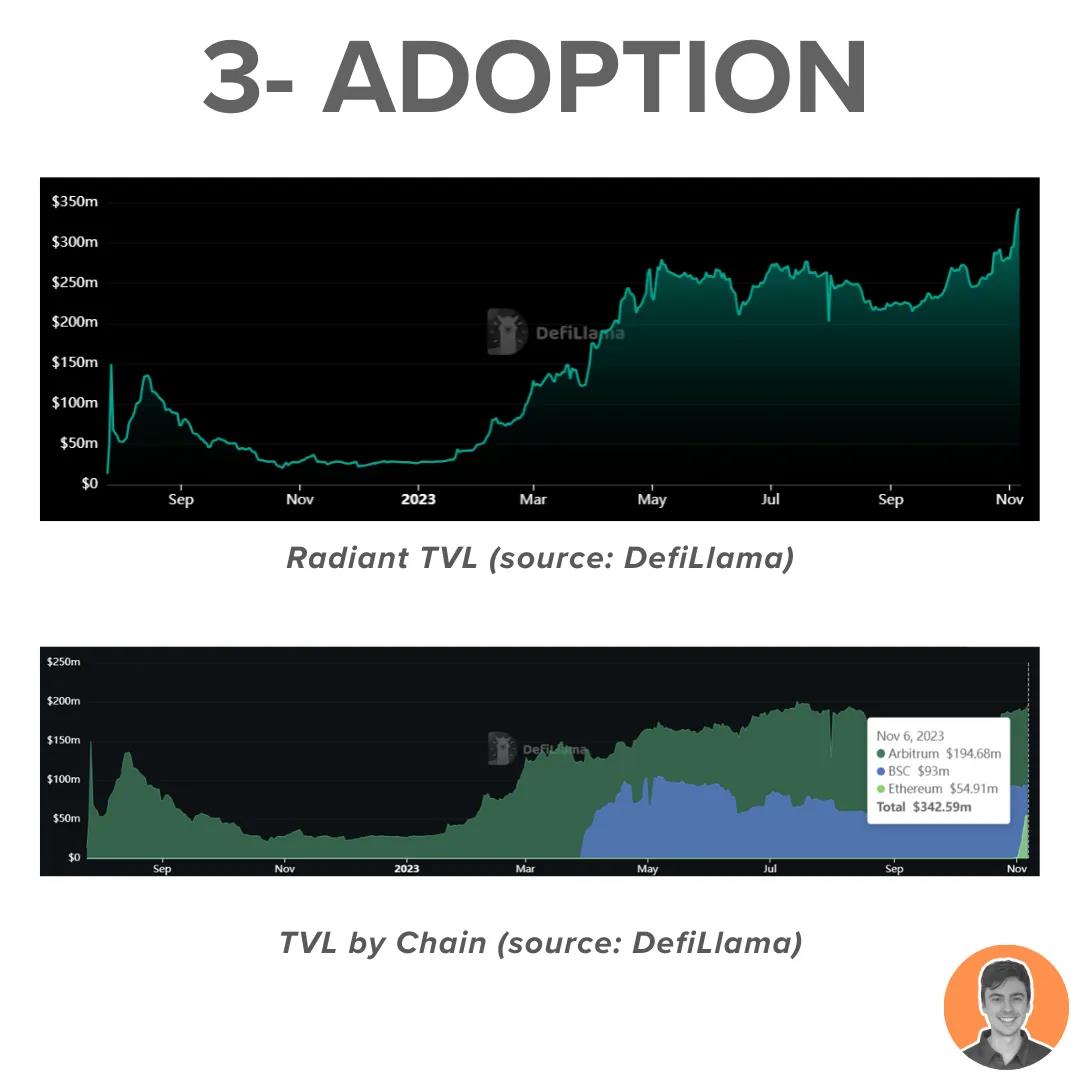

Radiant’s total value locked (TVL) continues to grow, reaching an all-time high of $342 million.

