1. Introduction

After reviewing the technical solutions, token values, and ecosystem landscapes of CP and Layer 2 Stacks, we provided some perspectives on choosing between them based on their technical characteristics and current ecosystem empowerment.

This allows developers and projects to select the approach that best fits their needs.

Subjectively, how does the community currently view the rising star Layer 2 Stacks? And how should the various Layer 2 develop their own omnichain networks? In this article, I will focus the discussion on these two aspects.

2. Industry Perspective

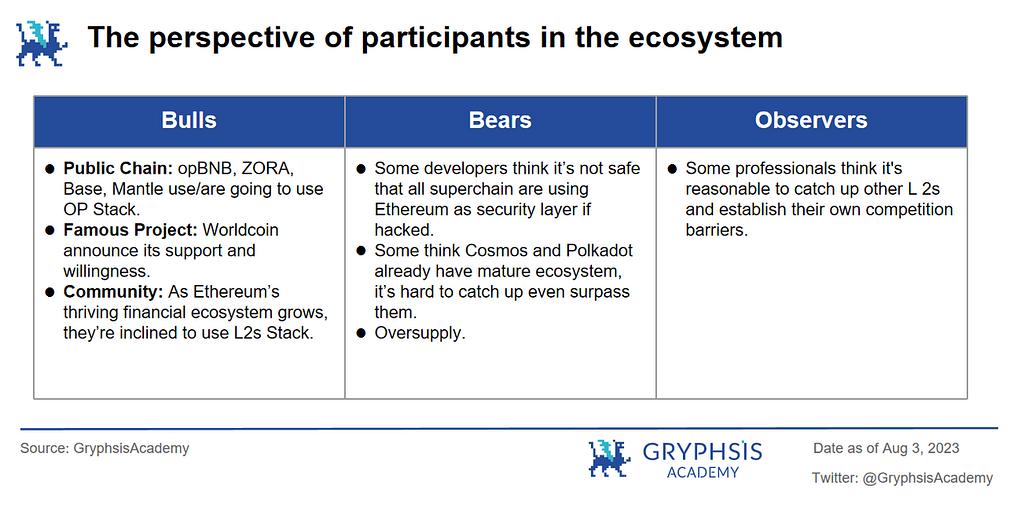

We’ve gathered insights from within the industry regarding the Layer 2 Stacks solutions and have categorized these views into three groups: Bull, Bear, and Observers.

2.1 Bulls

- Public Chains: Chains such as opBNB, ZORA, Base, Mantle, and others have announced deployments to OP Stack. Notably, BNB voiced its support for OP Stack as early as February this year and introduced its own opBNB. One and a half months after the testnet’s release, there have been more than 7 million transactions, 435,972 addresses, and over 40 Dapps deployed, receiving support from prominent projects like iZUMi Finance, Math Wallet, and BaBYGODE. This indicates a high level of community and developer acceptance for opBNB.

- Project Parties: Taking Worldcoin as an example, in May of this year, they expressed their intention to deploy Worldcoin and World App to the OP mainnet, which was implemented on the OP superchain in July. Worldcoin’s goal of creating a global identity and DID system aligns with OP superchain’s capabilities, allowing users to manage their identity IDs freely. Moreover, on August 11th, Debank announced its intention to launch a dedicated asset social Layer 2 chain on OP Stack. As a seasoned brand in the data asset service industry for over 5 years, this move underscores the eagerness of projects to deploy Layer 2 solutions, and the preference for OP Stack.

- Community: The Ethereum community holds a high degree of consensus and approval. Ethereum is fundamentally a financial superchain with a rich application scenario. Deploying Layer 2 on Ethereum will likely have stronger community awareness compared to ecosystems like Cosmos & Polkadot. Many believe Layer 2, with their full consensus layer, will grow much faster than CP, rapidly advancing the development of a superchain ecosystem.

2.2 Bears

- Developers: Some argue that relying solely on Ethereum for all superchain consensus layers is too risky. Should Ethereum face a malfunction or attack, all superchains would be affected. In comparison, CP seems more thoughtful regarding security. Cosmos allows for customized validators and security checks for individual chains, minimizing risk across the ecosystem. Polkadot offers more choices, letting chains share security with a relay chain or customize their own, further decentralizing risk. Clearly, the current Layer 2 Stacks should explore more security solutions.

- Projects: There might be an oversupply in the Layer 2 Stacks superchain network. For many projects, the difference isn’t significant as it’s fundamentally still Ethereum. Some project parties believe that the industry requires Layer 1 (like CP) and that not every chain is suitable for Layer 2.

