The market trend has changed and many sectors have become active again.

In addition to the Bitcoin ecosystem under the spotlight, the AI track has been a hot spot this year and has been a stage where demon coins frequently appear.

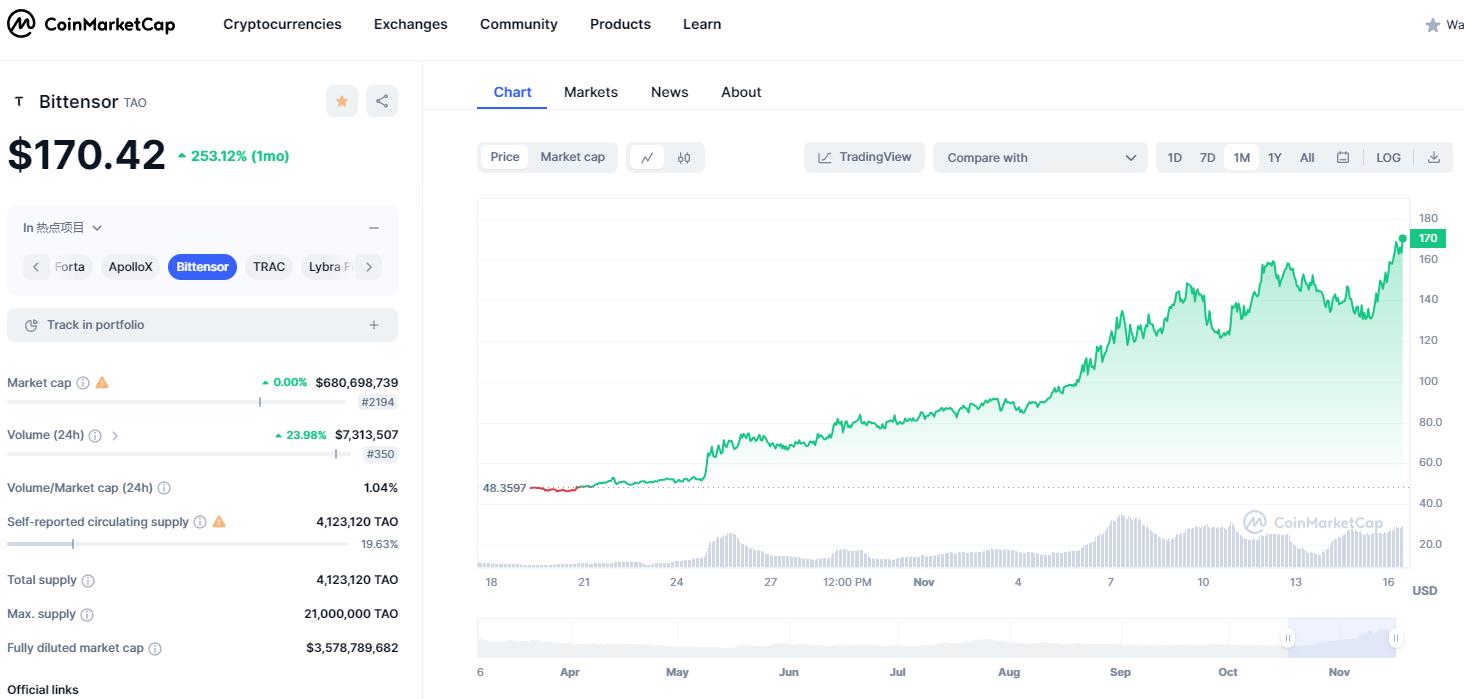

In addition to tokens such as FET, RNDR and OCEAN that are hotly speculated in the market, a token called TAO has tripled its value in the past month. The project behind it, Bittensor, is rarely used in the Chinese market. Analyzed in depth.

The rhythm on the other side is far faster than our reaction.

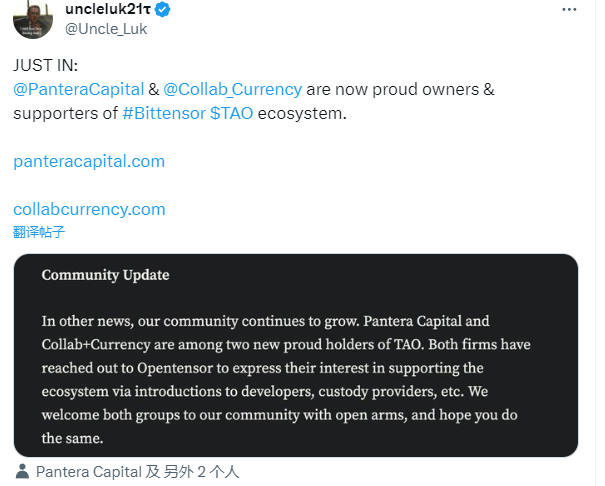

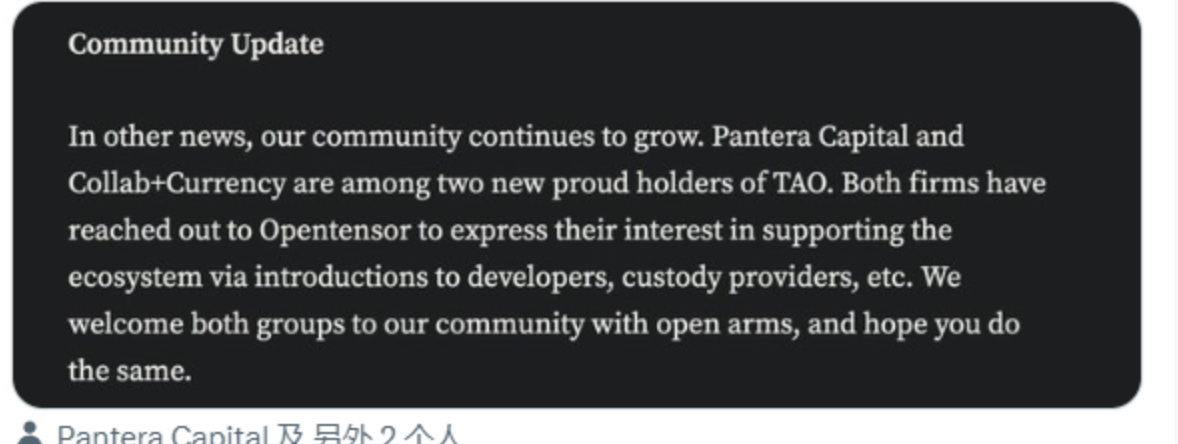

The explosive price also gave investors with a keen sense of smell an opportunity. The community announcement of the Bittensor project on Thursday announced that well-known crypto VCs Pantera and Collab Currency have become holders of TAO tokens and will provide more support for the ecological development of the project.

VCs are good at capturing the evolution of trends and even better at promoting the development of trends.

What’s so special about TAO, which is so popular and soaring in price? What are the characteristics of its narrative, products and token economy that are significantly different from mainstream projects in the AI track?

