Author: Simon, IOSG Ventures

Topics discussed

Why is buying volume so difficult for Web3 games?

Will traffic distribution platforms (e.g. marketplaces, aggregators, social media) continue to control their user attribution engines? Or will the openness and permissionless nature of Web3 data allow third-party attribution protocols to provide more powerful user behavior tracking and user analysis?

What unique attention economy models will Web3 have? What are the ways to combine it with advertising?

Part1: UA for Web3 Games

Traditional game UA/marketing experts should be familiar with the following calculations:

The 180-day LTV (Life-Time Value) of an IOS user is $5, our CAC (Customer Acquisition Cost) on Facebook in North America is $4, and the daily consumption is 80k. Mathematically, this is a course that can achieve "positive ROI" (Return of Investment) Business?

Traditional mobile app purchases are more like science than art, and every step of the process is quantifiable. Marketers and UA experts can enter the above information into a long-used table and then predict the LTV-to-CAC relationship to predict whether the business model of a certain mobile application/game is profitable.

However, if we want to obtain users so accurately, we need to deeply understand the users.

In the context of traditional games, users are relatively easy to identify and gain insight into – they can often be traced back to a specific mobile device. Therefore, even if there is still some error (such as a user using multiple devices at the same time), we can still link a certain mobile device to a series of in-game and out-of-game behaviors. This can help UA experts identify the channels through which these users enter our games, calculate the ROI of each channel, and adjust the corresponding delivery strategy.

However, in the world of Web3, we can no longer take it for granted that we can track and attribute user behavior.

While games distributed in traditional ways (app stores, PC game platforms, console game stores) enjoy the mature data pipeline of traditional distribution channels, and publishers have full insight into user behavior and preferences, wallet tracking and platform policies give web3 User acquisition for games presents many challenges.

1. Wallet attribution

Because Web3 games require wallet connections, game companies need to be able to directly target wallets to specific players. However, in the web3 world, wallets often do not correspond to specific users one-to-one.

Additionally, the contents of any given wallet change over time - NFTs and other tokens may be traded in and out at any time, asset values may fluctuate, and some assets may not even belong to the wallet holder at all. This makes it very difficult to correctly estimate LTV based on wallet contents alone.

Wallets also obscure a user’s real-life identity, making it more difficult to effectively target ads. Some wallets may not be operated by humans at all, but by bots or AI. Bot-controlled wallets may even have negative LTV, as bots tend to be economy withdrawal machines in Web3 games.

Correspondingly, this problem also gives opportunities for wallet profiling projects such as Thirdwave and Slise to enter. These projects rely on algorithms or manual indexing to sort out information on the chain and find the user portraits behind the wallet, laying a solid foundation for targeted advertising.

2. Platform policy

Traditional game distribution platforms are limited by the sharing models of Google and Apple, and their attitude towards Web3 games has always been very hesitant and ambiguous. Now any purchase of NFT on ios and Android devices must go through IAP (In APP purchase). While Google and Apple continue to get 30% of the pie, the use scenarios of NFT are also greatly restricted.

Although console developers are quietly promoting investment and research and development of Web3 games, they are still very cautious in their external attitude.

On the computer side, both Steam and Epic are very secretive about blockchain, while the other welcomes it with open arms.

But in general, various uncertainties and the lack of distribution infrastructure (including the lack of Web2 distribution infrastructure interface & the lack of Web3 local distribution infrastructure) lead Web3 game projects to often choose the easier path - making a game based on Web-based game.

Although games on the web are adapted to the current level of infrastructure development, the lack of user data accumulation makes the cost-per-install metric mentioned above useless on the web. Even if the user's source channel can be identified by tracking the wallet, players can easily link/unlink the wallet. It is difficult to determine whether a user has been "acquired" by an application, or whether the person just linked the wallet casually for curiosity. look.

1. If we cannot calculate LTV relatively accurately,

2. If we cannot trace back the CAC relatively accurately,

3. Can Web3 really buy volume scientifically?

Not to mention that purchasing volume in Web2 has reached a bottleneck due to Apple's privacy policy, and the price of volume is also rising day by day.

