Written by: ZK

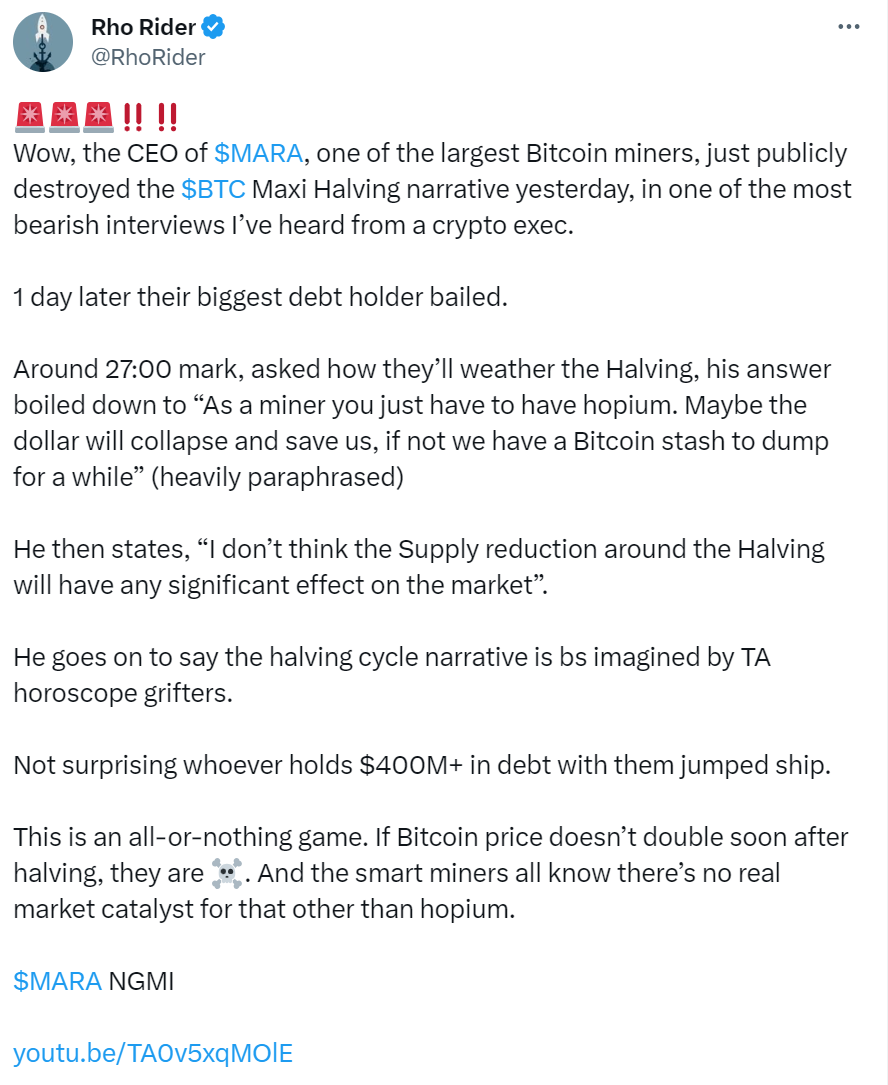

Fred Thiel, CEO of Marathon Digital Holdings, one of the largest Bitcoin mining companies, publicly stated in an interview that自己不认为存在比特币减半牛市,称其为“幻想”

Marathon Digital Holdings is one of the largest, most energy-efficient and technologically advanced Bitcoin mining companies and one of the largest Bitcoin holders among North American public companies, founded in February 2010.