In this issue, we will go deep into Bittensor and conduct a comprehensive analysis of its track background, project goals, technical composition, token valuation, etc., to provide a reference for everyone's judgment and decision-making.

Don’t worry, first find out the investment logic of Cyrpto + AI

The rise of any token is supported by basic investment logic and the overall narrative of the industry. Before studying TAO, you might as well take a look at the overview of the entire AI industry.

The AI craze amid the bond bubble

The concept of AI tokens is very popular, but there is actually no Crypto, which does not affect the popularity of independent AI.

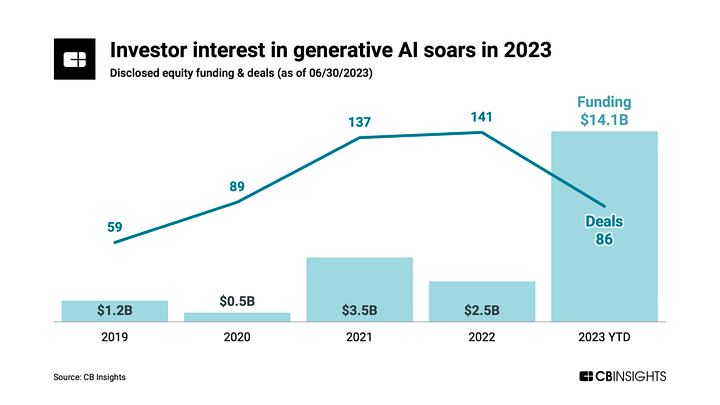

Data from CB Insights shows that the market's interest in generative AI has grown significantly in 2023, and the total financing amount invested in AI-related companies and projects has soared to 14 billion U.S. dollars; last year, this number was only 2.5 billion U.S. dollars.

Image source: CB INSIGHTS

Therefore, whether it is TAO, RNDR or FET, the deep driving force behind it is by no means as simple as ChatGPT and NVIDIA on the surface.

In a recent blog , industry leader Arthur Hayes showed a situation that may or is happening--- a collective AI funding boom caused by the bond bubble.

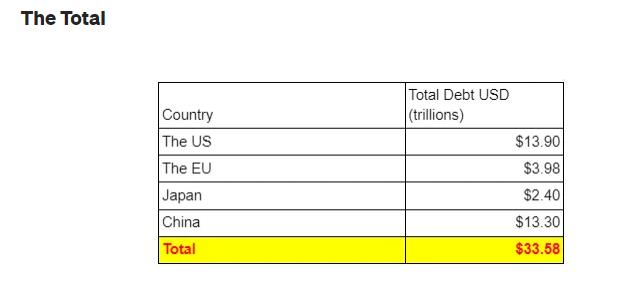

According to estimates, the total amount of government debt that must be rolled over and issued due to fiscal deficits in the world's largest economies, led by the United States, in the next three years is expected to reach 33.58 trillion.

The government issues bonds and promises to repay the principal and interest upon maturity. If the bond interest is high, it means that all the funds will be used to buy government bonds, causing the capital of the private sector (corresponding to the government's public sector) to be absorbed, which will inevitably squeeze out other sectors of society. Investment and financing opportunities, such as other companies unable to raise funds, or the stock market is in a downturn.

Therefore, Arthur believes that the U.S. central bank will inevitably require printing money and issuing its own money to purchase the debt it issues, thereby reducing the impact on the private sector; and this will be expected to lead to a significant increase in the world's fiat currency supply in 2026 (even more than COVID-19) period).

Where will all the extra money go?

“Money will flow to new technology companies that promise crazy returns when they mature. Every fiat liquidity bubble has a new form of technology that attracts investors and attracts large amounts of capital.”

There was the Internet bubble in the 1990s, and there was online advertising and social media after the 2008 financial crisis; but this time it is AI's turn.

This may be one of the underlying reasons why generative AI has received so much investment this year. GPT's technology is obvious to all, but from a larger perspective, it is only the brightest pearl in the flood of capital. The trend of collective capital influx into AI has already emerged.

Crypto + AI, narrative direction division

The money comes in, and the next question is what to invest in. Let’s take a closer look at the investment logic of Crypto + AI.

