- Network participants are making economically viable transactions

- MKR Price Prediction: 2,000 USD could be the next target

MKR was one of the cryptocurrencies hardest hit in the market crash caused by TerraUST in May 2022. At the time, Dai was one of the most prominent stablecoins built on algorithmic mechanisms, a trait Chia with the ill-fated UST stablecoin.

Following the systemic price drop, the MakerDAO team took frantic steps to amend the Dai stablecoin collateral mechanism. In fact, it has moved to a hybrid regime, with a mix of large-cap Capital , Collateralized Stablecoin , and US Fed-issued debt instruments now supporting Dai.

On-chain data shows that those efforts have yielded the desired success, as the MKR token deployed in daily transactions is now reaching peaks last seen during the 2021 bull market .

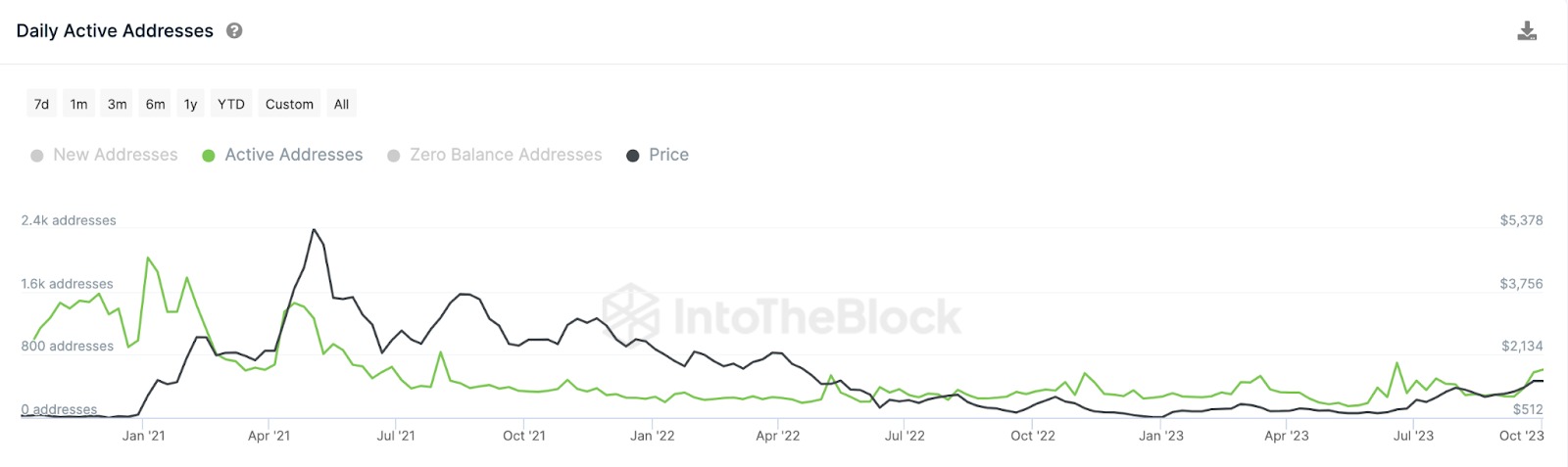

As seen below, Daily Active Addresses MKR reached a 2-month high of 761 on October 2. But more importantly, it has reached the 400 mark for a consecutive week, since September 26.

Notably, this last happened in May 2021 when MKR reached All-Time-High price of $6,290.

MakerDAO's daily active address (MKR). Source: IntoTheBlock

When daily network activity thrives at historical peaks over an extended period of time, as observed above, it indicates healthy growth in the ecosystem.

Going by the historical trend seen in 2021, it is only a matter of time before network participants take the MKR price to new heights.