Written by JAKE PAHOR

Compiled by: TechFlow TechFlow

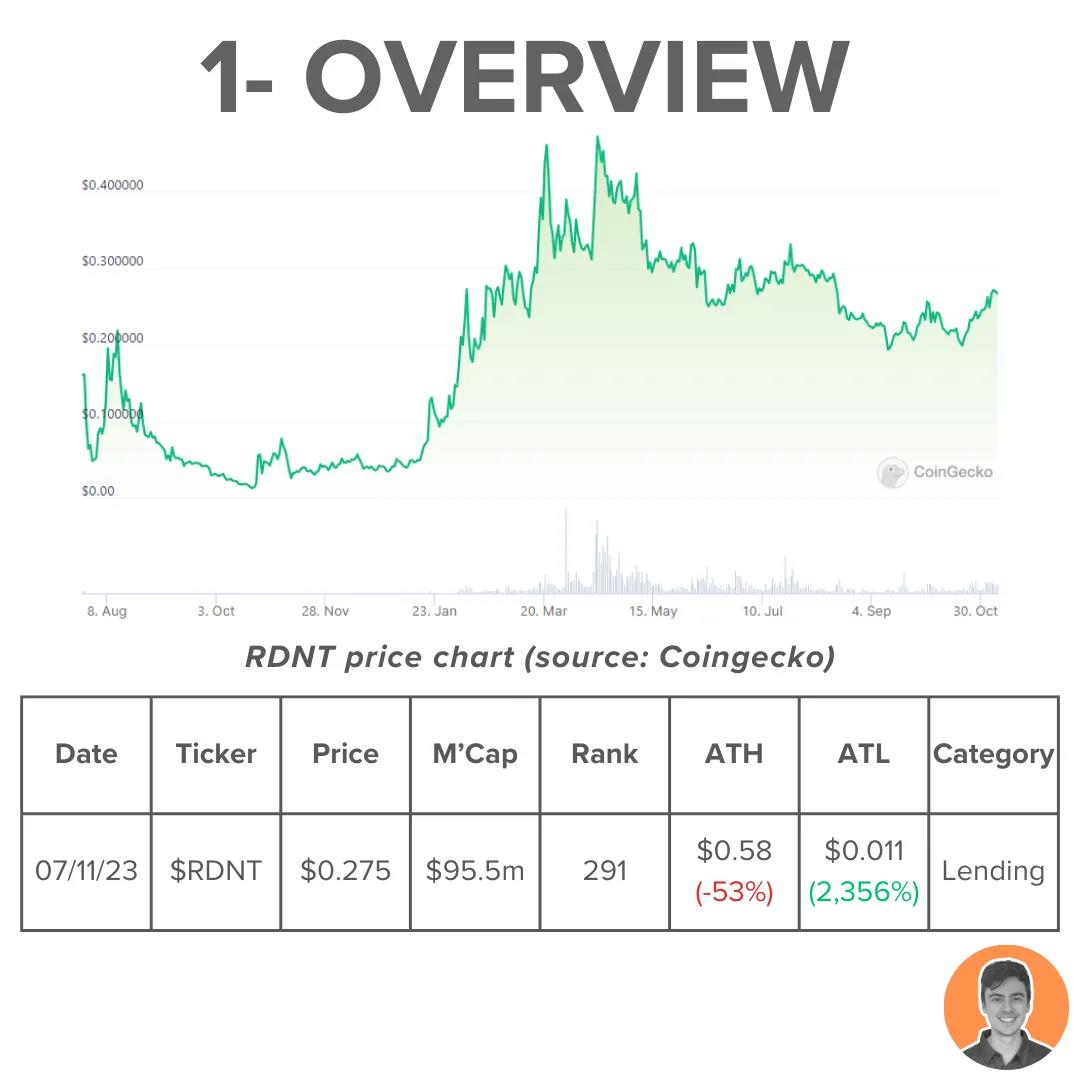

Arbitrum season is upon us, and Radiant Capital is well positioned for the coming Arbitrum bull run. Below is my November 2023 research report on RDNT.

