Have you ever seen a hillside approaching 90 degrees? The marble-paved roads and the perpetually jammed traffic allow Turkish taxi drivers to rush up quickly at the touch of the accelerator. When taking a taxi in Istanbul, you never know what blind box you are about to open. Prices are skyrocketing, speed is crazy, and even as soon as you open the door, you will encounter a Taxi Driver who is speculating on coins on the exchange.

"I have never believed in the lira. I feel that my money will return to zero at any time." This country, which is located at the junction of the Eurasian continent and sits on the entire Black Sea Strait, is facing the deconstruction and reorganization of the economic system, and borderless currency and The crypto industry that followed was also filled with gold in this ancient Roman capital.

During Devconnect, I randomly interviewed 10 taxi drivers, participated in 13 side events, visited hundreds of streets, and tried to open up this nation and the blockchain industry, where 99% of the people are religious, from the physical world. A glimpse into today, yesterday and the future.

1. Volatility and War: The Future of Cryptocurrency

Turkey's official currency, the lira, is experiencing an unprecedented plunge.

Due to geographical location and global economic trends, economic fluctuations in both Europe and Asia will have a huge butterfly effect on Turkey's domestic currency system. Since the beginning of this year, the lira has fallen by more than 50%. For local Turkish residents who know Crypto, USDT/USDC is undoubtedly the best choice.

Interestingly, some people hold stablecoins but will not purchase other Crypto Currencies. To a certain extent, in this country that connects Europe, Asia, and even the world, what many residents want more is just the stability of wealth.

Kucoin released a report in September that over the past year and a half, Crypto adoption rate among the Turkish population increased from 40% to 52%. Among the ten drivers I interviewed, 5 knew about Bitcoin, 2 held stablecoins or Crypto, and 1 still didn’t understand his reply because of his poor English. When I asked about compliance issues, a driver told me enthusiastically that two years ago, the country banned Crypto-related payments, but from his frequent gestures in his eyes and euphemistic expressions, I thought of the most common political textbooks in my childhood. The slogan: " Nothing is prohibited by law ."

When he was done talking, he covered his mouth and whispered quietly: "You know, a friend of mine has gone to jail because his credit limit is too large."

A local friend helped me translate a Turkish payment report. The data shows that in Turkey, the number of ETFs, POS and bank cards has increased dramatically.

- The total number of electronic transfer transactions in Turkey in September 2023 was 2.1 billion, with a total value of TL 3.5 trillion.

- The total number of POS transactions in September 2023 was 1.5 billion, with a total value of TL 238 billion.

- The number of bank cards in circulation in September 2023 was 394 million, and ATM machines can be found everywhere, but the exchange rate varies slightly in different regions.

Similar to the Korean market, when it comes to trading memes and Altcoin, there is some deviation between the local Top and the international Top. The top three local exchanges that are most recognized by the local people interviewed are: Paribu, Bitçi and BTCTürk .

In Istanbul, the capital of the world that connects the world, BTCTürk’s advertisements are prominently placed in the middle of every boarding gate. Queen of Cities, Cryptocurrency is in full swing.

2. New speculation: Ethereum’s new narrative is weak?

From Hong Kong in April, to Paris in July, to Singapore in September, and Turkey in November, I participated in all Ethereum Staking activities, and I also paid attention to ZK, games and other related fields.

Generally speaking, the narrative of Ethereum has reached a dark place, and it is difficult to have shining moments. Many people came with high expectations and left with a little bit of disappointment.

The concept of Plasma has returned to the public again. In Vitalik's speech, he mentioned that Plasma can avoid data availability problems and greatly reduce transaction costs. However, it is actually a new concept with mixed reviews.

If we classify the themes of this conference, it is actually very simple, mainly the following three: L2 war and full-chain, Staking and Restaking, Autonomous World and full-chain games.

L2 war and full chain (Onmi-chain)

In this Devconnect, Layer 2 activities became a major event.

In addition to established public chains such as Polygon, Arbitrum, and Zksync, Starknet, Linea, Scroll, Taiko, Manta, etc. also have their own merits. Different from the previous volume performance, the current L2 competition is no longer just about the underlying infrastructure, but more focus has begun to shift to volume business and users .

Many primary funds have already given up on investing in Infra and the overly popular Layer 2, and have turned to investing in Consumer (consumer applications). It's like a real estate ghost town. Currently, many public chains have no applications, no users, and just a bunch of empty nodes. The old routine of running an odyssey, attracting hair studios, attracting a bunch of projects through Grant, and then issuing coins has been familiar to many people. The ecological growth of public chains urgently needs new ways of playing.

ZK is the combustion accelerator that runs through the entire Layer 2. At the same time, many project parties currently say that they dare not be completely bound to one Layer 2. Most of them deploy multiple chains and bloom multiple nodes. The whole chain seems to be an increasingly strong trend. In this process, developers are also an important part.

