On November 3, 2022, the American media CoinDesk exposed FTX’s accounting problems, and then a series of storms swept the entire cryptocurrency industry. FTX, the world's second largest exchange, was exposed to insolvency and misappropriation of assets. It declared bankruptcy a few days later. FTX users were unable to retrieve their assets. Many companies with investment or lending relationships with FTX suffered major losses or went bankrupt.

Nearly a year later, CoinDesk’s reporting won the “ Gerald Loeb Award ”, an honorary award for business journalism in the United States. Former crypto star – FTX founder Sam Bankman-Fried (hereinafter referred to as: SBF) has been put on trial, and many senior executives have been put on trial. Guan plead guilty.

In November 2023, let us review the rise and fall of the FTX empire and its impact on the overall industry.

※This article was jointly compiled by Zombit, Grenade, ABMedia, Daily Coin Research, BlockCast, and Crypto City.

One year anniversary of FTX bankruptcy, prosperity chapter

Why is FTX so popular and so popular?

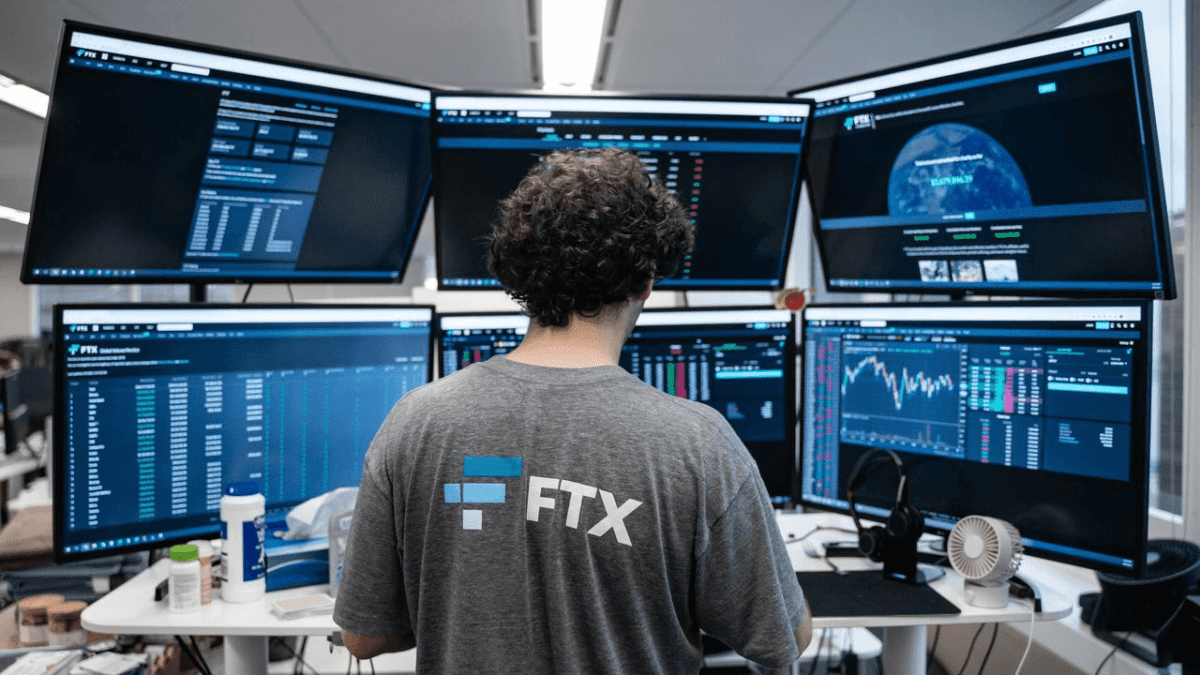

Established in May 2019, FTX, an exchange that started from Hong Kong and developed globally, also expanded in Taiwan in the same year. Although the Taiwan market has a small population base, it can be said to be very enthusiastic about FTX. At its peak, more than 10% of FTX trading volume even came from Taiwanese users. Therefore, Taiwanese investors suffered heavy losses after the collapse of FTX.

Why do so many Taiwanese users like to use FTX?

It has a lot to do with its positioning as "born for traders". Here is an inventory of FTX's key functions:

- No transaction fees for withdrawals

- Smooth spot leverage experience and improved capital utilization rate

- "Cross-Currency Margin" Contract Trading

No transaction fees for withdrawals

There is no handling fee for users to withdraw their assets to FTX in the early stage. Later, with the number of pledged$FTT tokens, the corresponding withdrawal amount will be increased. This is also because the procedure for withdrawing tokens is more expensive than other exchanges. The price is very low, and FTX has become the preferred “fund parking station” for large investors on the chain.