Bitcoin Halving and Miners’ Departure and Retention

On September 6, Marathon Digital Holdings CEO Fred Thiel participated in Brave New Coin’s online interview show. When asked how miners would survive the halving, Fred Thiel said: “我们没有无法控制比特币价格、无法控制全球挖矿算力,我们只能关注于自身的挖矿效率、收入支出情况。我们持有约39000枚比特币,100万美元现金,如果减半后价格没有大的改善,我们会持续的抛售所获得的比特币,直到2026年。如果价格像前两次减半一样上涨,那么对我们矿工来说是很有利的。但我认为这不会发生,比特币的交易价格和流动性周期的关系更紧密,而不是减半。也许美元会崩溃并拯救我们,否则我们就会将比特币储备抛售一段时间。”

“区块奖励从9个变成4个不会对交易市场有多么大的影响。但可以预见的是,如果价格没有上涨,那么很多矿工会因为收支不平衡而退出挖矿,从而导致算力下跌,在那个时候,挖矿的效率是最为重要的因素。未来10年,比特币将要经历两轮减半,挖矿收益会下降到不足2BTC每区块,我期望比特币能够在这期间获得更多的人采用,从而提升比特币的交易手续费收入。”

Fred Thiel’s statement largely represents the perspective of miners:如果没有利益,矿工就会被迫抛售、离开比特币。

This also hints at another situation that will be faced.如果出现了效益更高的机会,矿工也会离开比特币网络而去往收益更高的地方, such as Ethereum .

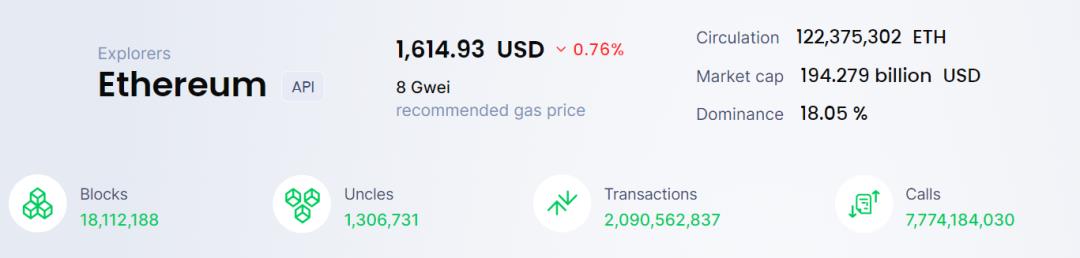

Bitcoin appeared nearly 8 years earlier than Ethereum, but the number of transactions on the chain is less than half that of Ethereum.

What level of revenue are we talking about?

Running an Ethereum validator requires staking 32 ETH. With the help of various staking applications such as Lido, the cost of the validator operator can be reduced to 1 ETH. Plus the hardware cost of running the software, the currency-based yield can Reach 5% to 20%. On the other hand, the reduction in the cost of validators will also improve the decentralization of the network.

