Starting this year , the cryptocurrency market is undergoing important changes, and global investors are beginning to realize that the launch and expansion of spot Bitcoin ETFs play a crucial role in bridging traditional financial markets. According to a survey by XS.com , the total investment in global Bitcoin spot ETFs has reached US$41.6 billion.

Canada has launched 7 Bitcoin spot ETFs

Canada leads the way in this area, with 7 Bitcoin spot ETFs with a total investment of $2 billion, the most famous of which is the world’s largest Purpose Bitcoin ETF with total assets of $819.1 million, which is also considered crypto One of the successful cases of currency integration into the mainstream financial system.

In Europe, Germany has taken the lead and adopted a more flexible regulatory approach. For example, the ETC Group Physical Bitcoin launched in June 2020 has an asset value of US$802 million and is the world's second largest Bitcoin investment fund. Europe, on the other hand, has seven other tax-advantaged ETFs. Rania Gule, a market analyst at XS.com, believes that this policy strengthens the legal and financial framework for cryptocurrencies and makes Europe more friendly to cryptocurrencies.

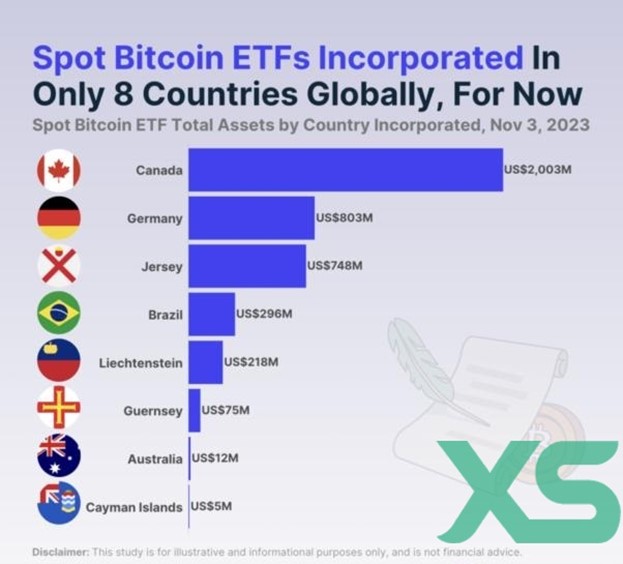

Currently, eight countries around the world have adopted spot Bitcoin ETFs, including G20 members, Canada, Germany, Brazil, Australia, Liechtenstein, Guernsey and the Cayman Islands. Despite this, the United States remains cautious about current applications from major institutions, and the U.S. Securities and Exchange Commission (SEC) has only approved ETFs related to Bitcoin futures.

Extended reading: Preview of the Bitcoin spot ETF battle situation: Besides BlackRock, who has the first-mover advantage?

Analyst: Conservative estimate is that $155 billion will flow into the market

Analysts say that as long as U.S. Bitcoin spot ETFs are approved, about $155 billion will flow into the Bitcoin market. Currently, many asset management giants manage more than US$15.6 trillion. If they allocate just 1% of their total assets under management to Bitcoin ETFs, that $155 billion is almost a third of Bitcoin's current market cap.

The SEC’s decision on the application for spot Bitcoin ETFs may become a turning point in the development of cryptocurrency. The current SEC approval is expected to be finalized in the first quarter of 2024. It is worth mentioning that, in conjunction with the expected fermentation of the Bitcoin halving, Rania Gule pointed out that immediate demand for Bitcoin through exchange-traded ETFs may exceed miner sales by 6-7 times at peak times, and that by 2028, Bitcoin spot ETFs may account for 9-10% of total circulating Bitcoin.

Extended reading: Spot ETF boost》Digital asset investment saw a net inflow of US$326 million last week, the highest in 15 months