Author: ZENECA / Source: https://zeneca33.substack.com/p/blur-blast-bingo?utm_source

Translation: vernacular blockchain

If you just woke up and saw everyone promoting blast.io referral codes, do you feel funny? Many people know that Blur Season 2 has ended, but what will happen to the NFT market and are there any plans for Season 3 and beyond?

Let’s take a closer look at what happened and how you can take advantage of what could be one of the most lucrative opportunities in the next six months. Actually, before we dive in, some macro/meta-thinking: it’s all pretty convoluted, messy, complicated, and crazy.

It might be easy to ignore it. It might be easy to not want to get involved. There are plenty of reasons why these options are sound, but if making money is something you're interested in, it's worth paying attention to what's going on here.

The greater the difficulty involved in doing something, the greater the opportunity tends to be. This is the truth of the crypto world (and indeed the world in general). While there will be some difficulties involved in understanding and participating in the various point farming mechanics below, I think there is a lot of room for growth for those who choose to participate.

An early disclaimer: I am an investor in Blur, so I have a (literal) stake in the success of their token. I was not an investor in Blast, and to this day I don't even know it exists.

1. Blur Season 2

The second season of Blur lasted for about 9 months from February 14th until it ended on November 20th. It has caused a lot of controversy in the industry. Some people like it very much, while others hate it and think it embodies everything wrong with NFT. I'm not here to judge or accuse, but more to report the facts.The idea of Season 2 is that by performing certain actions on the Blur platform, you can earn points, which determine how many tokens you receive in their airdrops.

There are many factors that influence this process: bidding activity, listing activity, buying activity, borrowing activity, and your "loyalty" (if you only buy and sell on Blur, you get a higher allocation than if you also buy and sell elsewhere need more).

Many people tried to obtain Token through this airdrop, but the results varied widely.

There are extreme examples like MachiBigBrother, who received about $2 million worth of BLUR in the airdrop, but lost about $14 million in the process, so he wasn't happy.

To be fair, he made some pretty crazy/bad decisions, buying large amounts of items at high prices and then selling them off en masse at lower prices. I suspect Machi doesn't have many supporters.

On the other end, there are smart traders/farmers like Cirrus, who made money while mining and got about a 6-figure airdrop (around $150,000).

There are various situations. The largest airdrop appears to have come from Hanwe, which received approximately $7.2 million worth of tokens:

Overall, approximately 300 million BLUR Tokens were distributed in the airdrop, worth approximately $100 million to $120 million at current prices. This is a considerable amount of incentive funding.

Speaking of price, there is no doubt that after the airdrop, BLUR Token quickly plummeted as people started claiming and selling their tokens. Somewhat surprisingly, the price subsequently rebounded and BLUR Token has been trending upward ever since.

This is because of Season 3 and Blast. But before we can talk about season three, we first have to talk about Blast.

2. What exactly is Blast?

According to themselves, Blast is: the only Ethereum Layer 2 that provides native yields for ETH and stablecoins.And: Blast is an EVM-compatible optimistic rollup that improves baseline benefits for users and developers without changing the experience crypto-native users expect.