Overview

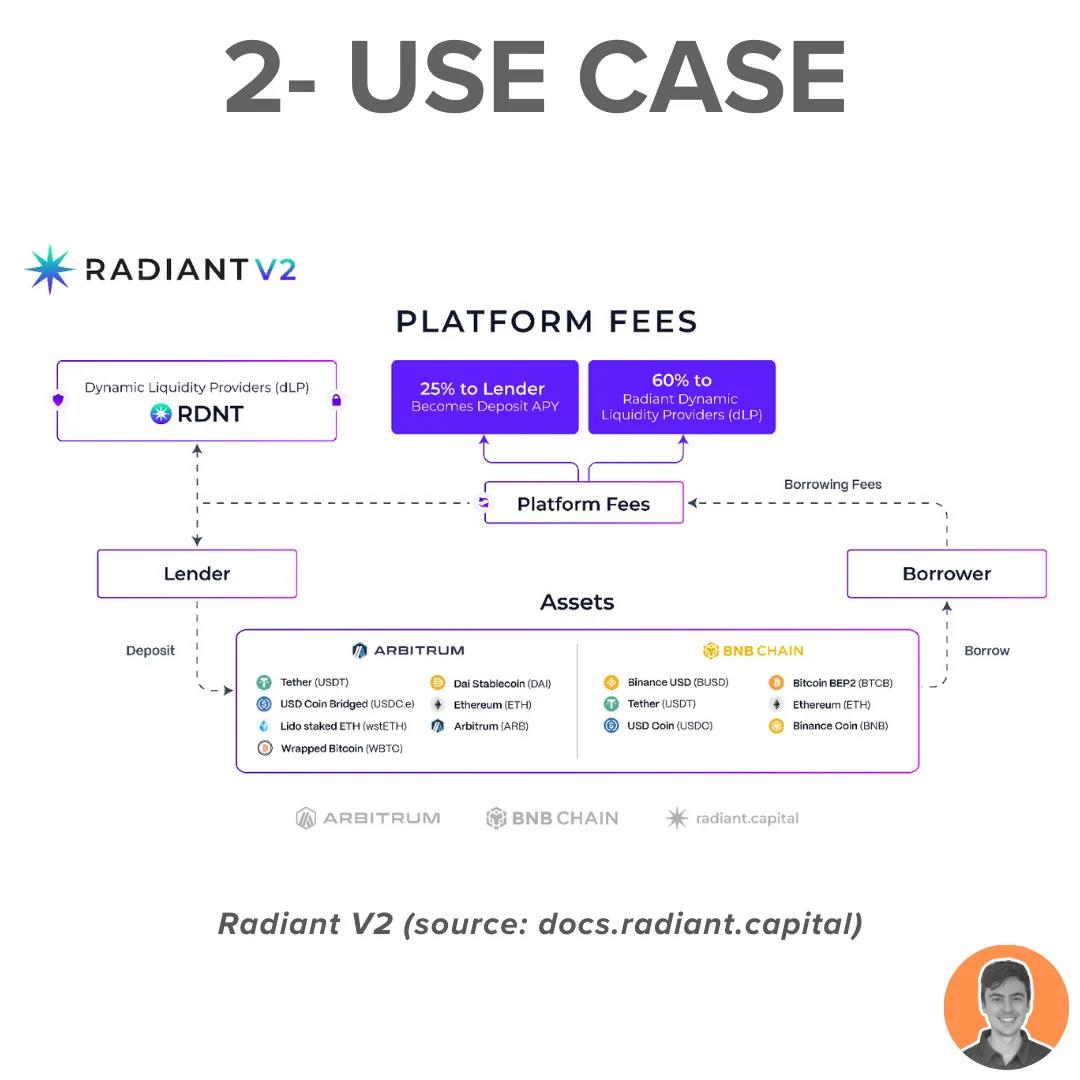

Radiant Capital is a full-chain lending protocol. It is built on LayerZero and allows users to:

Deposit collateral – e.g. USDC on Ethereum

Borrow money on other chains, such as ETH on Arbitrum.

Example

A major problem with DeFi is liquidity fragmentation. Borrowers must choose a chain, and the assets they withdraw must exist on the same chain. Bridging between different chains can be cumbersome and risky. So the goals of Radiant are:

unified liquidity

Simplify the lending experience

Innovate on this basis

With the release of Radiant V2 in March 2023, the project has significantly reduced inflation and improved overall token economics.

Now users’ behavior is consistent with the protocol, and rewards are only distributed to RDNT holders

Increase income to lockers (50% -> 60%) and decrease to lenders (50% -> 25%).

Adoption

Radiant’s total value locked (TVL) continues to grow, reaching an all-time high of $342 million. In the past month alone, its TVL has grown by 26%, mainly due to its launch on Ethereum in October.

This ranks Radiant 7th among lending protocols and 32nd among all protocols on DefiLlama.