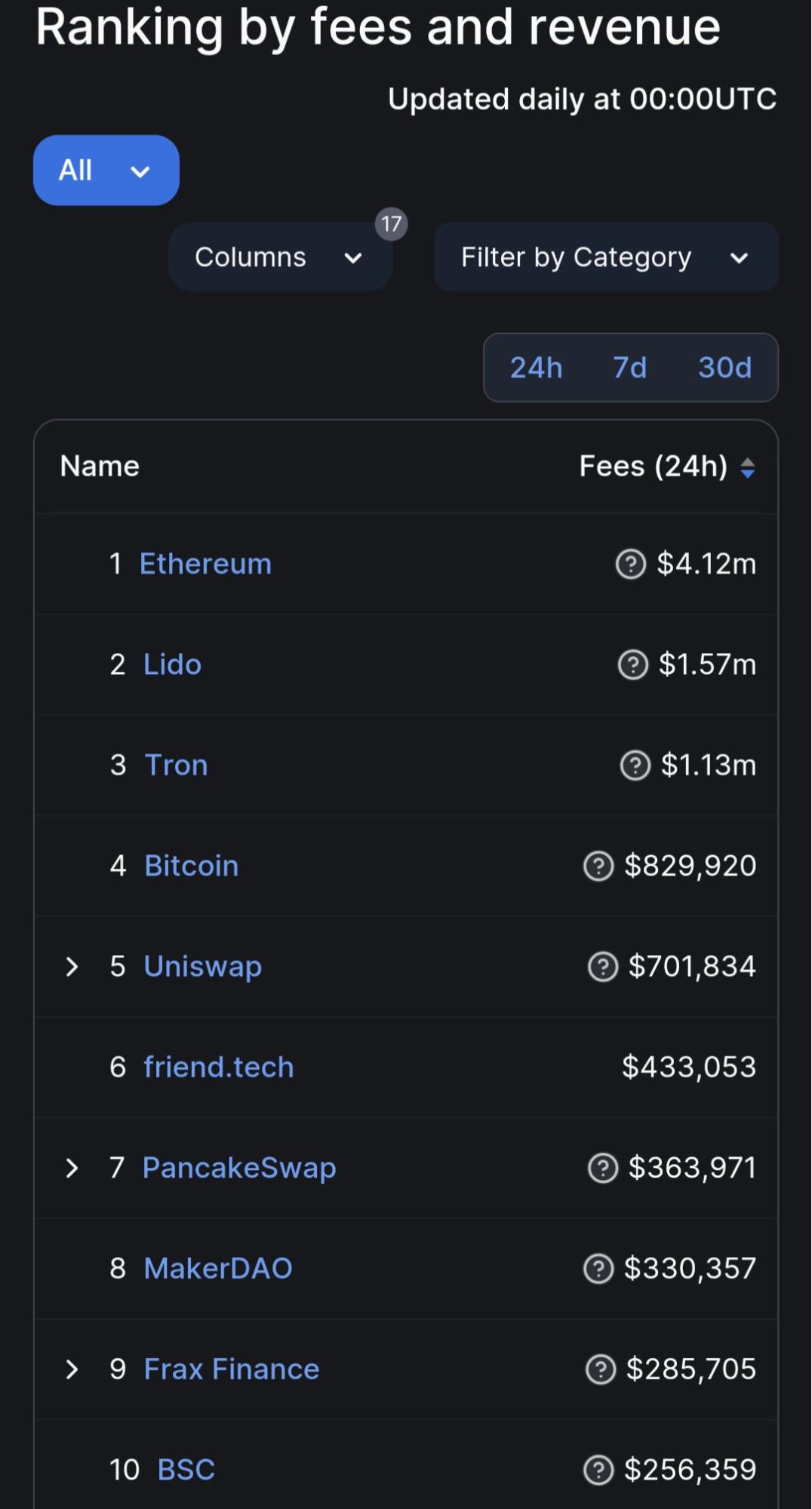

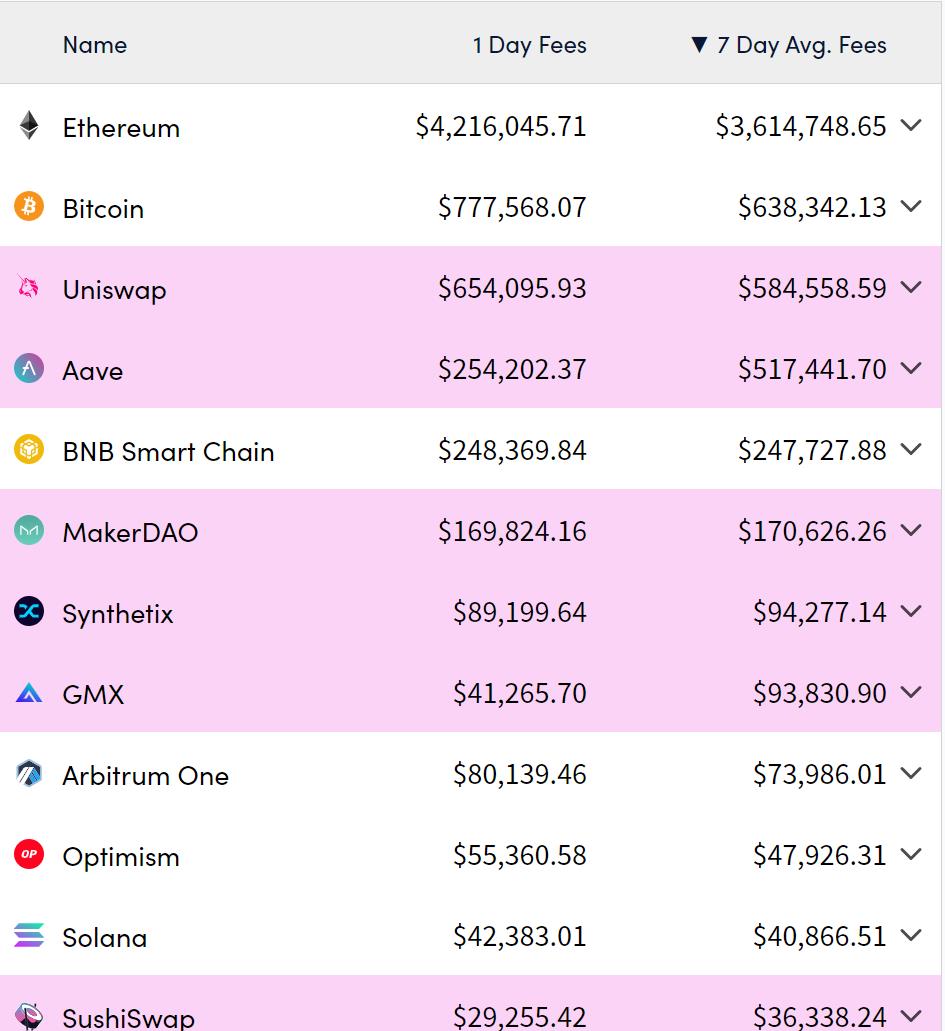

The American exchange Coinbase uses the OP Stack technology of Ethereum Layer 2 Optimisitc to build a Base chain. Friend tech产生的交易手续费,就大于整个比特币网络的交易手续费.

More comparisons can be seen at https://cryptofees.info/ . The income of the Ethereum ecosystem is much higher than that of Bitcoin.

基于比特币的交易太少了,还被CEX、闪电网络分走了很大部分. On the opposite side of the booming Ethereum ecosystem, Bitcoin miners are about to face a halving of profits. On the one hand, there is low investment and high returns, and on the other hand, high investment is accompanied by declining returns. It is difficult to prevent miners from being shaken after seeing such a comparison of data.

While users in the crypto world are anticipating the Bitcoin halving,矿工却只能指望美元崩溃来拯救他们. It’s ironic that instead of making itself better, decentralized cryptocurrencies are waiting for their enemies to weaken themselves .

Bitcoin is the best Layer 1

Bitcoin is not hopeless. In this interview, Fred Thiel also expressed this view: “我认为比特币是最好的Layer 1,在它之上能够建立起各种非常有趣的应用。”

This is also another common idea among miners:基于比特币的交易增多,而矿工自身要做的事情依旧是挖矿、验证交易.

Bitcoin is the best Layer 1. There should be a premise here, that is, it must be the most secure network in order to become the final settler. The security of the Bitcoin network is directly proportional to the network's computing power and the benefits it can bring to miners. Scaling Bitcoin is the only solution to this problem.

网络扩容——矿工收益提升——更多的矿工加入——网络安全提高——使用者增多——矿工收益提升

Just like the need to ensure network security, the expansion route cannot be large blocks and other horizontal expansion methods similar to Web 2's continuous increase of servers. They will lead to a significant increase in the cost of running Bitcoin software, thereby affecting the security of Bitcoin.

Where there is Layer 1, there will be Layer 2. The vertical and hierarchical expansion method is an effective way to solve the Blockchain Trilemma of blockchain: Layer 1保证安全性与去中心化程度,Layer 2提供高度的可拓展性和强性能,提供维持网络安全的经济动力