Smooth spot leverage experience and improved capital utilization rate

The previous feature mentioned that the free withdrawal fees have made many high-net-worth users accustomed to using FTX, and then there is another key feature: "Spot Leverage". In FTX, it is very simple to withdraw crypto assets that "you do not hold" , through this type of lending funds, you can enlarge your capital utilization rate, which will not hurt the principal, but can also make risk-free arbitrage. Therefore, when market sentiment is high, it is favored by many large investors.

"Cross-Currency Margin" Contract Trading

In general exchanges, it is often necessary to separate "capital accounts" and "contract accounts" when performing contract trading operations. At that time, FTX allowed traders to directly use spot funds as margin for contract transactions, allowing users to use spot assets It can be maximized and the efficiency of fund use can be improved again.

At that time, many of FTX's functions and services brought new trends to the market. It may also be that SBF and others came from Wall Street trading institutions and clearly understand how to improve traders' experience and adjustments, thus attracting a large number of users who are keen on trading in the bull market in 2020.

Loyal FTX users recall the past

The success of FTX has a lot to do with the product itself and the positioning of the platform. An anonymous industry insider said in an interview that many of FTX’s functions are designed for traders and are quite practical in operation. For example, the "sub-account function" that can open multiple accounts is very convenient for traders:

Most of the functions on other exchanges require certain qualifications to be activated, but on FTX everyone can use it, which is very convenient for traders to divide investment positions (such as long-term and short-term positions).

On the other hand, cross margin margin also allows traders who like to gamble to use unused spot stocks as margin to increase capital efficiency. In the bull market before the FTX thunderstorm, this function provided users with great leverage. It was easy to make money in the bull market, so users naturally retained it. In addition, respondents added that high live interest rates are also an attractive factor:

The seemingly reasonable but doubtful figure of 6% annual interest rate has become a lure for many users to deposit their assets in FTX.

Another interviewee who has frequent transfer needs believes that the 0 handling fee for withdrawing coins is the biggest reason for him to use it. Especially during the bull market period when gas fees are rising, it can save him considerable on-chain costs. However, He also lamented that he never expected that in the end he would end up losing a lot because of a small thing.

In addition, the two interviewees also unanimously stated that FTX’s diversified products, such as volatility contracts, Trump contracts, and equity tokens, are also features that are rare on other platforms.

FTX’s glorious record

2019 was the initial stage of FTX. In this year, FTX successively launched the exchange ecological token $FTT, leveraged tokens and perpetual contract functions. It not only completed a seed round of financing of US$8 million, but also completed a seed round of financing of US$8 million on December 20. On this day, it received strategic investment from the largest exchange Binance. From this day on, FTX Exchange began a period of explosive growth.

Time came to the next year (2020), when the FTX exchange first emerged. While developing rapidly, it also began to connect with American political and business celebrities:

- January: FTX exchange’s 24-hour bilateral trading volume exceeded US$20 billion, setting a record high since its establishment

- February: Taking advantage of the US election period, TRUMP-2020, a contract to tokenize election predictions, was launched and rose 24% after opening.

- March: Received Series B investment from Beijing-based venture capital firm Liquid Value Capital

- April: Launch of WTI crude oil futures contract OIL

- May: Launch of US-based trading platform FTX.US

- August: Recruited Robinhood’s former crypto chief Sina Nader as the operating director of FTX.US and acquired mobile cryptocurrency asset management app Blockfolio for $150 million.

- November: During the US presidential election, founder SBF suspected of donating US$5.2 million to candidate Biden.

In 2021, the bull market in the cryptocurrency market has begun. Unsurprisingly, this year can be said to be the fastest growing year for FTX and the year with the greatest marketing efforts. FTX chose the marketing path that Web2 giants will use - sports, not only invited Many sports stars serve as spokespersons and spend large sums of money on publicity through advertising, title sponsorship, etc.:

- February: Announced the establishment of a public welfare foundation and launched a zero-handling fee service for currency withdrawals. It has become the first choice for many investors to make deposits, withdrawals, and transfer transactions without the need for Gas Fees.

- April: Subsidiary FTX.US signed a 19-year exclusive home naming rights contract with the NBA Heat worth US$135 million. In the same month, the Coinbase Pre-IPO product was launched. The single-day trading volume once exceeded 10% of the global total, which was the same as the previous year. A year-on-year increase of 8000%.

- May: Following the tokenization of the election predictions of the previous year, a futures contract was launched to predict the results of the Brazilian presidential election. In the same month, it was announced that it would invest in Circle, a development company of the well-known stable currency $USDC, and cooperate with the International Chess Championship.

- June: Signed a contract with the well-known American e-sports club TSM for US$210 million, obtained the naming rights of the team (Team SoloMid FTX), sponsored the Wall Street Cycling Competition, cooperated with Major League Baseball (MLB), and found the legendary NFL quarterback Tom Brady and his wife made a high-profile investment.

- July: Completed US$900 million in Series B financing at a valuation of US$18 billion, the largest financing record in entrepreneurial history.