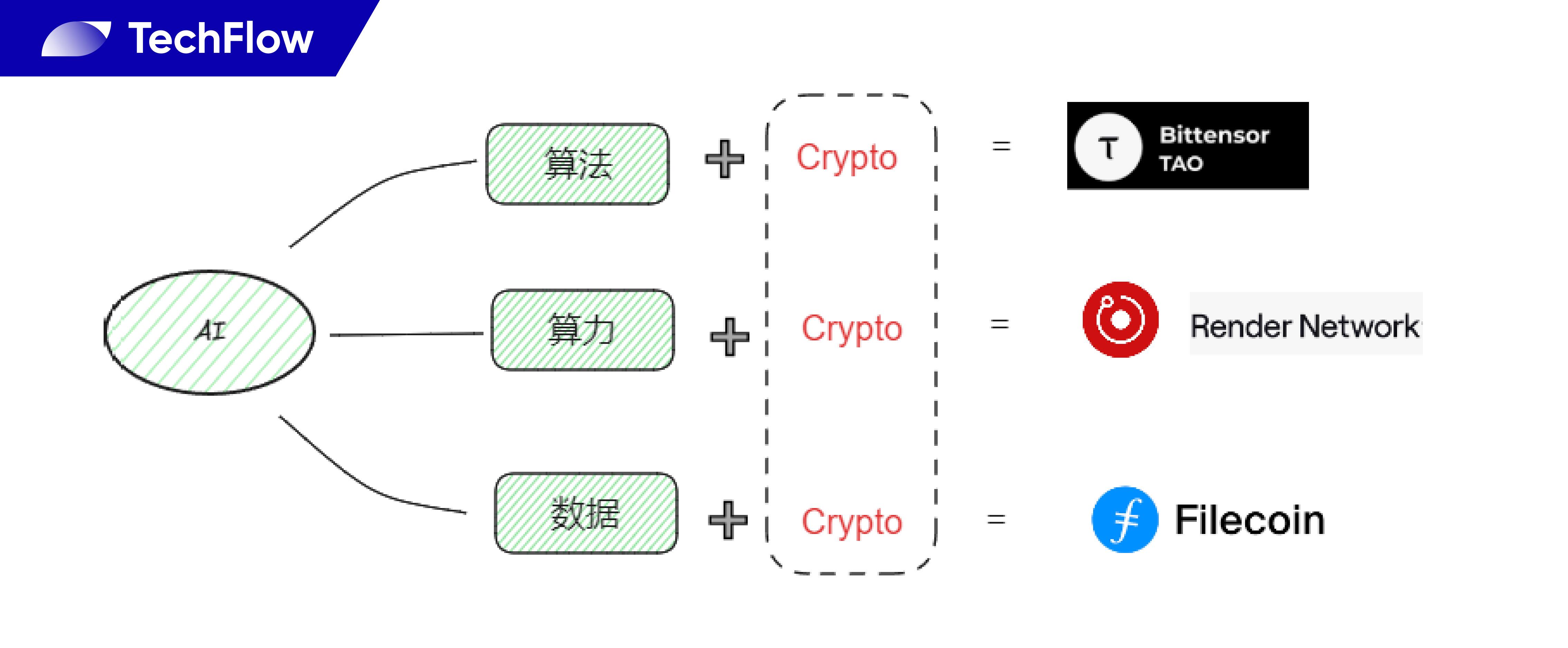

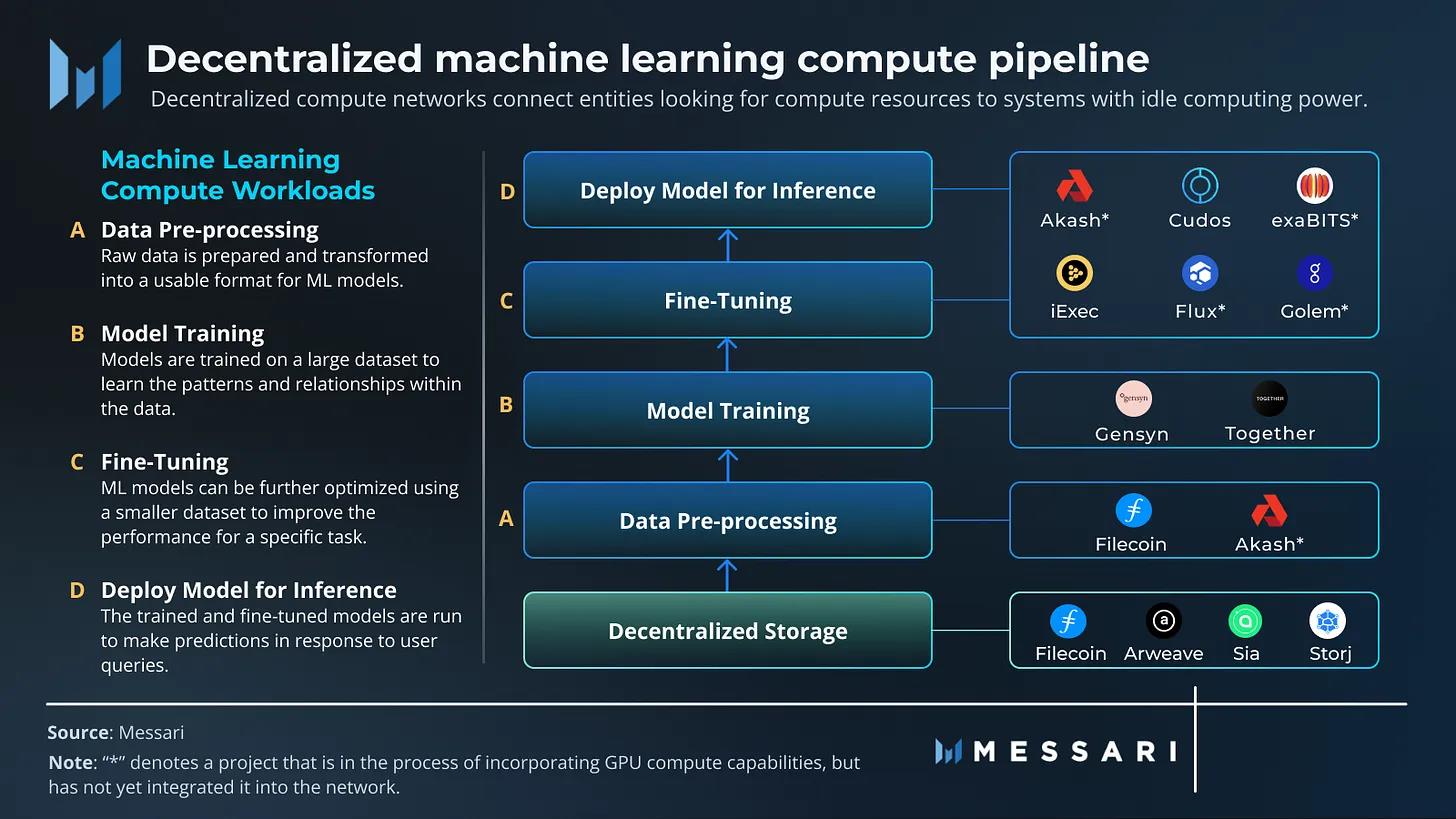

As a cliché, AI is essentially an advanced productive force, and its rapid development relies on three core elements: data, algorithms, and computing power ; cryptocurrency and blockchain are more about production relations, through incentives, coordination, and changes in organizational forms. Promote changes in the above three elements.

Which tokens can improve these three factors have the possibility of hot combination.

Let’s not discuss feasibility for now. At least in previous projects, we have intensively seen two narrative directions of crypto + data , and cylinder + computing power :

- Cyrpto + Data: AI requires massive amounts of data to train models. Blockchain can mobilize data providers to contribute data through incentives, or use decentralized data storage to pave the way for more democratized and decentralized data training needs. .

Under this narrative, the cryptocurrencies that benefit can be decentralized storage infrastructure, such as Arthur’s powerful Filecoin;

- Crypto + computing power : The implementation of AI models requires powerful computing power. Major manufacturers or some computing resource providers have this capability, but the long-tail market can still be considered to allow computing resources scattered around the country (personal graphics cards/ Equipment), etc. contribute computing power to obtain cryptocurrency incentives.

Under this narrative, cryptocurrencies that benefit such as RNDR and other projects that can contribute computing power.

As for the algorithm, it is a different set of logic.

-Crypto + algorithm: Different from the "resource-intensive" ones of the first two, the algorithm itself is a technology-intensive thing, and it is also the secret recipe and barrier for the continuous iteration of various AI companies. It is difficult for you to go from 0 through the incentives of cryptocurrency." Create “a better algorithm; the logic of contribution, coordination, and incentives does not work in algorithm creation.

( Note: A certain AI model is the result of algorithm training. Strictly speaking, there is a sequential relationship between the algorithm and the model. However, in the following description, the author mixes the two for easier understanding.)

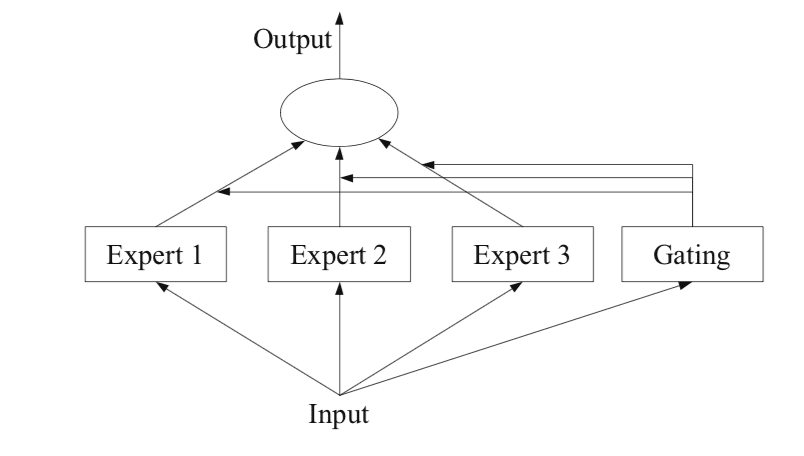

However, you can use incentives to "screen" a better algorithm from existing algorithms without letting everyone use the same company's products. Similar to the oracle project, which uses incentive mechanisms to encourage competition and select better data sources.

