Original author: Phyrex (X: @ @Phyrex_Ni)

Related Reading:

" Special Topic|Binance pleads guilty and settles, CZ steps down, biggest regulatory boot falls "

Editor’s note: On Tuesday, November 21, local time in the United States, Binance and its CEO CZ pleaded guilty to criminal charges of anti-money laundering and violation of U.S. sanctions, and reached a settlement with U.S. regulators and paid a fine of more than $4 billion. Behind the sky-high fines, are the sanctions against Binance and CZ a good thing or a bad thing? What role did the SEC, CFTC, US Treasury Department, etc. play in this incident? Is Binance’s imagination better off after being freed from its biggest shackles? Crypto analyst Phyrex published an article on the X platform to provide an in-depth explanation of the Binance sky-high price fine incident and the full picture of CZ’s resignation as CEO. The Odaily Odaily compiled it as follows:

More than 10,000 BTC, nearly 100,000 ETH, 400 million USDT, 150 million USDC, and $2.2 billion worth of ALT. These five data are the withdrawals from Binance in the last 24 hours. Although Binance is still It holds more than 6.7 billion US dollars in assets, but the wave of withdrawals is not over yet. Assets are being lost from Binance almost every minute. When almost the entire network is bidding farewell to CZ, half of Bloomberg’s front page headlines are Hamas, half of it was given to CZ and Binance. If we push the time forward, I don’t know how many friends remember that in October, I focused on the House Finance Committee’s pursuit of cryptocurrency as a source of terrorist financing. , last week, 57 members of Congress even signed a petition asking Biden and Yellen to provide detailed cryptocurrency support for terrorist activities on the 27th of this month.

