue sharing for tokens, so investors will be more inclined to hold tokens

The deflation/inflation range will be between -30%/+30% and will be affected by three main factors:

• Token price

• Robot trading volume

• Total transaction volume

4. Preliminary value assessment

4.1 Core issues

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

The Banana Gun project has a solid competitive advantage, which is mainly due to the following factors:

1) Resource advantages: Banana Gun successfully attracted the participation and use of a large number of users in its early stages, thus establishing a large and active user base. This creates economies of scale and network effects for Banana Gun, making it take a long time for other non-leading competitors to catch up.

2) Marketing strategy: The Banana Gun project has implemented a successful strategy in marketing. By adopting effective marketing strategies and channels, Banana Gun has successfully attracted more user attention and engagement. This superior marketing capability helps increase brand awareness and user recognition, giving it a competitive advantage.

3) Market share: Banana Gun has occupied a certain market share, which shows that Banana Gun has established a certain influence in the market. Compared with competitors who have recently entered the market, they have a relatively solid position and have increased user loyalty and market share.

However, it should be noted that market competition is an ever-changing environment, and competitors are constantly developing and improving. In order to maintain a competitive advantage, the Banana Gun project needs to continue to innovate, improve user experience, and maintain close interaction and feedback mechanisms with users. This can continuously meet user needs and maintain continued growth of competitive advantage.

What are the main operational variables of the project? Is this factor easy to quantify and measure?

The main operational variables of the Banana Gun project include the following aspects:

1) User growth: User growth is a key variable factor and can be measured by counting the number of registered users, active users, paying users, etc.

2) User retention: User retention rate is a measure of user loyalty and stickiness, which can be quantified by tracking user activity and repurchase rates.

3) Revenue and profitability: Revenue and profitability are important indicators for measuring project sustainability. Sales, net profit, and more can be tracked to measure revenue and profitability.

4) User satisfaction: User satisfaction is a key indicator to understand how satisfied users are with products and services. User satisfaction can be measured quantitatively or qualitatively through questionnaires, user feedback, reviews, etc.

5) Market share: Market share is an indicator that measures the status and influence of a project in the entire market. Market share can be measured through market research, competitive comparison and other methods.

These variable factors can be quantified and measured to a certain extent. These factors can be evaluated and compared by collecting and analyzing relevant data. However, some factors, such as user satisfaction, may be more subjective and require qualitative methods to be measured and understood. In addition, appropriate measures and indicators need to be set based on the specific circumstances and objectives of the project to ensure accuracy and comparability.

4.2 Valuation level

1) Before the token is launched:

Since pre-sales account for 20% and the maximum pre-sale amount is 800E, as of September 14, 2023, the price of Ethereum is US$1,621, so based on this ratio, according to the information provided, the valuation of Banana Gun can be calculated as follows Calculated:

Maximum pre-sale amount: 800E

Ethereum price: $1,621 (2023.9.14)

Pre-sale ratio: 20%

Valuation = Maximum pre-sale amount x Ethereum price/pre-sale ratio

Valuation = 800Ex $1621/20% = $6,484,000

Therefore, based on these parameters, Banana Gun is valued at approximately $6,484,000. This is an estimate based on the data and calculation methods provided, and actual valuations may be affected by a variety of factors.

2) After the token is launched

As of September 17, 2023, the current token price is $8.493, and the FDV (fully diluted market value) is $84,929,995. Therefore, the current FDV of the project has exceeded $84 million, and the valuation is approximately 12 times the pre-launch valuation.

4.3 Main risks

1) Security risks: The project requires users to provide private keys. Although a seed phrase is not required, there are still security risks. The private key is sensitive information of the user's wallet. Once leaked or accidentally operated, it may lead to the loss of assets. Therefore, users need to pay special attention to protecting private keys and ensure that necessary security measures are taken when interacting with projects.

2) Token economic model risk: The project’s token pre-sale accounts for 20% of the total supply, which may lead to greater selling pressure. If a large number of token holders sell off in the market, it could have a negative impact on the token price. Investors need to consider this factor carefully and understand token supply and distribution.

3) Professional level of the development team: The project's development team may have problems, including code errors, etc. Vulnerabilities occurred in the early stages of the token's launch, which indicates that there are certain deficiencies in the technical capabilities and professionalism of the development team. Users need to conduct due diligence on the team behind the project and evaluate its development and management capabilities.

5. References

1.https://docs.Bananagun.io/ official website

2. https://twitter.com/BananaGunBot Official Twitter

3. https://www.coingecko.com/en Coingecko

4.https://Unibot.app/ Unibot official website

5. https://docs.maestrobots.com/faq/smart-rug-auto-sell maestro official website

6.https://www-telegram.org/318 Telegram usage report

7. https://www.web3sj.com/news/81503/ The popular Unibot and Telegram Bot tracks

8.https://dune.com/whale_hunter/dex-trading-bot-wars Dune data

9.https://dune.com/whale_hunter/banana-gun-bot Dune data