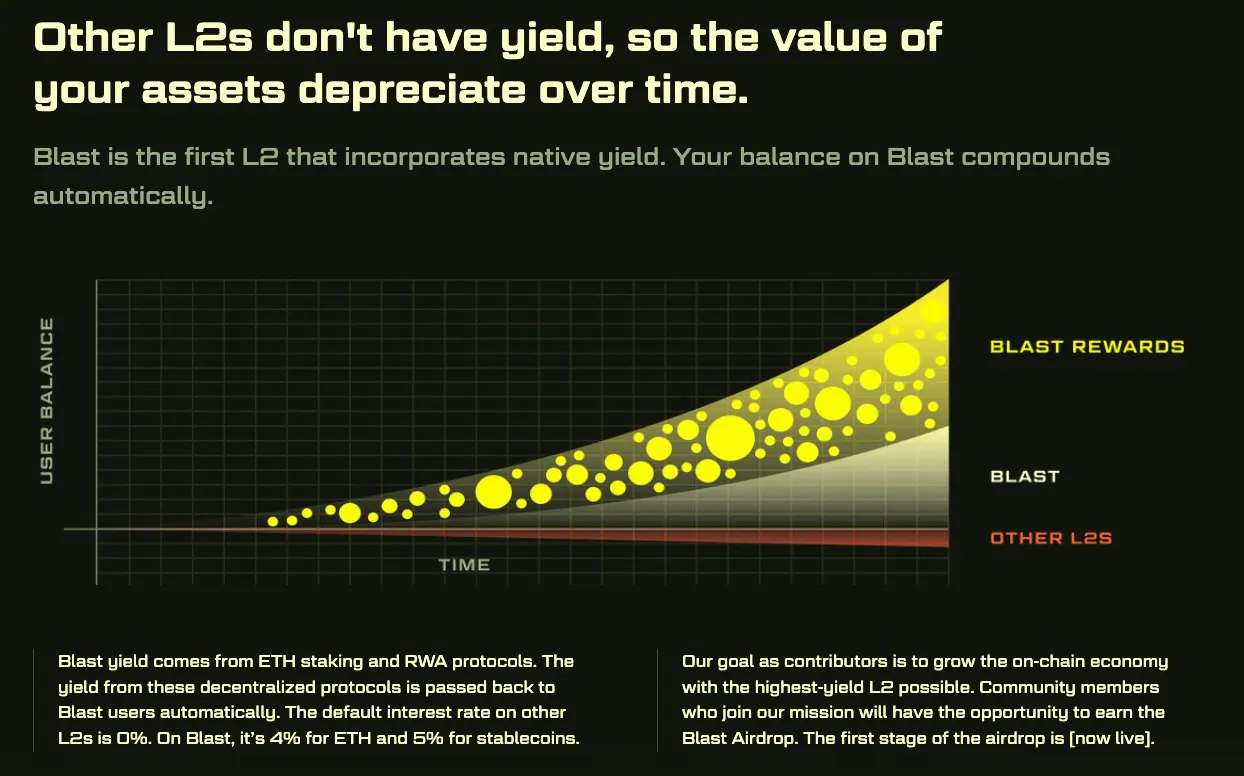

Okay, let me try to explain it more simply and understandably. Blast is a new type of Layer 2 being built, and they are differentiated from other Layer 2s by so-called native yield.

This means that if you hold ETH or stablecoins in your wallet on Blast, they will automatically generate yield (4% for ETH and 5% for stablecoins).

That's... pretty good, right?

The current situation is that anyone can stake ETH or stablecoins, but this will require an operation (and gas fees) to stake and then unstake. It is impractical to stake all your funds. Blast claims to be building a way for all funds on the chain to automatically generate returns.

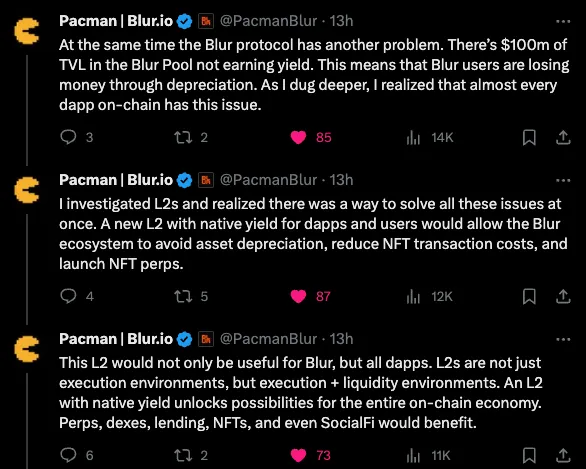

This is not limited to funds in your wallet, but also includes funds deposited into any dapp/protocol. Pacman, the founder of Blur and now one of the founders of Blast, said one of his inspirations for building Blast was when he saw that the $100 million in TVL locked in the Blur pool was not generating any revenue:

Another huge source of inspiration is seeing all the gas fees being wasted on ETH. Of course, this is nothing new, and the waste of gas fees on NFTs (among other things) is the main reason many of the existing excellent L2s exist in the first place.

Here are some excellent thoughts put forward by Foobar (who is indeed an investor in Blast, but is also a great developer/builder in the space): So, Blast is the new L2 under construction, and the idea is to trade a lot of NFTs Move onto the platform to provide native yields for on-chain funding and ideally develop many other dapps and use cases. Sounds great, but how does this affect Blur and Season 3?

The Ponzi game begins!

While Blur seasons one and two resulted in people being airdropped $BLUR Token, season three is all about BLAST? There are several ways to earn this speculative token, let’s take a look. Important note: All the following methods are for obtaining or Blast's "airdrop points" - there is currently no mention of airdropping any $BLUR Token again.

