Preface

Turkey has one of the highest cryptocurrency adoption rates in the world. According to data from HedgewithCrypto, adoption in the country has more than doubled in the past three years, from 16% of the population to 40%. It is estimated that two out of every five citizens hold cryptocurrencies. Turkey is also the world’s fourth-largest cryptocurrency market by estimated trading volume, ahead of other major economies, according to Chainanalysis.

November 2023 belongs to Istanbul, Turkey. There will be nearly 300 large and small peripheral activities in 2 weeks. The encryption fever throughout November is focused on the Turkish market, with practitioners and encryption enthusiasts from the Americas, Asia, Europe, and the Middle East. Participants gathered here for in-depth exchanges.

Vitalik Buterin gave a speech on plasma at the Istanbul Convention and Exhibition Center

MIIX CAPITAL was invited to participate in a roundtable discussion hosted by TVH and 3WW3 to express how capital companies can empower project development in the bull-bear market.

Macroeconomic indicators and current situation

Turkey is the 11th largest economy in the world by GDP. It is a founding member of the Organization for Economic Cooperation and Development (OECD) and a member of the Group of Twenty (G20). On December 31, 1995, Turkey became an EU Customs A member of the alliance. It is also one of the candidate countries for EU membership.

1.1 Land and population size

Turkey is a country that straddles the Asian and European continents. Its capital is Ankara. It has a land area of 783,356 square kilometers and is divided into 81 provinces. According to system records, Turkey's national population in 2022 was 85,279,553 people, of which 93.4% lived in provincial and regional centers, while only 6.6% lived in towns and villages, with an average population density of 111 people per square kilometer. Between 1950 and 2020, Turkey's population more than quadrupled, from 20.9 million to 83.6 million.

1.2 Economic and related indicators

The World Bank classified Turkey as an upper-middle-income country based on its per capita GDP in 2007. The CIA classifies Turkey as a quasi-developed country, but economists and political scientists often identify Turkey as a newly industrialized country, while Merrill Lynch, the World Bank and The Economist magazine classify it as an emerging market.

It ranks 17th in the world in terms of nominal GDP and 11th in terms of purchasing power parity. According to IMF estimates, Turkey's GDP per capita in purchasing power parity in 2023 will be $41,412, while its nominal GDP per capita will be $11,932.

As of 2019, approximately 11.7% of Turks are at risk of poverty or social exclusion. Türkiye's unemployment rate in 2021 is 12%. According to World Bank data, Turkey's middle class population accounts for approximately 41% of the total population.

1.3 High economic growth and high inflation go hand in hand

Turkey's banking industry is developed, with more than 50 banks. As of March 2023, the Turkish Central Bank's foreign exchange reserves were US$62.6 billion (a month-on-month increase of 2.3%), gold reserves were US$52.2 billion (a month-on-month increase of 7.2%), and official reserves Assets were US$122.4 billion (up 4.3% sequentially).

In the first quarter of this year, Turkey's GDP increased by 84.4%, while the lira depreciated by 26%, which led to Turkey's first-quarter GDP growth to $245.5 billion, which is the highest level ever.

At the same time, according to data released by the Turkish Statistics Agency on November 3, 2023 local time, Turkey’s inflation rate reached 61.36% in October. The Central Bank of Turkey also raised its inflation forecast for this year from 58% to 65% and from 33% to 36% in 2024. Turkey currently has one of the highest inflation rates in the world.

1.4 Türkiye’s economic development forecast

In February 2022, the OECD used the PPP exchange rate to conduct long-term GDP forecasts for the largest 16 economies from 2030 to 2060: Due to population growth and urbanization, Turkey is expected to have long-term GDP growth and is expected to enter the Top5 ranking in 2060 .

Since entering 2023, although the Turkish government has taken many measures in the face of high inflation, prices are still rising. The continued rapid depreciation of the Turkish lira has aggravated domestic economic turmoil, making imported products more expensive, and bringing consequences to the country's economic stability. additional obstacles.

Turkey's stubborn inflation is exacerbating household poverty in the longer term, and will get worse in 2024 as consumer prices peak, according to the latest official forecasts. "In the face of staggering inflation, many families have insufficient income, and poverty has become a major problem in Turkey." Istanbul economist Iris Cibre said that nearly 60% of Turkey's labor force has a monthly minimum wage of 11,400 lira ($405), which is very low. largely below the poverty line.