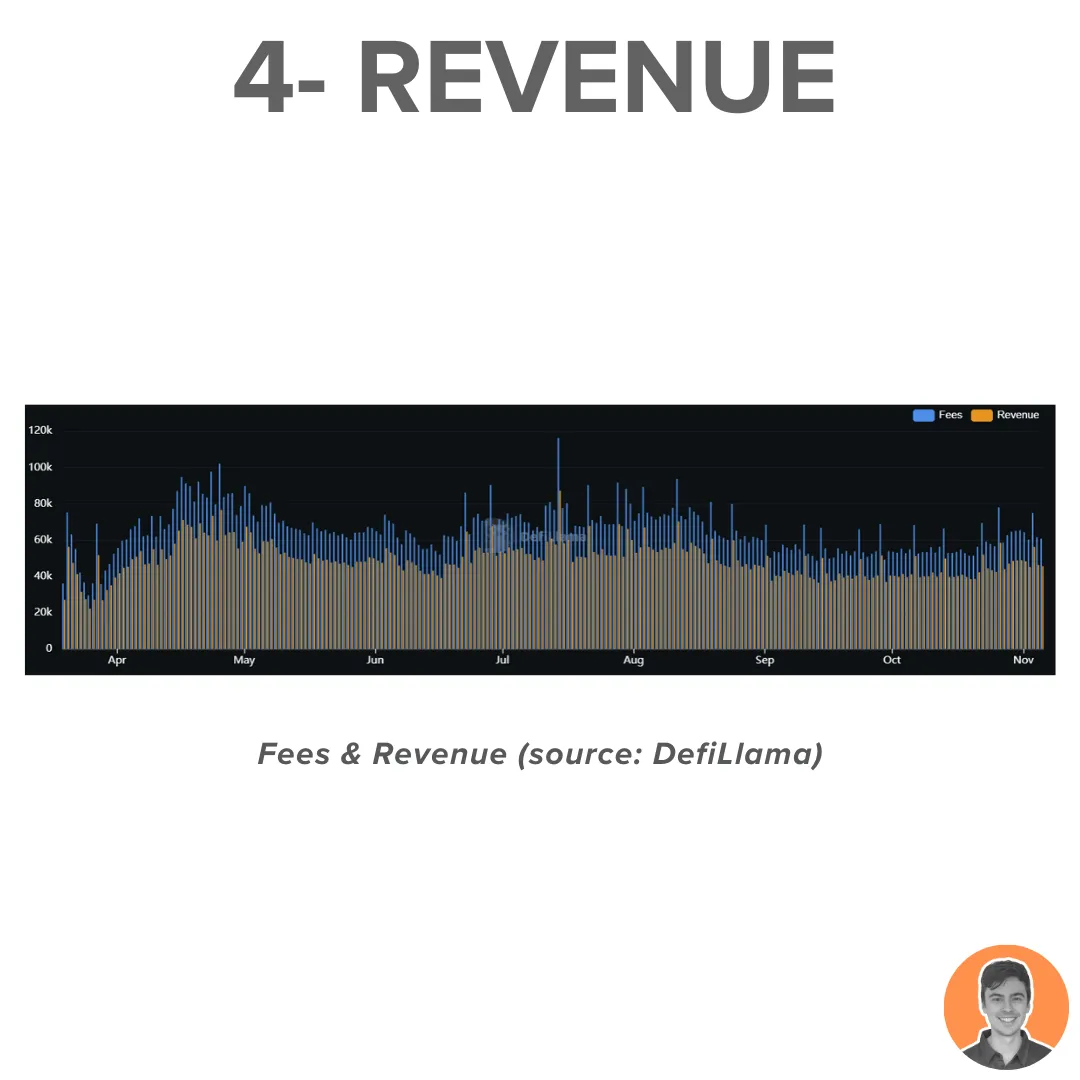

income

The income distribution of the agreement is as follows:

60% - locked RDNT dLPs;

25% - Lender;

15% - Operating expenses.

In the past 30 days, the agreement has produced:

$1.78 million in fees;

Revenues of $1.33 million.

This puts it at No. 2 among lending protocols and No. 15 overall.