- August: Recruited Ryne Miller, former legal advisor to the Chairman of the US SEC, rose to second place in Bitcoin futures market share, signed a 7-year sponsorship contract with the "League of Legends" LCS league, and named the California Memorial Stadium at the University of Berkeley.

- September: Recruited NBA star Stephen Curry as a global ambassador and shareholder, and signed a long-term sponsorship agreement with the F1 team Mercedes-AMG Petronas. At the same time, affected by China's cryptocurrency ban, the headquarters was moved from Hong Kong, China, to Nassau, the capital of the Bahamas.

- October: Became an official partner of the International Cricket Council and completed a US$420 million B-1 round of financing at a valuation of US$25 billion, including well-known asset management companies such as BlackRock and Tiger Global. All the giants participated.

- November: Recruited MLB star Shohei Ohtani as FTX global brand ambassador, and recruited former CFTC Commissioner Mark Wetjen as head of policy and regulatory strategy for FTX.US.

- December: Recruited golfer Albane Valenzuela as a sports ambassador and sponsored the NBA Golden State Warriors for US$10 million. At the same time, CEO SBF was invited to attend the U.S. Congressional encryption hearing.

Finally, the time comes to 2022. This year, FTX will strategically target overseas markets, including Japan, Europe and other countries/regions, which have become FTX’s key marketing and business expansion areas. SBF has been more frequently featured in the New York Times, In major foreign media such as "The Wall Street Journal", "Forbes" and "Bloomberg", the exposure has reached an unprecedented peak:

- January: FTX.US and FTX completed US$400 million in Series A and Series C financing respectively, and announced the launch of US$2 billion venture capital fund FTX Ventures

- February: In order to attack the Japanese market, it acquired the compliance exchange Liquid (the parent company is Quoine), and while attending the U.S. Senate encryption hearing, it spent US$32.5 million on advertising in the 56th Super Bowl in the United States, setting a record for encryption advertising spending. highest record.

- March: Launched the charity fund FTX Future Fund, established FTX Europe, and FTX Australia entered the European and Australian markets. Japanese tennis star Naomi Osaka was hired as FTX global ambassador, and participated in the financing of Yuga Labs, the parent company of "BAYC".

- April: SBF ranked second on the Forbes Crypto Rich List, and the Crypto Bahamas conference hosted by SBF was officially opened in the Bahamas, including the former British Prime Minister, the former President of the United States, the Prime Minister of the Bahamas, the Super Bowl champion, the former Chairman of the CFTC, and the CEO of Ark Investment Celebrities including Cathie Wood were in attendance.

- May: The regulatory teams of SBF and FTX visited the White House and were selected into Time magazine's "Top 100 Most Influential People in the World". At the same time, its market share surpassed Coinbase and became the world's second largest cryptocurrency exchange.

- June: Launched Japanese domestic exchange FTX Japan, acquired Bitvo, and entered Canada.

- July: FTX.US plans to use US$680 million in loans and acquisitions of BlockFi, and leads Aptos financing.

- August: CNBC reports that FTX’s revenue exceeds $1 billion.

- September: The former CFTC commissioner joined the FTX.US board of directors, invested in Sui developer Mysten Labs, and NFT project Doodles, and planned to acquire 30% of SkyBridge Capital's shares and the assets of Celsius, while winning the bid for Voyager's asset auction.

In its heyday, the FTX exchange was so prosperous that it was even expected to become the world's number one exchange. From the many records and achievements set by FTX, it is not difficult to see that FTX’s successful marketing has had a profound impact on the cryptocurrency market. The reaction of the crypto to FTX’s collapse soon was more shocked, stunned and Very sad.

One-year anniversary of FTX bankruptcy, decline chapter

The origins of FTX’s battle with Binance

There are different opinions on whether the catalyst behind the collapse of FTX was "Coindesk, which had unidentified assets," or "Binance, which added fuel to the fire." However, what is certain is that FTX did have a close relationship with Binance before this happened. (Binance) is making a fuss.

In addition to the fact that Binance CEO CZ(CZ) once hinted through tweets that FTX had used U.S. regulatory relations to quietly attack Binance behind the scenes, in fact, the love-hate entanglement between the two exchange giants must be mentioned in FTX 2 years ago. investment case.

FTX completed a Series B financing of US$900 million in July 2021, with a valuation of US$18 billion. This investment case can be said to shock the crypto, because it also broke the record for the highest financing amount in the history of the cryptocurrency industry. After the news was released $FTT, it immediately surged by nearly 30% within 12 hours, once exceeding US$30, which also made FTX founder SBF worth more than US$16 billion.