3. Blur Season 3

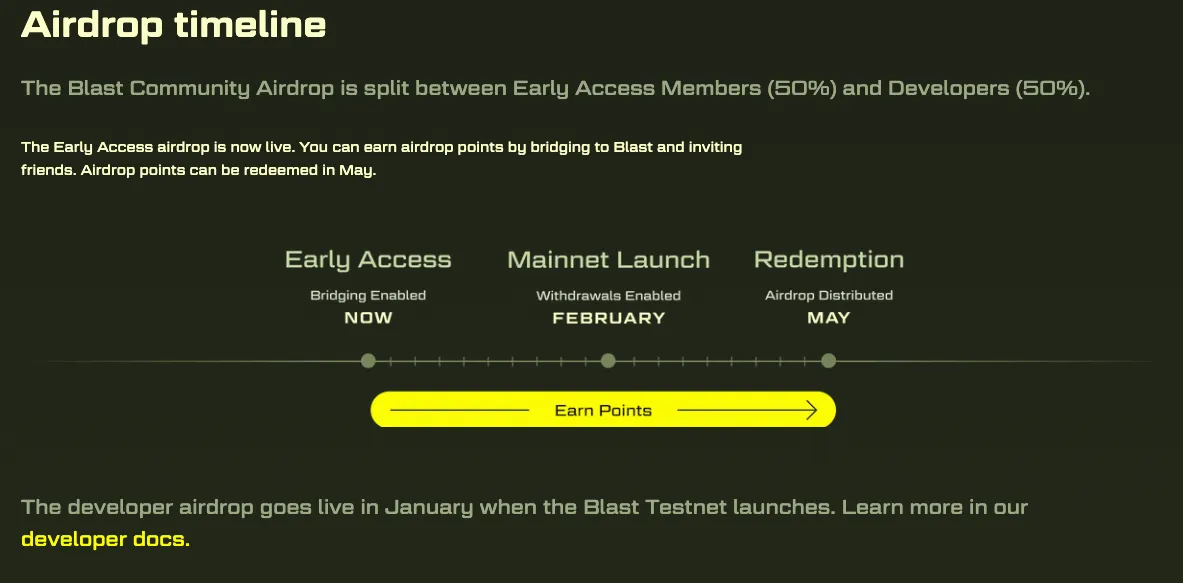

Unlike Season 2, Season 3 has an official end date, which is great news. The third season will end in May 2024 after running for 6 months. The reward is as mentioned above, and it seems likely to be some kind of Token related to $BLAST.

50% of this will be distributed to people based on their Blur Points and the other 50% will be distributed based on their Holder Points. Let's look at Holder Points first since they are simpler.

Token holds points (Holder Points)

In short stake your BLURToken and earn points. The longer you mortgage, the more points you earn. The earlier you start staking, the more points you will earn.

There are high incentives for staking today, you can earn 4x points per BLURToken (per hour). This number will gradually decrease from November 26 to 1x points for each BLURToken.

Your points will gain a multiplier based on the length of your mortgage, increasing by 0.5 times every month. If you stake now and hold to maturity, you should get a 3x increase.

You can withdraw at any time and keep all holder points, but your multiplier will decrease.

This is a pretty clever token economics mechanism that prevents people from immediately dumping their BLUR airdrop tokens. It’s worth noting that when you claim your airdrop, it is automatically staked and points awarded. This largely explains why the price of BLURToken has remained stable.

The other half of Blur Points Season 3 rewards will be distributed to users using the Blur protocol, similar to Season 2, but with some notable changes.

The three ways to earn points now are bidding, listing, and borrowing.

Bidding: Bidding is basically the same as s2. When you bid on collections, you will earn points. The higher your bid, the more points you earn. The longer your bid remains active, the more points you earn. The greater the transaction volume of the collection you bid on in the past 24 hours, the more points you will receive.

In short, bid on popular collections and get your bids at or near the top to start earning some bidding points.

Listing: Listing points cannot be seen until the end of the season, but the general idea is that if you list naturally, you will receive points. Active collections, i.e. more 'blue chip' collections, will earn you more points.

Borrowing: Borrowing points are earned by providing borrowing. The higher the maximum loan amount, the more points you earn. The lower the APR, the more points you earn.

It is worth noting that borrowing points are issued at half the rate of bidding and listing points.

Loyalty: This is important. Loyalty is basically what it sounds like: how loyal you are to Blur. If you list your NFT on other platforms, your loyalty will decrease. They also made some sarcastic criticisms of Flooring Protocol:

Providing liquidity for NFTs or fractionated NFTs can also impact your loyalty.

Based on individual evidence, it appears that people who are less loyal but have higher points receive a much smaller allocation in the airdrop than people who are more loyal but have lower points. If you want to get $BLAST, I would be very careful about loyalty.

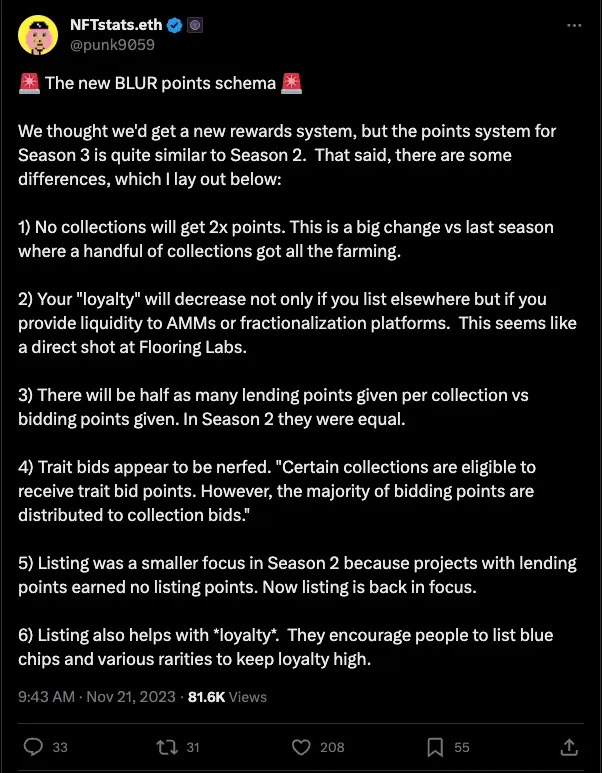

Here's a great post by Sam/NFTStats highlighting the changes between Q3 and Q2.