After communication, everyone generally feels that the public chains dominated by the West/India are more open , have a more community concept, and the team has a greater sense of equality in service. Some Chinese projects are very closed, like an agency , and it is difficult to prosper.

Although everyone's expectations for Linea were low due to Metamask's announcement that it would not issue coins, the performance of the entire Linea team throughout the event was refreshing.

At the same time, major exchanges are also actively launching new public chains. OKX has released Layer2 and X1 in cooperation with Polygon. Sources pointed out that Foresight is also actively preparing for new public chains.

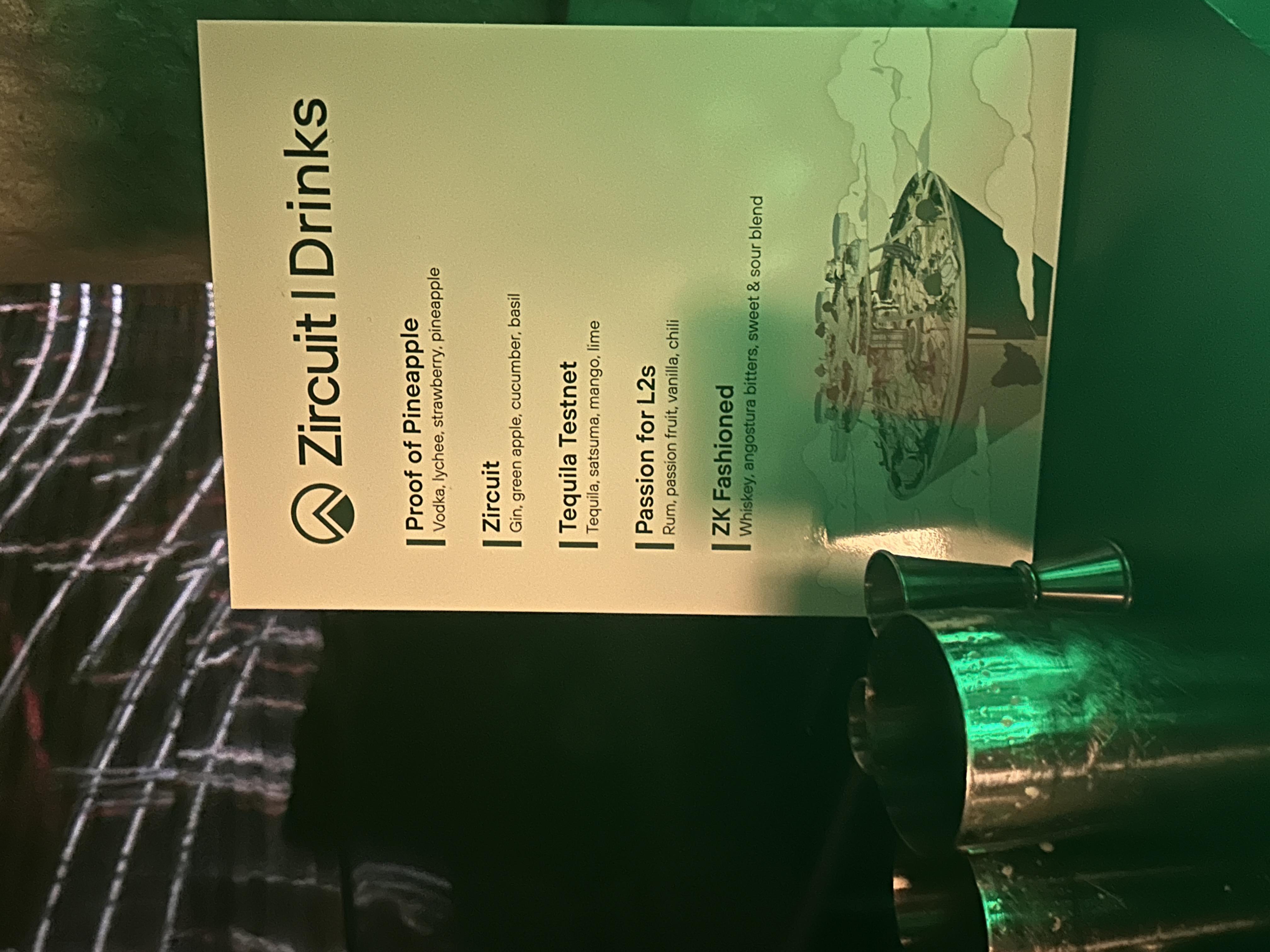

Finally, Taiko became the center of attention at this event with an all-pink army, and the dungeon where Zircuit held the event was generally well-received.

In the past, the Panel+Networking model of Side Events has been difficult to attract Crypto practitioners who often run conferences around the world. Not only does the narrative need to be new, but the event format also needs to be new!

Staking and Restaking

Staking occupies an important position in this event. After the Staking Summit lasted for two days, the Restaking Summit continued to make efforts.