When FTX announced the successful completion of fundraising, Binance also announced its withdrawal from FTX equity investment almost at the same time. This investment is an undisclosed strategic investment made by Binance in FTX in 2019. It turns out that Binance had already formed a relationship with Sequoia Capital as early as 2017. Binance was involved in the Series A financing due to The "exclusivity clause" was sued by Sequoia Capital, and the situation has been at odds ever since. It may have been introduced by Paradigm co-founder Matt Huang (formerly a partner of Sequoia Capital). Sequoia Capital participated in this FTX financing, and the camps were clearly divided.

The fact that they are both exchange competitors and the above-mentioned history has also planted a dark seed in the relationship between FTX and Binance. Since then, the two exchanges have continued to fight openly and secretly, and "Binance" has become one of the targets of FTX's collapse.

CoinDesk first shot: key Alameda financial doubts

A series of FTX collapse events originated from a report by Coindesk. On November 3, CoinDesk reported that Alameda Research, founded by FTX founder SBF, was in an insolvency crisis and its finances were not transparent, sparking heated discussions.

This report accuses market maker and investment institution Alameda Research that most of the assets on its balance sheet are the platform currency $FTT issued by the FTX exchange itself, rather than the most popular mainstream currencies in the market such as Bitcoin and Ethereum.

40% of Alameda’s $14.6 billion in assets is $FTT, the native token of FTX, of which $3.66 billion is “unlocked FTT” and $2.16 billion in “FTT collateral.” Other collateral also includes SOL and Alameda investments Projects mainly issue tokens. In addition, Alameda's total assets and liabilities are US$8 billion, and there is no clear solution to solve this funding gap, which has triggered heated discussions.

When $FTT the price fell, the implied risk further expanded, triggering the insolvency crisis of Alameda.

On November 7, CZ, CEO of Binance, stated on Twitter that he plans to sell the $FTT held by Binance in batches on the open market in the next 1-2 months on the grounds of "risk management". This matter has also evolved. It became the "last straw that broke the camel's back", which subsequently triggered large fluctuations in the currency market, leading to $FTT a collapse crisis.

FTX exchange suddenly went from being one of the top three leading exchanges in terms of contract trading volume to becoming a panicked time bomb.

FTX goes from denial to being unable to withdraw money

SBF issues first statement explaining rumors

At the beginning of the incident, FTX founder SBF expressed his views on the liquidity crisis to the media. And at 0:00 a.m. on November 9, SBF posted on its social media account saying :

Things have come full circle, we have reached a strategic transaction agreement with FTX’s first and last investor: Binance (pending due diligence). Our team is handling accumulated withdrawal requests as is, which will eliminate the liquidity crunch; all assets can be repaid 1:1. This is one of the main reasons why we asked Binance to join. This may take some time to fully resolve, and we apologize for that.

A big thank you to CZ, Binance and all our supporters. This is a user-centric development that benefits the entire industry. CZ has made incredible efforts in building the global encryption ecosystem and creating a freer economic world, and will continue to do so in the future.

Binance CEO CZ(CZ) later said on social media:

FTX came to us for help due to a severe liquidity crunch. To protect our users, we signed a non-binding letter of intent for Binance to fully acquire FTX. We will conduct a full investigation into this matter in the coming days. There's a lot to process and it will take some time. This is a highly dynamic situation and we are evaluating it on the fly. Binance reserves the right to withdraw from the transaction at any time. As the situation develops, we expect the price of $FTT to fluctuate significantly in the coming days.

A sudden turn of events, acquisitions disrupted

On November 10, just when the entire industry thought that the two exchanges had finally reached peace and that the incident would end smoothly, the next big news directly sentenced FTX to death. Binance announced on Twitter that due to the company's due diligence and news reports that FTX manipulated customer funds and was investigated by US agencies, Binance decided not to pursue the acquisition of FTX.

The failure of the acquisition added to market jitters. SBF publicly admitted its mistake , believing that its negligence and ignorance caused FTX's liquidity problems, and promised to return money to users. Since then, SBF has gone from being a successful entrepreneur to a fraudster. The glorious achievements he and FTX had achieved in the past were wiped out overnight.

Lack of funds, declared bankruptcy

The liquidity crisis worsened day by day, and FTX was forced to suspend withdrawals. SBF said FTX faces a shortfall of up to $8 billion and is in urgent need of funds.

In the end, due to the inability to solve the liquidity problem, FTX, FTX US, Alameda Research and approximately 130 other affiliated companies (collectively known as the FTX Group) initiated bankruptcy reorganization in Delaware under Chapter 11 of the U.S. Bankruptcy Code on November 11.

This incident not only revealed the capital risks of exchanges under a liquidity crisis, but also sounded the alarm for the cryptocurrency market, reflecting the fragility and uncertainty of the market. In addition, even seemingly successful platforms may quickly encounter liquidity crises, which highlights that in this market, operators and investors should have higher risk alertness and responsibility.