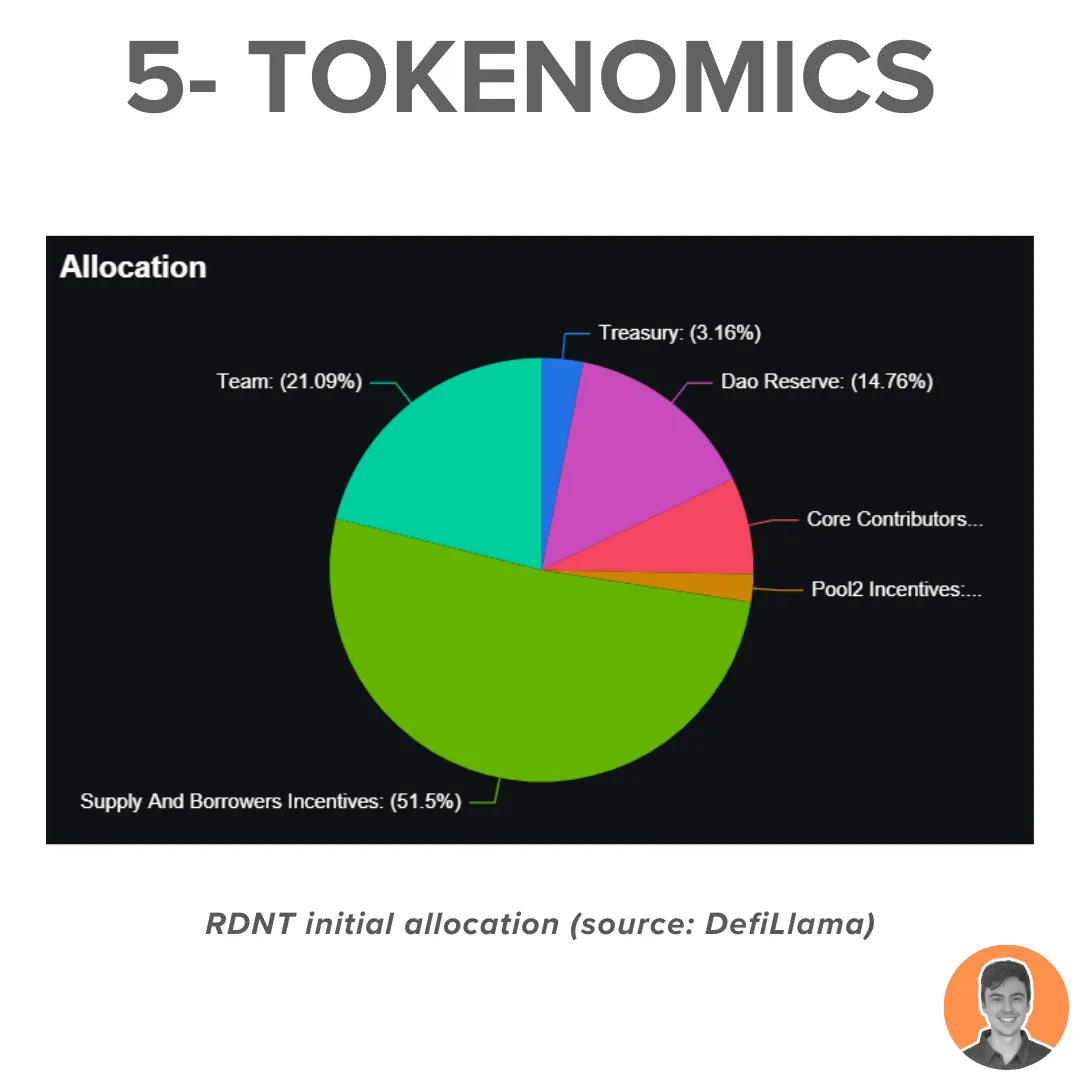

Tokenomics

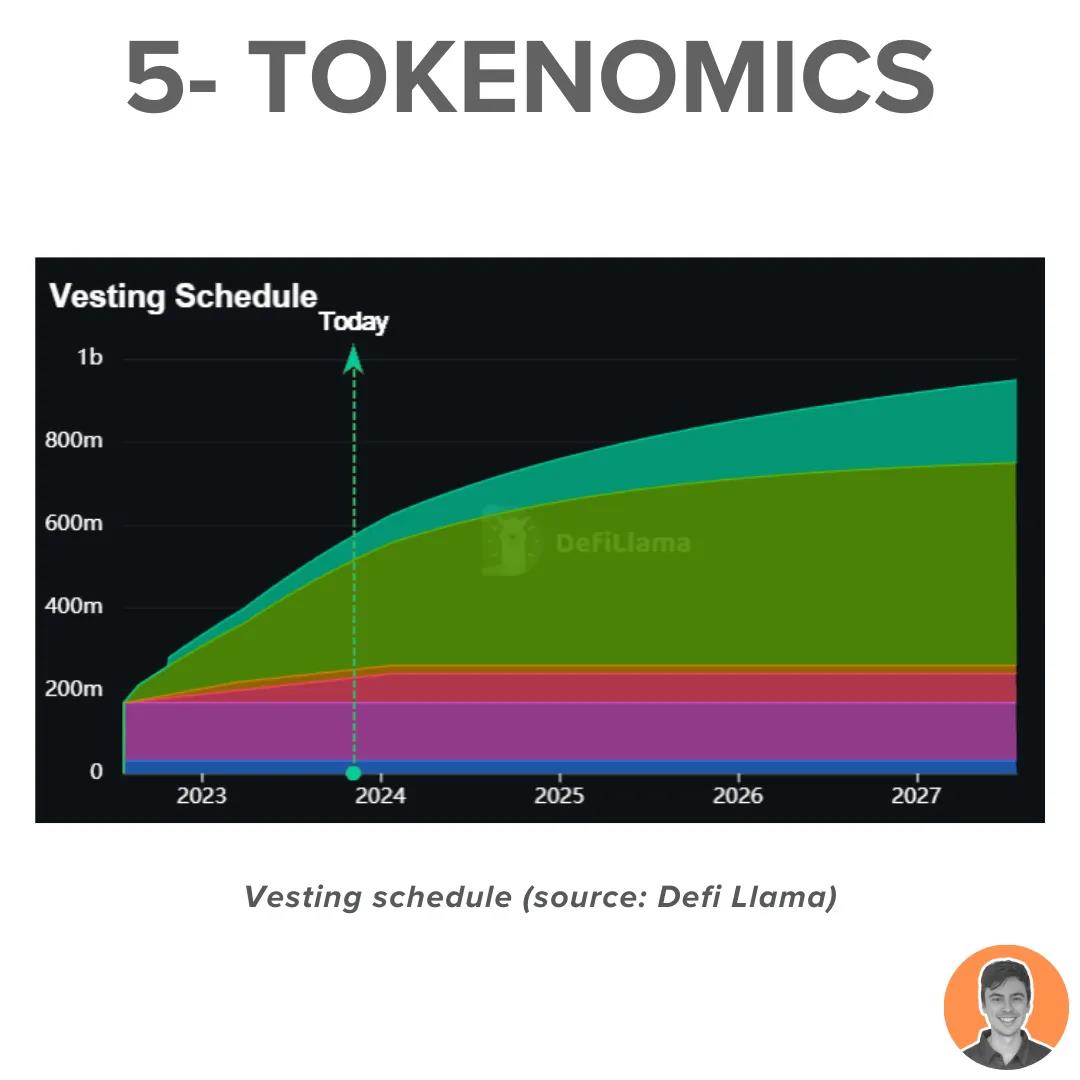

$RDNT is Radiant’s native utility token (OFT-20). LayerZero’s full-chain solution enables seamless on-chain token transfers. $RDNT supports protocol fee sharing and provides governance via locked dLP.

The protocol is now live on Arbitrum, BNB Chain, and Ethereum. All vesting will be completed in 2027.

Current supply statistics:

Circulating supply = 347 million

Maximum supply = 1 billion

Market cap = $95.5 million

FDV = $275.2 million

Market cap/FDV = 0.35.