- Community: As an Ethereum scaling solution, Layer 2 may struggle to function independently of Ethereum in the short term. Balancing the economic model between ETH and native tokens is challenging. Compared to the established Cosmos and the market-cap-rich Polkadot, Layer 2 might lack the necessary community-driven momentum to compete.

2.3 Observers

- Some developers suggest that Layer 2 Stacks initiatives aim primarily to attract more developers to their ecosystems. After major Layer 2 like OP and Arb announced their superchain intentions, the moves to accommodate market trends are somewhat understandable. Layer 2 inherently processes and packages transactions (execution layer), so recursive compression from superchains (L3) to Layer 2 could significantly increase throughput. However, hastily pursuing trends without evaluating the current chain ecosystem and economic incentives might be premature.

The author believes that given the current situation, the Stack solution, especially the OP Stack, is promising. With backing from top exchanges and renowned Web2 giants, projects like BNB, Base, ZORA, Mantle, Worldcoin, and Debank position OP Stack at the forefront of Layer 2, potentially making it the go-to solution for major projects. The market and industry’s logic for the Layer 2 Stacks seems validated, and its practical applications are evident.

However, in the long run, the Ethereum ecosystem built collaboratively with Layer 2 will thrive. Within this ecosystem, challenges persist. Questions on how Layer 2 will navigate their relationship with Ethereum, capture value from their multichain system, establish competitive barriers, or co-create Layer 2 superchain networks with other Layer 2, will heavily influence Layer 2 future direction.

3. How Can Layer 2 Develop Their Stack Networks?

3.1 Technical Optimization

In the traditional development journey of public blockchains, the “impossible triangle” conundrum exists scalability, security, and decentralization. The emergence of Layer-2 solutions has alleviated scalability issues, and the respective introduction of Stack solutions by Layer 2 primarily aims at creating layer-2 networks, addressing the scalability of most underlying infrastructures. Apart from this, what challenges might emerge in the development of Layer 2 Stacks solutions?

(1) Structural Security

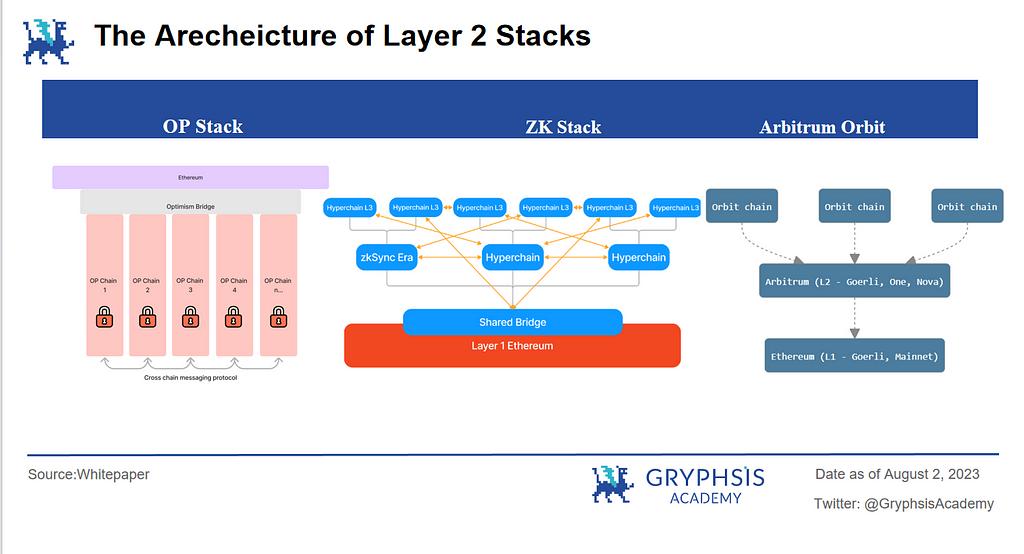

The emergence of Layer 2 structures undoubtedly adds complexity to the Layer 2 ecosystem. Can the Stack framework of Layer 2 support concurrent application chains of various types? We have conducted a structural analysis of the already released Stack frameworks of Optimism, zkSync, and Arbitrum.

OP Stack uses shared cross-chain bridges for asset transfer, and all OP Chains (1-n) created using the Stack solution are on par with the OP Mainnet. The underlying structure of ZK Stack & Arbitrum is similar, but they support the issuance of L3 and L4, forming a scalable hyperchain network. Polygon 2.0 (as a sidechain, not listed in the table) uses Ethereum as the staking layer, and the current Polygon zkEVM blockchain operates in parallel with the hyperchain, sharing an interoperable layer.

