MicroStrategy, a listed company in the United States , has always been a firm believer in Bitcoin, and it is best known for buying and holding for the long term. In the financial report released yesterday (2), the company held a total of 158,400 Bitcoins. Coin, with the recent surge in the overall currency market, the position has once again turned a profit, with the current floating profit reaching approximately US$960 million.

MicroStrategy co-founder: Halving will reduce Bitcoin selling pressure by 50%

As Bitcoin made huge profits after MicroStrategy released its financial report, its co-founder Michael Saylor also shared his views on the future trend of Bitcoin in a CNBC interview.

Michael Saylor predicts that Bitcoin will soon experience the largest price increase in modern financial history, starting with the "halving" event in April next year, when Bitcoin mining rewards will be reduced by 50%, thus significantly reducing the number of miners selling. The number of Bitcoins, which means that the selling pressure after the halving will be reduced by about 50% along with the rewards.

Extended reading: Bitcoin halving analysis: Why is now the best time to “buy BTC”?

Michael Saylor: 'Unprecedented' demand will send Bitcoin up 10x

Immediately afterwards, Michael Saylor said that another argument for welcoming Bitcoin's rise is that the "Spot Bitcoin ETF" is likely to be approved before Christmas, allowing the asset to usher in mainstream capital inflows.

He said:

Investors will see the $12 billion annual sell-off reduce to a natural sell-off of $6 billion annually, while products such as spot Bitcoin ETFs increase demand for Bitcoin. That's why we're all pretty optimistic about the next 12 months: "Demand is going to increase and supply is going to contract," which is unprecedented in the history of Wall Street.

Michael Saylor further emphasized that when Wall Street banks and responsible custodians manage Bitcoin, the entire industry will move away from those "Altcoin" that distract and destroy shareholder value, and the crypto industry will move to a new level. , Bitcoin will rise at least 10 times more than .

Extended reading: Bloomberg analyst: Bitcoin spot ETF is expected to be approved early next summer; after the Fed raises interest rates, BTC is proving its value

MSTR stock price outperforms BTC

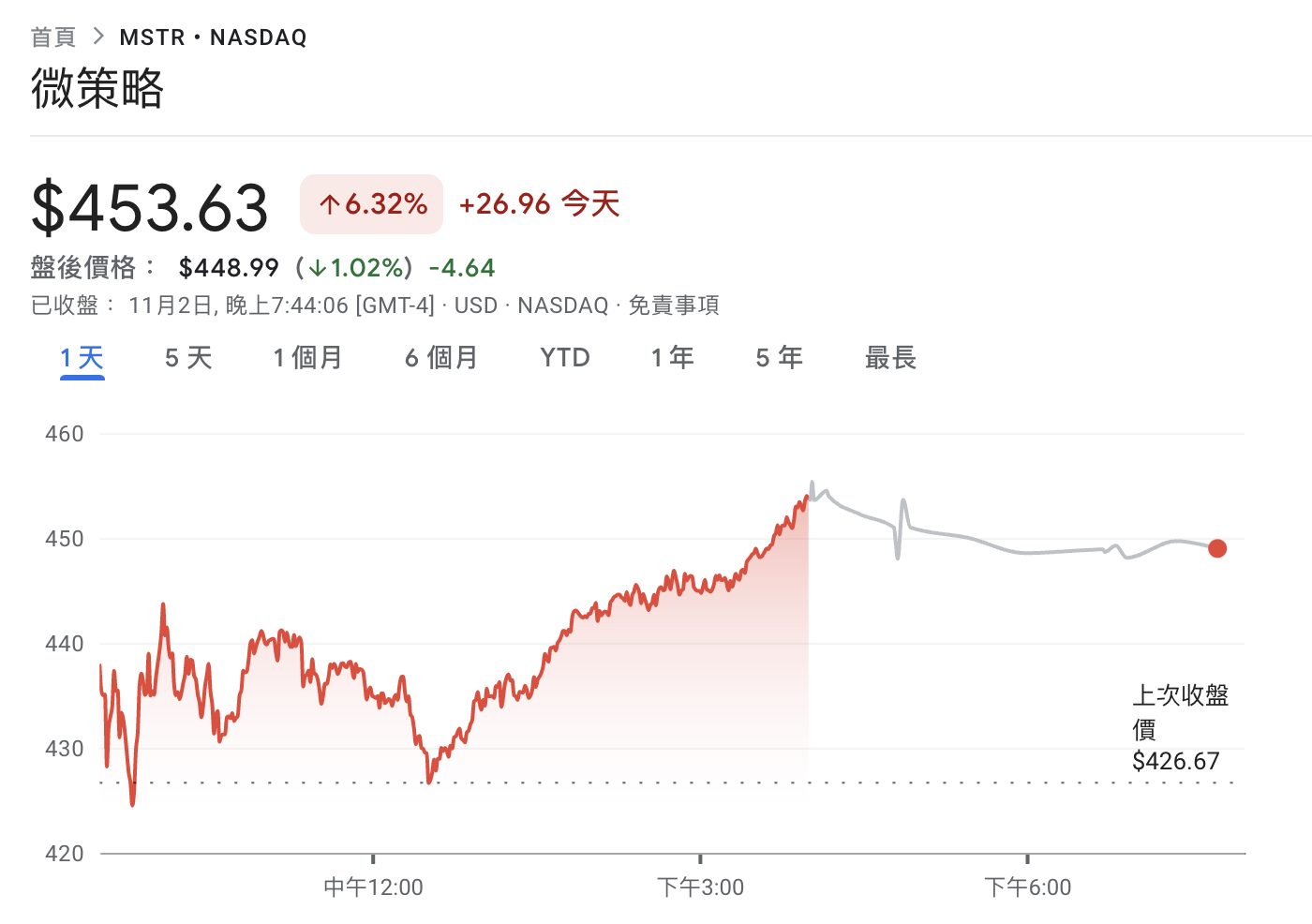

It is worth noting that since the beginning of October, the micro-strategy stock price MSTR has performed even better than Bitcoin. In the past month, MSTR has risen by about 31% and Bitcoin has risen by 25.7%.

As of the time of writing, MSTR's closing price per share on Thursday (2nd) was tentatively trading at $453.63, rising 6.32% after the financial report was released.