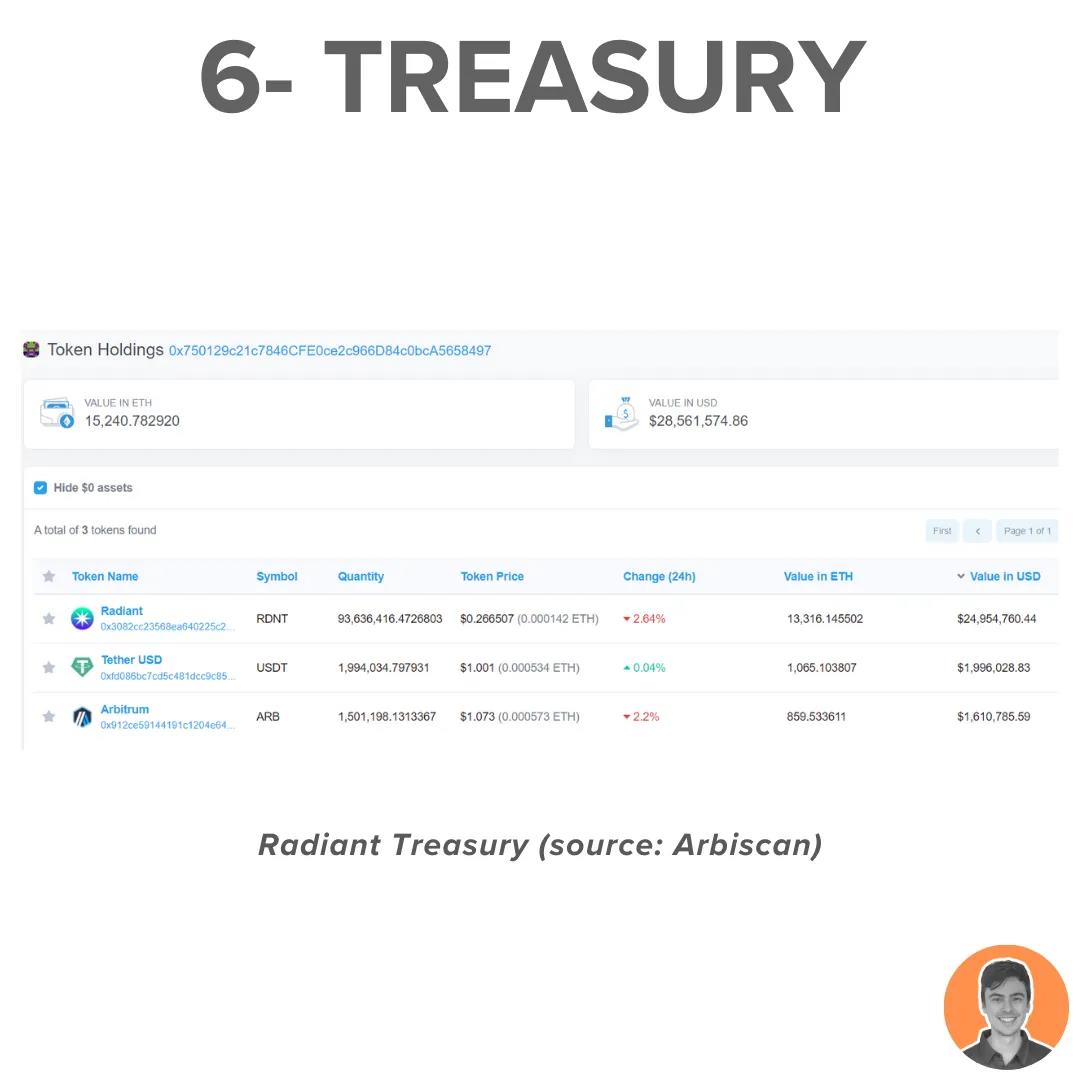

treasury

Radiant DAO has two main treasury wallets:

Radiant Reserve - $44 million

Radiant DAO Treasury - $28.5 million (RDNT, USDT, ARB).

The DAO reserves funds and has the right to decide the issuance and distribution plan of RDNT. Treasury funds are used for daily operating expenses (such as wages, listing, marketing, etc.).