Geographical and economic impacts on the industry

2.1 Geographical conditions are promoting the prosperity and diversity of the crypto market

Turkey is located at the intersection of Eurasia and has the geographical advantage of being a bridge and hub. Turkey is also an important energy transit country between the Middle East and Europe, controlling access to and from the Black Sea. This gives Turkey a strategic position in energy supply and geopolitics, playing an important geopolitical role. While its relations with Iran, Russia and other countries have an important impact on regional stability, it is also affected by the mutual relations and cultural changes in the Middle East, Russia and Ukraine. Influence.

It is precisely because of this geographical relationship that Turkey has invisibly become a hub connecting the Web3 industry between Russia and the Middle East. There is an inevitable mutual influence in culture, economy, finance and other aspects. For encryption practitioners in various regions of Europe and Asia, it is a A key node for communication, collision and integration. From user characteristics to technology applications, from industry extension to track development, under the influence of geographical factors, people are more likely to be exposed to and accept diversified industry trends, and a prosperous and diverse encryption market has been spawned.

2.2 People’s livelihood economy is driving the crypto economy to take root and deepen

Turkey has been experiencing economic hardship and trough in the past five years. Recent information shows that Turkey's inflation rate recently exceeded 83%, a 24-year high. The lira also hit a record low against the dollar as the government adopted an unorthodox policy of cutting interest rates. "In the face of staggering inflation, many families have insufficient income, and poverty has become a major problem in Turkey." Istanbul economist Iris Cibre said that nearly 60% of Turkey's labor force has a monthly minimum wage of 11,400 lira ($405), which is very low. largely below the poverty line.

Funds with a keen sense of the market, under the strong contrast between the country's economic downturn and the ensuing crypto bull market cycle, will inevitably begin to seek hedging and chase higher returns; exchanging and purchasing crypto assets has become the best choice, and contact and understand the crypto industry through crypto assets. It has made young people have a strong interest in new technologies, and more people have begun to join in to jointly promote the in-depth development of the Web3 industry in the region. The encryption industry in Turkey has also changed from an emerging industry that meets the needs of the people to a popular and cutting-edge industry with widespread participation.

Current status of the crypto market in the region

3.1 The fourth largest cryptocurrency market in the world

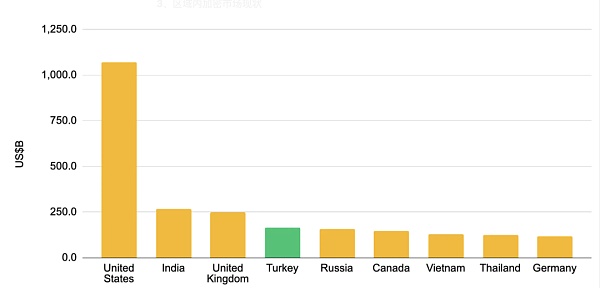

Recently (November 2023), Binance Research Institute released a research report on "The Current Situation of the Turkish Crypto Market", which showed that 40% of citizens hold cryptocurrency investment exposure, and 73% of Turkish respondents believe that in the next 5 years The number of crypto investors will continue to increase every year. As the world's fourth largest crypto-asset trading market, Turkey's crypto-asset trading volume is significantly higher than several other large economies in the world. Binance’s internal trading data also shows that in early September this year, Turkey’s lira (local legal currency) once topped the list of legal currency trading pairs on the entire exchange, accounting for an astonishing 75%.

In addition, Turkish citizens’ acceptance of encryption does not lag behind these countries at all. Scored using the same encryption acceptance index criteria, Turkey also ranks 12th in the world; considering its positioning in the world’s geo-economics and its small size compared to other economies, Turkey’s encryption acceptance level very high.