We originally expected there would be a brand new reward system, but in fact the points system in Season 3 is quite similar to that in Season 2. Still, there are some differences, which I'll list one by one:

- No more collections will earn double points. This is a significant change from last season, where only a handful of collections earned all the farm points.

- “Loyalty” decreases not only because you list elsewhere, but also because you provide liquidity to an AMM or fractionalization platform. This seems to be directed at Flooring Labs.

- The number of borrowing points received for each collection will be only half of the bidding points. In season two, they are equal.

- Feature bidding appears to have weakened. "Certain collections are eligible for feature bid points. But the majority of bid points are allocated to bidding on collections."

- In Season 2, listing is not a priority because items with borrowed points do not receive listing points. And now putting it on the shelves has become the focus again.

- Being on the shelf also helps ensure loyalty. They encourage people to list blue chip and various rare collectibles to keep loyalty high.

4.BLAST.IO

Blast.io is an upcoming L2 project and a starting point to start earning points that will help you earn BLAST allocations. Actually, the Blast website doesn't use the word "removed", they call it airdrop points.Theoretically, the content you get through Blur's Q3 rewards could be different than the content you get through bridging/earning points through Blast.io. Initially I thought they would be the same, but the languages used by both sites are different, which may mean they are different.

I guess it could still be part of BLAST (or a future token), but we don't know for sure. Maybe it’s a multi-token ecosystem, with Blur’s second quarter rewards for one of the tokens and Blast’s airdrop points for another – this is just speculation.

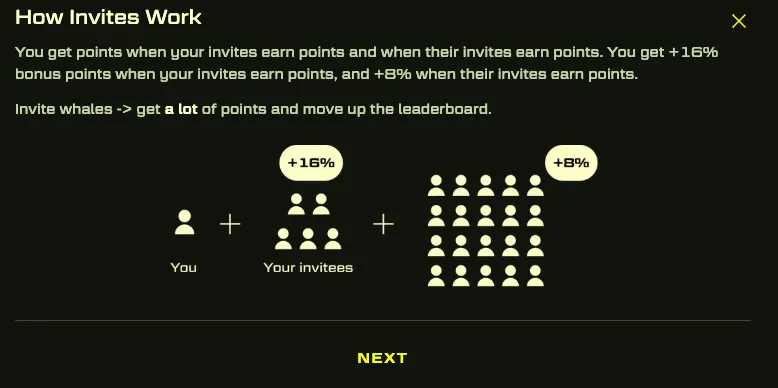

Let’s talk about points. You need an invitation code to sign up, and here's the fun part: every time someone signs up using an invitation code, they generate points for the people who signed up using their link.