There is currently no particularly prominent representative of the project in this segmented narrative, and Bittensor is one of them - it neither directly contributes data nor computing power. It uses the blockchain network and incentive mechanism to control different projects. Algorithms are used for scheduling and screening , allowing the AI field to form an algorithm (model) market for free competition and knowledge sharing.

Understand Bittensor in seconds Narrative: AI Lego makes algorithms composable

Sound complicated?

In order to facilitate understanding, you can roughly summarize Bittensor in one sentence: We do not produce algorithms, we are just porters of high-quality algorithms .

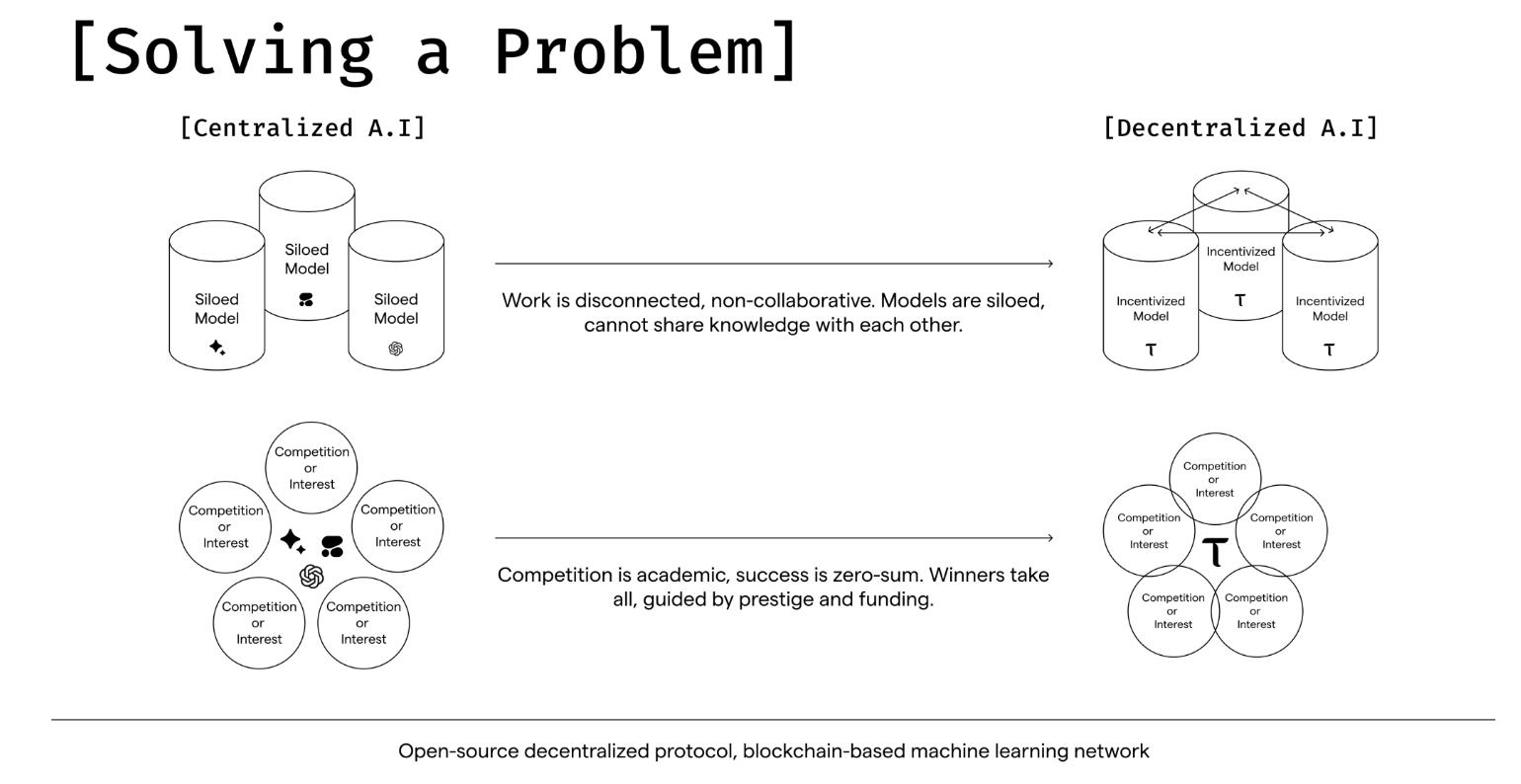

Why move the algorithm? If you look at the current ecological status of the AI field, you can find problems.

For players in the AI track, each company’s algorithms and models are currently isolated . Due to business competition, you cannot let the algorithms of two companies learn from each other and make progress together; this also means that from the AI supply side, competition is zero-sum: if one company's AI wins the market, the other companies will be eliminated .

Image source: Bittensor official website

For competition winners, this is certainly no problem.

However, Bittensor believes that this is detrimental to the progress of the entire AI and the efficiency of algorithm innovation. Isolated models and AI services that only select winners mean that once someone wants to develop a new model, they may have to start from scratch;

Assume that model A is proficient in Spanish and model B is proficient in writing code. When a user needs to ask AI to explain the code with Spanish comments, it is obvious that the two algorithms work together to produce the best output, but this is not possible in the current environment;

In addition, since third-party application integration requires the permission of the AI model owner, limited functionality also means limited value, and the synergy of the entire AI field is not actually released.

Therefore, the big goal of the Bittensor project is to enable different AI algorithms and models to collaborate, learn, and combine with each other to form more powerful models and better serve developers and users.