3.2 The encryption market has a strong atmosphere and high popularity

Data from the poll shows that in Turkey, Web3 and cryptocurrency have been deeply integrated into people’s lives:

The roadside Teller Machine (similar to the deposit machine of the Bank of China) can conduct cryptocurrency transactions;

There are many advertising displays for local exchanges on airport bridges and outdoor billboards;

There are many cryptocurrency OTC exchange places offline;

Real estate transactions or offline catering all support transaction payments using cryptocurrency;

Coworking Space at ICC

Many friends of the younger generation will hang some decorations with the Bitcoin logo in their bedrooms, and many people will also talk about Bitcoin on TV programs; a large number of young people regard the Web3 career as the key to controlling their destiny and changing their destiny, and are keen on communication and sharing. The technical atmosphere is very strong.

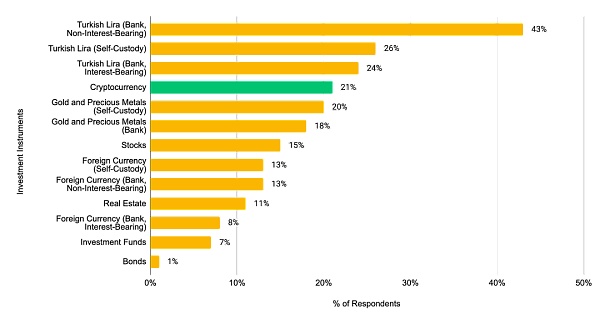

In a survey commissioned by Binance and conducted by consumer research firm Twentify, more than a fifth (21%) of survey respondents have invested in cryptocurrencies. Cryptocurrencies rank second only to Turkey’s official currency, the Turkish lira, in this ranking of investment vehicle popularity. Notably, cryptocurrency adoption rates are higher than traditional asset classes such as precious metals, stocks, and bonds

A surrounding event scene during Blockchain Week, very popular

3.3 CEX usage rate is much higher than that of decentralized wallets

Users in Turkey are very dependent on CEX. The number of single-day transactions by its cryptocurrency users across the entire network (all CEX) reached a level of 500,000 to 700,000 in December 2021. As the market situation declined, in 2023 In February, the number of cryptocurrency trading users across Turkey dropped to the range of 270,000 to 410,000. Among the global CEXs, the ones most recognized and liked by Turkish users are Binance, Bybit, OKX and KuCoin, all of which support Turkish and Turkish lira (TRY) deposit transactions; while local Paribu and CoinTR are either headquartered in Turkey or have acquired Turkish The regulatory agency Turkey's Financial Crime Investigation Association (MASAK) has registered a license and has cooperated with two Turkish state-owned banks, Zirrat Bank and Vakif Bank, to open legal currency transactions.

In contrast, Turkey has relatively low usage of non-custodial wallets. Recently (November 2023), Binanc officially launched the Binance Web3 wallet at Turkey Blockchain Week, and Bitget Wallet also announced that it will launch a Turkish ecological development plan. The convenience and profit potential of Web3 wallets, as well as the growing interest in emerging concepts such as NFT and the Metaverse, will, to a certain extent, catalyze Turkish users' use of decentralized wallets to increase the diversification and maturity of the regional market.

3.4 Popular tracks and applications in Türkiye

Generally, users are concentrated on CEX, so there are very few DeFi projects; however, Gaming projects are very popular in Turkey, and GameFi, SocialFi and NFT projects are very popular with ordinary users; there are also a small number of infrastructure projects, but because Turkey’s VCs are not There are more companies investing in Web3, and the overall fundraising capabilities are much worse than those in Asia-Pacific, Europe and the United States.

Among them, the Turkish government agency "Turkey Science and Technology Council" Blockchain Research Institute's views on the application of digital currency. They are more optimistic about DID and putting government data on the chain through smart contracts.

Data shows that nearly 16% of Lens Protocol’s website visits come from Turkey, and Turkish users are very fond of searching for “free Bitcoin” on Google. They will look for websites that perform tasks to get small amounts of Bitcoin for free. This is certain. The extent to which SocialFi, or chasing airdrops, is popular in Turkey.

Source: 3WW3 Viewpoints from Space activities of the Institute of Asia, Africa and Latin America

4. Analysis of regional user characteristics

Binance’s research report shows that 71% of the investors surveyed check market conditions multiple times a day, and 46% of the surveyed people conduct at least one transaction a day on average, representing the local people’s interest in crypto assets. Investment enthusiasm. The reason why 66% of people invest in crypto assets is for the expected profits. The second reason is simple portfolio management and optimism about technology.