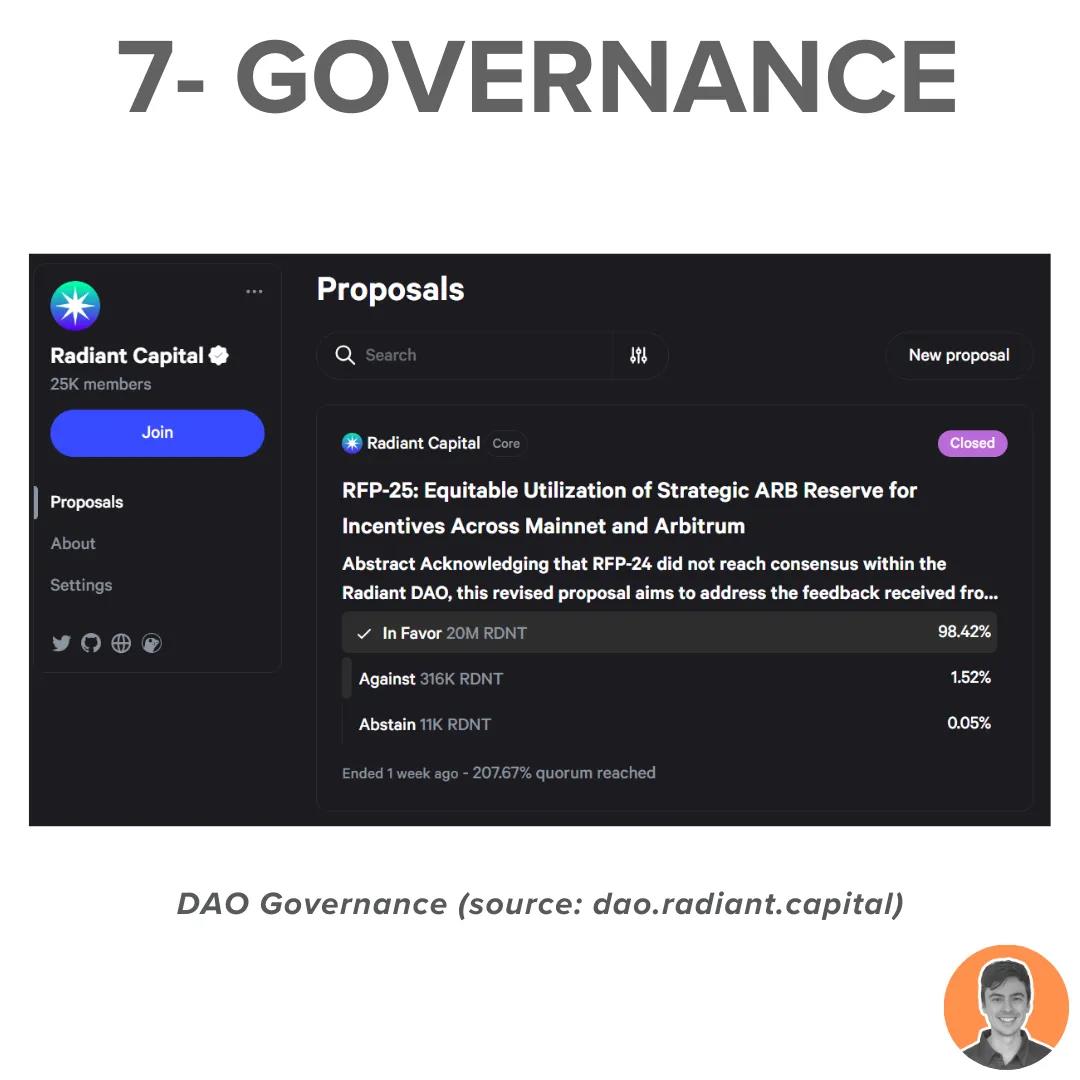

governance

Radiant Capital, which operates as a DAO, has 25,000 members on the governance forum and has voted on 25 proposals to date. To participate in the voting process for these proposals, you will need to lock up your RDNT tokens.

Currently, there are over 44 million dLP tokens locked.

Team/Investors

Radiant launches in 2022, with the founding team funding development themselves (approximately $1.5 million). There are no VCs, private sales or ICOs to raise capital.

Main partners:

LayerZero

Chainlink

Lido

Arbitrum

Balancer Labs

Binance Labs.

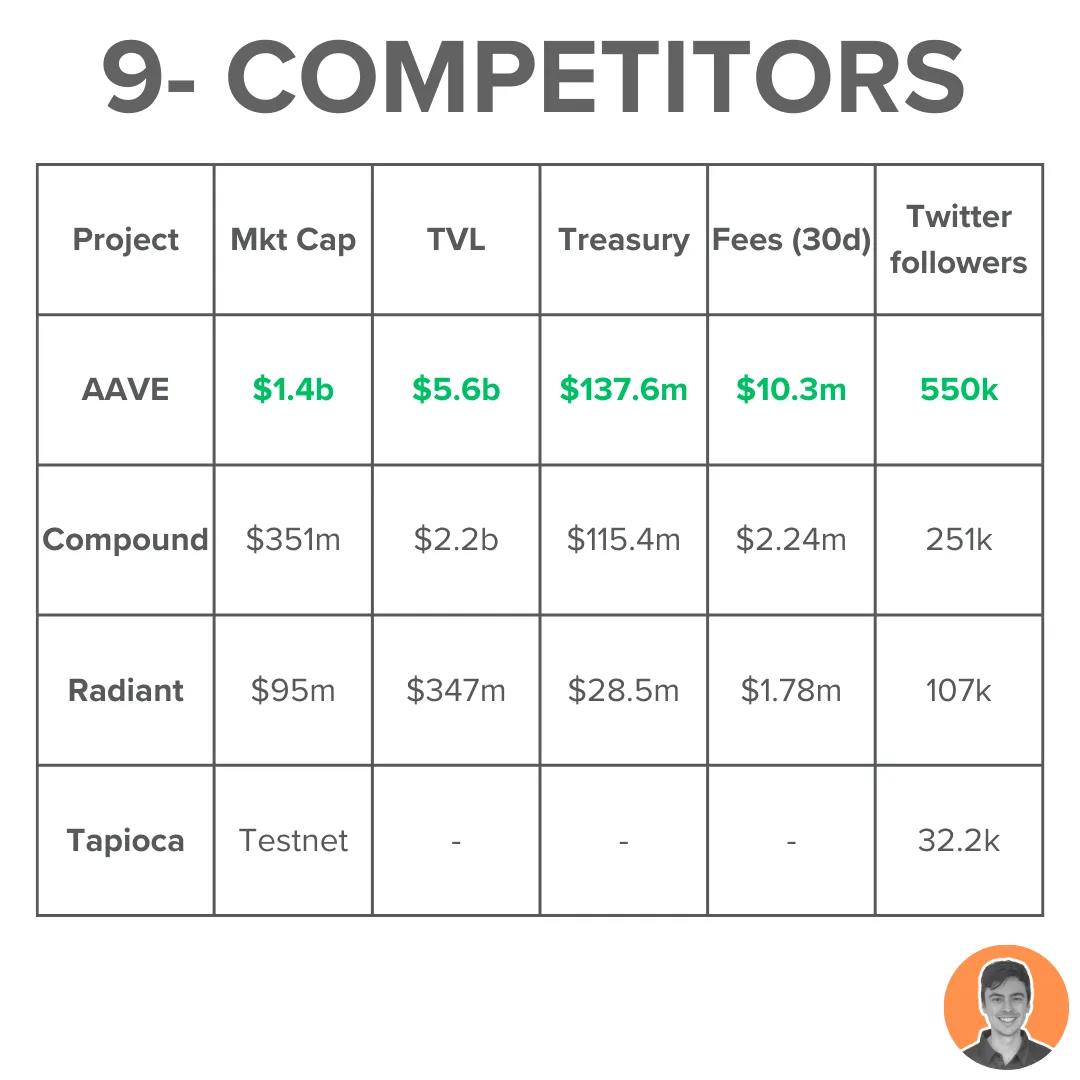

competitors

Aave is the dominant player in DeFi lending. Radiant is a fork of Aave and is becoming a strong competitor with full-chain capabilities.