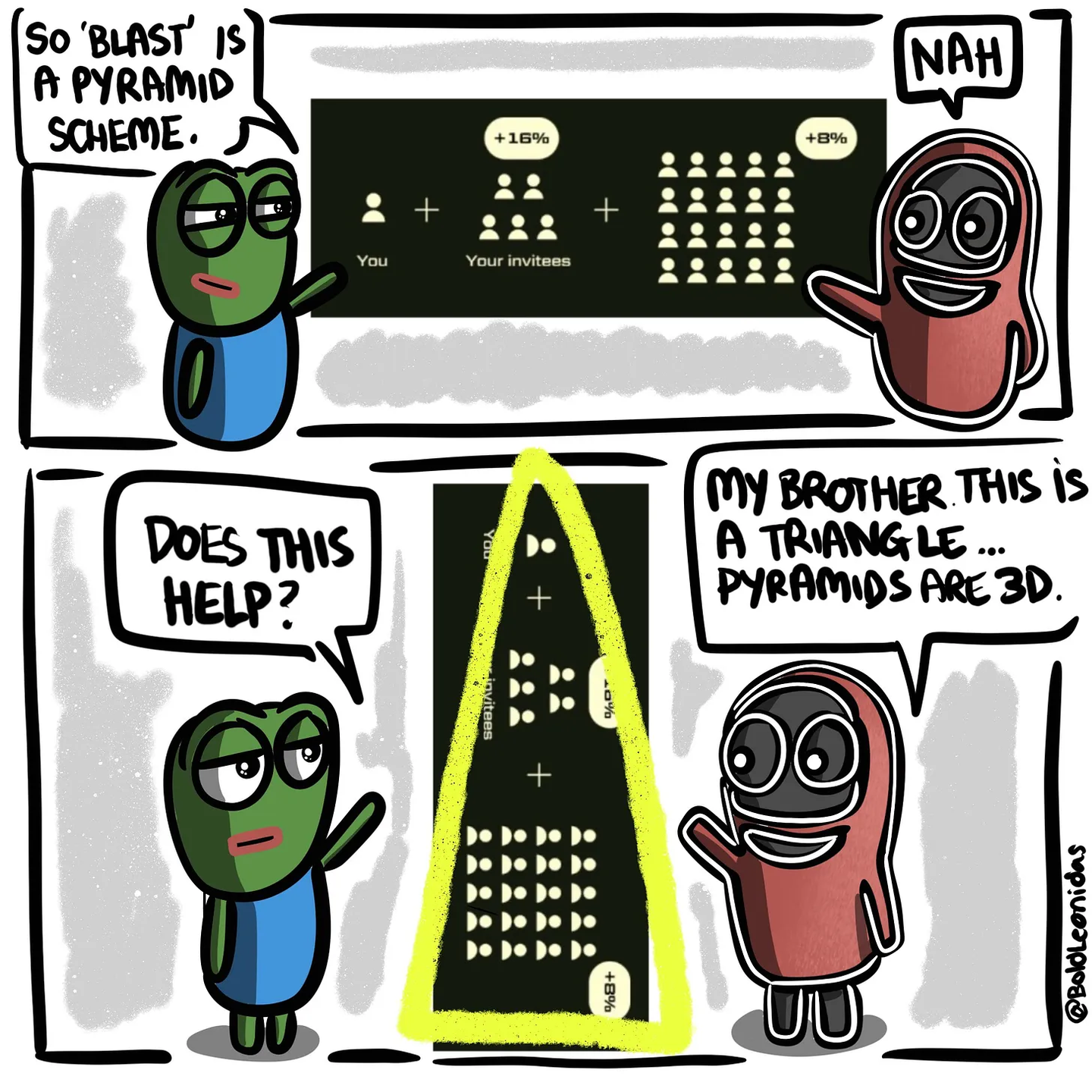

Okay, let’s put aside the lottery and carousel talk for a moment and enjoy this awesome meme from BoldLeonidas:

You can earn points in several ways.

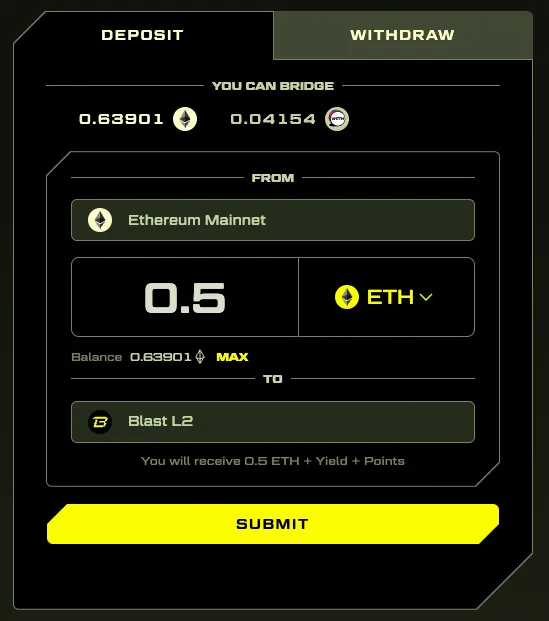

First, you can earn points by bridging Ethereum or stablecoins . At the same time, you will also receive a profit (4% for Ethereum and 5% for stablecoins). It’s important to note that when you bridge, you won’t be able to withdraw your funds until mainnet goes live and withdrawals are enabled (assuming they follow the schedule). Therefore, please do not bridge funds that you may need access to in the near future.

Earn points by spinning the wheel. Because today’s crypto world wouldn’t be complete without that extra bit of gambling. You'll get 1 spin initially, then 1 more by tweeting, and then 1 spin per week for every Ethereum (or USDC equivalent) bridged.

As mentioned above, if someone you refer bridges, spins, and earns points, you will receive a portion of their points (and also a portion of the points earned by the referred person).