In this event, institutional staking such as Buzz and Word began to enter the game, and decentralized staking has also become an important topic of discussion. The risks of centralization of node operators and the risks of not having to bear the burden of the consensus layer that Vitalik mentioned before have been gradually tried to be solved. During this process, DVT technology has also developed, and the infrastructure business of SSV and Obol connecting to the Validator layer has begun to be built on top, and the entire Staking ecosystem has developed rapidly. Although the current pledge rate of Ethereum is still around 20%, many people are recognizing that interest-bearing Ethereum must be the next generation currency.

Eigenlayer's performance is also very impressive, and the progress of Restaking is gratifying. According to incomplete statistics, Eigenlayer's ecosystem currently has 58 projects. This huge ecosystem is even more prosperous than some public chains.

From LSD and LSDFi, to LST and LSTFi, to the new concepts LRT (Liquidity Restaking Token) and LRTFi that have appeared many times in this event, Staking’s DeFi Lego continues to stack up. Even when participating in a staking event, I saw two founders who were both doing Index LST looking at each other. Whether it was the CDP or lending that was screwed up, there will definitely be a new round of deposit-taking war after the Eigenlayer mainnet goes online next year.

One layer, and another, and another. The building blocks of DeFi are getting higher and higher. Is there a new crisis behind the excitement and carnival brought by leverage?

It is worth mentioning that Lido’s friends told me that they are currently preparing relevant materials for ETF applications. Once the situation is ready, interest-bearing Ethereum will become an important ETF asset.

Autonomous World and full-chain games

Before coming here, I didn’t expect that the strong winds of AW and Fully On-Chain Game would be so strong. AW’s activities attracted most of the practitioners to participate. When asking friends who also participated in ETH CC and other Ethereum activities, everyone generally agreed that if there is a new narrative, it must be the autonomous world.

Among them, using MUD engine to make full-chain games has also become an important part of the discussion. Projects such as Primodium and Redstone have been discussed more frequently, and concepts such as OP, Plasma, DA, and L2 are fully occupied. In the process of combining AW and full-chain games, three areas can be focused on:

(1) Use ZK to provide fairness and ensure privacy for games. Computing concepts such as ZKML will also provide a broader space for game design;

(2) Combine the financial attributes of DeFi, refer to existing token economic experience, and expand the scope of financial interaction;

(3) Community governance, the development of full-stack Dapps, and the creation of hyperapps, providing a new paradigm for the governance of the autonomous world.

Of course, the concept of AW still exists at the narrative level for many people, and every creator is a dreamer and a great writer. When you seriously enter the world built by AW, it seems that you have really seen the future, but when you step out, you will feel that it is completely blank.

3. Chaos is Laddar: A place where order collapses and Crypto is full of gold.

“Look, people here are literally degens when it comes to crypto, the main cause is the high inflation and continues drop in local currency, so anything can generate income for them, they are open for it!”

A local Turkish KOL left me a message on Telegram. In Turkey, people do not believe in the lira or banks. They will buy gold and land with their savings and pass them on from generation to generation.

Another Turkish Crypto practitioner told me that Turkey has a total population of 80M+, but 8-10M are Crypto holders. The local exchanges Paribu and Btctürk have more than 6M local registered users. He was once the CMO of an organization, and Crypto brought him a lot of wealth. Another set of data, dictated to me by a friend, is that 16% of the Turkish population owns a cryptocurrency wallet.

When we look past the clock, we will find that despite experiencing many cold winters and market crashes, Argentina in South America has more and more cryptocurrency believers. As the second largest economy in South America, the inflation rate reached nearly 100% in 2022, and people began to turn their attention from the US dollar to cryptocurrency. In countries with excessive inflation, the increase in people's salaries is far less than the rate of price growth. The devaluation of savings and the shrinkage of wealth will promote the prosperity of stable currencies. War, economic crisis, where order breaks down, Chaos is laddar.

Unlike East Asian cultures, in these countries, there are more brave and creative female entrepreneurs. Perhaps life has pushed them into a desperate situation, or perhaps it is their resistance to the constraints of the headscarf and religious ethics in religion. After communicating with them, I felt the power of life.

Yes, just like female practitioners looking for opportunities in desperate situations, the non-sovereign currency that emerged from chaos is now gradually moving from chaos to order.

In Turkey, almost every Crypto practitioner I met had strong beliefs about the adoption of ETFs. Some people say that Blackrock's application is very professional and never goes into an unprepared battle; others analyze that the entire global market sentiment has put tremendous pressure on the SEC; some even say that they have insider information... No matter what, faith is everything. .

At present, on one side, Ethereum’s narrative is weak, and on the other side, the BTC ecosystem is booming. For the current market, more opportunities lie not with large-capital institutions or VCs that focus on value investing, but with individuals. Where does Ethereum go next? What kind of excitement will there be in the next cycle?

This industry rises on the border of order and chaos, and moves from unrest to transparency.

Just as many local practitioners in Turkey are looking forward to the Crypto policy in mid-2024, every digital nomad who comes to Turkey gathers in the ancient Roman capital, recharges their faith, and then returns to other parts of the world.