The Chaos After FTX’s Bankruptcy

The Chaos After FTX’s Bankruptcy: A Simple Timeline

November 11, 2022, may be the darkest day for FTX users. Not only are they unable to withdraw funds, but they also see FTX officially filing for bankruptcy and reorganization, CEO SBF resigning, and a series of weird and chaotic events that have occurred, leaving users at a loss as to what to do.

In order to facilitate everyone's understanding, we have organized the timeline and tried to restore that chaotic time:

| November 11, 2022 | FTX files for bankruptcy reorganization, CEO SBF resigns |

| "Weird transfers" were reported from the FTX exchange hot wallet, making users mistakenly think they could withdraw funds. Some people in the industry speculated that internal employees may have secretly enabled the withdrawal function. | |

| FTX cooperates with Tron, and users can withdraw funds from Justin Sun series currencies such as $TRX and $BTT. However, the premium is serious and the value will shrink significantly after withdrawal. | |

| FTX officially stated that it is processing withdrawals from users in the Bahamas. | |

| SBF promised that FTX.US would not be affected, but there are still users complaining about withdrawal delays. | |

| The Bahamas Securities and Exchange Commission ordered the assets of FTX’s Bahamas subsidiary to be frozen. | |

| November 12, 2022 | A developer discovered that millions of dollars of assets were flowing out of the FTX wallet, which was very unusual. |

| The official FTX Telegram administrator stated that the system was hacked, and the community called for the app to be deleted quickly. | |

| FTX general counsel Ryne Miller said there was "unauthorized access" to certain FTX assets. | |

| November 13, 2022 | The Bahamas Securities and Exchange Commission was slapped in the face and never ordered FTX to open withdrawals for local users. |

After the FTX bankruptcy incident unfolded, it gradually attracted the attention of Taiwan's mainstream media. First, some media claimed that the number of affected households in Taiwan was as high as 500,000, and more and more victims were interviewed by the media. However, according to "ABMedia", FTX sources pointed out that there are approximately 120,000 FTX users in Taiwan.

FTX Japan possible reboot? A parallel time and space far away in the East

After Japanese regulatory intervention, FTX Japan continued to disclose the status of user asset balances and developed an independent system that allows users to withdraw funds. In February 2023, FTX Japan users were finally able to withdraw fiat and cryptocurrency assets.

In addition, FTX's bankruptcy documents show that current CEO John Ray discussed and planned the restart of FTX Japan many times in March 2023.

While FTX.com is causing a stir, Japan's FTX Japan seems to have become a "parallel world". Not only will it soon allow users to withdraw money, but it seems that there is also the possibility of "restarting operations". We have compiled a simple timeline :

| November 10, 2022 | The Japan Financial Services Agency ordered FTX Japan to cease operations and required it to submit a business improvement plan within a time limit to explain how to protect user assets. |

| November 11, 2022 | FTX Japan allows users to withdraw fiat currency |

| February 2023 | FTX Japan fully opens user withdrawals (fiat currencies, crypto assets, etc.) |

| April 2023 | FTX Japan plans to restart |

Does FTX Japan’s safe escape highlight the importance of supervision?

The fact that users of FTX Japan are not affected by FTX's bankruptcy is related to compliance operations and clear supervision.

Experts later analyzed that this was because the Japan Financial Services Agency formulated a strict regulatory framework (CAESP) after the Mt. etc., regulations used to protect customers.

After the bankruptcy of FTX, global encryption regulations have taken new actions. The European Union, South Korea, Hong Kong, etc. will further regulate cryptocurrency through special laws or licenses in 2023. The Taiwan Financial Supervisory Commission also launched the " VASP Guiding Principles " in September 2023 to provide relevant guidance for virtual asset traders, and hopes to observe whether there is a need to add encryption regulations six months after the industry association is established.

The first anniversary of FTX’s bankruptcy, the embers

John Ray Takes Over: Claims Websites and Costly and Time-consuming Litigation

After the bankruptcy team took over, FTX began a lengthy restructuring process, led by well-known lawyer John Ray as CEO of FTX. John Ray was the Chicago attorney who handled the liquidation of Anlon Corporation. The Enron bankruptcy case occurred in October 2001. It was not only the largest bankruptcy case in U.S. history, but also the largest audit failure.

Due to the serious lack of FTX's company operating records and financial information, the bankruptcy team hired a large number of consultants and lawyers to try to dig out all unrecorded remaining assets from different places and also recover funds from multiple related debt entities. However, proactive handling of bankruptcy proceedings is a good thing, but it also comes at a cost to creditors.

According to statistics, the bankruptcy management team burned through US$330 million in funds eight months after taking over, and these expenses must naturally be borne by creditors. The increasing expenses of the bankruptcy management team have made many creditors restless. The FTX Creditors Committee publicly criticized the bankruptcy management team at the bankruptcy hearing in August:

Now their monthly expenses are nearly $50 million, with literally hundreds of attorneys, financial advisors and bankers working on the job full-time. Every expense in the case essentially directly reduces the amount of money that creditors may recover.