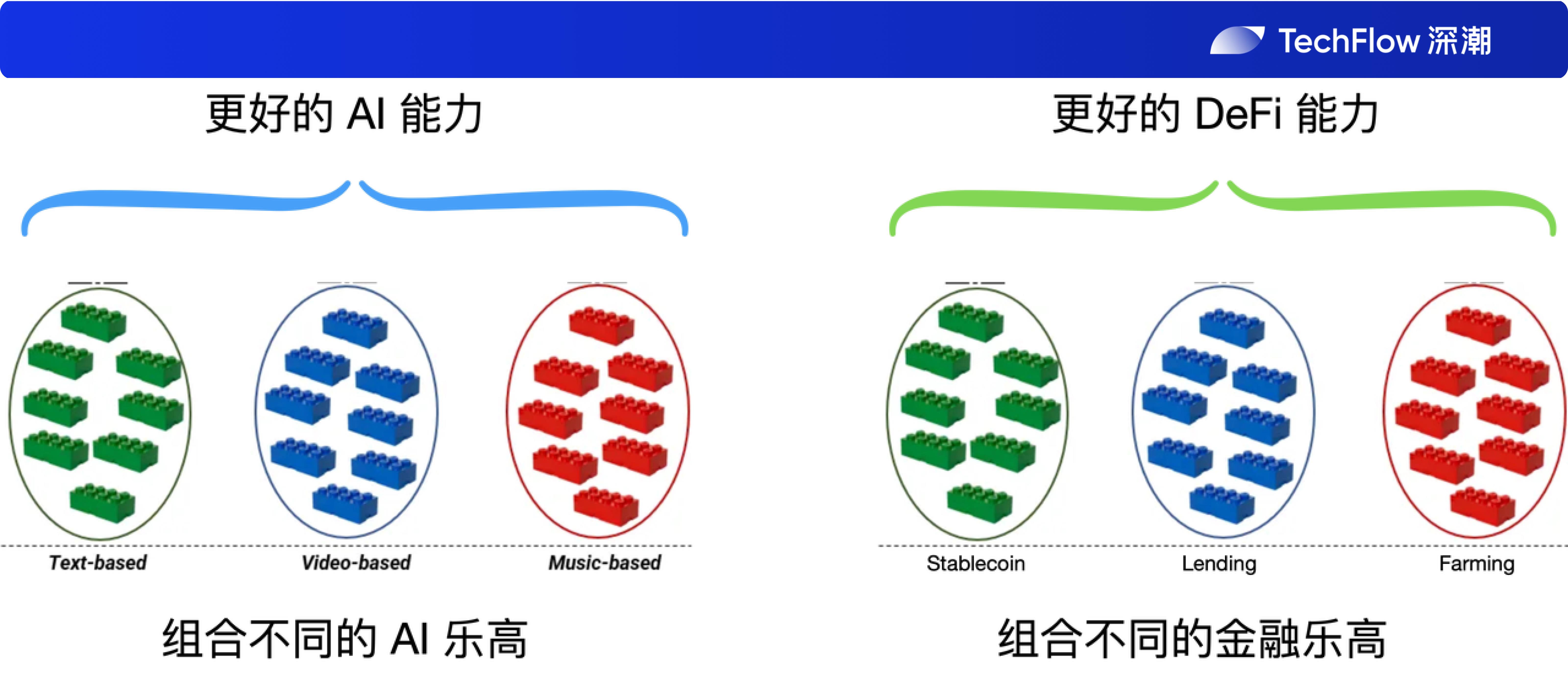

We actually saw this idea and formula in the DeFi Summer a few years ago - Financial Lego .

Financial components such as stablecoins, lending, and liquidity mining are all open source and permissionless, and demand parties can combine them at will, just like Lego blocks, to form new products and services.

Similarly, AI algorithm models that are good at image processing, text processing or audio processing can be combined to serve different tasks to form AI Lego.

Therefore, for Bittensor, the project itself will neither perform calculations nor provide data for on-chain machine learning. Instead, it will mobilize all other off-chain AI models to collaborate together.

In theory, by building AI Lego bricks, Bittensor can expand its AI capabilities faster and more efficiently than an isolated model.

However, it remains to be seen whether the provider of the AI model will buy it in reality, how to do business expansion, and whether it can be implemented.

Based on mining and incentives, realize the "oracle" of the AI model

Letting different AIs collaborate with each other is a big goal, but how can it be achieved?

The answer given by Bittensor is to establish a blockchain network that is coordinated and operated through mining incentives.

Bittensor adopts Polkadot's parallel chain (application chain) design on the core, which is equivalent to having its own chain to specifically handle the collaboration of AI models, and has its own token $TAO for incentives.

To understand the operating mode of this chain, at least three questions need to be clarified:

First, what are the roles in this chain?

Second, what are these characters doing? How are they related to each other?

Third, what behaviors do tokens incentivize these characters?

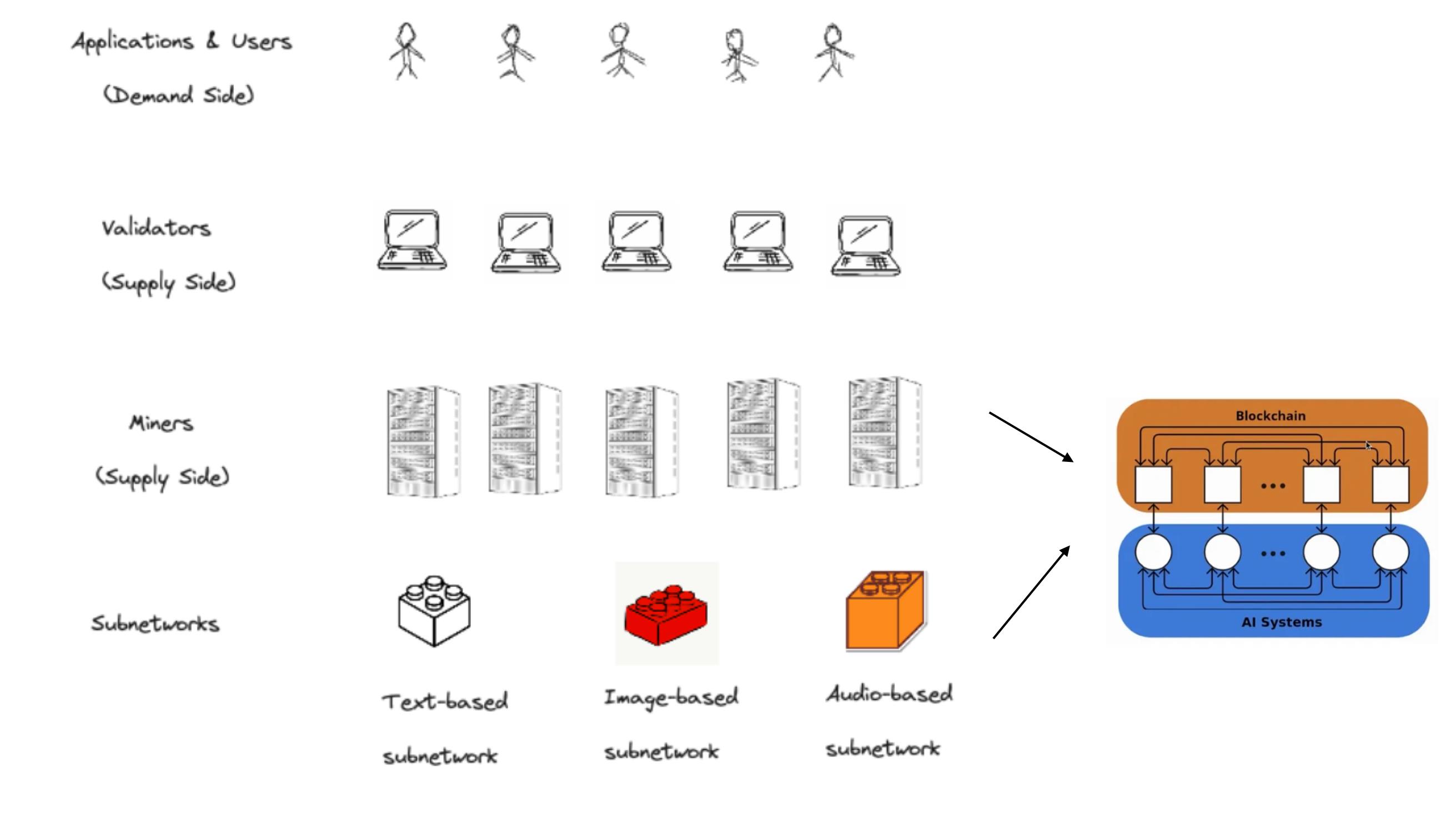

- Roles and functions on the chain:

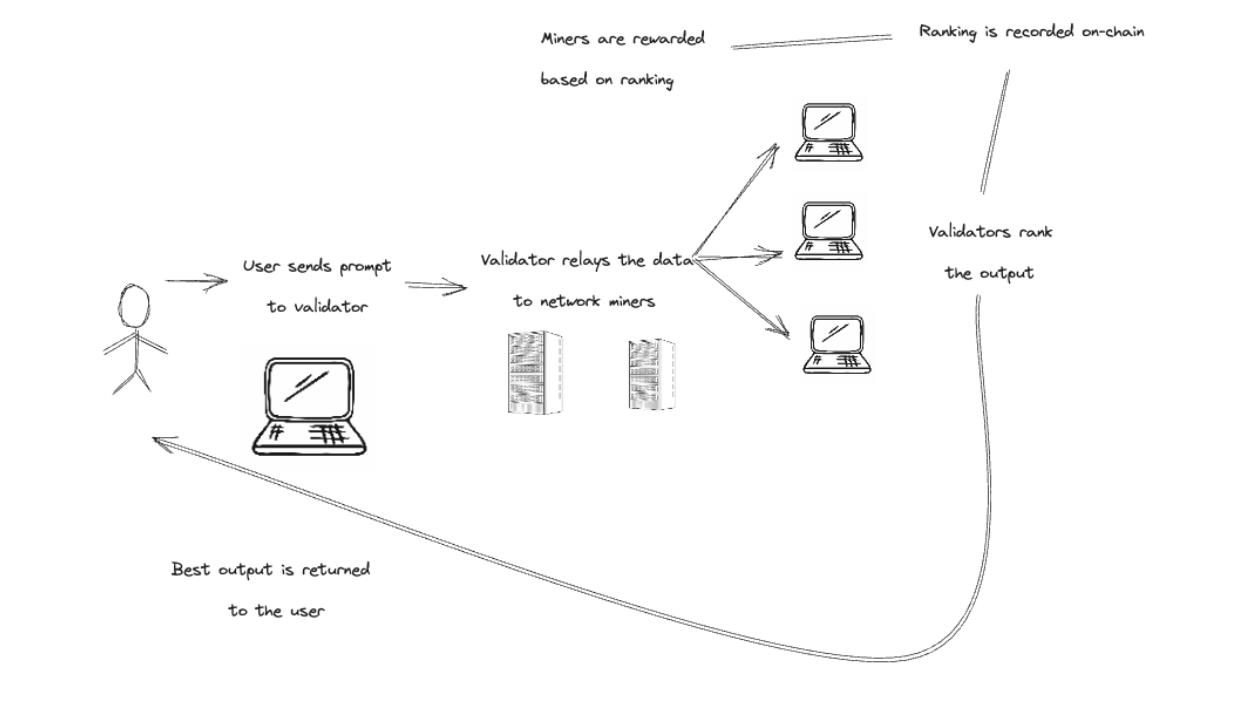

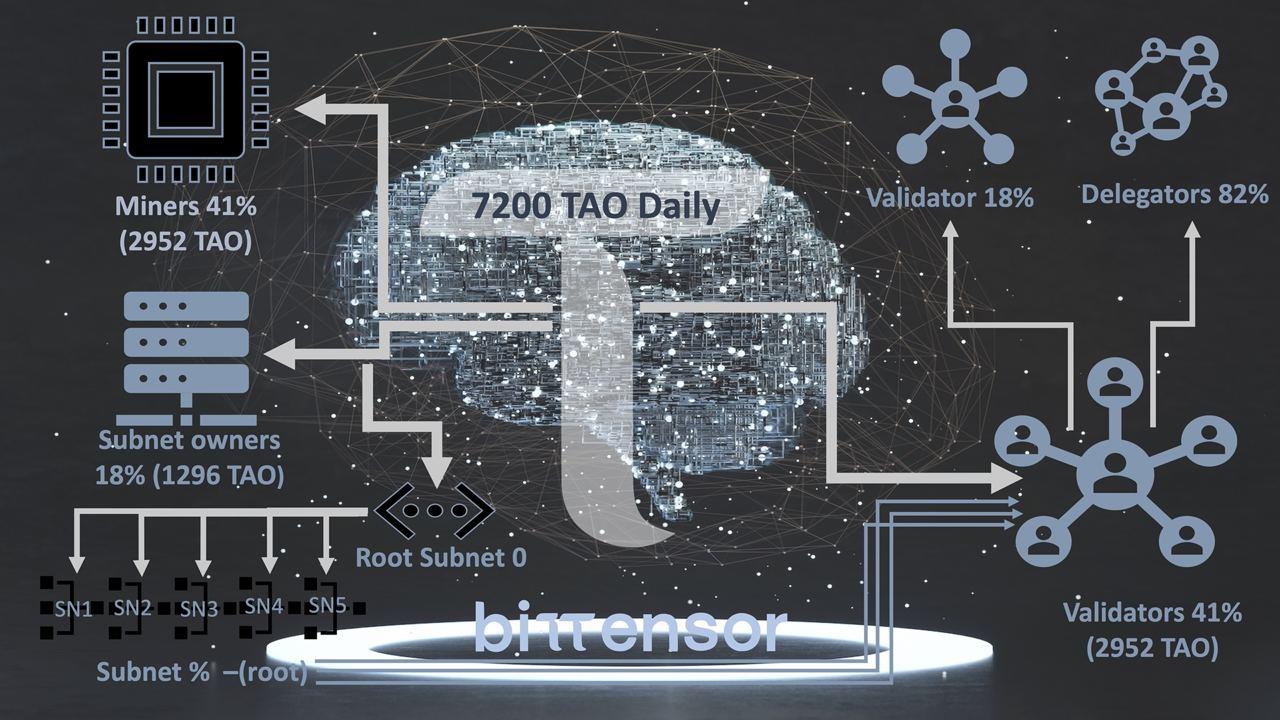

- Miners: can be understood as providers of various AI algorithms and models around the world. They host AI models and provide them to the Bittensor network; different types of models form different subnets, such as models specializing in pictures or sounds.

- Validator: The evaluator within the Bittensor network. Evaluate the quality and effectiveness of AI models, rank AI models based on performance on specific tasks, and help consumers find the best solutions.