4.1 Young people are more willing to invest in cryptocurrency

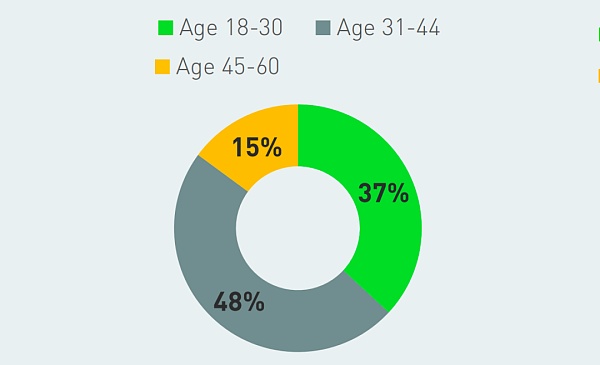

Turkey’s cryptocurrency market is dynamic and constantly developing. 27% of investors who currently hold crypto assets have entered the industry for less than a year. That is, more than a quarter of investors entered the bear market in the past year. market, and most of them are young people under the age of 30.

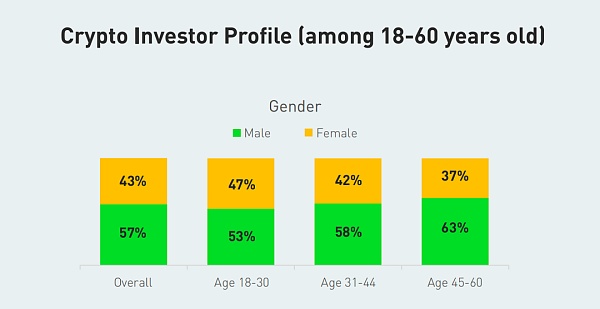

In KuCoin’s latest survey data on users in the Turkish market, the younger generation has a higher willingness to invest. People aged 31-44 account for 48% of the total number of people involved in cryptocurrency investment, and people aged 18-30 account for 37% of the total number of people. Turkey’s cryptocurrency market is dynamic and growing, with crypto investors under the age of 30 entering the market within the past year.

While male investors still account for 57% of all cryptocurrency investors, there is a growing trend among younger female investors. Only 37% of investors over the age of 45 are female, but almost half (47%) of cryptocurrency investors aged 18 to 30 are female, suggesting that the gender gap is gradually narrowing as cryptocurrency adoption becomes mainstream.

4.2 There are differences in preferences for investing in cryptocurrency among various age groups

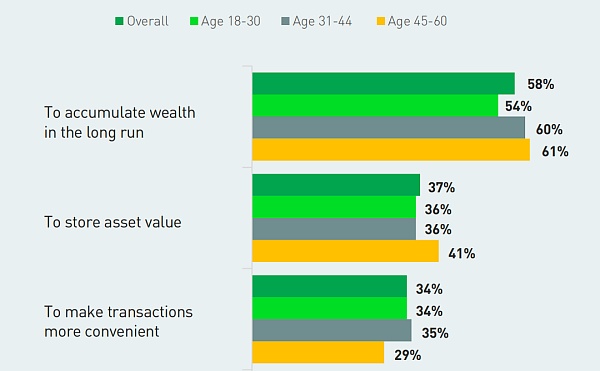

In Turkey, 58% of respondents said their main motivation for investing in cryptocurrencies was long-term wealth accumulation, which was consistent across age groups, arguing that investing in cryptocurrencies can lead to wealth growth over time.

There are obvious differences between various age groups in investment strategies: older investors prioritize value storage and portfolio diversification; while the younger generation will pay more attention to the convenience of transactions and short-term benefits.

37% mentioned that the main reason for investing in cryptocurrencies was to store asset value, and 25% cited diversifying their portfolios as the main motivation and recognizing the benefits of cryptocurrencies in reducing risk, these were mainly 45-year-olds Investors above;

34% of people hold cryptocurrencies for easier transactions, indicating that people recognize the efficiency and speed that crypto brings;

17% admitted that they were motivated by short-term and pure enjoyment of the profit-making investment process, which is consistent with the experimental and exploratory nature of the crypto market.