On the other hand, wassielawyer, an anonymous lawyer who has experience as a bankruptcy lawyer, pointed out that the reason why the bankruptcy management team dared to spend so much money was because the cryptocurrency field lacked the ability to check and balance these "financial vultures." Wassielawyer explained that in the traditional financial world, creditors or other stakeholders usually have checks and balances on these activities, and no one is willing to lose their reputation in the financial world just to make a little more money, especially when BlackRock When such a financial giant is one of the creditors, no one dares to offend him.

However, the bankruptcy team that took over FTX and Three Arrows Capital did not care what the cryptocurrency industry thought of them. Even if the most influential people or entities in the cryptocurrency industry were dissatisfied with them, they would not be indifferent because these people would later It is almost impossible to interact with these cryptocurrency funds or traders again, and their actions will not have any impact on their professional reputation. In this case, FTX creditors may have only two ways to check and balance the team's continued burning of money: "collectively make a voice to attract the attention of the bankruptcy court", or "sell the claims to the old Jianghu of traditional financial institutions" and let them pursue these bankruptcies Manager’s Responsibilities.

FTX’s tumultuous relationship with Alameda, the truth breaks out

After the bankruptcy reorganization team and FTX's new CEO John J. Ray III took over, the messy fund management details behind FTX gradually emerged.

John Ray once said:

Never in my career have I seen such a complete failure of corporate controls and a complete lack of credible financial information.

SBF: The user’s deposit address is shared with Alameda

This is what SBF has said so far. He described the long-term misalignment of Alameda and user addresses to foreign media Vox reporter Kelsey Piper in November:

It's like if FTX doesn't have a bank account, everyone can still wire transfer to Alameda's bank account and trade on FTX. Three years later, it seems that everyone has wired $8 billion to Alameda, but we have forgotten the relationship between Alameda and the FTX account, resulting in some funds never arriving on FTX.

However, such claims were gradually overturned after investigations by John Ray and the CFTC.

Gary Wang, the former chief technology officer of FTX, also stated when testifying in court recently that Alameda can withdraw money from FTX unlimitedly.

Therefore, massive misappropriation of customer deposits, excessive spending, and insolvency caused by a large number of runs in November 2022 seem to be the main reasons for FTX's bankruptcy.

Alameda offers unlimited loans for executives

John Ray cited legal documents last year saying Alameda provided loans to three FTX executives:

- SBF: $1 billion

- Nishad Singh, head of engineering at FTX: $543 million

- FTX Digital Markets co-CEO Ryan Salame: $55 million

Alameda will not be liquidated

John Ray told the bankruptcy court that Alameda was secretly exempt from FTX's automatic liquidation agreement to some extent.

This statement is also consistent with the CFTC's investigation.

In its indictment against FTX, the CFTC listed Alameda’s numerous privileges at FTX, including:

- Alameda account is the portal for user deposits

- Alameda Unlimited Withdrawals

- Will not be automatically liquidated

- Front-running transactions faster than all API users

Alameda’s profitability is questionable and venture capital is rampant

In addition, the CFTC also cited the SBF's unreleased draft and pointed out that the SBF has long been aware of Alameda's low profitability and is even considering closing Alameda in 2021.

In addition to low profitability, Alameda's undisciplined venture capital seemed to have paved the way for FTX's collapse.

The Financial Times pointed out that in an investment portfolio of approximately US$5.4 billion, Alameda-related holding companies have made illiquid investments in more than 500 projects, including weight-loss drug companies and other projects that have nothing to do with blockchain .

Several senior executives of FTX plead guilty, and SBF was arrested and put on trial

FTX-related senior executives are being pursued by U.S. regulators, including four senior executives: FTX Engineering Director Nishad Singh, FTX Co-Founder and Chief Technology Officer Gary Wang, former Alameda Research CEO Caroline Ellison (SBF’s ex-girlfriend), FTX Digital Markets (FTX Bahamas entity ), former co-executive Ryan Salame, have all pleaded guilty, and all except Ryan Salame have become tainted witnesses.

The founder, SBF, has always pleaded not guilty. After being indicted in December 2022, he was arrested by the Bahamas police and extradited to a US prison in the same month. In October 2023, the SBF court trial began in the New York Court of the United States. Former FTX executives testified in court, and a series of secrets were revealed. For example: SBF wants to be the president of the United States, the FTX insurance fund is generated by random numbers, venture capital Paradigm admitted that it did not do due diligence, the former CEO of Alameda said everything was influenced by SBF, and SBF's younger brother was involved in the case, etc.

In addition, SBF’s parents, Joseph Bankman and Barbara Fried, are also considered important players in the FTX empire and are responsible for tax and political relations. The bankruptcy and restructuring team has also filed a lawsuit against them.