Their structural frameworks are similar, and they all face the same kind of issues, namely: all hyperchains rely on Ethereum as the underlying secure consensus, so if Ethereum were to come under attack, would the hyperchains remain secure? In terms of coordination among hyperchains, Layer 2 primarily rely on shared communication bridges, so how should issues with these bridges be resolved? For such single-point-of-failure scenarios, Layer 2 should consider adopting multiple alternative solutions or directly optimizing their frameworks to address these concerns.

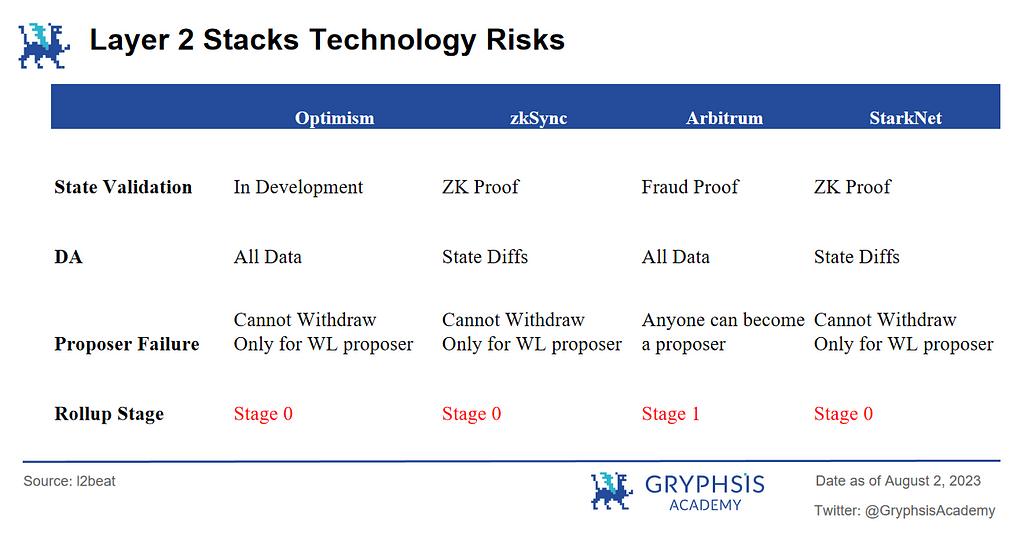

(2) Risk Assessment

While the security of Ethereum is unquestionably high, the ability of Layer 2 solutions to inherit the same level of security is a matter of concern. For Layer 2, primarily using Rollup technology, their most crucial function is transitioning “execution” operations to the layer 2 chain. However, when users initiate transactions on the Layer 2 chain, although costs are significantly reduced, can the security be guaranteed? Are there corresponding fail-safe mechanisms in place to protect user assets promptly?

In this regard, we have compiled several key metrics from the l2beat website to assess the risk factors of current Layer 2 Stacks:

- State Validation: State validation refers to the mechanism Layer 2 use to verify the correctness of transactions. From the table, it’s evident that Optimism, as the first user of OP Rollup, is still in the early stages of developing its verification mechanism. In contrast, Arbitrum has implemented a fraud proof mechanism for validation, and its Rollup Stage has progressed further than Optimism. In terms of transaction security and correctness, Arbitrum appears to have an advantage. Additionally, both zkSync and StarkNet employ ZK Proofs, and their Rollup Stages are at a similar stage of development.

- DA (Data Availability): Data availability is defined differently by various sources. For analysis, we will consider l2beat’s interpretation, which defines it as the requirement to publicly disclose the correctness of state transitions. There’s no need to broadcast complete transaction data, which could infringe on user privacy. Furthermore, all this data must be on-chain, allowing those capable of verifying “state transitions” to do so on-chain. From the table, it’s evident that the current data of these Layer 2 is on-chain. OP Rollup, for example, uploads all data related to transactions to Layer 1. In contrast, ZK Rollup chains only send “state variables” on-chain, significantly reducing transaction costs and blockchain congestion.