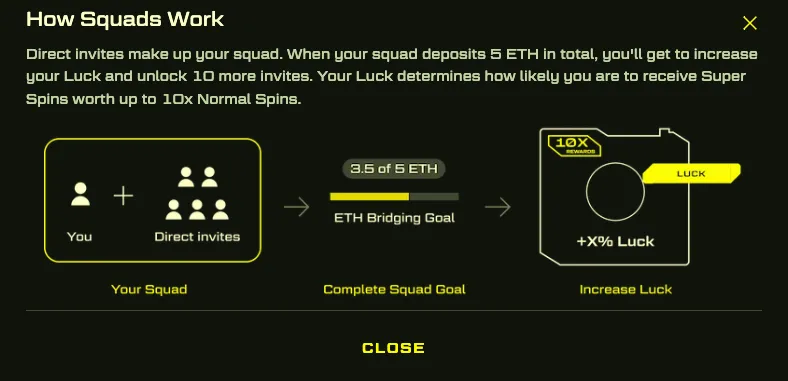

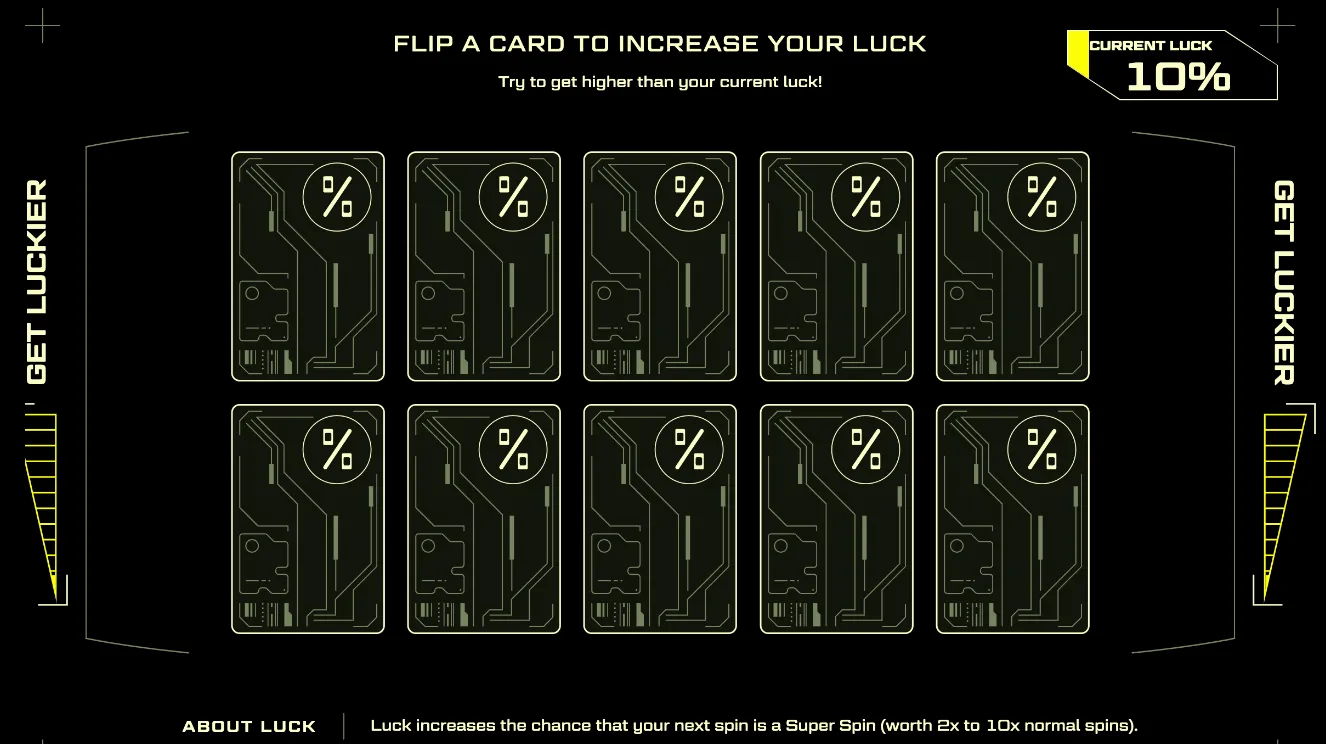

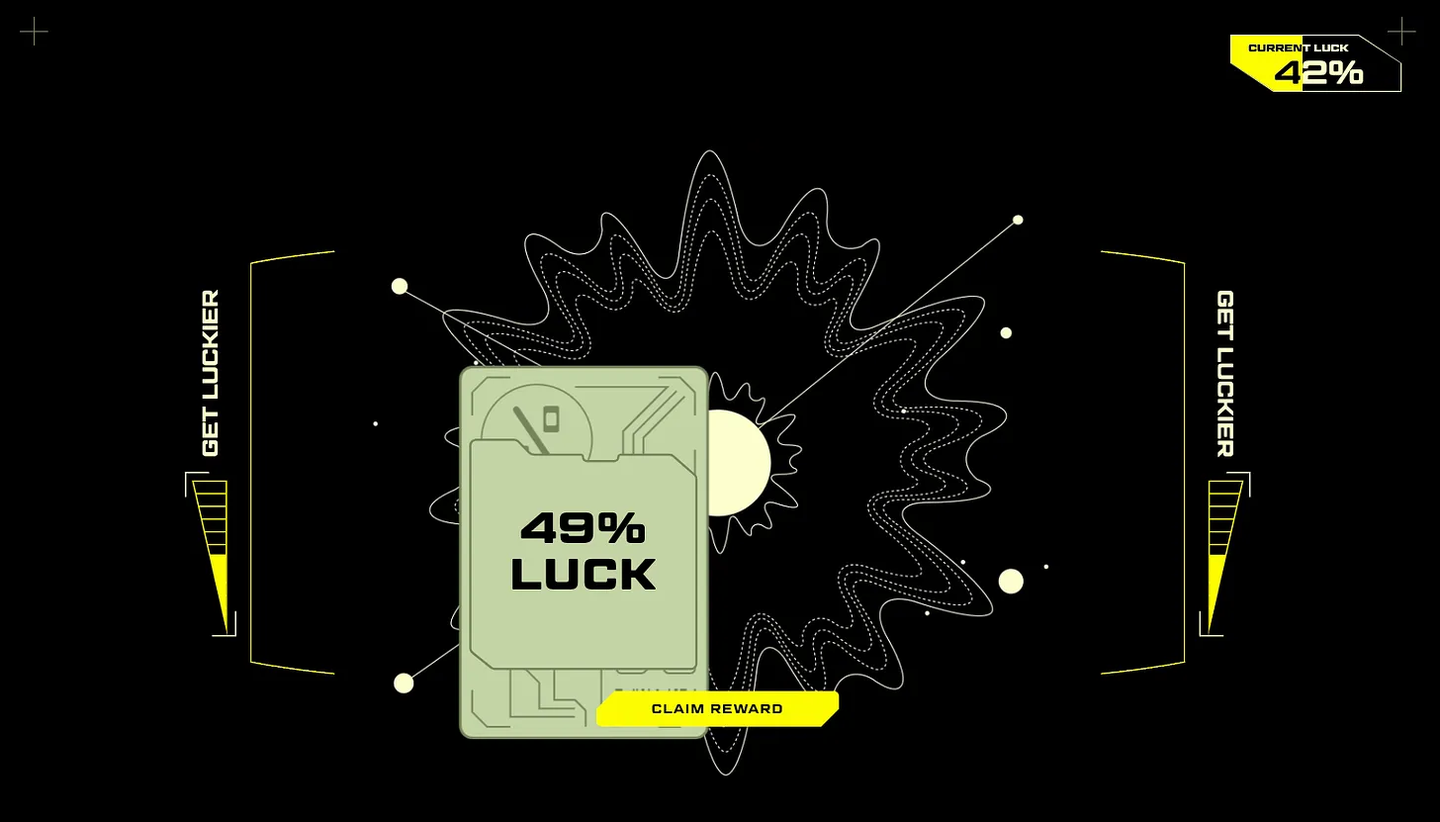

Finally, you can increase your luck on the roulette spin. Whenever your "squad" bridges a certain amount of funds (I believe it's in units of 5-10 Ethereum), you have the opportunity to turn over some cards to increase your luck! More gambling fun!

Everyone in the squad gets these flops, so it makes sense to join a squad of people who bridge a lot of Ethereum!

Basically, you turn over a card to increase the odds that the next spin will be a "Super Spin," which will net you 2-10x the points of a normal spin. It’s worth mentioning that your luck value does not “run out”, it is permanent in your account until you get a better/higher luck value card.

They really know how to harness dopamine and use these long, regular gacha game mechanics to drive user engagement and capture our attention.

To briefly summarize, here’s how to earn airdrop points:

Bridging Ethereum and Stablecoins

Spin the Roulette ( Bridge Ethereum to get 1 spin per week)

Share your invitation code and let these people earn points

As your team bridges more Ethereum, you will unlock team rewards.

So far, the rewards seem to be more of invitation codes, as well as turning over "lucky" cards to increase the results of your spins.

One final note of note - it's worth noting that all of these points only account for half of the Blast community airdrop allocation. The other half is allocated to developers building apps on Blast.

If you're a developer interested in the concept of native revenue, it's definitely worth considering experimenting with Blast. Okay, so that’s basically all about earning points, Ponzi schemes, that sort of thing.

Now I'll share a little bit about my thoughts on all of this, both as a personal strategy going into the Blast airdrop/launch, and as a reflection on what it might mean for the market in the short, medium and long term.

5. What is the situation of the NFT market?

There is so much speculation about what will happen to the NFT market during the airdrop. For a while I thought this might cause the market to rise, which was quite possible. But when I saw what happened in Q3 for Blur and Blast, my mind quickly changed.I like to think in terms of probabilities and imagine different scenarios.

A situation that may cause NFT prices to increase is:

BLUR airdrop → people sell to get ETH → buy NFT

Another one does the opposite:

BLUR Airdrop → People sold and invested in other cryptocurrencies/maintained stablecoins But now, we have at least two other viable avenues:

BLUR Airdrop → People stake and hold Q3 points

BLUR Airdrop → People sold to get ETH/stablecoin, and then bridged to Blast to get airdrop points. The market originally thought/expected a lot of money to flow into the NFT market, but now they will no longer do so. Not to mention that people may take out the extra funds originally used to purchase the NFT and choose to bridge it to Blast.