The entire case is still ongoing. From the testimony, we can understand FTX's abuse of assets, SBF's ambition to achieve its goals by any means, high-level collusion in fraud, and the capital market's blind trust in FTX. Judging from the existing evidence, there are still many relevant people who may be traced in the future.

All VCs in the crypto world have been shot, and many banks have gone bankrupt one after another.

Institutional Victims of FTX

After the bankruptcy of FTX, in addition to ordinary retail investors, institutional investors in FTX were also severely affected. Many well-known VCs lost tens of millions or even hundreds of millions of dollars in this incident, including:

- Paradigm: $290 million

- Jump Trading: $280 million

- Sequoia Capital: $213.5 million

- Pantera Capital: Possibly more than $100 million

- Softbank: Nearly $100 million

- Galaxy Digital: $76.8 million

- Galois Capital: $40 million

- Tiger Global: ~$38 million (equity)

- CoinShares: ~$30 million

- Multicoin Capital: ~$25 million

- SkyBridge: $10 million

In addition, crypto income and lending platforms were also overwhelmed during the crisis, and many companies went bankrupt within a few months of the incident, including DCG Group subsidiaries Genesis and BlockFi. Celsius, which declared bankruptcy due to the UST collapse, is temporarily unable to recover US$13.9 million due to the bankruptcy of FTX.

Looking back at Taiwan, apart from FTX, the platforms that have the greatest impact on Taiwanese users are the asset management platform Steaker and the exchange AAX. At present, Steaker has launched the Dawn Project, which will repay user assets step by step. However, the funds that users can withdraw so far are still quite limited. As for AAX, there is no news and no user compensation behavior.

The crypto crisis spreads and banking institutions collapse one after another

In addition to affecting companies and investors in the crypto, this catastrophe in the crypto market has also had a chain reaction on traditional banking institutions.

The first to send out a warning signal was Silvergate, a bank known for its crypto-friendliness. At the end of last year, in response to the fluctuations in the cryptocurrency market and large user withdrawals, it sold large amounts of bonds as compensation, which in turn led to the problem of being unable to submit its Q4 financial report.

In the end, Silvergate was cut off from its business by multiple encryption companies, and when its business could not operate smoothly, it announced its own liquidation in March this year.

After Silvergate announced its liquidation, Silicon Valley Bank (SVB), which specializes in providing financing services to technology startups, also faced the same dilemma due to a higher-than-expected loss of customer deposits. It had to sell bonds at a discount, resulting in The company lost $1.8 billion and caused the company's stock price to plummet overnight.

Stablecoin issuer Circle also used Silicon Valley Bank as a reserve bank, which caused the market to worry about the stability of USDC, which once caused USDC to decouple.

In order to alleviate this financial disaster, the Federal Deposit Insurance Corporation (FDIC) issued an emergency announcement announcing the takeover of SVB the day after its stock crashed. SVB also filed for bankruptcy reorganization in New York a week later.

In a joint statement issued by the U.S. Department of the Treasury, the Federal Reserve, and the FDIC, another crypto-friendly bank, Signature, has been closed by its state charter institution due to similar systemic risks.

Impact and changes in the encryption industry

The collapse of FTX has put the encryption industry in the US system under tremendous pressure: the US Federal Reserve pointed the cause of some bank failures to the "crypto industry", and Coinbase and Binance US subsequently encountered strong enforcement, and each filed lawsuits for illegal matters such as providing unregistered securities. Not only that, the U.S. Securities and Exchange Commission (SEC) and the Trade Commission (CFTC) have significantly increased enforcement cases against exchanges, DeFi platforms, NFT and other businesses involved in illegal matters. The voice of the American industry on supervision has also changed from peaceful talks and communication to fierce backlash. Due to FTX's extensive involvement in political circles, subsequent politicians no longer dared to speak out actively for cryptocurrencies in the past.

The existing mature and diversified financial regulation in the United States means that it does not tend to establish special laws for supervision, but uses existing laws to interpret and enforce the law. Countries and regions outside the United States are also becoming more active in the encryption regulatory framework: the European Parliament passed the MiCA Act in 2023, Hong Kong established an exchange license framework, the United Kingdom and Canada tightened supervision and many exchanges withdrew, and Japan and Singapore are also continuing to improve Existing framework. Taiwan will also release guiding principles and open trade union self-discipline in 2023.

"Proof of Reserve" (PoR) has become a must-have propaganda for centralized exchanges. By revealing the on-chain address and verifying it with encryption technology, it can convince users that the platform has not misappropriated assets or that it is in good financial condition. Although exchanges only partially disclose it and cannot know the actual asset and debt status, under the influence of the FTX incident, "proof of reserves" has become a common awareness among users.