- Proposer Failure: Proposer failure refers to a situation where a node/proposer fails to complete a task due to various reasons. This can lead to network errors or interruptions and may cause transactions to fail, resulting in the loss of node data. As a consequence, users may be unable to withdraw their assets from Layer 2 to Layer 1, commonly referred to as the “exit mechanism.” Currently, none of the Layer 2 solutions on the market have fully implemented an exit mechanism. As seen in the table, all Layer 2 are Whitelist Proposers, meaning only they have the authority to submit the Layer 2 state root to Layer 1. Consequently, if they were to be attacked, users would be left powerless, and their assets could be frozen. Arbitrum has a slight advantage in that it allows anyone to apply as a Proposer approximately one week after discovering the inactivity or failure of a node/proposer. This mechanism does provide some level of protection. However, the Whitelist Proposer mechanism is essentially a closed system, contradicting the decentralized and open nature of blockchain. While users can apply to become Proposers, the process still has a relatively high technical barrier, requiring users to have basic equipment to become nodes/ proposers. Furthermore, this approach hasn’t been widely applied in the market, and there are no corresponding incentive mechanisms for these Proposers. Therefore, when considering the overall picture, the asset exit mechanisms of current Layer 2 are not yet sufficiently robust.

- Rollup Stage: Stage2 represents the endpoint for inheriting security in all Layer 2. Currently, Arbitrum appears to be the most secure, with the most comprehensive risk mechanisms. Considering its upcoming BOLD mechanism, a new permissionless validation solution designed to strengthen its dispute protocol against a form of denial-of-service attack called “delay attack,” Arbitrum’s security measures may become even more decentralized.

(3) Inter-Chain Security:

Considering the OP Stack example, aiming to offer a unified modular framework for seamless communication between layer-2 chains. The modular architecture facilitates the development of individualized layer-2 chains, yet it also opens the door for any developer to create and manage modules. This ability, while offering flexibility, raises the question of managing security between different chains when each chain could potentially follow its own set of rules. As the Stack evolves, how can inter-chain security be maintained?

(4) Cross-Chain Coordination:

As Gavin Wood, the founder of Polkadot, suggests, shared chains or bridges for communication essentially create divisions. Although chains can communicate, they are essentially in a single-chain plus bridge configuration. In the context of Layer 2 Stacks, OP, ZK, and Polygon all employ shared cross-chain bridges.

How can seamless communication and interaction between different chains be achieved? Could the current communication frameworks within Layer 2 Stacks also serve as cross-chain protocols or even opportunities for the development of public chains? Here, we present several possibilities:

- Low-Growth Public Chains: Public chains such as Celo and Pantom have lower market capitalization compared to current EVM layer-2 solutions. Integrating their ecosystems into the Stack, leveraging the underlying super-finance chain ETH and a rich set of parallel chains, could bring new growth opportunities, whether in terms of ecosystem collaboration or interaction demands for DApps. Some public chains have already started deploying this approach:

- Celo initiated a proposal in July to transition from an EVM Layer 1 to an OP Stack Layer 2.

- Pontem Network plans to develop a new Layer 2 using OP Stack for the Move VM.

- Highly Cohesive, Low Externally Coupled DApps: Applications like derivative exchanges, GameFi, and Socialfi have complex and frequent internal transactions, with less reliance on external assets or projects. For these applications with lower cross-chain demands but high efficiency in handling internal transactions, the Stack might provide an optimal development environment.

- Cross-Chain Protocols: Notable examples like Owlto Finance, a DeFi protocol for cross-chain interactions on Layer 2 Rollups, currently supports cross-chain interaction across all ETH Layer 2 chains. Another example is Socket Protocol (and its well-known product Bungee), dedicated to developing cross-chain protocol Stack. If deployed on the OP Stack, these protocols could play a crucial role in facilitating asset and information communication among layer-2 chains.

3.2 Ecosystem Incentives

In addition to attracting support from developers and users through technological advancements, Layer 2 can rapidly build their ecosystems using the most direct incentive methods. Taking the current Optimism & Polygon as examples, let’s explore the ways Layer 2 might employ to establish their ecosystems.

- OP Grants: As an ongoing developer incentive program by Optimism, it sponsors developers to create Dapps and tools on the Optimism network. Multiple rounds of grants have already been initiated, with over $30 million invested.

- RetroPGF (Retroactive Public Goods Funding): In March 2023, RetroPGF Round 2 was launched, providing $10 million worth of $OP tokens as incentives for ecological projects. This round primarily focused on rewarding projects in the categories of Tools, Infrastructure, and Education. A total of 195 projects/developers received rewards. In June 2023, RetroPGF Round 3 commenced, offering $30 million worth of $OP tokens to contributors in areas such as OP Stack, Collective Governance, Developer Ecosystem, End User Experience & Adoption, and more.

- OP Warriors Season: Users are rewarded with NFTs for participating in community activities related to ecosystem projects.