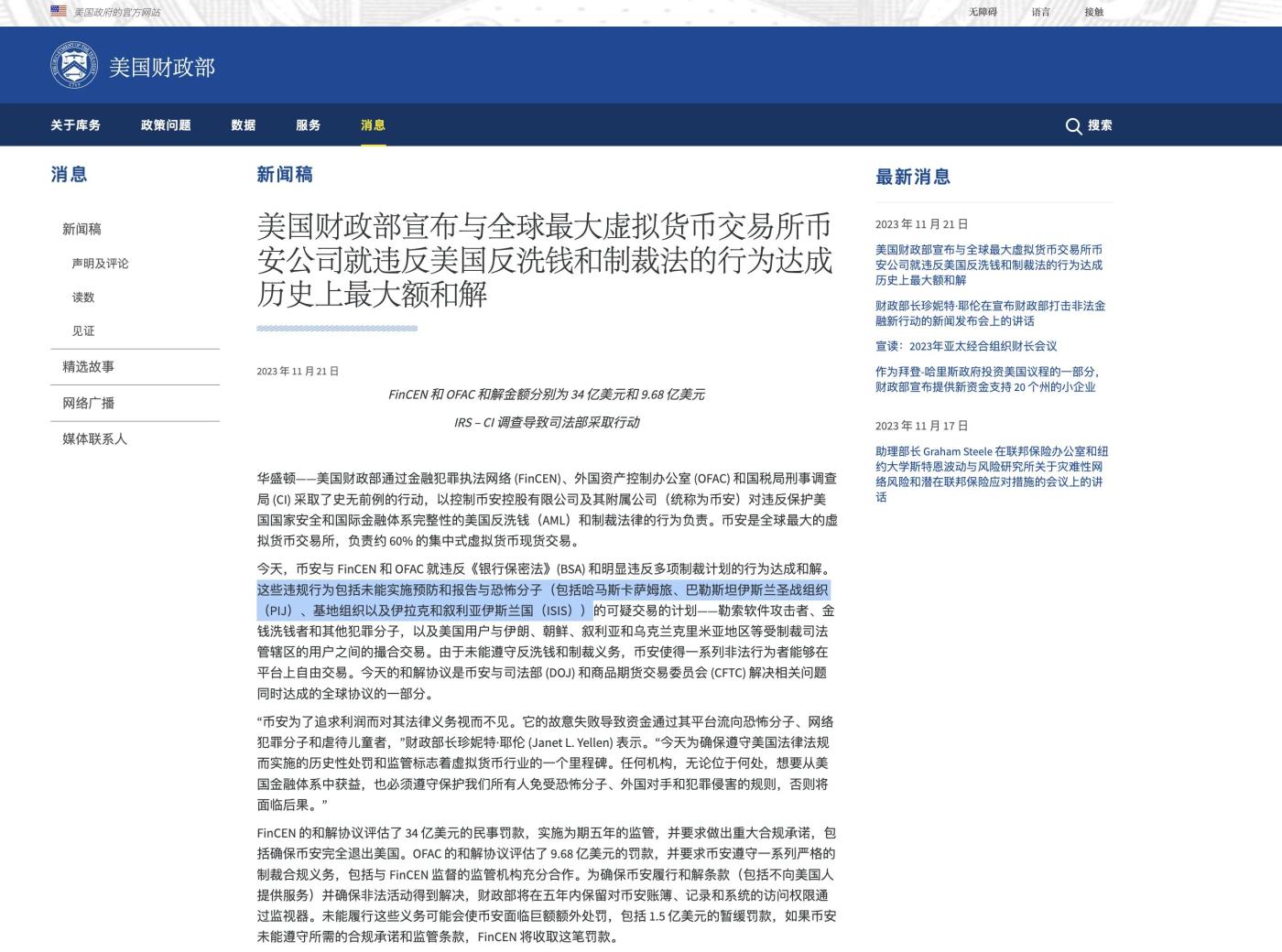

Pulling the time back to the present, of the sky-high $4.3 billion in fines, the settlement of the Financial Crimes Enforcement Network (FinCEN) is $3.4 billion, and the settlement of the Office of Foreign Assets Control (OFAC) is $968 million, of which the settlement was paid to Of the $3.4 billion in payments from the Financial Crimes Enforcement Network (FinCEN), $2.7 billion was paid to the Commodity Futures Trading Commission (CFTC). Of the $2.7 billion, $1.35 billion was transaction fees charged to U.S. customers, and the other $1.35 billion was paid to the Commodity Futures Trading Commission (CFTC). In addition to the fine, CZ himself was also punished with a suspended fine of US$150 million. From this point of view, Binance’s biggest problem should be to allow American customers to participate in transactions. After all, this part of the fine is the highest.

But in fact, the answer from the Ministry of Commerce, the highest agency that actually investigated Binance this time, is that it neither allowed Americans to trade nor violated securities laws. These are SEC matters. By the way, this settlement It ended a multi-year investigation on behalf of Binance and including the Treasury Department, the Department of Justice, and the Commodity Futures Trading Commission (CFTC), but this does not include the U.S. Securities and Exchange Commission (SEC). We will discuss this issue later. Rather, it is because Binance violated U.S. anti-money laundering (AML) and sanctions laws that protect U.S. national security and the integrity of the international financial system. To put it bluntly, Binance did not strictly control the number of traders on the platform, allowing Hamas, among others, to Domestic use by terrorists defined by Europe and the United States is the most intolerable thing for the United States, and the rest is just a matter of money.

Therefore, in this report, both the Ministry of Commerce and the Ministry of Justice defined Binance as not implementing AML well, and even the Commodity Futures Trading Commission (CFTC) provided Binance staff in the actual prosecution. The chat related to Hamas’s record of buying an AK 47 for less than $600. This is what gives Binance the biggest headache. Violating AML and financing terrorism are two completely different natures. Fortunately, , the direct answer Yellen gave this time was that Binance simply did not strictly implement AML, and CZ also admitted the charges of anti-money laundering and violation of US sanctions. This made Binance actually avoid the biggest crisis. It can even be said that from today At the beginning, Binance, including BinanceUS, faced only the problem of money, and money was the least of Binance’s worries.

According to the plea agreement, CZ’s maximum 10-year prison sentence will be reduced to no more than 18 months. Currently, CZ has given up the appeal. The sentencing will be postponed for 6 months. After paying a bail of 175 million US dollars, he will be released and can travel back and forth at any time. Arthur Hayes , the co-founder and former CEO of BitMEX , has also experienced this treatment in the United Arab Emirates and the United States. At that time, Arthur Hayes's sentence was 6 months of home detention and 2 years of probation. From this perspective, CZ is likely to be sentenced to home detention. But this is not the point. The point is that Arthur Hayes, who has retired as CEO, is still the co-founder of BitMEX. Although he does not take on the work of BitMEX, he can "jointly" handle BitMEX matters in the form of a consultant.

Having said this, some smart friends may have already thought of it. It is true that CZ is no longer the CEO. Indeed, CZ’s self-report stated that he will take a break recently, but this does not mean that CZ will stay away from Binance, although CZ is no longer the CEO. , but as the co-founder of Binance, He Yi @heyibinance has not been implicated in any way in this problem. I don’t need to say more about her relationship with @cz_binance , so has Binance changed? No, CZ's role is more of a decision-maker than an executor. It doesn't matter whether he is the CEO. The CEO only works for the board of directors. This case did not deprive CZ of his status as a director, and the United States did not There is no way to deal with BinanceUS in the same way as TikTok, and even CZ can continue to tweet for Binance.