The sentiment is more pronounced among the younger generation;

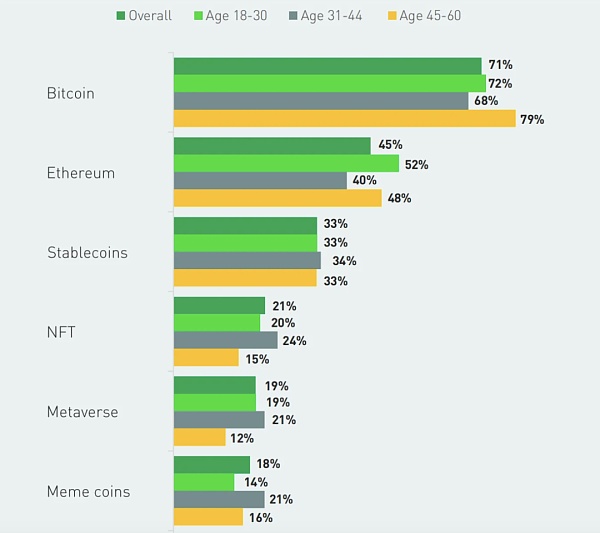

Bitcoin is very popular as an investment option for adult cryptocurrency investors in Turkey. 71% of investors expressed interest in investing in Bitcoin, including 79% of elderly investors; 45% of investors expressed interest in investing in ETH. Interest, among which 52% of young investors are interested.

In addition, about 33% of investors are interested in stable currency investment, about 21% of investors are interested in NFT, about 19% of investors are interested in the Metaverse, and 18% of investors are interested in emerging categories such as Meme coins. interest.

4.3 The promotion effect of word-of-mouth effect is particularly prominent

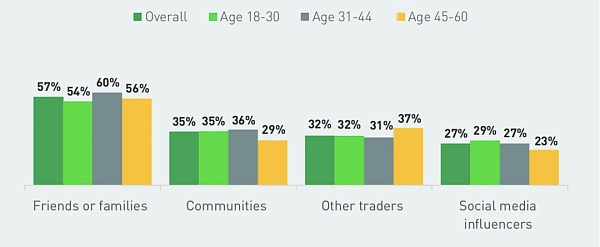

According to the survey, 57% of people were introduced to cryptocurrencies through friends or family, and 35% were introduced through communities, highlighting the critical role of relationships in sparking curiosity and encouraging new people to enter the world of digital finance.

Whether through online forums, social groups, or local meetups, the community provides a supportive environment for individuals to learn and explore cryptocurrency concepts, reflecting the collaborative nature of the Turkish cryptocurrency community. 32% of respondents noted that other traders played a role in their introduction to cryptocurrency, illustrating the interconnected nature of the trading environment and that individuals embarking on their crypto journey often start in the same uncharted territory. Sail there to find guidance and inspiration from other traders.

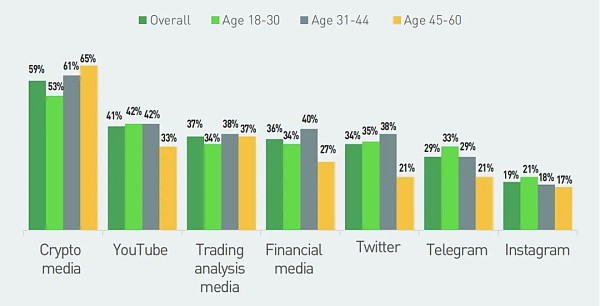

Finally, social media has had a significant impact, with 27% of respondents attributing their entry into the crypto world to influencers. YouTube, Twitter, Telegram, and Instagram are trusted by cryptocurrency investors, especially younger groups, as reliable sources of information.

5. Regulatory policies for the crypto market in the region

Turkey is already a highly receptive and reputable market when it comes to blockchain and cryptocurrencies. Major global cryptocurrency exchanges like Binance and Huobi have all made moves to establish local exchanges in the country. The government has a vision to build a national blockchain infrastructure and a digital currency issued by a central bank. Although Turks are very interested (in cryptocurrencies), Turkey does not have regulations specifically targeting the crypto market.