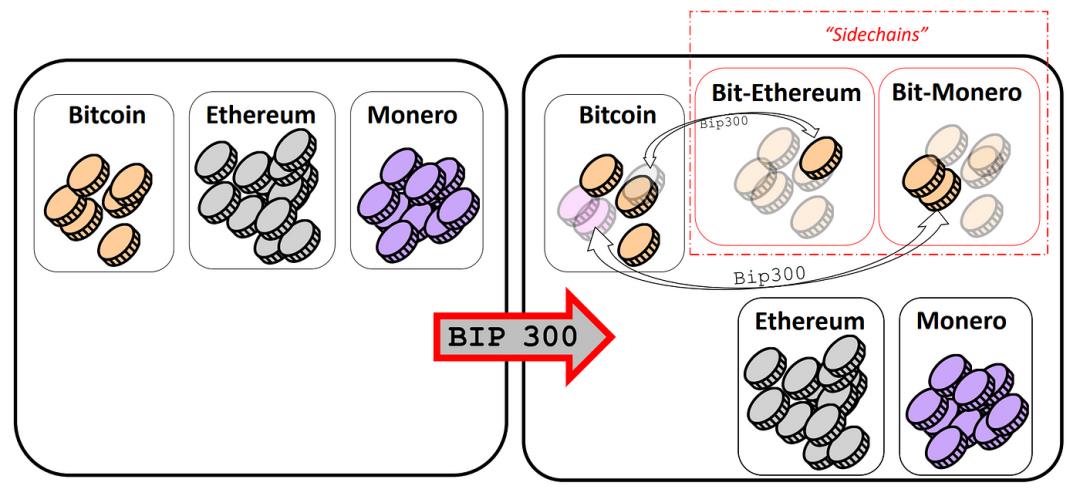

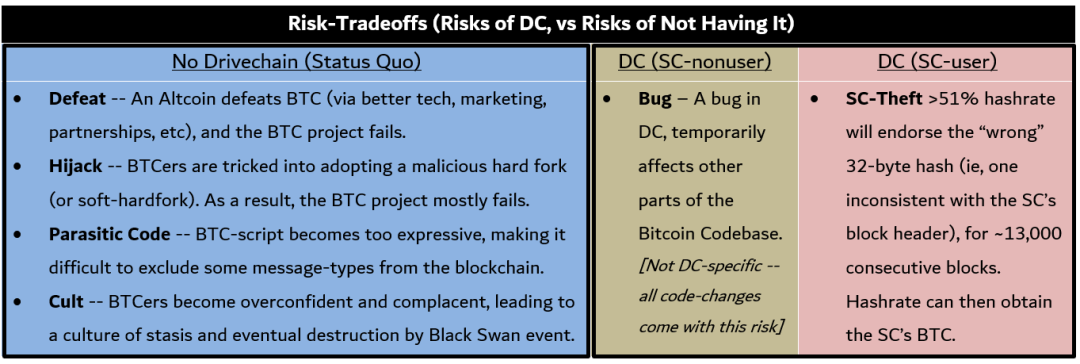

Based on BIP-300/301, DriveChain is able to mine the value of Bitcoin as the best Layer 1. Satoshi Nakamoto also designed such a function in 2010. The merged mining design is a recognition of the existence of side chains.

Bitcoin is the best Layer 1, and expansion through layering and side chains is an ecosystem that benefits from both prosperity and loss.

DriveChain unlocks Bitcoin’s value

DriveChain uses a safe and simple way to achieve layered expansion of Bitcoin to meet the needs of all parties.

DriveChain provides developers with the opportunity to take advantage of the powerful value and effect of Bitcoin, achieve their goals at extremely low cost, and have completely independent design space.

For Bitcoin holders, DriveChain can bring more use value and value-added opportunities, allowing Bitcoin to fully utilize its properties as a currency and asset.

Bitcoin miners will receive considerable and continuous income in the prosperous Bitcoin side chain ecosystem, and the Bitcoin network will continue to operate healthily.

We must realize that Bitcoin’s network effects are a double-edged sword. After the success of Bitcoin, Maxium users became famous for their religious piety and fanaticism.这种狂热造就了强大的网络效应,也蒙蔽了其中一些人的眼睛: holders seemed to be under the long-term influence of the strong network effect. There is a sense of contempt for everything and a sense of superiority that Bitcoin is impeccable.

Compared with miners who check Bitcoin usage data every day, their perception is lagging behind. Regarding the problems that Bitcoin is about to face, they believe that nothing needs to be changed, and that everything will change from big to small under the influence of network effects. However, Hua Wu lacks the sense of urgency and motivation to make changes. Therefore, they are afraid of change and fear that mistakes will affect their network reputation.

And when innovation encounters network effects, its role and value will expand rapidly. It is like suppressed desires have been released, and energy spurts out. The value of the Bitcoin network should be used correctly.