GM friends.

I hope you’re enjoying the insane market pump we've seen over the past weeks.

After 2 years of chop, staying in crypto finally started to pay off.

Cheers to everyone who’s still here🥂

In today’s newsletter:

🕵🏼 This Week's Top Stories: Arbitrum & Polygon’s incentive programs, and LayerZero’s airdrop alpha

📊 This week’s On-chain Alpha

🗞️ The Latest DeFi news

Today’s email is brought to you by Holdstation - the project behind one of the most advanced Account Abstraction Wallets

Claim free GOLD tokens from Holdstation here!

🕵🏼 This Week's Top Stories

1. Arbitrum’s $50M ecosystem program

This week, the much-anticipated incentives have finally kicked off.

And we’re already starting to see their effects:

$44.17M worth of tokens have been bridged to Arbitrum L2 in the past 7D

GMX V2 TVL almost doubled over the past few days

GMX is currently among the only protocols that got a large grant and started distributing incentives to liquidity providers, but many others will follow in the coming days.

Besides this, a proposal to backfund 26 other ecosystem projects with 21M additional ARB tokens is also being discussed.

But the fact that GMX V2 TVL doubled in <2 days since the protocol started distributing ARB rewards shows that incentives can have a very strong impact on protocol growth.

I’ll keep an eye on Camelot, MUX, Radiant, JonesDAO, Vertex, and Pendle, as those are the protocols that got the largest ARB grants.

2. Polygon launched a $90M ecosystem incentive program

Last cycle, many L1s saw massive success following the launch of their large incentive programs. Now Ethereum L2s are trying to run the same playbook again.

As the market conditions have significantly improved, Polygon dropped several big announcements recently:

Just a few hours ago, Polygon announced a $90M ecosystem incentive program. For context, Polygon zkEVM currently has less than $100M in TVL. $90M in incentives should help it to significantly grow in popularity.

a partnership with Near Foundation - together with Near, an L1 with a very skilled tech team, Polygon Labs is building a ZK prover for WASM chains. This will enable devs to work in programming languages other than Solidity when building a chain with Polygon’s Chain Development Kit

POL, a major upgrade of the MATIC token that will significantly increase its utility, went live on Ethereum mainnet

On top of that, Sandeep Nailwal revealed that Polygon will make another big announcement on November 14th.

Polygon’s zkEVM L2 has grown relatively slowly since its launch in March.

But I think that this could change in the coming months.

Its team continued to work very hard through the bear market, and they know how to create hype and make big announcements that pump prices.

LayerZero’s Airdrop: What do insiders know?👀

Polymarket is the world's largest prediction market.

Since the end of October, the odds of a LayerZero airdrop in 2023 have doubled on Polymarket. The same thing also happened a few weeks before the ARB airdrop.

LayerZero is a very popular protocol that enables building cross-chain applications.

On top of that, LayerZero also got an SSL certificate for layerzero.foundation.

And there’s a high chance that they’ve done this in preparation for an airdrop.

For context, the recent airdrops of many popular projects like Arbitrum, Sui, and Aptos were all managed by their foundations for legal reasons.

So if you used dApps that are part of the LayerZero ecosystem (such as Stargate, and Radiant Capital), there might be an airdrop coming your way soon.

For those who didn’t, there might still be time to qualify, but most likely the snapshot with the eligible wallets was already taken.

Still, if you want to bridge your tokens to another chain in the coming days, do this using Stargate. (Stargate is the largest bridge built on LayerZero)

Who knows, you might get some free money in the form of an airdrop for doing this soon after.

Today’s issue is brought to you by Holdstation:

DeFi has a major UX problem.

Holdstation is building a DeFi ecosystem of products intending to make DeFi as easy as CeFi with a primary emphasis on enhancing the user experience.

Here’s what you need to know about it:

Holdstation’s wallet leverages Account Abstraction technology to redefine the user experience. The wallet simplifies onboarding by enabling social login and seedless recovery. On top of that, it enables using stablecoins for paying gas fees and fee-free trading just like on CEXs.