(Note: The current verifiers seem to be institutions owned by the project party , which may not be decentralized enough. However, as the network develops, other organizations may be recruited to act as verifiers)

- Nominator : Delegate tokens to a specific validator to show support, or you can delegate tokens to different validators. It's a bit like DeFi where you pledge your tokens to Lido to get income.

- User: The end user of the AI model provided by Bittensor. It can be an individual, or it can be developers seeking to use AI models for applications.

- Connections between characters:

Users need better AI models, validators are responsible for screening better AI models according to different uses, miners provide their own AI models, and nominators choose to support different validators.

To put it bluntly, it is an open AI supply and demand chain: some people provide different models, some evaluate different models, and some use the results provided by the best model .

Image source: ReveloIntel

The above picture provides a simple explanation: users enter their needs, and the verifier routes the needs to the miners in the Bittensor network; the miners output the answers, and the verifiers evaluate the quality of the answers, and finally return them to the users.

- What do TAO tokens incentivize?

- For validators : The more accurate and consistent the screening and evaluation of AI models, the more rewards they will receive. Obviously, to become a validator, you need to stake a certain amount of TAO tokens.

- For miners : provide their own models in response to user needs and obtain TAO tokens based on their contributions.

- For nominators : entrust their TAO to the verifier, similar to liquidity staking rewards

- For users : Pay TAO tokens to start tasks, which is equivalent to consumption

Ideally, different AI models in this network will collaborate, and there is a high probability that different models will perform differently on different tasks; since the network nodes on these task chains are visible, the models can actually learn from each other, so as to Make different adjustments based on the task.

Image source: ReveloIntel

A better analogy is: Bittensor is a bit like an AI “oracle”. Oracles in DeFi are "feeding the best prices" to applications that have needs, and Bittensor is "feeding the best models" to users with AI needs.

As for how to participate in this network as a validator and miner, it will not be described here because it involves technical code and development interfaces. Interested readers can view the official documentation here.

$TAO Token: How is it best valued?

- Token Economic Model

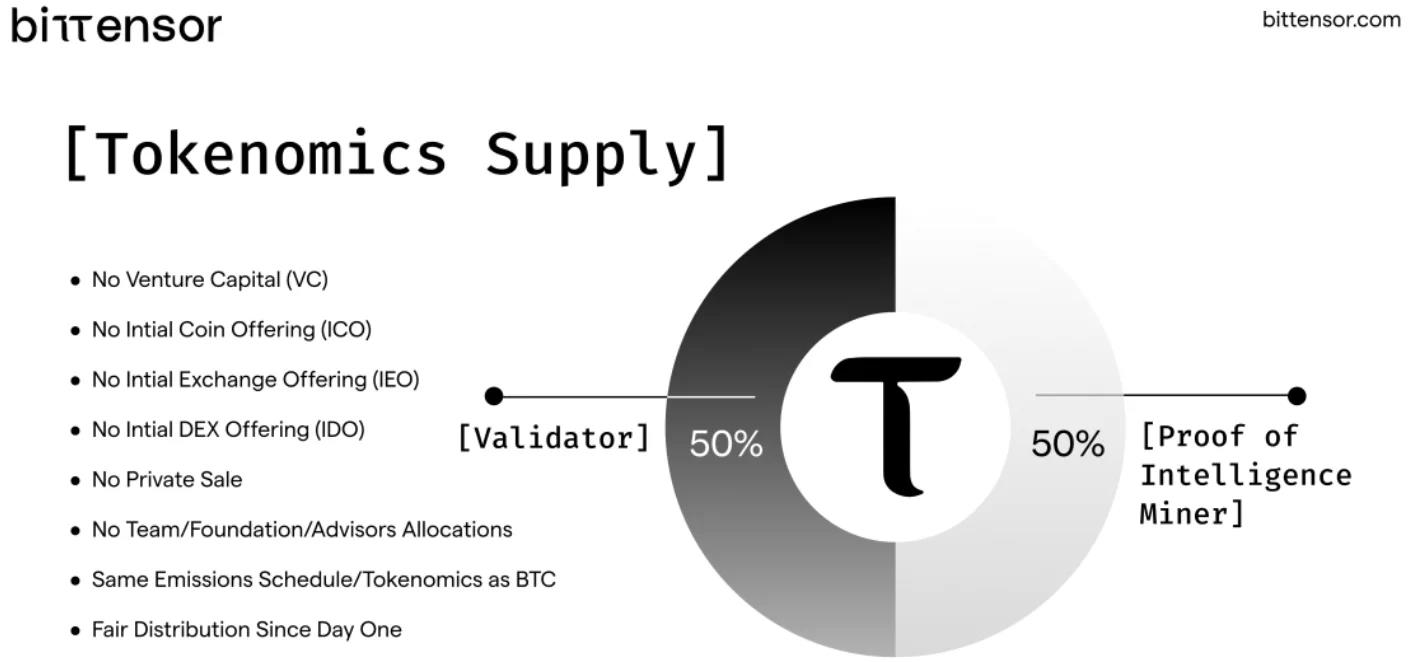

According to official documents, Bittensor will be "fairly launched" in 2021 (without pre-mined tokens), and the token is called TAO.