Network participants are making economically viable transactions

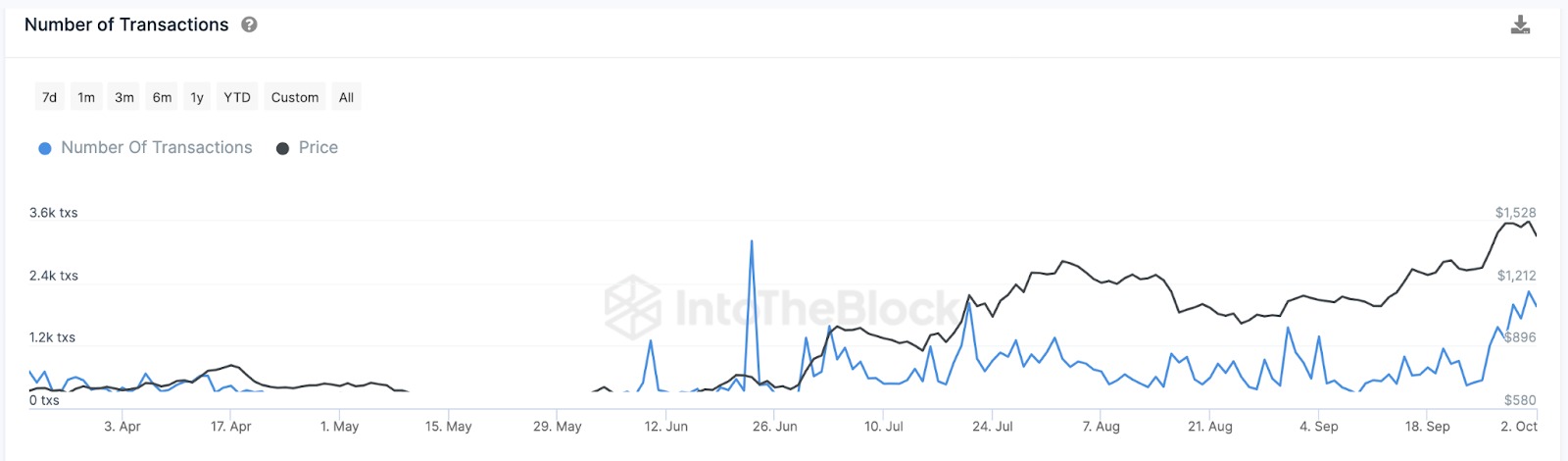

Furthermore, MKR daily transactions have increased about the same in recent weeks. After the US Fed announced an interest rate pause on September 20, the number of daily transactions on the MakerDAO network increased significantly as investors became increasingly confident in the attractive 8% Dai savings rate. .

The chart below shows that the Maker network recorded 2,240 confirmed transactions on October 1. Similar to the amount of Dai, it has continuously recorded a transaction count greater than 1,200 since September 26.

MakerDAO (MKR) Daily Transaction Count. Source: IntoTheBlock

Typically, when daily active Addresses coincide with network demand, it indicates users making economically viable transactions.

Such a consistent increase in network activity means that the underlying native token is now in demand. Unsurprisingly, the Maker Token price saw a 15% price increase between September 25 and October 3.

This therefore confirms predictions that renewed Maker network user engagement rates could push MKR price even higher in the coming weeks.

MKR Price Prediction: 2,000 USD could be the next target

Key on-chain data points analyzed indicate that sentiment around the MakerDAO ecosystem is largely bullish. Therefore, the price is likely to continue to rise towards $2,000 if the bulls remain in control.

The Global In/Out Money Around Price (GIOM) data, which depicts the input price distribution of current MakerDAO network participants, also validates this bullish prediction.

It shows that if MKR price can scale the initial resistance at $1,800, the bulls are likely to fuel a rally above $2,000

As shown below, 7,930 addresses purchased 74,650 MKR Token at an Medium price of $1,813. If they take profits early, they can cause a temporary retracement.

But if network activity intensifies, the price rally could eventually reach a new 2023 high of $2,500.

GIOM data. Source: IntoTheBlock

However, the bears could invalidate this optimistic prediction, should the Maker Token price fall below $1,200. However, as shown above, 9,250 addresses purchased 238,700 MKR Token at a maximum price of $1,199.

If they HODL, MKR can avoid the bearish trend.

But if the bulls cannot defend that critical support, MKR price could decline and eventually slide below $1,200.

VIC Crypto compiled

Related articles:

The reason Bitcoin suddenly turned around and dropped below 28,000

The reason Bitcoin suddenly turned around and dropped below 28,000

New update from Ripple lawsuit causes XRP to increase in price

New update from Ripple lawsuit causes XRP to increase in price

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Crypto investment is a form of risky investment and participants must take full responsibility for their investment.

Follow us: Fanpage | Group FB | Group chat | Channel Analytics | Channel Non-Fungible Token Youtube