Hong Kong's RWA craze has made STO popular in previous years. In September, Hong Kong claimed to have been approved for the first real estate fund STO product, but recently there has not been much noise. Let’s start with the securities tokenization of real estate physical assets and talk about how to design real estate RWA products?

Hong Kong RWA’s recent circular defines (tentatively) securities tokenization, and other types of more complex digital securities are temporarily not encouraged or require more complex regulation. In the current securities tokenization, SFC is defined as traditional financial products (bonds or funds) that use DLT (distributed ledger) technology. When issuing, they need to first issue fund-type securities products and then hold them through DLT technology and digital wallets. have.

Although the regulatory strategy of Hong Kong SFC is relatively compromised and regressive, it is relatively stable from their regulatory perspective and is suitable for traditional financial institutions and old money to enter in a familiar way.

Combined with many years of experience in the real estate private equity fund business, our main customers in our traditional business are real estate companies. Our main investment and financing services include bond issuance, ABS and REITs, etc. After the three red lines, real estate companies have issued overseas bonds through Hong Kong. This product is actually very similar to the currently defined basic traditional financial products; in addition, real estate REITs are also issued and traded on the Hong Kong Stock Exchange, but because the stock business of the Hong Kong Stock Exchange is too strong As a result, there are more than a dozen real estate REITs in business, which is far smaller than the REITs market size in Singapore and Japan. Financial products such as bond issuance, ABS and REITs around real estate can all adopt the Fund model. Bond issuance is fixed-income financing, with credit rating + mortgage or credit enhancement, and can be smuggled into the fund model; ABS begins to combine income rights and franchise rights. Asset securitization such as accounts receivable or accounts receivable also requires a private equity fund structure; REITs focus on income rights, and the transaction structure adopts private equity funds + special plans or trusts. Since we are accustomed to using real estate instead of real estate, because there are also some infrastructure, industrial real estate, logistics real estate, etc., I will express it later in terms of real estate asset securitization or real estate financial products.

In fact, the financial products of real estate asset securitization are already very mature, and they basically need to be in the form of Fund, which matches the regulatory requirements of SFC. Therefore, in theory, they can become one of the preferred underlying assets of Hong Kong RWA. one.

Hong Kong Real Estate STO Case Report

Taiji Capital announced the launch of PRINCE Token, Hong Kong's first real estate fund security token for PI (professional investors). PRINCE tokens are issued by a closed-end fund managed by Tai Chi Capital's Pioneer, with a fundraising target of approximately 100 million yuan. The entry fee is HK$1,000, which is far lower than the US$1 million generally required to invest in private real estate funds. The funds raised will be used to acquire five retail properties located in the tourist hotspot of Prince Edward in Kowloon District. Details of the target properties have not been disclosed yet. By holding PRINCE tokens, investors can obtain the annual rental income generated by the relevant properties and benefit from the future appreciation of the properties. PRINCE tokens are ultimately settled on the public Ethereum blockchain and, if approved by regulatory authorities, will be listed on the HKbitEX platform to achieve greater liquidity potential.

Currently, Pioneer Asset Management, a subsidiary of Taiji Capital, has been approved for Uplift’s No. 4 and 9 asset management licenses, which can provide virtual asset management and managed investments up to 100% of virtual asset portfolios; HKbitEX, a subsidiary of Taiji Capital, is also applying for a virtual asset trading license.

Real estate physical asset securities tokenization product design

We combine the dismantling analysis of traditional real estate asset securitization product models and compare the above-mentioned real estate STO cases of Taiji Capital to understand the design ideas of tokenization of real estate physical asset securities.

First, product structure.

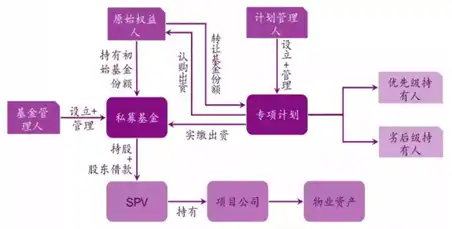

As mentioned briefly before, real estate asset securitization is based on the form of private equity funds. The product structure generally achieves the acquisition or holding of SPV company/project company equity through private equity funds (if assets are raised to acquire, it is acquisition; if it is owned assets, it is acquisition). Some involve asset transfer). SPV is a franchised purpose company. You can simply understand it as a mezzanine company for the purpose of holding or acquiring. For example, when private equity funds like Pioneer Asset Management acquire the Prince's Shop in Kowloon, they need to set up an SPV. In this structure, the fund manager can sell and dispose of the property assets themselves or transfer the equity of the project company holding the property assets and other interests on behalf of the private equity fund. as the picture shows:

Second, product design path

The design and issuance of a real estate asset securitization product is still relatively complex. Let us simply expand on the product design path of real estate asset securitization as a reference for everyone to think about the design of real estate RWA products.

1. Participants and underlying assets

1) Participants

These two are the basis of real estate securities products, because the core purpose of designing products is to invest in real estate assets through the issuance of securities: on the one hand, it can enable the original equity holders of the project assets to obtain financing; on the other hand, it can also allow more of investors participated in real estate project investments.