As part of their products, there is also Holdstation DeFutures. Holdstation DeFutures enables to trade multiple assets with leverage up to 500x and no gas fees.

HOLD is the upcoming utility governance token of Holdstation. By using Holdstation’s wallet, you can qualify for a future airdrop. There’s a strong possibility it will be launched in November.

Holdstation’s most active users can earn GOLD tokens for free by engaging with the wallet. GOLD is a utility token, that is rewarded for product usage. The token can be converted to uGOLD to pay discount fees, exchange for stablecoins, and much more.

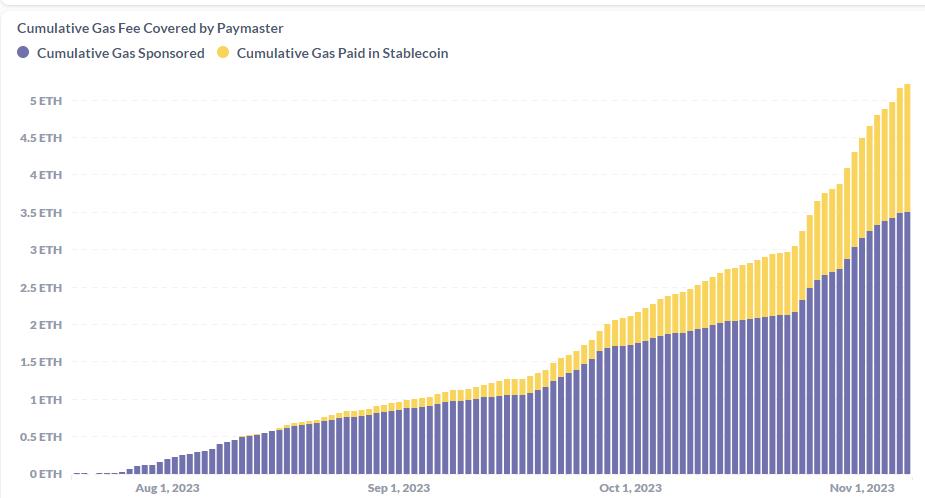

Over 1.7 worth of ETH has been paid by the wallet users for transaction fees in the form of stablecoins. By enabling users to pay transaction fees using stablecoins, Holdstation enables much greater flexibility than other wallets.

The project achieved almost 50,000 users and over $330M in total trading volume in less than 6 months after launch.

Claim some free GOLD tokens from Holdstation here!