- Bridging Summer: On August 3, 2023, the OP officially supported the Socket cross-chain protocol with 400,000 $OP tokens. Any project that undergoes cross-chain bridging during Bridging Summer will receive a certain amount of $OP tokens. For instance, if you perform a cross-chain transfer worth $100U from Polygon to OP and are required to pay a fee of $2.5, you will receive $2.25 worth of $OP tokens in return. Moreover, you can claim this amount every month.

It’s evident that Optimism has been consistently introducing various activities to enrich its ecosystem and attract more users. Not only that, but OP also has a relatively mature incentive mechanism. In the early stages of their grant programs, many projects received sponsorship but then disappeared without fulfilling their promises for OP ecosystem development. Learning from these experiences, OP has been refining the rules in recent grant rounds to ensure that resources are effectively utilized.

OP’s governance mechanisms are becoming more refined, and their incentive projects are becoming more diverse. These lessons and improvements can potentially be applied to future Stack developments, with the only change being a shift from the original “Sapp” to Layer 2-based chains.

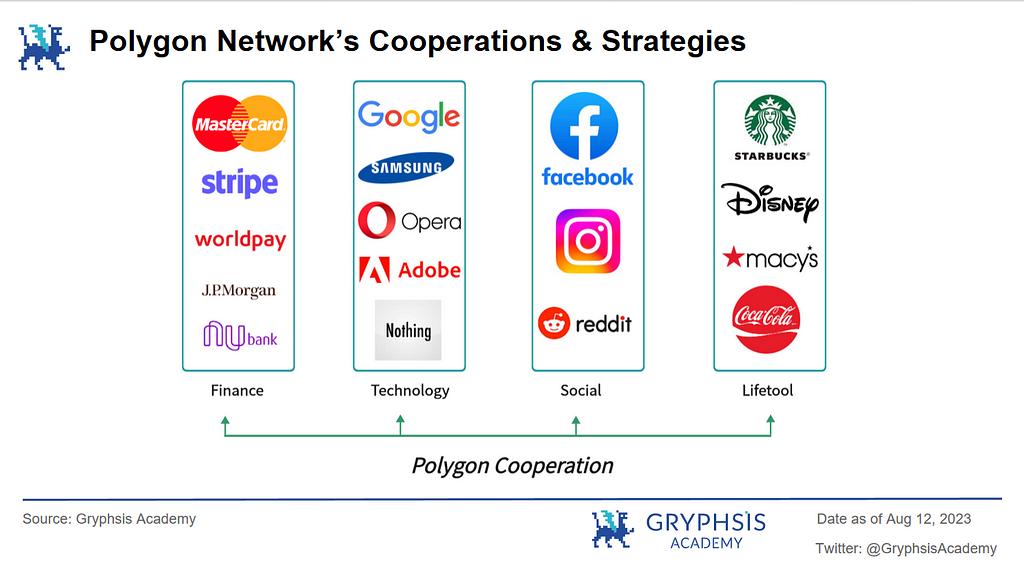

In addition to this, Polygon’s approach to leveraging business partnerships to drive ecosystem growth is also noteworthy:

- Nation: Collaborating with India to issue “caste” certificates on Polygon to prevent fraudulent claims from marginalized groups for government welfare; Partnering with Singapore to facilitate cross-border transactions of digital yen and new Singaporean dollars using Polygon and Aave.

- Finance: Partnering with payment giant MasterCard to launch the MasterCard Artist Accelerator, helping music artists learn how to expand their brand through NFT minting and building online communities; WorldPay, a subsidiary of FIS Group, adding support for Polygon USDC.

- Technology: Collaborating with software giants like Adobe and PS developer to integrate NFTs into their social platform Behance; Google’s BigQuery, a big data analytics service, adding support for Polygon blockchain data; Samsung issuing NFTs wearable in the metaverse platform Decentraland through Polygon.

- Social: Meta’s Facebook and Instagram planning to develop an NFT marketplace based on Polygon, integrated into both platforms, allowing users to create and sell their own NFTs; Reddit launching the NFT series “Collectible Avatars” on Polygon.

- Lifestyle: Starbucks launching the loyalty program “Odyssey” on the Polygon network; Being one of the six companies selected for the “2022 Disney Accelerator Program”; Collaborating with Coca-Cola artists to release 136 NFTs as a tribute to the brand’s 136-year history.

- Gaming, Music, Entertainment, Fashion & Beauty, Sports, Automotive, Celebrities…

This business approach can also be applied to the Polygon 2.0 solution. By aligning their Layer 2 network with enterprises, inviting traditional business institutions to deploy, they can bridge the gap between blockchain and the business world. These partnerships can bring higher quality projects to Polygon 2.0, driving its ecosystem development and creating a positive cycle.