In less than 24 hours, the total value locked on Blast has exceeded $60 million. This is crazy! Especially considering this is still just an L2 project that hasn’t launched a testnet yet, and the “bridge” is just a multi-signature wallet with 5 signers, but sometimes that’s the risk game we take.

Another point that was considered was “What would the big farmers do?”

Those who own hundreds of NFTs from multiple collections. If Blur stopped all incentives, they would likely sell them - but given the continued incentives in Q3, we haven't seen that happen yet.

All in all, the market was hit pretty hard (it was even hit harder by the Binance/CZ news). It's hard to know whether it will continue to fall or whether it will bottom out and rebound, but I have had a plan for several weeks to liquidate a lot of collectibles that I am not very optimistic about and invest in more confident projects. This plan is still not Change. It's really frustrating that prices are falling, but we have to keep the faith.

The question I ask myself every day now is: If I had a magic wand and could liquidate my entire portfolio, would I repurchase all my NFTs at the current price they can be sold for? The reality is that almost all of my NFTs are negative. So, I should sell. I just need to stop being emotional, stubborn and lazy.

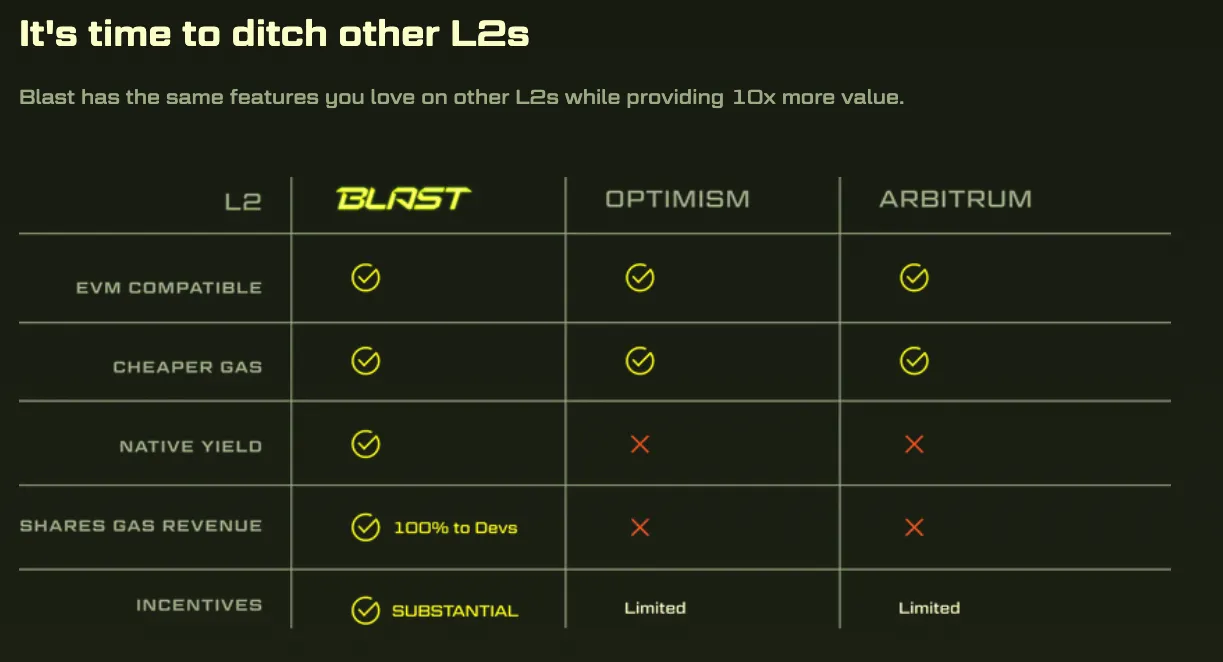

In addition, there is such a slightly conspiracy-like table in Blast’s “Developer Documentation”:

I really like Optimism and Arbitrum, and I think they are both huge positive additions to our field. In fact, from what I hear, Blast is using Optimism's technology stack (which they have permission to do under the MIT license). I'm not 100% sure about the tech stack they're using for their chain, but have heard some positive things, if anyone knows something different please let me know and I'll correct it.

The last line is particularly egregious - both OP and ARB are doling out massive incentives to builders, creators, developers, users, etc. The same goes for Base.

Bottom line, Blast is a business, they want more users and total value locked (TVL), and they're very good at knowing how to play the game to achieve that. This makes me not want to bet against them and stay neutral on the whole airdrop/points situation.

The one L2 missing in all of this is Frame, an L2 designed specifically for NFTs. By the way, I also have high respect for cygaar.

Alas, while they may not be interested in Ponzi schemes , the crypto space has proven time and time again... that we are. We think where the money is and where the attention is. That's not to say Frame can't succeed - it's entirely possible, and I hope it does - and there are many non-Ponzi, non-hype protocols that are doing extremely well.

But in this writer's opinion, it will be difficult for any L2 to compete with Blast's popularity in the coming months.