5.1 Open with caution and relatively loose policies

For a long time in the past, the Turkish government’s attitude towards web3 has been unclear, although in 2018 Turkey’s Ministry of Digital and Technology mentioned in a strategy paper that it would establish a National blockchain infrastructure. (National-level blockchain infrastructure), but no big implementation has been seen.

In 2021, the Central Bank issued a policy prohibiting Turkish citizens from purchasing or providing cryptocurrency-based services. But the director of the Digital Transformation Office under the Turkish President’s Office refuted the rumors: “The policy promulgated by the Central Bank at that time to ban crypto transactions did not prohibit Turkish citizens from owning crypto assets.”

On the whole, the Turkish government is cautious and open to the encryption industry. It has neither strict restrictive policies nor strong promotion of compliance policies. Let Turkey's encryption market be filled with more freedom, which is very conducive to the rapid development and popularization of the encryption industry.

5.2 Supervisory policies will be implemented in a planned manner

In October this year, Turkish Finance Minister Mehmet Simsek announced that Turkey would introduce new legislation to cover crypto assets in order to comply with FATF recommendations. The move aims to remove Turkey from the gray list, as inclusion on the list can have a negative impact on a country's investment rating and reputation. On October 27, according to Cointelegraph, Turkey’s official gazette released the 2024 Presidential Annual Plan, which aims to complete Turkey’s encryption regulations within the next year.

“Introducing certain licensing standards will be one of the first priorities of the new regulations,” said Bora Erdamar, director of the BlockchainIST Center, a blockchain technology research and development center. He added that this would “also include capital adequacy requirements, measures to improve digital security.” Measures, Escrow Services and Certificates of Reserves”.

The promotion and implementation of regulatory policies illustrates from the side that the encryption market has taken root in Turkey. As more and more businesses enter, and accompanied by more and more frequent exchanges and collisions, regulatory policies will provide assistance to the prosperity and development of the encryption market. , providing practitioners and users with more convenience and security.

5.3 Plan to establish a central custody bank for cryptocurrency

In order to prevent cryptocurrency exchanges from running away and funds being hijacked, the Turkish Ministry of Finance decided to implement a cryptocurrency central custody bank mechanism. If this mechanism is implemented, Turkey will be the first country in the world to include cryptocurrency custody business among enterprises, and the Turkish Central Bank will control the storage and circulation of cryptocurrency.

In the long term, the establishment of a central custodian bank for cryptocurrencies provides a solution to safeguarding the cryptocurrency market. It will help improve the asset security of cryptocurrency exchanges and ensure the stable operation of the market, allowing the cryptocurrency industry to develop in a more stable and transparent direction.

However, the asset security, management robustness and user privacy protection of cryptocurrency exchanges all need to be taken into consideration during the management process. The cryptocurrency market is still in its early stages of development, and its governance needs to be continuously explored and improved with the joint efforts of all parties.

6. Summary

Turkey straddles the Asian and European continents, and its GDP index ranks very high in the world. In recent years, high economic growth has been paralleled by high inflation. The continued rapid depreciation of the Turkish lira has aggravated domestic economic turmoil and brought negative consequences to the country's economic stability. additional obstacles. But this has also accelerated the popularity and prosperity of cryptocurrency in Turkey. In terms of transaction volume, Turkey is already the fourth largest cryptocurrency market, second only to the United States, India and the United Kingdom.

In addition, Turkey’s population size and geographical factors make it a very suitable place for communication and collision for practitioners from all continents. A very large proportion of local people of all ages in Turkey engage in the value-preserving and value-adding business of cryptocurrency as part of their investment portfolios. And more and more young people are becoming interested in Web3 technology and industry, and actively participate in technology learning and entrepreneurship.

As Web3 technology is used and shared by more people in the region, and regional regulatory policies are gradually implemented, Turkey's community activity, population size, and geographical factors determine that it will play an important role in the future development of the encryption industry. Turkey may also become a paradise for crypto practitioners.

Mark, an investment research analyst from MIIX CAPITAL, took a photo at the event

MIIX CAPITAL has gained a lot from this trip to Istanbul. I have made friends with practitioners from all over the world, and I have a full understanding of the development status of each track. Every time I meet a new friend, it is like opening a blind box. The encryption industry The development is really blossoming everywhere and thriving! Looking forward to seeing you next time in Türkiye!