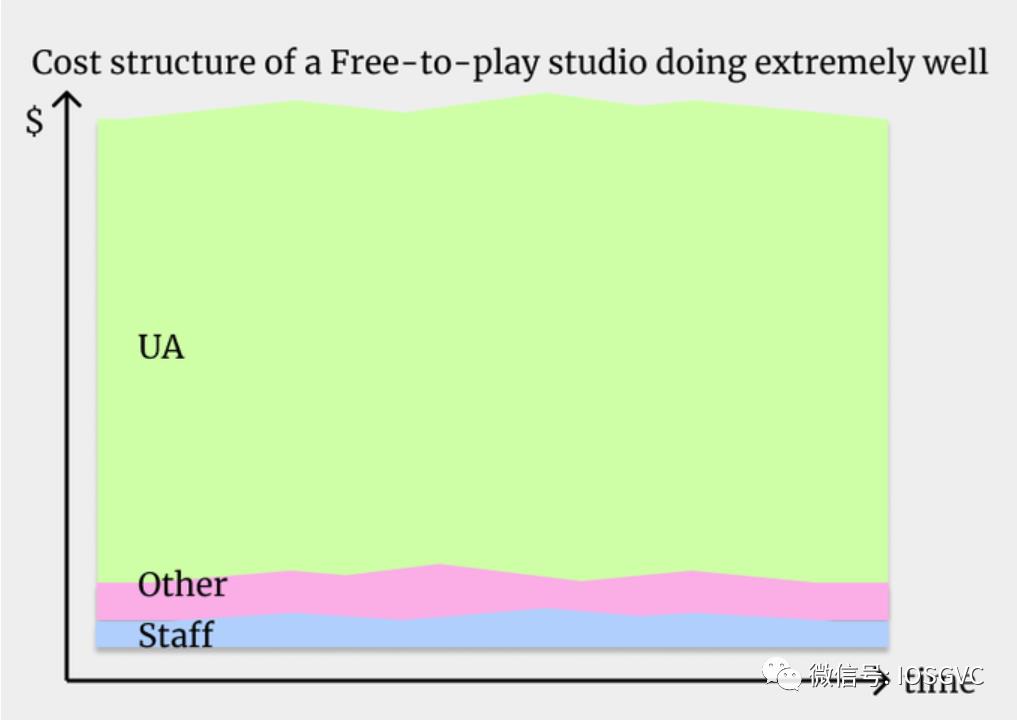

Source: Joakim Achren / Twitter

If a Web3 game aims to achieve mass adoption, it will face challenges such as user entry, traffic source tracking, LTV tracking, and platform policies. Compared with those Web2 counterparts that have many years of historical UA data and clear and quantifiable standards for every link of the funnel, they are at an absolute disadvantage.

Therefore, traditional performance marketing is often a bad option for most early-stage and capital-rich Web3 Native projects, or for projects with only a small amount of Web3 Inergration.

From a traditional gaming industry perspective, these may be a huge challenge for gaming startups. However, at the same time, Web3 also provides a series of unique, Web3 Native user acquisition solutions.

Part 2: Crypto Native Ads Stack

In the world of Web3, the use of advertising as a business model has always been controversial.

For many consumers, advertising always evokes negative associations. Web2 giants use massive amounts of user data to present advertisements to consumers in the form of Super Targeting. Users often lack the ability to actively choose when faced with advertisements. On the other hand, most smaller individual creators are unable to convert advertising into stable income and turn to subscriptions.

But objectively speaking, advertising combines the goal of product distribution with a stable revenue stream, making it one of the best profit models in business history.

That’s why social media giants and search engines subsidize their platforms with ads, while top content creators on platforms like Substack and Spotify make money with ads instead of subscriptions.

But the openness of Web3 breaks the traditional platform business model - this model relies on relatively closed user data and strong lock-in between users and the platform. We might as well define the Web3 advertising stack in the context of data openness, then the core components include advertisers, advertising protocols, markets, and applications.