The FTX incident caused many venture capital companies, start-ups, traditional financial institutions and investors to pay a heavy price. The United States continues to raise interest rates to combat inflation, coupled with the rise of AI, hot money has obviously left the crypto market. FTX has made the world's impression of cryptocurrencies even more negative. Under the bear market, exchanges have laid off employees significantly, new startups have ceased operations, and even Uniswap, the oldest DeFi currency exchange protocol, has begun charging fees for operations.

On the other hand, we have also seen traditional financial institutions actively involved in the field of digital assets, such as: the financial giant BlackRock entered the competition for Bitcoin spot ETFs, the compliance exchange EDX supported by the Wall Street giant Citadel, and JP Morgan Chase and Citigroup is investing in research on “deposit tokens”. There are various signs that traditional financial institutions’ interest in blockchain technology may also be a way to popularize the application of digital assets in the future.

The distrust of centralized exchanges has once again aroused people's expectations for decentralized applications. ZK ( zero knowledge ) technology has attracted attention for improving the efficiency of base facilities and privacy applications; under the dual pressure of supervision and distrust of centralized exchanges, people have high hopes for decentralized exchanges (DEX), and industry players have also Invest in a more diverse and efficient trading experience.

FTX is the world's largest exchange failure since Mt. Gox in 2014. So far, Mt. Gox has not fully compensated the victims. The FTX incident in 2022 will be more complex and huge. It can be expected that the follow-up processing will be a longer journey. Looking back on the first anniversary of the FTX incident, it has written a profound history for the cryptocurrency world that can never be erased. It is also a lesson that everyone involved in the development of emerging financial technologies needs to learn.

It has been nearly a year since FTX collapsed. How have various cryptocurrency market makers responded to market changes?

With nearly a year to go since the collapse of the FTX exchange, cryptocurrency market makers are faced with the challenge of generating revenue in a market that lacks volatility and trading volume. They have adopted different strategies to respond to market changes, such as seeking new opportunities beyond market making. Source of income. The founder of market maker Wintermute said the company is diversifying its business and is considering launching a cryptocurrency derivatives exchange. GSR Markets focuses more on trading the largest currencies such as Bitcoin and Ethereum.

(2023/11/2)

FTX has transferred out 170 million magnesium crypto assets, and the debt transaction price is expected to increase after SOL continues to rise.

According to information shared by Spot On Chain, the wallet addresses of FTX Exchange and Alameda Research transferred tokens with a total value of approximately US$46 million to multiple trading platforms, including SOL, MATIC, and ETH. According to statistics, since October 25 to the present, FTX has transferred a total value of nearly $170 million in cryptocurrency assets.

(2023/11/2)

FTX founder SBF testified in court: he had selective amnesia and claimed that his actions were all based on the advice of FTX lawyers

SBF, the founder of bankrupt exchange FTX , testified in his criminal trial last night. Although SBF has been trying to describe the collapse of FTX as an "unavoidable accident" and has publicly defended himself many times, his appearance in court this time is equivalent to putting himself under the gun of the prosecutor, and has been criticized by many The lawyer commented that it was a very dangerous choice.

(2023/10/27)

FTX continues to be liquidated! Related addresses transferred SOL, ETH, RNDR and COMP, with a total value of approximately US$20 million.

Following the liquidation of approximately US$10 million worth of cryptocurrency assets yesterday, the on-chain wallet addresses of FTX and Alameda continued to send cryptocurrency to the exchange today.

According to Arkham’s data, wallet addresses labeled FTX and Alameda once again transferred $3 million in cryptocurrency assets to Wintermute’s Binance deposit address. These assets were 974,000 RNDR (worth approximately $2 million), and 21,900 COMP (worth approximately US$1 million).

(2023/10/26)

FTX related news (updated to 2023/11/3)

Sangbi has helped you sort out the content we have reported recently, so that readers can easily grasp the recent FTX-related news.

- It has been nearly a year since FTX collapsed. How have various cryptocurrency market makers responded to market changes?

- FTX has transferred out 170 million magnesium crypto assets, and the debt transaction price is expected to increase after SOL continues to rise.

- FTX founder SBF testified in court: he had selective amnesia and claimed that his actions were all based on the advice of FTX lawyers

- FTX continues to be liquidated! Related addresses transferred SOL, ETH, RNDR and COMP, with a total value of approximately US$20 million.

- FTX is negotiating with three bidders to restart the platform and will make a decision before mid-December

- The bankruptcy team is in liquidation? FTX transfers tens of millions of dollars worth of crypto assets to Binance and Coinbase

- How much money can FTX recover? OTC price exceeds 50% of face value

- FTX used billions of customer funds to buy back Binance holdings

- FTX parties have reached an agreement on the restructuring plan. Will the withdrawals made before bankruptcy be recovered?

- FTX engineering director appeared in court to testify: dissatisfied with SBF showing off its wealth, spending money to cooperate with Telegram, and the exchange’s KYC backdoor

- FTX Reorganization Team pledges Ethereum and SOL, worth nearly $150 million