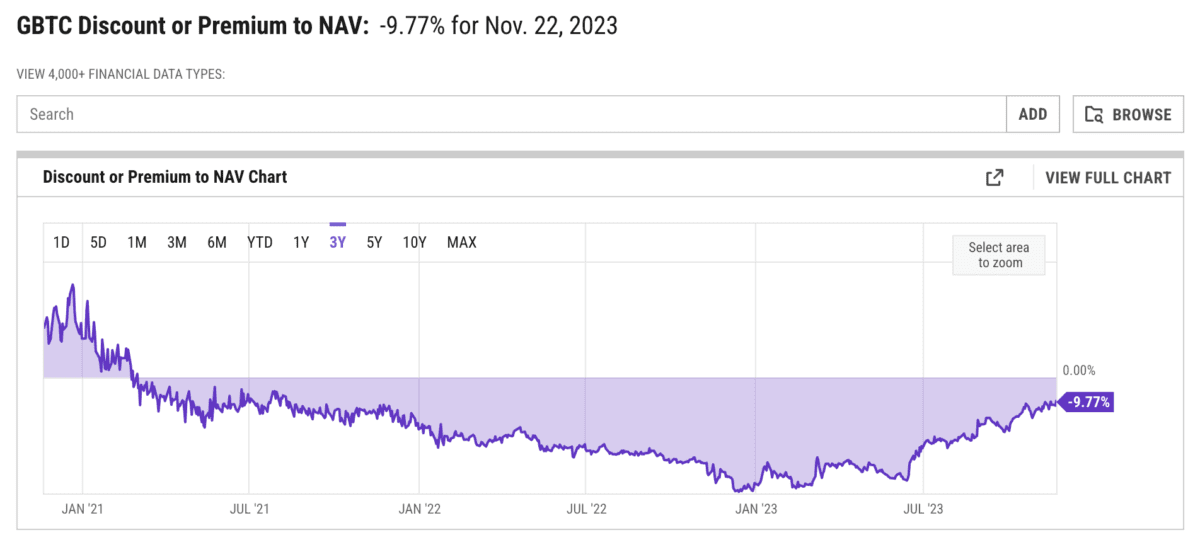

GBTC negative premium narrows significantly

Since the beginning of the year so far, traders have been buying Grayscale Bitcoin Trust (BTC -0.05% ) which has a market price that trades at a negative premium to the underlying value. Data shows that GBTC’s premium rate has rebounded to -9.77% from nearly -50% at the end of last year.

The sudden rebound in market demand can be attributed to traders' growing confidence in GBTC's transformation to spot Bitcoin ETFs, and they expect the negative premium problem to disappear after the transformation while earning profits from the difference. This means that most GBTC traders may seek to cash out rather than continue to hold after a successful transition.

At least US$2.7 billion outflow

JPMorgan analysts pointed out this phenomenon in their latest report and looked at GBTC inflows since 2023 to calculate the value of the shares that might be sold at the time of conversion. Analyst Nikolaos Panigirtzoglou found that after considering parameters such as Bitcoin’s daily price changes and trading volume year-to-date,

“Total net flows into Grayscale Bitcoin Trust since the beginning of the year are approximately $2.5 billion. If combined with the closing of short positions that began at the beginning of the year, this amount may be closer to $2.7 billion.”

Analysts at JPMorgan Chase believe that assuming that the $2.7 billion inflows so far this year are mainly due to the expectation of Grayscale Bitcoin Trust's transformation into ETF, then the possibility of investors leaving the market at a profit after GBTC is converted into ETF is very high. In other words, JPMorgan analysts expect that GBTC will experience an outflow of at least US$2.7 billion when converted to an ETF, and if GBTC still maintains the current 2% annual management fee after converting to an ETF, the outflow may further increase. The analyst said:

“Once the SEC approves a spot Bitcoin ETF in the United States, we foresee average Bitcoin ETF fees to become more competitive and approach the levels of gold ETFs, which are currently around 0.5%.”

The impact of capital outflows on the market

Analysts pointed out that if it is true that all US$2.7 billion in funds will be withdrawn, then such an outflow will of course cause serious downward pressure on the price of Bitcoin. However, analysts emphasized that these funds may not completely leave the Bitcoin market, and most may be transferred to other Bitcoin instruments, such as other Bitcoin spot ETFs approved by the SEC. Therefore, the negative impact on the market will be relatively mild, but the overall trend is still downward. The analyst said:

“This means that the asset distribution in the Bitcoin fund space may adjust from $23 billion in Grayscale Bitcoin Trust and $5 billion in other funds to $20 billion in Grayscale Bitcoin Trust and $8 billion in other funds. But in our view, Bitcoin The balance of risk for Bitcoin prices is tilted to the downside as some of this $2.7 billion may exit the Bitcoin space entirely."