Web3 ads do not have to have a one-to-one correspondence with their Web2 ad stack. While all components in the stack are critical to Web3 native ads, we can focus on the basic unit of the ad stack—the ads themselves.

Potential Web3 advertising gameplay

Advertising capitalization: Turn ads into NFT, turn recommendation links into NFT, or use NFT as proof of ownership of advertising space (Ads Space)

Token empowerment: Assetize user attention, use Token transactions and empowerment (attention assets: homepage content, store homepage)

Integrate targeted advertising on and off the chain: Open up user portraits on and off the chain

Advertising capitalization

CryptoSlam made some attempts at this form of advertising a long time ago. CS has sold NFTs that grant owners rights to homepage banner ads. Each NFT ad corresponds to a banner ad on the CryptoSlam homepage on a specific date.

Taking this idea a step further, perhaps CryptoSlam can financialize its advertising into NFTs and create a secondary market for it, which can provide continuous royalty income for CS. Platforms or advertising protocols can also enforce advertising NFT royalties, requiring buyers to pay royalties to obtain advertising placement. Compared with the traditional advertising sales model, the financialized advertising market can better match supply and demand, allowing micro/small advertisers to adapt to appropriate advertising resources.

In addition to NFT advertising, Crypto can also achieve more efficient Pinduoduo new pulls (Referal). Crypto projects also have tools that can be used, such as [ShareMint], which provide on-chain referral links, dynamically reward recommenders, and use tokens for targeted reward programs.

In the music NFT protocol [Sound.xyz] fans can receive 5% of the tokens generated by bloggers through their recommended links and playlists.

As more user behaviors can be transferred to the chain, there will likely be more incentive programs in the future to allow newcomers to create value at different stages of the product marketing life cycle.

Token empowerment

On social/search engines, advertisers pay for additional attention. In Web2, paying for ads with Google allows your website to rank higher in search results. Traffic aggregation sites in Web3 can use tokens as tools to value attention assets.

NFT art platform SuperRare utilizes its RARE Token in several aspects for curation. First of all, SuperRare Token holders have the right to curate and decide which entities or individuals can create SuperRare stores.

In SuperRare, galleries are valuable attention assets because top galleries can get more views and higher sales, in a sense better galleries = better advertising spots.

Taking it a step further, imagine if a user could stake tokens to decide which store appears first on the homepage of that user’s website/marketplace/social app? In this model, the curation token will become a kind of "stream advertising", and a part of the sales revenue on the store and the SuperRare protocol will belong to the token holders.

The interaction between users and advertisers is no longer one-way, and users can decide what types of ads they want to see. This also allows the token to capture additional value and provide revenue sharing to platform stakeholders.

Integrate targeted advertising on and off the chain

Several companies, including Slise and Hypelab, are building protocols focused on user activity tracking. Simply put, they try to link the user's Web3 identity and Web2 identity together to piece together a complete user portrait.

For example, imagine an NFT Marketplace wants to understand the effectiveness of its marketing campaigns; by using a campaign attribution protocol, the marketplace can track whether an individual who clicks on a referral link or Twitter ad 1) actually uses their protocol, and 2) passes through the marketplace Purchase assets.

Looking at the current situation, very few Web3 companies or protocols use advertising as a business model, but the evolution of this field can be predicted to a certain extent.

Although the grand vision of a Web3 native, cross-platform Generalized Ads Protocols sounds exciting, the lack of control over content/attention distribution will become a bottleneck for the large-scale application of such protocols.

In contrast, Apps or Marketplaces that control user distribution and attention may try to control their advertising experience for various reasons, and user tracking engines may be acquired by large Socialfi platforms.

But no matter how the old stories of web2 are repeated in the competitive landscape, this time we can be sure that in web3, where data is relatively open, Attribution Engine, which can integrate real user portraits, can create greater possibilities than Web2 counter parts. The price of Web2 AdSense is US$102 million. What do you think the valuation of Web3 AdSense is?