In summary, the collaborations between Polygon and traditional web2 industry giants, in terms of their impact and breadth, have the potential to become the preferred blockchain network for web2 users and global businesses in the next 10 years. If these resources are effectively utilized, they could be potential projects for the future Polygon 2.0 Layer 2 network.

3.3 Token Empowerment

For ZK and OP, which primarily utilize Rollup technology, how should the economic model be designed to enhance the value of the underlying tokens upon launching the Stack solution? Compared to Layer 2 Stacks, CP’s token empowerment faces fewer obstacles.

For example, in Cosmos, even though each chain had its own ecosystem and token in the initial version, $ATOM struggled to find a prominent use case. However, in Cosmos 2.0, the team decided to make $ATOM the gas fee standard for the Hub, allowing custom chains to share security with the Hub. In Polkadot, the current $DOT supports network governance, a treasury, and slot auctions. In the upcoming 2.0 version, the auction model will transition into Coretime’s marketplace.

This contrasts with CP, where ZK and OP are both Ethereum Layer 2 Rollup solutions, aimed at addressing Ethereum Layer 1’s scalability issue. All transactions need to be verified by deploying smart contracts on Layer 1, and confirmed assets are considered true value. Users trust Layer 2 when their assets are confirmed on Layer 1, making Gas payments in ETH.

In other words, Layer 2 serves as an enhancer for Layer 1, aiding in its scalability. Each transaction processed on Layer 2 enhances the credit and value of Layer 1 tokens. Layer 2 can’t truly detach from Layer 1. This is why it’s crucial to determine token distribution for Layer 2 in the vision of a superchain.

Although detailed solutions are lacking, the mentioned EVM Layer 2 hasn’t revealed how their tokens will derive value from the superchain network. However, designing an economic model could consider the following aspects:

(1)Layer 2 Network Governance (Inspired by Polkadot):

While using ETH as the underlying token base for the ecosystem is inevitable, leveraging the native tokens of Layer 2 at the network governance level enjoys higher acceptance.

- To participate in the Stack ecosystem, superchains must hold a certain amount of native tokens.

- Token holders can engage in network governance, vote, adjust parameters, etc., to empower the tokens.

- Establishment of a governance hub/treasury: This serves as the governing body for the ecosystem, ensuring unified value management while retaining Layer 2 autonomy.

By enabling developers and users to fully engage with the ecosystem, a stronger sense of identity and participation is fostered. This strategy also expands token utility within Layer 2 and efficiently mobilizes network participants.

(2) Superchain Fee Distribution (Inspired by Cosmos):

When constructing cross-chain networks on Layer 2, they can adopt Cosmos’ practice of using native tokens for cross-chain fee distribution. Although running smart contracts on Layer 2 still requires using ETH to pay gas fees, fees generated from cross-chain interoperability among superchains could be paid using the native tokens of Layer 2.

For instance, in Cosmos, $ATOM is utilized for paying IBC cross-chain fees and rewarding validators participating in cross-chain validation. This concept can be extended to Layer 2 Stacks, wherein fees for asset transfers across superchains are paid in native tokens; a portion of the cross-chain revenue could be distributed to token stakers. Additionally, the development and validation of cross-chain function modules could be incentivized using these tokens.

This approach preserves the core role of ETH in the Ethereum ecosystem while allowing OP tokens to contribute to governance and value transfer in cross-chain networks. If thoughtfully designed, it could establish a positive incentive mechanism to drive the development of the Optimism cross-chain network.

(3) Renting Model (Inspired by Ethereum):

On August 25th, Base introduced an economic collaboration agreement with OP: Base will offer OP either 2.5% of sequencer revenue or 15% of profits (whichever is greater); in return, OP will provide Base with 2.75% of $OP tokens.

This solution immediately sparked extensive discussions. Based on the circulating supply & price of $OP, it is estimated that the total value of $OP tokens provided to Base is approximately $177 million. Considering Base’s valuation, the 15% profit share equates to around $1.1 billion, meaning OP holds a 15% stake in Base. Even if the 2.5% sequencer fee is used, it is essentially akin to OP receiving rent.

In Ethereum’s history, as a ToB underlying chain, it outsourced other interaction actions to Layer 2, with a portion of the fees generated on Layer 2 given to Layer 2 as execution fees and the remaining portion to Layer 1 for secure settlement, serving as Ethereum’s revenue source. Therefore, OP and Base’s approach could be considered an alternative renting model for Layer 2.