Tapioca DAO is another emerging protocol operating as a full-chain money market on LayerZero.

In short, there is fierce competition in this space.

risk and audit

V2 of the codebase has been audited by Open Zeppelin, Peckshield, and Zokyo, and there are no outstanding critical or high-risk issues.

Additionally, there is a bug bounty program run by Immunifi.

However, like any DeFi investment, there are always potential contractual risks.

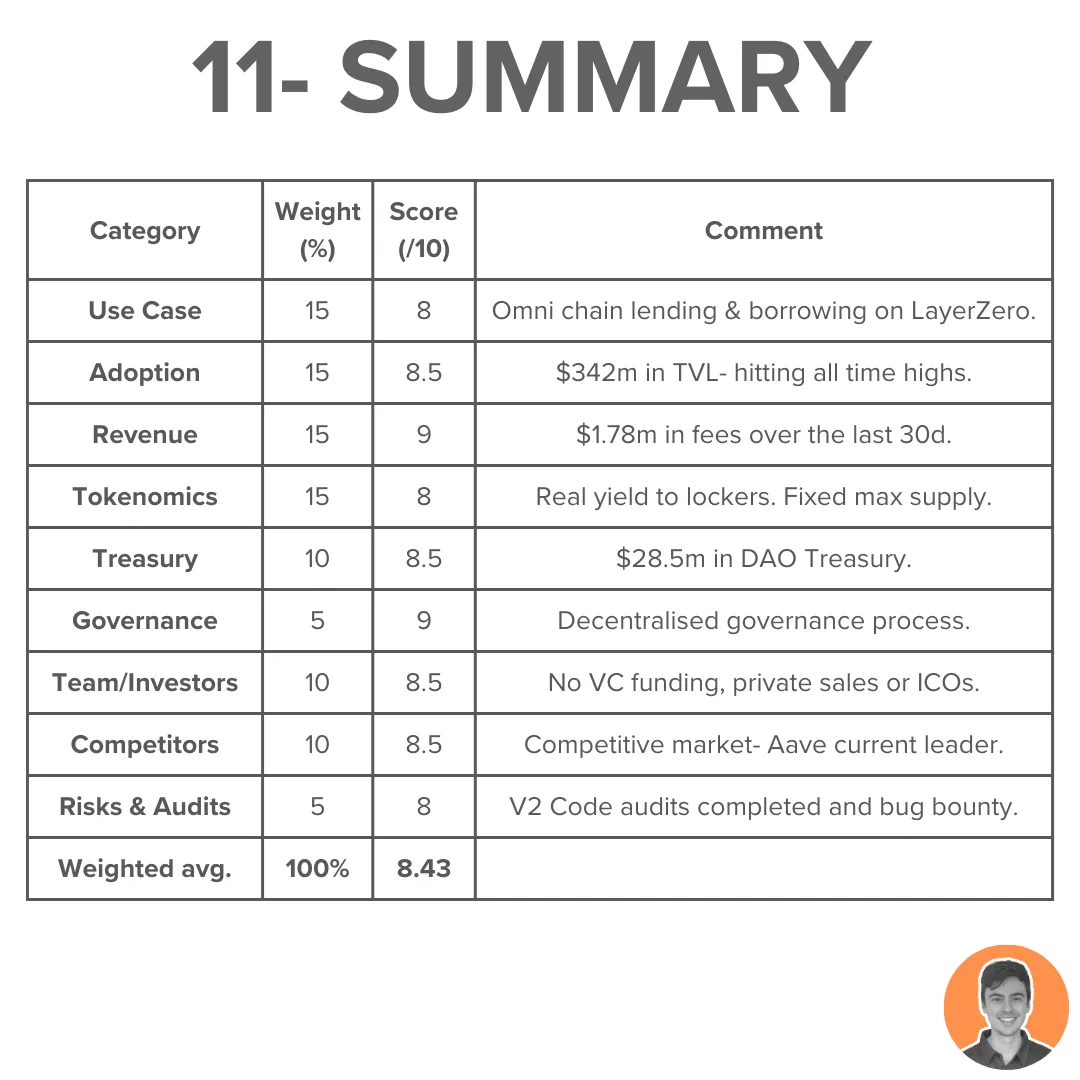

Summarize

Overall, I am optimistic about $RDNT and the Radiant protocol, with a score of 8.43. And there are some upcoming positive factors:

Launched on Ethereum

ARB season

STIP Grants – ARB points to new dLP stakers

LayerZero Narrative

Radpie integration.

https://jakepahor.substack.com/p/arb-season

TechFlow is a TechFlow-driven in-depth content platform dedicated to providing valuable information and thoughtful thinking.

Community:

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Add assistant WeChat to WeChat group: blocktheworld