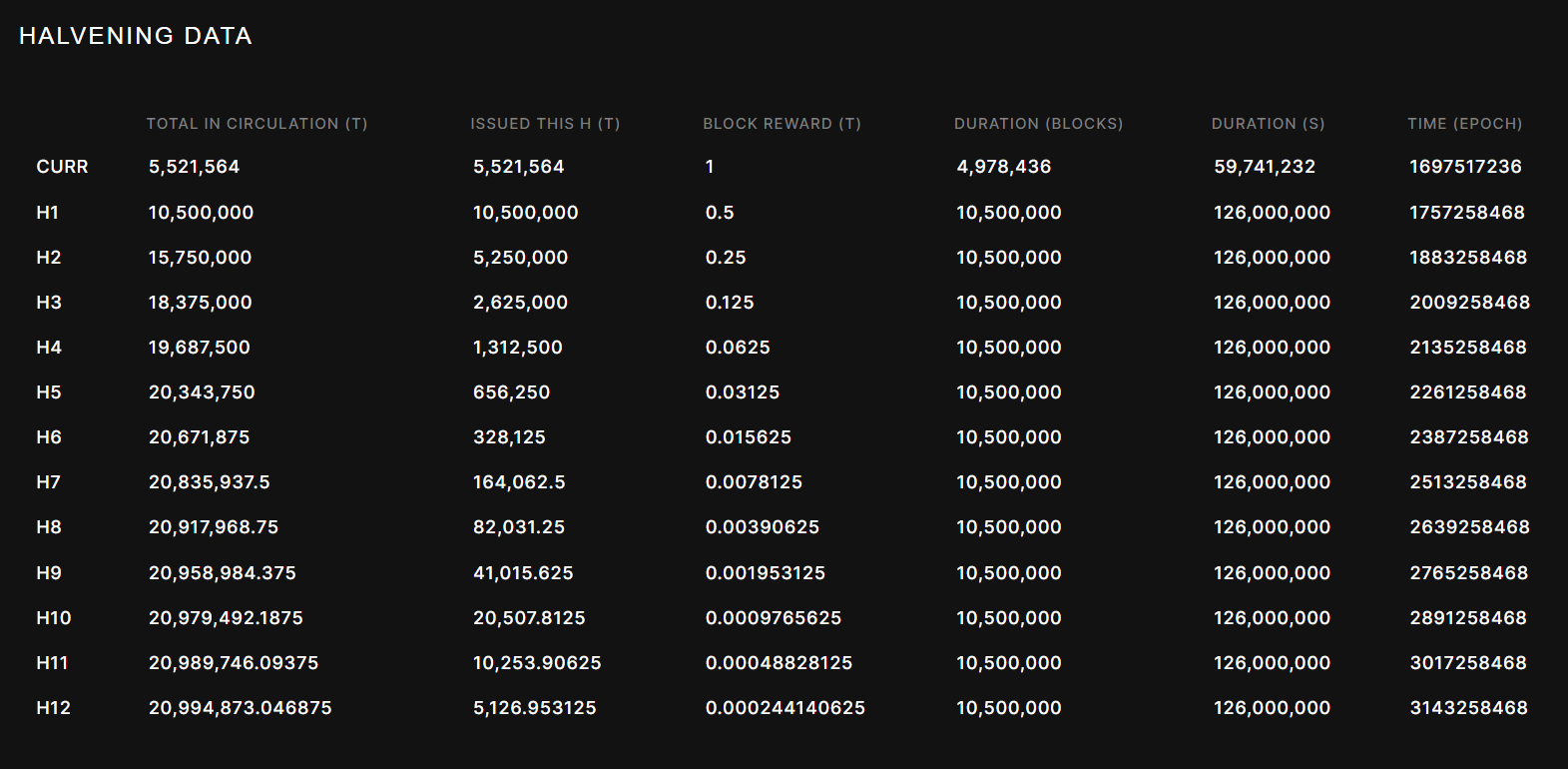

The supply of TAO is 21,000,000 (a nod to BTC), and it also has a 4-year halving cycle, with the reward of each block halved every 10.5 million blocks. A total of 64 halving events will occur, with the most recent halving cycle occurring in August 2025.

What is a bit sci-fi is that according to this halving cycle, it will take 256 years for these tokens to be completely mined .

Currently, a TAO is sent to the network every 12 seconds. A rough calculation shows that 7,200 TAOs will be produced in a day, with miners and validators each getting half.

The fair launch of TAO means that there are no common routines such as VC rounds, private equity rounds, ICO/IEO/IDO, foundation reservations, etc. It can be understood as a pure mining currency.

For each mining round, TAO will be distributed between validators and miners.

However, on Bittensor’s official website, we also see well-known investors and market makers such as DCG, GSR, Polychain and Firstmask.

A reasonable speculation is that most of the validators in the network are currently associated with Bittensor’s official institutions, which means that the mined coins can be returned to their own hands and then distributed to market makers for market making;

At the same time, these large institutions can also come in to act as verification nodes or even miners to mine TAO.

We also mentioned at the beginning of the article that crypto VCs such as Pantera have recently become TAO holders. Therefore, Bittensor itself is launched fairly, but it does not mean that there is no VC involvement at all;

However, in this new market cycle, the currency issuance model of "VC sold to secondary companies" is no longer popular. TAO's model of "fairness first, and then attracting capital intervention" is objectively speaking, it has done its best. fair.

- Market performance and valuation

Judging from TAO's market performance alone, the token price has increased more than 5 times from the lowest point this year to now;

But the problem is that other AI projects have also seen good growth. For example, RNDR has increased almost 5 times since the beginning of the year.

Therefore, it is not very useful to analyze the value of tokens based on absolute increase.

Compared with other popular AI projects, TAO's market value is currently second only to RNDR . However, due to the long-term release mechanism of halving in 4 years, the ratio of market value to fully diluted value is the lowest among several projects, which also means that TAO The overall circulation volume is currently relatively low, but the unit price is high .

Original picture: X user @Moomsxxx, TAO price is calculated by the author as of press time

In some cases, low circulation means that a small market is easier to pull up. In addition, assuming that the price remains unchanged (current price is $160), all 7,200 TAOs are mined and sold every day, and the selling pressure of the entire market is $1.15 million. Judging from the current market popularity and trading volume (TAO’s daily trading volume is US$5 million), digesting the selling pressure is not a problem.

If you look beyond TAO, the valuation of the token actually makes sense when compared with existing projects with similar businesses.

As mentioned above, the direction of Bittensor is crypto + algorithm/model. In a strict sense, it cannot be directly compared with projects that provide basic computing power such as RNDR.

Judging from Nansen's AI track research report below, Bittensor's business should be considered in the "Model Traning" (model training) track. Similar competitors include Gensyn and Together, and the former is also supported by a16z.

However, neither project currently has public tokens, so it is not feasible to compare TAO with the market value of these two projects.

Source: Nansen Research

David Attermann, co-founder of Omnichain Capital, gave a more radical approach in his blog in May this year - directly benchmarking Bittensor with OpenAI .

Interestingly, David specifically reminded that he did not hold a position in TAO when posting to prove that his analysis was objective.

Since the core business is the training of models and their use by users, one is a closed-source company, and the other is coordinating global AI models. Both of them have the same goal but to enable users to better use AI.

Considering that OpenAI previously obtained a private market valuation of $29B (nearly $30 billion) from Microsoft, and today TAO's FDV is around $3.6 billion, TAO still has room for about 8 times of valuation upside .

The author does not completely agree with this valuation comparison method . The fundamentals, growth pace and market focus of Web3 and Web2 projects are different. The 8 times space based on valuation alone may be for reference only. More depends on TAO Its own benefits and the influence of financial enthusiasm .

in conclusion

To sum up, TAO/Bittensor provides another possible narrative in addition to the well-known AI-themed encryption projects, that is, it does not involve productivity links (computing resources and data), and relies purely on the mobilization of production relations. Let AI models collaborate, compete, and tune.

This narrative itself does have a certain appeal, but key factors such as the docking of AI models, the centralization of verification nodes, and the evaluation of model quality cannot be easily solved with a white paper --- AI itself is very simple, but business Gaming is not the case . How to persuade more people to participate in this network with token rewards and how to persuade technology companies to collaborate with other AI models is still a matter of opinion.

In addition to fundamentals, the increase in tokens has shown that the market has collectively bought into the concept of the AI track. Considering that Bittensor cannot find an opponent of similar size in the subdivided track, TAO may collectively gain traction in the AI track. The carnival has ushered in more good news, but due to the lack of suitable valuation benchmarks, whether it is worth holding on to for the long term is still a question mark.

Paying close attention to project news updates and sudden changes in transaction volume may be a more practical option.