On-chain Alpha🔎

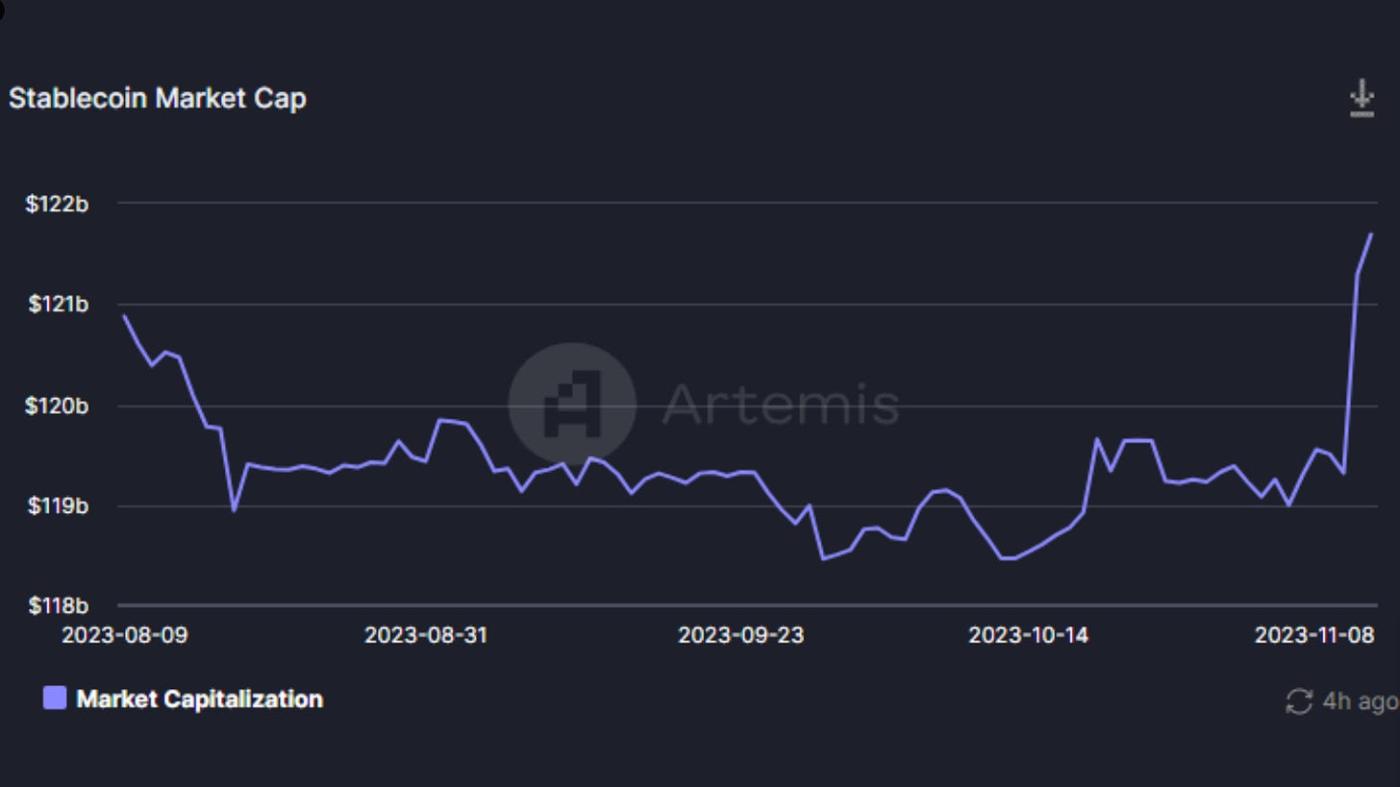

Stablecoin liquidity started trending up

Last week, I talked about how for the first time in a while, the total stablecoin market cap seemed to have reached the bottom and stopped decreasing.

Now the stablecoin netflows have turned positive.

This generally means that more and more investors are preparing to deploy capital in the market, so it’s a very good sign.

The latest developments in DeFi

Arbitrum’s ARB ecosystem incentives have begun and the ARB staking proposal was approved by the DAO

AAVE paused the Aave V2 Ethereum market due to a critical vulnerability found. A proposal to fix the vulnerability & restore normal operation was made

Radiant Capital went live on Ethereum mainnet. Radiant is building the first cross-chain money market powered by Layer Zero

Rage Trade introduced the Rage V2 Aggregator, a perps aggregator that enables trading perps across multiple chains.

Vela Exchange announced that its biggest trading event yet will start on 11/13. The perpetual DEX also hit $1B in trading volume this week

Polygon Labs teamed up with Near to develop a ZK prover for Wasm chains in order to maximize developer customizability.

Velodrome has released Relay, an incentive engine that enables veVELO lockers to maximize their staking rewards

Uniswap DAO voted for Uniswap V3 deployment on Scroll

=nil, a new scalability solution that scales Ethereum through sharding, was introduced. =nil will allegedly be able to support 60k TPS

Render Network has successfully migrated to Solana. Render is the leading provider of decentralized GPU-based rendering solutions

Lido Finance approved a proposal to incorporate a distributed validator technology module from SSV Network. This will enable a stronger diversification of the Lido Node Operator set

Jupiter Exchange has launched a novel perpetual DEX on Solana. The DEX works in a similar way to GMX

Notional Finance released Notional V3, a fixed-rate lending protocol, on Arbitrum. It enables fixed-rate lending & borrowing and leveraged yield strategies

That’s all for this week!

Until next time,

The DeFi Investor

For more DeFi content, follow me on Twitter.