While the likelihood of using Layer 2’s native tokens as gas units for superchains is low, given that ETH remains the consensus token, viewing Layer 2 as Stack’s contractor responsible for network construction, introducing investments, and aiding ecosystem development, with the superchain delivering a portion of the profits, is indeed an attractive profit model, especially for powerful Layer 2 like OP.

(4) Mutual Empowerment with Projects:

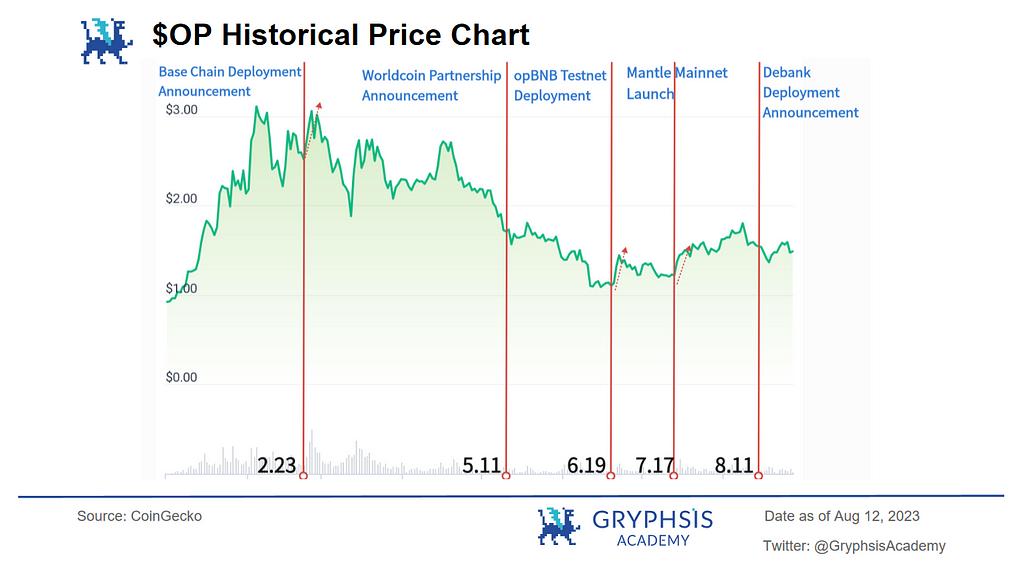

Taking OP Stack as an example, opBNB, ZORA, Base, Mantle, Worldcoin, and Debank have all aligned themselves with OP Stack. Their involvement significantly impacts the price of $OP. Due to time constraints, it’s challenging to visualize daily growth trends. For now, let’s take the price change of $OP on the day when Base announced its deployment as an illustrative case:

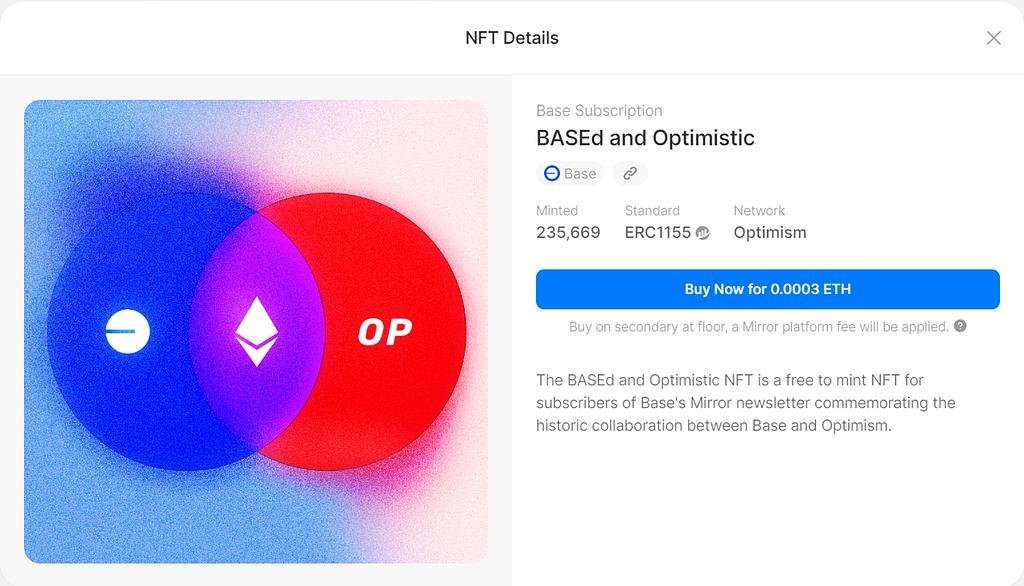

It’s evident that on February 23rd, the price of $OP surged to $3.01 at one point. This surge was most likely triggered by Base’s collaboration NFT announcement on the OP mainnet around 10:30 PM, followed by a rapid increase in price around 11:00 PM, and then a subsequent decline.