Product participants are mainly composed of five parts: promoters, original equity holders, managers, investors and other service organizations. The first four are relatively easy to understand. For example, in the case, the sponsor may be Taichi Capital, and the manager may be Pioneer Asset Management. The original equity holder has not been disclosed. It may already be Taichi Capital’s own assets or a financing client such as Kaisa Real Estate, which is easy for investors to understand. Investors who purchase products, but investors in mainland real estate asset securitization products are basically institutional clients rather than retail investors; in addition, other service institutions play an important role in product design and issuance, mainly by legal It is composed of service agencies, accounting service agencies, valuation service agencies, custody agencies and distribution agencies.

2) Basic assets

The core of real estate securities products is the selection of underlying assets, which generally require three core characteristics:

-The underlying assets must be real estate with clear ownership and cannot be attached with other rights;

-The project must have been completed and entered a stable operation period. It is difficult to securitize real estate that has not yet been completed or under construction;

-The project should have sustained and stable operating cash flow and all financial indicators should be healthy.

The Prince's Shop in Kowloon in the case is a typical commercial property. Its main sources of income are rental income from the lease of the shop property and charges for supporting services. However, whether this type of commercial property assets can become high-quality securitized assets must be judged from three aspects: versatility, scarcity and cash flow quality. Let’s not talk about the versatility of shops. Scarcity mainly refers to the rarity of assets. For commercial properties, the rarity is location, location, location. It is not bad for a Kowloon Prince shop to be located in an area frequented by tourists, but market research data is required for the specific location. ; Cash flow quality mainly evaluates the timeliness of recovery of operating cash flow and the dispersion of income sources. The timely solvency of cash flow is high, and the more dispersed the income, there will be no fluctuations and declines. These are evaluated by professional service agencies.

2. Product design ideas

The core of the design idea of real estate asset securitization products is that investors indirectly hold underlying assets by investing in securities products, and obtain final returns through the cash flow generated from the operation of the underlying assets and the premium obtained from selling the underlying assets. The income is generally obtained by dividing the annual income of the underlying assets as dividends. When the product matures, the assets are sold to recover the principal and obtain asset premium income.

Credit enhancement measures, such as mortgages and guarantees, will also be considered in product design. It is also possible to set up a hierarchical structure and set up a secondary structure (first priority and inferior) in private equity funds, so that the secondary shares form a certain risk protection for the priority shares.

In the design of the product period, compared with the liquidity characteristics of virtual assets, it is recommended to consider a relatively short holding period, and at the same time set more flexible options for the product’s exit period, which can help managers choose more favorable options. Opportunity to sell underlying assets for higher yields.

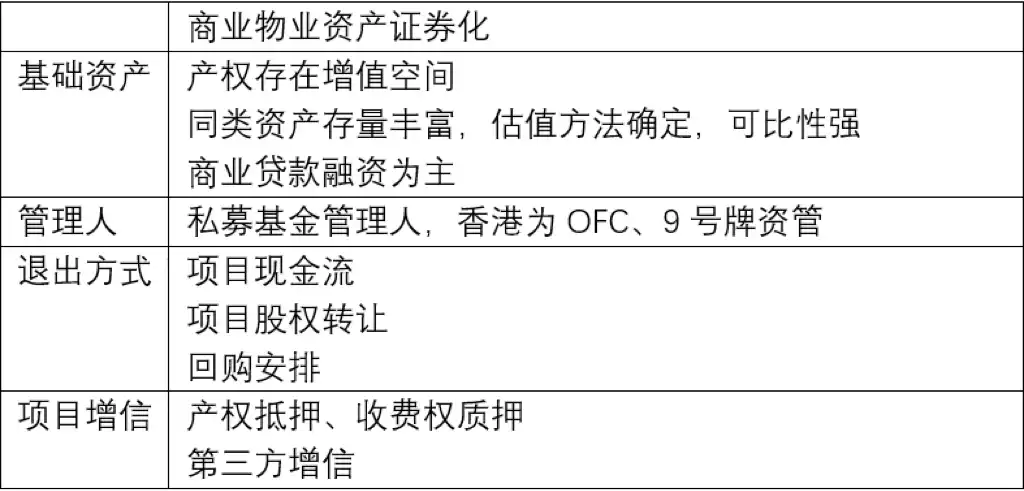

Attached table: Key points of commercial property asset securitization

3. Design plan

1) Scale, term, income distribution

To determine how large a product will be, it is not just a matter of setting a HKD 100 million or HKD 200 million. Rather, it is necessary to evaluate the value of the underlying assets themselves and the value of operating cash flow, and then look at the needs of the original equity holders whether to sell or recycle the next 5-10 years. Annual cash flow realization, and this fixed-income financing model, generally have a value discount (around 50%-70%);

The product period is recommended to be 3-5 years. Although the investment payback period of real estate is relatively long, currently this type of investment is generally aimed at real estate with operating cash flow. Those real estate REITs generally have a 10-20 years or even longer. This type of securities represents Monetized basic private equity fund products are more suitable for flexible term settings such as "3+x". That is, after the three-year closed operation period ends, the manager has the right to appropriately extend the product duration based on the actual situation. The purpose is to choose the right Sell assets at a more favorable price to obtain premium income;

The income distribution and payment of products usually use fixed income to determine the income for each fixed period during the product holding period. The income is paid annually and the principal is repaid in one go at maturity; while the premium income when selling assets and exiting is floating. The income is paid in one lump sum according to the agreement.