From the perspective of a staged conclusion, the United States used a reason that Binance could not ignore to make Binance make the final decision, "Either you follow my rules and play within the framework of my rules, or you don't play anywhere." ”. This is why I focused on the fact that Binance only violated AML, rather than providing support to terrorists. These two decisions are actually made in a single thought. If you are obedient, it will be the former. If you are disobedient, it will be the latter. Choosing the former and fines is not the purpose. Does the United States lack the $4.3 billion? What the United States lacks is whether the world's largest cryptocurrency exchange behind the $4.3 billion is under its control. Yellen's words are the best definition, "The result of these agreements will be to end the long-term interference with the U.S. financial system and the U.S. Corporate conduct that poses risks to citizens and U.S. national security.”

At this point, Binance has been released from a blacklist of risk companies that pose a "threat" to the United States. This not only means that Binance still has the opportunity to operate BinanceUS, but also means that channels in the United States and Europe, including payments, can serve Binance again. , these are the most important things for Binance. I have stated many times before that compliance will be what all exchanges must face if they want to go further. Binance, which has always been under the iron fist of multiple departments in the United States, has had to A lot of markets have been abandoned, and starting today, these once-abandoned markets and opportunities have the possibility of starting over, and the payment is only a quarter’s profit and CZ nominally leaves the position of CEO, so Binance has changed ? Things have definitely changed, and Binance’s imagination will be better after the biggest shackles are removed.

After BinanceUS solves the SEC problem, it will be more likely to be favored by Wall Street and will be one step closer to listing. Speaking of the SEC, we have to mention that the SEC sued Kraken again yesterday. The reason for the lawsuit was almost exactly the same as that of Coinbase . As we said before, this settlement in the United States did not include the SEC. This also means that The SEC’s supervision of Binance is not a matter of “political stance.” Even with the settlement with the CFTC, Binance has paid fines and confiscated funds for allowing U.S. customers to trade, so the SEC will most likely not continue to struggle with this issue. , then the remaining purpose of the SEC may be to pave the way for cryptocurrency compliance, and a milestone on this road may be Bitcoin and Ethereum spot ETFs.

Of course, for Binance, which has got rid of the biggest shackles, the issue with the SEC does not involve criminal matters. It should even be said that there is no lawsuit between Binance and the SEC. The ones who have the lawsuit are BinanceUS and CZ himself, so the result is nothing more than either Coinbase Like Kraken, it's either a hard sell or a settlement. Either way, it's just a matter of money. From my personal understanding, the latter is more likely. After all, Coinbase is a listed company in the United States, Kraken is also a compliant exchange in Europe and the United States, and BinanceUS is essentially Binance’s attempt to list in the United States and bundle Wall Street funds. important layout, and the biggest problem between BinanceUS and SEC is Binance itself and CZ itself. Now the former is fine, and the latter has accepted the penalty.

So as long as BinanceUS chooses to reconcile with the SEC, BinanceUS's road to listing will be smooth. Of course, the most critical thing in this process is the reconciliation conditions between BinanceUS and the SEC. So when we finally look at this issue from God’s perspective, we can know that the overall situation is a win-win situation. The United States has removed an uncontrolled financial risk, and Binance has removed the long-arm jurisdiction and all the long-arm jurisdiction of the United States. The collateral damage caused by the so-called sky-high fine is the first step of Binance's "compliance certificate". As for CZ, it only removed an unimportant title, but obtained the "identity" of free entry and exit of the United States. It also means that both Binance and CZ can participate in the American political and economic fields under the sun. But what I want to know most now is, is it the Democratic Party or the Republican Party? There must be one.

The adult world considers more interests, whether they are national interests, corporate interests or private interests. This time, whether Binance is really one of Hamas's financing channels, this is not the most important thing. As long as this hat is buckled, what Binance will face is no longer just a "cat and mouse" game in terms of economic interests, but has risen to the level of national security. This is not something that can be solved with money. What we see is a $4.3 billion "transaction" disclosed, but underneath it is the life and death line between Binance and CZ, and the result is that Binance and CZ used the "least valuable" price to complete the identity upgrade. The conversion, the instantaneous surge and fall of Coinbase's stock price last night is the best proof.

Binance’s incident not only failed to increase Coinbase’s market value and market potential, but instead made the market realize that after getting rid of the shackles, Binance was once and for all qualified to challenge Coinbase in the United States, and this incident was a minefield for the cryptocurrency industry itself. , is also a good thing. At least within the foreseeable two or three cycles, as long as Binance does not commit suicide, things will get smoother and smoother. In fact, FTX and Sam have provided the best process. The FTX main site is developing wildly. As long as it is under the framework and supervision of the United States, it can be done in any way, while FTXUS is a "money-attracting" weapon in the United States. Compliance, tying up with Wall Street, and going public are the brightest paths for BinanceUS.