Since Binance announced the opBNB concept and with the addition of high-quality projects like Base Protocol, ZORA, Mantle, and Debank to the OP Stack, it’s undeniable that these projects have brought visibility and prestige to OP, attracting more projects to take interest in OP Stack.

For projects planning to deploy on OP Stack, it’s a reasonable choice to purchase and hold $OP tokens. This not only allows them to participate in the ecosystem but also serves as a value investment. $OP is poised to have a significant role in the future of the cross-chain ecosystem, and holding $OP can grant projects additional rights. Furthermore, since projects and OP are essentially mutually beneficial, as the value of $OP tokens rises with more projects deploying on OP Stack, project teams stand to benefit directly. OP Stack, in turn, actively supports and promotes project teams, providing positive exposure and growth opportunities. This win-win situation encourages more projects to join, creating a positive cycle. In this aspect, OP seems to be setting a positive example.

4. Conclusion

The battle between CP and Layer 2 in the development of multi-chain ecosystems fundamentally aims to improve the infrastructure of blockchain technology. For a blockchain team, developing all aspects of a network, including security, cryptography, and more, is resource-intensive. Optimizing business logic on top of a pre-prepared framework for networks, consensus, communication, and other elements can greatly streamline network development efforts, allowing specialization in specific areas and enhancing interoperability to foster a thriving ecosystem.

However, currently, it seems that CP technology is more mature than Layer 2, but the Layer 2 community is more vibrant. If Layer 2 solutions want to further develop multi-chain networks, they should focus on addressing the technical risks inherent to their own chains.

In addition, there’s an interesting phenomenon where the Ethereum Foundation’s definition of Layer 2 is somewhat vague. The Ethereum official website also states that there is currently no officially certified Layer 2 solution. It’s clear that Ethereum’s stance will influence Layer 2 solutions. From an Layer 1 perspective, Ethereum likely prefers to delegate “execution” to Layer 2 while benefiting from the rent-seeking opportunities. The definition of Layer 2 must align with Ethereum’s interests.

If one day Layer 2 solutions abandon Ethereum and use their tokens to build their own gateways, it remains to be seen how Ethereum will respond.

Whether it’s multi-chain ecosystems like CP (Layer 0/Layer 1) or Layer 2 (Layer 2/Layer 3) Stacks, each has its unique advantages and use cases. Aside from potential operational issues that could lead to the gradual fading of certain solutions, these diverse multi-chain approaches are more likely to coexist and, through different forms of connectivity, ultimately create a fully interconnected multi-chain ecosystem. The future success of projects in this multi-chain landscape will depend on how they manage their operations and adapt to evolving market dynamics.

References

https://medium.com/@eternal1997L

https://tokeneconomy.co/the-state-of-crypto-interoperability-explained-in-pictures-654cfe4cc167

https://research.web3.foundation/Polkadot/overview

https://foresightnews.pro/article/detail/16271

https://messari.io/report/ibc-outside-of-cosmos-the-transport-layer?referrer=all-research

https://stack.optimism.io/docs/understand/explainer/#glossary

https://www.techflowpost.com/article/detail_12231.html

https://gov.optimism.io/t/retroactive-delegate-rewards-season-3/5871

https://wiki.polygon.technology/docs/supernets/get-started/what-are-supernets/

https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

https://era.zksync.io/docs/reference/concepts/hyperscaling.html#what-are-hyperchains

https://medium.com/offchainlabs

Declaration

The present report is an original work of @sldhdhs3, @GryphsisAcademy trainee, under the mentorship of @Zou_Block and @artoriatech. The author(s) alone bear the responsibility for all content, which does not essentially mirror Gryphsis Academy’s views or that of the organization commissioning the report. The editorial content and decisions remain uninfluenced by the readers. Be informed that the author(s) may own the cryptocurrencies mentioned in this report.

This document is exclusively informational and should not be used as a basis for investment decisions. It is highly recommended that you undertake your own research and consult a neutral financial, tax, or legal advisor before making investment decisions. Keep in mind, the past performance of any asset does not guarantee future returns.