2) Layering

Product layering is not mandatory. The original intention of designing a two-layer structure in the product is mainly to consider risk sharing. The two-tier structure is priority shares and secondary shares. Priority shares receive fixed income first, while secondary shares can receive all fund assets except the principal and income of priority shares. However, in terms of payment order, the payment of secondary shares The order is after the priority, thereby providing certain risk protection for the priority shares. In the event of a loss in the value of the underlying assets, the principal and income of the priority shares will be protected first.

3) Exit method:

There are two main types of product exit methods: the first type, exit by selling assets upon maturity, which is the most common exit method; the second type, exit by relying on the operating cash flow of underlying assets, which is quite special and is often non-fixed income. Designed, the middle layer ABS asset-backed plan has been calculated to cover principal and income. In this case, the first method was adopted, selling and exiting at maturity.

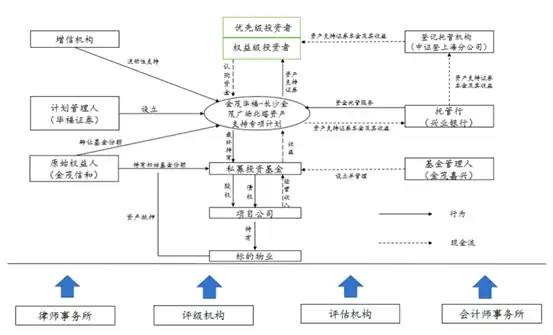

4) Transaction structure

Product transaction structures are generally complex. Here is a brief introduction. The most critical link in transaction structure design is the construction of a Special Purpose Vehicle (SPV). The specific organizational form of an SPV can be a company, a limited partnership, or a private placement. Fund or trust plan.

The purpose of constructing an SPV is mainly as follows: first, to hold underlying assets. Since the underlying assets of real estate securities products must be properties with clear ownership that comply with relevant regulations, can be independently operated and generate cash flow, therefore, they need to be structured An SPV acquires underlying assets to achieve isolation of the underlying assets; secondly, it carries out active management. If you pursue floating income when selling assets, injecting the underlying assets into the SPV can enable the manager to better actively manage assets and make it easier for product exits. Conduct transactions; third, construct equity and debt investment methods to achieve tax penetration. By rationally constructing SPV, an investment method that combines equity and debt can be realized, which is more conducive to tax optimization in the cash flow recovery process. (The content here is a bit boring, you can refer to the following pictures to understand)

Product design summary

Here we introduce a real estate asset securitization transaction structure and product plan diagram as an overall reference:

This structure diagram can help you understand the lengthy dismantling analysis of traditional real estate securities products. You must know that traditional finance and traditional financial practitioners are just like this to make simple things complicated in order to collect your money. Originally, RWA should be more upgraded and digitally native, but Hong Kong RWA can’t help it. Of course, the current RWA product is still a compromise model in the transitional period. In the future, RWA may be more intermediary and de-FIAT, and more digitally native.

There are a few points that need to be emphasized again:

1) Requires the participation of a large number of SFC-approved professional service organizations, such as lawyers, ratings, evaluations and accounting audits

2) Asset valuation methods require professional auditing or valuation agencies, rather than slapping your own head.

3) Issuance and underwriting. Distribution institutions are very important. Instead of directly trading on licensed exchanges for retail investors, you have to rely on distribution institutions and institutional customers. Distribution institutions are mostly securities firms, banks, trusts, etc. that have high-net-worth customers or qualified investors. If a fund sales company, etc. directly sells a 100-200 million real estate securities tokenized product to retail investors, how long will it take to sell it?

In the past, when we issued bonds or ABS for clients, we would conduct preliminary research and communication on the quota in advance, and communicate the time limit, cost and credit enhancement measures in detail. Basically, when we had almost discussed it, we would then invite tenders for sale or increase the pre-sale quota. Exchange. This is different from what many people in the RWA field think at present. Many people think that once an RWA product is released on a licensed exchange, it will be sold. No!

After dismantling, I summarize a point: Although real estate securities products are the most mature and standardized, real estate assets are currently not high-quality targets for Hong Kong RWA, because as mentioned earlier, real estate securities products often rely on asset sales premiums to exit. In the past, economic growth was At that time, real estate prices were constantly rising, so operating cash flow income was secondary, and asset premiums far exceeded operating income, but now it is reversed.

Finally, I leave a question for those who really want to participate in Hong Kong RWA and are willing to think about it:

Combined with the previous product design disassembly analysis, please analyze what are the problems and what needs to be refined in the real estate closed-end fund STO case of Pioneer Asset Management?